What is the Food Fortification Market Size?

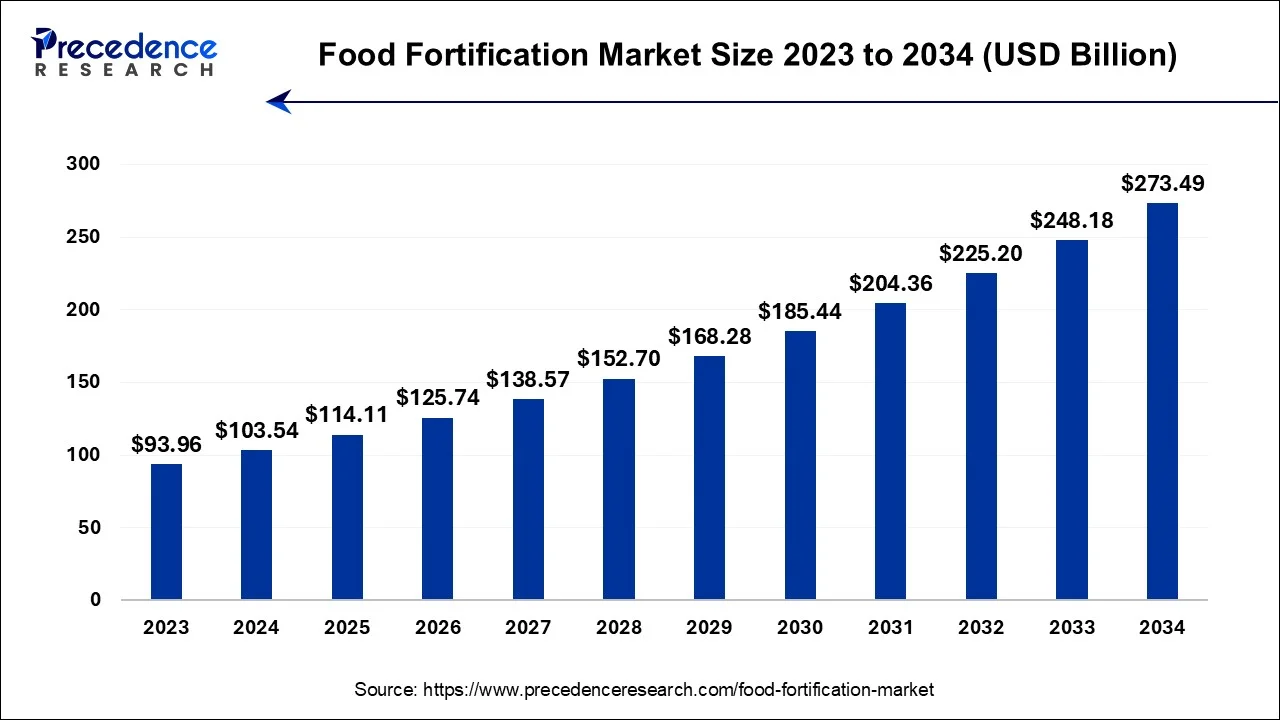

The global food fortification market size is estimated at USD 114.11 billion in 2025and is predicted to increase from USD 125.74 billion in 2026 to approximately USD 297.25 billion by 2035, expanding at a CAGR of 10.05% between 2026 and 2035.

Market Highlights

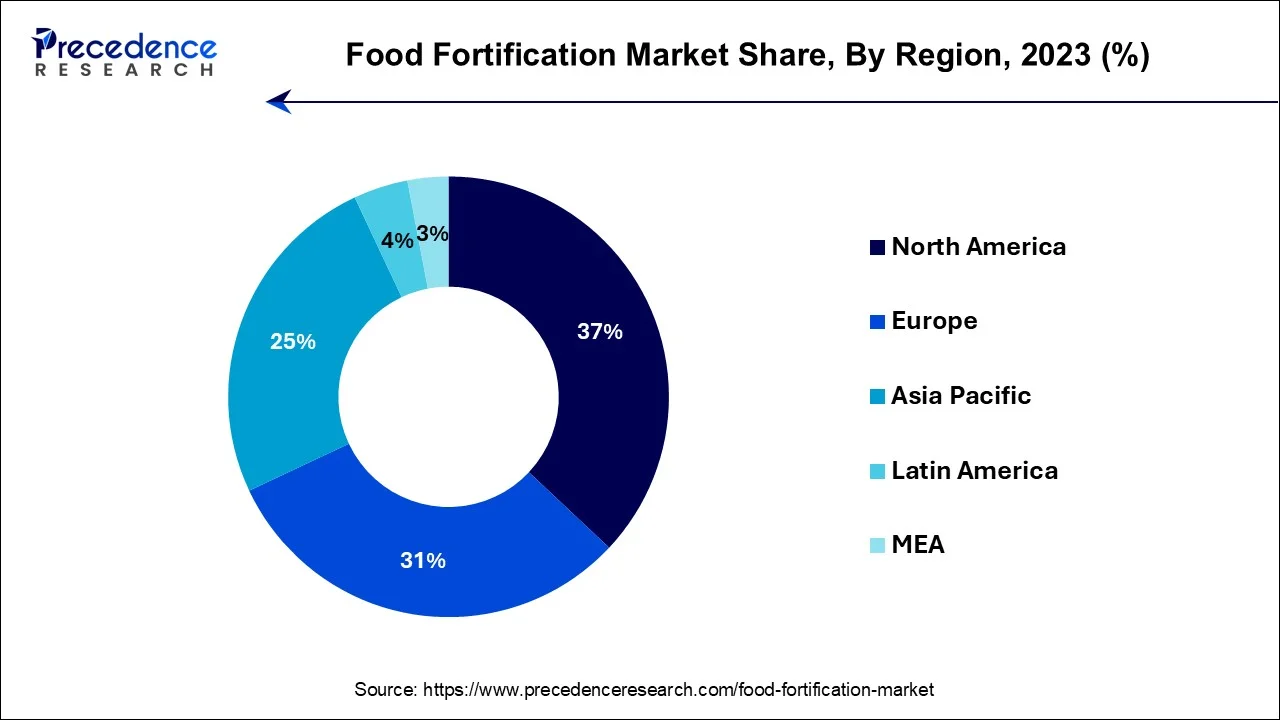

- North America contributed more than 37% of revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By Type, the proteins & amino acids segment has held the largest market share of 45% in 2025.

- By Type, the vitamins segment is anticipated to grow at a remarkable CAGR of 14.1% between 2026 and 2035.

- By Application, the dairy & dairy-based products segment generated over 38% revenue share in 2025.

- By Application, the infant formula segment is expected to expand at the fastest CAGR over the projected period.

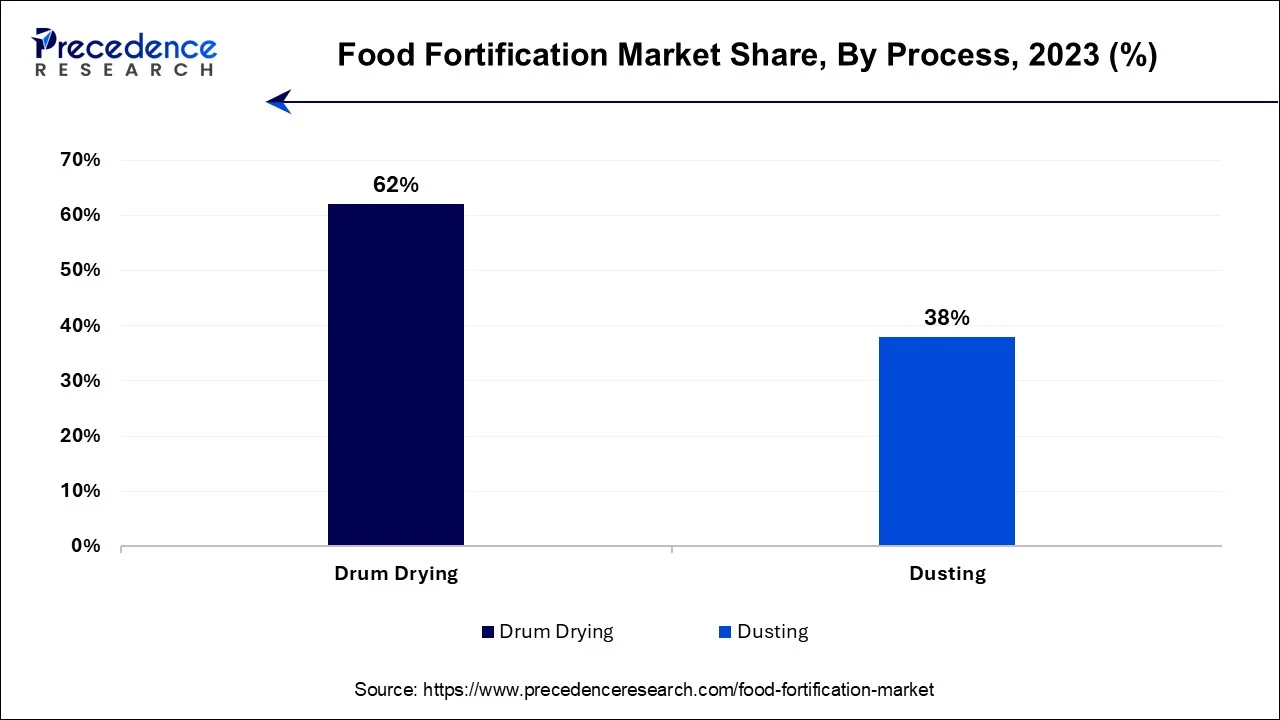

- By Process, the drum dying segment had the largest market share of 62% in 2025.

- By Process, the dusting segment is expected to expand at the fastest CAGR over the projected period.

What is Food Fortification?

The food fortification market involves the process of enhancing food products with essential vitamins, minerals, and other micronutrients to address and prevent nutritional deficiencies in populations. This strategy aims to improve public health by ensuring that everyday food provide a balanced intake of key nutrients.

Food fortification is often employed to deal with specific deficiencies like vitamin D, iron, or folic acid. It is commonly used in staples like cereals, flour, anddairy productsto reach a wide consumer base, especially in regions where nutrient deficiencies are prevalent, contributing to better overall health and well-being. The market encompasses fortification techniques, regulatory compliance, and the production and distribution of fortified food.

How is AI contributing to the Food Fortification Industry?

Artificial Intelligenceplays a significant role in food fortification by optimizing the blending of nutrients, ensuring accurate production, improving the tracking of the entire supply chain, facilitating public health analytics, and creating new data-driven personalized nutrition methods to efficiently deal with micronutrient deficiencies in large groups of people.

Food Fortification Market Growth Factors

- Governments worldwide implement food fortification programs to combat nutrient deficiencies, ensuring a steady market growth trajectory. Widespread malnutrition, especially in underdeveloped regions, calls for fortification as a solution.

- The aging demographic seeks fortified products for overall well-being, leading to expanded opportunities in functional food. Increased awareness of specific nutrients' benefits propels the demand for tailored fortified food.

- Partnerships with non-governmental organizations (NGOs) and international bodies create opportunities for large-scale fortification programs in regions with high malnutrition rates.

- Increasing consumer demand for clean label products has led to the development of fortification methods using natural and organic ingredients.

- Biofortified crops, genetically enhanced to be nutrient-rich, offer a sustainable approach to fortifying staple food and addressing nutrient deficiencies. Advancements in personalized nutrition make way for tailor-made fortification solutions based on individual nutritional requirements, offering a new frontier in this market.

- Industry trends include the use of innovative fortification techniques, such as encapsulation and nano-encapsulation, to enhance nutrient stability and bioavailability. Challenges encompass regulatory hurdles and concerns about over-fortification and the necessity for accurate labeling.

- Business opportunities lie in expanding fortification to diverse food categories, developing customized fortification solutions, and leveraging technological advancements to meet evolving consumer demands for healthier, nutrient-rich products. The food fortification market is poised for sustained growth as it aligns with the global shift toward healthier eating and improved public health.

Market Outlook

- Industry Growth Overview: The market saw a rapid growth primarily due to awareness campaigns, which led to the establishment of laws to tackle malnutrition and the increased demand for foods rich in nutrients.

- Sustainability Trends: By making biofortification their primary strategy, supporting the innovative idea of climate-resilient crops, and giving inclusiveness a priority, the stakeholders of the sector will ensure continuous nutritional security.

- Global Expansion: The practice of fortification is spreading all over the world as a result of the obligatory enrichment of the basic food items, and it is already having a positive effect on the nutritional status of the population.

- Major Investors: The list of the major investors includes Nestlé, Cargill, DSM-Firmenich, UNICEF, and the Bill & Melinda Gates Foundation, all of which are focused on supporting the advancement of technology.

- Startup Ecosystem: The new companies are working on ways to make better use of personal nutrition delivery systems as well as coming up with new techniques for fortification that can be easily scaled.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 114.11 Billion |

| Market Size in 2026 | USD 125.74 Billion |

| Market Size by 2035 | USD 297.25 Billion |

| Growth Rate from 2026 and 2035 | CAGR of 10.05% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 and 2035 |

| Segments Covered | By Type, By Process, and By Application, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Global malnutrition challenges and nutritional deficiency awareness

Global malnutrition challenges have become a major catalyst for the increasing demand in the food fortification market. Persistent malnutrition challenges, primarily prevalent in developing regions, pose significant health risks. Governments and organizations are increasingly acknowledging the effectiveness of fortifying staple food with essential nutrients to address these issues on a broader scale. The demand for fortified food and beverages has been steadily rising due to growing consumer awareness about health and the risk of vitamin deficiencies, which can lead to various health issues such as anemia, scurvy, beriberi, and pellagra, among others. Research also suggests that these conditions are not limited to malnourished populations but can affect well-nourished individuals in society.

Moreover, the growing awareness of nutritional deficiencies and their impact on health is driving consumers to seek out fortified food and beverages. As people become more health-conscious, they are proactively choosing products that offer added nutritional benefits. Food manufacturers are responding by fortifying a wide range of products, from cereals to dairy, to cater to this demand for enhanced nutrition. Nutritional deficiency awareness is not only shaping consumer preferences but also promoting collaborations between governments, non-governmental organizations, and the private sector to implement and promote fortification programs. This surge in both consumer and stakeholder awareness underscores the vital role of food fortification in addressing malnutrition challenges and promoting public health.

Restraint

Cost of fortification and nutrient stability

The cost of fortification, which encompasses the procurement, processing, and distribution of fortified ingredients, can be a significant barrier. For many food manufacturers, the initial investment required for fortification, including the purchase of fortified additives, equipment, and quality control measures, can be substantial. These added costs may be passed on to consumers, potentially making fortified products less affordable, particularly in regions with lower income levels.

Moreover, nutrient stability is a crucial challenge. Some vitamins and minerals are sensitive to factors such as heat, light, and oxygen, which can lead to nutrient degradation during processing and storage. Maintaining stability and bioavailability throughout the product's shelf life is essential to ensure that consumers receive the intended nutritional benefits. Formulating products to withstand these challenges while meeting regulatory requirements adds complexity and cost to food fortification initiatives. To address these restraints, ongoing research and innovation are necessary to develop cost-effective fortification methods that maintain nutrient stability, making fortified food more accessible and beneficial for a broader consumer base.

Opportunity

Biofortification programs and fortification in convenience food

Biofortification programs are playing a pivotal role in boosting the demand for food fortification. By enhancing the nutrient content of staple crops like rice, wheat, and maize through biofortification techniques, these programs are addressing widespread nutrient deficiencies. Consumers can access essential vitamins and minerals from their daily diet, reducing the reliance on supplements. This approach not only aids in improving public health but also creates a lucrative market for biofortified food and ingredients.

The fortification of convenience food is another significant driver. As urbanization and busy lifestyles become increasingly prevalent, consumers turn to packaged and convenience food. Food manufacturers recognize this trend and incorporate fortification to meet the demand for healthier options. These fortified convenience food offer consumers the benefits of added nutrients, making them a convenient choice for maintaining a balanced diet in today's fast-paced world. As a result, the food fortification market experiences sustained growth driven by these impactful factors.

Segment Insights

Type Insights

According to the type, proteins & amino acids has held 45% revenue share in 2025. Proteins and amino acids are essential nutrients that play a crucial role in overall health. The fortification of food with proteins and amino acids has gained momentum due to the rising demand for functional and protein-rich diets. This trend caters to fitness enthusiasts, vegetarians, and individuals looking to manage weight. Fortified protein products include plant-based protein sources, such as soy, and products with added essential amino acids to meet dietary requirements.

The mineral segment is anticipated to expand at a significant CAGR of 14.1% during the projected period. Mineral fortification addresses mineral deficiencies by incorporating essential minerals like iron, calcium, and zinc into food products. The ongoing trend involves fortifying staple food, dairy products, and beverages to boost mineral intake. These fortified products cater to specific health concerns, such as anemia prevention through iron-fortified cereals or improved bone health with calcium-fortified dairy. The mineral fortification trend aligns with the growing focus on nutrition and wellness, making it a key driver in the food fortification market.

Application Insights

Based on the application, dairy & dairy-based products is anticipated to hold the largest market share of 38% in 2023. Fortification in dairy products has gained traction due to its role in enhancing calcium and vitamin D intake. Calcium-fortified milk and dairy alternatives cater to consumers looking to improve bone health. Additionally, probiotic-fortified yogurt has seen growing popularity, promoting digestive health. These trends align with the increasing emphasis on overall wellness and the desire for functional food that deliver more than just traditional dairy products.

On the other hand, the infant formula segment is projected to grow at the fastest rate over the projected period. The infant formula segment is crucial for providing infants with essential nutrients for their growth and development. Recent trends in this category involve fortifying formulas with omega-3 fatty acids, prebiotics, and vital vitamins. As parents become increasingly educated about nutrition, there is a growing demand for formulas that closely mimic the composition of breast milk, which is known to promote cognitive and immune system development. To meet these evolving consumer expectations, the infant formula industry continues to witness innovations and fortification efforts.

Process Insights

In 2025, the drum drying segment had the highest market share of 62% on the basis of the process. Drum drying is a process commonly used in the food fortification market. It involves spreading a thin layer of a food mixture onto the surface of a heated drum. As the drum rotates, moisture evaporates, leaving behind a dry, fortified food product. This method is known for its efficiency in preserving the nutritional quality of the added fortificants and is widely used for making powdered drink mixes, cereals, and instant soups.

The dusting segment is anticipated to expand at the fastest rate over the projected period. Dusting, on the other hand, is a technique used for food fortification. It involves applying a powdered or granulated fortificant directly onto the surface of a food product. This process is commonly used for salt fortification with iodine and vitamin A, where the fortificant is dusted onto salt crystals. Dusting is appreciated for its simplicity, cost-effectiveness, and suitability for fortifying various food products.

Regional Insights

What is the U.S. Food Fortification Market Size?

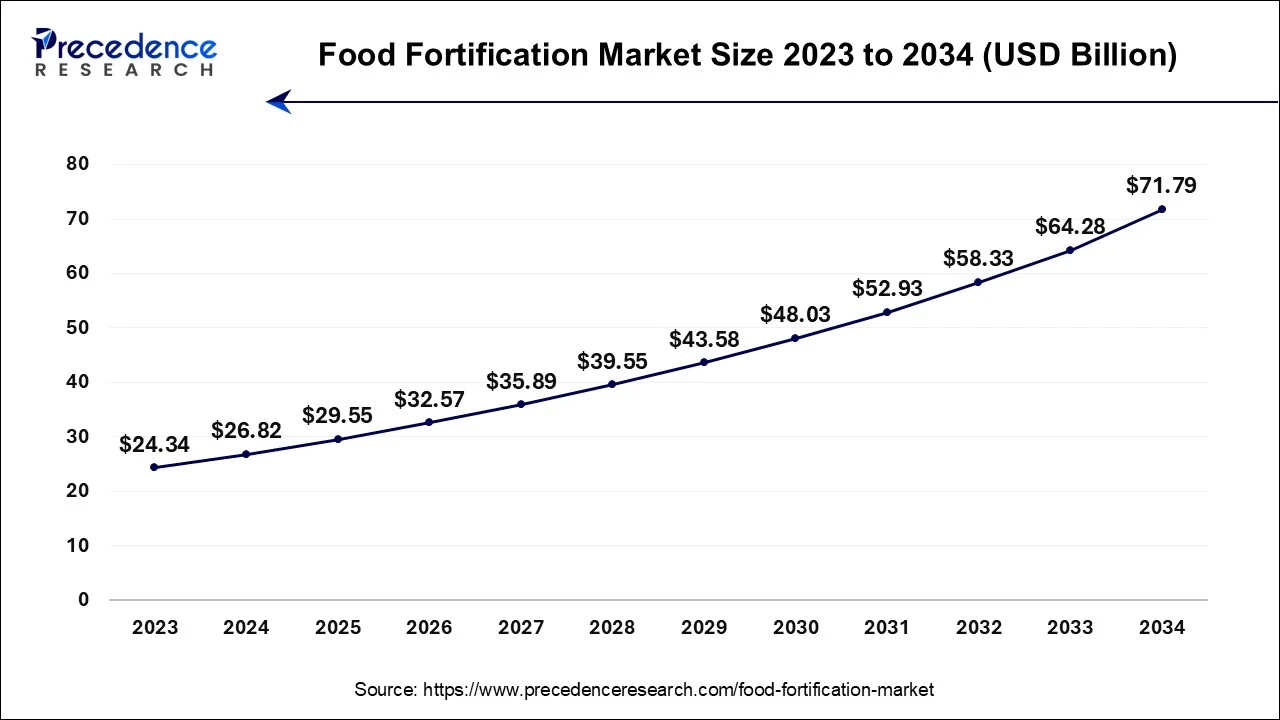

The U.S. food fortification market size is estimated at USD 29.55 billion in 2025 and is expected to be worth around USD 78.26 billion by 2035, growing at a CAGR of 10.23% from 2026 and 2035.

U.S. Food Fortification Market Analysis

The market in the U.S. is growing because consumers are increasingly health-conscious, seeking preventive nutrition, and demanding fortified staples, functional foods, and beverages that address nutrient deficiencies. Moreover, a growing aging population contributes to the increased demand for fortified foods.

North America has held the largest revenue share 37% in 2025. In North America, the food fortification market has witnessed a growing emphasis on addressing specific health concerns. With a health-conscious population, fortified products targeting vitamins, minerals, and functional ingredients are gaining popularity. Moreover, government initiatives to combat nutrient deficiencies and mandatory fortification programs contribute to market expansion.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia-Pacific is estimated to observe the fastest expansion. In Asia Pacific, the food fortification market reflects the diverse dietary preferences and nutritional needs of its vast population. Governments and international organizations are actively engaged in addressing micronutrient deficiencies through fortification programs, particularly in staple food. The market also sees a surge in the fortification of traditional food to cater to the region's cultural diversity. As awareness of nutrition and well-being continues to grow, food manufacturers are exploring innovative fortification strategies to meet the unique demands of this dynamic market.

Why is the Market for Food Fortification Growing in Europe?

In Europe, there is a rising interest in natural and clean-label fortification. Consumers are increasingly seeking products that use natural sources of vitamins and minerals. Organic and non-GMO fortification is a notable trend. Additionally, fortified dairy and plant-based alternatives are on the rise, aligning with the growing demand for functional food and fortified food in the region.

India Food Fortification Market Analysis

India's market is growing due to the increasing prevalence of micronutrient deficiencies, strong government initiatives like FSSAI's Fortification Programs, and mandatory fortification of staples. Additionally, rising health awareness, expanding middle-class population, and increased focus of food manufacturers to improve nutrition and public health outcomes nationwide contribute to the market.

UK Food Fortification Market Analysis

In the UK, the market is expanding due to increasing consumer awareness about health and nutrition, coupled with rising demand for functional foods and fortified beverages that help prevent nutrient deficiencies. Additionally, supportive government guidelines and public health campaigns encouraging nutrient-enriched diets are driving manufacturers to develop fortified products to meet these needs. This trend is further boosted by a growing aging population seeking preventive nutrition solutions.

Combating Micronutrient Deficiencies: The Latin America Food Fortification Market

Latin America's market shows notable growth during the forecast period. Latin America faces a unique difficulty where, because of the consumption of high-calorie, low-nutrient processed foods, obesity, along with micronutrient deficiencies, coexist, even in the same individual. Fortification is considered one of the most cost-effective development priorities, with studies stating that every $1 spent on fortification results in $9 in advantages to the economy through increased productivity, along with reduced healthcare costs.

Brazil Food Fortification Market Trends

In Brazil, the state programs state mass fortification of staples, aimed at fortification for vulnerable groups, and market-based functional foods. Manufacturers depend on premixes tailored to product matrices, processing conditions, and regulatory limits, ensuring bioavailability as well as sensory acceptance. Partnerships between academia, health agencies, and industry underpin evidence-driven formulations and consumer education.

Public Health Initiatives Driving the Food Fortification Market in MEA

MEA's market shows fast growth during the forecast period. Nutritional deficiencies are a vital health challenge in the Middle East, with nearly 32% of children under five suffering from anemia. In the wider MEA region, iron deficiency is a major issue, affecting 30–70% of pregnant women. Users are increasingly looking for foods that boost immunity, enhance mental clarity, and encourage overall well-being, driving market growth.

UAE Food Fortification Market Trends

The market in the UAE is undergoing rapid growth, driven by intense user focus on health and rising lifestyle-related diseases such as diabetes and obesity. Growing disposable incomes, along with a preference for convenient, "better-for-you" foods such as fortified dairy and beverages, encourage producers to innovate with fortified products.

Food Fortification Market-Value Chain Analysis

- Raw Material Procurement: Acquiring agricultural and aquatic inputs directly from farmers and fishers while ensuring their quality, availability, and consistency

Key Players: Food Corporation of India (FCI), Aachi Special Foods - Processing and Preservation: The process of transforming raw materials into safe fortified products, and at the same time keeping the nutrients stable

Key players: Nestlé S.A., Cargill, Britannia Industries, ITC Limited - Quality Testing and Certification: Assessing the safety, nutritional content, and compliance with the legal standards that have been set

Key players: Eurofins Scientific, SGS SA, Intertek Group, Bureau Veritas, and TÜV SÜD - Packaging and Branding: Keeping fortified products safe while making the nutritional advantages known through good labeling

Key Players: Amcor PLC, Tetra Pak, UFlex Limited, Berry Global - Cold Chain Logistics and Storage of Food Fortification: To transport under temperature-controlled conditions, preserving the nutrients and safety of the products

Key players: Lineage Logistics, Americold, Snowman Logistics, Gati Kausar

Top Companies Operating in the Market & Their Offerings

- Archer Daniels Midland (ADM): Provides a comprehensive portfolio of vitamins, minerals, and functional botanical extracts tailored for human and animal nutrition.

- Cargill, Incorporated: Delivers micronutrient-dense solutions and partners on large-scale biofortification projects to increase essential minerals like iron and zinc in staple crops.

- BASF SE: Specializes in high-stability micronutrient formulations, such as vitamin A powders and oily blends, specifically designed for fortifying edible oils, flour, and rice.

- DSM Nutritional Products: Offers a vast range of customized nutrient premixes and specialized "sprinkle" powders used to fortify staple foods like flour, rice, and dairy.

- Glanbia PLC: Provides advanced nutraceutical and functional ingredients, including protein-based fortificants and micronutrient premixes for the performance nutrition sector.

- Tate & Lyle PLC: Focuses on specialty food ingredients that enhance the nutritional profile of products, particularly through fiber enrichment and sugar reduction solutions.

- Lonza Group AG: Manufactures high-quality nutritional ingredients and delivery systems, such as specialized capsules and branded nutrients, for the global health and wellness market.

- Buhler Group:Provides advanced food processing and fortification technologies, enabling precise nutrient addition, improved food quality, large-scale grain milling, and fortified staple food production worldwide.

- FMC Corporation:Offers nutritional ingredients, including minerals and specialty additives, supporting food fortification, functional foods, and improved nutrient stability for enhanced human health outcomes.

- Corbion N.V.: Specializes in lactic acid, preservatives, and functional ingredients that enhance the shelf life, safety, and nutritional value of fortified foods and beverages globally.

- Tate & Lyle PLC: Develops specialty food ingredients such as fibers, sweeteners, and texturants that support nutrient fortification, healthier formulations, and improved taste and texture.

- Lonza Group AG: Supplies high-quality vitamins, minerals, and nutritional ingredients used in food fortification, dietary supplements, and health-focused consumer products worldwide.

- Watson, Inc.: Provides customized vitamin and mineral premixes for food and beverage fortification, supporting regulatory compliance, nutrient stability, and tailored nutrition solutions.

- SternVitamin GmbH & Co. KG: Produces tailored vitamin and micronutrient premixes for fortified foods, beverages, and supplements, focusing on bioavailability, stability, and regulatory standards.

Other Major Key Players

- Nestle S.A.: Invests in the development of fortified cereals that give special attention to children's health and population-level improvement programs, besides the already existing micronutrient deficiencies.

- Kellogg Company: The company embarked on a new journey through the introduction of vitamin and mineral fortification in the cereal category, aimed at supporting the family's wellness and balanced daily nutrition intake.

- General Mills, Inc.: The company increases its cereals with the provision of extra vitamins while cooperating with international organizations in the school meal fortification projects.

Other Major Key Players

- The Archer Daniels Midland Company

- Cargill, Incorporated

- BASF SE

- DSM Nutritional Products

- Glanbia PLC

- Tate & Lyle PLC

- Lonza Group AG

Recent Developments

- In October 2025, Millers for Nutrition, with TechnoServe, GRFMA, and Fortify Health, launched seven fortified wheat flour brands in Ahmedabad, boosting India's fight against malnutrition and anaemia.(Source:https://www.fnbnews.com)

- In June 2025, Punjab's Jindal Rice Mills launched Nourifyme, a fortified staples range, including rice and wheat atta, in Chandigarh to boost nutrition and support India's health goals. (Source:https://nuffoodsspectrum.in)

- In November 2025, the NFS is releasing a guideline on fortifying edible oils and fats with vitamins A and D to enhance public health. It offers clear, evidence-based recommendations to improve vitamin A and D levels and overall health in populations.

(Source: https://www.who.int/ ) - In October 2025,Millers for Nutrition announced significant progress in Asia, combating hidden hunger by supporting millers in producing fortified staples. Over 20 new fortified food brands launched in India and Bangladesh, with growing momentum in Indonesia.(Source: https://millingmea.com/ )

- In 2022, Angie's Artisan Treats, LLC, a US-based food product manufacturer, introduced a new gluten-free rose-flavored variant of its popular kettle corn snack, "BOOMCHICKAPOP." This addition expands the brand's product offerings to cater to diverse consumer preferences.

- In 2022, Cargill unveiled its inaugural Food Innovation Center in India, aimed at collaborating with local food and beverage industry partners to revamp products by reducing fat, salt, and sugar content, all while preserving the delectable taste and desired texture. This initiative addresses growing consumer health-consciousness and dietary preferences.

- In 2021,Evolve BioSystems secured a substantial strategic investment from Cargill and Manna Tree to advance their groundbreaking probiotic technology aimed at enhancing infant gut health. This partnership and investment drive research and development efforts in California, focusing on improving the well-being of newborns.

Segments Covered in the Report

By Type

- Proteins & Amino Acids

- Vitamins

- Lipids

- Prebiotics & Probiotics

- Carbohydrates

- Minerals

- Others

By Process

- Drum Dying

- Dusting

By Application

- Infant Formula

- Dairy & Dairy-based Products

- Cereals & Cereal-based Products

- Fats & oils

- Beverages

- Dietary supplements

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting