What is the Green Methanol Market Size?

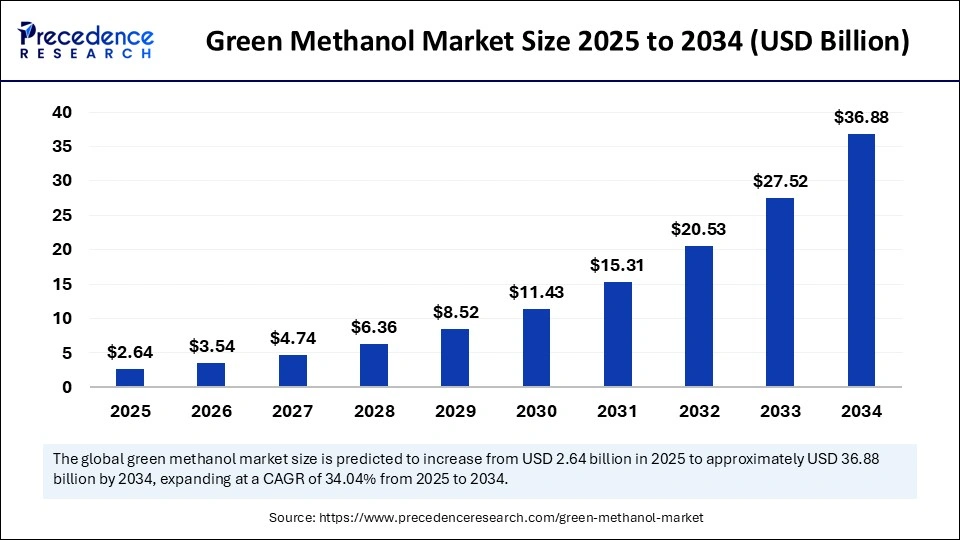

The global green methanol market size is accounted at USD 2.64 billion in 2025 and predicted to increase from USD 3.54 billion in 2026 to approximately USD 36.88 billion by 2034, expanding at a CAGR of 34.04% from 2025 to 2034. The market growth is attributed to increasing regulatory pressure for carbon emission reductions and increasing investments in renewable and energy-efficient methanol production technologies.

Green Methanol Market Key Takeaways

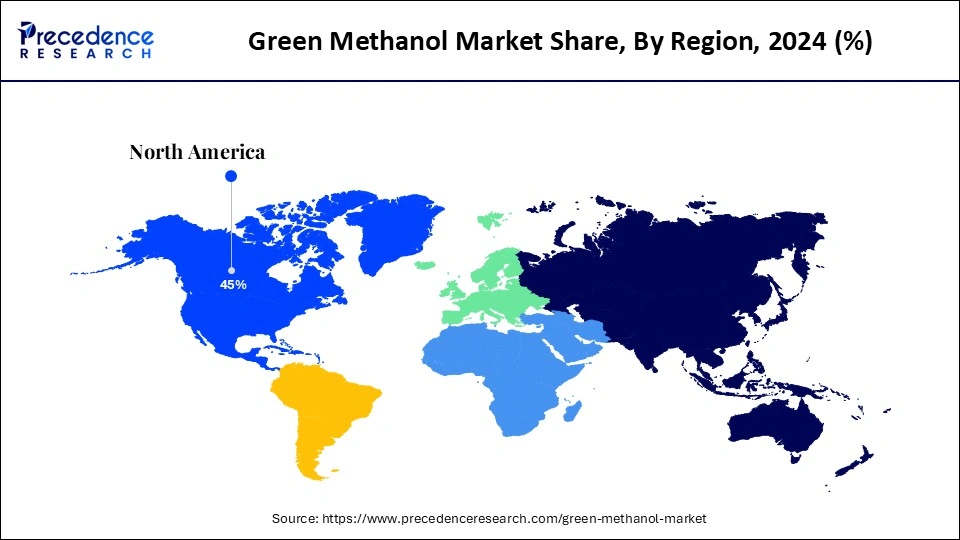

- North America dominated the global market with the largest revenue share of 35% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR between 2025 and 2034.

- By type, the biomethanol segment held the major revenue share of in 2024.

- By type, the e-methanol segment is projected to grow at a notable CAGR between 2025 and 2034.

- By production route, the biomethane reforming segment held the largest revenue share in 2024.

- By production route, the power to methanol segment is likely to expand at a significant CAGR in the coming years.

- By end use, the chemical segment dominated the market in 2024.

- By end use, the fuel segment is expected to grow at a significant CAGR over the projected period.

Artificial Intelligence: The Next Growth Catalyst in Green Methanol

Artificial Intelligence contributes greatly to the growth of the market for green methanol by enhancing productive outcomes, decreasing expenses, and helping to achieve sustainability goals. AI-driven systems are applied by producers to closely watch and regulate various reactions that make renewable feedstocks into methanol. This maintains the quality and minimizes unnecessary waste. Furthermore, AI technologies allow facilities to adjust their processes in the most energy-efficient way, which lowers their emissions.

Artificial Intelligence: The Next Growth Catalyst in Green Methanol

The worldwide green methanol market is witnessing rapid growth, driven by the rising need for sustainable and low-carbon fuels. Green methanol plays an important role in helping the world move away from fossil fuels. To make green methanol, methanol is synthesized with hydrogen made from water electrolysis, leading to the development of a fuel with no carbon footprint. Governments and international organizations, including the IRENA, are encouraging the adoption of green methanol to help achieve difficult climate targets.

- In 2024, the IRENA found that global electrolyzer capacity jumped by over 50% due to greater investments in green hydrogen. Furthermore, green methanol is considered by the IMO to be a promising fuel for the industry to achieve its carbon reduction targets by 2050. (Source:https://www.irena.org)

(Source: https://www.imo.org)

Green Methanol Market Growth Factors

- Increasing Focus on Carbon-Neutral Fuel Adoption: Global emission reduction goals are propelling the demand for sustainable fuels and boosting green methanol uptake across transport and industrial sectors.

- Breakthroughs in Electrolyzer and Carbon Capture Technologies: Continuous advancements improve efficiency and cost-effectiveness, enhancing green methanol production scalability.

- Expansion of Maritime Decarbonization Efforts: Growing regulatory pressure on shipping fuels accelerates the integration of green methanol in marine vessels.

- Growing Investment in Renewable Hydrogen Production: Rising support for green hydrogen infrastructure drives upstream availability for power-to-methanol processes.

- Advancements in Waste-to-Methanol Conversion: Innovative technologies enable efficient use of organic waste, increasing feedstock diversity and sustainability.

- Strategic Public-Private Partnerships: Collaborations between governments and industry players expedite the development of methanol production and fueling infrastructure.

- Scalable and Cost-Effective Methanol Synthesis Methods: New process improvements reduce capital expenditure, expanding green methanol accessibility in emerging markets.

Market Outlook:

- Market Growth Overview: The green methanol market is expected to grow significantly between 2025 and 2034, driven by decarbonization and sustainability goals, innovation in production technologies, efficient biomass gasification, and advanced carbon capture and utilization methods.

- Sustainability Trends: Sustainability trends involve significant greenhouse gas reduction, integration with renewable energy, and technological innovation for efficiency.

- Major Investors: Major investors in the market include TotalEnergies, Cepsa, Avaada, Maersk, Hapag-Lloyd, and OCI Global

- Startup Economy: The startup economy is focused on niche feedstocks, venture capital, and corporate venture capital funding, and acquisition as an exit strategy.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 36.88 Billion |

| Market Size in 2025 | USD 2.64 Billion |

| Market Size in 2026 | USD 3.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 34.04% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Production Route, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand for Cleaner Fuel

Increasing demand for sustainable marine fuel is expected to drive the growth of the green methanol market. The International Maritime Organization (IMO) ensures that emissions from ships are reduced, which encourages owners to switch to cleaner energy sources. Green methanol is produced using biomass and carbon that has been known for fewer emissions and blended with current fuels. Worldwide shipping firms are buying dual-fuel ships and supporting green methanol pilot programs to show the fuel succeed in the industry. According to the World Economic Forum, the demand for methanol-powered vessels rose by 88% in 2023, highlighting the need for green methanol. Green shipping has been advanced by Maersk, a leading company in shipping, introducing several methanol container ships, including 'Laura Maersk', which launched in 2023.

- In May 2025, Denmark became home to the world's first commercial-sized e-methanol plant, producing enough green methanol each year to aid the shipping industry in switching to low-emission fuels. Furthermore, the growing focus on reducing emissions and meeting environmental sustainability targets supports market growth.

(Source: https://www.dnv.com)

(Source: https://indiashippingnews.com)

Restraint

Insufficient Infrastructure for Distribution and Storage

Insufficient infrastructure for distribution and storage is projected to impede the adoption of green methanol across industries, hindering the growth of the market. A shortage of efficient infrastructure for storing and distributing green methanol significantly impacts the market expansion. Current systems for distributing and storing fossil fuels need major changes to cope with methanol's erosive properties and lower heating value. The fact that green methanol requires its own pipelines, storage, and bunkering options reduces its availability for various sectors. All these issues lead to more difficulties and higher costs of green methanol, further hampering the market growth.

Opportunity

Government Support and Incentives

Rising government policies and financial incentives are anticipated to create immense opportunities for key players competing in the green methanol market. Such policies create favorable conditions for using green methanol in the transportation sector. Governments of various nations are promoting the use of clean hydrogen. Governments of some countries are offering subsidies and grants to establish production plants and accelerate the production of green methanol. Such projects cut financial risks to investors, boost confidence in the industry and shorten the time to bring new green methanol technologies into the market. The EU Innovation Fund gave European Energy more than €50 million in October 2024 to launch a green methanol factory in Denmark, stressing the EU's focus on easing the shift to sustainable energy. Furthermore, rapid shifts toward sustainable fuels open up new growth avenues for the market. (Source: https://www.wri.org)

(Source: https://europeanenergy.com)

Type Insights

The biomethanol segment dominated the green methanol market with the largest share in 2024. This is mainly due to its effective and low-cost production. Biomethanol is produced from agricultural residues and waste collected from towns and left over things. The production of biomethanol requires lower initial investments, making it possible for new entrants to enter the market. Stringent regulations and increased need for bio-based fuels further bolstered the growth of the segment.

The e-methanol segment is projected to grow at a significant rate in the coming years, owing to its capability to produce low-carbon fuel and match worldwide goals for reducing carbon emissions. E-methanol is produced by blending green hydrogen and carbon dioxide, reducing dependency on biomass. In 2024, the IEA emphasized that global electrolyzer value added went up by about 3XX, which improved the chance for more e-methanol production. Furthermore, strict climate rules and the increasing need to reduce carbon emissions are expected to boost the use of e-methanol. (Source: https://www.iea.org)

Production Route Insights

The biomethane reforming segment held a significant share of the green methanol market in 2024, owing to advancements in reforming technology. Renewable methane from either anaerobic digestion or biogas upgrading undergoes biomethane reforming, resulting in efficient methanol production with known processes. This technology improves the capabilities of green methane production by focusing on waste-to-energy and circular economic strategies. In 2024, the Department of Energy made funding for biomethane reforming projects. Furthermore, biomethane reforming produces less carbon than equivalent fossil gas reforming.

The power to methanol segment is likely to expand at a significant CAGR during the forecasting period due to its close link to renewable sources and the quality of its carbon-neutral methanol. This production method uses green hydrogen from water electrolysis powered by renewables and carbon dioxide taken directly from the air. Investments focused on electrolyzer technology brought down the cost of hydrogen production. According to the European Commission's 2024 Hydrogen Strategy, power-to-methanol is a major route for reducing carbon emissions in industries that are difficult to change over to hydrogen. Furthermore, green hydrogen and carbon capture support led to a rise in power-to-methanol projects in Europe and China, thus fueling the segment. (Source: https://ec.europa.eu)

End Use Insights

The chemical segment dominated the green methanol market in 2024, as it provides the main raw material for producing formaldehyde, acetic acid, and several polymers. Many industries choose biomethanol and e-methanol in order to reduce their carbon emissions and keep product quality high. In 2024, IRENA reported that chemical manufacturing factories are increasingly using green methanol to fulfill new sustainability requirements. Additionally, many chemical companies invested heavily in green methanol, as they wanted to match ESG standards and cut down on greenhouse gas emissions. (Source: https://static.pib.gov.in)

The fuel segment is expected to grow at a significant CAGR over the projected period, owing to the growing shift toward sustainable fuels in the maritime, automotive, and power generation sectors. Green methanol is gaining popularity for its clean burning and produces less sulfur and particulate pollution, which aligns with global emission regulations. The IMO report for 2024 underlines how methanol fuel has a major role in helping the industry to meet its emissions goals by 2025. Governments around the world are investing heavily in producing methanol-based fuel, contributing to segmental growth. (Source: https://www.imo.org)

Regional Insights

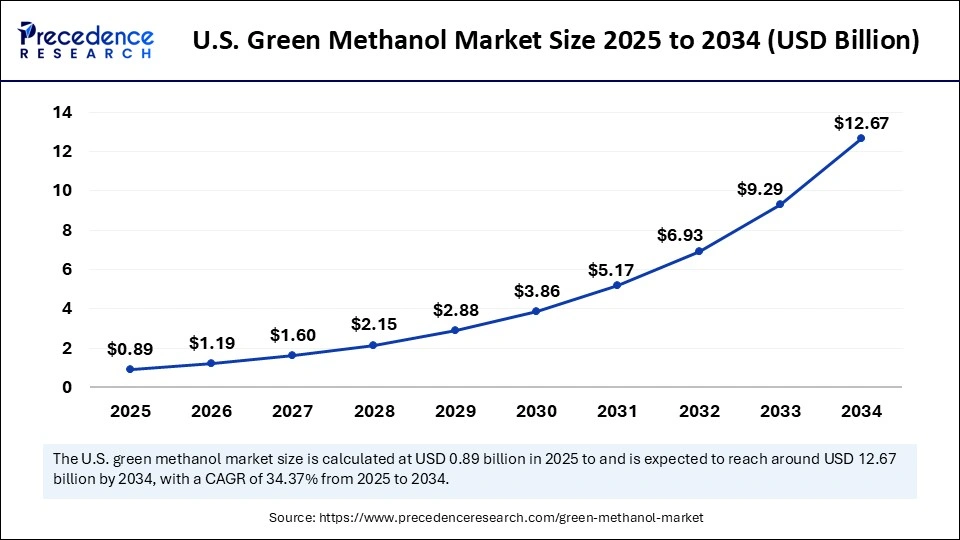

U.S. Green Methanol Market Size and Growth 2025 to 2034

The U.S. green methanol market size is exhibited at USD 0.89 billion in 2025 and is projected to be worth around USD 12.67 billion by 2034, growing at a CAGR of 34.37% from 2025 to 2034.

North America led the green methanol market by capturing the largest share in 2024. This is mainly due to increased investments in clean energy and beneficial government policies. Substantial tax credits and incentives offered by governments for green hydrogen and clean fuel further bolstered the market's growth in the region. The Inflation Reduction Act of 2022 (IRA) includes clean energy tax credits and other provisions that help increase domestic renewable energy production. The IRA's clean energy incentives include many provisions for clean hydrogen and fuel cell technologies, sustaining the long-term growth of the market.

North America: Canada Green Methanol Market Trends

Canada is a major player in the market, driven by its strong focus on green methanol as part of its goal for net-zero emissions, which is further facilitated by its plentiful biomass and strong hydroelectric power sources. There is a rapid shift toward a green hydrogen economy. Furthermore, the existing network of natural gas pipelines opens options for modifying systems and including biomethane and green methanol, further fueling the market growth. (Source: https://www.energy.gov)

(Source: https://about.bnef.com)

Why Is Asia Pacific the Fastest-Growing Region in the Green Methanol Market?

Asia Pacific is anticipated to witness the fastest growth during the forecast period, owing to the rapid increase in the production of sustainable fuels, growing use of energy, and government programs for clean fuel. China, Japan, and South Korea put a strong emphasis on blending green methanol with their fuels to avoid using coal and fossil fuels so much. In 2024, the IEA noticed that China raised its green hydrogen capacity by around 30%, which helped boost power-to-methanol production directly. Furthermore, the expansion of international hydrogen supply networks is expected to drive market growth. (Source: https://greenreview.com.au)

Asia Pacific: China Green Methanol Market Trends

China's strong government subsidies and a focus on decarbonizing the shipping and chemical industries. The accelerated expansion of e-methanol and bio-methanol production capacity, leveraging abundant domestic feedstocks and affordable infrastructure.

Europe is expected to be a significantly growing area. The growth of the green methanol market in the region is attributed to stringent rules and a strong focus on reducing emissions. As a result, there is rising demand for green fuels. Emission reduction targets set by the European Commission and rising investments in the production of green methanol further contribute to regional market growth. In a 2024 report, IRENA highlighted that Europe led in the installation of electrolyzers, representing over 40% of the global market and remaining a top producer of green hydrogen and methanol. The European Commission's Hydrogen Strategy for 2024 increased support for adding green methanol to chemical and maritime sectors. (Source:https://www.irena.org)

(Source: https://energy.ec.europa.eu)

Europe: Germany Green Methanol Market Trends

The German green methanol market is driven by ambitious climate targets and strong government backing through initiatives like H2Global. The acceleration of e-methanol production using innovative technologies developed by pioneers like C1, often through pilot projects integrating renewable energy and CO2 capture. Significant investment is flowing from both public and private sectors, including corporate venture capital from entities like Maersk.

Value Chain Analysis of the Green Methanol Market

- Inbound Logistics

This stage involves the sourcing, procurement, and transportation of sustainable feedstocks such as biomass (agricultural waste, forestry residues), municipal solid waste, captured CO2 (from industrial processes or direct air capture), and green hydrogen derived from renewable electricity. - Operations

This stage covers the conversion of feedstocks into green methanol through processes like gasification (for biomass) or e-methanol synthesis (using hydrogen and CO2). - Outbound Logistics

Outbound logistics involves the storage and distribution of the finished green methanol product to end-users such as shipping ports, chemical plants, and fuel stations. - Marketing and Sales

This stage focuses on promoting and selling green methanol to diverse industrial customers who are seeking to reduce their carbon emissions. - Service

The service stage involves post-sale support, technical assistance with the implementation of green methanol as a fuel or feedstock, and ongoing maintenance of related infrastructure (like fueling stations or ship engines).

Top Companies in the Green Methanol Market & Their Offerings:

- WASTEFUEL: This company likely focuses on converting waste materials into sustainable fuels, contributing to the green methanol market by providing technology or operations for the production of biomethanol from varied waste streams.

- Veolia: A global leader in optimized resource management, Veolia contributes by developing and implementing solutions for treating waste and producing energy from it, including the generation of green methanol as a circular economy solution.

- Thyssenkrupp Uhde: This company provides engineering and construction services for industrial plants, contributing expertise and technology crucial for building large-scale green methanol production facilities.

- SunGas Renewables: SunGas specializes in the gasification of biomass to produce synthesis gas, a key intermediate for the production of green methanol. Their advanced gasification technology provides a sustainable pathway to produce renewable energy from abundant biomass feedstocks.

- Sodra: As a prominent Swedish forest industry group, Sodra contributes to the market by providing certified, sustainable biomass feedstock from its forests, which is a primary resource for biomethanol production.

- Proman: Proman is an integrated energy company with expertise in methanol production and distribution, contributing by investing in and operating green methanol production facilities and securing long-term supply agreements.

- OCI: A global producer of nitrogen fertilizers and methanol, OCI is strategically shifting towards green methanol production, leveraging its existing infrastructure and expertise to decarbonize operations and supply growing demand from the shipping industry.

- Mitsubishi: Through its diverse operations, Mitsubishi Corporation contributes to the green methanol market via investments, technology development, and establishing global supply chains for the fuel.

- Methanex Corporation: As the world's largest producer and supplier of methanol, Methanex contributes by leveraging its global reach and infrastructure to integrate green methanol into its product offerings, though its primary business is conventional methanol.

- Enerkem: Enerkem specializes in producing advanced biofuels and circular chemicals from non-recyclable waste materials through a thermochemical process, contributing to the market by turning difficult-to-manage waste into valuable green methanol.

- Cepsa: A global energy and chemical company, Cepsa contributes to the green methanol market through its integrated "Positive Motion" strategy, involving large-scale production projects in Spain to supply green hydrogen derivatives and advanced biofuels, including green methanol.

- Carbon Recycling International (CRI): CRI is a technology leader in the power-to-methanol process, contributing innovative technology for producing e-methanol from captured CO2 and green hydrogen.

- AVEL Energy: AVEL Energy focuses on developing advanced energy solutions, likely contributing to the green methanol market through innovative production technologies or project development, although specific public information is limited. Their involvement may be in securing feedstocks or developing specific regional projects.

- AVAADA: Primarily known for its solar and wind energy projects, AVAADA contributes to the green methanol market by ensuring a reliable supply of green hydrogen derived from renewable electricity, which is essential for e-methanol production.

- ANDRITZ: ANDRITZ provides plants, equipment, and services for the hydropower, pulp and paper, metals, and waste-to-energy industries, contributing to the green methanol market through its expertise in biomass processing and gasification technology.

Green Methanol Market Companies

- WASTEFUEL

- Veolia

- Thyssenkrupp Uhde

- SunGas Renewables

- Sodra

- Proman

- OCI

- Mitsubishi

- Methanex Corporation

- Enerkem

- Cepsa

- Carbon Recycling International

- AVEL Energy

- AVAADA

- ANDRITZ

Latest Announcements by Industry Leaders

- In March 2025, BASF has entered into a strategic early disclosure agreement (EDA) with Forestal de Atlántico S.A. (Forestal) to advance the development of e-methanol (eMeOH) production through innovative carbon capture technology. As part of the partnership, BASF will provide its proprietary OASE blue gas treatment technology—an advanced solution designed to efficiently capture CO? from flue gases—for integration into Forestal's Triskelion project in Galicia, Spain. The Triskelion initiative, which aims to produce up to 156 metric tons of e-methanol per day, will utilize captured CO? from gas turbine exhaust and combine it with renewable hydrogen to synthesize e-methanol. This process represents a forward-looking model for sustainable fuel production by directly addressing the need for scalable carbon capture and utilization (CCU) solutions. “This collaboration marks a significant step toward reducing global emissions,” said Torsten Katz, Global Business Director of OASE Gas Treating Technologies at BASF. “By working with Forestal, we are establishing one of the first facilities to apply our OASE blue technology for e-methanol production, expanding its use into a pioneering sustainable fuel application.” The partnership reflects a growing industry shift toward clean energy innovations and demonstrates how technological synergies can accelerate the transition to carbon-neutral fuels.(Source: https://www.basf.com)

Recent Developments

- In February 2025, MAIRE announced that KT Tech, a subsidiary of NEXTCHEM, has secured a licensing contract for its proprietary NX AdWinMethanol Zero technology. This technology will be implemented in Pacifico Mexinol, an ultra-low carbon methanol facility near Los Mochis, Sinaloa, Mexico. Once operational, the plant will produce over 2.1 million tons of methanol per year.

- In March 2025, WasteFuel, a U.S.-based next-generation bioenergy company, and ITC, a leading Turkish integrated waste management company, announced today a partnership to commence the Front-End Engineering Design (FEED) on a green methanol biorefinery located in Ankara, Türkiye, the first green methanol facility in Anatolia and one of the largest of its kind in the world. The biorefinery, which would adjoin ITC's existing integrated waste management facility, would utilize biogas derived from anaerobic digestion and landfill gas collection. Once operational, its green methanol will be intended for use as low-carbon fuel for the maritime shipping market.

- In November 2024, Ohmium International (“Ohmium”), a leading green hydrogen company that designs, manufactures, and deploys advanced Proton Exchange Membrane (PEM) electrolyzers, is pleased to partner with the Jawaharlal Nehru Centre for Advanced Scientific Research (JNCASR), Breathe Applied Sciences, and Spirare Energy, to announce India's first CO2-to-Green Methanol plant.

- In May 2025, the world's first commercial-scale e-methanol plant began operations in Denmark, with shipping giant Maersk (MAERSKb.CO), opens new tab set to buy part of the production as a low-emission fuel for its fleet of container ships. The shipping sector is under pressure to find new sources of fuel after a majority of countries gave their backing to measures to help meet the International Maritime Organization's targets towards eliminating carbon emissions by 2050.(Source: https://chemindigest.com)

(Source: https://www.businesswire.com)

(Source: https://www.businesswire.com)

(Source: https://www.reuters.com)

Segments Covered in the Report

By Type

- Biomethanol

- E-Methanol

By Production Route

- Power to Methanol

- Biomethane Reforming

- Biomass Gasification

- Waste to Methanol

By End-Use

- Chemical

- Fuel

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting