What is the Electric Vehicle Fluids Market Size?

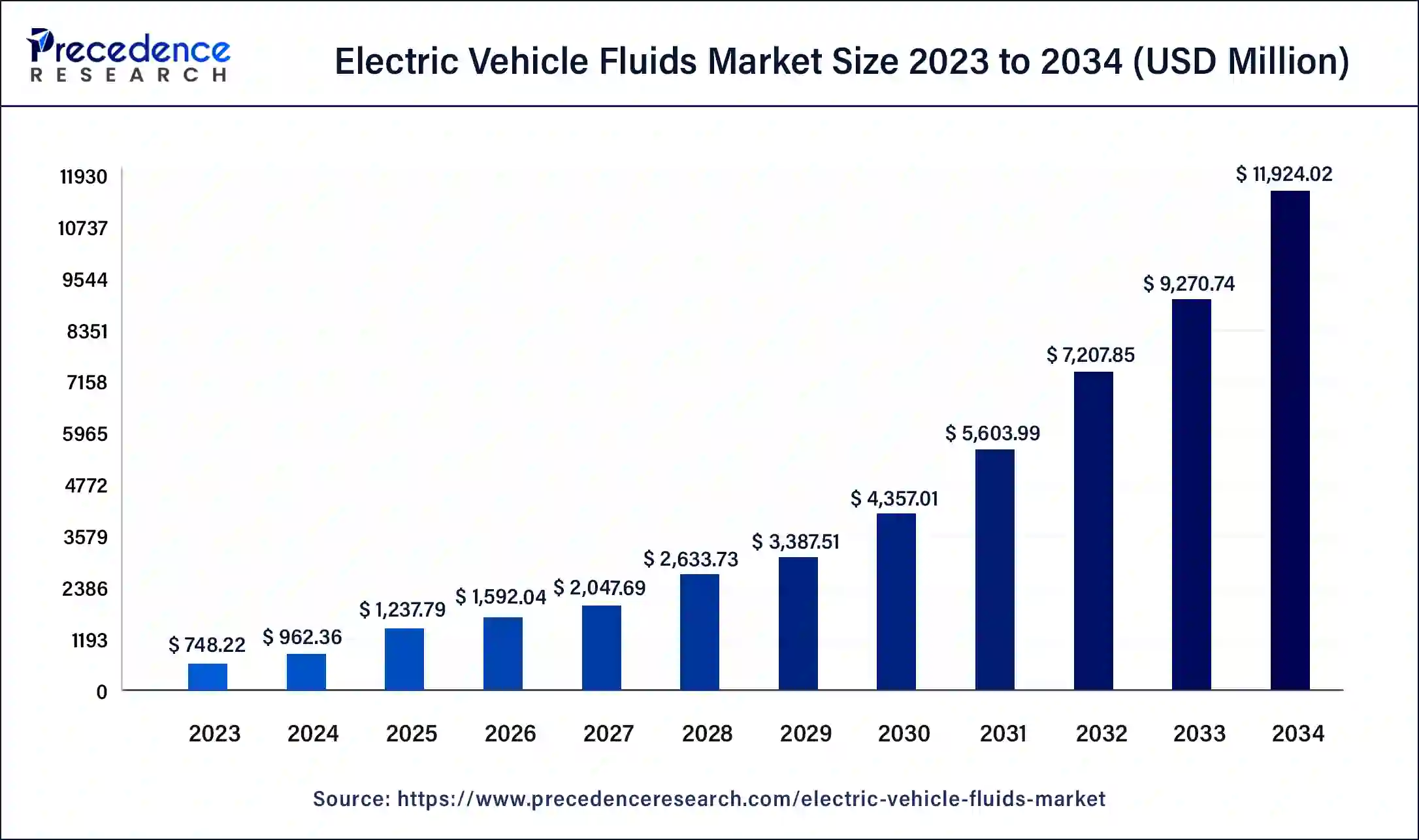

The global electric vehicle fluids market size is valued at USD 1.24 billion in 2025 and is predicted to increase from USD 1.59 billion in 2026 to approximately USD 11.92 billion by 2034. The market is expanding at a solid CAGR of 28.65% over the forecast period 2025 to 2034. Rising inclination towards electric vehicles worldwide to combat environmental changes and governments increasing approvals for electric vehicles (EVs) are the major factors driving the electric vehicle fluids market globally.

Electric Vehicle Fluids Market Key Takeaways

- The global electric vehicle fluids market was valued at USD 0.96 billion in 2024.

- It is projected to reach USD 11.92 billion by 2034.

- The electric vehicle fluids market is expected to grow at a CAGR of 28.65% from 2025 to 2034.

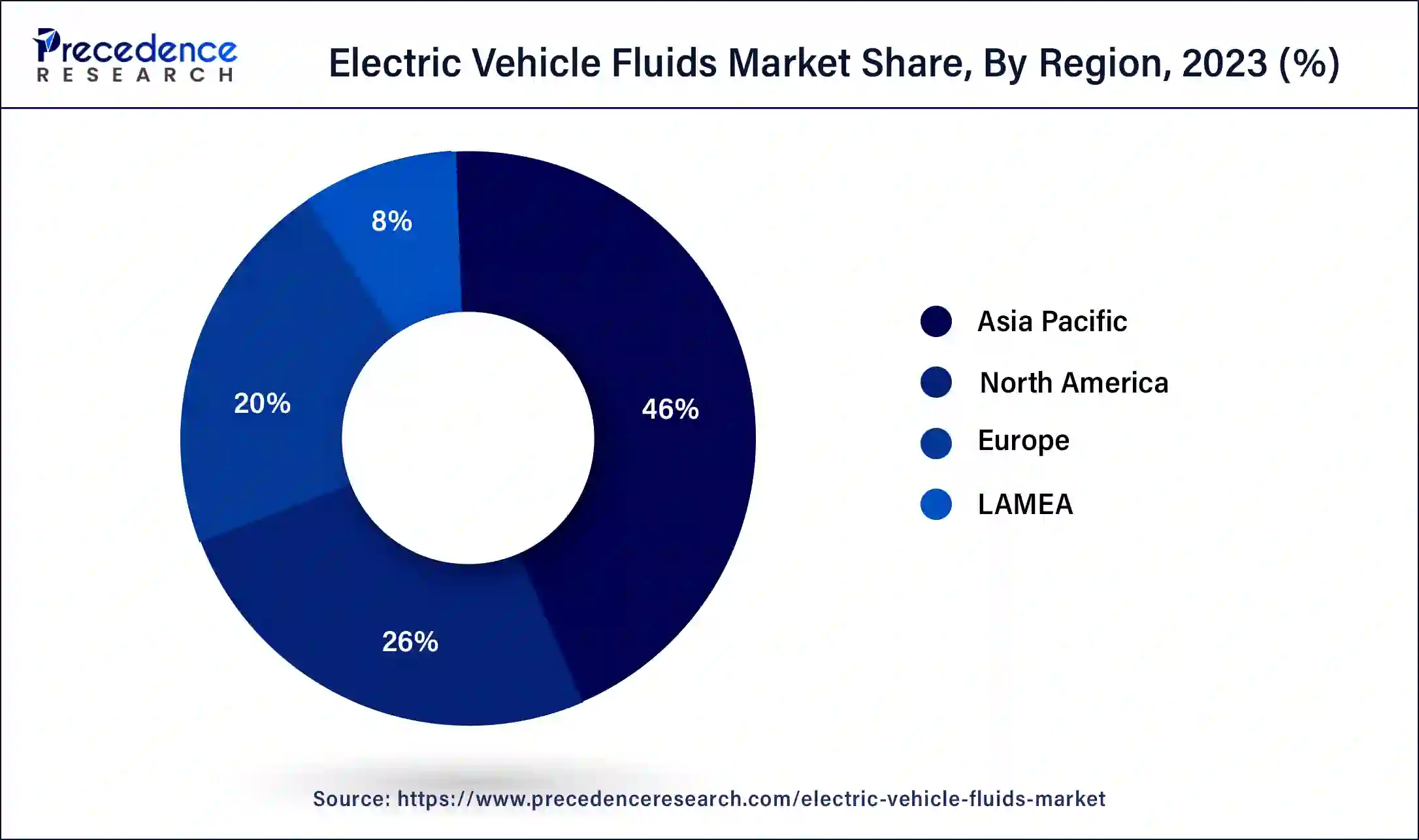

- Asia Pacific dominated the global electric vehicle fluids market with the largest revenue share of 46% in 2024.

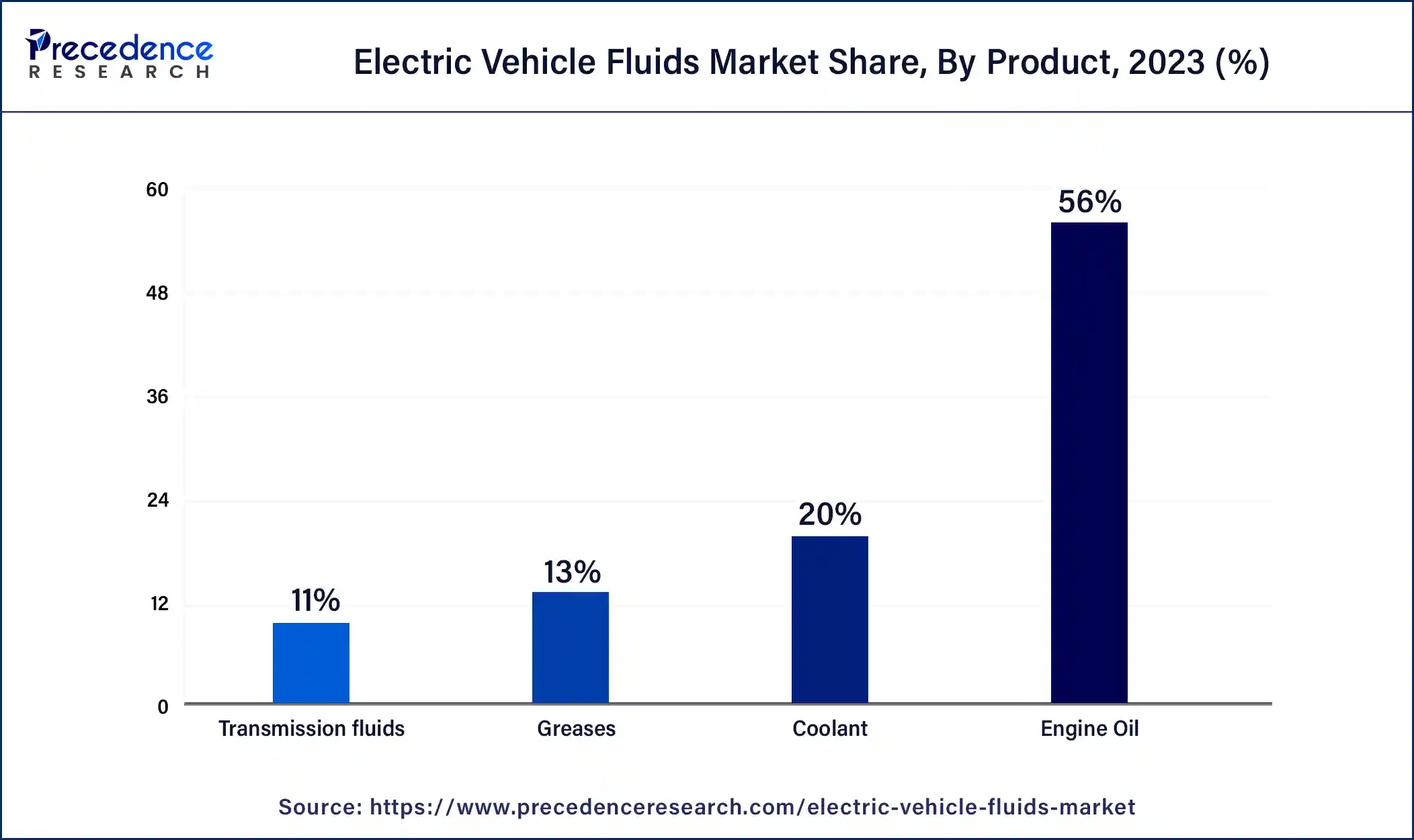

- By product, the engine oil segment has generated more than 56% of revenue share in 2024.

- By product, the coolant segment is expected to witness promising future growth in the market.

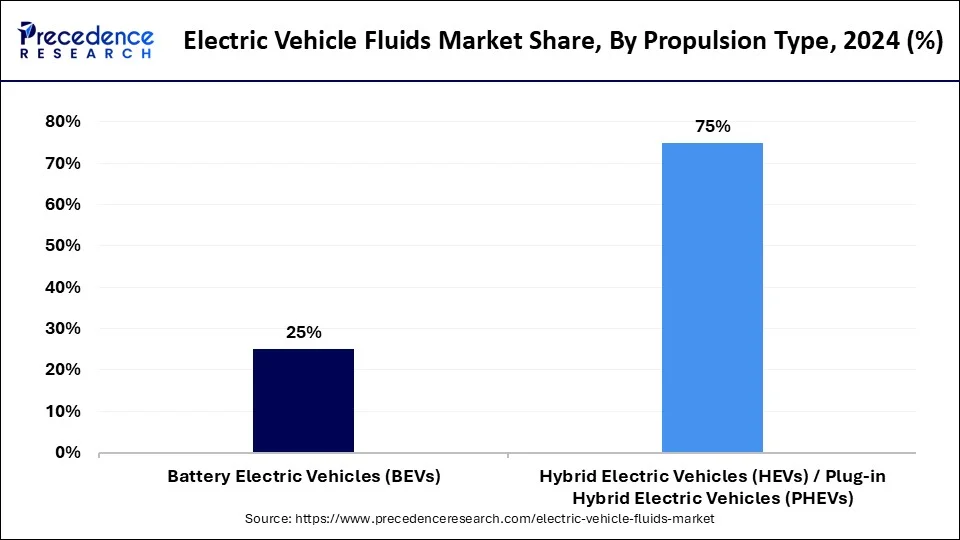

- By propulsion type, the hybrid electrical vehicles (HEVs)/plug-in hybrid electrical vehicles (PHEVs) segment accounted for a largest revenue share of 75% in 2024.

- By propulsion type, the battery electric vehicles (BEV) segment is expected to show significant growth in the global market in the upcoming years.

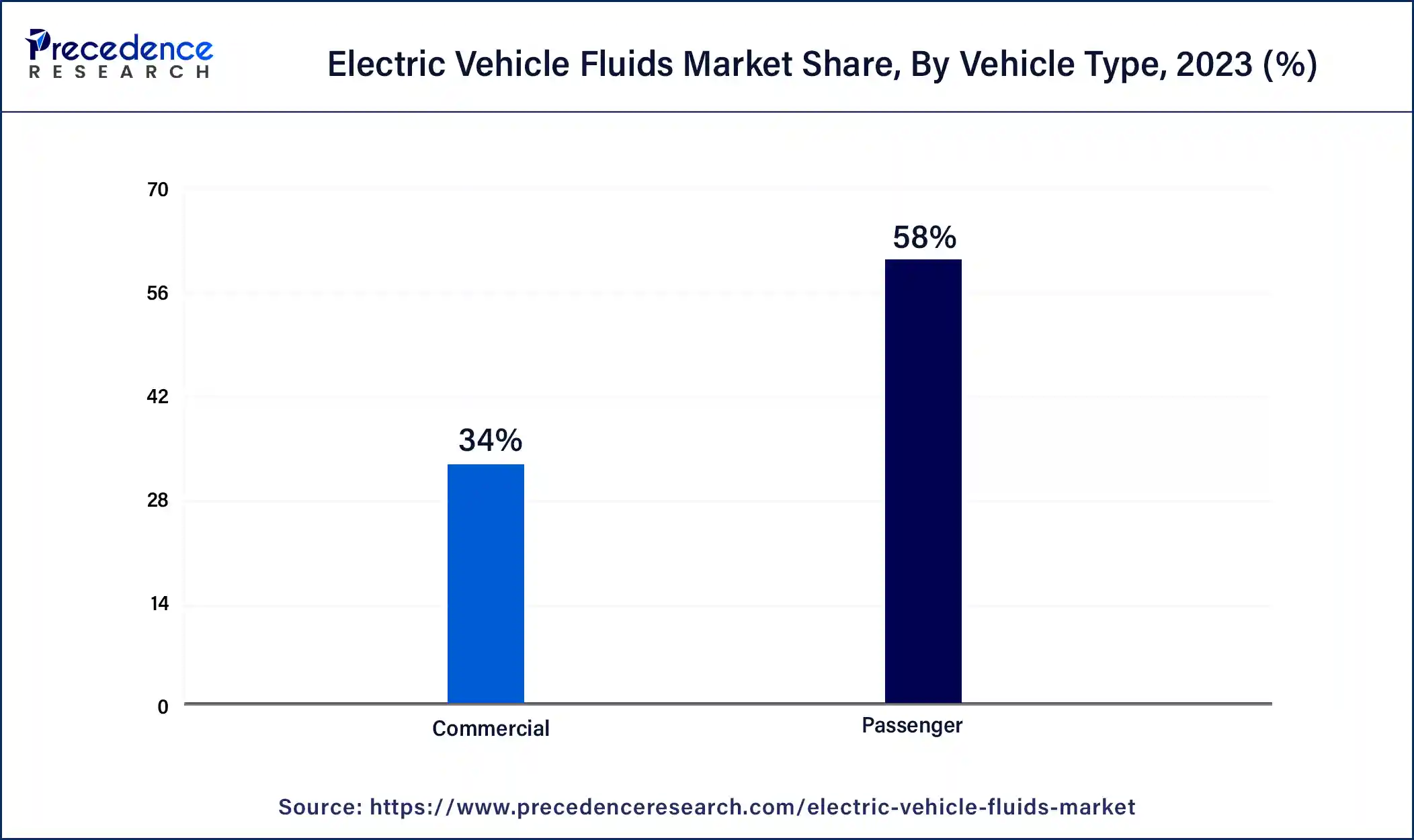

- By vehicle type, the passenger segment has contributed the biggest revenue share of 66% in 2024.

- By vehicle type, the commercial segment is expected to witness notable growth in the market in the forecast period.

What is an Electric Vehicle Fluid?

The electric vehicle fluids market is experiencing rapid growth, driven by the increasing adoption of EVs worldwide. These specialized fluids, including coolants, lubricants, and transmission fluids, are essential for maintaining EV performance and efficiency. With rising environmental concerns and stringent emission regulations, the demand for EVs and, consequently, EV fluids is surging. Major players are innovating to develop advanced, eco-friendly fluids to enhance battery life and vehicle efficiency.

Asia Pacific, particularly China and India, is leading the market due to high EV adoption rates. The electric vehicle fluids market is also expanding in Europe and North America, driven by government incentives and growing consumer awareness. Overall, the EV fluids market is set for significant expansion in the coming years.

What Are the Growth Factors in the Electric Vehicle Fluids Market?

- A rising adoption of EVs worldwide fuels the demand for the electric vehicle fluids market.

- Increasing inclination towards sustainable transportation.

- Government incentives and subsidies to promote environmentally friendly transportation like EVs.

- The U.S. government announced a substantial funding initiative to enhance EV infrastructure, including the expansion of charging stations and research into advanced EV technologies.

- The evolving market of EVs with ongoing advancements in the technological aspect of electric vehicles further fuels the electric vehicle fluids market.

- To prevent the aging and capacity loss of batteries used in electric vehicles, coolant fluids hold the utmost importance, thus increasing the demand for electrical vehicle fluids.

- Vehicle manufacturers need specialized fluids to comply with the technically advanced engines of electric vehicles to manage the heat created by EVs.

- Sustainability and climate-friendly fluids have gained hype in recent years due to rising awareness among the masses about climate change and its way of preservation for better livelihood.

Electric Vehicle Fluids Market Outlook

- Industry Growth Overview: The electric vehicle fluids market is anticipated to experience a growth spurt from 2025 to 2030, as EV purchases continue to accelerate globally. EV fluids gained traction because of a combination of advanced thermal management, higher-performance lubricants, and coolants infused with battery-safe properties. The growth of the fluids market in the Asia-Pacific and North America was robust, benefiting from rapid growth in EV production capabilities, leading to the proliferation of charging networks.

- Global Expansion: Major players in the fluids sector are surging to develop plants and R&D changes to facilitate production of EV fluids, including production near the largest EV hubs located in China, Europe, and Southeast Asia. Key players expanded operations to facilitate EV fluids for developed EV segments, capitalizing on their regional incentives, products, or labor force. In addition, a few suppliers mentioned increasing blending capacity in China to respond to the fast growth of EV battery and drivetrain needs.

- Key Investors: Several private equity firms, along with an increasing number of automotive firms, ventured into the growing market for high-margin EV fluid technologies and saw an increase in major investment activity. The technical barriers to entry for these technologies are significant, and the establishment of long-term relationships with OEMs helps major investors cover the risk of new and/or unproven solutions.

- Startup Ecosystem: The startup ecosystem in EV fluids has grown, driven primarily by innovation in nano-enhanced coolants, fire-safe dielectric liquids, and ultra-low-viscosity lubricants. Firms in the US, Europe, and India have received significant venture firm interest by offering safer solutions with superior efficiency in cooling batteries and power electronics. Moreover, these emerging firms have focused on maximizing performance, sustainability, and scalable speed.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 11.92 Billion |

| Market Size in 2025 | USD 1.24 Billion |

| Market Size in 2026 | USD 1.59 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 28.65% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Propulsion Type, Vehicle Type, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Market Dynamics

Driver

Governments worldwide are offering incentives to promote EV

The major driver for the electric vehicle fluids market is the accelerating global shift towards electric mobility, driven by environmental concerns and stringent emission regulations. Governments worldwide are implementing policies and offering incentives to promote EV adoption, which in turn boosts the demand for EV-specific fluids. These fluids, such as coolants, lubricants, and transmission fluids, are crucial for maintaining the efficiency and longevity of EV components, especially the battery and powertrain.

Advancements in EV technology, such as improved battery efficiency and thermal management systems, are driving the need for innovative and specialized fluids. Developing nations like China are also witnessing substantial growth in EV adoption, further propelling the electric vehicle fluids market.

- In June 2024, the European Parliament approved a draft regulation mandating this transition, aiming to reduce carbon emissions and combat climate change. This policy significantly pushes the automotive industry towards electric mobility, leading to increased demand for high-performance EV fluids that ensure optimal vehicle performance and safety.

- In May 2024, the Chinese government announced new subsidies and infrastructure developments to support the EV sector, fostering a robust EV ecosystem and boosting the demand for EV fluids. In a nutshell, the global push towards electric mobility, supported by regulatory measures and technological advancements, is the primary driver of the burgeoning EV fluids market.

Restraint

Limited availability of advanced EV fluids

A significant restraint for the electric vehicle fluids market is the high cost and limited availability of advanced EV fluids. Developing specialized fluids that meet the unique requirements of EVs involves extensive research and development, leading to higher production costs. These costs are often passed on to consumers, making EV fluids more expensive compared to traditional automotive fluids. This price disparity can deter some consumers and smaller automotive service providers from adopting these specialized products.

The limited infrastructure for EV maintenance and servicing poses a challenge. Many regions still lack the necessary facilities and trained personnel to handle EV-specific fluids properly. This gap can hinder the widespread adoption of advanced EV fluids, as consumers may face difficulties finding reliable service centers equipped to manage their vehicles' fluid needs. In addition, fluctuating raw material prices and supply chain disruptions can impact the availability and cost of EV fluids, further restraining the electric vehicle fluids market growth. These factors collectively pose significant challenges to the widespread adoption of EV fluids.

Opportunity

Innovations in fluid formulations

The electric vehicle fluids market significant opportunities for growth, driven by technological advancements and increasing investments in EV infrastructure. One key opportunity lies in the development of high-performance, eco-friendly fluids that enhance the efficiency and lifespan of EV components. Innovations in fluid formulations, such as improved thermal management solutions and longer-lasting lubricants, can address the specific needs of EVs, offering manufacturers a competitive edge.

- In August 2023, a notable development in this space was the announcement by a leading company for automobiles offering a new range of EV-specific fluids designed to optimize battery cooling and powertrain efficiency. These fluids are engineered to meet the stringent requirements of modern EVs, providing enhanced performance and sustainability.

Another significant opportunity in the electric vehicle fluids market is the expansion of EV charging infrastructure. India also offers vast growth potential. With increasing government incentives and a developing EV market, companies have the chance to tap into this emerging market. Collaborations with local manufacturers and service providers can help establish a strong foothold. As governments and private entities invest in building more charging stations, the demand for EV maintenance services, including specialized fluids, is set to rise.

- In September 2023, the U.S. government announced a huge investment to expand the national EV charging network, which will indirectly boost the demand for EV fluids.

Product Insights

The engine oil segment registered with the largest share of the electric vehicle fluids market in 2024. Engine oil continues to hold the largest market share in the automotive fluids sector, driven by its critical role in maintaining engine performance and longevity. Recent advancements include synthetic oils that offer superior protection and efficiency. Despite the growth in electric vehicles, internal combustion engines still dominate the market, sustaining demand for engine oils globally. The ongoing innovation in oil formulations underscores its enduring importance in automotive maintenance and performance.

- In April 2023, ExxonMobil, based in the U.S., introduced a new line of fully synthetic engine oils designed to meet the stringent requirements of modern vehicles, enhancing fuel economy and engine durability.

- In August 2023, Castrol announced the launch of the hybrid engine oil performance standard, Hyspec, with the increasing consumption of hybrid electric vehicles.

The coolant segment is expected to witness promising future growth in the electric vehicle fluids market. These specialized fluids are crucial for maintaining optimal operating temperatures in EV batteries and powertrains, enhancing overall vehicle efficiency and longevity. With advancements in coolant technology and rising EV production, the demand for high-performance coolant fluids is expected to continue growing, catering to the specific needs of modern electric and hybrid vehicles.

- In January 2023, Valvoline expanded its product line with the launch of a new performance fluid pertaining to electric vehicles to increase battery shelf life and tackle other electric vehicle functioning problems. This is compatible with hybrid electric vehicles, battery electric vehicles, and plug-in electric vehicles.

Propulsion Type Insights

The hybrid electrical vehicles (HEV's)/plug-in hybrid electrical vehicles (PHEV's) segment accounted for a substantial share of the electric vehicle fluids market in 2024. Hybrid electric vehicles (HEVs) offer several benefits, making them a popular choice for environmentally conscious consumers. HEVs combine an internal combustion engine with an electric motor, providing improved fuel efficiency and reduced emissions compared to traditional vehicles. This dual-power system allows HEVs to operate on electric power at lower speeds, minimizing fuel consumption in urban traffic and stop-and-go conditions.

Additionally, HEVs produce lower greenhouse gas emissions, contributing to cleaner air and reduced environmental impact. They also offer an increased driving range compared to pure electric vehicles, alleviating range anxiety. HEVs are seen as a transitional technology towards fully electric vehicles, offering a practical solution for consumers looking to reduce fuel costs and environmental footprint.

- In November 2022, Total Energies announced the launch of its electric fluid range, Quartz EV Fluid for hybrid electric cars and Hi-Perf EV Fluid for electric bikes.

The battery electric vehicles (BEV) segment is expected to show significant growth in the global electric vehicle fluids market in the upcoming years. Battery electric vehicles (BEVs) are experiencing notable growth due to advancements in battery technology, expanded charging infrastructure and increasing consumer adoption. Governments worldwide are promoting electric vehicle adoption through incentives and regulations, further driving demand for BEVs. Automakers are expanding their BEV offerings with models that offer longer ranges and faster charging capabilities, enhancing their appeal to a broader audience.

Vehicle Type Insights

The passenger segment is estimated to hold the highest share of the electric vehicle fluids market in 2024. Major automakers like Volkswagen and BMW are also aggressively expanding their EV lineups to meet rising demand. The appeal of passenger EVs lies in their environmental benefits, lower operating costs, and advancing technology, such as longer battery ranges and improved charging infrastructure. Governments globally are incentivizing EV adoption, further boosting market penetration. As consumer preferences shift towards greener mobility solutions, passenger EVs continue to lead the charge in reshaping the automotive industry towards a more sustainable future.

- In June 2023, Tesla announced record-breaking sales figures for its Model 3, highlighting the increasing popularity of passenger EVs.

The commercial segment is expected to witness notable growth in the electric vehicle fluids market in the forecast period. Commercial electric vehicles are experiencing notable growth as businesses seek to reduce operating costs and carbon footprints. Companies like Amazon and UPS are expanding their fleets of electric delivery vans and trucks. With advancements in battery technology and government incentives, commercial EVs offer a practical solution for logistics and transportation sectors aiming to achieve sustainability goals.

Regional Insights

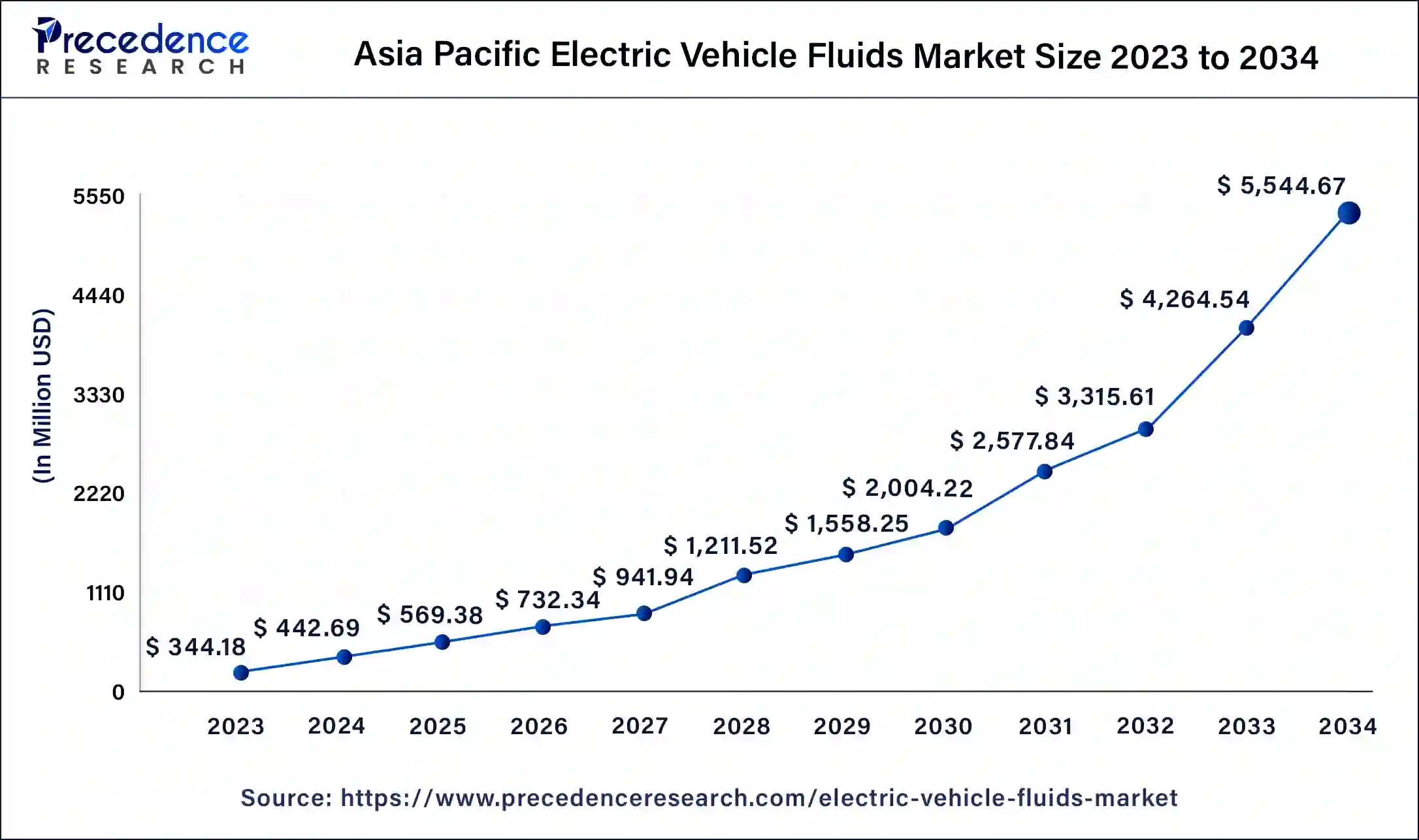

Asia Pacific Electric Vehicle Fluids Market Size and Growth 2025 to 2034

The Asia Pacific electric vehicle fluids market size is exhibited at USD 569.38 million in 2025 and is projected to be worth around USD 5,544.67 million by 2034, poised to grow at a CAGR of 28.76% from 2025 to 2034.

Asia Pacific led the electric vehicle fluids market in 2024 with the largest share. Asia Pacific is emerging as the fastest-growing region in the electric vehicle fluids market, fuelled by rapid industrialization, increasing urbanization, and supportive government policies. Countries like China and India are leading the charge with ambitious plans to reduce carbon emissions and promote sustainable transportation solutions.

Moreover, the Asia Pacific's robust manufacturing base and growing consumer awareness about environmental sustainability are further propelling market growth. Local and international automotive manufacturers are expanding their EV production capacities in Asia Pacific, creating a substantial electric vehicle fluids market that enhance vehicle performance and efficiency.

- In March 2023, China announced new subsidies and incentives to bolster EV adoption, stimulating demand for EV-specific fluids such as coolants and lubricants.

- In December 2023, the Indian government announced the launch of a production-linked incentives scheme for automotive industries to promote domestic manufacturing of electric vehicles with a huge investment in the next five years.

Europe is observed to grow at a notable rate in the global electric vehicle fluids market during the forecast period, leaving behind a notable trail of advancement in the global electric vehicle fluids market. Europe is emerging as a notably growing region in the electric vehicle fluids market, driven by stringent emissions regulations and a strong push towards sustainable transportation.

Countries within the European Union are increasingly adopting policies to phase out internal combustion engine vehicles, accelerating the shift towards electric mobility. This transition is creating a robust demand for the electric vehicle fluids market, including coolants and lubricants, which are essential for maintaining EV performance and longevity. Moreover, European automakers and fluid manufacturers are investing heavily in research and development to innovate and meet the evolving needs of the expanding EV market in the region.

North America is expected to grow significantly in the electric vehicle fluids market during the forecast period. There is a rise in the adoption rates of electric vehicles in North America, which is increasing the demand for electric vehicle fluids. At the same time, the growing technological advancements are developing various new electric vehicle fluids for improving the efficiency and performance of these vehicles. Similarly, bio-based fluids are being developed due to growing environmental awareness and to promote their use. Furthermore, these developments are being supported by the government's investments. Thus, this promotes the market growth.

North America: U.S. Electric Vehicle Fluids Market Trends

The U.S. market is growing rapidly, fueled by surging EV adoption and strong demand for specialized coolants, greases, and transmission fluids. OEMs are the dominant buyers as electric automakers scale production of powertrains that require high performance thermal management. Battery cooling coolants (especially non-conductive types) are leading the product mix, driven by the need to regulate high voltage systems.

Why Did Latin America Experience Significant Growth in the Electric Vehicle Fluids Market?

Latin America experienced significant growth in the electric vehicle fluids market, driven by favorable government regulations and increasing interest in green transportation. Several countries within the region committed investments in charging networks and local electric vehicle assembly, which created demand for electronic vehicle coolants, dielectric fluids, and electric vehicle lubricants. The heightened awareness of energy efficiency also offered the electric vehicle industry opportunities for developing high-performance electric vehicle fluids and lubricants. To fulfill the increasing needs of electric vehicles, international brands expanded beyond North America. In general, Latin America continues to represent a strong market for electric vehicle fluid suppliers and technology developers.

Brazil Electric Vehicle Fluids Market Trends

Brazil led the Latin American region due to its extensive automotive production and significant electric vehicle market growth and acceptance. The government-funded electric mobility programs also increased the demand for electric vehicle coolants and thermal electric vehicle fluids, as well as battery-safe lubricants. Additionally, Brazil offered opportunities for suppliers who develop lower-cost, energy-efficient fluid and lubricant solutions. The growth in charging infrastructure and overall interest in hybrid vehicles also assisted the stabilization of the electric vehicle fluids market.

Why did the Middle East and Africa Experience Substantial Growth in the Electric Vehicle Fluids Market?

The Middle East and Africa experienced substantial growth in the electric vehicle fluids market from increased EV awareness and the push for clean energy from various countries. The growth of charging networks and interest in smart mobility have driven up demand for coolants and thermal fluids. Global electric vehicle fluid suppliers entered the market to service early adopters of electric vehicles. In addition, opportunities increased for eco-friendly lubricants and battery-safe fluids. The rising trend of investment into green transportation resulted in an emerging growth market for electric vehicle fluid suppliers.

The UAE Electric Vehicle Fluids Market Trends

The United Arab Emirates was the leading country in the region due to substantial investments in EV charging stations and a clean transportation policy. The country's emphasis on smart cities has created a demand for high-performance coolants and lubricants. The UAE has been a lucrative opportunity for global suppliers of electric vehicle fluids, with the category of luxury electric vehicles on the rise. The UAE has been supportive of advanced thermal management technologies and financially supports, equipping the market for the latest electric vehicle models. This has made the UAE a significant growth market in the region.

Electric Vehicle Fluids Market Companies

- Exxon Mobil Corporation

- BP Plc.

- Shell Plc.

- FUCHS

- TotalEnergies

- Petroliam Nasional Berhad (PETRONAS)

- Saudi Arabian Oil Co.

- Repsol

- ENEOS Corp.

- Gulf Oil International Ltd.

Recent Developments

- In July 2025, by using immersion cooling technology for the development of electric vehicle pack systems and energy storage systems (ESS), a collaboration between two Korean companies, that is Bumhan Unisolution and S-OIL, was formed. For the electric vehicle batteries, this immersion cooling technology is considered a next-generation solution. Moreover, the risk of fire and energy consumption is also reduced by it. Thus, with the use of cooling oil from S-OIL, electric vehicle battery packs were launched by Bumhan Unisolution.

- In July 2025, a collaboration between Numeros Motors, which is a pioneering force in the indigenous electric vehicle (EV) market, and Perpetuity Capital, which is a non-banking financial company in the EV financing sector, was announced. To enhance the affordability and accessibility of electric vehicles and to provide modified financing solutions to the consumers, along with flexible repayment plans and competitive interest rates, will be the main goal of this collaboration. Moreover, the Diplos Go e-scooter was launched by Numeros Motors in line with this collaboration, which consisted of liquid immersion cooling innovation and a 2.5 kWh battery.

- In January 2023, CRP Automotive unveiled its newest line of Pentosin automotive fluids tailored for several widely used Tesla models currently traversing the roads. This collection comprises two variants of Electrical Drive Fluids (EDF) specifically crafted for Tesla models spanning from 2009 to 2021

- In December 2023, Texaco Lubricants, affiliated with the Chevron brand family, broadened its product offerings by introducing a fresh lineup of electric fluids (e-fluids) tailored to support the growing EV sector. This endeavor reflects the company's commitment to reducing the carbon intensity of its operations and promoting lower-carbon businesses

- In August 2022, Castrol, an oil company, entered a three-year collaboration contract with the China-based automobile manufacturer BYD to utilize its fluids in the electric vehicles it manufactured.

- In December 2022, Gulf Oil Lubricants India Ltd. announced that it had entered into a partnership agreement with Altigreen to receive electric vehicle fluids.

- General Motors announced in October 2023 plans to increase its EV lineup, further boosting the market for EV fluids as the demand for efficient and high-performance vehicles grows.

Segments Covered in the Report

By Product

- Engine Oil

- Coolant

- Transmission Fluids

- Greases

By Propulsion Type

- Battery Electric Vehicles (BEV's)

- Hybrid Electric Vehicles (HEV's)/ Plug-in Hybrid Electric Vehicles (PHEV's)

By Vehicle Type

- Commercial

- Passenger

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting