What is the Dementia Treatment Market Size?

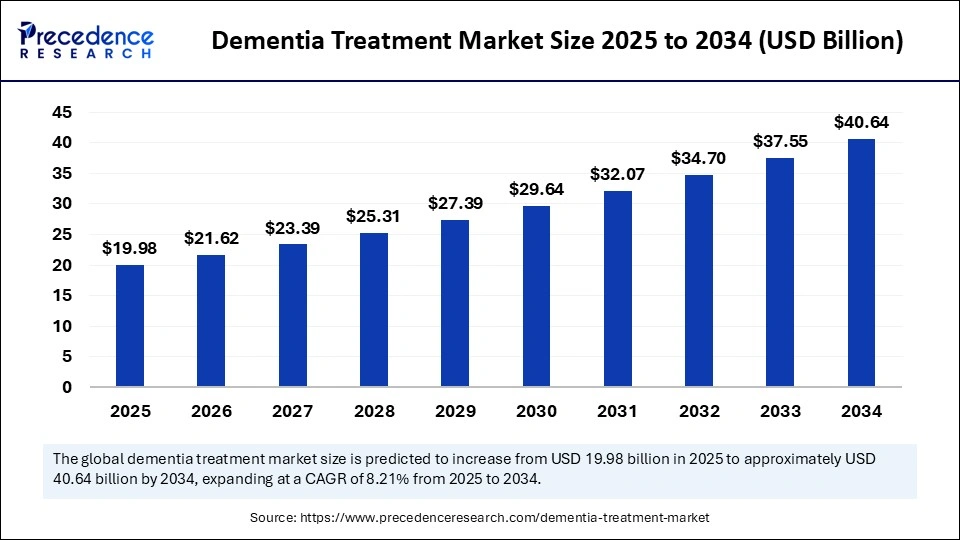

The global dementia treatment market size accounted for USD 19.98 billion in 2025 and is predicted to increase from USD 21.62 billion in 2026 to approximately USD 40.64 billion by 2034, expanding at a CAGR of 8.21% from 2025 to 2034. The market for dementia treatment is driven by rising healthcare expenditure, a surge in the prevalence of dementia, a rising geriatric population, increasing R&D activities, and the increasing introduction of new therapeutic products.

Market Highlights

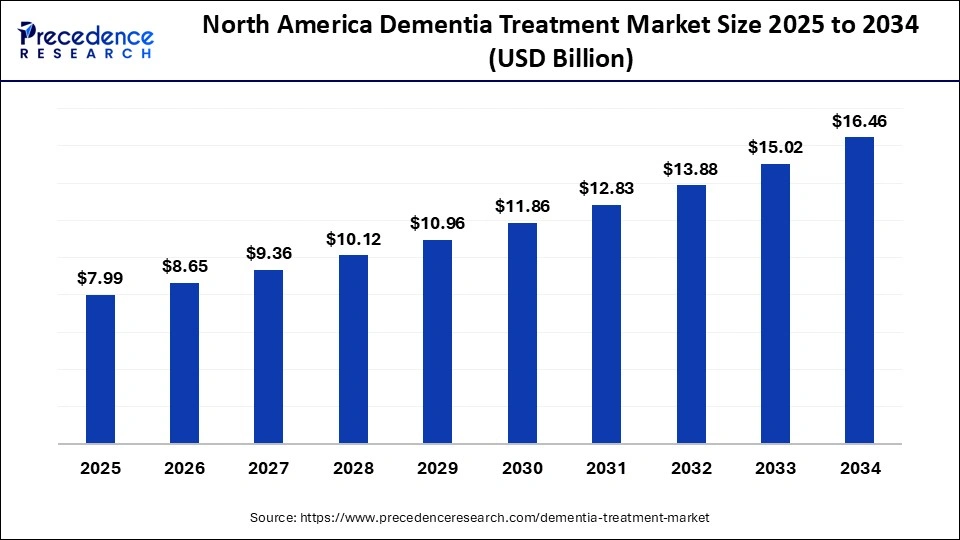

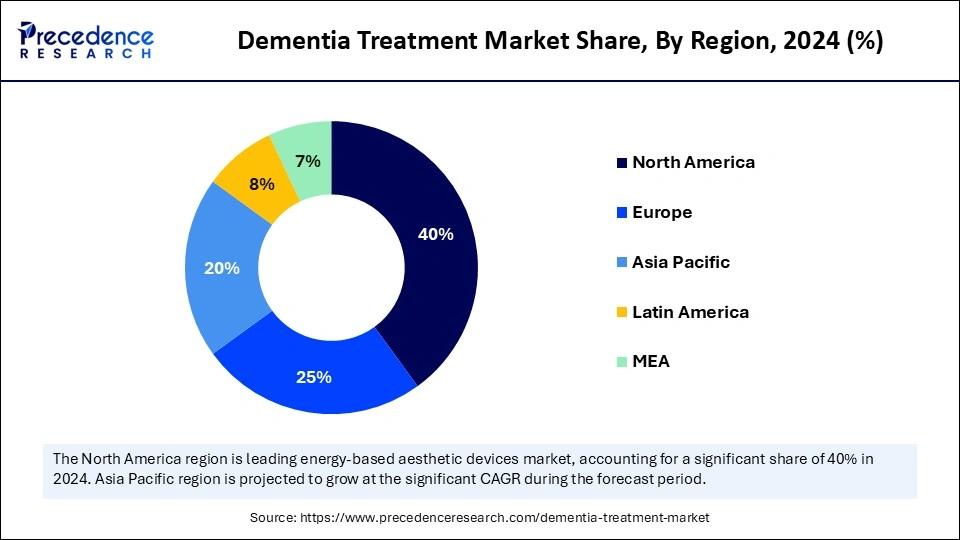

- North America dominated the market, holding the largest share of 40% in 2024.

- The Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By dementia type, the Alzheimer Disease segment held the largest market share of 55% in 2024.

- By dementia type, the Lewy body dementia segment is growing at a remarkable CAGR between 2025 and 2034.

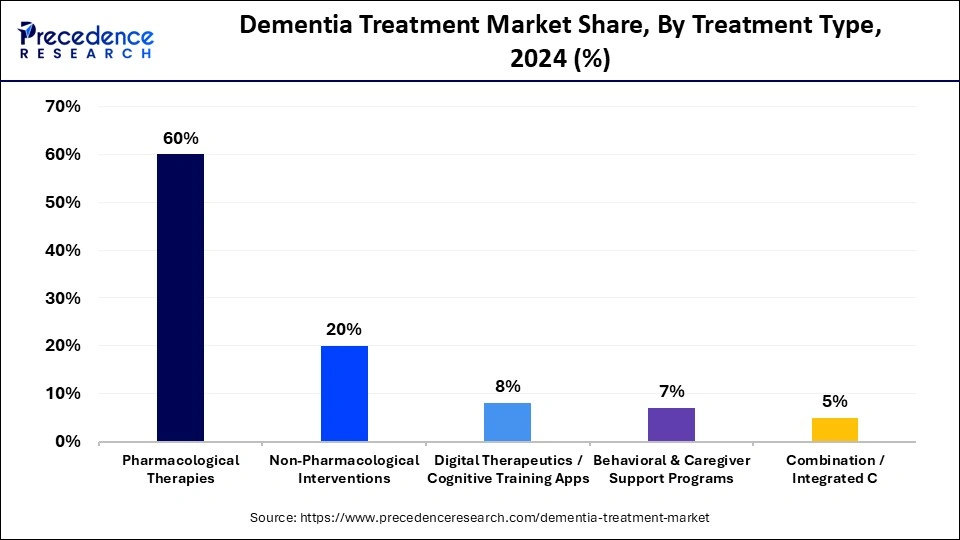

- By treatment type, the pharmacological therapies segment contributed the the biggest market share of 60% in 2024.

- By treatment type, the digital therapeutics / cognitive training apps segment is expanding at a strong CAGR between 2025 and 2034.

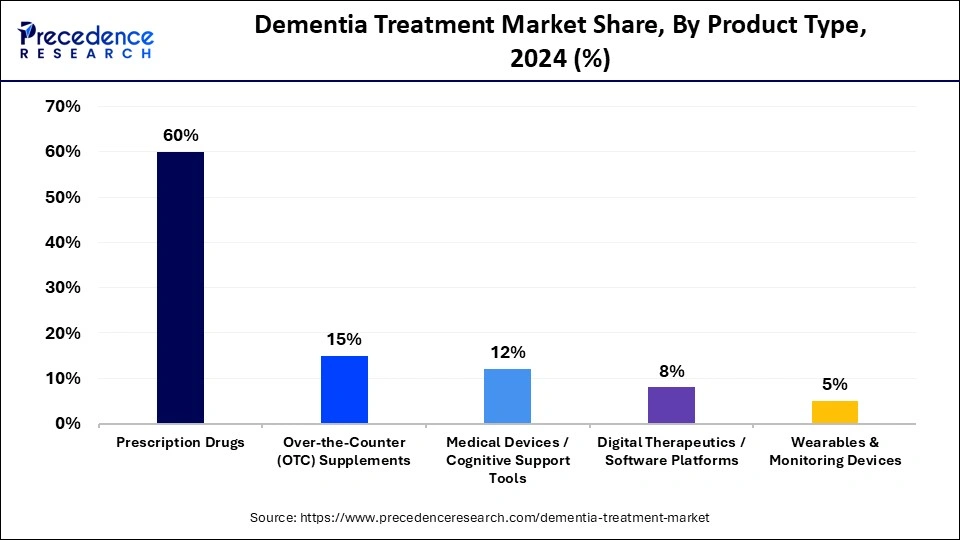

- By product type, the prescription drugs segment accounted for the biggest market share of 60% in 2024.

- By product type, the digital therapeutics/software platforms segment is set to grow at the fastest CAGR between 2025 and 2034.

- By end-user, the hospitals & neurology clinics segment held the major market share of 40% in 2024.

- By end-user, the home care/assisted living facilities segment is growing at a remarkable CAGR between 2025 and 2034.

Navigating Dementia Care: Innovative Treatments Emerge

Dementia treatment aimed at managing, slowing the progression, or alleviating symptoms of dementia, a group of neurodegenerative disorders characterized by cognitive decline, memory loss, and impaired daily functioning. These conditions place a heavy burden on patients, families, and healthcare systems, which increases the need for therapies that support long-term independence and quality of life. Growing diagnosis rates and an aging global population are further strengthening demand for comprehensive care approaches.

Treatments include pharmacological therapies such as cholinesterase inhibitors, NMDA receptor antagonists, and anti-amyloid monoclonal antibodies, as well as non-pharmacological interventions like cognitive stimulation, behavioral therapies, and digital therapeutics. These options help slow symptom progression, stabilize daily routines, and support emotional well-being. Advances in digital health tools and earlier screening programs are also improving access to personalized care and continuous monitoring.

AI Integration: Reshaping the Dementia Treatment Landscape

As technology continues to evolve, Artificial Intelligence (AI) emerges as a transformative force. It is significantly accelerating the growth of the dementia treatment market by improving diagnostic accuracy, allowing for earlier diagnosis, facilitating personalized medicine, and supporting tailored treatment plans. AI can detect early signs of dementia before clinical symptoms appear, which is critical for timely intervention.

AI integration has significantly accelerated the drug discovery process and clinical trials for dementia treatment, which have traditionally been long and expensive. AI-driven imaging tools can analyze brain scans and cognitive patterns, allowing healthcare professionals to identify dementia at its earliest stages and improve treatment outcomes through timely intervention and personalized care strategies tailored to an individuals unique needs, genetic profile, and lifestyle factors.

Dementia Treatment Market Outlook

Between 2025 and 2030, the dementia treatment industry is expected to experience accelerated growth, driven by the improved diagnostics enabling earlier detection and treatment initiation, expansion of digital therapeutics, a rapidly aging global population, increasing prevalence of dementia, and growing demand for absolute treatment. Additionally, the introduction and regulatory approvals of new disease-modifying therapies that expand addressable patient populations and treatment paradigms are anticipated to propel the growth of the dementia treatment market.

Leading players are expanding their geographical presence. For instance, according to a news report in Kathimerini, the countrys leading daily newspaper, in September 2025, Greece announced the creation of a major new Center of Excellence for Dementia, in a move to fast-track treatment of cognitive decline across the country and bring support for despairing families of those suffering from Alzheimer. The new facility, the first of its kind in Greece, will link up many eminent scientists in the field of dementia, including several internationally recognized Greek expats working on research into the condition.

Several global strategic investors and major market players in the dementia treatment market. For instance, in September 2025, the CUREator + Dementia and Cognitive Decline BioMedTech Incubator today announced seven companies will receive $15,765,871 in non-dilutive funding. With funding from the Australian Federal government Department of Health, Disability and Aged Care and the Medical Research Future Fund, CUREator+ supports the development and commercialization of medical innovations that improve the lives of people affected by dementia and cognitive decline worldwide.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 19.98 Billion |

| Market Size in 2026 | USD 21.62 Billion |

| Market Size by 2034 | USD 40.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.21% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Dementia Type, Treatment Type, Product Type, End-User/Customer Segment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regulatory Landscape in the Dementia Treatment Market

| Country/Region | Regulatory Body | Key Regulations | Focus Areas | Notable Notes |

|

United States |

U.S. Food and Drug Administration (FDA) | Federal Food, Drug, and Cosmetic Act (FD&C Act) and Public Health Service Act (PHS Act) | Demonstrating Clinical Benefit, Patient-Focused Drug Development (PFDD), Safety Monitoring, and Specific Indications | The regulatory body is responsible for ensuring the safety and effectiveness of drugs and medical devices, including those used to treat dementia. |

| European Union | European Medicines Agency (EMA) | Regulation (EU) 2017/745 on medical devices (MDR) | Clinical Data and Evidence, Biomarkers, Risk Management, Post-Market Surveillance, and Traceability and Transparency | The EU for the dementia market strongly focuses on developing therapies and on using new diagnostic criteria and biomarkers for early and even asymptomatic disease stages to enable earlier intervention. |

| India | Central Drugs Standard Control Organization (CDSCO) | The Drugs and Cosmetics Act, 1940, and the Drugs and Cosmetics Rules, 1945 | New Drug Approval and Clinical Trials, Medical Device Regulation, Quality and Safety Standards, and Data Privacy. | The CDSCO ensures the safety, efficacy, and availability of dementia treatments. |

Dementia Treatment Market Segment Insights

Dementia Type Insights

The alzheimers disease segment is dominating the dementia treatment market by holding a share of 55%, driven by the increasing incidences of alzheimers disease, increasing awareness regarding the early symptoms among people, and the rising geriatric population. According to the Alzheimers Association, nearly 7 million Americans are living with Alzheimers. By 2050, this number is projected to rise to nearly 13 million. An estimated 7.2 million Americans age 65 and older are living with Alzheimers in 2025. Seventy-four percent are age 75 or older. About 1 in 9 people age 65 and older (11%) has Alzheimer. Almost two-thirds of Americans with Alzheimers are women. The lifetime risk for Alzheimers at age 45 is 1 in 5 for women and 1 in 10 for men.

The Lewy body dementia (LBD) segment is anticipated to grow at the fastest CAGR in the dementia treatment market. The segment includes Parkinsons disease dementia and dementia with Lewy bodies. Lewy body dementia (LBD) is characterized by abnormal deposits of the protein alpha-synuclein in the brain. Lewy body dementia (LBD) is the third most common cause of dementia after vascular dementia and Alzheimers disease. Dementia treatment focuses on effectively managing symptoms and improving quality of life.

The vascular dementia segment is poised for notable growth in the dementia treatment market. The segment includes post-stroke dementia and subcortical ischemic dementia. These conditions arise from impaired blood circulation, and their prevalence is increasing as stroke cases rise globally and populations continue to age. As awareness improves, more patients are being diagnosed earlier, which increases the need for targeted therapies and long-term management. Vascular dementia is caused by blocking or reducing blood flow to the brain, which damages and kills brain cells.

Treatment Type Insights

The pharmacological therapies segment dominated the dementia treatment market, accounting for 60% of the market share in 2024. Cholinesterase inhibitors, NMDA receptor antagonists, Anti-amyloid therapies / monoclonal antibodies, and Symptomatic therapies are the major drug classes widely used to manage cognitive decline in mild to severe Alzheimers and vascular dementia.

On the other hand, the digital therapeutics/cognitive training apps segment is expected to see the highest CAGR during the forecast period, owing to rising awareness of cognitive health and an aging population. Digital therapeutics and cognitive training apps are widely used to manage these various chronic conditions. Moreover, the growing importance of brain fitness and early detection of cognitive decline is encouraging the active use of cognitive training apps and various preventive measures

The non-pharmacological interventions segment is set to see notable growth in the dementia treatment market. Non-pharmacological interventions play a vital role, focusing on improving quality of life, managing behavioral symptoms, and maintaining cognitive function. Non-pharmacological interventions can help reduce costly outcomes and unnecessary hospitalizations.

Product Type Insights

The prescription drugs segment dominates the dementia treatment market, accounting for 60% of the market. The segments growth is supported by the introduction of new prescription drugs, recent advancements in treatments, and rising research and development funding. In addition, it is primarily influenced by rising government initiatives, and partnerships among pharmaceutical companies and research institutions are anticipated to propel the segments growth during the forecast period.

The digital therapeutics/cognitive training apps segment is projected to be the fastest-growing segment in the dementia treatment market between 2025 and 2034, driven by the rising acceptance of technology-supported care, the growing reach of smartphones, and strong interest in remote monitoring and home-based support. This segment is expanding because digital tools offer structured exercises, personalized cognitive programs, and consistent engagement that patients and caregivers can access anytime. These apps help track daily performance, provide reminders, support memory routines, and offer real-time feedback that strengthens long-term adherence. Healthcare providers are also encouraging the use of these apps because they help reduce clinic visits, improve early detection of changes in cognitive status, and offer data that supports more informed care decisions.

The over-the-counter (OTC) supplements segment is poised for notable growth in the dementia treatment market, driven by rising demand for preventive measures to maintain cognitive function and overall wellness. The segment growth is driven by rising demand for over-the-counter (OTC) supplements, including omega-3 fatty acids and herbal/nutraceutical products. OTC supplements are widely available in pharmacies, retail stores, and online platforms without a prescription, making them a cost-effective and convenient option compared to complex prescription regimens.

The medical devices/cognitive support tools segment is expected to expand at a rapid pace. The rising cases of existing and new cases of Alzheimers disease and other common types of dementia create a significant demand for dementia care products. Moreover, the increasing integration of digital health technologies, including AI,virtual reality (VR), big data, and the Internet of Things (IoT), is improving treatment outcomes and enhancing care.

End-User/Customer Insights

The hospitals & neurology clinics segment dominates the dementia treatment market, accounting for 40%. Hospitals and neurology clinics play a critical role in the treatment of dementia. Hospitals and specialized clinics, including tertiary hospitals and specialized dementia centers, are meeting the growing need for novel drugs and therapies. Hospitals and neurology clinics serve as the primary points for early diagnosis, treatment, and the administration of advanced therapies.

The home care / assisted living facilities segment is anticipated to see the highest CAGR during the forecasted period. Home care// assisted living facilities are widely preferred by many families, which allows the patient to remain in a residential facility or familiar environment for effective care of early detection of dementia. Assisted living facilities also include dedicated memory care units and supervised settings for more advanced treatment.

The primary care/geriatric care centers segment is poised for notable growth in the dementia treatment market, as these centers, such as nursing homes and memory care facilities, serve as hubs for the care of the elderly population. The geriatric population is more susceptible to Alzheimers disease, vascular dementia, Lewy body dementia, and other types of dementia, which increases the need for geriatric care centers.

Dementia Treatment Market Regional Insights

The North America dementia treatment market size is estimated at USD 7.99 billion in 2025 and is projected to reach approximately USD 16.46 billion by 2034, with a 8.35% CAGR from 2025 to 2034.

Advancements in R&D and Healthcare Fuel the North American Dementia Treatment Market

North America dominates the dementia treatment market, holding a 40% share. The region is the largest and a dominant force in the global landscape, supported by a robust healthcare infrastructure, a rising geriatric population, the increasing adoption of advanced therapies, significant R&D investment, and a growing pipeline focused on Alzheimers and related dementias. The expansion of digital therapeutics, home care, and remote monitoring solutions that broaden care delivery models is accelerating the growth of the dementia market.

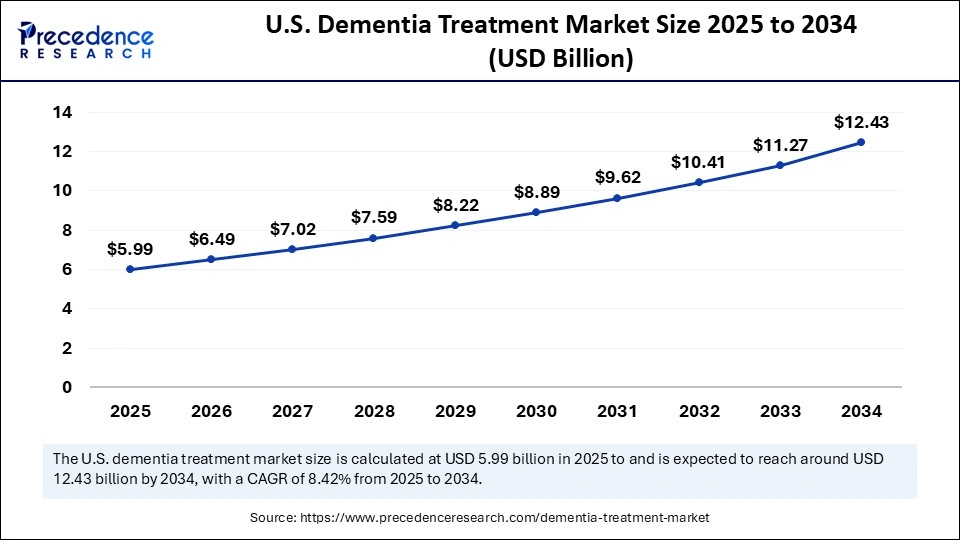

The U.S. dementia treatment market size is calculated at USD 5.99 billion in 2025 and is expected to reach nearly USD 12.43 billion in 2034, accelerating at a strong CAGR of 8.42% between 2025 and 2034.

The United States Leads the Charge in the Global Dementia Treatment Market

The United States holds the majority share of the regional market. The U.S. leads the dementia treatment market, driven by specialized healthcare infrastructure, an increasing number of dementia cases, a growing global geriatric population, and improved diagnostics enabling earlier detection and treatment initiation. The countrys growth is also characterized by substantial investment from pharmaceutical companies and governments in clinical research to develop novel biological and combination drugs. Such a combination of factors is propelling the regions growth during the forecast period.

The Asia Pacific dementia treatment market size is expected to be worth USD 8.33 billion by 2034, increasing from USD 4.00 billion by 2025, growing at a CAGR of 8.48% from 2025 to 2034.

What Factors Have Led the Asia Pacific Region to Lead the Growth of the Dementia Treatment Market?

The Asia Pacific region is expected to experience the fastest growth in the market for dementia treatment during the forecast period, as this regions growth is primarily fuelled by a developing healthcare infrastructure, a surge in the aging population, a surge in R&D investment by pharmaceutical companies, increased healthcare expenditure, and the introduction of disease-modifying drugs. The Asia Pacific region has a well-developed network of hospitals, neurology clinics, geriatric care centers, home care, assisted living facilities, pharmacies & retail (OTC distribution), which creates a strong demand for dementia treatment and effective care solutions.

India Dementia Treatment Market Analysis

Indias rising population base of older population is substantially increasing the number of people at risk for dementia. The market reflects trends towards research and development, leading to the introduction of new treatments and modern cognitive technologies for early diagnosis, remote monitoring, and improved patient support.

In September 2025, Epoch Elder Care, a provider of assisted living and dementia services in India, launched its newest facility, Epoch Monet House, in Punes Balewadi neighborhood. The 10-floor, 33,000-square-foot facility marks a step in the organization expansion strategy to serve Maharashtras geriatric population with assisted living and specialized care services.

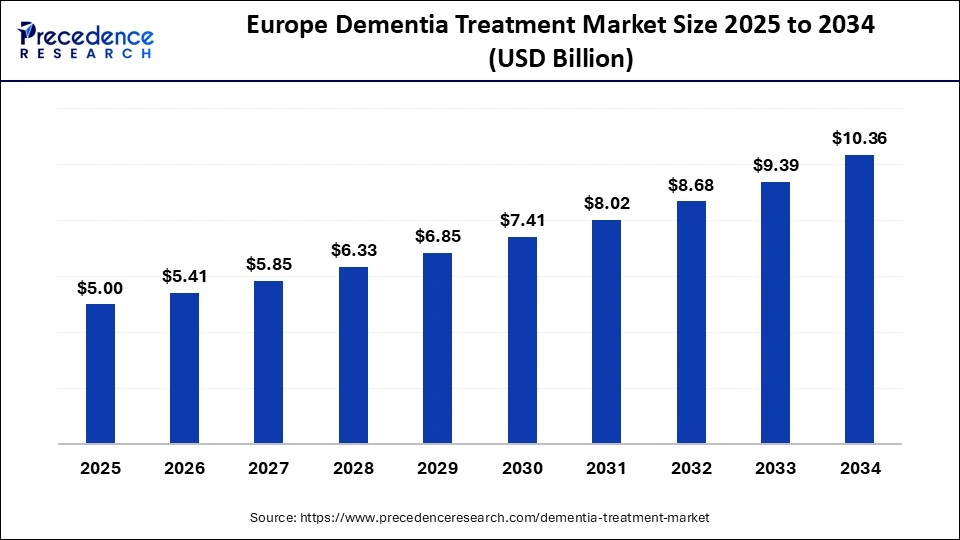

The Europe dementia treatment market size has grown strongly in recent years. It will grow from USD 5.00 billion in 2025 to USD 10.36 billion in 2034, expanding at a compound annual growth rate (CAGR) of 8.41% between 2025 and 2034.

How Is the European Region the Fastest-Growing in the Dementia Treatment Market?

Europe is set to see notable growth in the dementia treatment market, as this region has specialized healthcare providers, hospitals, long-term care facilities, and home-care settings that target patients with Alzheimers disease, vascular dementia, Lewy body dementia, frontotemporal dementia, and other forms of dementia. Moreover, technological advancements in medical devices and cognitive support tools, improved diagnostic technologies, a growing elderly population, and increased investment in research and development are anticipated to drive growth in the dementia treatment market in the region.

In September 2025, a UK trial launched to transform Alzheimers diagnosis with a simple blood test. A major UCL-led clinical trial, aiming to transform the diagnosis of Alzheimers disease through a simple blood test. The ADAPT (Alzheimers Disease Diagnosis and Plasma pTau217) team, led by Professor Jonathan Schott and Dr Ashvini Keshavan, is investigating whether a blood test that measures the protein p-tau217 can improve the early and accurate diagnosis of Alzheimers disease. The trial will examine whether providing the blood test results to patients and their clinicians near the start of an assessment for memory and thinking concerns is able to aid diagnosis and guide decisions.

Germanys Dementia Treatment Market Analysis

Germany is one of the largest contributors to the dementia treatment market in Europe. The country is experiencing growth, owing to the development of modern healthcare facilities, a surge in the dementia patient population, and high per capita healthcare expenditure. The country strongly focuses on integrated care, combining medication with psychosocial support and adopting cognitive support tools. Rising government funding for clinical trials and R&D activities to develop novel therapeutics is driving market growth in the country.

Dementia Treatment Market Companies

Biogen is a major developer of Alzheimers and neurodegenerative disease therapies, focusing on anti-amyloid antibodies and biomarker-driven approaches. The company leads multiple clinical programs targeting disease modification and early-stage dementia.

Lilly develops late-stage monoclonal antibody therapies designed to slow cognitive decline by reducing amyloid buildup. The company invests heavily in Alzheimer diagnostics, early-detection tools, and precision-driven treatment strategies.

Roche advances dementia treatment through biologics targeting amyloid, tau, and synaptic pathways, supported by strong diagnostic imaging platforms. The company emphasizes integrated therapeutic and diagnostic solutions for Alzheimers progression monitoring.

Novartis explores neuroprotective mechanisms and symptomatic treatments for dementia, including cholinergic and glutamatergic targets. Its global research network supports partnerships on disease-modifying and biomarker-based drug candidates.

Eisai is a leading Alzheimers treatment developer with multiple approved and pipeline therapies focused on amyloid clearance and cognitive stabilization. The company also collaborates globally to advance early-stage dementia intervention.

J&J researches neurodegenerative diseases via amyloid, tau, and neuroinflammation pathways and supports early-diagnosis technologies. The company works with partners to develop next-generation Alzheimers therapeutics.

Pfizer focuses on neuroinflammation, synaptic support, and early-stage R&D collaborations in dementia after scaling down direct Alzheimers drug development. The company continues to invest in neuroscience through joint programs and precision research.

Merck develops CNS therapies centered on neuroprotection and cognitive impairment reduction, including candidates targeting amyloid processing and neuronal signaling pathways.

Takeda explores dementia therapies focusing on neuroimmune modulation, synaptic repair, and brain metabolic pathways. The company invests in collaborations to accelerate next-generation Alzheimers treatments.

AbbVie targets tau protein aggregation and neuroinflammatory pathways through its neuroscience division. The company is advancing biologics and small molecules for slowing disease progression in multiple dementia subtypes.

Lundbeck specializes in CNS disorders and develops therapies addressing both symptoms and underlying neurodegeneration. Its pipeline includes disease-modifying candidates for Alzheimer and frontotemporal dementia.

Acadia develops treatments addressing neuropsychiatric symptoms of dementia, including agitation and hallucinations. Its therapies aim to improve behavioral and daily functioning in patients with advanced disease.

Axsome focuses on novel CNS agents that target agitation, mood disruption, and cognitive symptoms associated with Alzheimers. The company develops multifunctional therapies using innovative delivery mechanisms.

Recent Developments

- In March 2025, GSK plc announced a major new research collaboration with the UK Dementia Research Institute (UK DRI) and Health Data Research UK (HDR UK) to advance understanding of neurodegeneration with a first-of-its-kind dementia study. The innovative project aims to use the UKs health data ecosystem to explore a potential association between GSKs shingles vaccine, Recombinant Zoster Vaccine (RZV), and a reduced risk of dementia. If successful, this could serve as a blueprint for population-level health data research models, reinforcing the UKs position as a leading destination for scientific research.(Source:https://www.gsk.com)

- In August 2025, Cleveland Clinic unveiled its plan to participate in the davos alzheimers Collaborative Accurate Diagnosis Project. The project aims to develop a pathway for accurate and timely Alzheimers disease diagnosis.(Source: https://newsroom.clevelandclinic.org)

Dementia Treatment MarketSegment Covered in the Report

By Dementia Type

- Alzheimers Disease (AD)

- Early-onset AD

- Late-onset AD

- Vascular Dementia (VaD)

- Post-stroke dementia

- Subcortical ischemic dementia

- Lewy Body Dementia (LBD)

- Parkinsons disease dementia

- Dementia with Lewy bodies

- Frontotemporal Dementia (FTD)

- Behavioral variant FTD

- Language variant FTD

- Mixed Dementia

- Other/Rare Dementias

- Creutzfeldt-Jakob disease

- Huntingtons disease dementia

By Treatment Type

- Pharmacological Therapies

- Cholinesterase inhibitors (Donepezil, Rivastigmine, Galantamine)

- NMDA receptor antagonists (Memantine)

- Anti-amyloid therapies/monoclonal antibodies

- Symptomatic therapies (antidepressants, antipsychotics)

- Non-Pharmacological Interventions

- Cognitive stimulation therapy

- Reminiscence therapy

- Music & art therapy

- Digital Therapeutics/Cognitive Training Apps

- Memory training platforms

- Brain games & cognitive coaching apps

- Wearable-assisted cognitive support

- Behavioral & Caregiver Support Programs

- Caregiver training & education

- Behavioral modification programs

- Combination/Integrated Care

By Product Type

- Prescription Drugs

- Over-the-Counter (OTC) Supplements

- Omega-3 fatty acids

- Herbal supplements/nutraceuticals

- Medical Devices/Cognitive Support Tools

- Digital Therapeutics/Software Platforms

- Wearables & Monitoring Devices

By End-User/Customer Segment

- Hospitals & Neurology Clinics

- Tertiary hospitals

- Specialized dementia centers

- Primary Care/Geriatric Care Centers

- Home Care/Assisted Living Facilities

- Pharmacies & Retail (OTC distribution)

- Research Institutes/CROs

- Caregiver/Direct-to-Consumer

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting