Fingerprint Biometrics Market Size and Forecast 2025 to 2034

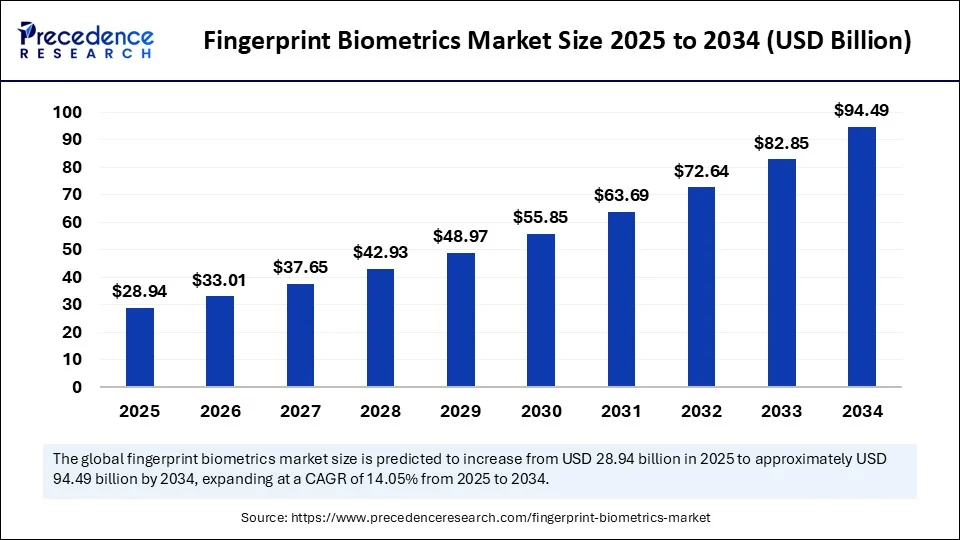

The global fingerprint biometrics market size accounted for USD 25.38 billion in 2024 and is predicted to increase from USD 28.94 billion in 2025 to approximately USD 94.49 billion by 2034, expanding at a CAGR of 14.05% from 2025 to 2034. The market for fingerprint biometrics has emerged as a cornerstone of modern identity verification and security systems.

Fingerprint Biometrics Market Key Takeaways

- In terms of revenue, the global fingerprint biometrics market was valued at USD 25.38 billion in 2024.

- It is projected to reach USD 94.49 billion by 2034.

- The market is expected to grow at a CAGR of 14.05% from 2025 to 2034.

- Asia Pacific dominated the fingerprint biometrics market with the largest market share of 38% in 2024.

- North America is anticipated to grow at the fastest CAGR during the forecast period.

- By component type, the hardware segment held the biggest market share in 2024.

- By component type, the software segment is expected to grow at the fastest CAGR during the forecast period.

- By sensor/technology type, the optical sensors segment led the market in 2024.

- By sensor/technology type, the ultrasonic sensors segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By fingerprint type/capture mode type, the mobile single-finger capture segment captured the highest market share in 2024.

- By fingerprint type/capture mode type, the partial fingerprints segment is set to experience the fastest CAGR from 2025 to 2034.

- By authentication mode, the verification segment contributed the highest market share in 2024.

- By authentication mode, the identification for large-scale ID systems is expected to emerge with notable growth during the forecast period.

- By deployment model, the hydrographic surveying & nautical charting segment accounted for the significant market share in 2024.

- By deployment model, the mobile segment is projected to expand rapidly during the forecast period.

- By end-user type, the consumer electronics segment generated the major market share in 2024.

- By end-user type, the Government & Border Control segment is projected to expand rapidly over the coming years.

- By application type, the mobile device unlock segment captured the maximum market share in 2024.

- By application type, the eKYC segment is projected to expand rapidly during the forecast period.

How AI Is Transforming the Fingerprint Biometrics Market?

Artificial intelligence is reshaping the fingerprint biometrics market landscape by enhancing both speed and accuracy of recognition systems. AI-powered algorithms now enable real-time fingerprint matching, even under challenging conditions such as partial prints or degraded skin textures. Deep learning models improve system resilience against spoofing and fraudulent attempts, bolstering trust in biometric security. Moreover, artificial intelligence facilitates adaptive learning, allowing systems to evolve with user behavior and environmental variables. Integration with machine vision and multimodal biometrics expands the application scope, where fingerprints are analyzed alongside facial or iris recognition for higher precision. These advancements reduce false acceptance and rejection rates, driving greater adoption across industries. In essence, AI is not only modernizing traditional fingerprint biometrics but also redefining its potential in the age of intelligent security systems.

- In July 2025, BigBear.ai announced the deployment of several copies of its biometric software to assist in enhanced passenger processing (EPP) for airports catering to international flights in North America. This software used in the initiative was developed by Pangiam, which was later taken over by BigBear.ai. The software is currently live at Dallas Fort Worth International Airport, Charlotte Douglas International Airport, John F. Kennedy International Airport, and Los Angeles International Airport, among many others. The software has also reached the Canadian Montréal-Pierre Elliott Trudeau International Airport.

(Source: https://www.passengerterminaltoday.com)

Asia Pacific Fingerprint Biometrics Market Size and Growth 2025 to 2034

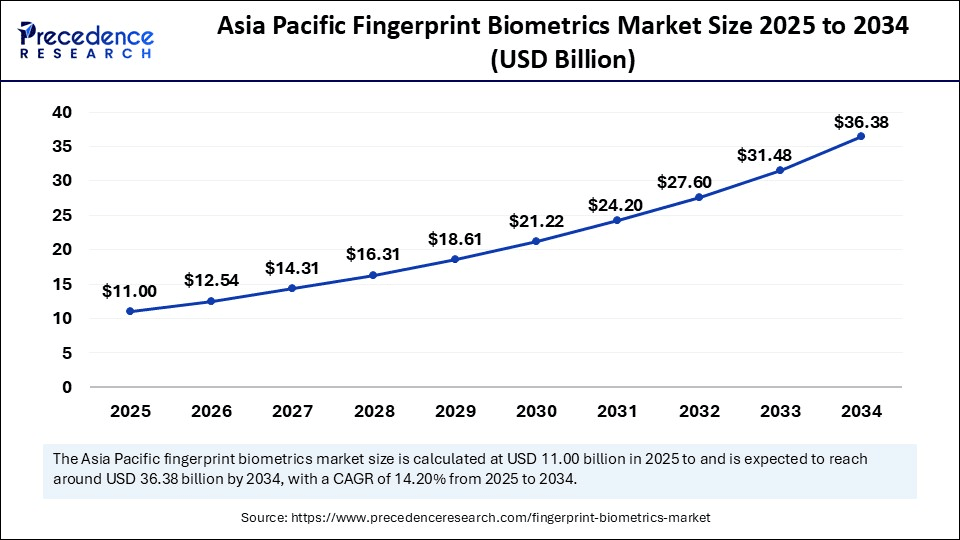

The Asia Pacific fingerprint biometrics market size is exhibited at USD 11.00 billion in 2025 and is projected to be worth around USD 36.38 billion by 2034, growing at a CAGR of 14.20% from 2025 to 2034.

Why Does Asia Pacific Lead the Global Market?

By region, Asia Pacific dominated the global market in 2024, driven by rapid digital transformation and government-backed initiatives. Countries like India, China, and Indonesia are rolling out large-scale biometric identification programs for national ID, banking access, and e-governance. The proliferation of affordable smartphones equipped with fingerprint sensors has made biometrics widely accessible across the region. Moreover, the booming fintech ecosystem in Asia-Pacific creates high demand for secure digital transactions, with biometrics emerging as the preferred solution. Healthcare and education sectors are also rapidly embracing fingerprint technology to improve operational efficiency and accountability. The region's large population base, coupled with rising awareness of digital security, ensures sustained momentum. As investments in AI and contactless biometrics accelerate, the Asia-Pacific region is set to redefine the global trajectory of fingerprint authentication.

Why Is North America the Fastest-Growing Fingerprint Biometrics Region?

North America is the fastest-growing region in the fingerprint biometrics space, driven by widespread technological adoption and robust infrastructure. The region benefits from strong government initiatives, such as the use of biometrics in border security, e-passports, and national databases. Leading technology companies headquartered in the U.S. also invest heavily in biometric research and development, propelling innovation. The healthcare and financial sectors in North America are early adopters, utilizing fingerprint biometrics to strengthen compliance and safeguard sensitive data. Consumer demand for advanced security features in smartphones and smart devices adds another growth catalyst. Additionally, a favorable regulatory environment and significant cybersecurity concerns fuel further investment in biometric authentication. Collectively, these factors position North America as a powerhouse in the global fingerprint biometrics landscape.

Market Overview

The fingerprint biometrics market refers to the ecosystem of technologies, products, and services that use unique fingerprint patterns to verify or identify individuals for security, authentication, and forensic purposes. It encompasses hardware such as sensors, scanners, and terminals; software platforms including algorithms, middleware, and cloud-based database solutions; and service layers such as integration, enrollment, and managed identity verification. The market spans applications across government, law enforcement, banking, consumer electronics, healthcare, enterprise access, and border control, with adoption driven by the demand for reliable, cost-effective, and user-friendly biometric authentication in both physical and digital environments.

The fingerprint biometrics market is witnessing substantial growth, fueled by the demand for reliable authentication methods in both public and private sectors. Governments are increasingly incorporating biometric systems into national identity programs, e-passports, and border security frameworks, enhancing both efficiency and safety. Simultaneously, enterprises are deploying biometric solutions to protect sensitive data, reduce fraud, and streamline access management. Consumer electronics, particularly smartphones and wearable devices, have further normalized fingerprint authentication, making it a daily necessity for millions. Sensitive data, reduce fraud, and streamline access management. Consumer electronics, particularly smartphones and wearable devices, have further normalized fingerprint authentication, making it a daily necessity for millions. With miniaturized sensors and embedded biometric chips, the technology has become more affordable and accessible. The healthcare sector also benefits significantly, with fingerprint systems ensuring secure patient identification and record management. Collectively, these dynamics underscore the market's pivotal role in balancing convenience with stringent security requirements.

Market Key Trends

- Proliferation of in-display fingerprint sensors in smartphones and consumer electronics.

- Rising adoption of multimodal biometrics, combining fingerprints with facial or iris recognition.

- Increasing emphasis on contactless fingerprint technology, particularly post-pandemic.

- Deployment of cloud-based biometric authentication platforms.

- Expanding use of biometrics in fintech, digital banking, and remote KYC processes.

- Growing investment in biometric security for healthcare and critical infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 94.49 Billion |

| Market Size in 2025 | USD 28.94 Billion |

| Market Size in 2024 | USD 25.38 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.05% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Sensor / Technology Type, Fingerprint Type / Capture Mode, Authentication Mode, Deployment Model, End-User / Buyer, Application, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Security at Your Fingertips

The chief driver of the fingerprint biometrics market is the unique advantage of offering unmatched security combined with convenience. Unlike passwords and PINs, fingerprints are unique, non-transferable, and difficult to replicate, making them a superior form of authentication compared to most others. The increasing frequency of cyberattacks and identity theft has accelerated the shift toward biometric solutions. Organizations across industries are compelled to adopt robust technologies that protect sensitive information while enabling seamless access. Government initiatives, such as national ID systems and biometric passports, further reinforce market momentum. In the consumer domain, the ubiquity of smartphones with fingerprint sensors has made the technology both familiar and indispensable. Ultimately, fingerprint biometrics represents a balance between high security and easy, user-friendly design, fueling its widespread adoption worldwide.

Restraints

Barriers Beyond the Surface

Despite its significant advantages, the fingerprint biometrics market faces some notable restraints, such as privacy concerns, as users worry about misuse or unauthorized storage of their biometric data. Technical challenges such as false negatives due to injury, dryness, or aging skin also persist. High implementation costs can limit adoption in small and medium enterprises or developing regions. Additionally, hackers are continuously innovating, raising fears of biometric spoofing and breaches. Regulatory frameworks regarding biometric data usage differ across countries, creating compliance challenges for global organizations. Lastly, cultural acceptance varies, with some populations remaining skeptical of biometric surveillance. These barriers highlight the need for greater transparency, advanced anti-spoofing technologies, and globally harmonized regulations to sustain long-term market growth.

Opportunity

Unlocking New Frontiers

The market provides vast opportunities as fingerprint biometrics extend beyond traditional domains into new sectors. Emerging economies are actively investing in biometric-enabled e-governance, financial inclusion programs, and border management systems, creating fertile ground for growth. The rise of digital banking and fintech solutions opens opportunities for secure, biometric-driven financial transactions. In healthcare, biometric authentication ensures error-free patient identification and protects sensitive medical data, addressing a critical global need. The education sector is also beginning to deploy fingerprint-based attendance and examination monitoring systems. Furthermore, advancements in AI and sensor miniaturization are enabling novel applications in IoT devices, smart homes, and wearables. These opportunities collectively indicate that the fingerprint biometrics market is on the cusp of unlocking unprecedented growth potential.

Component Insights

Why Hardware Is Dominating the Market?

Hardware continues to dominate the fingerprint biometrics market, as physical devices such as scanners, sensors, and modules remain essential for accurate identification. The rising adoption of smartphones, laptops, and access control systems ensures a sustained demand for robust hardware solutions. Manufacturers are investing heavily in miniaturization, durability, and energy efficiency to enhance user convenience. Hardware also plays a pivotal role in government initiatives like national ID programs and border security. Its reliability, speed, and proven track record make it indispensable across critical industries. As a result, hardware forms the backbone of the global biometrics infrastructure.

Software solutions are set to witness rapid growth, driven by advancements in AI and machine learning for biometric authentication. Unlike hardware, software provides flexibility and scalability, enabling seamless integration with cloud platforms and digital ecosystems. It allows real-time data analysis, anti-spoofing measures, and adaptive learning for higher security standards. The proliferation of mobile apps, eKYC solutions, and fintech platforms further fuels demand. Cloud-based biometric software also facilitates remote verification, a feature increasingly important in post-pandemic digital transformations. Consequently, software is becoming the fastest-growing segment, complementing hardware by unlocking new possibilities for biometric applications.

Sensor / Technology Type Insights

Why Do Optical Sensors Lead the Fingerprint Biometrics Market?

Optical sensors led the market in 2024 for fingerprint biometrics due to their wide adoption in smartphones and access control systems. They are valued for their ability to capture detailed fingerprint images using light-based technologies. Their affordability and mass production capability have strengthened their position across both consumer and enterprise markets. Recent innovations have improved image resolution, enhancing security and accuracy. Despite competition from other sensor types, optical sensors maintain the largest market share because of their reliability and maturity. Their widespread integration in everyday devices ensures they remain the most commonly used sensor type.

Ultrasonic sensors are emerging as the fastest-growing segment, fueled by their superior accuracy and ability to capture 3D fingerprint patterns. Unlike optical sensors, they can penetrate skin layers, detecting ridges, pores, and sweat ducts, which makes them highly secure. This technology also performs well in challenging conditions such as wet or dirty fingers, where optical systems may fail. Their growing integration in high-end smartphones demonstrates rising consumer confidence. Ultrasonic sensors are also increasingly being considered for defense, healthcare, and financial sectors requiring heightened security. As the demand for foolproof authentication rises, ultrasonic sensors are positioned for exponential growth.

Fingerprint Type / Capture Mode Insights

Why Is Mobile Single-Finger Capture Making Up a Prominent Fingerprint Biometrics Market Share?

The mobile single-finger capture segment accounted for a prominent share of the market due to its seamless integration in smartphones, tablets, and laptops. Consumers demand secure, convenient, and fast biometric authentication, making embedded solutions a default feature in most devices. Their compact design and low power consumption make them ideal for portable electronics. Governments and enterprises also use embedded modules in ID cards, e-passports, and access badges. This form factor has become a standard, ensuring mass adoption across industries. Its ubiquity secures its role as the leading segment in the biometrics market.

The partial fingerprint segment represents the fastest-growing form factor, transforming the way consumers interact with devices. Their integration beneath smartphone screens offers a sleek, futuristic design without compromising on functionality. They provide enhanced user convenience by eliminating the need for physical buttons or modules. Advanced optical and ultrasonic in-display technologies are driving premium smartphone adoption. The growing preference for bezel-less and foldable devices is accelerating demand for these sensors. As design aesthetics and user experience become key differentiators, in-display sensors are expanding rapidly.

Authentication Mode Insights

Why Does the Verification Segment Hold the Largest Share in the Fingerprint Biometrics Market?

Verification currently holds the largest share in the fingerprint biometrics market, as it forms the backbone of secure access control across industries. In verification, a fingerprint scan is matched against a stored template for one-to-one authentication, making it widely used in smartphones, laptops, ATMs, and workplace security systems. Its dominance is attributed to the rising demand for convenience and enhanced security in personal devices and financial transactions. Governments and enterprises continue to adopt verification-based solutions to safeguard data, prevent fraud, and strengthen access protocols. The increasing integration of biometric verification in payment systems, border control, and e-governance platforms further accelerates its adoption. With its proven reliability and cost-effectiveness, verification is expected to remain the cornerstone of fingerprint biometrics deployment.

Identification is emerging as the fastest-growing application within the fingerprint biometrics market, driven by the need for large-scale, one-to-many matching. Unlike verification, identification involves comparing a fingerprint against a database to establish or confirm identity, making it essential for law enforcement, border management, and civil identification systems. National ID programs, voter registration initiatives, and large-scale security projects are fueling rapid growth in this segment. Moreover, the rise in smart city projects and public safety initiatives is creating strong demand for identification-based fingerprint systems. Technological advancements in sensors, AI-driven matching algorithms, and cloud integration are further improving accuracy and scalability. As societies move toward digital governance and seamless citizen verification, identification-based fingerprint biometrics is poised for exponential growth.

Deployment Model Insights

Why On-Premise Deployment Dominates the Market?

On-premise deployment dominates due to industries requiring full control over biometric data and infrastructure. Government agencies, defense organizations, and financial institutions prefer localized solutions to safeguard sensitive information. These systems ensure compliance with strict regulations and minimize risks of third-party data breaches. On-premise setups also allow for customization according to organizational needs. While cloud adoption is rising, legacy systems and data sovereignty issues keep on-premise solutions in strong demand. Their security and control advantages secure their dominant market position.

Cloud-based biometric solutions are the fastest-growing deployment model, enabling scalability, remote access, and cost efficiency. They support real-time verification across global networks, essential for digital banking, eKYC, and online services. Cloud platforms also enable faster software updates, AI-driven analytics, and integration with IoT devices. The rise of remote working and digital identity programs further strengthens this trend. Businesses prefer cloud deployment for its agility and reduced infrastructure investment. As digital ecosystems expand, cloud-based biometrics will continue to grow at an accelerated pace.

End Use Insights

Why Do Consumer Electronics Maintain a Leading Position in the Market?

Consumer electronics dominate fingerprint biometrics usage, with smartphones, tablets, and laptops being the largest adopters. Biometric authentication enhances device security while providing users with quick, convenient access. The ubiquity of mobile payments and app-based services has further entrenched fingerprint sensors in consumer devices. Hardware manufacturers compete to embed increasingly advanced sensors into affordable products. Wearables and IoT devices are also adopting fingerprint authentication to strengthen consumer trust. This widespread adoption ensures consumer electronics remain the primary end-use segment.

Government and border control applications are the fastest-growing, driven by the need for secure national identification and immigration systems. Biometric passports, e-IDs, and voter registration programs increasingly rely on fingerprint authentication. Border security agencies employ fingerprint biometrics for rapid traveler verification, enhancing safety and efficiency. Large-scale public initiatives in developing economies are further fueling demand. Investments in smart cities and surveillance infrastructure also leverage biometric technologies. As governments prioritize digital identity and secure borders, this segment is set for rapid expansion.

Application Insights

Why Mobile Devices Dominate the Market?

The mobile device unlock/smartphone authentication segment dominates the application landscape, as it is the most common and widespread use of fingerprint biometrics. Nearly every smartphone incorporates fingerprint authentication for user convenience and data protection. The simplicity and reliability of this application drive consumer acceptance. It has become a standard feature, especially in mid-range and premium devices. The growing volume of smartphone shipments worldwide ensures the continued dominance of this segment. As mobile devices evolve, this application remains central to consumer adoption of biometrics.

The eKYC (Electronic Know Your Customer) is the fastest-growing segment, particularly in the financial services and digital banking sectors. Fingerprint biometrics enable secure, instant verification of customer identities during onboarding. This reduces fraud, enhances compliance, and improves user experience. Governments and fintech platforms increasingly mandate eKYC for seamless digital transactions. The surge in online services post-pandemic has accelerated adoption across multiple industries. As digital identities gain prominence, eKYC applications will continue to expand rapidly.

Industry Vertical Insights

Why did Consumer Electronics & Mobile OEMs make up the largest market share?

The consumer electronics & mobile OEMs made up the largest share in the fingerprint biometrics sector, driving large-scale adoption of fingerprint biometrics in everyday devices. Smartphones, tablets, laptops, and wearables integrate these systems as a standard security measure. The convenience of unlocking, mobile payments, and personal data protection cements their role in this sector. Manufacturers continue innovating with embedded and in-display sensors to enhance user experience. The sheer volume of consumer device shipments worldwide secures its leadership. This dominance is unlikely to diminish as technology evolves further.

The government & public sector segment is anticipated to grow with the highest CAGR in the market during the studied years, fueled by large-scale national projects. From biometric passports to voter ID systems, governments deploy these technologies for secure citizen identification. Public safety, law enforcement, and surveillance initiatives also increasingly leverage biometrics. Digital governance and smart city programs further accelerate growth in this sector. Developing economies are investing heavily in identity verification infrastructure. This momentum positions government and public applications as the fastest-rising industry vertical.

Fingerprint Biometrics Market Companies

- IDEMIA

- Fingerprint Cards (FPC)

- HID Global

- NEC Corporation

- Suprema Inc.

- ZKTeco

- Synaptics

- Goodix Technology

- Thales Group

- Crossmatch

- Idex Biometrics

- SecuGen

- Dermalog Identification Systems

- Neurotechnology

- Aware, Inc.

- Fujitsu Limited

- BioEnable Technologies

- Anviz Global

- M2SYS Technology

- Daon

Recent Developments

- In August 2025, the Unique Identification Authority of India (UIDAI) directed schools nationwide to facilitate timely Aadhaar biometric updates for children at the ages of five and fifteen. In a letter addressed to the chief secretaries of all states and union territories, UIDAI chief Bhuvnesh Kumar emphasized the need to organise special camps within schools to address the existing backlog. The Ministry of Electronics & IT confirmed this initiative in an official press release.

(Source: https://www.hindustantimes.com)

Segment Covered in the Report

By Component

- Hardware

- Fingerprint Sensors/Modules (Optical, Capacitive, Ultrasonic, Thermal, Piezoelectric)

- Readers & Terminals (Standalone, Embedded, Mobile Attachable)

- Scanners (Flatbed, Slap, Swipe, In-Display)

- Enclosures & Mounts

- Accessories (Cables, Mounting Kits, Protective Covers)

- Software

- SDKs & drivers

- Biometric Middleware & Fusion Software

- Matching/Algorithms (1:1, 1:N Search Engines)

- Liveness Detection Software

- Device Management & Provisioning Software

- Analytics & Reporting

- Services

- Integration & System Design

- Maintenance & Managed Services

- Cloud Hosting & SaaS Biometric Subscriptions

- Training & Consultancy

- Enrollment & Data Capture Services

- Others

By Sensor / Technology Type

- Optical (Area)

- Capacitive (Cmos Capacitive)

- Ultrasonic

- Multispectral

- Thermal / Infrared

- Pressure / Piezoelectric

- Swipe (Rolling)

- In-Display / Under-Glass

- 3d/Structured Light

- Others

By Fingerprint Type / Capture Mode

- Rolled (Slap) Fingerprints

- Plain/Flat Fingerprints

- Partial Fingerprints

- Latent/Forensic Prints

- Mobile Single-Finger Capture

- Multi-Finger Capture

- Others

By Authentication Mode

- Verification

- Identification

- On-Device/Local Matching

- Network/Cloud Matching

Continuous Authentication - Multi-Modal Fusion (Fingerprint + Face/Iris)

- Others

By Deployment Model

- On-Premises (Local Servers)

- Cloud-Based (SaaS/IDaaS)

- Hybrid Deployment

- Edge Deployments (On-Device Matching)

- Managed/Hosted Services

- Others

By End-User / Buyer

- Government & Defense (Border Control, National ID, Passport, Immigration)

- Law Enforcement & Forensics

- Banking & Financial Services (ATMs, Authentication, Payments)

- Consumer Electronics (Smartphones, Tablets, Wearables)

- Enterprise (Physical Access Control, Logical Access)

- Healthcare (Patient ID, Record Access)

- BFSI (Branch Security & Teller Auth)

- Telecom & SIM authentication

- Retail & Hospitality (POS, workforce)

- Transportation & Airports (Check-In, Boarding)

- Education (Campus Access)

- Others

By Application

- Physical Access Control

- Logical Access/Workstation Login

- Time & Attendance/Workforce Management

- Mobile Device Unlock / Smartphone Authentication

- Payment Authentication / mPOS / ATM Authentication

- Border Control & Immigration

- eKYC / Identity Verification (Banking Onboarding)

- Forensics & Criminal Identification

- Voter Registration & Election Authentication

- Healthcare Patient Identification

- Law Enforcement Investigations

- Others

By Industry Vertical

- Government & Public Sector

- Banking, Financial Services & Insurance (BFSI)

- Consumer Electronics & Mobile OEMs

- Healthcare & Life Sciences

- Retail & Hospitality

- Transportation & Logistics

- Education

- Enterprise & Corporate (SMB + Large Enterprises)

- Telecom & ISPs

- Industrial & Manufacturing (Secure Facilities)

- Others

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting