Esophageal Cancer Molecular Diagnosis Market Size and Forecast 2025 to 2034

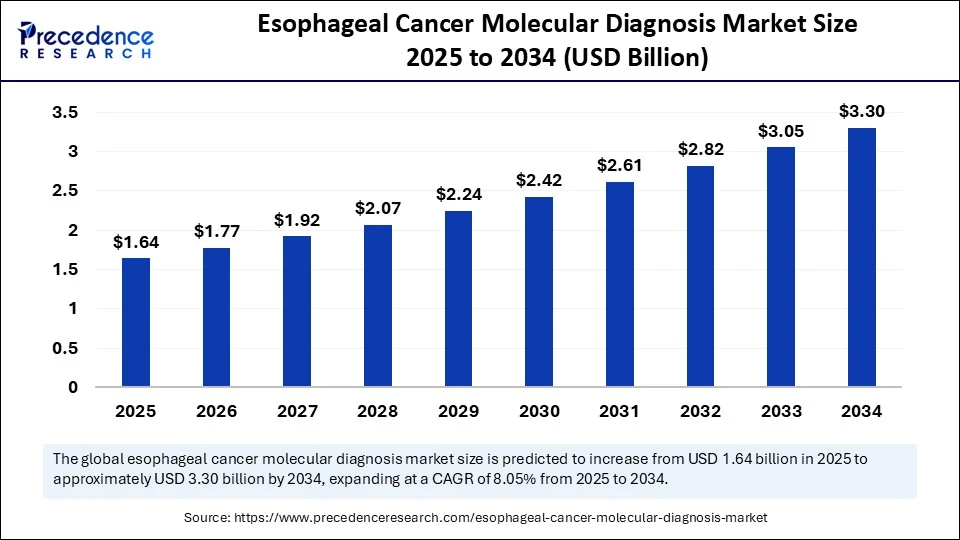

The global esophageal cancer molecular diagnosis market size accounted for USD 1.52 billion in 2024 and is predicted to increase from USD 1.64 billion in 2025 to approximately USD 3.3 billion by 2034, expanding at a CAGR of 8.05% from 2025 to 2034. The market is experiencing significant growth due to the rising prevalence of esophageal cancer and the growing demand for early and accurate detection. This growth is further supported by advancements in biomarker research and non-invasive diagnostic technologies. Additionally, the increasing adoption of personalized medicine is expected to accelerate market expansion in the coming years.

Esophageal Cancer Molecular Diagnosis MarketKey Takeaways

- In terms of revenue, the global esophageal cancer molecular diagnosis market was valued at USD 1.52 billion in 2024.

- It is projected to reach USD 3.3 billion by 2034.

- The market is expected to grow at a CAGR of 8.05% from 2025 to 2034.

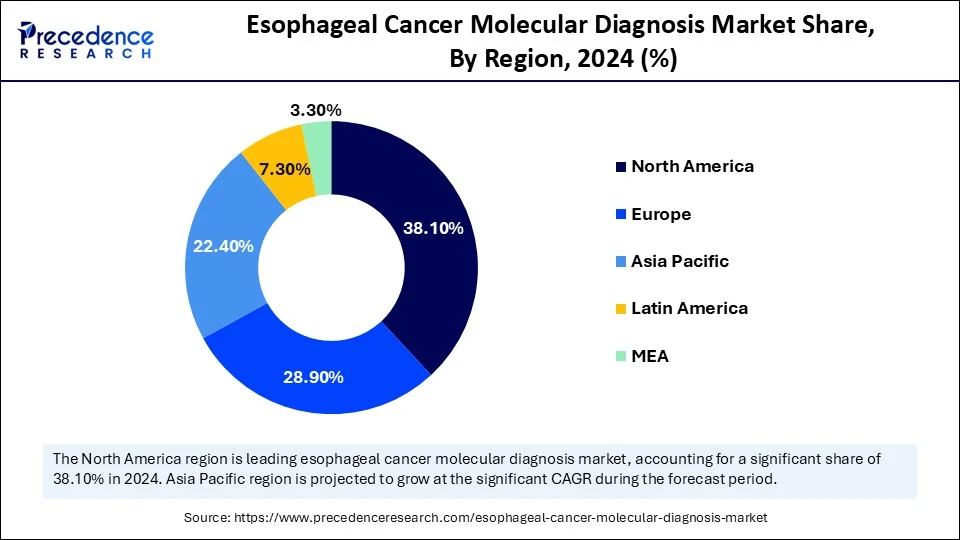

- North America led the global esophageal cancer molecular diagnosis market with the largest share of 38.1% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By technology, the polymerase chain reaction (PCR) segment captured the largest share of 29.8% in 2024.

- By technology, the liquid biopsy segment is experiencing rapid growth during the forecast period.

- By biomarker type, the genetic markers segment held the major market share of 32.5% in 2024.

- By biomarker type, the circulating tumor DNA (ctDNA) segment is projected to grow at a significant CAGR between 2025 and 2034.

- By cancer type, the esophageal adenocarcinoma segment contributed the highest market share of 57.2% in 2024.

- By cancer type, the esophageal squamous cell carcinoma segment is expanding at a significant CAGR from 2025 to 2034.

- By sample type, the tissue biopsy sample segment captured the largest market share of 49.3% in 2024.

- By sample type, the blood (liquid biopsy) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By application, the companion diagnostics (therapy selection) segment generated the major market share of 34.6% in 2024.

- By application, the early detection/screening segment is expected to grow at a significant CAGR over the projected period.

- By end user, the hospitals segment contributed the maximum market share of 37.5% in 2024.

- By end user, the diagnostic laboratories segment is expected to grow at a significant CAGR from 2025 to 2034.

How Can AI Make an Impact in the Esophageal Cancer Molecular Diagnosis Market?

Artificial intelligence (AI) is transforming the esophageal cancer molecular diagnosis landscape by boosting early detection, refining treatment strategies, and accelerating research. AI-driven tools, especially in endoscopy and liquid biopsy analysis, enhance diagnostic accuracy, help identify high-risk patients, and enable personalized treatment approaches. This results in better patient outcomes, lower healthcare costs, and a more efficient health system. AI algorithms analyze circulating tumor cells and DNA in blood samples, like liquid biopsies, to detect cancer early and monitor how well treatments work. Additionally, by integrating imaging, genomic, and clinical data, AI supports the creation of individualized treatment plans tailored to each patient's specific cancer characteristics.

U.S. Esophageal Cancer Molecular Diagnosis Market Size and Growth 2025 to 2034

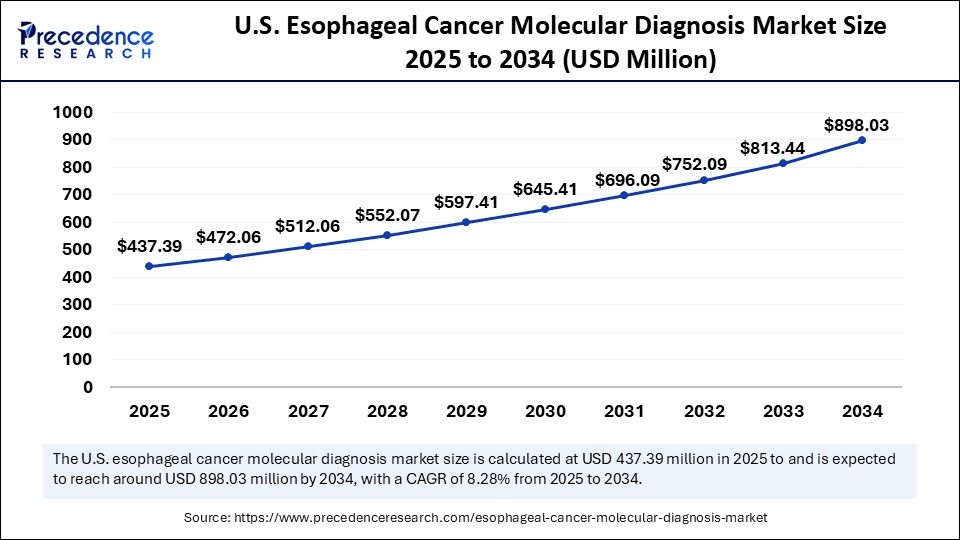

The U.S. esophageal cancer molecular diagnosis market size was exhibited at USD 405.38 billion in 2024 and is projected to be worth around USD 898.03 billion by 2034, growing at a CAGR of 8.28% from 2025 to 2034.

How Did North America Dominate the Esophageal Cancer Molecular Diagnosis Market in 2024?

North America led the esophageal cancer molecular diagnosis market in 2024. This is due to higher incidence rates of esophageal adenocarcinoma, especially in the U.S., strong healthcare infrastructure, and increased research activities. North America boasts a vibrant ecosystem for cancer research, with numerous institutions and pharmaceutical companies investing in innovative diagnostic tools and therapeutic strategies, including immunotherapy. The U.S. and Canada have well-established healthcare systems with advanced diagnostic and treatment facilities, providing better access to molecular testing and personalized therapies. Various government initiatives, advancements, and collaborations, especially those focusing on immunotherapy and personalized medicine, further reinforce the region's leadership in this field.

In August 2024, Johns Hopkins Kimmel Cancer Center investigators developed a new test called Esopredict. This PCR-based laboratory test uses biopsy samples to measure DNA methylation changes in genes like RUNX3, p16, HPP1, and FBN1. Methylation changes often occur early during abnormal cell growth, before clinical symptoms appear, to manage patients with potential neoplastic progression. (Source: https://www.hopkinsmedicine.org)

The U.S. Esophageal Cancer Molecular Diagnosis Market Trends

The U.S. plays a dominant role in the global market. Its strong research and development ecosystem, driven by leading institutions and supported by government agencies like the National Institutes of Health, fosters innovation in areas such as next-generation sequencing, liquid biopsies, and biomarker discovery. This innovation, coupled with the rising prevalence of esophageal cancer, increased demand for personalized medicine, and favorable reimbursement policies for advanced diagnostics, fuels the market's significant growth potential.

What Made Asia Pacific the Fastest-Growing Region in the Esophageal Cancer Molecular Diagnosis Market in 2024?

Asia Pacific is experiencing the fastest growth in the esophageal cancer molecular diagnosis market. This growth is driven by a high incidence of esophageal cancer, increasing healthcare spending, and greater adoption of advanced diagnostic technologies. Growing awareness about cancer and early detection emphasizes the importance of molecular diagnostics, leading to broader access. Countries like China, India, and Japan have a large pool of skilled professionals in medical research and clinical trials, enhancing regional leadership. Specific initiatives, such as government-backed programs promoting personalized healthcare and research collaborations, are further accelerating this trend.

India Esophageal Cancer Molecular Diagnosis Market Trends

India plays an evolving role in the market, primarily due to its large patient population, rising healthcare expenditure, and technological advancements. Increasing awareness of early cancer detection, coupled with government initiatives like Day Care Cancer Centers and financial support schemes, is fueling growth. Key players, including multinational companies, local diagnostic firms, and startups like Molbio Diagnostics and 4baseCare, are actively developing innovative molecular diagnostic solutions, contributing further to market expansion.

Why is Europe Considered a Notable Region in the Esophageal Cancer Molecular Diagnosis Market?

Europe is expected to see notable growth in the foreseeable future, driven by the high prevalence of esophageal cancer, increased disease awareness, and advancements in diagnostic technologies. Europe faces a significant burden of esophageal cancer, with substantial incidence and mortality rates. Initiatives like the European Health Data Space and the Pharmaceutical Strategy aim to improve data sharing and coordination, spurring further growth. Developed European economies such as Germany, Spain, the UK, France, and Italy have advanced healthcare infrastructure, facilitating research and development in cancer diagnostics.

How Will Latin America Surge in the Esophageal Cancer Molecular Diagnosis Market in 2024?

Latin America is experiencing considerable growth in the market primarily due to factors such as rising cancer rates, growing awareness of personalized medicine, and technological advancements. Though challenges remain, increased government investment and international collaborations are driving this positive trend. Governments across Latin America are investing more in research and healthcare infrastructure, especially in cancer diagnostics, with funding supporting these efforts. Collaborations between Latin American institutions and international organizations are enabling knowledge exchange and access to advanced technologies.

How Will the Middle East and Africa Emerge in the Esophageal Cancer Molecular Diagnosis Market in 2024?

The Middle East and Africa are also seeing substantial growth, supported by rising healthcare spending, increased prevalence of chronic diseases, and government initiatives to modernize healthcare infrastructure. The availability of various diagnostic tools, like endoscopic procedures, imaging, and molecular testing, makes diagnosis more accessible and faster. Countries such as Saudi Arabia and the UAE are heavily investing in healthcare modernization, including cancer diagnostics, and leading efforts to adopt cutting-edge technologies. Additionally, localizing medical technology production and developing domestic talent are fostering self-reliance and opening doors for groundbreaking advancements.

Market Overview

The esophageal cancer molecular diagnosis market focuses on using molecular and genomic tools to detect, classify, monitor, and guide treatment for esophageal cancer within oncology diagnostics. It involves techniques like polymerase chain reaction (PCR), next-generation sequencing (NGS), in situ hybridization (ISH), immunohistochemistry (IHC), and liquid biopsy, which identify genetic mutations, epigenetic modifications, biomarkers, and gene expression patterns linked to esophageal cancer subtypes, such as adenocarcinoma and squamous cell carcinoma. These molecular diagnostics are increasingly embedded in early detection, staging, prognosis, therapy choices, and recurrence tracking in clinical settings.

What Are the Key Trends in the Esophageal Cancer Molecular Diagnosis Market?

- Advancements in Molecular Diagnostics: Technological improvements, such as next-generation sequencing, polymerase chain reaction, and microarrays, have enhanced the sensitivity and accuracy of cancer staging and treatment decision-making, leading to better patient outcomes.

- Increasing Awareness and Screening: Heightened awareness of risk factors, along with the availability of screening programs, is fostering earlier diagnosis and treatment among healthcare professionals and patients, thereby driving market growth.

- Improved Imaging Techniques: Advanced imaging modalities like CT scans, endoscopic ultrasound (EUS), and PET scans, when combined with molecular diagnostics, provide a more comprehensive approach to cancer staging and treatment planning, further increasing the demand for molecular diagnostic tools.

- Liquid Biopsy Development: Non-invasive or minimally invasive liquid biopsy techniques are gaining popularity as they offer a more patient-friendly method for sample collection for molecular analysis, resulting in more effective and targeted therapies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 3.3 Billion |

| Market Size in 2025 | USD 1.64 Billion |

| Market Size in 2024 | USD 1.52 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.05% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology, Biomarker Type, Cancer Type, Application, Sample Type,End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Esophageal Cancer

The main driver in this market is the rising prevalence of esophageal cancer, especially adenocarcinoma (EAC). This trend is supported by technological advances in molecular diagnostics and the growing demand for personalized medicine. As esophageal cancer, covering both EAC and squamous cell carcinoma, becomes more common, with EAC particularly increasing in high-income countries, factors like obesity, GERD, and Barrett's esophagus contribute to EAC, while smoking and alcohol consumption are linked to ESCC. Consequently, molecular diagnostics are vital for pinpointing specific genetic mutations and biomarkers, enabling clinicians to customize treatments based on individual patient tumor profiles.

Restraint

Limited Awareness and Access to Advanced Diagnostics

A key restraint remains the limited awareness and access to advanced diagnostics, mainly in resource-limited areas. This hampers early detection and allows diagnoses to be delayed or missed entirely, which diminishes the benefits of early treatment. Many developing countries lack awareness regarding risk factors and symptoms, and face hurdles such as limited access to tools like endoscopic ultrasound, molecular testing, and specialized imaging. The high costs of such equipment and the need for skilled personnel further create financial and educational barriers, especially in low-resource settings.

Opportunity

Personalized Medicine Through Advancements in Genomic Profiling and Biomarker Discovery

Looking forward, the biggest opportunity lies in personalized medicine through advancements in genomic profiling and biomarker discovery. This allows tailored screening and treatment strategies based on individual risk factors and the genetic traits of tumors, analyzed through DNA sequencing to identify mutations or gene expression patterns associated with the disease. These genomic insights aid in diagnosing esophageal cancer, predicting tumor behavior, and shaping treatment plans. By detecting biomarkers that forecast responses to specific therapies, doctors can develop more targeted and effective treatments.

Technology Insights

What Made the Polymerase Chain Reaction (PCR) Segment Lead the Esophageal Cancer Molecular Diagnosis Market?

The polymerase chain reaction (PCR) segment dominated the market in 2024 because of its high sensitivity, rapid results, and affordability, making it ideal for detecting cancer-related genetic mutations. Its ability to amplify small amounts of DNA or RNA allows for quick, accurate detection of mutations tied to esophageal cancer. Compared to NGS, PCR is generally less expensive and more accessible for routine diagnostics and large-scale screening. With a long history of use in cancer diagnostics, including early detection, therapy monitoring, and residual disease assessment, PCR can also be combined with other techniques like NGS to provide a more comprehensive analysis.

The liquid biopsy segment is experiencing the fastest growth, mainly due to its non-invasive nature, ability to detect early-stage cancers, and suitability for personalized treatment monitoring. Liquid biopsies analyze circulating tumor DNA or cells in blood, offering a minimally invasive, safer alternative to traditional tissue biopsies. They are especially useful for monitoring treatment effects and detecting recurrence. Advances innext-generation sequencing and digital PCR have improved the sensitivity and accuracy of these tests, allowing for the detection of minimal residual disease and ongoing treatment assessment.

Biomarker Type Insights

How Did the Genetic Markers Segment Dominate the Esophageal Cancer Molecular Diagnosis Market in 2024?

The genetic markers segment led the market in 2024 due to their ability to provide detailed, personalized insights into cancer development and progression. Identifying specific genetic mutations helps tailor targeted therapies to each patient's unique genetic profile, a key aspect of precision medicine that improves outcomes and reduces side effects. Genetic markers can also serve as early warnings for cancer, enabling earlier interventions. Moreover, some markers help predict prognosis, guiding clinicians in decision-making for treatment intensity and monitoring.

The circulating tumor DNA (ctDNA) segment is set to grow rapidly in the market, mainly because of its non-invasive collection process, ability to detect tumor heterogeneity, and potential for real-time treatment monitoring. As ctDNA analysis involves a simple blood draw, making it less invasive than tissue biopsies, it is especially advantageous in advanced esophageal cancer cases where tissue samples are hard to obtain. ctDNA captures genetic information from all tumor sites, offering a more comprehensive view of tumor genetics than a single tissue biopsy. Its levels can be tracked over time, allowing continuous monitoring of how well treatments are working and detecting minimal residual disease.

Cancer Type Insights

How the Esophageal Adenocarcinoma Segment Led the Esophageal Cancer Molecular Diagnosis Market in 2024?

The esophageal adenocarcinoma segment led the market in 2024, driven by its rising incidence caused by Barrett's esophagus and GERD, along with the availability of targeted treatments and diagnostics specific to this subtype. This trend has intensified research and diagnostic efforts focused on this cancer. Chronic GERD can progress to Barrett's esophagus, a precancerous condition where the normal esophageal lining is replaced by tissue resembling the intestinal lining. This metaplastic tissue may then develop into dysplasia and eventually adenocarcinoma. Additionally, advances in molecular biology have uncovered specific genetic and molecular changes in cancer, leading to the development of targeted therapies and diagnostic tools.

The esophageal squamous cell carcinoma segment is experiencing rapid growth during the forecast period. This growth is mainly fueled by its high prevalence in developing countries and its strong association with modifiable risk factors like smoking and alcohol consumption. This connection enables targeted screening and prevention efforts, further increasing the demand for diagnostic tools that can identify at-risk individuals. Molecular diagnostics provide higher sensitivity and specificity than traditional methods, including multi-gene panels, liquid biopsies, and AI-powered image analysis for diagnosis and prognosis, allowing detection of subtle genetic changes indicative of early-stage ESCC, which is increasingly important in managing ESCC.

Sample Type Insights

How did the Tissue Biopsy Sample Segment Become Dominant in the Esophageal Cancer Molecular Diagnosis Market in 2024?

The tissue biopsy sample segment dominated the market in 2024, primarily because it provides direct tissue samples for analysis, which are essential for accurate diagnosis and staging. Tissue biopsies are the most reliable method for obtaining tumor samples, confirming malignancy, determining tumor histology, and identifying metastases for staging. These samples enable detailed molecular and genetic profiling, which is becoming more vital for personalized cancer treatments and targeted therapies. The increased use of molecular pathology allows for detecting genetic and molecular alterations, providing valuable information for diagnosis, prognosis, and treatment planning.

The blood (liquid biopsy) segment is experiencing the fastest growth in the market. This trend is due to its non-invasive nature, ability to detect circulating tumor DNA (ctDNA), and potential for early detection and disease monitoring. Blood-based liquid biopsies offer a less invasive alternative to traditional tissue biopsies, especially important in esophageal cancer, where tissue sampling can be challenging. These tests can identify circulating tumor DNA fragments released by tumor cells into the bloodstream, enabling early cancer detection and tracking genetic changes in the tumor over time.

Application Insights

What Made the Companion Diagnostics (Therapy Selection) Segment Dominate the Esophageal Cancer Molecular Diagnosis Market in 2024?

The companion diagnostics (therapy selection) segment led the market in 2024, especially those focusing on assays, kits, and reagents, because they play a crucial role in identifying specific biomarkers that guide targeted therapies. These assays detect biomarkers predictive of a patient's response to specific treatments, allowing clinicians to select the most effective therapies, improving outcomes, and reducing adverse effects. These diagnostic tools are widely adopted in oncology and other therapeutic fields due to their ability to identify biomarkers that forecast treatment response.

The early detection/screening segment is the fastest growing in the market during the forecast period, as early detection significantly boosts survival rates. Advances in molecular diagnostics, including blood tests and AI-powered imaging, make it easier and more accurate to identify esophageal cancer at early, treatable stages. Early detection greatly improves survival chances, with patients diagnosed at stage I or II having a much higher probability of long-term survival compared to those diagnosed later. It also allows for more personalized treatment approaches based on the specific characteristics of the cancer and patient.

End User Insights

How did the Hospitals Segment Dominate the Esophageal Cancer Molecular Diagnosis Market in 2024?

The hospitals segment dominated the market in 2024 primarily because hospitals serve as the main point of care, where molecular diagnostics are increasingly incorporated into standard diagnostic and treatment pathways. Hospitals have the specialized equipment, trained personnel such as pathologists, molecular biologists, oncologists, and labs needed for conducting molecular diagnostic tests, and are actively involved in clinical trials and research studies. Their infrastructure and expertise make them well-equipped to perform complex molecular tests and manage cancer patients. Furthermore, hospitals are leading the way in clinical research, promoting the adoption of new molecular diagnostic technologies.

The diagnostic laboratories segment is experiencing rapid growth in 2024 due to rising awareness of personalized medicine, technological progress, and increasing demand for accessible and affordable diagnostic services. As personalized treatment based on individual genetic and molecular profiles becomes more prevalent, diagnostic laboratories require advanced tools. The rising incidence of esophageal cancer and focus on early detection and screening also drive demand for diagnostic services like molecular testing, supported by government initiatives and the need for accessible options, especially in underserved areas.

Esophageal Cancer Molecular Diagnosis Market Companies

- Roche Diagnostics

- Thermo Fisher Scientific

- QIAGEN

- Illumina

- Bio-Rad Laboratories

- Agilent Technologies

- Guardant Health

- Foundation Medicine

- Invitae Corporation

- Genomic Health (Exact Sciences)

- BGI Genomics

- Myriad Genetics

- Caris Life Sciences

- Natera

- NeoGenomics Laboratories

- F. Hoffmann-La Roche Ltd

- Sysmex Corporation

- Danaher Corporation (Leica Biosystems & Cepheid)

- Personalis Inc.

- Biocartis Group NV

Leaders' Announcements

- In December 2024, Lucid Diagnostics Inc., a subsidiary of PAVmed Inc., announced a partnership with VITALExam LLC to improve access to its EsoGuard Esophageal DNA Test for firefighters at risk of esophageal precancer. Shaun O'Neil, President of Lucid Diagnostics, praised VITALExam's commitment to first responder health, while Dr. Marci Vitale, CEO of VITALExam, emphasized the importance of integrating EsoGuard into their wellness programs for early detection. "Integrating EsoGuard into our services perfectly complements our mission to protect first responders' health," said Chief Executive Officer Marci Vitale. (Source: https://ir.luciddx.com)

Recent Developments

- In December 2024, BeiGene, Ltd. announced it would rebrand as BeOne Medicines Ltd. The FDA approved TEVIMBRA (tislelizumab-jsgr) for first-line treatment of unresectable or metastatic HER2-negative gastric or gastroesophageal junction adenocarcinoma in adults with PD-L1 (≥1) expression. Chief Medical Officer Mark Lanasa highlighted this approval as a significant advance in cancer therapy.

- In November 2023, Lucid Diagnostics launched EsoGuard 2.0, an improved version of their Esophageal DNA test, demonstrating enhanced performance and reduced costs. Lucid's CEO, Lishan Aklog, noted that this milestone marks over a year of research and development and builds on EsoGuard's previous success in detecting esophageal cancers and precancers. The advancements also aim to further lower testing costs in the coming months.(Source: https://www.prnewswire.com)

Segments Covered in the Report

By Technology

- Polymerase Chain Reaction (PCR)

- Next-Generation Sequencing (NGS)

- Fluorescence In Situ Hybridization (FISH)

- Immunohistochemistry (IHC)

- Microarray

- Liquid Biopsy

- Sanger Sequencing

- Others

By Biomarker Type

- Genetic Markers (e.g., TP53, KRAS, EGFR, HER2)

- Epigenetic Markers (e.g., DNA methylation)

- Protein Biomarkers (e.g., p53, Ki-67, PD-L1)

- Circulating Tumor DNA (ctDNA)

- Circulating Tumor Cells (CTCs)

- MicroRNA

- Others

By Cancer Type

- Esophageal Adenocarcinoma

- Esophageal Squamous Cell Carcinoma

- Others (e.g., small cell carcinoma, sarcomatoid carcinoma)

By Sample Type

- Tissue Biopsy

- Blood (Liquid Biopsy)

- Saliva

- Others (e.g., urine, gastric lavage)

By Application

- Early Detection/Screening

- Prognostic Testing

- Companion Diagnostics (Therapy Selection)

- Recurrence Monitoring

- Research Use

- Others

By End User

- Hospitals

- Cancer Research Institutes

- Diagnostic Laboratories

- Academic & Research Centers

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting