What is the CRISPR-Based Diagnostics Market Size?

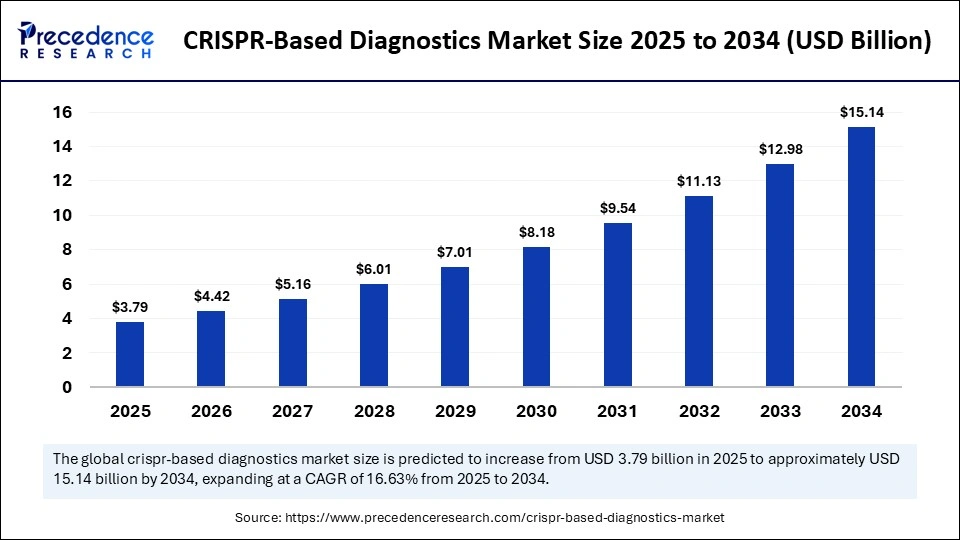

The global CRISPR-based diagnostics market size is anticipated at USD 3.79 billion in 2025 and is predicted to increase from USD 4.42 billion in 2026 to approximately USD 15.14 billion by 2034, expanding at a CAGR of 16.63% from 2025 to 2034. The market growth is attributed to growing disease burden, increasing demand for accurate diagnostics and point-of-care testing, as well as growing innovations and the application of CRISPR-based diagnostics.

Market Highlights

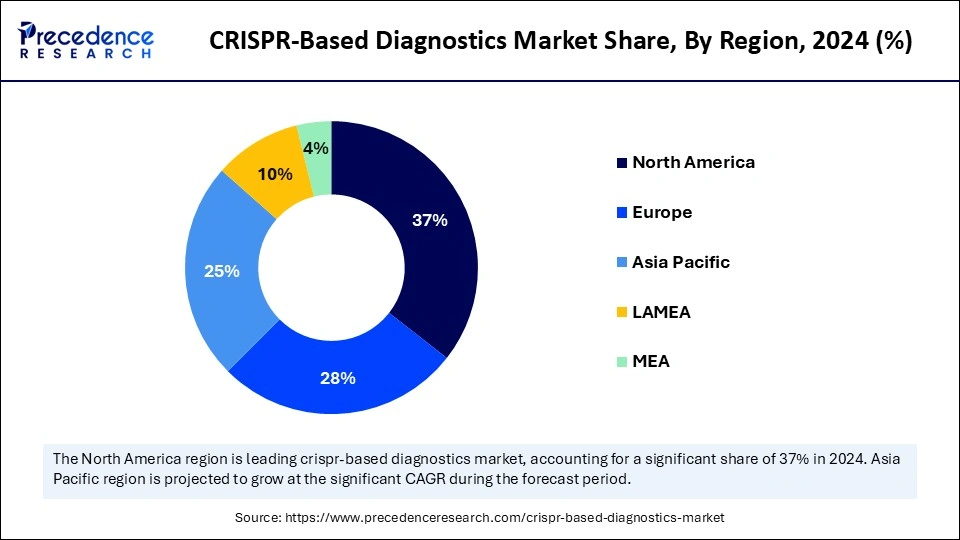

- North America dominated the global CRISPR-based diagnostics market holding more than 37% of market share in 2024.

- Asia Pacific is expected to be the fastest-growing at a notable CAGR from 2025 to 2034.

- By product type, the kits & assays segment held the major market share in 2024, accounting for 44%.

- By product type, the services segment is expected to be the fastest growing at a CAGR from 2025 to 2034.

- By technology/CRISPR platform, the Cas12-based diagnostics segment contributed the biggest market share in 2024.

- By technology/CRISPR platform, the Cas13-based diagnostics segment is expected to be the fastest growing from 2025 to 2034.

- By detection method/readout, the fluorescence-based detection segment dominated the CRISPR-based diagnostics market in 2024.

- By detection method/readout, the optical & imaging-based detection is expected to be the fastest growing from 2025 to 2034.

- By application, the infectious disease detection segment dominated the global market with the largest share in 2024.

- By application, the oncology biomarker testing segment is expected to be the fastest growing from 2025 to 2034.

- By distribution channel, the direct sales to hospitals, labs & research centers segment held the major market share in 2024.

- By distribution channel, the online platforms & e-commerce segment is expected to be the fastest growing from 2025 to 2034.

Market Overview

The CRISPR-Based Diagnostics Market encompasses products, platforms, and services leveraging Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR) technology for the rapid, accurate, and cost-effective detection of nucleic acids associated with infectious diseases, genetic disorders, oncology biomarkers, and other conditions. CRISPR diagnostics use guide RNA (gRNA)-directed Cas enzymes (e.g., Cas12, Cas13, Cas9) to recognize specific DNA/RNA sequences and generate detectable signals through fluorescence, colorimetry, or electrochemical readouts. The market is driven by increasing demand for point-of-care (POC) testing, advancements in CRISPR platforms like SHERLOCK, DETECTR, and FELUDA, growing investments in genomics, and rising infectious disease outbreaks.

Impact of Artificial Intelligence on the CRISPR-Based Diagnostics Market

The precision of the CRISPR-based diagnostics can be enhanced by integrating it with AI. With the use of AI, the accuracy of CRISPR can be improved for disease detection. At the same time, the effectiveness of the CRISPR-based diagnostic can also be improved using AI. A vast amount of genomic data can be analyzed by AI, offering precision in the disease diagnosis by CRISPR. The disease risk prediction and complex genetic information are also provided by AI, promoting early diagnosis. Thus, by integrating AI, the diagnostic accuracy can be enhanced.

CRISPR-Based Diagnostics Market Growth Factors

- Growing diseases: Due to growing incidences of diseases, there is a rise in the demand for early and accurate diagnostics, which is increasing the use of CRISPR-based diagnostics.

- Growth in research and development: Due to growing R&D for developing therapeutic approaches, the use of CRISPR-based diagnostics is increasing, where they are also focusing on enhancing its applications.

- Rising use for point-of-care testing: The CRISPR-based diagnostics are increasingly being used for emergency situations, remote areas, and home testing for rapid and accurate diagnosis of diseases.

- Increasing demand for personalized medicine: Due to growing demand for personalized medicine, the use of CRISPR-based diagnostics is increasing, as it can identify the genetic information of the patient, promoting their development.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.79 Billion |

| Market Size in 2026 | USD 4.42 Billion |

| Market Size by 2034 | USD 15.14 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 16.63% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Technology/CRISPR Platform, Detection Method/Readout, Application, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Why is the Growing Demand for Accurate Diagnostics a Driver in the CRISPR-Based Diagnostics Market?

Due to growing diseases, there is a rise in the demand for accurate diagnoses. This, in turn, increases the use of CRISPR-based diagnostics due to their high sensitivity and specificity. This helps in detecting the disease rapidly with improved accuracy. It also helps in the detection of mutating targets, which in turn increases their use for early diagnosis of various diseases. At the same time, it also offers reproducible diagnostics, which is increasing its use. Thus, this drives the CRISPR-based diagnostics market growth.

Restraint

High cost

For the development of CRISPR-based diagnostics, specialized equipment are required along with recurrent use of reagents. This increases the cost of their development, making it expensive. This limits the adoption of the diagnostics by hospitals with limited infrastructure or in remote areas. Thus, high cost restrains the use of CRISPR-based diagnostics.

Opportunity

How Does Growing CRISPR-Based Diagnostics Innovation Expand Opportunities in the CRISPR-Based Diagnostics Market?

There is a growth in the innovations of CRISPR-based diagnostics to enhance their accuracy and applications. Different types of platforms are being developed to improve their speed and sensitivity. At the same time, innovations are also being made to promote its use as a point-of-care diagnostic solution or for home testing. Additionally, the industries are also focusing on using it for the detection of multiple targets simultaneously, for developing multiplexing diagnostics. Similarly, portable CRISPR-based diagnostics are also being developed. Thus, these innovations are promoting the CRISPR-based diagnostics market growth.

CRISPR-Based Diagnostics MarketSegment Insights

Product Type Insights

By product type, the kits & assays segment held the largest share of the market in 2024, as it was easy to use. It also provided ready-to-use materials, which enhanced the testing speed. This, in turn, increased their use for R&D purposes. This enhanced the market growth.

By product type, the services segment is expected to show the highest growth during the upcoming years due to growing demand for customized assays. They are also being used in clinical trials. Additionally, the growing trend of outsourcing is contributing to the same.

Technology/CRISPR Platform Insights

By technology/CRISPR platform, the Cas12-based diagnostics segment led the market in 2024, driven by its high specificity and sensitivity. This provided an accurate diagnosis of the disease. They were also used to detect pathogens. Moreover, due to the fast results, their use in emergency situations also increased.

By technology/CRISPR platform, the Cas13-based diagnostics segment is expected to show the fastest growth rate over the coming years, as it enables the detection of RNA viruses. This is increasing its use in the diagnosis of infectious diseases. Furthermore, innovations are being made to enhance its use in the detection of neurological diseases.

Detection Method/Readout Insights

By detection method/readout, the fluorescence-based detection segment held the dominating share of the market in 2024, as it provided quantitative results. They demonstrated high sensitivity, which enhanced their diagnostic accuracy. This, in turn, increased their use in a wide range of disease diagnoses. Thus, this enhanced the market growth.

By detection method/readout, the optical & imaging-based detection segment is expected to show the highest growth over the forecast period, due to its ease of use. They are being used as a point-of-care diagnostic solution. Advancements are also increasing their accessibility. This is increasing their use for remote diagnosis.

Application Insights

By application, the infectious disease detection segment led the global market in 2024, due to its increasing incidence. This increased the use of CRISPR-based diagnostics for their rapid diagnosis. It also provided accurate results with increased sensitivity. Moreover, they were also used for decentralized testing.

By application, the oncology biomarker testing segment is expected to show the fastest growth rate during the predicted time, as there is a rise in the demand for their early diagnosis. With the use of the CRISPR-based diagnostic, the mutation can be detected accurately. Moreover, due to its non-invasive diagnostic technique, its use is increasing.

Distribution Channel Insights

By distribution channel, the direct sales to hospitals, labs & research centers segment held the major market share in 2024, for rapid diagnostic purposes. They were the primary user of the CRISPR-based diagnostics. The CRISPR-based diagnostics were used for research purposes or for training. Moreover, their continuous use increased demand for them.

By distribution channel, the online platforms & e-commerce segment is expected to show the highest growth over the coming years, as it enhances accessibility. This is increasing their use in remote areas as well. Moreover, they are increasing patient convenience by providing home deliveries. Furthermore, their affordability is also enhancing their use.

CRISPR-Based Diagnostics Market Regional Insights

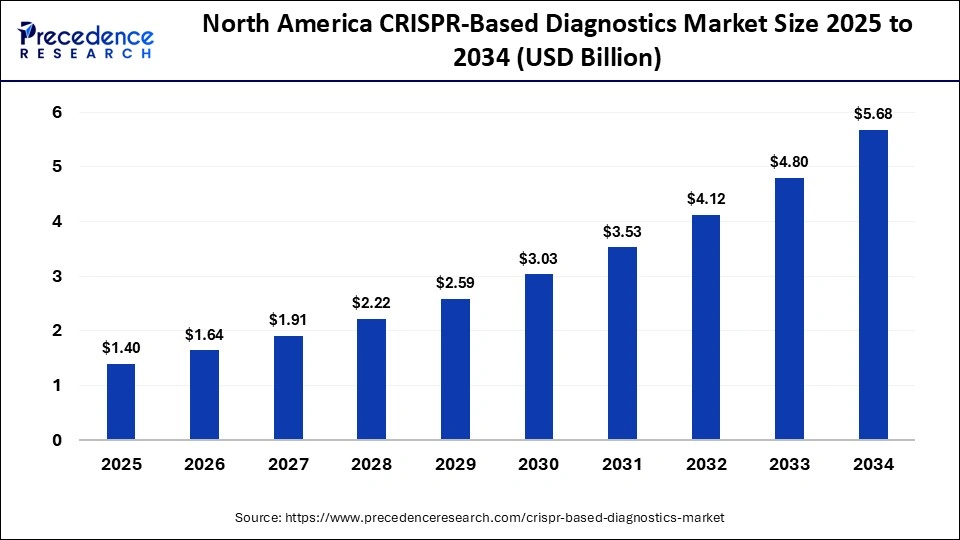

The North America CRISPR-based diagnostics market size is estimated at USD 1.40 billion in 2025 and is projected to reach approximately USD 5.68 billion by 2034, with a 16.82% CAGR from 2025 to 2034.

Why did North America Dominated the CRISPR-Based Diagnostics Market in 2024?

North America led the CRISPR-based diagnostic market in 2024 due to its well-developed healthcare sector. This, in turn, has increased the use of CRISPR-based diagnostics for early disease diagnosis and the development of personalized medications. Moreover, the growth in research and development also contributed to their increased use and to clinical trials. These developments were supported by government funding or investments. Additionally, the regulatory bodies also granted them fast-track approval, which in turn encouraged their innovations. Furthermore, the companies enhanced their development, leading to new collaborations among them. Thus, this, in turn, enhanced market growth.

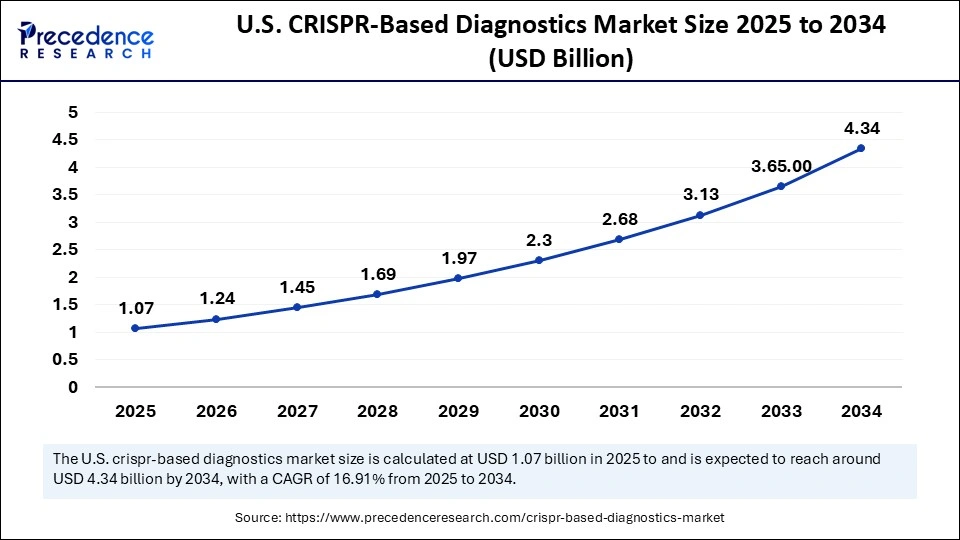

The U.S. CRISPR-based diagnostics market size is calculated at USD 1.07 billion in 2025 and is expected to reach nearly USD 4.34 billion in 2034, accelerating at a strong CAGR of 16.91% between 2025 and 2034.

U.S. Market Analysis

The United States is the most advanced commercial market for CRISPR-based diagnostics, driven by strong private funding, active start-ups scaling prototype assays, and a regulatory environment that enabled emergency use authorizations for CRISPR COVID tests during the pandemic, which helped prove the technologys real-world utility, according to the FDA in 2021. In 2024, Sherlock Biosciences began a large clinical trial for an over-the-counter CRISPR STI test, according to Reuters, showing the move from lab proofs toward consumer and decentralized applications.

At the same time, Mammoth Biosciences continued to broaden partnerships and product roadmaps in 2024 and 2025, according to company announcements, which reflects increasing industry investment in commercialization, platform robustness, and lower cost-of-goods for point-of-care use. These factors, combined with established clinical laboratory networks, payer focus on clinically validated performance, and ongoing R&D in multiplexed and instrument-lean CRISPR assays, make the U.S. market the leading proving ground for regulatory approval, scale-up, and early commercial rollouts.

Asia Pacific is anticipated to grow at the fastest rate in the CRISPR-based diagnostics market during the forecast period, due to the expanding healthcare sector. This, in turn, is enhancing the adoption of advanced technologies and promoting investments in CRISPR-based diagnostics. To minimize the disease burden, their use and manufacturing are increasing. There is a rise in the development of portable, cloud-based, AI-based, and smartphone-integrated CRISPR diagnostics. Moreover, the government is supporting these advancements to make these diagnostics more affordable by introducing new initiatives and investments. Furthermore, startups are also collaborating to advance the development of new CRISPR-based diagnostic tools. Thus, this promotes market growth.

China Market Analysis

China is a rapidly active market for CRISPR diagnostics research and pilot deployments, supported by deep genomics capacity, large sequencing and reagent manufacturers, and government interest in bioscience self-reliance, as reflected in expanded national genomics initiatives and industrial players moving into diagnostic technologies. Academic groups and domestic biotech firms have published new CRISPR assay methods and are exploring localized applications for infectious disease screening and oncology, according to recent scientific reviews.

Chinas market is shaped by strong domestic supply chains for sequencing and reagents, close industry-academia collaboration, and heightened geopolitical and regulatory scrutiny that has influenced cross-border partnerships, as noted in 2024 reporting on legislative measures and national security discussions involving major Chinese genomics firms. Taken together, China offers rapid research throughput and large pilot populations for CRISPR diagnostics validation, while commercial expansion will depend on domestic regulatory pathways, local manufacturing scale, and how international collaboration and data governance issues evolve.

Latin America became a notable region of growth for CRISPR-based diagnostics in 2024, driven by rising interest in rapid, low-cost molecular tests, growing local R&D capacity in genomics and synthetic biology, and increasing collaboration between global CRISPR companies and regional research centres and diagnostic labs. Over the past three years, CRISPR diagnostic platforms have moved from proof-of-concept toward clinical trials and commercial pilots, with companies pursuing partnerships to bring decentralized, point-of-care molecular testing to markets that need fast, field-ready diagnostics for infectious diseases and sexual health, according to company announcements in 2023 and 2024.

Regional public-health laboratories and academic groups have also adopted CRISPR assays for research and pilot screening programs, helping to build local technical expertise and demonstrate real-world utility, while governments and private funders have shown growing interest in funding molecular diagnostic capacity and innovation. These developments, combined with unmet needs for rapid testing outside central labs and the potential of CRISPR assays to be lower-cost and instrument-lean compared with some PCR workflows, positioned Latin America as an attractor for CRISPR diagnostic investment and pilots in 2024.

Brazil Market Analysis

Brazil stands out as the leading Latin American country for activity in CRISPR-based diagnostics, because of its large public and private healthcare systems, active genomics and biotech research community, and history of adapting molecular tools for public-health use. In 2023 and 2024, global CRISPR diagnostics developers announced clinical programs and partnerships aimed at expanding testing options, and Brazilian research institutions and diagnostic networks engaged in validation and pilot studies to evaluate CRISPR assays for pathogens and targeted molecular tests, according to press releases and institutional announcements from that period.

Brazils national labs and major research centres, with experience scaling molecular testing during the COVID-19 pandemic, provide a practical environment for translating CRISPR platforms from lab to field, although widespread clinical adoption will depend on regulatory approvals, reimbursement pathways, and supply-chain localization. Given its combination of technical capability, large patient volumes, and public-health demand for decentralised testing, Brazil is the most prominent Latin American market for CRISPR diagnostics development and early deployments.

Quick Picks by Regional Insights for CRISPR-Based Diagnostics Market

| Company | Country | Product/Platform | Uses |

| Sherlock Biosciences | U.S. | SHERLOCK/INSPECT CRISPR-based assay | Rapid, point-of-need detection of infectious diseases (e.g. COVID-19) using CRISPR-Cas13/12 technology. |

| Mammoth Biosciences | U.S. | Ultra-small Cas systems (Cas12, Cas14) for diagnostics | Development of next-generation CRISPR diagnostics platforms with enhanced sensitivity and versatility. |

| CrisprBits | India | PathCrisp CRISPR diagnostics platform | Affordable CRISPR-based diagnostics for infectious diseases and rare disease screening in resource-constrained settings. |

| CASPR Biotech | Argentina/U.S. | Portable CRISPR-Cas12 device | Low-cost CRISPR diagnostics tool intended for infectious disease detection via new Cas enzymes from extremophiles. |

| Thermo Fisher Scientific | U.S. | CRISPR-based molecular diagnostics reagents & platforms | Supplies materials and platforms supporting CRISPR diagnostics development (drives ecosystem). |

CRISPR-Based Diagnostics Market Vlaue Chain

The value chain starts with sourcing Cas enzymes (Cas12, Cas13, Cas9 variants), CRISPR guide RNAs, reporter molecules, nucleic acid substrates, and microfluidic consumables. Suppliers are mainly biotech firms and synthetic biology companies (e.g., IDT, Twist Bioscience, Thermo Fisher) specializing in high-purity, lab-grade reagents. Quality, stability, and lot-to-lot reproducibility are critical for assay performance. Upstream value capture lies with companies owning enzyme engineering IP and scalable biomanufacturing capabilities, as these form the foundation of all CRISPR-based diagnostic platforms.

This is the core value-creation stage, where CRISPR-based reagents are integrated into diagnostic kits and platforms (e.g., SHERLOCK, DETECTR, CRISPR-Chip). Developers focus on sensitivity, specificity, multiplexing ability, and instrument-free detection for rapid testing. Key technologies include lyophilized reagents, lateral flow readouts, and microfluidic integration. Companies in this stage invest heavily in R&D, clinical validation, and regulatory submissions (FDA EUA, CE-IVD). Value capture is highest for platform developers with proprietary detection chemistries and protected intellectual property enabling licensing or OEM partnerships.

Diagnostic kits are distributed through clinical laboratories, point-of-care testing facilities, hospitals, and public health networks. Effective downstream integration requires cold-chain logistics, user training, and digital data connectivity for result reporting. In low-resource settings, partnerships with NGOs and government agencies are essential for adoption. Downstream value capture lies in scalability, regulatory approval, and distribution networks, where firms with strategic alliances (e.g., Mammoth Biosciences Aptitude, Sherlock Biosciences Cepheid) gain faster market penetration and recurring revenue from consumables.

CRISPR-Based Diagnostics Market Companies

- Headquarters: Cambridge, Massachusetts, United States

- Year Founded: 2018

- Ownership Type: Privately Held

History and Background

Sherlock Biosciences was founded in 2018 by leading scientists from the Broad Institute of MIT and Harvard, including Dr. Feng Zhang, Dr. Jim Collins, and Dr. Omar Abudayyeh. The company was established to harness CRISPR and synthetic biology for next-generation molecular diagnostics and biological computation. Sherlock Biosciences gained early recognition for its SHERLOCK (Specific High-sensitivity Enzymatic Reporter unLOCKing) platform, which uses CRISPR-based detection of nucleic acids.

In the context of the DNA data storage market, Sherlock Biosciences contributes through its innovations in programmable molecular systems and nucleic acid manipulation. Its CRISPR-based technologies have the potential to enable precise data retrieval, molecular indexing, and readout systems for DNA-encoded information, complementing existing synthesis and sequencing platforms used in molecular data storage.

Key Milestones / Timeline

- 2018: Founded with initial funding from the Broad Institute and MIT

- 2019: Launched SHERLOCK CRISPR-based diagnostic platform

- 2020: Received FDA Emergency Use Authorization (EUA) for its CRISPR-based COVID-19 test

- 2022: Began exploratory research in molecular computing and nucleic acid data processing

- 2024: Announced collaborative initiatives exploring CRISPR tools for DNA data storage and molecular indexing applications

Business Overview

Sherlock Biosciences operates as a biotechnology company focused on CRISPR and synthetic biology-based molecular systems. The companys core mission is to use programmable biology to detect, quantify, and manipulate genetic information. In the emerging DNA data storage space, Sherlocks expertise in nucleic acid programmability is being explored for molecular-level data readout and encoding validation within bio-computational architectures.

Business Segments / Divisions

- CRISPR Diagnostics and Molecular Detection

- Synthetic Biology and DNA-based Computation

- Collaborative Research and Development Programs

Geographic Presence

Sherlock Biosciences operates primarily in the United States, with partnerships and research collaborations across North America and Europe.

Key Offerings

- SHERLOCK and INSPECTR molecular detection platforms

- CRISPR-based nucleic acid manipulation systems

- Programmable molecular computation and data analysis tools

- Molecular indexing and readout solutions (research-stage)

Financial Overview

Sherlock Biosciences is a privately held company with funding from venture investors, including Northpond Ventures, Baidu Ventures, and the Open Philanthropy Project. The companys valuation and revenue are undisclosed, but it continues to expand its partnerships in diagnostics and molecular data technologies.

Key Developments and Strategic Initiatives

- 2021: Expanded SHERLOCK CRISPR detection capabilities to multiplex molecular systems

- 2023: Initiated research into DNA as a biological medium for information encoding

- 2024: Partnered with academic institutions to explore CRISPR-assisted molecular data retrieval

- 2025: Advanced CRISPR tools designed for high-precision DNA sequence indexing for data storage

Partnerships & Collaborations

- Collaborations with the Broad Institute and MIT for CRISPR-based molecular systems

- Partnerships with technology companies and synthetic DNA manufacturers for data encoding research

- Alliances with computational biology groups for molecular information processing

Product Launches / Innovations

- SHERLOCK CRISPR molecular detection platform (2019)

- INSPECTR synthetic biology based detection system (2020)

- Programmable CRISPR nucleic acid control platform for molecular computation (2024)

Technological Capabilities / R&D Focus

- Core technologies: CRISPR-Cas systems, synthetic biology, molecular computation, nucleic acid engineering

- Research Infrastructure: Internal R&D facilities in Cambridge and research collaborations with MIT and the Broad Institute

- Innovation focus: DNA as an information medium, CRISPR-assisted molecular indexing, and programmable DNA readout

Competitive Positioning

- Strengths: Founding expertise in CRISPR technology, strong institutional collaborations, and synthetic biology leadership

- Differentiators: Programmable molecular readout systems applicable to DNA data storage

SWOT Analysis

- Strengths: Advanced CRISPR expertise, institutional research backing, cutting-edge synthetic biology applications

- Weaknesses: Early-stage exploration of DNA data storage applications

- Opportunities: Integration of CRISPR in DNA storage retrieval and bio-computing

- Threats: Technical and scalability challenges in transitioning molecular tools for data infrastructure

Recent News and Updates

- March 2024: Sherlock announced exploratory research in molecular information encoding using CRISPR

- July 2024: Reported new CRISPR-Cas enzyme variants with enhanced sequence precision for bio-computation

- January 2025: Established partnership with an academic research consortium for DNA data readout and bio-storage applications

- Headquarters: Brisbane, California, United States

- Year Founded: 2017

- Ownership Type: Privately Held

History and Background

Mammoth Biosciences was founded in 2017 by Dr. Trevor Martin, Dr. Janice Chen, and Nobel Laureate Dr. Jennifer Doudna, co-inventor of CRISPR-Cas9 gene editing technology. The company was created to commercialize novel CRISPR systems for molecular diagnostics, therapeutics, and synthetic biology applications.

Mammoth Biosciences has emerged as a leader in programmable biology, developing compact and diverse CRISPR systems such as Cas14 and CasΦ (phi). These systems are capable of manipulating DNA and RNA with unprecedented precision and efficiency. In the context of the DNA data storage market, Mammoths technologies are being explored for molecular-level data reading, writing, and error correction, leveraging its CRISPR-based editing and detection tools to enhance DNA information encoding and retrieval fidelity.

Key Milestones / Timeline

- 2017: Founded in the San Francisco Bay Area by Jennifer Doudna and team

- 2018: Secured seed funding and initiated CRISPR-based diagnostic development

- 2020: Partnered with major healthcare organizations to develop CRISPR-based diagnostic platforms

- 2022: Began exploratory research on CRISPR enzymes for DNA computing and molecular storage applications

- 2024: Announced CRISPR-based molecular write-read framework for potential use in DNA data storage

Business Overview

Mammoth Biosciences develops CRISPR-based platforms for applications in diagnostics, therapeutics, and biotechnology. The companys focus on compact CRISPR enzymes allows integration into diverse biological and synthetic systems. Within the DNA data storage ecosystem, Mammoths CRISPR tools can be applied to precisely modify or retrieve encoded DNA sequences, offering molecular-level control critical to high-density, error-tolerant data storage.

Business Segments / Divisions

- CRISPR Diagnostics

- CRISPR Therapeutics and Editing

- Synthetic Biology and Molecular Engineering

Geographic Presence

Mammoth Biosciences operates primarily in the United States, with research collaborations in Europe and Asia through academic and industrial partnerships.

Key Offerings

- Compact CRISPR enzyme platforms (Cas14, CasΦ, and Cas12 families)

- Programmable molecular detection systems

- Molecular DNA editing and data encoding research tools

- Bio-computational CRISPR systems for DNA data manipulation (research-stage)

Financial Overview

Mammoth Biosciences has raised over $400 million USD in venture funding from leading investors including Mayfield, Decheng Capital, and Amazon Web Services. The company continues to expand its R&D and commercialization programs across diagnostics, therapeutics, and molecular data technologies.

Key Developments and Strategic Initiatives

- 2021: Expanded CRISPR toolkit with novel Cas enzymes for molecular manipulation

- 2023: Initiated molecular data research focusing on CRISPR-guided DNA editing for information storage

- 2024: Published findings on enzyme-directed molecular write and read operations

- 2025: Partnered with bioinformatics and DNA synthesis firms to develop CRISPR-assisted data storage frameworks

Partnerships & Collaborations

- Collaborations with academic research institutions for CRISPR-based data encoding methods

- Partnerships with biotechnology companies for integrating CRISPR into DNA data read-write systems

- Engagements with cloud and data storage technology partners for molecular information frameworks

Product Launches / Innovations

- CasΦ-based molecular editing toolkit (2023)

- CRISPR-guided DNA read-write prototype system (2024)

- Programmable bio-storage molecular architecture (2025)

Technological Capabilities / R&D Focus

- Core technologies: CRISPR-Cas enzyme engineering, molecular detection, nucleic acid manipulation, bio-computation

- Research Infrastructure: Headquarters R&D facility in Brisbane, California, and collaborations with UC Berkeley

- Innovation focus: Molecular data encoding, error correction, and DNA-based computation systems

Competitive Positioning

- Strengths: Pioneering CRISPR technology leadership, strong scientific pedigree, and diverse enzyme library

- Differentiators: Compact CRISPR enzymes optimized for programmable molecular manipulation

SWOT Analysis

- Strengths: Deep expertise in CRISPR biology, scalable molecular toolkits, high scientific credibility

- Weaknesses: Early-stage exploration of DNA data storage applications

- Opportunities: Integration of CRISPR into molecular data storage for enhanced precision and scalability

- Threats: Competition from established data storage developers and technology integration complexity

Recent News and Updates

- April 2024: Mammoth announced new CRISPR CasΦ enzyme applications for DNA editing and molecular computation

- August 2024: Reported collaboration with synthetic DNA firms for CRISPR-enabled data storage systems

- January 2025: Published white paper on programmable molecular frameworks for next-generation DNA data storage

Other Companies in the CRISPR-Based Diagnostics Market

- Caspr Biotech: Caspr Biotech develops portable CRISPR-Cas diagnostic devices for rapid and accurate detection of infectious pathogens. Its field-deployable diagnostic kits are designed to operate in resource-limited settings, providing high specificity and affordability. Casprs CRISPR systems are being adapted for use in emerging disease surveillance and public health response programs.

- CRISPR Diagnostics Ltd.: CRISPR Diagnostics Ltd. specializes in developing next-generation CRISPR-based point-of-care platforms for infectious disease detection. The companys microfluidics-integrated systems enable multiplexed, high-throughput CRISPR assays with quick turnaround times, addressing growing demand for fast and scalable molecular testing.

- Inscripta, Inc.: Inscripta provides CRISPR-enabled genome engineering platforms, including its Ony Digital Genome Engineering System, which supports assay optimization for diagnostic applications. Inscripta automated platform helps accelerate the design and validation of CRISPR-based diagnostic assays, enhancing accuracy and development speed for research and clinical use.

- Synthego Corporation: Synthego is a major provider of CRISPR reagents, synthetic guide RNAs, and genome editing tools, supporting diagnostic developers worldwide. The companys automation-driven workflows and synthetic RNA capabilities facilitate rapid prototyping and optimization of CRISPR-based detection systems.

- Danaher Corporation (Cepheid & IDT): Through subsidiaries Cepheid and Integrated DNA Technologies (IDT), Danaher plays a key role in CRISPR diagnostics. Cepheid provides molecular testing instruments and consumables, while IDT supplies CRISPR enzymes, gRNAs, and oligonucleotides essential for CRISPR assay development. This synergy positions Danaher as a strategic enabler of CRISPR diagnostic commercialization.

- Thermo Fisher Scientific Inc.: Thermo Fisher provides a comprehensive portfolio of molecular biology tools, Cas enzymes, and assay development kits used in CRISPR-based diagnostics. Its infrastructure supports scalable manufacturing of CRISPR components and integration with qPCR and sequencing platforms for advanced molecular detection.

- Merck KGaA (Sigma-Aldrich): Mercks Sigma-Aldrich brand supplies high-quality CRISPR-Cas nucleases, guide RNAs, and assay reagents for diagnostics and life sciences research. The companys global production capacity and regulatory compliance make it a preferred supplier for CRISPR assay developers.

- Agilent Technologies, Inc.: Agilent provides analytical instruments, molecular biology reagents, and PCR systems that complement CRISPR-based diagnostic workflows. Its precision detection and assay validation tools are instrumental in ensuring reproducibility and clinical-grade performance of CRISPR tests.

- Bio-Rad Laboratories, Inc.: Bio-Rads digital PCR and molecular diagnostic technologies play a crucial role in CRISPR-based assay quantification and validation. Its Droplet Digital PCR (ddPCR) systems enable ultra-sensitive nucleic acid quantification, supporting the verification of CRISPR diagnostic performance.

- Ginkgo Bioworks: Ginkgo Bioworks applies synthetic biology to enhance CRISPR enzyme discovery and optimization for diagnostics. Its biofoundry platform supports high-throughput screening and design of CRISPR-based detection systems, enabling customized solutions for diagnostic developers.

- GenScript Biotech Corporation: GenScript supplies custom CRISPR reagents, enzymes, and molecular biology components essential for CRISPR-based diagnostic research. Its global logistics network and manufacturing expertise support large-scale assay development and commercialization.

- F. Hoffmann-La Roche Ltd.: Roche integrates CRISPR-based detection into its advanced molecular diagnostics portfolio. Leveraging its strengths in PCR, sequencing, and digital health technologies, Roche is exploring CRISPR diagnostics for infectious disease, oncology, and genetic testing, with an emphasis on clinical-grade validation and scalability

Recent Developments

- In January 2025, in Bengaluru, a CRISPR gene editing and diagnostics laboratory was inaugurated by CrisprBits Private Limited, which is a Bengaluru-based biotechnology startup. The new facility consists of advanced infrastructure, which includes spaces for cell and tissue culture, molecular biology research, cleanroom operations, lyophilization, and bacterial culture. Moreover, to support the stem cell research specialized tissue culture area and a gene editing section will also be provided in this laboratory.(Source: https://www.prnewswire.com)

- In June 2025, a follow-on investment from Oost NL and SHIFT was received by Scope Biosciences B.V. A total of €2.5 million EIC Transition Grant was also provided to the company. Thus, a total of €6 million in seed-stage funding was received by ScopeBio by combining venture and strategic capital investments with non-dilutive support from leading Dutch and European innovation programs. These investments will be used by the company to accelerate the development of its next-gen CRISPR-based molecular diagnostics platform, which is scopeDx, to offer field-ready, ultra-precise, portable, single-nucleotide detection, eliminating the need for centralized labs and proprietary hardware, which is the ultimate mission of ScopeBio. (Source: https://www.wur.nl)

CRISPR-Based Diagnostics Market Segments Covered in the Report

By Product Type

- Kits & Assays

- Instruments & Devices

- Software & Data Analytics Tools

- Services

By Technology/CRISPR Platform

- Cas12-Based Diagnostics

- Cas13-Based Diagnostics

- Cas9-Based Diagnostics

- Other Novel Cas Enzymes

By Detection Method/Readout

- Fluorescence-Based Detection

- Lateral Flow Assays

- Electrochemical Detection

- Optical & Imaging-Based Detection

By Application

- Infectious Disease Detection

- Oncology Biomarker Testing

- Genetic Disorder Screening

- Prenatal & Neonatal Diagnostics

- Agricultural Pathogen Detection

- Environmental & Food Safety Testing

By Distribution Channel

- Direct Sales to Hospitals, Labs & Research Centers

- Distributors & Channel Partners

- Online Platforms & E-Commerce

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting