What is the Direct Selling Market Size?

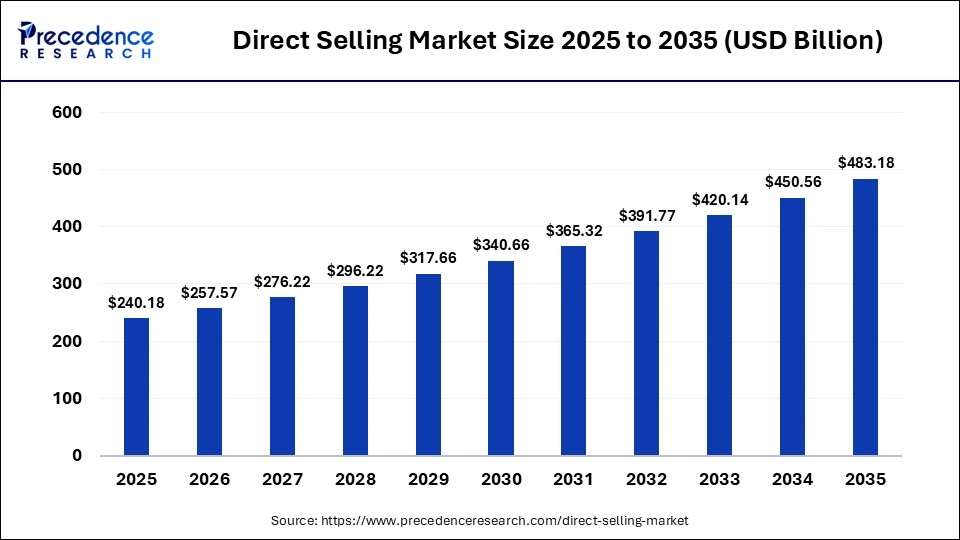

The global direct selling market size is calculated at USD 240.18 billion in 2025 and is predicted to increase from USD 257.57 billion in 2026 to approximately USD 483.18 billion by 2035, expanding at a CAGR of 7.24% from 2026 to 2035. The market growth is attributed to increasing health and wellness awareness and the expansion of mobile and social selling platforms, enabling independent distributors to reach broader consumer bases efficiently.

Market Highlights

- North America dominated the direct selling market in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

- By product, the healthcare & wellness segment contributed the largest market share of 36% in 2025.

- By product, the cosmetics & personal care segment is growing at a strong CAGR between 2026 and 2035.

Market Overview

Rising digital adoption strongly drives global direct selling growth as companies increasingly use mobile platforms, hybrid e-commerce models, and social selling tools to scale distributor networks and improve customer engagement. These solutions enable independent distributors to manage sales, marketing, and customer relationships more efficiently through digital channels. According to the World Federation of Direct Selling Associations' 2024 STATS report, global direct selling retail sales reached approximately USD 163.9 billion, reflecting sustained consumer acceptance of relationship-based and digitally enabled selling models.

North America holds the largest market share in the global direct selling market due to its mature direct selling ecosystem, high consumer purchasing power, and early adoption of digital and social commerce platforms. The region benefits from strong regulatory clarity, established compensation structures, and the presence of major direct selling companies that have successfully integrated omnichannel strategies. High internet penetration, widespread use of social media, and advanced payment infrastructure further support scalable distributor operations and consistent consumer engagement, reinforcing North America's dominant position.

Asia Pacific is projected to be the fastest-growing region in the direct selling market, driven by rapid urbanization, expanding middle-class populations, and rising adoption of mobile commerce across emerging economies such as China and Malaysia. Shifting consumer preferences toward personalized, convenience-oriented shopping are encouraging distributors to leverage digital direct selling tools to reach wider audiences. In addition, growing interest in entrepreneurship and flexible income opportunities is attracting a new generation of distributors, accelerating platform participation and driving rapid market expansion across the Asia Pacific region.

Growth Factors

- Integration of AI and Mobile Technologies: Adoption of AI-driven recommendation tools and mobile apps is propelling personalized selling and predictive consumer targeting.

- Growing Entrepreneurial Opportunities: Rising interest in flexible income streams is fueling new distributor recruitment and retention globally.

- Rising Cross-Border Direct Selling Initiatives: Expansion of international distributor networks is driving global sales growth and market penetration.

- Enhanced Digital Marketing and Training Programs: Investment in interactive online training and content marketing is boosting distributor efficiency and sales conversion rates.

Global Direct Selling Landscape and Workforce Scale

- In 2024, the total number of active independent direct sellers worldwide reached approximately 104.3 million, with 72.1% of them being female, indicating broad global participation in the direct selling channel.

- The U.S. remains the largest direct selling workforce in North America, with about 12.99 million active direct sellers recorded in 2023.

- China's direct selling sector reported around 2.97 million active direct sellers in 2023, making it one of the largest workforces in the Asia-Pacific region.

- India showed a high level of participation with an estimated 8.62 million active direct sellers contributing to the regional market in 2023.

- Cosmeticsand personal care products ranked as the second-largest global category in 2023, with around 24.2% of global direct selling sales, driven by skincare, beauty, and grooming items

- Combined, wellness, cosmetics, personal care, household goods, and durables accounted for nearly 72.9% of global direct selling product sales in 2023 across the industry

- In FY 2023–24, 54% of direct sellers globally continued to rely on traditional in-home demonstrations as their primary sales channel, underscoring that personal contact remains central to the direct selling model

- Women dominate the global direct selling workforce, accounting for approximately 70–72% of active direct sellers worldwide in 2024, with particularly high participation in Asia-Pacific, Latin America, and Europe.

Impact of Artificial Intelligence on the Direct Selling Market

The field of direct selling is transforming with the help of Artificial Intelligence that helps companies be more precise, efficient, and personal. The analytics based on AI can guide the selling companies to understand customer preferences and future purchasing behavior. This further offers personalized recommendations on products to enable distributors to attract potential customers more efficiently. Furthermore, the firms combine AI-based chatbots and virtual assistants to handle customer inquiries, make orders, and provide real-time customer support to enhance conversion rates and satisfaction.

What Are the Key Direct Selling Market Trends

- Growing Digital Tool Adoption for Seller Productivity

Direct selling companies are investing more in mobile apps, CRM systems, and AI assistance tools to improve distributor performance. The technologies facilitate the simplification of order management, customer tracking, and individual reach. Increased digital usage is fueling stronger seller efficiency across regions.

- Boosting Rural and Tier 2/3 Market Penetration

Improved smartphone and payment adoption continue to expand direct selling deep into rural and secondary cities. Last-mile distribution and digital engagement merge to open new customer clusters. This expansion pattern encourages broader economic involvement in the economy beyond urban cities.

- Propelling Regulatory Clarity and Industry Trust

Evolving consumer protection regulations and compliance frameworks are improving transparency and confidence in direct selling practices. Stricter regulations are used to distinguish between legitimate and fraudulent practices to enforce stronger consumer confidence.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 240.18 Billion |

| Market Size in 2026 | USD 257.57 Billion |

| Market Size by 2035 | USD 483.18 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.24% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Product, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Insights

Why Is Health & Wellness Dominating the Direct Selling Market?

The health & wellness segment dominated the direct selling market in 2025, due to the rising consumer focus on preventive care, immunity, and fitness products. Wellness is consistently listed among the top sectors alongside cosmetics and personal care in the WFDSA's 2024 STATS report covering 55 markets globally.

This segment retained the fastest-growing national markets in the world, as consumers sought immunity, preventive care, and nutritional supplements in their daily routines. Furthermore, the improvement of digital literacy, health, and wellness offerings further penetrates emerging economies. This drives higher penetration rates and encourages broader adoption of preventive health regimens through direct selling platforms. (Source:https://wfdsa.org.)

The cosmetics and personal care segment is expected to grow at the fastest rate in the coming years, as direct selling companies like Avon, Mary Kay, and Oriflame actively use mobile apps and digital catalogs to provide interactive experiences. Skincare, haircare, and beauty tools attracted younger consumers relying on social media influencers and virtual demonstrations for purchase decisions.

Cosmetics and personal care expansion is predicted to be strengthened by innovation and digital engagement instruments until 2025. In India, cosmetics and personal care accounted for 23.75% of total direct selling sales in FY 2023-24. Moreover, the new market segments like Southeast Asia, Latin America, and certain areas of Africa were facilitating the direct selling of cosmetics and personal care products with their strong population presence.

Regional Insights

Why Is North America Leading in Direct Selling Regional Performance?

North America led the direct selling market, capturing the largest revenue share in 2025. Due to a large base of tech-savvy consumers who actively engage with wellness, beauty, and nutritional products. North American sellers leverage social commerce, mobile selling technology, and in-between online and offline interaction to enhance customer relationships and speed up the conversion of orders. The area has a superior digital infrastructure and formed regulatory frameworks that facilitate compliance-based sales practices.

The desire to maintain good health and wellness among U.S. consumers contributed to the continuing popularity of the products sold on the direct channels. It is also likely that further innovation of the digital payment system and CRM tools would further boost the productivity of sellers to use the direct selling vision. Additionally, the regional associations will probably further adopt data-driven selling modes of approaching that enable distributors to customize offers and increase retention in the coming years.

How Is the U.S. Proving to Be North America's Growth Engine?

The U.S. leads the direct selling market in North America. Independent distributors used social commerce, mobile applications, and a hybrid selling format to penetrate urban and suburban consumers in the most effective way.

The Direct Selling Association training and support programs assisted distributors in increasing their product knowledge and ethical selling methods to increase customer trust. Furthermore, the online interaction based on hybrid engagement models that involve online and in-person interaction is likely to continue to grow strategies for direct selling solutions.

Why Is Asia Pacific Expanding Quickly in Regional Direct Selling?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to high retail sales share and participation in both emerging and mature markets. The area is the largest in total sales share of the world retail value, and there has been an active market in China, Korea, Malaysia, Japan, and India.

The growth of urbanization, the development of the middle classes, and the growth of disposable incomes contribute to the development of wellness, beauty, and personal care products in the form of direct sales. Moreover, the trend of growth in the Asia Pacific market is expected to pick up more until 2025 and 2026 due to the influx into the industry of younger, digitally connected sellers specialized in creating innovative engagement approaches.

China – Asia Pacific Market Leader

China is leading the charge in the Asia Pacific market, with a large group of tech-savvy consumers who are active in the wellness, beauty, and nutritional products field. The independent distributors used the mobile commerce platform and social selling to access the urban and semi-urban consumers effectively. Additionally, the high level of digitalization and well-developed logistics infrastructure in the region presuppose keeping the leadership of China in the Asia Pacific direct selling market until 2026.

Direct Selling Market Value Chain Analysis

- Product Development & Sourcing:Brands design and source products such as wellness, cosmetics, and home care for direct selling channels.

Key Players: Amway, Mary Kay, Avon Products, Longrich, Natura & Co.

- Inventory & Logistics Management:Finished products are stored and distributed through the company or third-party logistics networks.

Key Players: DHL Supply Chain, FedEx Logistics, DB Schenker, Kerry Logistics, SF Express.

- Distributor Recruitment & Onboarding:Companies recruit and onboard independent distributors to sell products directly to consumers.

Key Players: Amway, Herbalife, Tupperware, Nu Skin, QNET.

- Customer Engagement & Selling:Sellers connect with customers via in-person, social media, or hybrid channels to drive sales.

Key Players: Amway, Herbalife, Avon Products, Nu Skin, Oriflame.

- Order Fulfilment & Delivery:Orders are processed and shipped directly to customers through e-commerce and logistics systems.

Key Players: Amazon, DHL Supply Chain, FedEx, DB Schenker, UPS.

Who are the Major Players in the Global Direct Selling Market?

The major players in the direct selling market include Amway Enterprises Pvt. Ltd., Herbalife Nutrition Ltd., Natura & Co., Thermomix (Vorwerk), Nu Skin Enterprises, Tupperware Brands Corporation, Oriflame Cosmetics AG, Belcorp Corporation, Mary Kay Inc., Cutco Corporation.

Recent Developments

- In November 2025, Resale platform ThredUp launched its peer-to-peer marketplace in closed beta, allowing sellers to list items directly on its platform for the first time in its 15-year history. The move leverages ThredUp's proprietary resale technology to simplify pricing, logistics, and trust, addressing common friction points seen on peer-to-peer platforms such as eBay and Poshmark while expanding seller participation.

- In January 2026, Tulip introduced Outreach Plus, a multichannel communications platform designed to help retailers drive localized customer engagement and revenue growth. The solution enables store managers and associates to deliver personalized, store-led communications at scale, strengthening customer loyalty where centralized marketing often lacks local relevance.

- In August 2025, Modicare Limited expanded its health and nutrition portfolio with the launch of Modiway Shift Life, a new wellness range focused on long-term lifestyle improvement. The product line reflects growing demand for accessible, holistic health solutions within India's direct selling ecosystem, reinforcing distributor-led education and personalized wellness engagement.

Segments Covered in the Report

By Product

- Cosmetics & Personal Care

- Health & Wellness

- Household Goods & Durables

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting