What is the Epigenetic Drugs Market Size?

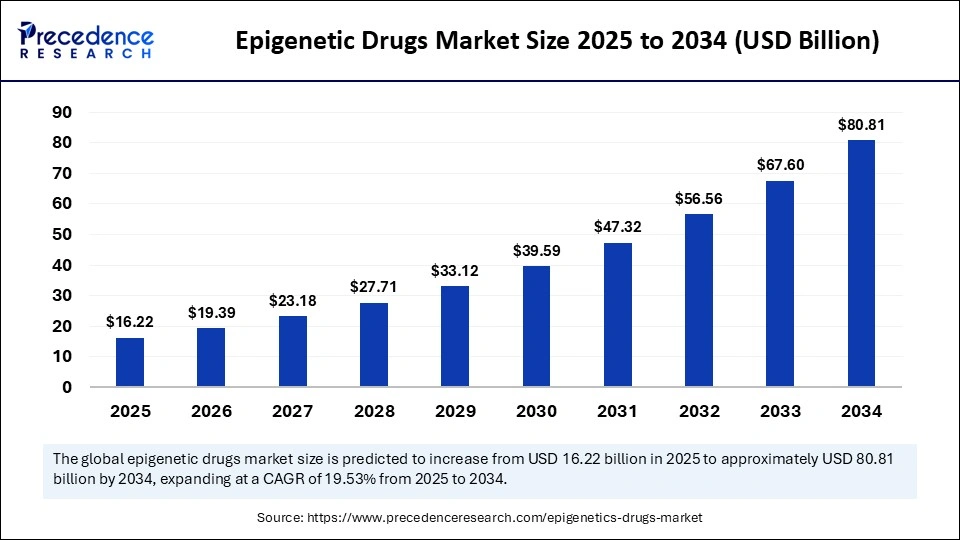

The global epigenetic drugs market size is calculated at USD 16.22 billion in 2025 and is predicted to increase from USD 19.39 billion in 2026 to approximately USD 80.81 billion by 2034, expanding at a CAGR of 19.53% from 2025 to 2034. The epigenetic drugs market is experiencing steady growth, driven by advancements in oncology research, rising adoption of precision medicine, and an increase in clinical trials targeting epigenetic mechanisms.

Market Highlights

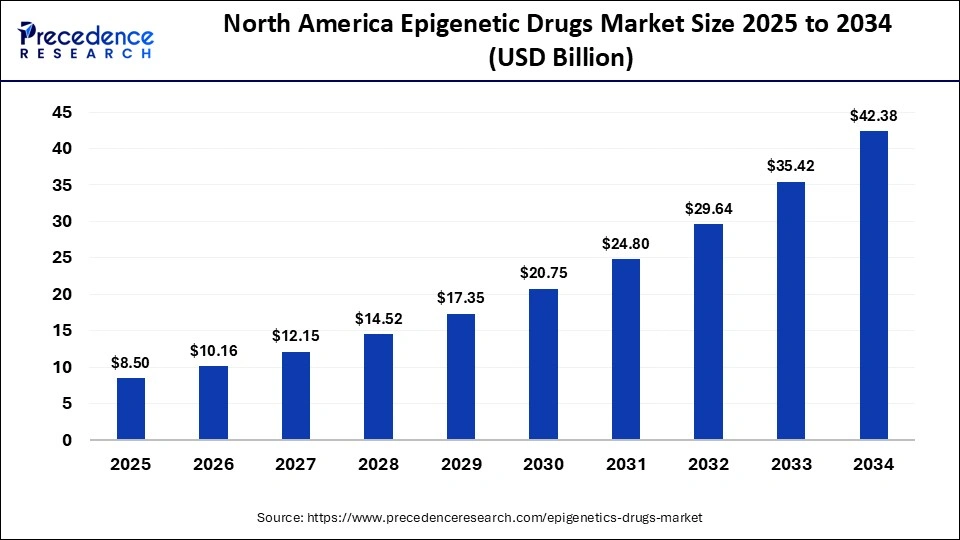

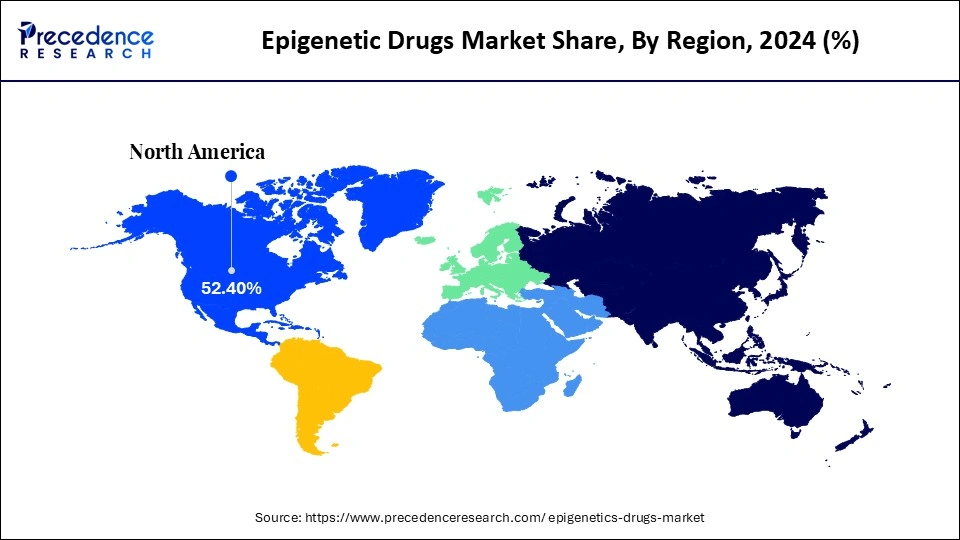

- North America led the epigenetic drugs market with around 58.4% of the market share in 2024.

- The Asia Pacific is estimated to expand the fastest CAGR of 12.8% between 2025 and 2034.

- By drug class, the HDAC inhibitors segment held the biggest market share of 45.1% in 2024.

- By drug class, the BET inhibitors segment is growing at the fastest CAGR of 12.8% from 2025 to 2034.

- By mechanism of action, the histone modification modifiers segment captured the largest market share of 48.5% in 2024.

- By mechanism of action, the non-coding RNA modulators segment is expected to expand at a double-digit CAGR of 13% from 2025 to 2034.

- By application, the oncology segment captured the biggest market share of 53.5% in 2024.

- By application, the neurology segment is expected to expand at a notable CAGR of 13.2% between 2025 and 2034.

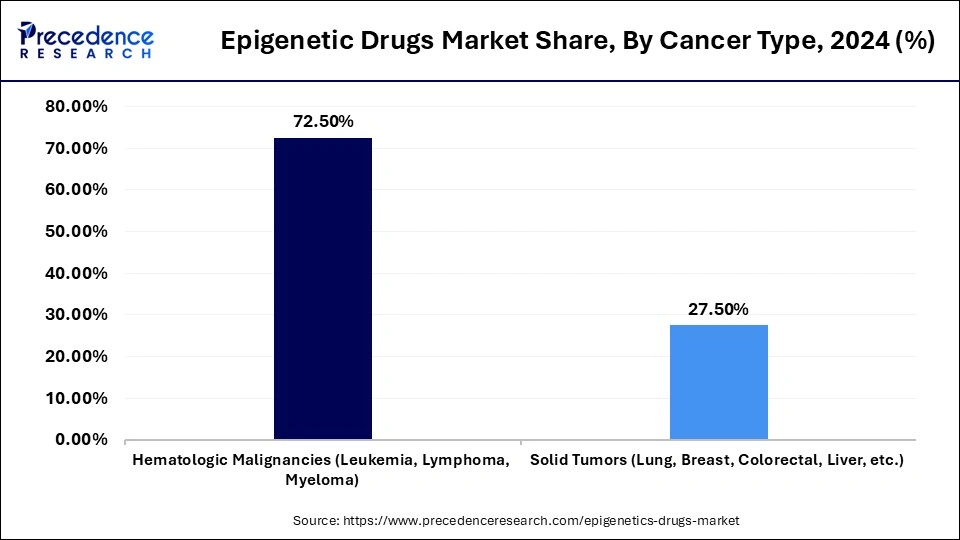

- By cancer type, the hematologic malignancies segment held approximately 72.5% of the market share in 2024.

- By cancer type, the solid tumors (lung, breast, colorectal, liver, etc.) segment is growing at a notable CAGR of 13% from 2025 to 2034.

The Emergence of Epigenetic Medicines

The current emphasis on personalized medicine, coupled with the ever-increasing incidence of cancer and genetic disorders, is are principal motivator for epigenetic medicines. These medicines are designed to precisely target reversible chemical modifications to DNA or histone proteins, thereby enabling the accurate regulation of biological processes without altering the genetic code.

The epigenetics drug market involves inhibitors of DNA methylation, histone modifications, and non-coding RNAs. The increase in clinical success and research of new epigenetic medicines focused on the treatment of cancer, neurodegenerative diseases, and inflammatory diseases will likely influence the drug supply. Recent collaborations between biotech firms and academic institutions are reportedly yielding new generations of epigenetic modulators with improved efficacy and adverse-event profiles.

AI-Driven Drug Discovery: Accelerating the Next Wave of Innovation

In a momentous development, artificial intelligence is quickly revolutionizing the epigenetic drug landscape by enabling more penetrating investigation of DNA methylation and histone modification patterns. This significant transition is exemplified in November 2025, with the unveiling of Heptas AI-based liquid biopsy platform that uses cell-free DNA epigenetic profiling and transformer algorithms to identify liver diseases, such as MASH, with tissue-level precision. This represents a fundamental leap forward in AI-mediated diagnostics anddrug discovery.

By integrating AI with epigenomic datasets, researchers can now expedite target identification, refine drug design, and personalize treatments. The increased interactions between AI developers and biotech companies represent an important step towards data-driven, precision-based epigenetic therapeutics, as they begin to drive the next healthcare innovation.

Epigenetic Drugs Market Outlook

The epigenetic drugs focus on approaches that modify gene expression (e.g., histone deacetylase or methyltransferase inhibitors), rather than changes to the DNA sequence. Recent literature has noted that these mechanisms can be reversible and facilitate new therapeutic approaches, especially in oncology, which signals an evolution in the pharma pipeline.

North America remains the largest base due to strong capacity for biotech R&D and an enabling regulatory environment; meanwhile, Asia-Pacific is a rapidly developing region, where China and India both have emerging genomics and epigenetics projects, creating regional expansion opportunities and shifting the global supply chain.

There has been an increase in the number of clinical trials. Small-molecule epigenetic inhibitors, including those classified as HDAC inhibitors, are advancing into later stages in their clinical development, and also expanding their indications from blood cancers into solid tumours and non-oncology areas outside the potentially trailblazing epigenetic drug category - this R&D momentum should foster medium-term value generation.

Primary growth drivers are the rising incidence of cancers and chronic diseases, applications of epigenetic modulation for disease states, and increased investment in the precision medicine space, where therapies could be offered based on an epigenomic profile, adding to commercial potential.

Constraints are a limited mechanistic understanding of epigenetic regulation in many diseases, the risks of impaired target selectivity and off-target side effects of broad-acting agents, and prohibitively high costs of drug development, meaning that timelines and risk will remain high for biotech and pharma companies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 16.22 Billion |

| Market Size in 2026 | USD 19.39 Billion |

| Market Size by 2034 | USD 80.81 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 19.53% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Deployment Model, End-User Industry, Application/Use Case, Sales Channel/GTM, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Epigenetic Drugs Market Segment Insights

Drug Class Insights

The epigenetic drugs market is led by Histone Deacetylase (HDAC) inhibitors, which account for a share of 45.1%. HDAC inhibitors are important regulators of gene expression by altering chromatin structure and have promise for the treatment of various cancers, neurological diseases, and inflammatory diseases. It has maintained a strong lead owing to the class consistent clinical success, its broad range of potential therapeutic applications, and regulatory approvals.

Bromodomain and Extraterminal (BET) inhibitors are expected to be the fastest-growing, with a 12.8% growth rate, due to the novelty of targeting epigenetic reader proteins that regulate gene transcription. BET inhibitors show promise in oncology, autoimmune, and even cardiovascular diseases, and, with the ongoing rise in clinical trials, they will soon find broader acceptance in drug discovery pipelines.

There is clearly emerging interest in other drug classes, such as sirtuin inhibitors and histone demethylase inhibitors, as potential treatments for metabolic and viral-related disorders. Sirtuins help regulate gene silencing and reactivation, which can be an attractive mechanism for drug development. Furthermore, there is significant potential for enhancing viral detection and quantification methodologies.

Mechanism of Action Insights

Histone modification modifiers are leading the epigenetic drugs market with a 48.5% market share, due to their important role in regulating chromatin structure and gene transcription. This class of modifiers includes histone acetyltransferase and deacetylase inhibitors, all of which are common due to their ability to reverse aberrant gene expression and are thus commonly used in cancer therapeutics and neurological disorders.

Non-coding RNA modulators are the fastest-growing segment, with a 13% CAGR, owing to research and the expansion of RNA-based therapeutics. Non-coding RNA modulators facilitate gene silencing or expression without altering the DNA sequence and have potential for advanced precision medicine strategies in oncology or rare genetic diseases.

Chromatin remodelling agents have become more popular for altering nucleosome positioning and promoting DNA transfection by increasing accessibility to the pathway. Uses of this mechanism have also expanded to include viral replication mechanisms and further advances in virus detection and quantification tools through epigenetic control of the host-viral interface.

Application Insights

Oncology is the prominent segment, with a current 53.5% share of the epigenetic drugs market. Epigenetic therapies have already demonstrated significant efficacy across multiple cancer types by reactivating silenced tumor suppressor genes and downregulating oncogene expression. Their role in advancing precision oncology and in the broader application of combination therapy has established a strong clinical and commercial presence.

Neurology is rapidly emerging as the fastest-growing segment with a 13.2% CAGR, driven by growing interest in epigenetic regulation in neurodegenerative and psychiatric disease research. Compounds that target histone and DNA methylation pathways have shown early promise and suggested effectiveness in targeting Alzheimers, Parkinsons, and depression, potentially leading to increased investment in neuro-epigenetic drug discovery.

Utilization in inflammatory diseases is expected to be a prominent area of application, given that epigenetic modulation has been shown to impact immune cell activation and cytokine production. Targeting these pathways has the potential to support new diagnostic platforms, applications for personalized therapy, and improved understanding of the biological mechanisms underlying immune-mediated conditions, including autoimmune disorders such as rheumatoid arthritis and viral-induced inflammation.

Cancer Type Insights

Hematologic malignancies, including leukemia, lymphoma, and myeloma, account for the dominant share of the epigenetic drugs market at 72.5%. Such cancers have very robust responses to epigenetic therapy - specifically HDAC inhibitors and DNMT inhibitors - that re-establish normal gene expression and restrict the proliferation of abnormal cells. The solid clinical results and regulatory approvals further underscore the dominance of hematologic malignancies.

Solid tumors, including lung cancer, breast cancer, colorectal cancer, and liver tumors, are the fastest-growing cancer type segment, with an expected CAGR of 13%. Improved knowledge of tumor-specific epigenetic signatures and enhanced drug-delivery platforms are expanding the use of epigenetic therapies in solid tumors and advancing the field of precision oncology.

Epigenetic Drugs Market Regional Insights

The North America epigenetic drugs market size is estimated at USD 8.50 billion in 2025 and is projected to reach approximately USD 42.38 billion by 2034, with a 19.54% CAGR from 2025 to 2034.

Why North America is Dominating the Epigenetic Drugs Market?

The strength of North America lies in established regulatory pathways, specialized translational R&D, and robust clinical trial networks that facilitate the advancement of epigenetic programs from early discovery to first-in-human clinical studies. Academic, US-based medical centers, and cooperative oncology organizations are generating field-leading epigenomic biomarker studies, and with the FDAs continual approvals pipeline and annual novel-drug reports, there is additional clarity in regulatory signaling for sponsors to run focused oncology and hematology epi-drug studies. Overall, clinical trials and regulatory activity in 2023 to 25 support ongoing forward momentum in the development of therapeutic agents and companion diagnostics based on epigenetic mechanisms of action.

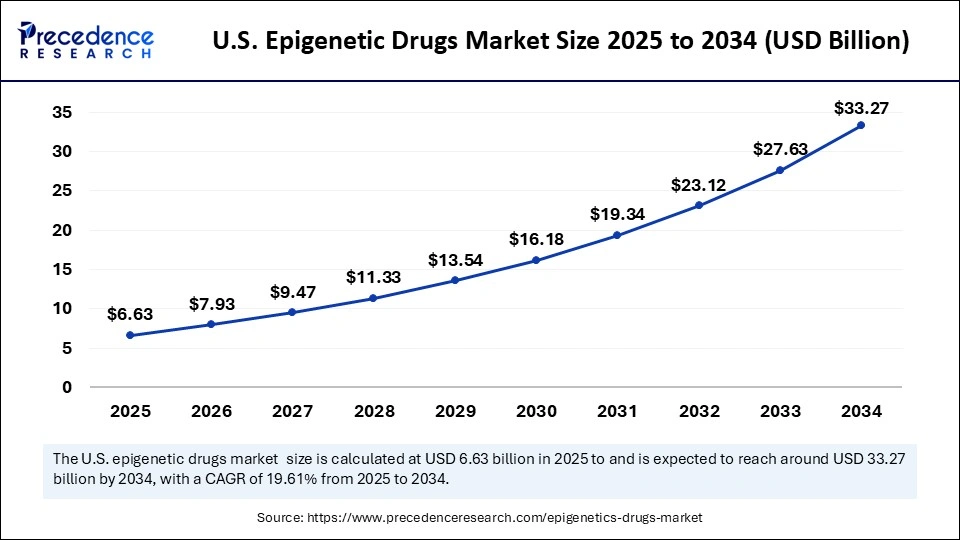

The U.S. epigenetic drugs market size is calculated at USD 6.63 billion in 2025 and is expected to reach nearly USD 33.27 billion in 2034, accelerating at a strong CAGR of 19.61% between 2025 and 2034.

United States Epigenetic Drugs Market Trends

The United States houses hospitals, specialized CROs, and translational laboratories that support patient-stratified, complex trials of DNMT, HDAC, and other epigenetic modulators. US-based clinical trial registries and recent medical literature reflect numerous early-phase trials that have combined different epistemological agents with either immunotherapies or other targeted drugs, exemplifying a commercial strategy to overcome treatment resistance and provide a clinical signal. The co-development environment (diagnostic + drug) and a more accessible, robust trial population shorten time to proof-of-concept compared to less-integrated market opportunities.

APACs growth is structural: rapid expansion of trial capacity, increased public and institutional research funding, and expanding CRO and hospital networks that enable more early-phase studies to be conducted locally. Academic publications and national trial registries show both growth in methylation/epigenomic biomarker research and the launch of more oncology trials in China, Japan, and India, which together reduce the cost of development and the timeline for sponsors in the region. Government reports and clinical-trial data highlight oncology as a consistent area of focus, with positive results for epi-drug pipelines targeting cancer epigenetics.

China Epigenetic Drugs Market Trends

China has regulatory reforms that are accelerating the review of innovative clinical trial applications, expanding hospital networks capable of recruiting patients for molecularly stratified studies, and increasing domestic translational publications, including NMPA-cleared epigenetic biomarker tests, such as methylation-based gastric cancer assays. These factors create a strong ecosystem for domestic biotechs to conduct proof-of-concept trials while concurrently developing diagnostics, speeding the transition from discovery to clinical validation in that region.

- In September 2025, Epigenic Therapeutics announced completion of a $60 million Series B financing, led by Lapam Capital, to advance its epigenetic-medicine platform, including lead assets EPI-003 and EPI-001.

Europes growth is attributed to a high level of academic expertise in epigenomics, relatively high levels of public research funding, and cross-border collaborative networks that facilitate discovery and clinical translation. Research consortia and cancer institutes in Europe are already working to incorporate epigenomic profiling into oncology trials, and biobanks and genomic data infrastructure to select patients for mechanism-specific studies. Collectively, these factors combine to generate a research environment that supports innovation and accelerates the validation of novel epigenetic drug targets in multiple therapeutic areas

United Kingdom Epigenetic Drugs Market Trends

The United Kingdom is clearly differentiated by its unique combination of world-leading universities, government-supported translational programs, and clinical trial infrastructure, integrated by the National Institute for Health and Care Research (NIHR). UK-based consortia are making headway in research on histone modification inhibitors and DNA methylation biomarkers, often linked to precision oncology programs offered at NHS hospitals. The combination of academia, health care, and biotechs aligns to make the UK an important European gateway for early-stage clinical trials and drug diagnostic development strategies in epigenetics.

Epigenetic Drugs Market Value Chain

Pharmaceutical firms and research organizations pour significant dollars into the effort to identify novel epigenetic targets, develop inhibitors, and validate therapeutic efficacy. All of this must be done with cutting-edge molecular and bioinformatics platforms to ensure precision and effectiveness.

Key Players: AstraZeneca plc, Epizyme, Broad Institute, Dana-Farber

This step consists of laboratory testing and staged clinical testing to determine safety, dosage, and therapeutic potential, which follows appropriate international regulations to achieve market clearance.

Key Players: IQVIA, ICON, National Cancer Institute (NCI)

Drugs must undergo rigorous efficacy, safety, and manufacturing assessment and control by regulatory authorities such as the U.S. FDA and EMA. This is an extremely important step prior to commercial sales.

Key Players: U.S. FDA, EMA, DCGI, CDSCO, PMDA, Health Canada

Once the drugs are approved, mass production can pursue characteristics such as chemical stability, bioavailability, and Good Manufacturing Practices (GMP) to ensure uniformity across global facilities.

Key Players: Catalent, Lonza, Thermo Fisher, Merck & Co., Inc., GlaxoSmithKline plc (GSK)

Once approved, the drugs will be sold and distributed through hospitals, specialty pharmacies, and online, while building strategic partnerships and relationships with oncologists, researchers, and healthcare organizations to promote the drugs as they become available for purchase.

Epigenetic Drugs Market Companies

Novartis develops epigenetic therapies targeting chromatin-modifying enzymes and gene-regulation pathways, with a pipeline focused on oncology and precision medicine. The company emphasizes next-generation small molecules aimed at reversing abnormal gene expression.

Celgene, now part of BMS, is a major contributor to epigenetic cancer drugs, including approved HDAC and DNMT inhibitors. The company continues advancing programs in hematologic malignancies and solid tumors.

Merck develops epigenetic modulators for oncology and immunotherapy combinations, focusing on agents that influence DNA methylation and chromatin dynamics to enhance anti-tumor response.

Eisai markets approved epigenetic drugs such as HDAC inhibitors and continues to explore novel epigenetic regulators for cancer therapy. The company integrates targeted therapeutics with biomarker-driven development.

GSK is active in epigenetic drug development, especially bromodomain (BET) inhibitors and other chromatin-targeting agents. Its programs target inflammatory diseases and difficult-to-treat cancers.

AstraZeneca invests in epigenetic oncology programs, including inhibitors targeting histone modifiers and transcriptional regulators. The company focuses on combinations with immuno-oncology and DNA damage response therapies.

Chroma develops small-molecule epigenetic modulators, particularly HDAC inhibitors, aimed at hematologic malignancies and inflammatory disorders.

Syndax focuses on epigenetic therapies such as HDAC and menin inhibitors for leukemia, solid tumors, and combination immunotherapy strategies. The company emphasizes precision targeting of gene expression drivers.

Mirati explores epigenetic mechanisms linked to oncogenic signaling, developing targeted agents that influence gene regulation and cancer cell dependency pathways.

Constellation, now part of MorphoSys, specializes in BET and other chromatin-modifying enzyme inhibitors. Its pipeline targets hematologic cancers and rare epigenetically driven diseases.

Recent Developments

- In January 2025, Tune Therapeutics secured $175 million+ in a Series B round, co-led by New Enterprise Associates and others, to fund its epigenome-editing therapy TUNE-401 targeting chronic hepatitis B virus.(Source: https://www.biopharmadive.com)

- In June 2025, SOLVE FSHD and Modalis Therapeutics announced a strategic collaboration to develop a CRISPR-based epigenome editing treatment (MDL-103) to silence the DUX4 gene in patients with Facioscapulohumeral muscular dystrophy (FSHD).(Source:https://crisprmedicinenews.com)

Expert Opinion

Analysts observe that the market for epigenetic drugs is set to grow steadily as private equity funding returns and translational biology supports targeted modulators and companion diagnostics. Recent funding and number of active trials indicate investor confidence and product pipelines can be ramped up relatively quickly. Still, the clinical outcomes for solid tumors remain variable; the heterogeneity and duration of response can be short, indicating challenges associated with single agents and providing biomarker information.

Other challenges in the near term will include regulatory rigor, reimbursement issues, and complex product manufacturing. Commercial opportunities exist in rational combinations with targeted and immunotherapy, in moving into non-oncology indications (e.g., viral and metabolic diseases), and in diagnostic-drug pairings that de-risk development. Companies focused on solid biomarker strategies, precision patient identification, and partnerships will gain outsized value.

Epigenetic Drugs MarketSegments Covered in the Report

By Deployment Model

- On-premise (perpetual / licensed)

- Subscription / Floating licenses

- Cloud-native SaaS / Pay-per-use

- Hybrid (cloud + on-prem)

- Other

By End-User Industry

- Semiconductor & Fabless IC Design Houses

- Electronic Systems OEMs

- Foundries & IDM

- PCB & EMS providers

- Academic & Research

- Government / Defense / Aerospace

- Other

By Application/Use Case

- ASIC/SoC Design

- FPGA Design & Toolchains

- PCB & Board-level Design

- Package / Substrate Co-design

- System-level & Multi-discipline (SI/PI, thermal)

- MEMS & Sensor design

- Power & Thermal analysis

- Other

By Sales Channel/GTM

- Direct enterprise sales

- Channel/Value-added resellers

- Online/Self-serve/App-store sales

- OEM bundling/ISV partnerships

- Other

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting