What is the Embedded Insurance Market Size?

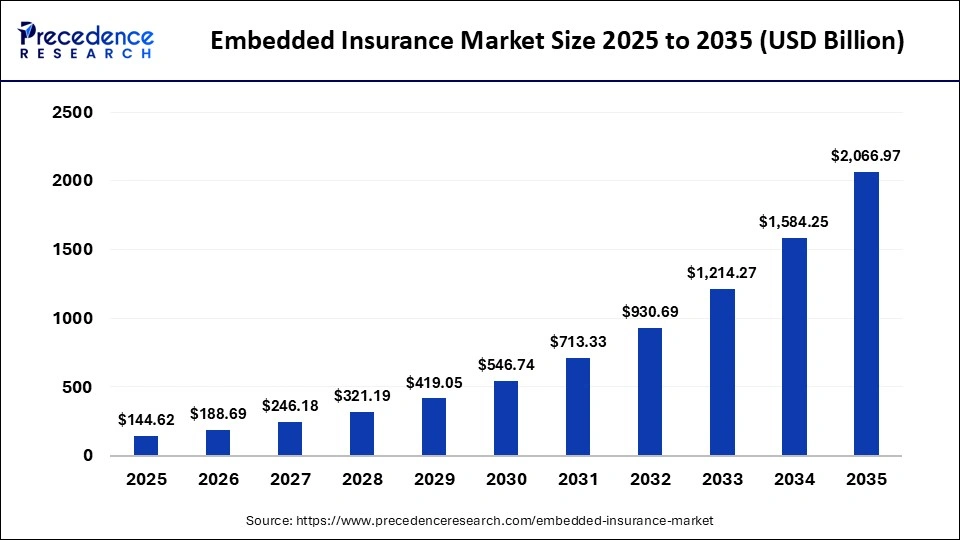

The global embedded insurance market size was calculated at USD 144.62 billion in 2025 and is predicted to increase from USD 188.69 billion in 2026 to approximately USD 2,066.97 billion by 2035, expanding at a CAGR of 30.47% from 2026 to 2035. This market is growing due to the increasing integration of insurance products into digital platforms at the point of sale, making coverage more convenient, accessible, and personalized for customers.

Market Highlights

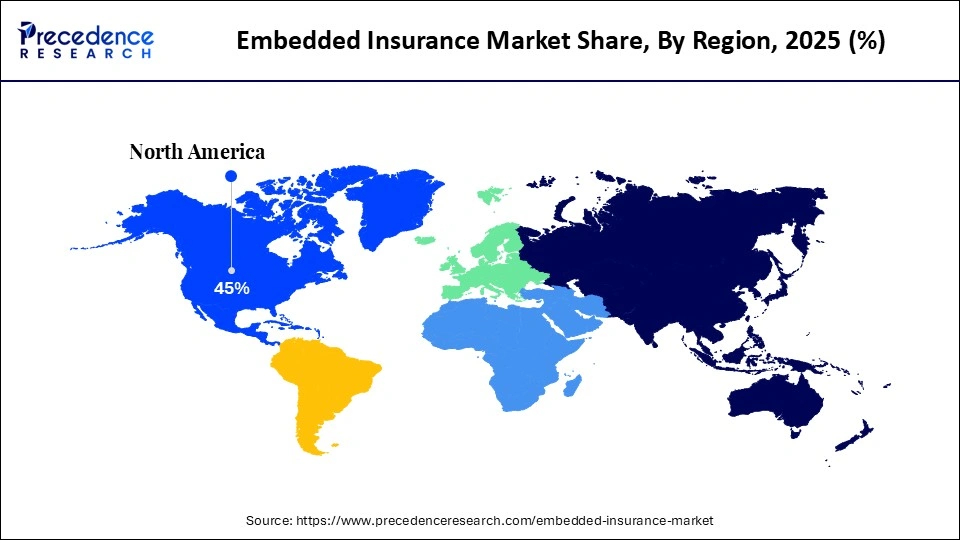

- North America dominated the global embedded insurance market with a major share of approximately 45% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

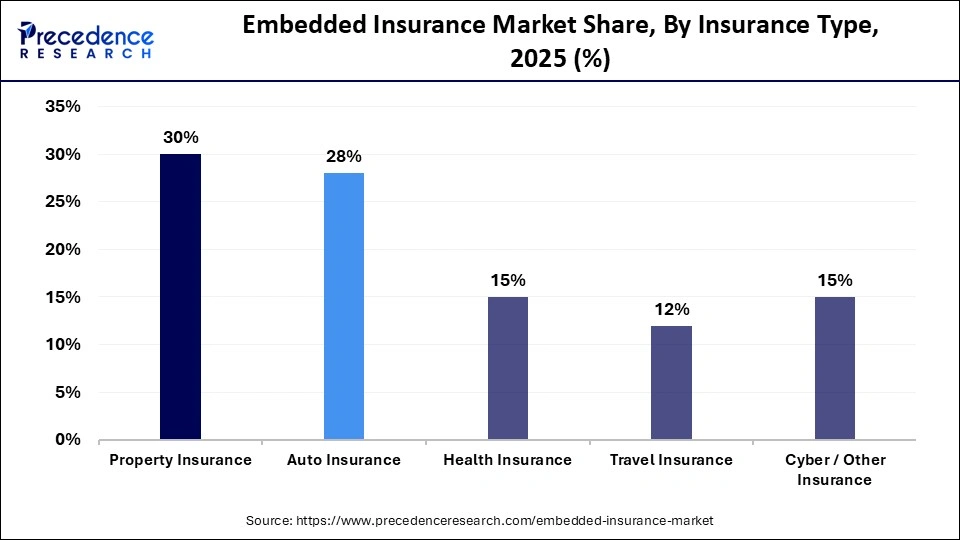

- By insurance type, the property insurance segment generated the biggest market share of approximately 30% in 2025.

- By insurance type, the auto insurance segment is expected to expand at the fastest CAGR between 2026 and 2035.

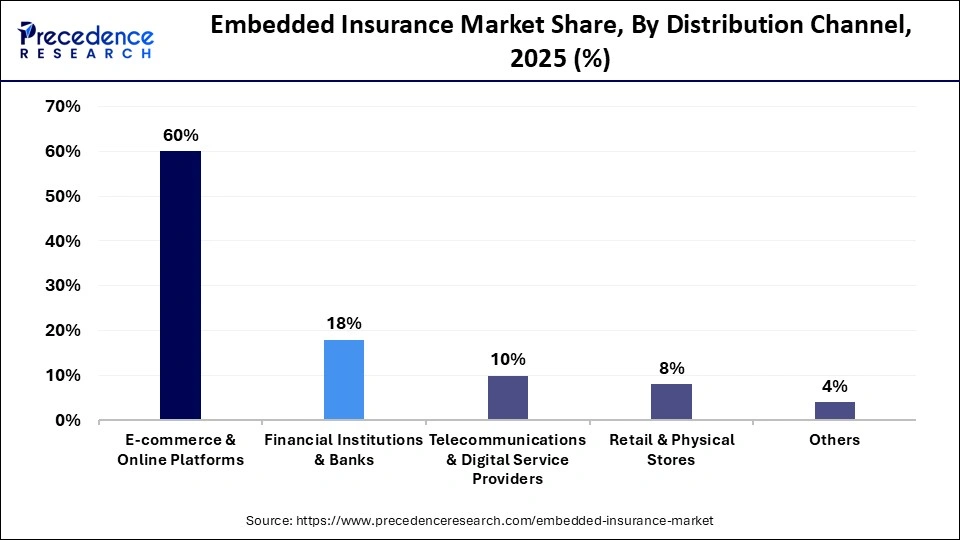

- By distribution channel, the e-commerce & online platforms segment contributed the highest market share of approximately 72% share in 2025.

- By distribution channel, the financial institutions & banks segment is expected to grow at a strong CAGR between 2026 and 2035.

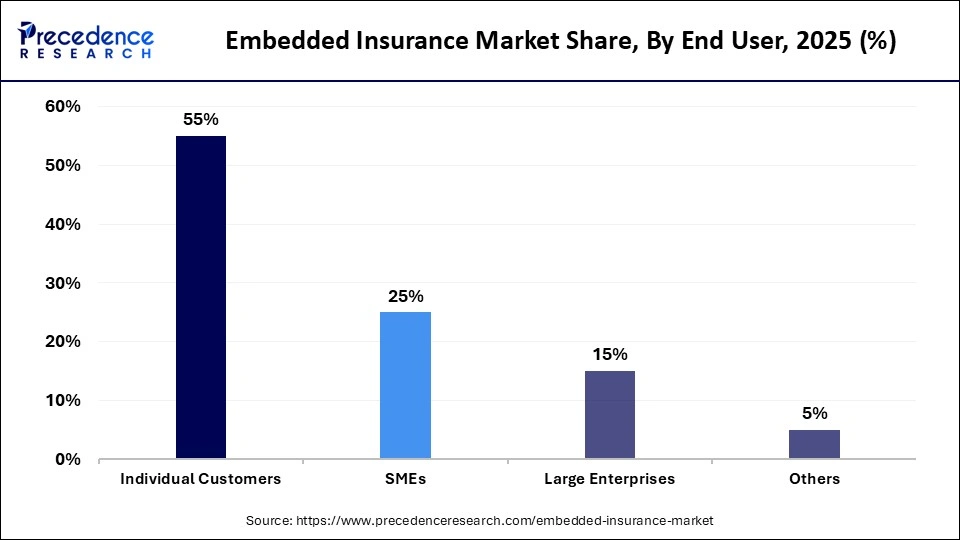

- By end user, the individual customers segment held a major market share of approximately 60% in 2025.

- By end user, the SMEs segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By application, the automotive segment generated the biggest market share of approximately 30% in 2025.

- By application, the travel & hospitality segment is expected to expand at the fastest CAGR between 2026 and 2035.

How is Embedded Insurance Reshaping the Insurance Industry?

The embedded insurance market is rapidly transforming the traditional insurance landscape by integrating insurance products directly into digital platforms, e-commerce websites, fintech apps, travel portals, and mobility services at the point of purchase. This model enhances convenience and boosts policy penetration by enabling customers to easily purchase pertinent insurance coverage when purchasing a good or service. Key drivers of market expansion include the rise in digital transactions, the growing desire of consumers for hassle-free protection plans, and collaborations between technology platforms and insurers.

How is AI Driving Growth in the Embedded Insurance Market?

Artificial intelligence is contributing to the growth of the embedded insurance market by making it possible for instant risk assessment at the point-of-sale, customized policy recommendations, and real-time underwriting. AI also improves efficiency and customer experience across digital platforms by strengthening fraud detection and streamlining claims processing. Furthermore, usage-based and microinsurance products that are customized to meet the needs of individual clients are designed by insurers with the aid of predictive analytics. Chatbots and virtual assistants driven by AI further improve engagement by offering immediate assistance and policy recommendations.

Embedded Insurance Market Trends

- Integration with Digital Platforms: Insurance products are increasingly embedded into e-commerce, travel, mobility, fintech, and retail platforms at checkout.

- Rise of API-Based Distribution Models: Insurers are leveraging APIs to seamlessly connect with partners and enable real-time policy issuance.

- Growth of Usage-Based Insurance: Data-driven models are supporting pay-per-use and on-demand insurance offerings.

- AI-Driven Underwriting and Claims: Automation and predictive analytics are improving risk assessment and reducing claims settlement time.

- Expansion of Microinsurance Products: Affordable, short-term policies are gaining popularity among digitally active consumers.

- Strategic Partnerships and Ecosystem Expansion: Collaborations between insurers, fintechs, and digital marketplaces are accelerating innovation.

- Focus on Customer-Centric Experiences: Personalized coverage options and seamless digital journeys are becoming key competitive factors.

Future Market Outlook

- Expansion in Emerging Markets: Growing digital adoption and low insurance penetration in emerging regions create strong growth potential.

- SME and Gig Economy Coverage: Tailored insurance solutions for freelancers and small businesses present untapped demand.

- Cross-Selling and Upselling Potential: Businesses can increase revenue by offering relevant coverage during product purchases.

- Integration with IoT and Connected Devices: Real-time data from vehicles, wearables, and smart devices enables innovative coverage models.

- Growth in Travel and Mobility Segments: Increasing online bookings create opportunities for embedded travel and ride insurance.

- Development of Cyber and Digital Risk Insurance: Rising cyber threats are driving demand for integrated digital protection plans.

- Advancement in Personalized Insurance Products: AI and data analytics enable highly customized insurance offerings.

Why is the Embedded Insurance Market Considered Highly Resilient in a Digital First Economy?

The embedded insurance market demonstrates strong resilience because it integrates seamlessly into online shopping and digital service experiences, making coverage a natural add-on rather than a standalone purchase. As fintech ecosystems, mobility platforms, and e-commerce continue to expand, consumers increasingly opt for travel, auto, and asset protection at the point of sale, even during economic downturns. The model enhances conversion rates, reduces distribution costs for insurers, and leverages API-driven architecture for rapid customization, supporting long-term scalability and sustainability.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 144.62 Billion |

| Market Size in 2026 | USD 188.69 Billion |

| Market Size by 2035 | USD 2,066.97 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 30.47% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Insurance Type, Distribution Channel, End User, Applicatio, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Insurance Type Insights

What made property insurance the dominant segment in the embedded insurance market?

The property insurance segment dominated the market with a 30% share in 2025 due to the growing need for commercial assets, electronics, and homes to be protected at the point of sale. Property coverage is increasingly included in real estate transactions and e-commerce platforms. The demand for this insurance is further bolstered by natural disasters and growing climate risks. Additionally, property insurance is relatively easy to standardize and underwrite, which aligns well with embedded insurance models that aim to simplify purchase, automate claims, and integrate coverage seamlessly into existing platforms or transactions.

The auto insurance segment is expected to grow at the fastest CAGR in the coming years, fueled by growing auto sales and connected automotive technologies. Convenience is increased when auto insurance is included at the time of car leasing or purchase. The adoption of telematics-driven and usage-based insurance models is speeding up. The growth of this segment is also fueled by collaborations between digital platforms, insurers, and automakers.

Distribution Channel Insights

Why did the e-commerce & online platforms segment dominate the embedded insurance market?

The e-commerce & online platform segment dominated the market with a 72% share in 2025 because digital checkout points seamlessly integrate policies, and online merchants combine consumer goods, electronics, and travel reservations with insurance. The segment's dominance is further supported by a high percentage of online shoppers and consumers who prioritize digital technology. Their vast user base, digital infrastructure, and real-time transaction capabilities allow insurers to offer instant, automated coverage with minimal friction. Additionally, the convenience of purchasing insurance at the point of sale drives higher adoption, while analytics from these platforms enable personalized pricing and risk assessment, reinforcing their dominance in the market.

The financial institutions & banks segment is expected to grow at the fastest CAGR in the coming years. This is because banks and fintechs act as trusted intermediaries that can seamlessly offer insurance products alongside existing financial services, such as loans, mortgages, credit cards, or investment accounts. Their established customer relationships, access to transaction and behavioral data, and digital banking platforms make it easy to bundle, cross-sell, and automate insurance purchases, increasing adoption rates. The use of embedded credit protection solutions and bancassurance models is growing. Rapid adoption of financial products is supported by growing bank trust.

End User Insights

Why did the individual customers segment dominate the embedded insurance market?

The individual customers segment dominated the market with a 60% share in 2025, driven by the increased demand for quick, affordable, and convenient insurance coverage. Most embedded insurance products, such as travel, gadget, or vehicle protection, are designed for personal, everyday needs. Furthermore, the widespread use of digital platforms and mobile apps allows insurers to reach large numbers of individual customers quickly, making this segment the largest end-user base in the market.

The SMEs segment is expected to grow at the fastest CAGR during the forecast period because small and medium-sized enterprises increasingly seek specialized, affordable coverage tailored to their business operations. Platforms like fintech apps, logistics services, and e-commerce seller tools enable SMEs to access embedded insurance seamlessly, helping them manage risks efficiently. Additionally, the ongoing digitalization of SMEs accelerates adoption, as businesses prefer quick, automated insurance solutions integrated directly into the platforms they already use.

Application Insights

What made automotive the dominant segment in the embedded insurance market?

The automotive segment dominated the market with a 30% share in 2025 because vehicles are frequently purchased, leased, or used via platforms, such as ridesharing, car subscriptions, and leasing services, where insurance can be seamlessly integrated at the point of use. Connected car technology enables real-time risk assessment and usage-based policies, while collaborations between OEMs and insurers make coverage more tailored and convenient. Additionally, telematics data improves pricing accuracy and reduces fraud, and the growing popularity of mobility-as-a-service models further drives adoption in this segment.

The travel & hospitality segment is expected to grow at the fastest CAGR in the upcoming period due to increasing demand for trip protection and the post-pandemic travel recovery. Insurance is embedded directly into airline bookings and travel platforms, with flexible cancellation policies encouraging adoption. The rise in international travel, instant digital policy issuance, and online claim settlements enhances traveler confidence, while the growth of online travel agencies further accelerates the segmental growth.

Regional Insights

How Big is the North America Embedded Insurance Market Size?

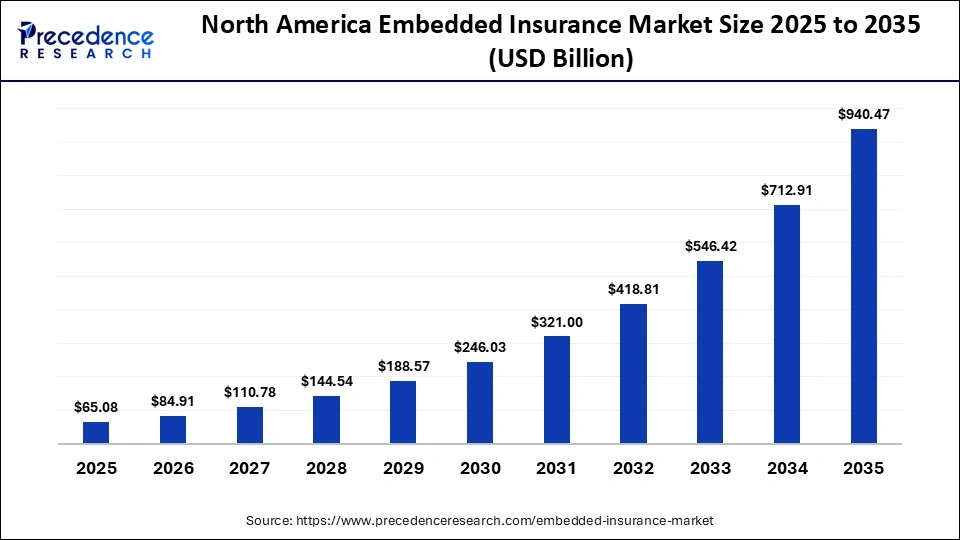

The North America embedded insurance market size is estimated at USD 65.08 billion in 2025 and is projected to reach approximately USD 940.47 billion by 2035, with a 30.61% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Embedded Insurance Market?

North America dominated the market with a 45% share in 2025. This is because of its robust Insurtech ecosystem and sophisticated digital infrastructure. There is a widespread adoption of application programming interface (API) and high e-commerce penetration, which facilitates the seamless integration of insurance. Regional strength is further enhanced by established insurance ecosystems and regulatory support. Insurers in the region are actively working with major retail and technology companies. High insurance penetration, consumer awareness, and ongoing innovation in AI and data analytics further strengthen the region's leadership in embedded insurance.

What is the Size of the U.S. Embedded Insurance Market?

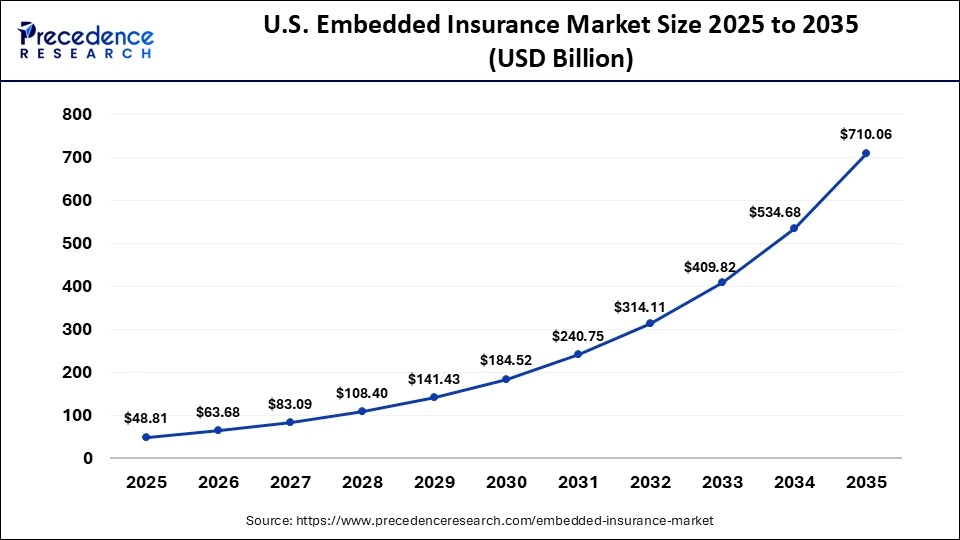

The U.S. embedded insurance market size is calculated at USD 48.81 billion in 2025 and is expected to reach nearly USD 710.06 billion in 2035, accelerating at a strong CAGR of 30.70% between 2026 and 2035.

U.S. Embedded Insurance Market Trends

U.S. leads the North American embedded insurance market due to its strong presence of InsurTech companies and a highly developed digital ecosystem. High e-commerce penetration and widespread digital payment usage enable seamless policy integration at checkout, while partnerships between insurers and retailers, automakers, and travel platforms expand embedded offerings. Growing consumer preference for convenience, strong insurance awareness, supportive regulatory frameworks, and ongoing innovation in data analytics and AI-driven underwriting further accelerate market growth.

How is the opportunistic rise of Asia Pacific in the Market?

Asia Pacific is expected to grow at the fastest CAGR in the market throughout the forecast period, driven by rapid fintech innovation and the expansion of online commerce. Rising smartphone penetration, financial inclusion initiatives, and the integration of insurance into super apps across markets like Southeast Asia, China, and India are unlocking significant untapped potential. Additionally, government-led digitalization efforts and a growing middle class are increasing demand for accessible and convenient protection solutions.

India Embedded Insurance Market Trends

The market in India is expanding, driven by the expansion of fintech and digital commerce. Government initiatives such as Digital India and the widespread adoption of UPI have strengthened the digital payments ecosystem, enabling seamless policy distribution through digital lenders, mobility apps, and micro-insurance platforms. A large underinsured population, rising smartphone penetration, partnerships between InsurTechs and banks or online platforms, along with low premiums and simplified onboarding, are creating strong growth opportunities.

Who are the Major Players in the Global Embedded Insurance Market?

The major players in the embedded insurance market include Allianz SE, AXA SA, Chubb Limited, Zurich Insurance Group, Munich Re, MetLife Inc., Prudential plc, State Farm, Lemonade Inc., Cover Genius, Qover, Trov Inc., Bolttech, Zego, and Slice Labs.

Recent Developments

- In November 2025, Chubb announced the launch of its new AI-Powered Optimization Engine for the Chubb Studio platform, designed to deliver real-time, personalized embedded insurance offers using proprietary AI. The engine features enhanced engagement tools like "click-to-engage" technology and three flexible integration models(Source: https://news.chubb.com/)

- In December 2025, Bolttech announced the acquisition of the Kenyan digital insurance platform mTek. This deal supports Bolttech's East Africa strategy, establishing Nairobi as a regional hub for its global embedded insurance ecosystem. mTek's platform, serving over 350,000 customers, will be integrated into bolttech's network(Source: https://ibsintelligence.com)

- In October 2025, AXA Partners and bolttech announced a strategic partnership to launch embedded insurance and assistance solutions across Europe. This collaboration leverages AXA's insurance expertise with bolttech's technology platform to create new B2B2C opportunities in sectors like telecommunications, financial services, and retail.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Insurance Type

- Property Insurance

- Auto Insurance

- Health Insurance

- Travel Insurance

- Cyber/Other

By Distribution Channel

- E-commerce & Online Platforms

- Financial Institutions & Banks

- Telecommunications & Digital Service Providers

- Retail & Physical Stores

- Others

By End User

- Individual Customers

- SMEs

- Large Enterprises

By Application

- Automotive

- Retail & E-commerce

- Travel & Hospitality

- Healthcare

- Other Services

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting