What is the Encapsulant Materials for PV Modules Market Size?

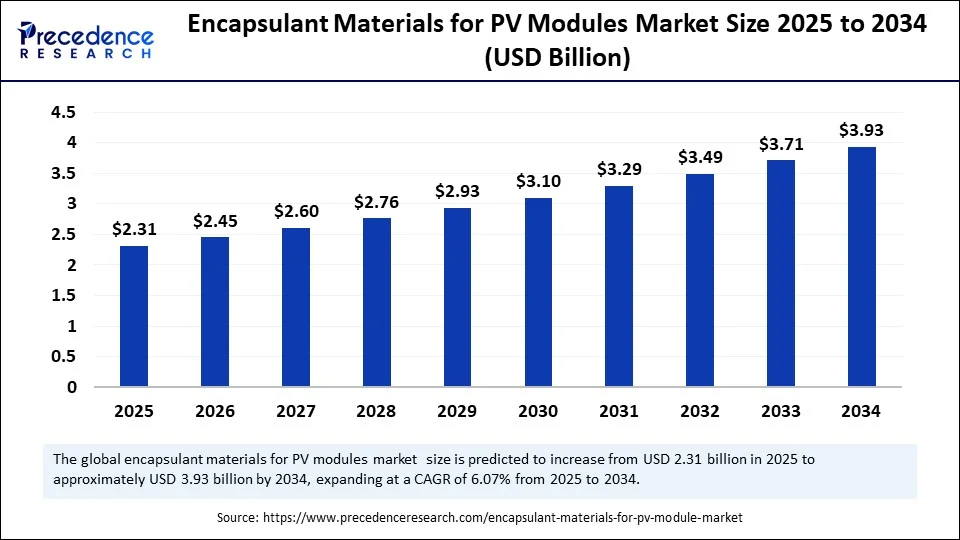

The global encapsulant materials for PV modules market size was calculated at USD 2.18 billion in 2024 and is predicted to increase from USD 2.31 billion in 2025 to approximately USD 3.93 billion by 2034, expanding at a CAGR of 6.07% from 2025 to 2034. The market is experiencing substantial growth due to the global push for renewable energy, supported by government policies. Demand is further driven by the rise in large-scale solar installations for residential, commercial, and industrial use. Additionally, market expansion is fueled by technological advancements in encapsulants and the increasing demand for high-performance and bifacial PV modules and accelerate market expansion.

Market Highlights

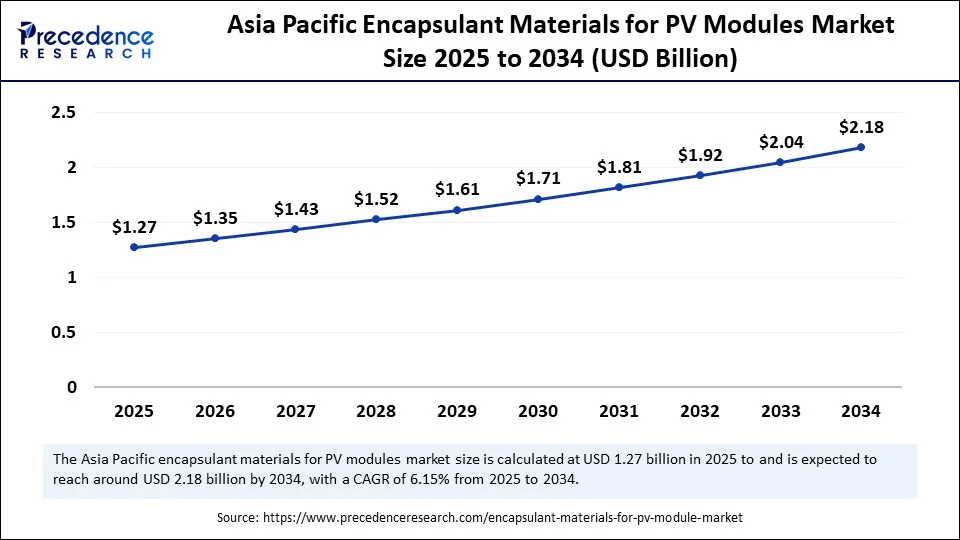

- Asia Pacific dominated the global encapsulant materials for PV modules market with the largest share of 55% in 2024.

- Europe is anticipated to grow at a significant CAGR from 2025 to 2034.

- By material type, the ethylene-vinyl acetate (EVA) segment captured the biggest market share of 48% in 2024.

- By material type, the polyolefin elastomer (POE) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By product form, the films/sheets segment contributed the highest market share of 80% in 2024.

- By product form, the liquid encapsulants segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By curing/processing, the peroxide cross-linked segment held the maximum market share of 55% in 2024.

- By curing/processing, the UV-curable systems segment is expected to grow at a significant CAGR from 2025 to 2034.

- By application, the crystalline silicon segment accounted for the significant market share of 70% in 2024.

- By application, the perovskite and tandem modules segment is expected to witness the fastest CAGR during the forecast period.

- By end-use deployment, the utility-scale ground mount segment generated the major market share of 42% in 2024.

- By end-use deployment, the commercial and industrial rooftop segment is expected to witness the fastest CAGR during the foreseeable period.

Market Size and Forecast

- Market Size in 2024: USD 2.18 Billion

- Market Size in 2025: USD 2.31 Billion

- Forecasted Market Size by 2034: USD 3.93 Billion

- CAGR (2025-2034): 6.07%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: Europe

What are Encapsulant Materials for PV Modules?

Encapsulant materials for photovoltaic (PV) modules are a protective, optically clear layer that adheres the solar cells to both the top and bottom surfaces of a PV module. These materials provide essential adhesion between components, protect the solar cells from moisture, UV radiation, and mechanical stress, and enhance the overall durability and performance of the modules.

How Can AI Impact the Encapsulant Materials for PV Modules Market?

Artificial intelligence (AI) is revolutionizing the encapsulant materials for PV modules market by predicting and optimizing material properties for improved solar cell performance and durability, rather than directly synthesizing materials. AI, particularly through machine learning and deep learning, is utilized in material discovery, high-throughput screening, and predictive modeling to accelerate the development of new and high-performance organic PV encapsulants, thereby minimizing experimental time and costs. AI models can also predict the performance and degradation of new materials under various operating conditions, improving their lifespan and reliability.

What Are the Key Trends in the Encapsulant Materials for PV Modules Market?

- Rising Demand for Solar Energy: The widespread adoption of solar power to achieve renewable energy goals is driving the overall demand for PV modules and their encapsulant materials. The shift towards renewable energy sources is a primary catalyst for this market growth.

- Module Efficiency and Longevity: As demand increases for more durable, efficient, and long-lasting PV modules, manufacturers are continually seeking ways to improve module efficiency and extend their operational lifespan. This involves protecting solar cells from degradation to ensure consistent performance.

- Government Support and Policy: Strong government support for solar energy, including incentives and favorable policies, is fueling investments in the solar sector, which in turn boosts demand for encapsulant materials.

- Technological Advancements: The development of new PV technologies and module designs, such as bifacial panels and advanced solar cells, necessitates the creation and adoption of specialized encapsulants that meet their unique performance requirements.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 2.18 Billion |

| Market Size in 2025 | USD 2.31 Billion |

| Market Size by 2034 | USD 3.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.07% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Product Form, Curing/Processing Method, Application, End-use Deployment, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Global Demand for Renewable Energy

The primary driver for the encapsulant materials for PV modules market is the growing global demand for renewable energy. This demand fosters innovation in advanced materials that enhance solar panel durability and efficiency. Countries are focusing on reducing carbon emissions and transitioning to sustainable energy sources, leading to increased adoption of solar power systems and a need for high-quality, long-lasting solar panels. There is a clear trend towards advanced materials that offer better resistance to UV radiation, moisture, and mechanical stress, which contributes to improved durability and performance.

Restraint

Balancing Cost with Performance and Longevity

The main restraint in this market is balancing cost with performance and longevity. Advanced encapsulants, which are necessary for durability and efficiency, tend to be expensive and can increase overall panel costs. This price increase may hinder adoption in price-sensitive markets. Furthermore, these advanced encapsulants, designed to withstand extreme environmental conditions and ensure module longevity, often require high-quality raw materials and complex manufacturing processes, resulting in higher production costs.

Opportunity

Developing Advanced Materials that Maximize Performance

The primary future opportunity in the encapsulant materials for PV modules market lies in developing advanced materials that maximize the performance of next-generation solar cells while enhancing the sustainability and longevity of the modules. This approach involves moving away from traditional ethylene-vinyl acetate toward advanced alternatives such as polyolefin elastomers and specialized hybrid materials. These advanced materials will provide encapsulants with excellent moisture and oxygen barriers, ensuring long-term stability and reliability by withstanding extreme conditions and integrating seamlessly into buildings.

Segment Insights

Material Type Insights

What Made the Ethylene-Vinyl Acetate (EVA) Segment Dominate the Encapsulant Materials for PV Modules Market in 2024?

The ethylene-vinyl acetate (EVA) segment dominated the market in 2024. This is due to its excellent optical transparency, strong adhesion to glass and solar cells, high mechanical and thermal stability, and cost-effectiveness, which ensure the long-term durability and performance of PV modules. EVA provides excellent protection against harsh environmental conditions, including humidity and UV radiation, and offers good mechanical and thermal stability to extend the longevity of solar panels. Its relatively low cost compared to other advanced encapsulant materials makes it a highly competitive choice.

The polyolefin elastomer (POE) segment is expected to experience the fastest growth during the forecast period. This is because of its superior moisture resistance, which is crucial for the longevity of advanced modules like bifacial and TOPCon cells, increasingly replacing traditional EVA. POE offers better ionic barrier properties, reducing potential-induced degradation (PID) and increasing module lifespan. As modules become more complex, the limitations of traditional encapsulants become more evident, creating a demand for alternatives like POE.

Product Form Insights

Why Did the Films/Sheets Segment Lead the Encapsulant Materials for PV Modules Market in 2024?

The films/sheets segment led the market in 2024. This is because films are the most common and efficient form for applying protective layers to solar cells, ensuring durability and performance. This segment is well-established, supported by the widespread use of film-based encapsulants like EVA and POE, which provide excellent adhesion, transparency, and weather resistance, crucial for protecting solar cells from environmental elements and moisture. The lamination process for applying films to solar cells is a mature and efficient manufacturing method used on a large scale.

The liquid encapsulants segment is expected to grow the fastest in the market. This is mainly due to their enhanced properties, such as superior UV resistance, high optical transparency, and improved durability, crucial for next-generation, high-efficiency photovoltaic modules. These liquid encapsulant processes can offer advantages like lower energy consumption and simpler manufacturing compared to the high-temperature, high-pressure lamination required for EVA.

Curing/Processing Insights

How Did the Peroxide Cross-Linking Segment Dominate the Encapsulant Materials for PV Modules Market in 2024?

The peroxide cross-linked segment held the dominant position in the market in 2024. This is because of its ability to create a strong, thermally stable network during lamination, which enhances mechanical properties, moisture resistance, and electrical insulation, boosting module reliability. The cross-linked structure provides excellent electrical insulation, preventing short circuits, and forms a tighter barrier against moisture ingress, a major cause of corrosion and degradation in PV modules. This makes it a financially viable choice for high-volume manufacturing.

The UV-curable systems segment is expected to grow the fastest during the forecast period. This is mainly due to their rapid curing times, which boost manufacturing throughput, and their ability to cure at lower temperatures, protecting heat-sensitive cells like perovskites from degradation. They offer low shrinkage, forming a uniform encapsulation layer with good adhesion to various components, resulting in a more robust and stable solar module. They also provide strong bonding for different components, ensuring durability.

Application Insights

How Did the Crystalline Silicon Segment Lead the Encapsulant Materials for PV Modules Market in 2024?

The crystalline silicon segment maintained its market lead in 2024. This is mainly due to its abundance, established manufacturing processes, high reliability, and excellent efficiency-to-cost ratio, making it the most widely used solar cell technology. Since silicon is the second most abundant element on Earth, it is readily available and relatively inexpensive, helping scale production efficiently. Widespread adoption of crystalline silicon modules has established industry standards for encapsulation materials and module designs, reinforcing its market position.

The perovskite and tandem segment is anticipated to see the fastest growth during the forecast period. This is because of the high efficiency and versatile applications of perovskite solar cells, which require new, specialized encapsulants. The lightweight and flexible nature of perovskites makes them suitable for applications beyond traditional rooftops, such as transparent solar windows, urban infrastructure integration, and portable devices—thus increasing their commercial viability and adoption.

End-Use Deployment Insights

Why Did the Utility-Scale Segment Lead the Encapsulant Materials for PV Modules Market in 2024?

The utility-scale segment led the market in 2024. This is because it represents the largest and fastest-growing deployment area for solar PV, needing large quantities of standardized encapsulant materials like EVA due to economic viability and proven reliability. The demand for consistent performance and efficient mass production in utility-scale projects encourages the use of reliable, standardized materials like EVA, which simplifies manufacturing and ensures compatibility with high-volume module assembly lines, aiming to replicate performance in real-world conditions.

The commercial and industrial rooftop segment is expected to grow the fastest because it aligns with corporate goals to reduce carbon footprints, lower operational costs, and achieve energy independence. Companies are investing in large-scale rooftop solar to generate clean energy, increasing demand for encapsulant materials that offer superior durability, efficiency, and longer lifespans to protect PV modules in harsh conditions—ensuring energy generation for manufacturing plants and large operations, meeting environmental targets, and enhancing brand image.

Regional Insights

Asia Pacific Encapsulant Materials for PV Modules Market Size and Growth 2025 to 2034

The Asia Pacific encapsulant materials for PV modules market size was evaluated at USD 1.20 billion in 2024 and is projected to be worth around USD 1.20 billion by 2034, growing at a CAGR of 6.15% from 2025 to 2034.

How Did Asia Pacific Lead the Encapsulant Materials for PV Modules Market in 2024?

Asia Pacific dominated the encapsulant materials market in 2024. This is mainly due to its large-scale solar manufacturing, strong government support, and focus on domestic production and export, especially in China and India. The region, particularly China, has established itself as a global manufacturing hub for solar panels, creating high demand to support large production volumes. There is a growing commitment to renewable energy across the region, with significant investments in solar infrastructure and favorable policies aimed at meeting climate goals, thereby increasing demand for encapsulant components.

India Encapsulant Materials for PV Modules Market Trends

India is transitioning from being an importer of PV module encapsulant materials to becoming a manufacturer, with the potential to export these materials. Government initiatives are incentivizing local production of materials such as EVA and POE. This shift has attracted investments from domestic companies, which are also developing encapsulant technologies tailored to India's unique climate. As a result, India is positioning itself as a significant player in the global solar supply chain, striving for self-reliance.

China Encapsulant Materials for PV Modules Market Trends

China currently holds a dominant position in the PV encapsulant market, controlling over 80% of all stages of solar panel manufacturing, including key materials like EVA and POE. This dominance is supported by substantial government investments, economies of scale, and cost advantages that render Chinese PV products highly competitive on the international stage. Furthermore, ongoing investments in advanced materials and research and development are focused on meeting the demands for next-generation technologies.

Why is Europe Considered the Fastest-Growing Region in the Encapsulant Materials for PV Modules Market?

Europe is expected to experience the fastest growth in the market. This is driven by ambitious EU renewable energy targets, robust government incentives, regulatory mandates for sustainable materials, increasing focus on local and secure solar supply chains, and increased investment by ESG-focused investors in solar infrastructure. These factors are pushing manufacturers to adopt more sustainable and recyclable encapsulant materials. This results in greater demand for advanced, high-performance encapsulants compatible with emerging solar cell technologies and sustainability requirements standards.

Encapsulant Materials for PV Modules Market Companies

- SABIC

- Evonik

- Dow

- 3M

- Asahi Kasei

- Teijin Limited

- Toray Industries

- Huntsman

- Henkel

- DuPont

- Eastman Chemical

- Covestro

- Wacker Chemie

- Mitsubishi Chemical

- Sumitomo Chemical

Leaders' Announcements

- In May 2025, Jindal Poly Films Limited (JPL) announced its acquisition of Enerlite Solar Films India, aiming to strengthen its presence in the solar components market. Following the transaction, Enerlite will become a wholly owned subsidiary of JPL. Currently, JPL holds a 33.05% stake in the company. The acquisition is being conducted at arm's length and is expected to be completed within six months, pending regulatory approvals.(Source: https://powerline.net.in)

Recent Developments

- In February 2025, RenewSys, a manufacturer of PV modules, encapsulants, and backsheets, introduced an advanced EVA encapsulant. This technological breakthrough was designed to address a longstanding issue that concerned the lifespan of solar modules.(Source: https://www.energetica-india.net)

- In July 2025, Alishan unveiled a new generation of encapsulant technologies, including Alishan Low Acid EVA, Alishan EPE-NT, and Alishan EPE-DC. These products are specifically engineered to meet the evolving needs of next-generation solar cells like TOPCon and HJT (Heterojunction Technology), which are known for their durability and greater accessibility.(Source: https://www.energetica-india.net)

Segments Covered in the Report

By Material Type

- Ethylene-Vinyl Acetate (EVA)

- Polyolefin Elastomer (POE)

- Polyvinyl Butyral (PVB)

- Silicone

- Thermoplastic Polyurethane (TPU)

- Ionomer

- Other Specialty Polymers and Blends

By Product Form

- Films/Sheets

- Liquid Encapsulants

- Coatings/Sprays

By Curing/Processing Method

- Peroxide cross-linked

- Thermoplastic (non-crosslinked)

- UV-curable systems

- Addition-cure Silicones

By Application

- Crystalline Silicon

- Bifacial Modules

- Thin-Film Modules

- Perovskite and Tandem Modules

- Building-Integrated PV (BIPV)

- Flexible/Portable PV Modules

By End-use Deployment

- Residential Rooftop

- Commercial and Industrial Rooftop

- Utility-scale Ground Mount

- Off-grid and Specialty Applications

ByRegion

- Asia Pacific

- Europe

- North America

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting