Electric Motorcycle and Scooters Market Size and Forecast 2025 to 2034

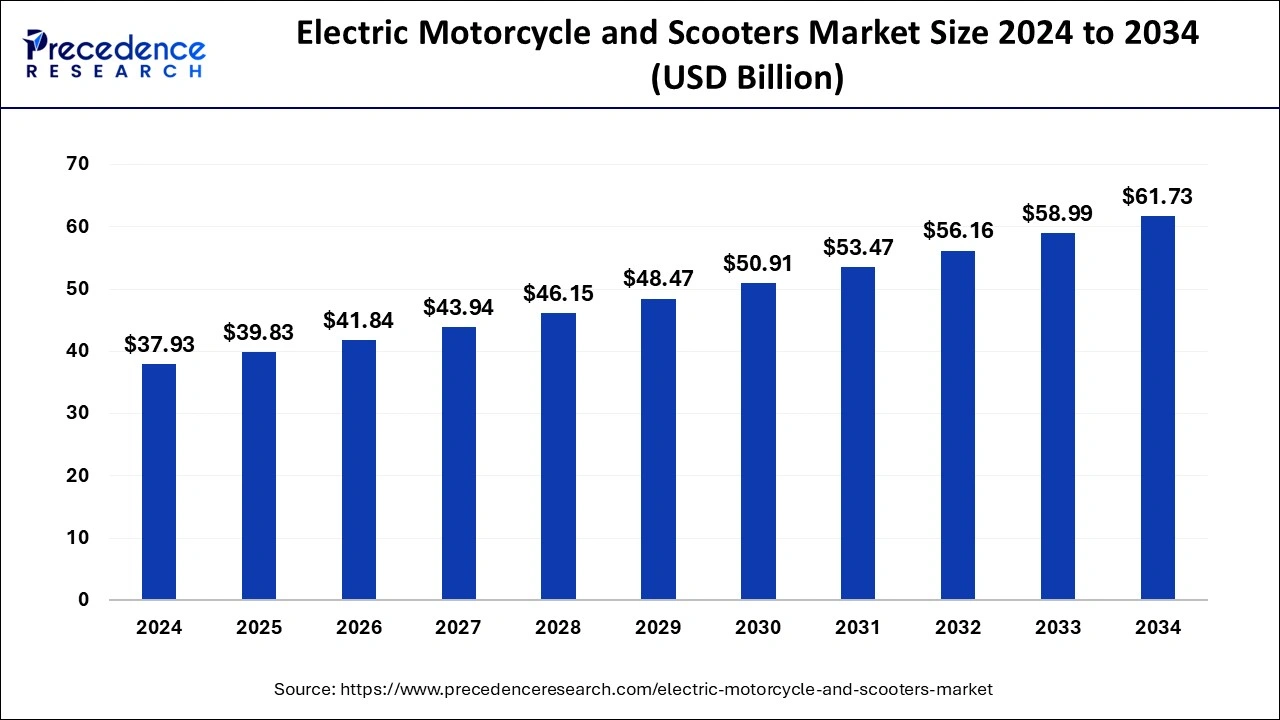

The global electric motorcycle and scooters market size was estimated at USD 37.93 billion in 2024 and is predicted to increase from USD 39.83 billion in 2025 to approximately USD 61.73 billion by 2034, expanding at a CAGR of 4.99% from 2025 to 2034.

Electric Motorcycle and Scooters MarketKey Takeaways

- In terms of revenue, the electric motorcycle and scooters market is valued at USD 39.83 billion in 2025.

- It is projected to reach USD 61.73 billion by 2034.

- The electric motorcycle and scooters market is expected to grow at a CAGR of 4.99% from 2025 to 2034.

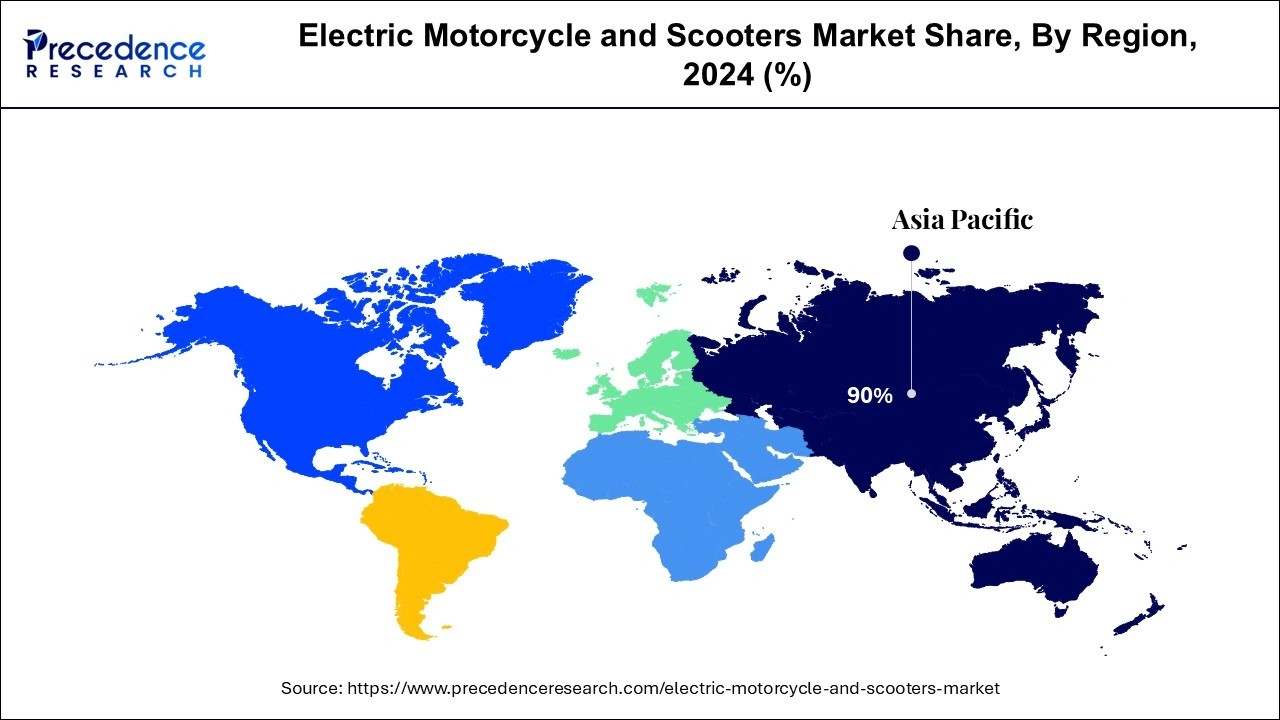

- Asia Pacific has contributed more than 90% of market share in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

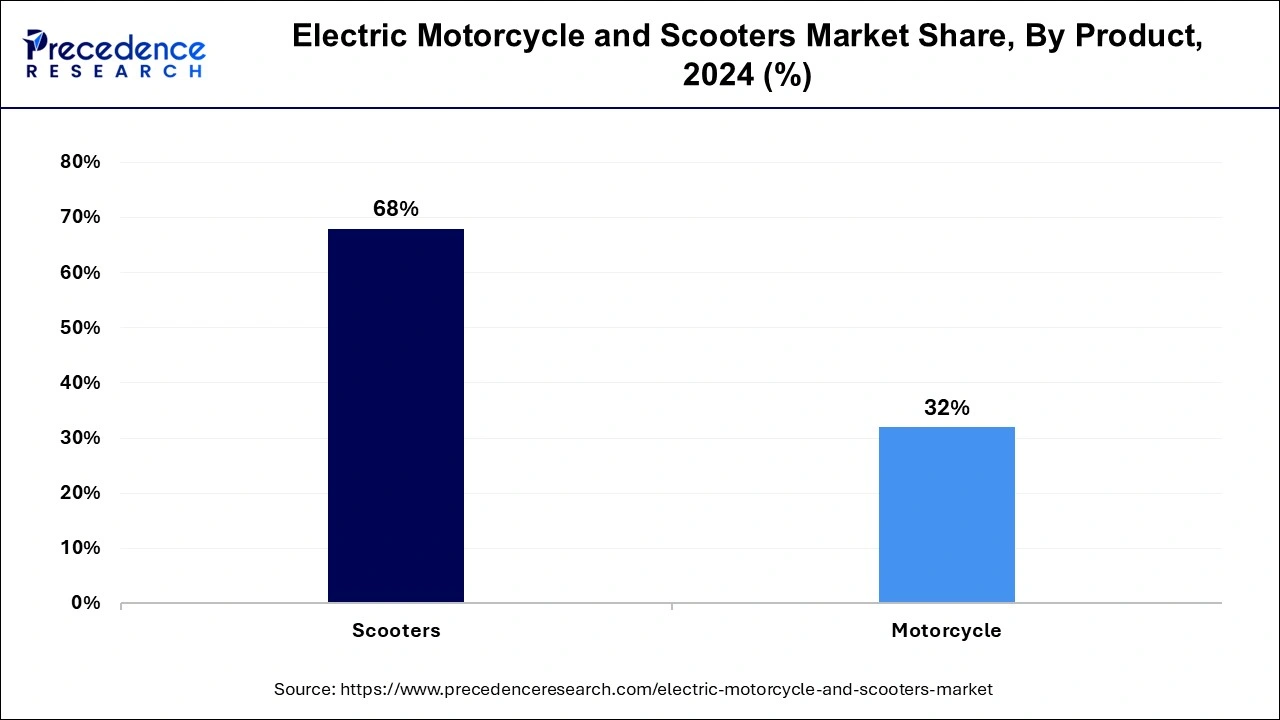

- By product, the scooters segment has generated the largest market share of 68% in 2024.

- By product, the motorcycle segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

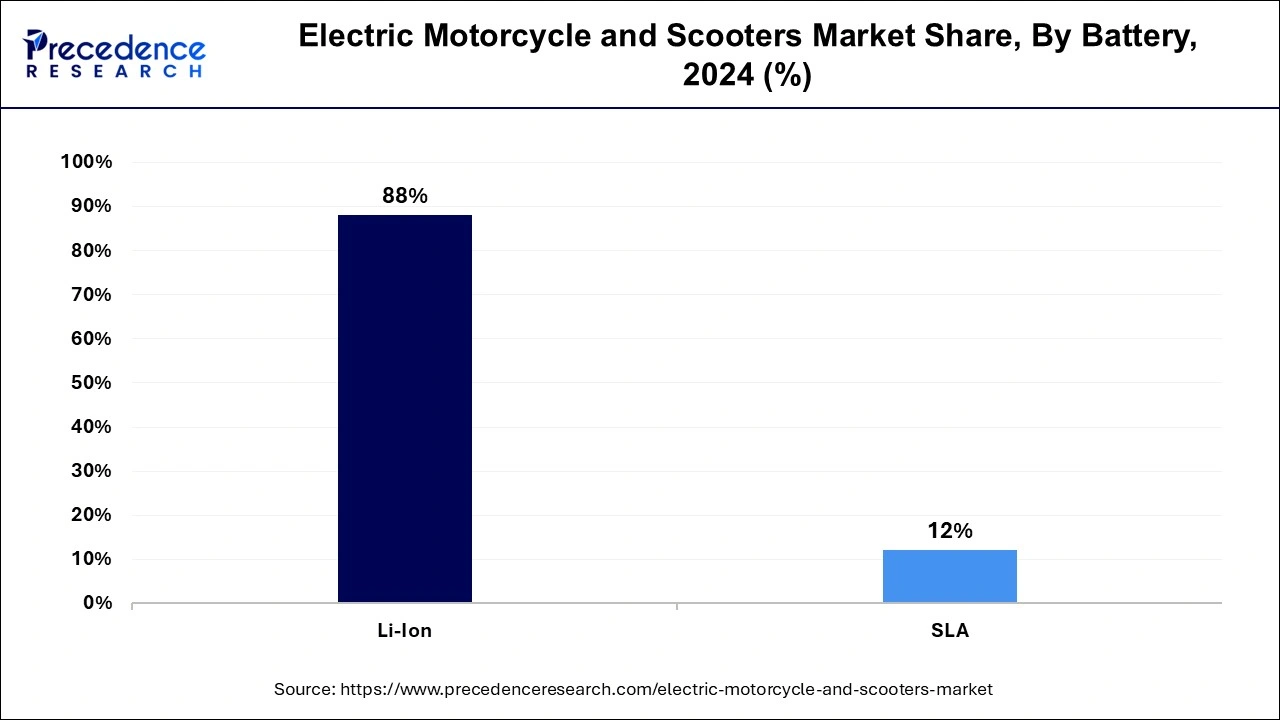

- By battery, the y, lithium-ion (Li-ion) battery segment generated over 88% of market share in 2024.

- By battery, the SLA segment is expected to expand at the fastest CAGR over the projected period.

- By voltage, the 36V segment has held the major market share in 2024.

- By voltage, the 48V segment is expected to expand at the fastest CAGR over the projected period.

Asia-PacificElectric Motorcycle and Scooters Market Size and Growth 2025 to 2034

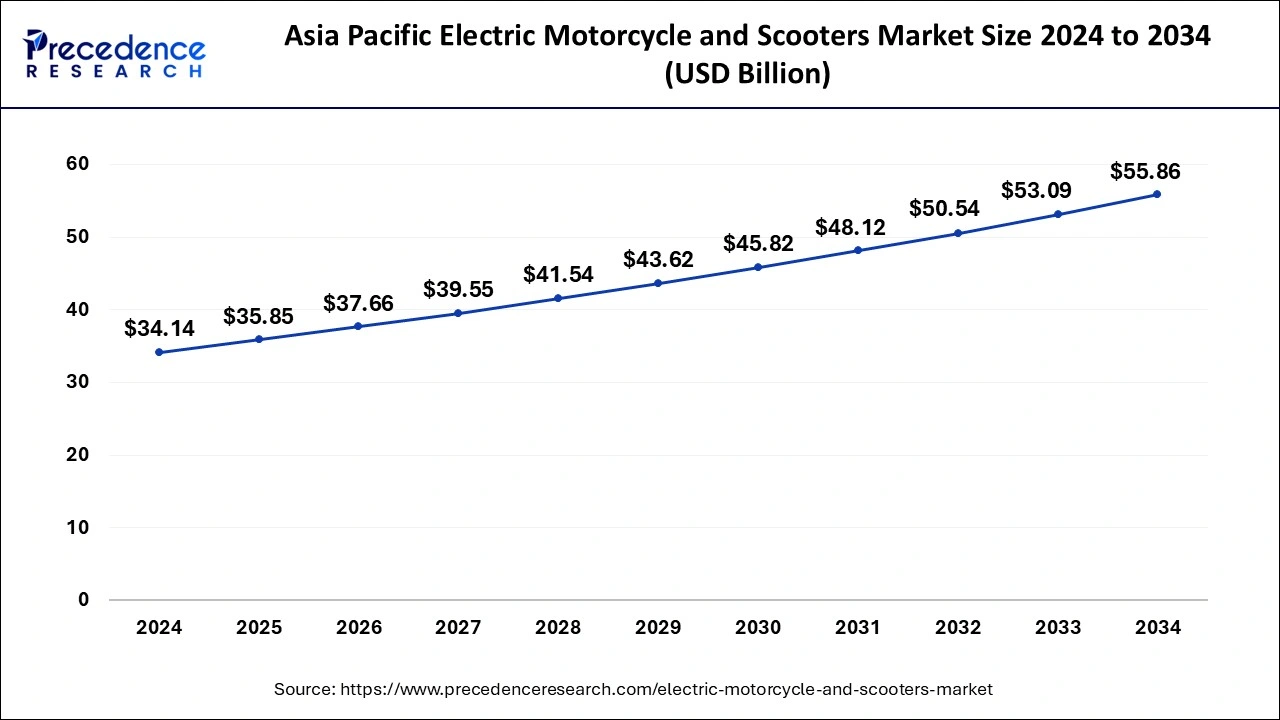

The Asia-Pacific electric motorcycle and scooters market size was estimated at USD 34.14 billion in 2024 and is projected to surpass around USD 55.86 billion by 2034 at a CAGR of 5.05% from 2025 to 2034.

Asia-Pacific held a share of 90% in the electric motorcycle & scooters market in 2024 due to several factors. This region has a large population with densely populated urban areas, leading to high demand for affordable and efficient transportation solutions. Additionally, supportive government policies, such as subsidies and incentives for electric vehicles, have accelerated the adoption of electric motorcycles and scooters. Furthermore, the presence of leading manufacturers and advancements in battery technology in countries like China, India, and Japan contribute to the dominance of the Asia-Pacific region in the market.

North America is witnessing rapid growth in the electric motorcycle & scooters market due to several factors. Increasing environmental consciousness, coupled with government incentives and stricter emissions regulations, is driving consumers towards eco-friendly transportation options. Additionally, advancements in battery technology and charging infrastructure are making electric vehicles more practical and convenient for daily use. Furthermore, rising urbanization and traffic congestion in cities are prompting commuters to seek efficient and cost-effective alternatives, further boosting the demand for electric motorcycles and scooters in North America.

Meanwhile, Europe is experiencing significant growth in the electric motorcycle & scooters market due to several factors. Stringent emissions regulations, rising environmental concerns, and government incentives are driving the demand for eco-friendly transportation options. Additionally, urbanization and traffic congestion in European cities are prompting consumers to seek efficient and sustainable mobility solutions like electric two-wheelers. Technological advancements, coupled with increasing consumer awareness and acceptance of electric vehicles, are further fueling the growth of the electric motorcycle & scooters market in Europe.

Market Overview

The electric motorcycle & scooters market offers two-wheeled vehicles that run entirely on electricity instead of gasoline. Just like traditional motorcycles and scooters, they have a seat for the rider, handlebars for steering, and wheels for movement. The main difference lies in their power source, electric bikes use rechargeable batteries to power an electric motor instead of a combustion engine. These batteries can be charged by plugging them into a standard electrical outlet, making them convenient and cost-effective to operate.

Electric motorcycles and scooters offer a quieter and smoother ride compared to their gas-powered counterparts. They also produce zero emissions, making them environmentally friendly options for transportation. With advancements in battery technology and the growing concern for the environment, electric motorcycles and scooters are becoming increasingly popular as efficient and sustainable modes of transportation for urban commuting and recreational riding.

Electric Motorcycle and Scooters Market Data and Statistics

- In January 2024, the Gujarat Government in India commenced the establishment of an electric vehicle (EV) charging infrastructure aimed at enticing investors in the electric vehicle manufacturing sector.

- According to the International Energy Agency (IEA), China accounted for over 95% of electric scooter and motorcycle sales globally in 2020.

- The European Union's target to reduce CO2 emissions from vehicles by 37.5% by 2030 is driving the adoption of electric two-wheelers in the region.

- According to BloombergNEF, the average energy density of lithium-ion batteries increased by approximately 5% per year between 2010 and 2020.

- BloombergNEF reported that the average lithium-ion battery pack price declined by 87% between 2010 and 2020, making electric vehicles more cost-competitive with internal combustion engine vehicles.

- According to the United Nations, approximately 68% of the world's population is projected to live in urban areas by 2050, further fueling the demand for urban mobility solutions like electric two-wheelers.

Electric Motorcycle and Scooters MarketGrowth Factors

- Government initiatives such as subsidies, tax incentives, and infrastructure development play a significant role in driving the growth of the electric motorcycle & scooters market. These incentives encourage consumers to choose electric vehicles over traditional ones, thereby boosting demand.

- Growing awareness about environmental issues and the need to reduce carbon emissions is driving the demand for electric motorcycles and scooters. As zero-emission vehicles, they offer a cleaner alternative to traditional gasoline-powered vehicles, appealing to environmentally conscious consumers.

- Continuous advancements in battery technology, electric motors, and charging infrastructure are improving the performance, range, and affordability of electric motorcycles and scooters. Enhanced technology makes these vehicles more appealing and practical for a wider range of consumers.

- The increasing urbanization and congestion in cities are driving the demand for alternative modes of transportation, such as electric motorcycles and scooters. Their compact size and maneuverability make them ideal for navigating through traffic and crowded urban areas.

- Electric motorcycles and scooters offer lower operating costs compared to traditional gasoline-powered vehicles. With fewer moving parts and no need for gasoline, maintenance and fuel costs are significantly reduced, making electric two-wheelers a cost-effective transportation option in the long run.

- Shifting consumer preferences towards sustainable and eco-friendly products are fueling the demand for electric motorcycles and scooters. As more consumers prioritize environmental sustainability and seek out cleaner transportation options, the market for electric two-wheelers continues to grow.

Trends

- The increasing popularity of the eco–friendly transportation initiatives is spearheading industry growth in the current period. As several major transportation brands are seen in the promotion of their sustainable transportation, the electric vehicle gained major attraction akin to its low CO 2 emission in recent years.

- The favorable government-supported initiatives for maintaining aims to maintain a green environment are driving the market growth over the past years. As the electric vehicle manufacturers are receiving attractive subsidies and tax reduction policies from several governments to encourage people to buy electric vehicles at a lower cost.

- The ongoing technological advancement in vehicle manufacturing is heavily contributing to the growth of the industry in the current period. Moreover, these advancements help manufacturers to create long-lasting vehicles that can gain individuals' attention toward electric vehicle purchases rather than traditional petroleum-based vehicles.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 4.99% |

| Market Size in 2025 | USD 39.83 Billion |

| Market Size by 2034 | USD 61.73 Billion |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Product, By Battery, and By Voltage |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Urbanization and traffic congestion

Urbanization and traffic congestion significantly drive the demand for electric motorcycles and scooters. As cities become more densely populated, traffic congestion worsens, leading to longer commute times and increased frustration among commuters. Electric motorcycles and scooters offer a practical solution to navigate through congested urban areas swiftly. Their compact size and agility allow riders to maneuver through traffic, enabling quicker and more efficient travel compared to traditional vehicles. Additionally, electric two-wheelers can access narrow lanes and shortcuts inaccessible to larger vehicles, further reducing travel time in congested urban environments.

Furthermore, as cities strive to reduce pollution and improve air quality, many are implementing regulations to restrict the use of gasoline-powered vehicles in urban centers. Electric motorcycles and scooters produce zero tailpipe emissions, making them an environmentally friendly alternative. Governments and city authorities may also offer incentives such as subsidies, tax breaks, or preferential parking to encourage the adoption of electric vehicles, further boosting their popularity among urban commuters seeking efficient, eco-friendly transportation solutions.

Restraint

Battery degradation and replacement costs

Battery degradation and replacement costs pose significant challenges to the expansion of the electric motorcycle & scooters market. Over time, the performance of lithium-ion batteries, which power most electric two-wheelers, deteriorates due to factors like usage patterns, temperature fluctuations, and aging. As batteries degrade, the vehicle's range and overall performance diminish, leading to decreased consumer satisfaction and confidence in electric vehicles. Moreover, the prospect of replacing degraded batteries adds to the total ownership cost of electric motorcycles and scooters.

Battery replacement can be a significant expense, potentially deterring budget-conscious consumers from purchasing electric vehicles. Additionally, concerns about the availability and cost of replacement batteries may cause hesitation among prospective buyers, especially in regions where infrastructure for battery recycling and disposal is underdeveloped. Addressing these challenges through advancements in battery technology, extended warranty options, and recycling programs is essential to alleviate consumer concerns and accelerate the adoption of electric motorcycles and scooters.

Opportunity

Collaboration with ride-sharing and delivery services

Collaboration with ride-sharing and delivery services presents significant opportunities for the electric motorcycle & scooters market. Ride-sharing companies can integrate electric two-wheelers into their fleets, offering customers a convenient and eco-friendly transportation option for short-distance trips within urban areas. By partnering with ride-sharing platforms, electric vehicle manufacturers can expand their market reach and increase brand visibility among a broader audience of potential customers.

Similarly, delivery services can benefit from using electric motorcycles and scooters for last-mile deliveries. These vehicles are well-suited for navigating through congested urban areas and can help companies reduce delivery times and operating costs while minimizing their carbon footprint. Collaborating with delivery services allows electric vehicle manufacturers to tap into the growing demand for sustainable logistics solutions and establish themselves as key players in the urban mobility ecosystem. Overall, these partnerships foster innovation and drive the adoption of electric motorcycles and scooters as efficient and environmentally friendly modes of transportation for both personal and commercial use.

Product Insights

The scooters segment held the highest market share of 68% based on the product. Scooters in the electric motorcycle & scooters market refer to two-wheeled vehicles powered by electric motors, designed for single riders and short-distance urban commuting. They typically feature a step-through frame and a platform for the rider's feet. Trends in the electric scooter segment include the development of lightweight and compact models, improved battery technology for extended range, integration of smart features such as connectivity and navigation systems, and customization options to appeal to diverse consumer preferences.

The motorcycle segment is anticipated to witness rapid growth at a significant CAGR of 6.4% during the projected period. The motorcycle segment in the electric motorcycle & scooters market encompasses two-wheeled vehicles designed for single-rider use, typically featuring a saddle-style seat and handlebars for steering. Trends in this segment include the development of high-performance electric motorcycles with improved range, acceleration, and top speeds. Manufacturers are also focusing on incorporating advanced technology such as regenerative braking systems, integrated connectivity features, and lightweight materials to enhance performance, safety, and rider experience in electric motorcycles.

Battery Insights

The lithium-ion (li-ion) battery segment held 88% market share in 2024. In the electric motorcycle & scooters market, the lithium-ion (Li-ion) battery segment refers to vehicles powered by rechargeable Li-ion batteries. These batteries offer higher energy density, longer lifespan, and faster charging times compared to other battery types, making them ideal for electric two-wheelers. A significant trend in this segment is the continuous improvement in Li-ion battery technology, resulting in increased range, improved performance, and reduced costs, driving the adoption of electric motorcycles and scooters as viable alternatives to traditional gasoline-powered vehicles.

The SLA segment is anticipated to witness rapid growth over the projected period. The SLA (Sealed Lead Acid) battery segment in the electric motorcycle & scooters market refers to batteries that use lead plates submerged in an electrolyte solution. While once popular for their low cost and reliability, SLA batteries are gradually being replaced by lighter and more efficient lithium-ion batteries. Despite this, SLA batteries still find application in entry-level electric two-wheelers due to their affordability. However, the segment is witnessing a decline in demand as lithium-ion batteries become more prevalent for their superior performance and energy density.

Voltage Insights

The 36V segment has held 38% market share in 2024. The 36V segment in the electric motorcycle & scooters market refers to vehicles powered by a 36-volt electrical system. These vehicles typically offer moderate power output, suitable for urban commuting and short-distance travel. In recent trends, manufacturers are focusing on enhancing the performance and range of 36V electric motorcycles and scooters through advancements in battery technology. This segment is popular among consumers looking for affordable and practical electric transportation options for daily commuting needs in urban environments.

The 48V segment is anticipated to witness rapid growth over the projected period. In the electric motorcycle & scooters market, the 48V segment refers to vehicles powered by a 48-volt electrical system. This segment typically includes lightweight urban commuter models designed for short to medium-range travel. Recent trends in this segment show a growing demand for affordable and energy-efficient electric two-wheelers suited for urban commuting. Manufacturers are focusing on developing 48V vehicles with improved battery technology, longer range, and enhanced features to meet the needs of urban commuters seeking eco-friendly transportation options.

Electric Motorcycle and Scooters Market Companies

- Zero Motorcycles

- Harley-Davidson

- Yamaha Motor Company

- Hero MotoCorp

- NIU Technologies

- Gogoro Inc.

- Vespa (Piaggio Group)

- Energica Motor Company

- BMW Motorrad

- KTM AG

- Revolt Motors

- Evoke Motorcycles

- Lightning Motorcycles

- Terra Motors Corporation

- Super Soco

Recent Developments

- In 2025, Honda Motors introduced their new electric scooter named QC1. The scooter has a digital speedometer and instrument cluster for the necessary data bridging. The range of the scooter is up to 80 km, as the company claimed. Source: timesbull.com

- The Indian high-performance electric bike producer, Ultraviolette, recently launched their first ever electric scooter in a forward event in Bengaluru, India. The name of the scooter is Tesseract, and it is loaded with innovative features. The scooter has front and rear radar for the first time. Source: rushlane.com

- In 2025, Simple Energy unveiled its latest electric scooter called Simple OneS. The company claimed that the scooter has a range of 181km and a top speed of 105 km. Also, the scooter is compatible with four riding modes: dash, eco, ride, and sonic. Source: thehindu.com

- In 2025, Hero Motocorp introduced the latest electric scooter, Vida V2. The scooter has an advanced braking system, such as an antilock braking system and disc brake options. Also, the scooter can travel 100km on one charge with an affordable price range, with a starting price of 96000 indian rupees only. Source: timesbull.com

- In December 2023, Yamaha made an investment in the battery-swapping firm, Swapping Battery Network, with the aim of creating a robust battery-swapping infrastructure across Europe to support its forthcoming electric scooter lineup. This strategic move is poised to enhance the overall charging ecosystem and stimulate market growth.

- In June 2023, Hero MotoCorp revealed plans to allocate up to USD 181.6 million towards the advancement of premium motorcycles and electric vehicles (EVs) in India. The company asserted that this strategic decision aligns with the evolving regulatory landscape pertaining to electric vehicles (EVs).

Segments Covered in the Report

By Product

- Motorcycle

- Scooters

By Battery

- SLA

- Li-ion

By Voltage

- 24V

- 36V

- 48V

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting