Halal Food Market Size and Forecast 2025 to 2034

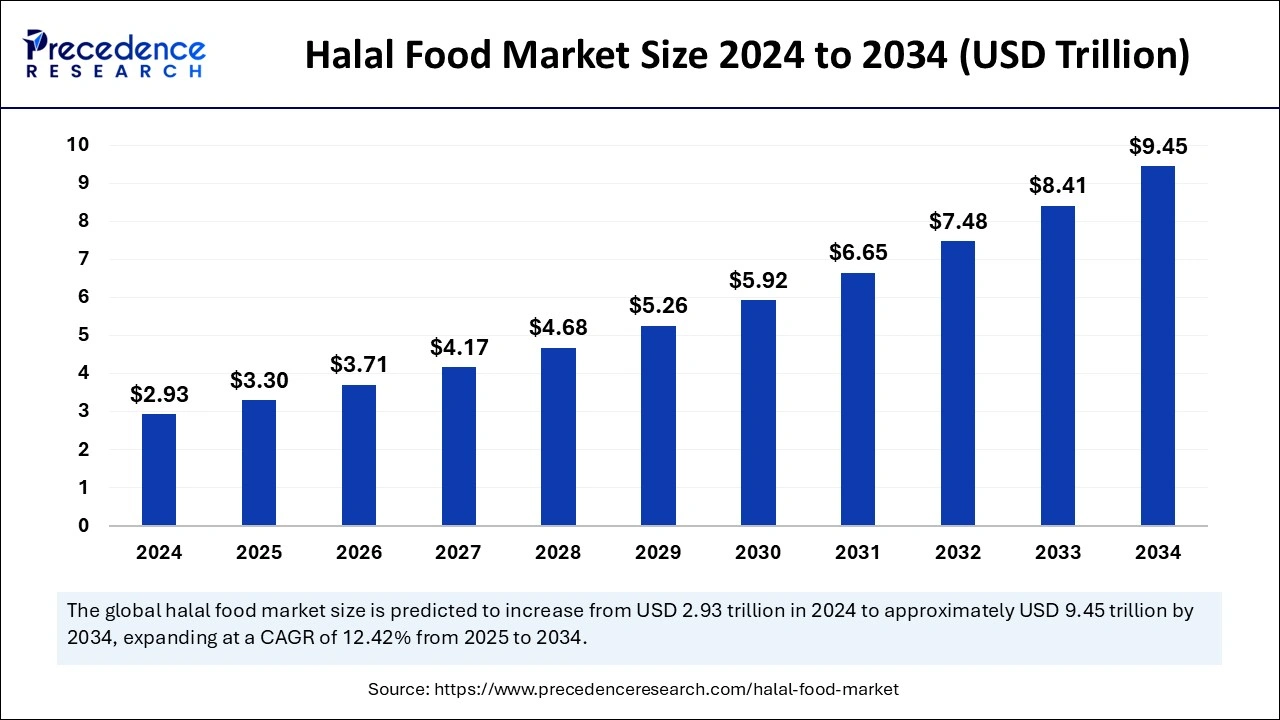

The global halal food market size was calculated at USD 2.93 trillion in 2024 and is predicted to reach around USD 9.45 trillion by 2034, expanding at a CAGR of 12.42% from 2025 to 2034. The halal food market expansion is attributed to clean hygiene followed for meat processes; it is free from harmful additives, preservatives, and chemicals, and the blood from meat is completely drained out, which makes it risk-free from foodborne illnesses.

Halal Food Market Key Takeaways

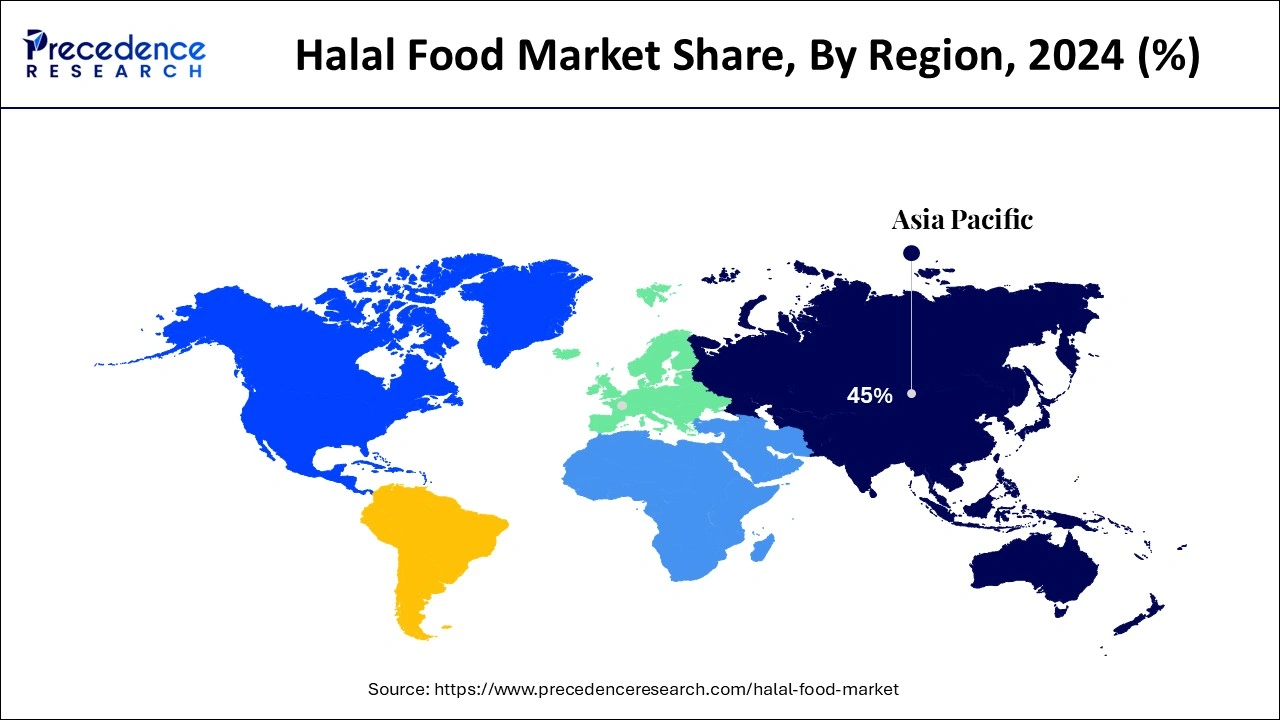

- Asia Pacific dominated the halal food market with the highest share of 45% in 2024.

- By product type, the meat and poultry segment dominated the global market in 2024.

- By product type, the dairy products segment is estimated to grow rapidly during the forecast period.

- By distribution channel, the supermarket and hypermarket segment captured the biggest market share in 2024.

- By distribution channel, the traditional retainer segment is expected to grow at a significant CAGR during the forecast period.

How is Artificial Intelligence (AI) Changing the Halal Food Market?

The integration of artificial intelligence in the halal food industry has the potential to improve the safety, quality, and transparency of halal products. AI helps ensure that the food product meets the strict halal standard regulations by consumers and regulators. Artificial intelligence technology has revolutionized the halal industry by connecting with the audience and creating campaigns with more target-specific, efficient, and data-driven insights. Furthermore, AI in the meat industry is proving to improve production efficiency and product quality in the processing stage. Implementation of AI algorithms provides accuracy, classifies carcasses, automates various processing tasks, and detects meat quality with higher accuracy.

- In March 2024, researchers from the Western College of Veterinary Medicine believe in using artificial intelligence for data gathering to improve animal welfare management on the farm. They are terming with the University of Saskatchewan's Department of Computer Engineering partnering with 14 industries supported by the Natural Sciences and Engineering Research Council of Canada, which have developed a computer-based automated system for skin lesions on the carcasses to be documented and assessed at slaughter.

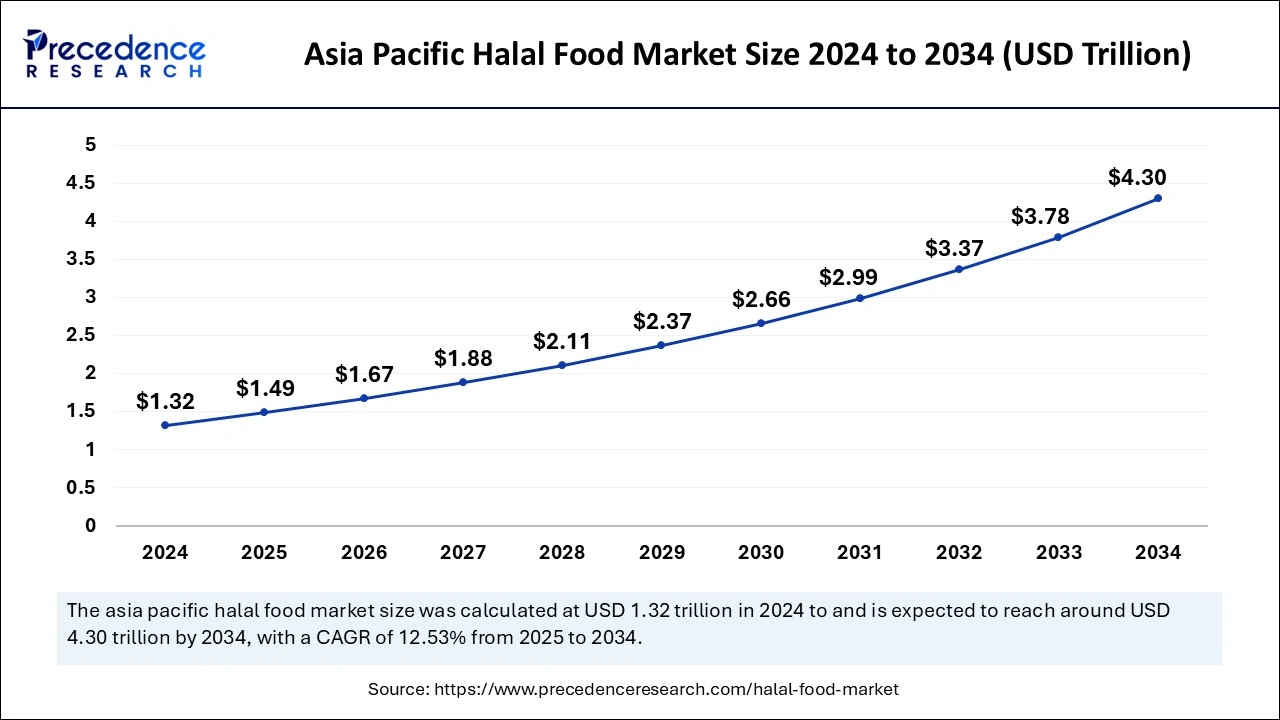

Asia Pacific Halal Food Market Size and Growth 2025 to 2034

The Asia Pacific halal food market size was exhibited at USD 1.32 trillion in 2024 and is projected to be worth around USD 4.30 trillion by 2034, growing at a CAGR of 12.53% from 2025 to 2034.

Asia Pacific dominated the halal food market with the highest share in 2024. The dominance of this region is credited to the growing number of consumers, the integration of halal certification, and diverse cuisines. The Organization of Islamic Cooperation (OIC) plays a critical role in implementing trends within countries such as Singapore, the Philippines, and South Korea, making an agreement with OIC countries, and offering various broad partnerships for the import and export of halal products and services.

The Malaysian government is working towards creating a Halal Hub a reality within a few years. Malaysia is expanding in the halal market due to factors such as special tax incentives for Halal products and companies investing in the halal food market, obtaining halal certification from the Department of Malaysia.

Europe is expected to grow at a notable rate over the forecast period. The growth of the region can be attributed to the increasing trend of certified products in major countries such as the U.K., Germany, and France. Furthermore, the extensive migration of people from Muslim-dominated nations to the countries in Europe is the major factor propelling regional growth. With the surge in the number of Muslims, the demand for halal-certified foods also increases.

Market Overview

Halal food encompasses animal meat accepted for consumption and slaughtered according to Islamic law. Halal food is generally considered cleaner, pure, and healthier because of the strict Zabihah slaughtering process. The meat processing method ensures that the blood is completely drained from the veins during slaughter. The halal food market is often associated with higher-quality and organic ingredients. Among the consumers, it is driven by the multifaced concerns it offers, such as being natural, environmentally friendly, eco-ethical, non-cruelty to animals (mercy kill), socially responsible, and reducing over-consumption. All typical slaughterhouses must own a Halal certificate, which is a legitimate recognition by a credible organization that the food product, ingredient, and process involved in the creation of food is followed by Islamic dietary laws.

Halal Food Market Growth Factors

- Increased awareness: The consumers are educating themselves regarding halal products associating them with quality and ethical production methods. Additionally, this increases the purchasing intention of culinary products.

- Globalization: The increase in tourism and population diversity brings increasing demand for various food options that meet consumers' dietary requirements, allowing for new flavors and dishes to be created.

- Health perception: A majority of consumers are looking for halal food to be healthier and more hygienic due to its strict preparation standards.

- Quality control: The strict quality control measures lead to a rise in quality standards throughout the fast-food industry as companies comply with requirements and gain certification.

- Technological advances: The implementation of new technologies for food preparations and storage is bringing greater advantages to halal food preparation, driving technological progress within the fast food industry.

Market Scope

| Report Coverage | Details |

| Market Size in 2034 | USD 9.45 Trillion |

| Market Size in 2025 | USD 3.30 Trillion |

| Market Size by 2024 | USD 2.93 Trillion |

| Market Growth Rate from 2025 to 2034 | CAGR of 12.42% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Distribution Channel, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. |

Market Dynamics

Drivers

Halal regulation drives global trade

The predominating factor driving the halal food market is credited with gaining consumer trust, which strengthens the market. Halal regulations are mandated for all halal product providers, and they have the authority to promote halal products locally and internationally. The implementation of mandatory regulations has provided the government with greater control and management over trade and production. This includes the integrated halal product codification and trade data system, which aims to enhance traceability and logistics for maintaining consumer trust.

- In October 2024, Indonesia's new regulation mandating Halal certification for all imported food products is expected to broaden the export gap between large conglomerates and small businesses in Korea due to the high costs and time needed to meet the requirement.

Restraint

Risk management

Within halal food product production, a strict risk identification process must be implemented to mitigate the potential risks that could compromise the halal integrity of the food product. The halal ethic of a product is a function of its supply chain; if there is a breakage in the integrity of the halal, the supply chain is disturbed. Most companies have a passive halal integrity, it is limited to the compliance of suppliers and own operations based on requirements of the halal certification body and standards.

Opportunity

Blockchain technology

The halal food market is anticipated to have a gradual integration of blockchain technology. This encompasses tracking food from the source to the consumer, which improves food safety and transparency. Blockchain is expected to offer a decentralized and tamper-proof system for tracking and verifying halal food products; the blockchain will be recording every stage of the supply chain, sourcing raw materials till the final product; this practice will eliminate fraud and build consumer trust by providing verifiable proof of halal products.

- In March 2025, Halal Oriental Market Malaysia launches in London, a success for Malaysian products. Key strategic sales hub for the Muslim community and Asian food enthusiasts marks a significant success for Malaysian-made products. This initiative is the result of a strategic collaboration between the Federal Agricultural Marketing Authority (Fama) and the Agricultural Representative Office in The Hague.

Product Type Insights

The meat and poultry segment dominated the global halal food market in 2024. This segment is greatly driven by the halal technique of slaughter, the demand for draining all the blood from the carcass. These practices are as painless kill and are conducted with consideration to animal welfare practices. Animals killed in a halal are cut through their windpipe, carotid artery, and jugular vein, which causes instant death. Along with this, the animal slaughtered must be alive and healthy at the time of killing.

The dairy products segment is estimated to grow rapidly during the forecast period. The growth of this segment is only considered when dairy products are received from halal animals, including cows, goats, and sheep. Products such as milk, yogurt, and cheese are highly considered halal food. Food must not contain any non-halal additives or processing aids, such as rennet from non-halal sources.

Distribution Channel Insights

The supermarket and hypermarket segment captured the biggest halal food market share in 2024. The presence of Halal marks or Arabic writing on the products purchased from supermarkets and hypermarkets contributes to the growth of the halal food market. Purchasing a product from a supermarket allows easy access to the identification of halal food, such as checking ingredients for animal derivatives, production of products, and any component prohibited by Islamic law.

The traditional retainer segment is expected to grow at a significant CAGR during the forecast period. The growth of this segment is experienced due to the guaranteed higher quality meat it has to offer to the consumers. The retailers stock fresh products and locally sourced meat. Additionally, traditional retailers offer custom cuts depending on the user's usage, ultimately bringing customer satisfaction.

Halal Food Market Companies

- Nestle SA

- BRF SA

- Cargill Inc

- Tahira Foods Limited

- 2000plus Groups, Inc.

- American Halal Company, Inc.

- AI Islami Foods

- Saffron Road

- Kawan Food Berhad

- Almarai

- Janan Meat Limited

- DagangHalal plc

- Global Food Industries

- QL Foods Sdn Bhd

- Cresent Foods

Recent Developments

- In January 2025, AIBarakah launched an exotic Arabian Nights-themed celebration at Crowne Plaza in Ortigas Center. It showcased its produced line, including corned beef and minced hash corned beef, protein bites, and flavorful coffee options such as 3-in-1 brown and white coffee.

- In January 2025, Singapore will lead the innovation in the Halal culinary experience by launching the HalalTrip Gastronomy Awards 2025. Johor was the first confirmed region for this global journey. The HTGA 2025 will evaluate Halal dining restaurants based on categories including creative presentation, flavor harmony, food quality, menu innovation, and service excellence.

- In October 2024, India announced new halal meat export guidelines, which will require products to be processed in i-CAS Halal-certified facilities. These halal-certified meat products will then be permitted to be exported to 15 target markets, including the UAE, Saudi Arabia, Oman, Qatar, Bahrain, Bangladesh, and Indonesia.

- According to a report published by Vietnam Briefing in November 2024, Vietnam is actively pursuing opportunities to expand its foothold in the global Halal market. With a strategic focus on the Middle East, Prime Minister Pham Minh Chinh's recent visits to the UAE, Saudi Arabia, and Qatar underscore Vietnam's ambition to position itself as a key supplier of Halal-compliant agricultural and fishery products.

- In August 2024, GoodLife Foods entered into an agreement to acquire Pure Ingredients, a prominent player in the halal frozen food sector. This acquisition aims to create a robust entity focused on the production and distribution of frozen snacks and meal components across Europe. Headquartered in Nettetal-Kaldenkirchen, Germany, Pure Ingredients specializes in halal-certified frozen products.

Segments Covered in the Report

By Product Type

- Meat and Poultry

- Dairy Products

- Fish and Seafood

- Cereals and Confectionery

- Others

By Distribution Channel

- Traditional Retailers

- Supermarkets and Hypermarkets

- Online

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting