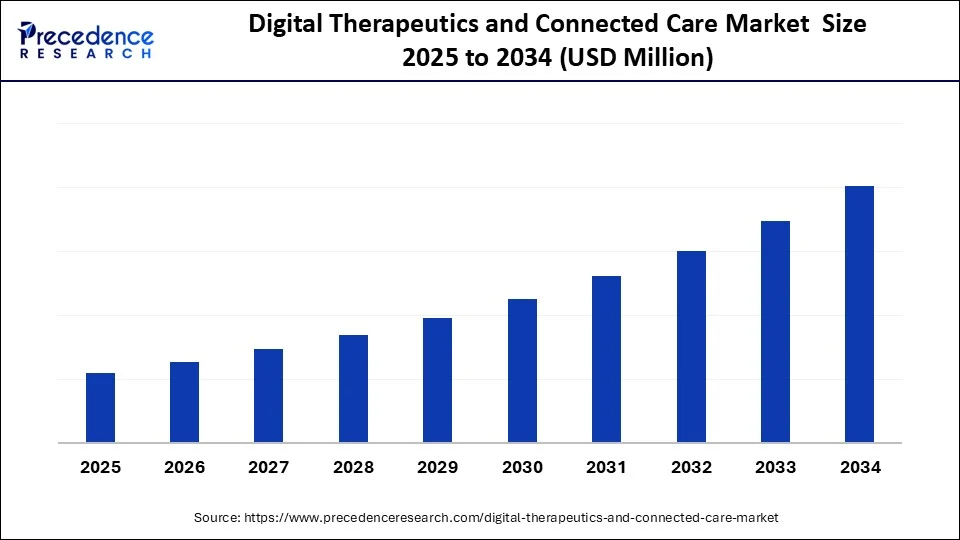

Digital Therapeutics and Connected Care Market Size and Forecast 2025 to 2034

Explore how digital therapeutics and connected care market is transforming patient outcomes through data-driven, personalized healthcare solutions. The digital therapeutics and connected care market is expanding rapidly due to the growing incidence of chronic conditions, an increased acceptance of remote healthcare, favorable regulatory environment, and advancements in technology that enable personalized and real-time patient care solutions.

Digital Therapeutics and Connected Care MarketKey Takeaways

- North America dominated the digital therapeutics and connected care market in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By application, the diabetes management segment contributed the biggest market share in 2024.

- By application the mental health (e.g., Depression, Anxiety, PTSD) segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By component, the software/apps segment captured the highest market share in 2024.

- By component, the services segment is expected to expand to a notable CAGR over the projected period.

- By therapeutic approach, the cognitive behavioral therapy (CBT)-based solutions segment generated the major market share in 2024.

- By therapeutic approach, the AI-based personalized interventions segment is expected to expand at a notable CAGR over the projected period.

- By business model, the business-to-business (B2B) segment held the largest market share in 2024.

- By business model, the B2B2C segment is expected to expand to a notable CAGR over the projected period.

- By end user, the patients (self-managed care) segment accounted for the highest market share in 2024.

- By end user, the payers (insurers, employers) segment is expected to expand at a notable CAGR over the projected period.

How is AI Shaping the Digital Therapeutics & Connected Care Market?

Artificial intelligence is becoming the backbone of today's digital therapeutics and connected care solutions and is enabling healthcare systems to deliver more personalized, proactive, and efficient care. For example, an article published in February 2025 reviewed 12 clinical trials and showed that an artificial intelligence-integrated virtual reality system provided dramatic improvements in mobility, cognitive function, and attention in Parkinson's patients.

In July 2025, Microsoft launched MAI-DxO, an artificial intelligence platform for diagnostics that outperformed physicians on complex NEJM cases with 85.5% accuracy, four times that of physicians working solo (FT). AI "scribes," such as DAX Copilot, have become widely adopted in hospitals across the U.S. Tools like DAX Copilot ease the burden of clinical documentation, improving efficiency by reducing the time spent on documentation by 60%. In addition, shifting time from documentation to direct care delivery renders a new standard in healthcare. While AI tools are known for their efficacy in healthcare as supportive software, the transition into its interpretative agency is facilitated through AI as a center of personalized, connected, and scalable healthcare through AI capabilities.

(Source: https://www.digit.in)

Market Overview

The Digital Therapeutics (DTx) & Connected Care Market encompasses clinically validated software-based solutions and digital platforms used to prevent, manage, or treat medical disorders or diseases. Digital therapeutics deliver evidence-based interventions via apps, sensors, or connected devices and are often used independently or alongside traditional therapies. Connected care refers to remotely enabled and real-time care delivery, allowing providers and patients to monitor, communicate, and manage conditions through telehealth platforms, wearable sensors, and remote monitoring tools. The market is growing due to rising chronic diseases, the need for personalized care, and digital transformation in healthcare.

Digital Therapeutics and Connected Care MarketGrowth Factors

- Growing burden of chronic disease- As the worldwide burden of diabetes, cardiovascular disease, and mental health develops further, increasingly chronic remedies will require continuous, non-invasive digital therapies to enable long-term disease observation and management.

- Regulatory and reimbursement advancements- As governments and payers continue to approve and reimburse digital therapeutics, market credibility increases, and patients and providers are more likely to adopt these products.

- Increased smartphone and internet adoption- Widespread digital access through smartphones and connectivity allows for greater uptake of app-based therapies, remote monitoring, and virtual consultations for healthcare in both high- and low-income countries.

- Movement to Value-based Care- Healthcare systems are now focused on outcomes instead of volume, thus increasing the need for digital tools to track ongoing health measures and help increase patient engagement and reduce avoidable hospitalizations.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Application, Component, Therapeutic Approach, Business Model, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is the rising chronic disease burden driving the adoption of digital therapeutics?

One of the major drivers of the digital therapeutics & connected care market is the global increase in the burden of chronic diseases such as diabetes, cardiovascular diseases, and mental health conditions. The World Health Organization (WHO) estimates that noncommunicable diseases (NCDs) account for nearly 74% of global deaths.

(Source:https://www.who.int)

Chronic diseases require continuous, long-term management, which digital therapeutics applications can provide. DTx applications can offer personalized interventions that can be monitored remotely and provide real-time feedback, thereby reducing the burden on traditional systems. Organizations are now beginning to recognize these advancements, as the U.S. Centers for Disease Control and Prevention (CDC) has added virtual models to its National Diabetes Prevention Program, allowing digital solutions to provide support for behavior change through a digitally based platform. This trend illustrates that digital therapeutics have the potential to redefine chronic disease management through scalable, data-driven, and accessible care.

Restraint

Is inadequate interoperability and integration constraining the development of connected care systems?

The issue of integrating digital therapeutics and patient-generated data into current healthcare IT systems is a key challenge to connected care. As reported by the NHS and Health Innovation Oxford & Thames Valley, many digital tools continue to struggle with interoperating with Electronic Health Records (EHRs), resulting in friction in the clinical workflow. In the U.S., 62% of EHR systems cannot consume DTx-generated datasets, requiring clinicians to manually extract data, which leads to dropped data, lost efficiencies for both the clinician and the health system, and clinician overload.

As the NHS, regulatory conversations highlight that the bespoke platforms of both digital therapeutics and standardized record systems contribute to the creation of data silos, ultimately slowing adoption. If concerns regarding interoperability standards and the availability of APIs for seamless integration are not addressed within a reasonable timeframe, this will continue to result in fragmented data flows, underutilized data-driven insights, clinician burnout, and slow adoption of connected care innovations in the wider health system.

Opportunity

Insurance Expansion

One key opportunity for the digital therapeutics & connected care market lies in the expansion of insurance and policies for digital and connected care. In May 2025, the U.S. Congress reintroduced the Access to Prescription Digital Therapeutics (PDT) bill, which would allow for Medicare coverage of FDA-cleared digital therapeutics. This is a crucial step toward legitimizing the use of DTx in healthcare and enhancing affordability and access for millions of patients.

(Source: https://www.congress.gov)

Coincidentally, the Centers for Medicare & Medicaid Services (CMS) and the Office of the National Coordinator for Health IT (ONC) issued a joint Request for Information to improve interoperability and health data exchange across digital health tools. Each initiative highlighted a clear push by the government to support and legitimize essential aspects of DTx platforms. If either policy measure can be implemented, it can contribute to quicker provider uptake, facilitate reimbursement pathways, and unleash potential market growth.

Application Insights

Which Application Dominate the Digital Therapeutics & Connected Care Market?

The diabetes management segment dominated the market, accounting for a 36% share in 2024. This is mainly due to the increased prevalence of diabetes. Type-2 diabetes is widespread, and the concept of controlling blood glucose without invasive tests is attracting end-users. Digital health technologies provide real-time glucose monitoring, medication reminders, dietary records, and connectivity with other devices that deliver insulin and medications. There is ample endorsement and validation from prominent organizations, such as the American Diabetes Association.

The mental health management segment is expected to grow at the fastest rate in the coming years, driven by the substantial increase in mental health problems such as anxiety, depression, PTSD, etc., over the past few years, including during COVID-19. Digital cognitive behavioral therapies are gaining traction along with mindfulness and telepsychiatry tools, which both patients and providers are accepting. The U.S. FDA approved multiple prescription digital therapeutics (PDTs) in 2024, which provided treatment for depression and substance use disorders. This segment is boosted by new insurance coverage, employer wellness programs, and demand for access that will not cause stigma.

Component Insights

Why is the Software/Apps Segment Leading the Charge?

The software/apps segment continues to lead the digital therapeutics & connected care market, as they are convenient and scalable options that support data-driven health personalization. They range from tracking metabolic conditions to encouraging behavioral change. App-based programs like Omada Health and Livongo have demonstrated effective clinical outcomes. The wide availability of smartphones and wearables, combined with many patients' familiarity with them, allows improved engagement and the ability to document treatment and monitor outcomes remotely.

The services segment is expected to grow at the fastest CAGR during the projection period. This is mainly due to the high demand for remote patient monitoring (RPM) and virtual coaching and behavioral counseling services, as healthcare organizations are moving toward continuous care and wearable/remote patient monitoring. These services combine human interaction with digital tracking, enabling patients to manage conditions such as chronic illnesses or mental health issues. Demand surged in the days following 2023 as Medicare and other private healthcare payers expanded reimbursement coverage for RPM and telehealth counseling. Companies such as Hinge Health and Lark Health, among others, are incorporating an AI-enhanced or scaled coaching model that is supported by live clinical staff.

Therapeutic Approach Insights

What Made CBT-Based Solutions the Dominant Segment in the Market in 2024?

The CBT-based solutions segment held a 45% share of the digital therapeutics & connected care market in 2024. They are structured, evidence-based methods designed to treat mental health conditions like anxiety, depression, and substance use disorders. As digital therapeutics, they can be scaled and are available on demand, making them accessible for both personal use and clinical contexts. Providers like SilverCloud and Pear Therapeutics, with their industry-first prescription digital therapeutic, reSET, have demonstrated clinical efficacy and are gaining insurance coverage and provider uptake.

The AI-based personalized interventions segment is expected to grow at the fastest rate, responding in real-time with the ability to adapt the therapeutic response based on users' data. They utilize machine learning to create tailored treatments, enable tracking of behavioral changes, and predict clinical deterioration. In 2024, Wysa and Biofourmis both launched AI-enabled platforms focused on mental health and CV health issues, respectively. These solutions enhance patient engagement and adherence through hyper-personalization.

Business Model Insights

Why Did the Business-to-Business (B2B) Segment Dominate the Market in 2024?

The business-to-business (B2B) segment dominated the digital therapeutics & connected care market, accounting for 58% market share in 2024. B2B models allow for tailored solutions to meet specific business needs. More providers of digital therapeutics are partnering with payers, employers, and health systems to help address the social structures of health program's with their solutions as it allows for scalability, more favorable reimbursement opportunities, and better fit within clinical workflows, for instance, CVS Health and UnitedHealth offering DTx solutions through chronic care programs.

The B2B2C segment is growing at the fastest CAGR, as this model allows healthcare providers to deliver digital therapeutics solutions directly to patients, enhancing outcomes. By combining B2B and B2C approaches, companies can deliver more effective therapeutic solutions to enhance patient outcomes. Companies like Kaia Health and Happify Health are pursuing this model to access employer health plans, employer plans, and retail pharmacy networks.

End User Insights

How Does the Patients (Self-Managed Care) Segment Dominate the Market?

Patients (self-managed care) segment dominated the digital therapeutics & connected care market with a 47% share in 2024. This is mainly due to the increased awareness of self-care. Digital tools enable individuals to autonomously manage chronic health or mental health conditions through mobile applications, wearable devices, or behavior-change programs. The attraction is the ability to manage everything conveniently and receive real-time feedback with actionable insights tailored to their personal needs.

The payers, including insurers and employers, are the fastest-growing segment in the market. Payers are adopting digital therapeutic technologies to lower long-term healthcare costs and are increasingly adding digital programs as part of their benefits packages to manage chronic diseases and promote the wellness of their workforce, thereby reducing absenteeism. Corporate wellness platforms, such as Virgin Pulse and Hello Heart, have evolved in their role with insurers. Initially, they incorporated wellness offerings into health benefit plans, then became part of the overall potential real-time ROI strategy for insurers and employers, and now actively engage populations with measurable ROI and outcomes-based engagement.

Regional Insights

Why Did North America Dominate the Digital Therapeutics & Connected Care Market in 2024?

North America dominated the market, accounting for nearly 48% of the market share in 2024. The region, specifically the U.S., has strong regulatory support for Prescription Digital Therapeutics (PDTs), cleared a path through the FDA, and is experiencing an increase in reimbursement frameworks. The region's sophisticated healthcare IT environment, combined with a patient population that is readily educated on digital tools for care, has further streamlined adoption. There is also reasonable insurance coverage, and urging reimbursement policies in support of value-based care encourages providers to adopt virtual care applications and tools, along with remote patient monitoring, patient education programs, and behavioral health applications.

The U.S. is a major force in the market, with companies such as Pear Therapeutics and Akili Interactive leading the charge in cognitive and behavioral digital therapeutics (DTx) innovation. There is also the CMS expanding coverage in remote care visits, which demonstrates continued strong federal support of DTx applications. The regulatory and commercial landscape across the U.S. makes this region a hub for connected healthcare innovation.

- In May 2025, U.S. and Singapore institutions (Heinz College, NUS, FriendsLearn) collaborated to advance R&D in digital therapeutics, including AI-enabled digital vaccines and connected-care solutions.

(Source: https://www.biospectrumasia.com)

Europe Digital Therapeutics & Connected Care Market Trends

Europe is experiencing notable growth in the digital therapeutics and connected care sectors, driven by regulatory support and increased investment in digital health solutions. With the EU's emphasis on interoperability in data and the integration of digital health tools into health care practices through programs such as the European Health Data Space, progress is being accelerated toward adoption. Moreover, public health systems across Germany, France, and the Nordic countries are moving toward DTx apps, particularly in the areas of mental health and chronic disease, and are exhibiting confidence in remote care methods. There is also growing support from physicians who use these tools, and meanwhile, a growing patient trust in the utilization of these digital resources.

Germany is a major player and leader in the European digital therapeutics space, particularly with its recent launch of the DiGA program, which provides an overall reimbursement framework for physicians who prescribe certified digital health applications. This reimbursement framework has led to a significantly wider acceptance of DTx. Germany's framework can serve as a model for other European countries and, in doing so, has increased innovation and uptake throughout the continent.

Asia Pacific Digital Therapeutics & Connected Care Market Trends

Asia Pacific is expected to grow at the fastest rate in the upcoming period. Given the tremendous advances being made in digital health ecosystems in countries such as India, China, and Japan, the region is poised for a favorable trajectory moving forward. Programs backed by government initiatives, such as India's Ayushman Bharat Digital Mission and China's Healthy China 2030, which promote virtual consultations, mobile health apps, and chronic disease management, lead the way for progress. The increasing availability and affordability of cellular devices have expanded access to internet connectivity for rural populations, thereby furthering the adoption of digital solutions throughout the healthcare continuum.

China is emerging as a digital health innovation leader in the Asia Pacific due to the rapid uptake of digital approaches in healthcare have been fueled by effective public-private partnerships around AI-enabled health (e.g., health data platforms), new telehealth and consultation services and mobile health-centered chronic disease applications. The National Health Commission of China has also prioritized mental health and elderly care applications on digital platforms. The rapid growth of new platforms, combined with the policy approach across the healthcare industry, is driving significant and rapid growth in China's digital therapeutics sector.

Digital Therapeutics and Connected Care Market Companies

- Omada Health

- Livongo Health (Teladoc Health)

- Big Health

- Propeller Health (ResMed)

- Happify Health

- Kaia Health

- Voluntis (AptarGroup)

- Better Therapeutics

- Click Therapeutics

Recent Developments

- In January 2025, Glooko, Inc. and Hedia introduced their interoperable solution, which combines connected care, remote patient monitoring, and digital therapeutic technologies enhancing access for people with Type 1 and Type 2 diabetes requiring advanced bolus insulin dosing support in their daily management.

(Source:https://www.businesswire.com)

- In February 2025, Microsoft and Cerebras embarked upon a partnership with the Mayo Clinic to develop AI tools to assist with medical imaging workflows and medical diagnostics.

(Source:https://www.emjreviews.com)

- In April 2025, the American Telemedicine Association announced acquisition with acquired the Digital Therapeutics Alliance, which aims to drive uptake of software-based healthcare tools. Kyle Zebley, executive director ATA Action and senior vice president of public policy at the ATA stated, "Our goal is to create a unified voice to shape healthcare policies, ensuring that telehealth and digital therapeutics remain integral components of the U.S. healthcare system."

(Source:https://www.healthcareitnews.com)

Segments Covered in the Report

By Application

- Diabetes Management

- Mental Health (e.g., Depression, Anxiety, PTSD)

- Cardiovascular Diseases

- Respiratory Diseases (e.g., COPD, Asthma)

- Obesity & Weight Management

- Neurological Disorders (e.g., ADHD, Epilepsy)

- Smoking Cessation

- Substance Use Disorder

- Oncology Support

- Insomnia/Sleep Disorders

- Others

By Component

- Software/Apps

- Prescription Digital Therapeutics (PDTs)

- Wellness & Lifestyle Apps

- Devices

- Wearables

- Smart Inhalers, CGMs, etc.

- Services

- Remote Patient Monitoring (RPM)

- Virtual Coaching & Behavioral Counseling

By Therapeutic Approach

- Cognitive Behavioral Therapy (CBT)-based Solutions

- Biofeedback & Gamification

- AI-based Personalized Interventions

- Mindfulness & Meditation

- Habit-Reinforcement Platforms

By Business Model

- Business-to-Consumer (B2C)

- Business-to-Business (B2B)

- Includes partnerships with payers, employers, and providers

- B2B2C

- Hybrid models involving pharma, insurers, and health systems

By End User

- Patients (Self-managed care)

- Providers (Hospitals, Clinics, Specialists)

- Payers (Insurers, Employers)

- Research & Academic Institutions

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting