Cosmeceutical API Market Size, Share and Trends 2025 to 2034

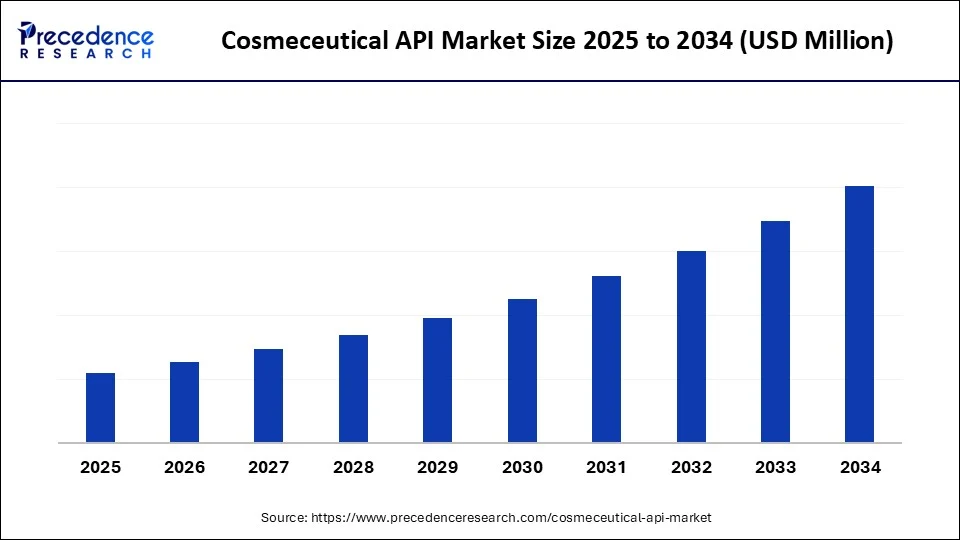

Discover how the cosmeceutical API market is revolutionizing skincare. Find analysis on APIs, regional demand, and market opportunities worldwide. The market sizing and forecasts are revenue-based (USD Million/Billion), with 2024 as the base year. The growth of the market is driven by the rising demand for anti-aging products. Moreover, rising consumer awareness about skin health and wellness contributes to market growth.

Cosmeceutical API Market Key Takeaways

- North America dominated the cosmeceutical API market in 2024.

- Europe is expected to expand at the fastest CAGR between 2025 and 2034.

- By product type, the retinoids segment held the largest market share in 2024.

- By application, the anti-aging segment captured the biggest market share in 2024.

- By end-user, the cosmetic companies segment contributed the highest market share in 2024.

Impact of AI on the Cosmeceutical API Market

Artificial Intelligence is dramatically reshaping the cosmeceutical API market's landscape. By integrating machine learning, predictive analytics, and molecular modelling, companies can now accelerate ingredient discovery, predict consumer preferences, and personalize skincare solutions with unparalleled precision. AI algorithms simulate how active ingredients interact with different skin types, optimizing efficacy while reducing R&D timelines. AI-driven skin analysis tools (via apps and devices) are helping brands deliver tailor-made products based on user data, skin conditions, and environmental factors. AI also streamlines ingredient sourcing, quality control, and regulatory compliance, thus reducing costs and time to market. AI is not just an add-on; it is becoming central to how new-generation APIs are being designed, tested, and delivered, making beauty not just skin-deep but science-driven.

Market Overview

The cosmeceutical API market represents a dynamic fusion of cosmetics and pharmaceuticals, offering skincare and personal care products with biologically active compounds. The global market for cosmeceutical API is witnessing remarkable growth, driven by key factors such as the increasing prevalence of skin-related ailments, a growing aging population, and a stronger consumer desire for products that offer both aesthetic enhancements and therapeutic benefits. The growing awareness among consumers about skincare and health boosts the demand for innovative products.

The market is also characterized by rising investments in R&D, strategic collaborations between pharmaceutical and cosmetic brands, and a strong push toward regulatory standardization to ensure product safety and efficacy. Increased R&D efforts by pharmaceutical companies and beauty conglomerates are leading to the development of novel APIs with enhanced stability, bioavailability, and targeted delivery. Technologies such as liposomal encapsulation, nano-emulsion systems, and controlled-release mechanisms are becoming common in cosmeceutical delivery formats.

Cosmeceutical API MarketKey Trends

- Personalized Skincare Solutions: Consumers are increasingly looking for tailor-made skincare regimes. This encourages brands to invest in APIs that can be customized based on skin type (oily, dry, sensitive), lifestyle, environmental exposure, genetics, and microbiome. Profiling personalized diagnostics through AI-driven skin analysis is pushing cosmeceutical brands to create bespoke formulations with specific APIs that target individual concerns.

- Rise of Plant-Based and Biotech-Derived APIs: With sustainability becoming a key purchasing criterion, there is a clear shift from synthetic to plant-based, marine-derived, and bioengineered APIs. Consumers are favoring clean-label, vegan, cruelty-free, and non-toxic products.

- Multifunctional and Hybrid APIs: Consumers now expect products that offer multiple benefits in a single formula. This trend has given rise to APIs that are anti-aging + UV-protective, hydrating, anti-inflammatory, and brightening anti-pollution. Formulators are developing multi-action APIs to simplify skincare routines while delivering clinical-grade performance.

- Nutricosmetics and Stress-Responsive APIs: There is a growing focus on the skin–brain connection, leading to the rise of nutricosmetics products formulated with APIs that impact emotional well-being through the skin. These include APIs that regulate cortisol levels, Actives promoting dopamine and serotonin release, and Calming ingredients that address stress-related skin aging. Such formulations appeal to consumers seeking holistic and mindful skincare experiences.

- Focus on Skin Barrier and Microbiome APIs: Skin barrier protection and microbiome health are becoming central themes in dermatology-inspired skincare. Key API trends include Ceramides and fatty acids for barrier repair, Prebiotics, probiotics, and postbiotics for microbiome balance, and Anti-inflammatory actives like niacinamide and panthenol.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Active Skincare Ingredients

One of the major factors driving the growth of the cosmeceutical API market is the rising global demand for active skincare solutions that blend beauty with health. Consumers are no longer satisfied with cosmetic products that offer only superficial benefits; they seek clinically effective formulations rooted in dermatology. This shift has triggered an increase in demand for APIs such as retinoids, peptides, and antioxidants, particularly in anti-aging and pigmentation treatment categories.

Additionally, the growing prevalence of skin-related disorders such as acne, rosacea, and photoaging, exacerbated by pollution and lifestyle stressors, is fueling market expansion. Regulatory bodies that encourage ingredient transparency and clinical validation are further prompting brands to invest in high-quality, pharmaceutical-grade APIs, ensuring both efficacy and safety.

Restraint

High Costs and Complex R&D

Despite its promising trajectory, the cosmeceutical API market faces several challenges that could impede growth. One of the primary restraints is the high cost and complexity of R&D involved in developing stable, bioavailable, and multifunctional APIs. Unlike standard cosmetics, cosmeceuticals require rigorous testing and validation to meet both consumer and regulatory expectations. Additionally, regulatory ambiguity in classifying cosmeceuticals (as cosmetic or pharmaceutical) in various countries often leads to compliance issues and delayed product launches. Supply chain disruption, particularly in sourcing rare botanical ingredients or peptides, also adds to production bottlenecks. Lastly, the presence of unregulated or counterfeit cosmeceutical products in the market undermines consumer trust, impacting the growth of authentic, science-backed formulations.

Opportunity

Rising Demand for Personalized Cosmeceuticals and Expansion into Emerging Markets

A significant opportunity in the market lies in the rising demand for personalized and AI-enhanced skincare, where APIs are tailored to individual genetic profiles, environmental exposure, and microbiome variations. This opens avenues for cosmeceutical brands to offer hyper-customized solutions that are data-driven and diagnostic-led. Moreover, Asia-Pacific presents vast untapped potential due to its growing middle-class population, increasing skincare awareness, and cultural acceptance of wellness-focused beauty routines. Another key opportunity is the expansion of plant-based and biotech-derived APIs, appealing to the clean beauty and vegan consumer base. With rising awareness about ingredient sustainability and ethical sourcing, companies embracing green chemistry and eco-conscious formulation practices are likely to gain a competitive edge.

Product Type Insights

Why Did the Retinoids Segment Dominate the Market in 2024?

The retinoids segment dominated the cosmeceutical API market with the largest share in 2024. This is mainly due to their proven efficacy in cell regeneration, collagen stimulation, and wrinkle reduction. As Vitamin A derivatives, retinoids such as tretinoin and retinol are widely adopted in anti-aging and acne-treatment formulations. Their scientifically proven performance in reversing photo-aging, fine lines, and hyperpigmentation makes them a staple across premium skincare products. Moreover, the global rise in dermatologist-recommended skincare and consumer demand for evidence-based activities has solidified the dominance of retinoids. As clean-label and high-performance products gain traction, retinoids remain at the forefront of therapeutic and cosmetic skin innovations.

On the other hand, the peptides and proteins segment is expected to grow at the fastest rate in the upcoming period due to their multi-functional role in skin repair, hydration, firmness, and elasticity. These bioengineered actives mimic the skin's natural processes, making them ideal for sensitive, aging, or stressed skin types. Cosmeceutical formulations are increasingly incorporating signal peptides, carrier peptides, and enzyme-inhibiting proteins to stimulate collagen synthesis, reduce inflammation, and enhance skin barrier function. With a rising preference for biologically compatible and precision-targeted ingredients, peptides and proteins are becoming the preferred choice in both luxury and mass-market skincare products.

Application Insights

How Does the Anti-Aging Segment Dominate the Cosmeceutical API Market in 2024?

The anti-aging segment dominated the market with a major revenue share in 2024. This is due to the global pursuit of youthful, radiant skin. Consumers across all age groups, especially those aged 30 and above, are seeking products that offer visible wrinkle reduction, improved skin texture, and prevention of age spots. APIs like retinoids, peptides, antioxidants (vitamin C and E), and hyaluronic acid are in high demand for their clinically validated anti-ageing results. Additionally, advancements in delivery systems such as liposomes and nanoemulsions have enhanced API penetration, making anti-aging formulations more effective than ever. This segment continues to lead the market with high R&D activity and consumer loyalty.

Meanwhile, the skin whitening/brightening segment is expected to grow at the fastest rate during the forecast period, as consumers are increasingly seeking safe, effective, and non-toxic alternatives to harsh bleaches and steroids. This demand has boosted the development of APIs like niacinamide, kojic acid, arbutin, glutathione, and peptides that inhibit melanin production without damaging skin. The influence of K-beauty, social media, and growing male grooming trends has further contributed to the segment's explosive growth. As regulatory standards rise, this market is shifting towards natural and science-backed brightening agents, offering immense commercial potential.

End-User Insights

What Made Cosmetic Companies the Dominant Segment in the Market?

The cosmetic companies segment dominated the market with the biggest share in 2024 due to their increased pipeline for innovative cosmeceuticals. These companies remain the major end-users, accounting for the highest volume of API consumption for skincare, haircare, and personal care formulations. Established beauty brands are integrating dermatology and pharmacology into product development, fueling demand for clinical-grade ingredients with proven efficacy. Driven by the rise in clean beauty, anti-ageing solutions, and high-performance products, these companies are heavily investing in API R&D, private labelling, and global product launches. From serums and masks to night creams and ampoules, cosmetic companies are transforming beauty routines with science-driven innovations, cementing their dominance in the API ecosystem.

On the other hand, the contract manufacturers segment is expected to grow at the fastest rate during the upcoming period. The growth of the segment is attributed to the rising trend of outsourcing. Due to a significant rise in the cosmeceutical pipeline, cosmetic and pharmaceutical companies are outsourcing their production operations to third parties, offering cost-effective, scalable, and customized production solutions. Contract manufacturers are becoming innovation hubs, offering end-to-end services from API sourcing and formulation to packaging and regulatory compliance. Their flexibility, compliance with GMP standards, and expertise in ingredient integration and delivery technology make them vital enablers of both speed-to-market and quality assurance in the fast-evolving cosmeceutical industry.

Regional Insights

Why Did North America Dominate the Cosmeceutical API Market?

North America dominated the global cosmeceutical API market with the largest share in 2024. This is mainly due to the increased demand for anti-aging products, coupled with a vast aging population. The region also benefits from high dermatological awareness, premium skincare consumption, and advanced research infrastructure. The U.S. boasts a robust base of pharmaceutical and biotech companies actively collaborating with cosmetic brands to develop partnered, science-backed APIs. Consumers in North America are more inclined toward products that promise clinical efficacy, anti-aging benefits, and skin restoration, making APIs such as retinoids, hyaluronic acid, and peptides extremely popular. Moreover, the region's regulatory framework, although stringent, encourages transparency, product safety, and innovation, which fosters a climate where equality APIs can thrive. With the rise of personalized skincare and the growing demand for multifunctional activities, North America holds a stronghold on the market.

European Cosmeceutical API Market Trends

Europe is expected to grow at the fastest rate in the coming years, driven by its long-standing tradition of skincare excellence and the recent surge in biotechnology adoption. Countries like France, Germany, and Switzerland are investing heavily in R&D, especially in sustainable and green APIs sourced from natural origins. European consumers place a high value on clean-label, eco-conscious, and vegan beauty products, which has led to a spike in demand for plant-based and probiotic APIs. Regulatory bodies like the European Medicines Agency and Reach have fostered an environment of safety, quality, and standardization, encouraging manufacturers to push the boundaries of scientific skincare. Furthermore, the region's aging population, particularly in Western Europe, is driving demand for anti-aging and dermal restoration APIs, driving market growth.

Asia-Pacific Cosmeceutical API Market Trends

Asia Pacific is expected to witness notable growth. The region is becoming the epicenter of skincare innovation. Countries like South Korea, Japan, China, and India are at the forefront of the cosmeceutical boom, each contributing in unique ways. South Korea's K-beauty movement has popularized functional skincare layered with advanced API's while Japan focuses on minimalism and dermal health is leading to breakthroughs in anti-inflammatory on minimalism and dermal health is leading to breakthroughs in anti-inflammatory and cell-repairing actives.

Meanwhile, China and India are witnessing rising urbanization, increased disposable incomes, and awareness of skincare science, prompting a shift from traditional cosmetics to evidence-based cosmeceuticals. The market is also fueled by a young demographic embracing skincare at an early age, coupled with a growing demand for whitening, brightening, and anti-pollution APIs. Regional manufacturers are increasingly investing in indigenous botanicals and Ayurvedic APIs, driving innovations and boosting market growth.

Cosmeceutical API Market Companies

- L'Oréal S.A.

- Allergan Plc.

- Avon Products Inc.

- Johnson & Johnson

- Procter & Gamble Co.

- The Estée Lauder Companies Inc.

- Merck & Company Inc.

- Royal DSM NV

- Unilever NV

- Evonik Industries AG

Recent Developments

- In June 2025, the prices of active pharmaceutical ingredients (APIs), which are essential for drug manufacturing, experienced a notable decline. This decrease in prices is providing considerable relief to India's pharmaceutical industry, benefiting manufacturers and potentially lowering costs for consumers. The reduction in API costs reflects broader market trends and may enhance competitiveness within the industry, fostering growth and innovation in the sector. Additionally, this price drop could encourage investment in the pharmaceutical market, ultimately supporting the availability of affordable medications for the population.

(Source: https://economictimes.indiatimes.com) - On June 2025, Hikal said that it had successfully cleared the Good Manufacturing Practices (GMP) inspection conducted by the Brazilian Health Regulatory Agency (ANVISA) at its API manufacturing unit in Jigani, Bengaluru, Karnataka. The audit, which covered multiple active pharmaceutical ingredients (APIs), was conducted. The successful completion of the inspection reinforces Hikals compliance with international standards and strengthens its position in regulated markets like Brazil.

(Source: https://www.business-standard.com) - On June 2025, Natco Pharma Ltd. reported that its active pharmaceutical ingredient manufacturing facility in Mekaguda, Hyderabad, received one observation from the US Food and Drug Administration, which conducted an investigation.

(Source: https://www.ndtvprofit.com)

Segments Covered in Report

By Product Type

- Retinoids (e.g., Retinol, Tretinoin)

- Peptides and Proteins

- Hyaluronic Acid

- Alpha Hydroxy Acids (AHAs)

- Beta Hydroxy Acids (BHAs)

- Antioxidants (e.g., Vitamin C, Vitamin E)

- Botanicals (Plant Extracts)

- Enzymes

- Sunscreen Agents (e.g., Zinc Oxide, Titanium Dioxide)

- Skin Lightening Agents (e.g., Hydroquinone, Kojic Acid)

- Others

By Application

- Anti-aging

- Acne Treatment

- Skin Whitening/Brightening

- Hair Care

- Sun Protection

- Moisturizing

- Others

By End User

- Cosmetic Companies

- Pharmaceutical Companies

- Contract Manufacturers

- Research Organizations

By Region

- North America

- APAC

- Europe

- Latin America

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting