What is the ENFit Syringes Market Size?

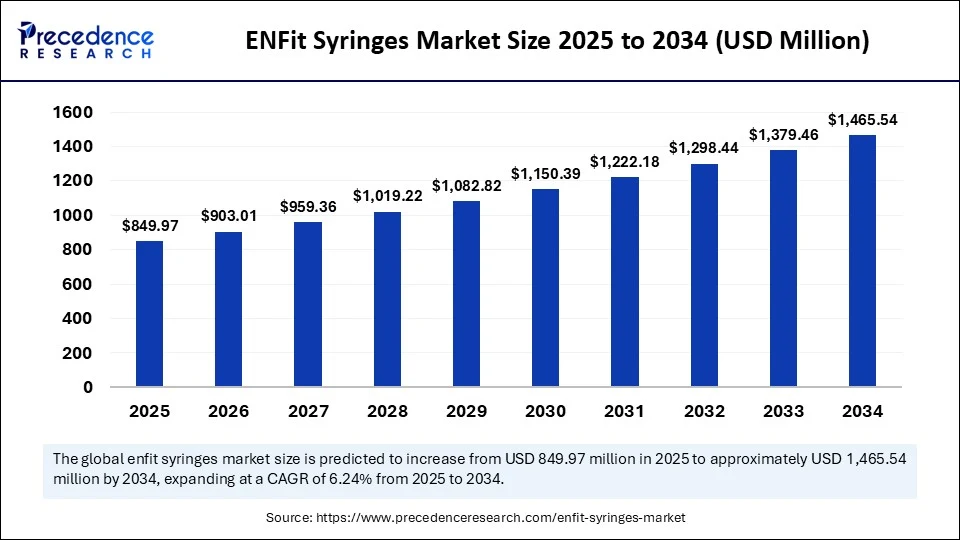

The global ENFit syringes market size is valued at USD 849.97 million in 2025 and is predicted to increase from USD 903.01 million in 2026 to approximately USD 1,465.54 million by 2034, expanding at a CAGR of 6.24% from 2025 to 2034. The ENFit syringes market is growing due to stricter patient safety regulations, increasing chronic disease cases, and rising demand for accurate, secure enteral feeding solutions in hospital and homecare environments.

ENFit Syringes Market Key Takeaways

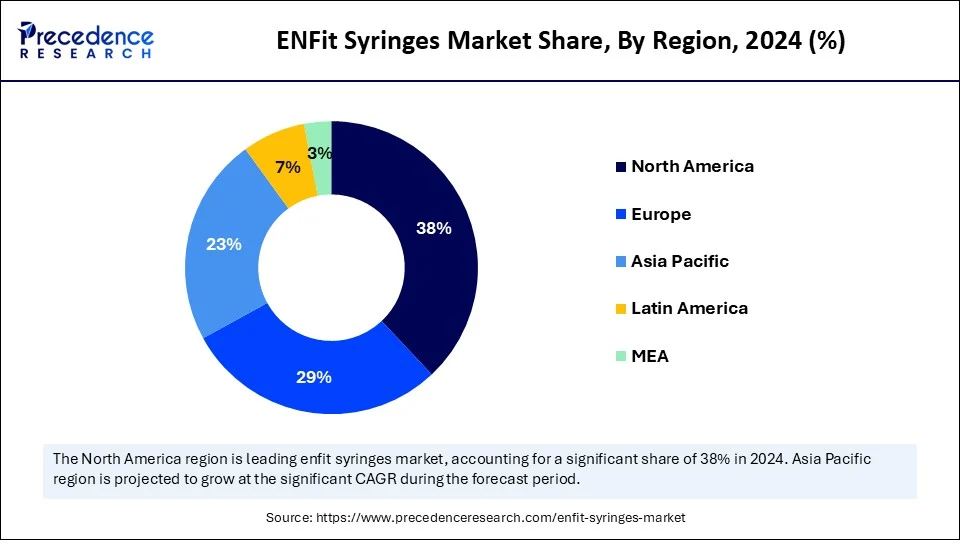

- North America dominated the global ENFit syringes market with the largest market share of 38% in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By syringe size, the 60 mL and above segment captured the biggest market share of 34% share in 2024.

- By syringe size, the 0.5 mL – 1 mL segment is expected to show considerable growth over the forecast period.

- By usage type, the disposable ENFit syringes segment contributed the highest market share of 77% in 2024.

- By usage type, the disposable ENFit syringes segment is expected to grow at the highest CAGR over the forecast period.

- By tip type, the standard tip ENFit syringes segment generated the major market share of 68% share in 2024.

- By tip type, the low-dose tip ENFit syringes segment is anticipated to show considerable growth in the market over the forecast period.

- By material type, the polypropylene segment held the largest market share of 45% in 2024.

- By material type, the silicone segment is expected to show considerable growth over the forecast period.

- By end user, the hospitals segment accounted for the significant market share of 39% in 2024.

- By end user, the home healthcare settings segment is anticipated to show considerable growth over the forecast period.

- By distribution channel, the direct tenders segment captured the biggest market share of 41% in 2024.

- By distribution channel, the online pharmacies segment is anticipated to show considerable growth over the forecast period.

- By application, the nutrition delivery segment contributed the highest market share of 52% in 2024.

- By application, the flushing segment is anticipated to show considerable growth over the forecast period.

- By patient group, the adults segment held the largest market share of 48% in 2024.

- By patient group, the neonates & pediatric segment is anticipated to show considerable growth over the forecast period.

Market Overview

The ENFit syringes market pertains to the global production, distribution, and utilization of syringes compliant with the ENFit standard, which is part of the ISO 80369-3 standard aimed at preventing misconnections between enteral feeding devices and other clinical applications. Enfit syringes are primarily used to administer enteral nutrition and medications, either directly to patients or via feeding tubes. These syringes come with a specific connector design that ensures compatibility only with enteral devices, thereby reducing the risk of misadministration via intravenous or respiratory routes. The demand for Enfit syringes is driven by regulatory mandates, increasing adoption of enteral nutrition, safety concerns, and growing use in neonatal and geriatric care settings.

The growth of the EnFit syringes market is driven by the growing focus on ensuring patient safety and reducing feeding tube misconnections. Technological innovation in syringe design, including improved ergonomics, dosing precision, and single-use designs, is also boosting the market. The growing elderly population and the rising prevalence of chronic illnesses like cancer, neurological conditions, and gastrointestinal ailments are increasing the use of effective and reliable enteral feeding systems in both acute and long-term care facilities.

Smart Syringes: AI-Powered ENFit Systems Arrive

Artificial intelligence is revolutionizing the ENFit syringes market by enhancing manufacturing accuracy, optimizing supply chains, and improving patient outcomes. While ENFit syringes are fundamental medical tools, AI integration has increased their value across various product lifecycle phases. AI in manufacturing has led to quality control systems that identify micro-defects, maintain product standards, reduce waste, and improve safety compliance. Manufacturers use AI to analyze usage data, forecast demand trends, and align inventory and distribution, particularly for homecare consumers. With the growth of home-based care, AI is also used in caregiver training modules and virtual support for ENFit equipment.

Market Outlook

- Industry Growth Overview:

The ENFit syringes market is growing, driven by the increasing prevalence of chronic disease, growing demand for harmless feeding practices, and advances in enteral nutrition technology. The growing cases of chronic conditions like cancer and diabetes, as well as the aging worldwide population - Global Expansion:

The ENFit syringes market is experiencing global expansion, as increasing patient safety guidelines and a growing requirement for enteral feeding. Manufacturers are focusing on advancing consumer-friendly, effective, and safe ENFit syringe designs. North America currently holds the largest share due to its progressive healthcare infrastructure and increasing prevalence of long-lasting diseases. - Major investors:

Major investors in the ENFit contribute a combination of massive organizations that invest strategically in the space, as well as specialized venture capital and spending firms focused on life sciences and biotechnology. ItWarburg Pincus, Casdin Capital, OrbiMed, and Illumina Ventures

What Factors are Boosting the Growth of the ENFit Syringes Market?

- Focus on Enhancing Patient Safety: Ensuring safe feeding is a primary concern in healthcare, leading to the adoption of ENFit devices in homes and hospitals. This trend towards safety-focused care is expanding the market's reach, especially in mature and growing healthcare systems.

- Technological Advancements in Syringes: Caregivers and patients are drawn to the new technologies in ENFit syringes, which include ergonomically superior designs, improved accuracy, and single-use options. These advancements offer a better user interface, reduce the risk of drug interactions and side effects, and support cleanliness in hospitals.

- Rising Geriatric Population and Chronic Disease Prevalence: The growing aging population and the increasing incidence of chronic diseases like cancer, neurological disorders, and digestive issues are driving the need for enteral feeding. ENFit syringes provide an effective and safe way to administer nutrition and medication.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 1,465.54 Million |

| Market Size in 2026 | USD 903.01 Million |

| Market Size in 2025 | USD 849.97 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.24% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Syringe Size, Usage Type, Usage Type, Material Type, End User, Distribution Channel, Application, Patient Group, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Home Healthcare Adoption

A growing trend of home healthcare is a major catalyst for the ENFit syringes market. There is an increase in the number of patients who prefer to carry out enteral feeding at home instead of clinical settings, as the number of elderly patients in the world is rising, and chronic diseases are becoming more common. This trend is particularly evident in the developed economies where the healthcare systems are promoting home care as an alternative to hospital stays. ENFit syringes, with their inherent safety and user-friendliness, are perfectly suited for use by non-professional caregivers, guaranteeing precise nutritional delivery without the potential for tube misconnections. The color-coded and standardized design further streamlines usability, empowering patients and families who manage enteral feeding independently.

Restraint

High Initial Costs

The high cost of converting from the legacy enteral feeding system to adopt the ENFit syringe is a significant restraint on its widespread adoption. The shift requires healthcare facilities to replace their existing inventory with ENFit-compatible syringes and connectors. This transition also necessitates comprehensive staff training to ensure safe and effective usage, which demands considerable time, financial resources, and organizational planning. These upfront costs can be particularly prohibitive for smaller clinics, potentially slowing adoption despite the long-term benefits of improved safety.

Opportunity

Hospital Standardization Initiatives

The ENFit syringes market is poised for substantial growth, driven by hospital-led standardization initiatives focused on enteral feeding equipment. As more healthcare institutions embrace these programs to enhance patient safety, simplify inventory management, and streamline procurement processes, the benefits of standardization become apparent. Regulatory compliance and accreditation, coupled with improved staff training and clinical workflows, further propel this trend. These programs are facilitated through strategic partnerships with suppliers and training firms, thereby enabling a smooth transition. As hospitals invest in comprehensive ENFit implementation plans, manufacturers are well-positioned to offer tailored solutions, support services, and training programs.

Syringe Size Insights

Why Did the 60 mL and above Segment Lead the ENFit Syringes Market?

The 60 mL and above segment led the market while holding a 34% share in 2024. This is mainly due to the widespread application of larger syringes in enteral feeding and medication administration is a key driver. Larger syringes are particularly useful for bolus feeding, flushing feeding tubes, and delivering larger volumes of nutrition or medication, making them essential in both hospitals and home care settings. Their capacity is especially beneficial for adult patients requiring long-term nutritional support due to chronic conditions such as cancer, neurological disorders, and gastrointestinal illnesses. Additionally, 60 mL syringes are frequently used in neonatal and pediatric care for flushing and cleaning feeding tubes.

The 0.5 mL – 1 mL segment is expected to grow at a significant CAGR over the forecast period, driven by its increasing use in pediatrics, neonatology, and precise drug administration. The demand for accurate administration of fluids and medications in neonatal intensive care units (NICU) necessitates the use of 0.5-1 mL syringes. The growing preference for personalized medicine and precise enteral medication delivery further contributes to this segment's expansion. Healthcare providers' emphasis on patient safety and dose accuracy makes these smaller syringes increasingly popular for delivering concentrated medications and micronutrients. Pediatric feeding regimens in home care are also on the rise, particularly for young children with developmental or gastrointestinal disorders.

Usage Type Insights

How Does the Disposable ENFit Syringes Segment Contribute the Most Revenue in 2024?

The disposable ENFit syringes segment dominated the market, holding a 77% share in 2024, due to the high demand for safe, single-use medical equipment. Healthcare systems are increasingly adopting disposable syringes to reduce the risk of cross-contamination and eliminate sterilization processes, given the potential for cross-contamination and the complexity of sterilization processes. Regulatory agencies and the World Health Organization support the trend towards single-use devices, prioritizing patient safety. The availability of various sizes and the convenience and cost-effectiveness of disposables make them suitable for both adult and pediatric patients.

The reusable ENFit syringes segment is expected to experience rapid growth in the upcoming period. These reusable syringes are beneficial in areas with limited medical supplies, such as rural or underfunded healthcare settings. Moreover, advancements in cleaning technologies and patient education promote the proper use of these products in non-clinical environments. With the growing trend of personalized care at home and an increasing emphasis on cost reduction and environmentally friendly medical practices, the reusable ENFit syringes segment is expected to grow steadily and expand its adoption.

Tip Type Insights

What Made Standard Tip ENFit Syringes the Dominant Segment in the ENFit Syringes Market in 2024?

The standard tip ENFit syringes segment led the market, holding a 68% share in 2024, driven by its widespread use in general enteral feeds. They are the standard in most hospitals, clinics, and homecare facilities due to their versatility, various sizes, and cost-effectiveness with standard ENfit feeding tubes. These syringes are typically used to administer nutrition, medication, and fluids to both adult and geriatric patients. The ease of use associated with the standard tip design enables healthcare providers and caregivers to administer safely and efficiently. Furthermore, regulations and cost-effectiveness make standard tip syringes the preferred choice for simplifying feeding protocols and preventing misconnections.

The low-dose tip ENFit syringes segment is expected to grow at a significant CAGR over the forecast period. These syringes are designed for high accuracy when administering small amounts of medication or nutrition, reducing the risk of dosage errors. Low-dose tips differ from standard tip syringes, featuring improved space and tolerances, making them ideal for use in neonatal intensive care units, pediatric wards, or infant home care. With the global focus on safety and accuracy in drug administration, especially for vulnerable populations, the demand for specialized tools like low-dose tip syringes is rising. They are also gaining adoption due to increased awareness among clinicians and caregivers about the dangers of overdosing or underdosing small-volume drugs.

Material Type Insights

Why Did the Polypropylene Segment Contribute the Most Revenue in 2024?

The polypropylene segment dominated the ENFit syringes market with a 45% share in 2024. Polypropylene is popular due to its cost-effectiveness, durability, and compatibility with various healthcare applications. It offers excellent chemical resistance and withstands sterilization processes, making it suitable for both single-use and reusable ENFit syringes. Health organizations favor polypropylene syringes for their consistent quality, ease of manufacturing, and ability to meet healthcare safety standards. It is also versatile across a wide range of syringe volumes, from low-dose to large-volume syringes, due to its lightweight nature. The use of disposable ENFit syringes made of polypropylene has increased.

The silicone segment is expected to expand at the fastest CAGR in the upcoming period. The softness, flexibility, and biocompatibility of silicone syringes make them suitable for sensitive patients like neonates, children, and the elderly. These syringes reduce pain during administration, especially for patients with sensitive feeding patterns or those requiring long-term enteral care. Silicone syringes are becoming more common in home care, where comfort and reuse are primary concerns because of their softness and reduced potential for abrasion.

Furthermore, their temperature resistance and reusability make them suitable for applications requiring frequent sterilization. These factors, along with the increasing emphasis on patient-centered healthcare needs and the demand for high-quality, comfort-oriented healthcare devices, are driving the segment's growth.

End User Insights

How Did the Hospitals Segment Contribute the Most Revenue in 2024?

The hospitals segment led the market, holding a 39% share in 2024. Hospitals are the primary locations for patients with chronic illnesses such as cancer, neurological, and gastrointestinal disorders, many of whom require enteral feeding. Consequently, hospitals have increased their use of ENFit syringes for delivering nutrition, hydration, and medication through feeding tubes, both in intensive care units and surgical wards. Hospitals also benefit from integrated procurement systems and standardized clinical guidelines, which favor ENFit-compatible equipment due to patient safety and regulatory compliance. They significantly influence market dynamics as hospitals prioritize high-quality and standardized enteral products to ensure safe and effective treatment outcomes.

The home healthcare settings segment is expected to expand at the fastest CAGR over the forecast period. As patients increasingly choose to treat chronic diseases outside of hospitals, the need for convenient, safe, and affordable syringes is growing exponentially, particularly concerning ENFit syringes. ENFit home syringes are simplified with color-based roll tips and easy-to-mark numbers to streamline and minimize hazardous use. The simplification and increased safety of ENFit-compatible systems benefit caregivers and patients, promoting their wider use. Moreover, home care is promoted by telehealth and remote monitoring, enabling clinical surveillance of enteral feeding procedures, thereby reducing the risk of hospital-based visits.

Distribution Channel Insights

Why Did the Direct Tenders Segment Lead the Enfit Syringes Market in 2024?

The direct tenders segment held a 41% share in the market in 2024, fueled by bulk-buying arrangements with manufacturers and highly established healthcare facilities like hospitals, government health institutions, and long-care networks. Direct tendering allows suppliers to secure long-term contracts and ensure continuous demand at a good price, along with tailored service packages. Combined with economic efficiency, this distribution model allows improved integration of training, support, and after-sales maintenance, essential for the safe and proper use of ENFit-related equipment. Hospitals prefer direct tenders because they reduce procurement logistics, and the same product can be applied in various departments. The model also offers steady revenue for suppliers and more efficient operations for healthcare providers.

The online pharmacies segment is expected to grow at the highest CAGR over the forecast period. As the world transitions to distance and distributed care, online platforms provide a resource-efficient and adaptable way for patients and caregivers to obtain ENFit syringes without traveling to physical stores. Online stores offer an easy-to-navigate interface, automated refill subscriptions, and home delivery directly to the doorstep, which is attractive to consumers with long-term enteral feeding requirements and home care. This channel also helps medical agents in rural or underserved regions, as conventional supply chains might be less reliable. In addition, alliances between manufacturers of ENFit syringes and e-commerce portals are enhancing access to certified products.

Application Insights

What Made Nutrition Delivery the Dominant Segment in the Market in 2024?

The nutrition delivery segment dominated the ENFit syringes market while holding a 52% share in 2024. The use of ENFit syringes is a fundamental initiative in feeding patients with nutritious formulations directly into the GI tract, particularly among those who cannot ingest food orally. The growing global aging population and the rise in long-term illnesses have largely contributed to the growth in demand for enteral nutrition support in the hospital and homecare sectors. ENFit-compatible syringes are the best choice in these conditions because of increased safety, standardized connectors, and high usability, which further prevent misconnections and feeding-related errors. Due to the urgency of nutritional therapy in enhancing recovery, preventing malnutrition, and sustaining healthy conditions, nutrition delivery is the biggest and most vital use of ENFit syringes.

The flushing segment is expected to grow at a significant CAGR over the forecast period. Flushing is a critical process employed before and after administering medication or food to avoid tube blockage, bacterial accumulation, and other issues, thus enabling effective tube functioning. ENFit syringes are ideal for flushing with control, simple to use on numerous patient groups, with their standardized connectors. Increased use of user-friendly flushing tools has been witnessed because of the expansion of home-based care and outpatient enteral feeding, giving rise to the need for flushing tools.

Patient Group Insights

Why Did the Adults Segment Lead the ENFit Syringes Market in 2024?

The adults segment held a 48% share in the market in 2024, due to the increased prevalence of chronic diseases and neurological conditions among this age group, all of which often require enteral nutrition and drug delivery. Enteral feeding is a common method for providing long-term nutritional support to adult patients, especially those in critical care, recovering from surgery, or dealing with degenerative illnesses like ALS or Parkinson's. These conditions are managed in various settings, including hospitals, long-term care facilities, and home care environments, where ENFit syringes are used to ensure safe and effective administration. The use of standardized, color-coded connectors in these syringes helps prevent misconnections and ensures accurate dosing, especially in complex treatment plans. Moreover, the ergonomic design of larger-volume syringes (e.g., 60 mL) caters to the needs of adults, making them convenient for healthcare providers and caregivers.

The neonates & pediatric segment is expected to grow at a significant rate during the projection period, driven by a heightened clinical focus on ensuring precise dosing, patient safety, and gentle treatment for the youngest and most vulnerable patients. This is particularly critical in neonatal intensive care units and pediatric hospitals, where strict protocols are essential. The shift toward safer enteral delivery practices has led hospitals and caregivers to prioritize devices that offer maximum comfort and accuracy for infants and children. Furthermore, the expansion of home care and outpatient pediatric services is fueling the demand for easy-to-use, ENFit-compatible syringes, which are safe for use by non-clinical caregivers.

Regional Insights

U.S. ENFit Syringes Market Size and Growth 2025 to 2034

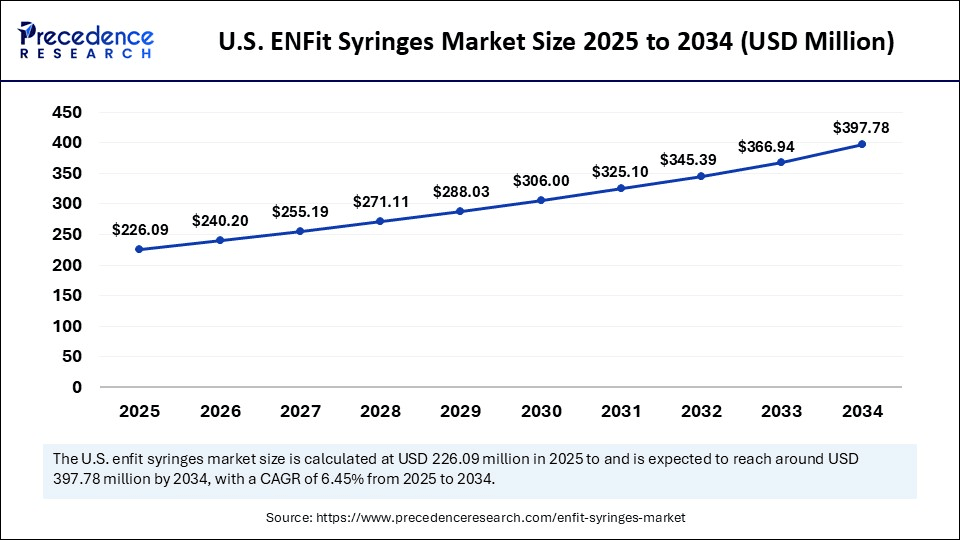

The U.S. ENFit syringes market size is evaluated at USD 226.09 million in 2025 and is projected to be worth around USD 397.78 million by 2034, growing at a CAGR of 6.45% from 2025 to 2034.

What Made North America the Dominant Region in the ENFit Syringes Market in 2024?

North America dominated the global market with the highest market share of 38% in 2024. The presence of a publicly funded healthcare system facilitated a more streamlined, nationwide adoption of ENFit systems, enhancing patient safety and operational efficiency. The region benefited from advanced healthcare technologies and a high level of awareness among clinicians and caregivers regarding the benefits of ENFit technology. Furthermore, the proactive approach of both patients and healthcare practitioners toward adopting advanced medical solutions drove market growth. The concentration of manufacturers and the establishment of strategic distribution platforms within North America also played a crucial role, ensuring easy access and competitive pricing.

U.S. Healthcare Policies Drive ENFit Syringe Market Growth

The U.S. is experiencing significant growth in the ENFit syringes market due to several key factors. A major driver is the strong emphasis on patient safety, supported by healthcare policies and regulatory bodies like the FDA, which encourage the adoption of ENFit-compatible systems. This shift minimizes the risks associated with tubing misconnections, enhancing patient outcomes. Furthermore, the increasing prevalence of chronic diseases and an aging population in the U.S. are fueling the demand for enteral feeding solutions, including ENFit syringes. The growing trend of home healthcare, where caregivers require user-friendly and safe medical devices, also contributes to market expansion. These combined factors position the U.S. as a rapidly expanding market for ENFit syringes.

The U.S. is a major contributor to the ENFit syringes market within North America, driven by its strong healthcare policies prioritizing patient safety. Following recommendations from GEDSA and with FDA support, U.S. hospitals adopted ENFit-compatible systems early on, reducing risks from tubing misconnections. The market's growth is also fueled by the prevalence of chronic diseases, an aging population, and the increasing need for home healthcare, collectively boosting the demand for ENFit syringes.

What Makes Asia Pacific the Fastest-Growing Region in the ENFit Syringes Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period. This growth is primarily attributed to improved healthcare infrastructure, increased healthcare spending, and growing awareness of patient safety in major economies such as China, India, and Japan. Regional governments are investing in modernizing healthcare systems, including infection control and medical device standardization. The presence of local and multinational syringe manufacturers, supported by a robust supply chain, further enhances market accessibility and affordability.

China's Healthcare Investments Fuel Enfit Syringe Growth

China is a major player in the Asia Pacific ENFit syringes market. This is mainly rising investments in universal healthcare and a growing focus on patient safety, which are driving the demand for standardized medical devices like ENFit syringes. A robust domestic manufacturing sector enables efficient production and distribution of ENFit-compliant syringes at competitive prices. As healthcare providers adopt international safety standards, the use of ENFit products is increasing, especially in urban healthcare facilities. Furthermore, the increasing prevalence of chronic diseases and an aging population in China are fueling the demand for enteral feeding solutions, including ENFit syringes.

What are the Key Factors Driving the Growth of the European Enfit Syringes Market?

The European ENFit syringes market is poised for notable growth, driven by medical device regulations, well-developed healthcare facilities, and patient safety awareness. The Medical Device Regulation (MDR) in Europe streamlines safety regulations, encouraging healthcare professionals to adopt standardized, ISO-compliant devices, including ENFit syringes. These regulations and established national health services facilitate steady market penetration in both acute and long-term care settings.

Patient Safety Drives UK ENFit Syringe Market Growth

The UK is a major player in the ENFit syringes market in Europe, driven by its focus on patient safety, stringent regulations, and healthcare system investments. The aging population and increasing chronic illnesses are boosting demand for long-term enteral feeding solutions, particularly in home and elderly care. Well-established supply chains, government medical support, and a healthcare-conscious population will continue to fuel the growth of the market in the region.

South America: Increasing Government support

South America is significantly growing in the market due to the increasing prevalence of malnutrition, chronic diseases, and the increase in preterm births needful enteral feeding. Growing medical care awareness and the enhancement of healthcare infrastructure in developing economies such as China and India. A significantly increasing geriatric population with chronic conditions that need specialized feeding or drug development.

Brazil: Favorable Regulatory Framework

Brazil's regulatory agency, ANVISA, aligns with global standards, which increases the adoption of novel technologies and inspires investment in the medical device field. The country has been enhancing healthcare facilities and a large public health system (SUS), growing the overall demand for medical supplies and tools.

MEA

Rising Awareness and Demand for Personalized Medicine

MEA is significantly growing in the market as this region has a high and increasing incidence of chronic conditions like diabetes, cancer, and neurological disorders. These health conditions often need specialized nutritional support and long-term care, including enteral feeding, driving the demand for related devices such as ENFit syringes.

South Africa: Technological Advancements

In South Africa, the Governments and regulatory bodies are progressively directing on quality standards and safety protocols for healthcare tools. Growing awareness among physicians and patients in the region about the significant role of appropriate nutrition in recovery and disease management which drives the use of enteral feeding devices.

ENFit Syringes Market- Value Chain Analysis

- R&D

Research and Development (R&D) processes in ENFit syringes focus severely on patient safety, government compliance, and act testing to prevent medical tool misconnections.

Key Players: Baxter and B. Braun - Clinical Trials:

Clinical trials and evaluations for ENFit syringes mainly focus on tool performance, dosing accuracy, and patient safety in real-world medical settings.

Key Players: Medicina and NeoMed - Patient Services:

ENFit syringes are intended specifically for enteral procedures to improve patient safety by preventing misconnections among enteral and non-enteral such as intravenous or respiratory systems.

Key Players: Cardinal Health, ICU Medical

Top Vendors in the ENFit Syringes Market & Their Offerings

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

BD |

United States |

Innovative R&D |

BD stated that ENFit's female and Low-Dose Tip (LDT) designs can increase the potential for human error and may require extra steps, such as manual wiping, to achieve accurate dosages. |

|

Cardinal Health |

Dublin, Ohio |

Extensive pharmaceutical and medical product distribution |

Monoject Enteral Syringes feature an ENFit connection and are available in multiple sizes, sterile and non-sterile. |

|

Baxter International |

United States |

Diversified product portfolio |

Baxter's enteral ENFit syringes are designed to improve patient safety during enteral nutrition (EN) therapy by preventing misconnections. |

|

Medtronic |

Ireland |

Broad and innovative product |

Medtronic has fully transitioned its enteral feeding products to the ENFit system and currently offers ENFit syringes and access devices. |

|

Terumo Corporation |

Japan |

Diverse core technologies |

Terumo Pharmaceutical Solutions develops patient-oriented parenteral delivery solutions for therapeutic performance and safety. |

Recent Developments

- In September 2024, Azurity Pharmaceuticals, a pharmaceutical company dedicated to the development of innovative dose forms and formulations of products that align with patient needs and unmet needs, announced the U.S. Food and Drug Administration (FDA) has approved Nymalize(r) (nimodipine) oral solution in a 30 mg / 5 L prefilled ENFit(r) syringe. (Source:https://azurity.com)

- In 2023, Fortune Medical manufactured two ENFit-compatible silicone feeding tubes (gastrostomy and nasogastric), which would help enteral feeding systems that conform to ENFit connectors or increase compatibility with ENFit-compatible syringes.(Source:https://fortunemed.com)

Segments Covered in the Report

By Syringe Size

- 0.5 mL – 1 mL

- 3 mL – 5 mL

- 6 mL – 10 mL

- 20 mL – 35 mL

- 60 mL and above

- Others

By Usage Type

- Reusable ENFit Syringes

- Disposable ENFit Syringes

By Tip Type

- Low Dose Tip (LDT) ENFit Syringes

- Standard Tip ENFit Syringes

- Others (e.g., catheter tip variants)

By Material Type

- Polypropylene (PP)

- Polyethylene (PE)

- Silicone

- Others (e.g., Glass, PVC-free polymers)

By End User

- Hospitals

- Home Healthcare Settings

- Long-Term Care Facilities

- Clinics & Ambulatory Surgical Centers

- Rehabilitation Centers

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Direct Tenders

- Others

By Application

- Medication Delivery

- Nutrition Delivery

- Flushing

- Sampling

- Others

By Patient Group

- Neonates & Pediatric

- Adults

- Geriatric

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting