What is the Healthcare Analytical Testing Services Market Size?

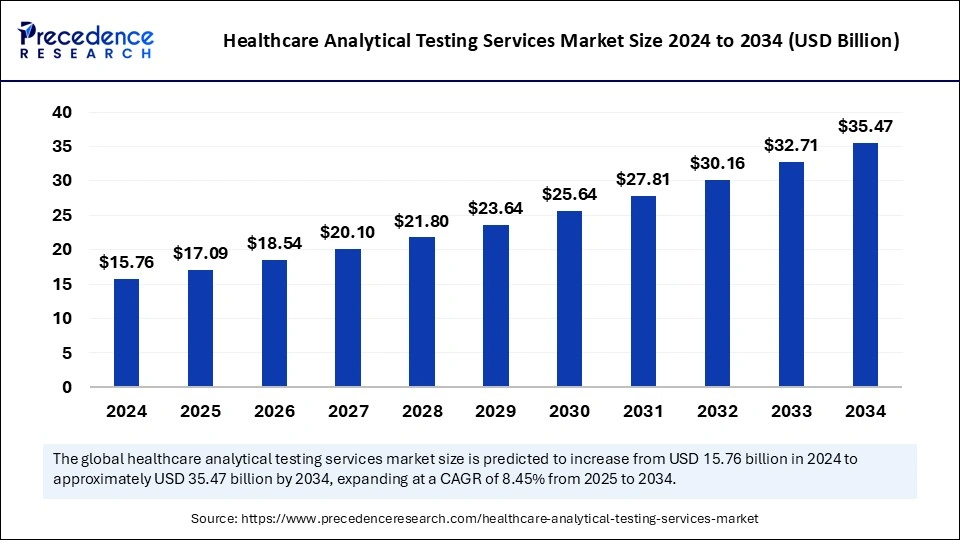

The global healthcare analytical testing services market size is valued at USD 17.09 billion in 2025 and is predicted to increase from USD 18.54 billion in 2026 to approximately USD 35.47 billion by 2034, expanding at a CAGR of 8.45% from 2025 to 2034. The market is driven by the increase in outsourcing businesses of analytical testing services by pharmaceutical or medical device firms.

Healthcare Analytical Testing Services Market Key Takeaways

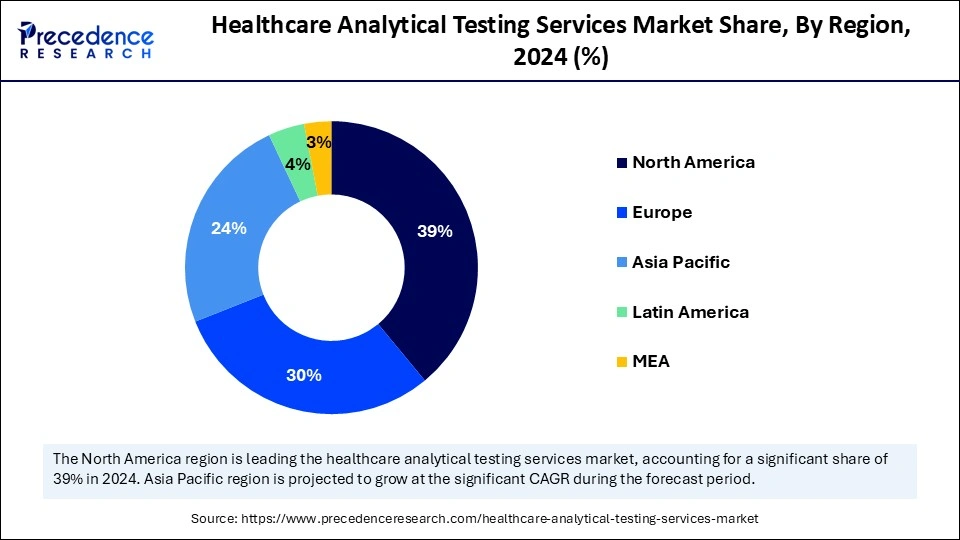

- North America dominated the global market with the largest market share of 39% in 2024.

- Asia Pacific is observed to host the fastest-growing market during the forecast period.

- By type, the pharmaceutical analytical testing services segment contributed the highest market share in 2024.

- By type, the medical device analytical testing services segment will witness significant growth during the forecast period.

How has AI Impacted the Healthcare Analytical Testing Services Market?

The presence of large datasets and substantial improvements in ArtificiaI Intelligence-powered medical algorithms extend beyond diagnostics. In the healthcare analytical testing services market, ArtificiaI Intelligence applications also reshape patient care management, healthcare administration, and drug discovery. In patient care, AI-driven chatbots, and virtual health assistants offer 24/7 support and monitoring, improving patient engagement and adherence to treatment plans. In drug discovery, AI speeds up drug development by anticipating how different drugs will react in the body, significantly reducing clinical trial time and cost.

The growth of AI in the healthcare analytical testing services market has been a steady journey driven by technological progress and the rising demand for improved healthcare services. Incorporating AI into medicine has transformed traditional practices, enhancing efficiency, accuracy, and personalized care. With the ongoing evolution of AI technology, its influence in healthcare is poised to expand, reinforcing its role as a crucial asset in contemporary medicine.

What is Healthcare Analytical Testing Services?

The healthcare analytical testing services market involves numerous diagnostic and investigative methods aimed at assessing disease conditions, evaluating patient health, and measuring treatment efficacy. These services employ sophisticated analytical technologies alongside various healthcare indicators to facilitate testing, prognosis, monitoring, and disease detection and to enhance informed clinical decision-making and personalized patient care. This service also supports drug development processes, spanning from discovery and clinical trials to the commercial use of medications.

- In October 2024, Eurofins Scientific, a scientific leader in bioanalytical testing with a rapidly developing existence in highly specialized and molecular clinical diagnostics testing and in-vitro diagnostic products worldwide, agreed to allow SYNLAB to acquire its clinical diagnostics operations in Spain.

What are the Growth Factors of the Healthcare Analytical Testing Services Market?

- The pharmaceutical industry increasingly targets biologics, complex molecules such as vaccines, proteins, and monoclonal antibodies. These drugs need more advanced and specialized analytical testing techniques than traditional small-molecule drugs.

- Governments of various countries and international health authorities are imposing more stringent regulations on pharmaceutical companies to guarantee drug safety, efficacy, and quality.

Healthcare Analytical Testing Services Market Outlook

- Industry Growth Overview: From 2025 to 2030, the market is expected to grow significantly with an increase in demand for complex testing in biologics, gene therapy, and high-potency drug testing. Growth is due to outsourcing patterns for testing, stringent quality specifications, and increasing pharma pipelines in Asia-Pacific and North America.

- Sustainability Trends: Sustainability is fostering the increased use of environmentally friendly testing workflows, digital data collection, and reduced-waste laboratory practices. Major service players are investing in automatic platforms, as well as reagents based on renewable resources, to support changing global compliance and lower environmental impact.

- Global Expansion: Major players are growing their laboratory networks in Southeast Asia, Eastern Europe, and LATAM, in closer proximity to CRO/CMO hubs. There are also new GMP-compliant laboratories that have recently been opened in Singapore and Poland by some of the leading companies clustering in areas of biologics development.

- Key Investors: Investors from private equity and strategic backgrounds are showing strong sentiment due to high regulatory barriers, stable demand, and attractive margins of profitability. Industry players such as KKR, Blackstone, and Bain Capital have ramped up contract testing, bioanalytics, and other regulated lab services.

- Startup Landscape: The startup landscape is evolving rapidly, in line with new developments in AI-led bioanalytics, microfluidic testing, and scannable speed release stability tools. Startups in the U.S., India, and Europe are attracting large investment from VCs for developing analytical solutions that deliver faster, are scalable, automated, etc.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 35.47 Billion |

| Market Size in 2025 | USD 17.09 Billion |

| Market Size in 2026 | USD 18.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.45% |

| Leading Region/ Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Increasing number of clinical trials

There is a rise in the number of deadly diseases, like cancer, which has created a demand to increase the production of drugs and develop new drugs to lessen the burden on existing ones. These factors raise pharmaceutical and biotechnology firms' demand for high-quality healthcare analytical testing services market services and have raised the number of clinical trials for different types of drugs. This is because they are required to focus more on their core competencies and the scientific aspects of the drugs. For smooth functioning, the pharmaceutical and biotechnology industry partners with vendors offering analytical testing services to ensure the product is not adversely impacted and the manufacturing facilities do not face regulatory compliance issues.

Restraint

Lack of skilled professionals

As the need for testing services grows across different industries, including food and beverage and pharmaceuticals, there is a growing demand for skilled individuals proficient in operating analytical testing equipment and accurately interpreting analytical results. Further, a lack of experienced professionals can hamper the healthcare analytical testing services market and lead to a slowdown in R&D activities, regulatory compliance efforts, and quality control processes.

Opportunity

Innovations and development of new products

Emerging technologies in the healthcare analytical testing services market have streamlined communication within medical organizations. A majority of healthcare professionals are utilizing tools such as video conferencing, AR/VR, real-time meetings, and various online platforms to engage with one another and enhance knowledge sharing in the field. These innovations enable providers to gain insights into patients' health, recognize potential risks, and recommend preventive strategies. Physicians can also rely on applications to spot medication errors and promote patient safety. Electronic health records (EHRs) allow doctors to readily access a patient's complete medical history to make well-informed decisions.

Type Insights

The pharmaceutical analytical testingservices segment dominated the global healthcare analytical testing services market in 2024. Manufacturers can verify that their products comply with purity and composition regulations by testing samples before release. This process assists in adhering to public health standards and minimizes risks linked to medications containing unknown ingredients or potency levels. Additionally, it helps producers maintain consistent product quality over time by monitoring for changes during production or storage. Furthermore, routine testing allows manufacturers to make necessary adjustments when variations happen during these processes, ensuring users are not exposed to unforeseen hazards.

The medical device analytical testing services segment will witness significant growth during the forecast period. Medical devices utilized for diagnosis, surgeries, and other medical procedures generally undergo rigorous biocompatibility testing in accordance with global regulatory standards to evaluate the biological risks associated with the device's contact with a patient. Medical device performance testing examines how a device operates under various conditions. This service aids manufacturers in assessing risks, preventing failures, and understanding the stresses a product may encounter throughout its lifespan. Additionally, performance testing offers manufacturers valuable insights for pinpointing and improving any weaknesses in the development process, enabling them to launch safe and effective products more swiftly.

Regional Insights

U.S. Healthcare Analytical Testing Services Market Size and Growth 2025 to 2034

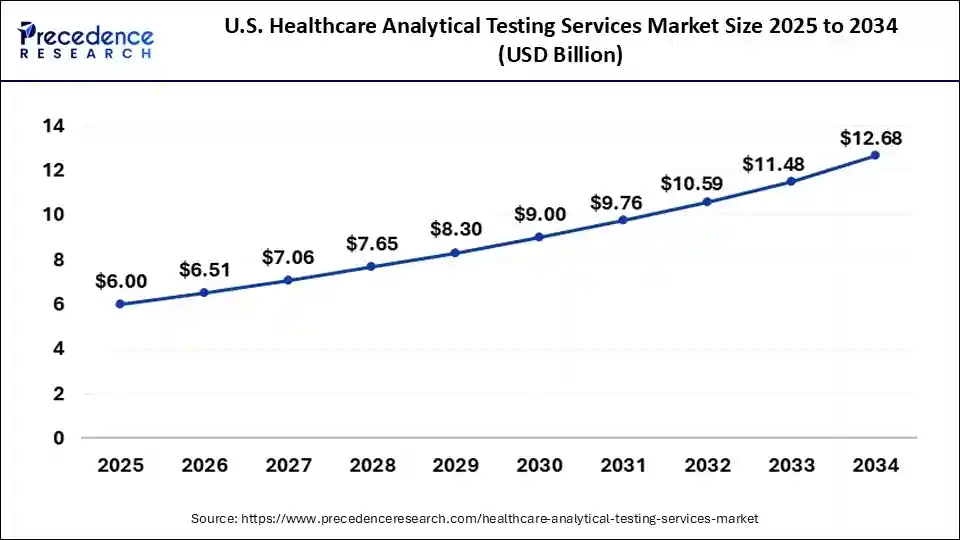

The U.S. healthcare analytical testing services market size is exhibited at USD 6.00 billion in 2025 and is projected to be worth around USD 12.68 billion by 2034, growing at a CAGR of 6.53% from 2025 to 2034.

North America held the largest share of the healthcare analytical testing services market in 2024. This is due to its advanced healthcare infrastructure and significant investment in research and development. North America has well-established pharmaceutical and biotechnology industries that boost a high need for analytical testing services to support the development of drugs, clinical trials, and regulatory compliance.

- In February 2024, Celerion declared the attainment of Clinical Laboratory Improvement Amendments (CLIA) certification for its cutting-edge bioanalytical laboratory. This milestone reinforces Celerion's dedication to advancing healthcare through high-complexity testing and diagnostic services, improving its role in clinical trials and patient care.

North America: U.S. Healthcare Analytical Testing Services Market Trends

The U.S. market is witnessing strong growth as pharmaceutical and biotech companies increasingly outsource testing to specialized labs to access advanced technologies without heavy in-house investment. The rising complexity of drugs, including biologics, biosimilars, gene therapies, and viral vectors, is driving demand for sophisticated analytical techniques such as high-resolution mass spectrometry and bioanalytical assays. Strict regulatory requirements for quality, stability, extractables/leachables, and method validation are pushing firms to rely on audit-ready, high-integrity testing services.

Asia Pacific is observed to host the fastest-growing healthcare analytical testing services market during the forecast period. The rising healthcare demands, a growing focus on drug development, clinical research, and economic development in the region are boosting the market growth. The increasing regulatory and quality control needs significantly contributed to the market's expansion in Asia-Pacific.

Asia Pacific: China Healthcare Analytical Testing Services Market Trends

China's market is rapidly expanding, driven by a surge in domestic pharmaceutical R&D and biopharma development, especially in biologics and biosimilars. The country is increasingly outsourcing analytical testing, including bioanalytical and stability testing, to CROs as companies look to scale more cost-effectively. Regulatory requirements in China are becoming stricter, pushing firms to demand high quality, audit-ready testing services to meet local and global standards.

As the biopharmaceutical industries grow, so does the demand for compliance with stringent international and local regulations standards enhancing. This has improved regulatory scrutiny necessitates comprehensive and reliable analytical testing services to guarantee that products meet safety, efficacy, and quality benchmarks before reaching the market.

- GBA Group has obtained a significant stake in Eureka Analytical Services (Eureka) testing labs and inspection service providers. This investment marks the GBA Group's entry into India. Starting with this investment, GBA will continuously seek opportunities for further investment in India's food, pharma, and environment testing market.

Why did Europe grow steadily in the healthcare analytical testing services market?

Europe's growth trajectory was steady due to strong regulatory frameworks, the continued expansion of biologics capacity, and increasing investments in advanced drug development. Several countries in Europe developed their GMP laboratories (a process that included adding new staff) and also encouraged innovation and investment in analytical testing methodologies. It was a major opportunity region for biosimilars testing, sterile manufacturing testing, and specialty bioanalytical testing. Furthermore, partnerships for research from CROS and the pharma company also supported the market expansion.

Germany Healthcare Analytical Testing Services Market Trends

Germany was the leading European country in the market because of its strong pharmaceutical base and growing manufacturing capacity within the country. Furthermore, Germany played a more significant testing role for pharma companies because of their stringent quality requirements that increased the demand for testing services. Global companies had many major laboratories in Germany because of its good infrastructure, skilled workers, and emerging opportunities in biologics testing, stability studies, and advanced chromatography.

What made Latin America grow substantially in the healthcare analytical testing services market?

Latin America has substantial potential as pharmaceutical and biotech activities are expanding in the region. The region has invested in improving regulatory systems and building modern testing labs. Likewise, analytical testing is necessary due to an increased demand for generics, vaccines, and biologics. There are also high-growth opportunities in outsourcing, microbiology testing, and quality control services in Latin America, while many countries have prioritized developing partnerships with global companies to increase capacity.

Brazil Healthcare Analytical Testing Services Market Trends

Brazil was the leading country in the Latin American region as it has the largest pharmaceutical sector in the region and is receiving strong support from the government to develop vaccines and biologics. Brazil also developed GMP-compliant lab facilities and partnered with global CROs to respond to the rising testing needs. Stability testing, bioanalysis, and QC outsourcing directly increased opportunities in Brazil as healthcare demand and manufacturing activities increased.

What made the Middle East and Africa experience progressive growth in the healthcare analytical testing services market?

The Middle East and Africa experienced progressive growth as countries committed to modernizing healthcare, local manufacturing of pharmaceuticals, and improving laboratory systems. There was a rising demand for testing of generic pharmaceuticals, vaccines, and other imported medications. The region also provided opportunities in microbiology testing, stability studies of medications, and quality control testing of medications manufactured in other countries. Governments were promoting engagement with international companies in a testing capacity to grow and expand systems and processes and increase regulations above acceptable levels.

The UAE Healthcare Analytical Testing Services Market Trends

The UAE led the region largely due to increased investment in healthcare, a sophisticated laboratory infrastructure, and burgeoning pharmaceutical imports. The country is focused on improvements in regulatory systems and is designed to attract international/global companies to test pharmaceuticals. Furthermore, opportunities in QC testing, microbiology, and bioanalysis arose naturally as the country expanded its research and healthcare facilities.

Healthcare Analytical Testing Services Market Companies

- Thermo Fisher Scientific, Inc.

- ICON plc

- LabCorp

- Charles River Laboratories International, Inc.

- Toxikon, Inc.

- Intertek Group

- Eurofins Scientific

- Pace Analytical Services, LLC

- Syneos Health

- SGS SA

Latest Announcements by Industry Leaders

- In February 2024, Thermo Fisher Scientific Inc. will add mycoplasma and additional biosafety testing capabilities to its enlarging portfolio of services at its good manufacturing practices lab. This new service, provided by the analytical testing service of the clinical research business, guarantees that biopharmaceutical goods are free of contaminants, helping consumers deliver safe medicines for patients.

Recent Developments

- In March 2024, LGM Pharma declared a significant enhancement of its capabilities: a 50% expansion and an investment crossing USD 2 million in its standalone providing for Analytical Testing Services along with the introduction of new suppository manufacturing capabilities to its contract development and manufacturing portfolio.

- In January 2024, Kindeva Drug Delivery initiated a new global business unit offering integrated and stand-alone analytical support to the wider pharmaceutical, biopharmaceutical, and medical device fields. Kindeva has developed significant knowledge, experience, and expertise working on inhaled, injectable, and transdermal drug delivery development programs and cGMP commercial supply for over half a century.

Segments Covered in the Report

By Type

- Medical Device Analytical Testing Services

- Extractable and Leachable

- Material Characterization

- Physical Testing

- Bioburden Testing

- Sterility Testing

- Other Tests

- Pharmaceutical Analytical Testing Services

- Bioanalytical Testing

- Method Development and Validation

- Stability Testing

- Other Testing Services

By Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting