Diabetes Nutrition Market Size and Forecast 2025 to 2034

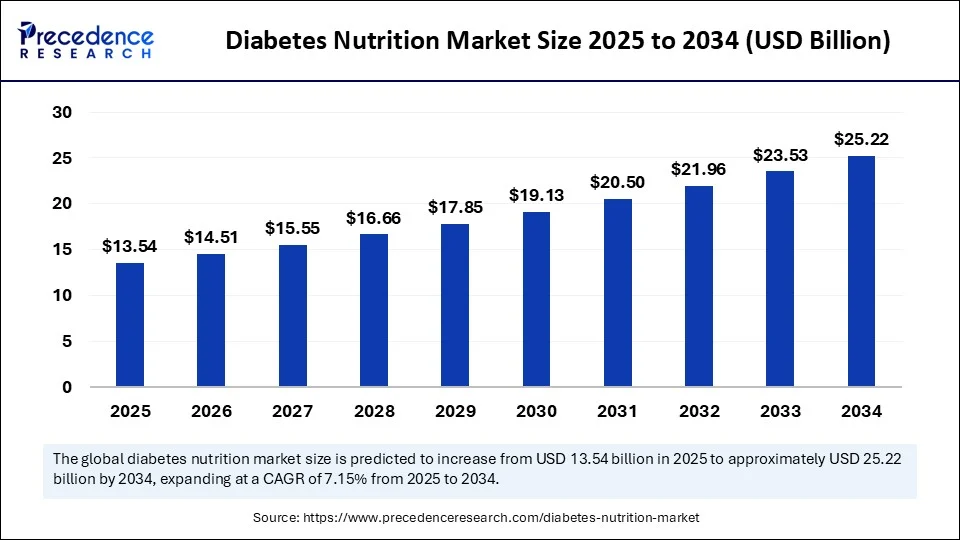

The global diabetes nutrition market size accounted for USD 12.64 billion in 2024 and is predicted to increase from USD 13.54 billion in 2025 to approximately USD 25.22 billion by 2034, expanding at a CAGR of 7.15% from 2025 to 2034.The market is on the rise due to the increase of diabetes worldwide, the global population is aging, and urbanization and demand for dietary products designed for consumers with diabetes, ranging from low-sugar to low-carbohydrate.

Diabetes Nutrition MarketKey Takeaways

- In terms of revenue, the global diabetes nutrition market was valued at USD 12.64 billion in 2024.

- It is projected to reach USD 25.22 billion by 2034.

- The market is expected to grow at a CAGR of 7.15% from 2025 to 2034.

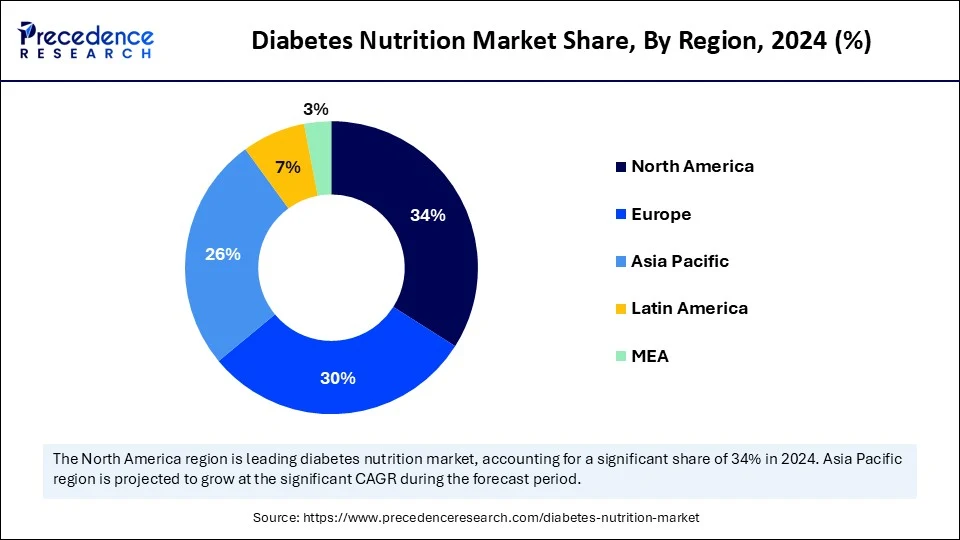

- North America led the diabetes nutrition market with a 34% of market share in 2024.

- Asia Pacific is projected to expand the fastest CAGR in the market between 2025 and 2034.

- By product type, the medical nutrition for diabetes segment held more than 40% of the market share in 2024.

- By product type, the diabetic nutritional supplements segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By age group, the adults (18–64 years) segment captured the highest market share of 46% in 2024.

- By age group, the geriatric (65+ years) segment will expand at a notable CAGR over the projected period.

- By form, the powder segment accounted for the major market share of 38% in 2024.

- By form, the capsules & tablets segment is expected to expand at a notable CAGR over the projected period.

- By end user, the type 2 diabetes patients segment contributed the highest market share of 54 in 2024.

- By end user, the prediabetic individuals segment is expected to grow at a notable CAGR over the projected period.

- By sales channel, the supermarkets/hypermarkets segment held the largest market share of 35% in 2024.

- By sales channel, the online pharmacies & e-commerce segment is expected to expand at a notable CAGR over the projected period.

Smart Diabetes Nutrition Powered by AI - Personalized, Predictive, and Proactive

Artificial intelligence is driving innovation in diabetes nutrition by providing more individualized, flexible, context-based dietary support. For example, new technologies like the MealMeter system that utilizes multimodal sensory inputs combining glucose levels, heart rate, physical activity, and real-time environmental clues now provide an estimated macronutrient intake to support real-time dietary decisions. Furthermore, new approaches combining continuous glucose monitor (CGM) data with food photos and microbiome data, during meal time, through new software programs, are providing greater calorie estimates compared to traditional methods. In the patient tech area, Omada Health launched a nutrition coach called OmadaSpark that leverages AI to offer individualized education, meal logging utilizing photos or bar codes, and also provides adaptive "anti-diet" guidance in the context of diabetes and obesity treatment that is ideal.

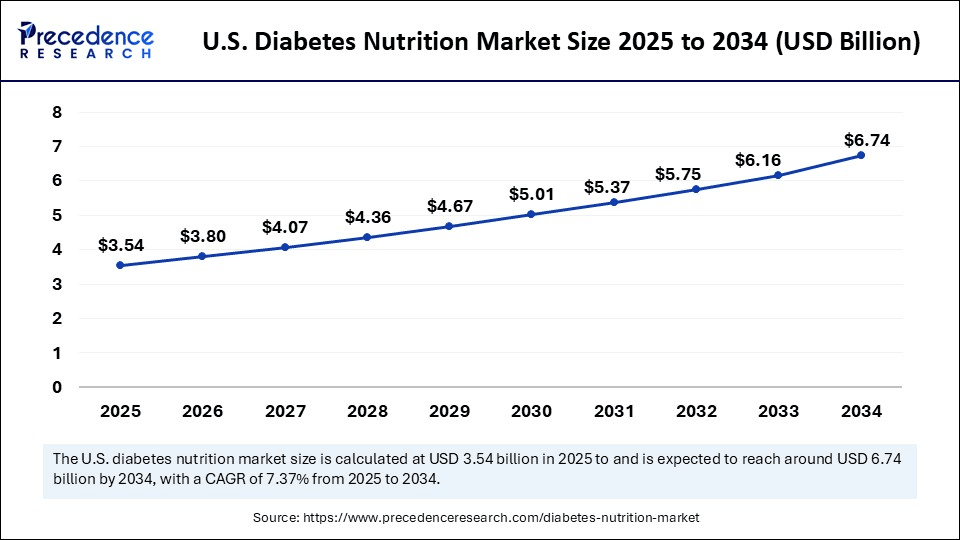

U.S. Diabetes Nutrition Market Size and Growth 2025 to 2034

The U.S. diabetes nutrition market size was exhibited at USD 3.31 billion in 2024 and is projected to be worth around USD 6.74 billion by 2034, growing at a CAGR of 7.37% from 2025 to 2034.

What Are the Reasons for North America's Dominance in the Diabetes Nutrition Market?

North America led the diabetes nutrition market, largely due to the extensive burden of disease in the region, in addition to its significant investment in healthcare spending. In 2024, an estimated 56 million adults in the North America and Caribbean region (about 1 in 7 adults) were diagnosed with diabetes, and this is expected to increase over the decades. In terms of health expenditures on diabetes, the North America region has the largest burden across the world, accounting for 43% of global health expenditures on diabetes, and the average cost per person is amongst the highest of all regions across the world. It is also estimated that 30% of cases of diabetes are undiagnosed, highlighting systemic flaws in screening and management that increase the use of nutritional interventions. The presence of increasing naked glucose tolerance and naked fasting glucose also highlights the preventive potential of nutrition programs for progression to diabetes.

The diabetes burden in the United States is significant, as 15.8% of adults are living with total diabetes, which includes 11.3% who have been clinically diagnosed and an additional 4.5% who are undiagnosed, according to recent CDC data.Men have a higher prevalence, and with advancing age, rising BMI, and lower levels of education, the burden increases. According to the National Health and Nutrition Examination Survey (NHANES) using 24-hour dietary recall data, the consumption of UPFs accounted for 58.2% of total energy intake in the U.S. is associated with a 27% increase in gestational diabetes mellitus (GDM) risk for every 100 g increment in UPF consumption. (Source: https://www.e-dmj.org)(Source: https://www.ncbi.nlm.nih.gov)

Why is Asia-Pacific the Fastest-Growing Region in the Diabetes Nutrition Market?

Asia-Pacific is the fastest-growing region in the diabetes nutrition market. It is at the forefront of diabetes nutrition growth because of the extreme diabetes prevalence, changing lifestyles, and increased access to care. Asia-Pacific has the highest diabetes population and has experienced a spike in type 2 diabetes because of urbanization, sedentary lifestyles, and dietary changes. Additionally, the rise in disposable income and awareness about health is fueling the growth of diabetes-specific nutrition products and supplements. Finally, governments are placing a higher value on noncommunicable disease management. The growth of e-commerce and retail infrastructure is improving access to therapeutic nutrition.

India is shouldering a global diabetes burden, with more than 77 million adults living with diabetes, and nearly 25 million are pre-diabetics, which is second worldwide only to China.The nation is also experiencing rising obesity and prevalence of metabolic syndrome, especially in urban areas. Rapidly growing smartphone penetration will aid in telemedicine and provide app-basedpersonalized nutrition coaching, coupled with the expanding middle class, which is sparking demand for functional foods and supplements to manage glycemic control. Government initiatives, coupled with rising out-of-pocket expenses towards health delivery, are expanding the acceptance of preventive and therapeutic diabetes nutrition solutions across the healthcare sector and supporting market demands for diabetes nutrition in the retail sector. (Source: https://www.who.int)

Market Overview

The diabetes nutrition market encompasses dietary products, supplements, functional foods, beverages, and medical nutrition solutions formulated specifically for individuals with diabetes or prediabetes to help regulate blood glucose levels, maintain healthy body weight, and prevent complications. These products are designed to provide balanced macronutrients, low glycemic index carbohydrates, controlled sugar content, and essential micronutrients, often tailored for specific patient groups (type 1, type 2, gestational diabetes). The market includes medically prescribed formulas, over-the-counter functional foods, fortified products, and nutritional supplements for both preventive and therapeutic use.

U.S. Diabetes Nutrition MarketGrowth Factors

- Rising Incidence of Diabetes- The growing incidence of diabetes, particularly type 2 diabetes connected to aging and urbanization, and sedentary lifestyles, is driving demand for specialized nutrition products to assist in glycemic control and diabetes management.

- Increased Health Interest & Changes in Diet- With increased consumer awareness about diabetes management through diet, along with consumer interest in organic, low-GI, low sugar, functional foods, the demand for specialized diabetic nutrition options has increased.

- Advances in Technology & Product Development- Advances in the development of new sugar substitutes (e.g., allulose or stevia), new fibers and proteins, appealing meal replacement and snacks are driving healthy and appealing product options for diabetics.

- Increased Trends in Digitalization & Personalization- Using digital platforms, e-commerce, and personalized nutrition plans, consumer access and customization will enhance the use of targeted dietary solutions for diabetic management through the combination of AI and genetic factors.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 25.22 Billion |

| Market Size in 2025 | USD 13.54 Billion |

| Market Size in 2024 | USD 12.64 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Age Group, Form, End User, Sales Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Could a surge in diabetes prevalence create a global need for specialized nutrition solutions?

A substantial opportunity exists in the diabetes nutrition market from the growing prevalence of diabetes globally, since it is leading to increased demand for specialized nutrition. As of 2025, there are about 589 million adults between 20–79 years with diabetes, and it is projected to reach 853 million by 2050, a 46% increase.

As the number of individuals with diabetes grows, the demand for nutritional products to help manage blood glucose levels will be spurred and occur, such as for example high protein, low sugar, and high fiber foods. For example, major companies like Nestlé and Danone have product lines across offering foods and beverages specifically for persons taking GLP-1 injections, which are regularly prescribed for diabetes and weight loss purposes. These opportunities signal growth availability in the diabetes nutrition market, and a need for individualized nutrition consideration to manage or ideally prevent diabetes related complications.

Restraint

Is limited access to specialized nutritional support impeding growth in the diabetes nutrition market?

Limited access to specialized nutritional support is one of the major challenges for diabetes nutrition, especially since most diabetes patients consuming these products are located in low- and middle-income countries. Many of these patients will not have access to a certified dietitian, structured nutrition programs, or affordable diabetes specific foods, which will inhibit disease management practices.

According to the International Diabetes Federation and its diabetes atlas, in 2025, over 4 in 5 adults (81%) living with diabetes are in low- and middle-income countries, where they are subject to inadequate healthcare systems and lack nutrition education. Cultural dietary customs and lack of knowledge about specialized diabetic nutrition will negate or slow adoption. Limited access to education and resources not only affects patient outcomes but also represents a barrier to the entirety of the diabetes nutrition market potential globally. (Source:https://idf.org)

Opportunity

Is the global movement toward 'food as medicine' poised to disrupt the diabetes nutrition market?

An emerging opportunity in the diabetes nutrition market is the increased uptake of the "Food as Medicine" (FIM) front integration of nutrition with disease prevention and management. In the U.S., organizations like EatSF and Vouchers 4 Veggies are providing produce prescriptions to low-income consumers to redeem fruits and vegetables with large infusions of public money, including integration into Medicaid and Medicare Advantage.

This shift creates demand for personalized, evidence-based nutritional products for diabetes care, and companies like Nourish are taking advantage of this market by funding $70 million Series B funding round, bringing total funding to $115 million to tackle chronic disease like diabetes and obesity, with AI powered care, as well as employing 3,000 dietitians and utilizing AI to support patients and clinicians. (Source:https://www.businesswire.com)

Product Type Insights

Why Does the Medical Nutrition Segment Hold Such a Significant Share of The Diabetes Nutrition Market?

The medical nutrition for diabetes segment is the dominant product type in the diabetes nutrition market, because it provides evidence-based, nutrient-dense food to strengthen metabolic health and balance nutrients to manage blood sugar. The appeal of medical nutrition is due to support from healthcare professionals, hospital dietary programs, and more diagnosed patients using medical nutrition products. There is also increased awareness of dietary management (evidence-based) and more prescribed food replacements. Medical nutrition remains strong in clinical settings, at home, and wherever people live their lives.

The diabetic nutritional supplements segment has the highest growth among product types, due to persistent demand for travel-friendly, on-the-go options designed to help improve blood sugar levels and overall wellness. The growing interest in nutritional supplements stems from new formulations of nutritional supplements, such as new plant-based proteins, functional fibers, and micronutrient blends designed to regulate blood glucose levels. Increased importance of e-commerce channels, appropriate targeted marketing, and flexible dietary strategies will open the market for young adults with diabetes and prediabetes.

Age Group Insights

Which Age Group Segment Dominated the Diabetes Nutrition Market?

The adults (18–64 years) segment is the primary consumer in the diabetes nutrition market in 2024, with a sizable market segment occupying them. This segment has more products available to them, as a wide range of diabetic foods/drinks/supplements/medical nutrition items are available for their lifestyle (management of diabetes) and clinical (often associated with a medical diagnosis and/or medically-derived consumers).

The geriatric (65+ years) segment is the fastest-growing consumer segment for diabetes nutrition. Product demand is coupled with the higher incidence of complications related to diabetes, often resulting in nutrition deficiencies in older adults. Older adults are increasingly dependent on individualized nutrition to maintain their energy, muscle mass, and management of blood sugars. Broader acceptance of newer easy-to-digest foods, fortified products, and medical nutrition made for seniors is fueling adoption, and health care providers are uniquely positioned as credible support for long-term wellness and quality of life.

Form Insights

Why are powder forms Dominant in 2024?

The powder segment is the leading segment in the diabetes nutrition market because it can be formulated in many ways, allows for certain flavouring profiles, and compatibility with other nutrient blends. They are widely used in the categories of medical nutrition and supplements. They can be made in a dosage that is specific to each individual and are easily mixed with liquids or food. The increase in clinical recommendations, and the common use for hospitals, fitness centers, and home care for powder form, strengthens the position of this form.

The capsules & tablets segment is the fastest-growing form in the diabetes nutrition market. They are identified for their portability, precise dosage, and shelf life. Capsules and tablets are convenient for busy lifestyles, and have discrete consumption without preparation. They are being used by actual diabetics or pre-diabetics. Innovations such as sugar-free coatings, proprietary blends of nutrients to enhance take-up, and the growth of direct-to-consumer are increasing the adaptive uptake of capsules and tablets in many global markets.

End User Insights

Why the Type 2 Diabetes Patients the Dominates End-User Segment?

The type 2 diabetes patients segment held the largest share of the end-user segment, simply because they represent the greatest number of people globally with lifestyle diabetes. For this reason, these individuals constantly need to manage their diabetes or dietary practices and depend heavily on specialized nutrition for dietary products that successfully manage blood glucose, help in maintaining weight, and keep one's metabolic health optimum. In addition, such products are highly recommended by physicians and can create a lifetime dependency, which sustains demand, and patients with type 2 diabetes will be the most viable target market for producers.

The pre-prediabetic individuals segment represents the fastest-growing end-user segment, driven by increased awareness of early intervention to prevent progression. The prevalence of health screenings, workplace wellness initiatives, and consumer emphasis on preventative healthcare are helping to spur eventual usage and adoption of wellness-based dietary products and services. This group is using more functional foods, fortified supplements, and low-GI meal replacements, along with changes in their active lifestyles and the sheer convenience or ease of integrating these products into their daily lives.

Sales Channel Insights

Why Does Sales Channel Segment Dominate the Market In 2024?

The supermarkets/hypermarkets segment dominates the diabetes nutrition market as the sales channel with the most sales volume due to their broader product offerings, bulk purchasing, and product promotion in ways difficult to compare online. These retail formats allow consumers to physically compare different products side-by-side, evaluate multiple brands, assess various price points, and take advantage of any discounts. With the proper location of diabetic-friendly food and supplement sections and increased cooperation between brands and major retailers, there is strengthening evidence to support that supermarkets/hypermarkets will remain in a dominant position.

The onlinepharmacies & e-commerce segment is the fastest-growing sales channel. Consumers are attracted to convenience, home delivery, and a variety of access to specialty and niche products, typically in the diabetes nutrition category. Online channels allow retailers to offer personalized product recommendations, subscription models, and interactive experiences with products through health apps. The shift towards purchasing products on smartphones, telehealth consultations, and brand recommendations from health professionals, especially registered dietitians, also supports the shift to online channels for diabetic nutrition solutions.

Diabetes Nutrition Market Companies

- Abbott Laboratories

- Nestlé Health Science

- Danone S.A.

- Fresenius Kabi AG

- Glanbia PLC

- Mead Johnson Nutrition (Reckitt)

- Unilever PLC

- Kellogg Company

- PepsiCo Inc.

- The Hershey Company (Sugar-Free Line)

- The Kraft Heinz Company

- GlaxoSmithKline Consumer Healthcare

- Amway Corp.

- Herbalife Nutrition Ltd.

- Bayer AG (Consumer Health)

- BASF SE (Nutrition & Health)

- Ajinomoto Co., Inc.

- Sun Pharma Nutritionals

- Nutricia (A Danone Company)

- Medtrition Inc.

Recent Development:

- In June 2024, Nestlé Health Science launches a GLP-1 nutrition support platform in the U.S. to improve treatment for metabolic diseases, focusing on personalized nutrition solutions that complement GLP-1 therapies and improve patient outcomes.(Source: https://www.nestle.com)

Segments Covered in the Report

By Product Type

- Diabetic Foods

- Low/No Sugar Bakery Products

- Sugar-Free Confectionery

- Low-Glycemic Cereals & Snacks

- Diabetic Dairy Products (Low-fat, Fortified Milk, Yogurt)

- Diabetic Meal Replacements (Powders, Bars)

- Others (Soups, Ready-to-Eat Meals)

- Diabetic Beverages

- Low/No Sugar Juices

- Herbal Teas & Infusions for Blood Sugar Control

- Low-Calorie Functional Drinks

- Diabetic Protein Drinks

- Others (Diabetic Coffee, Plant-Based Milks)

- Diabetic Nutritional Supplements

- Multivitamins & Minerals for Diabetics

- Omega-3 & Fatty Acid Supplements

- Antioxidant Formulas

- Probiotic & Gut Health Supplements

- Herbal & Botanical Extracts (Bitter Melon, Fenugreek, Cinnamon)

- Others (Specialized Fiber Blends)

- Medical Nutrition for Diabetes

- Oral Nutritional Supplements (ONS)

- Enteral Nutrition Formulas

- Parenteral Nutrition Additives for Diabetic Patients

- Others (Clinical Protein Formulations)

By Age Group

- Pediatric (0–17 years)

- Adults (18–64 years)

- Geriatric (65+ years)

- Others (Pregnant Women with Gestational Diabetes)

By Form

- Powder

- Liquid

- Bars/Solid Foods

- Capsules & Tablets

- Others (Gummies, Sachets)

By End User

- Type 1 Diabetes Patients

- Type 2 Diabetes Patients

- Prediabetic Individuals

- Gestational Diabetes Patients

- Others (High-Risk Groups)

By Sales Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies & E-Commerce

- Supermarkets/Hypermarkets

- Specialty Stores (Health & Nutrition Stores)

- Others (Direct-to-Consumer, Wellness Centers)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting