What is the Hemodynamic Monitoring Systems Market Size?

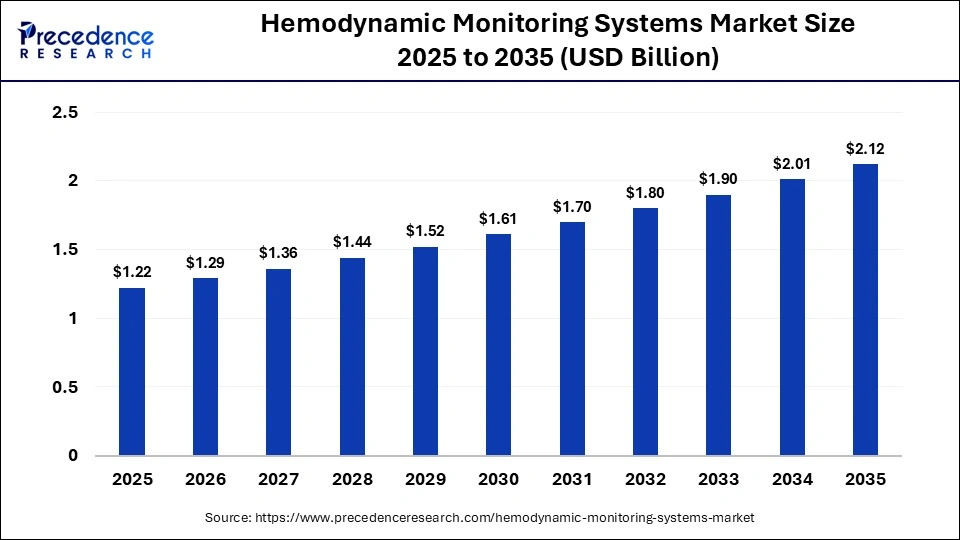

The global hemodynamic monitoring systems market size was calculated at USD 1.22 billion in 2025 and is predicted to increase from USD 1.29 billion in 2026 to approximately USD 2.12 billion by 2035, expanding at a CAGR of 5.68% from 2026 to 2035.The hemodynamic monitoring systems market is experiencing unprecedented growth, driven by the rising geriatric population and the rising prevalence of chronic conditions such as COPD and cardiovascular diseases (CVDs).

Market Highlight

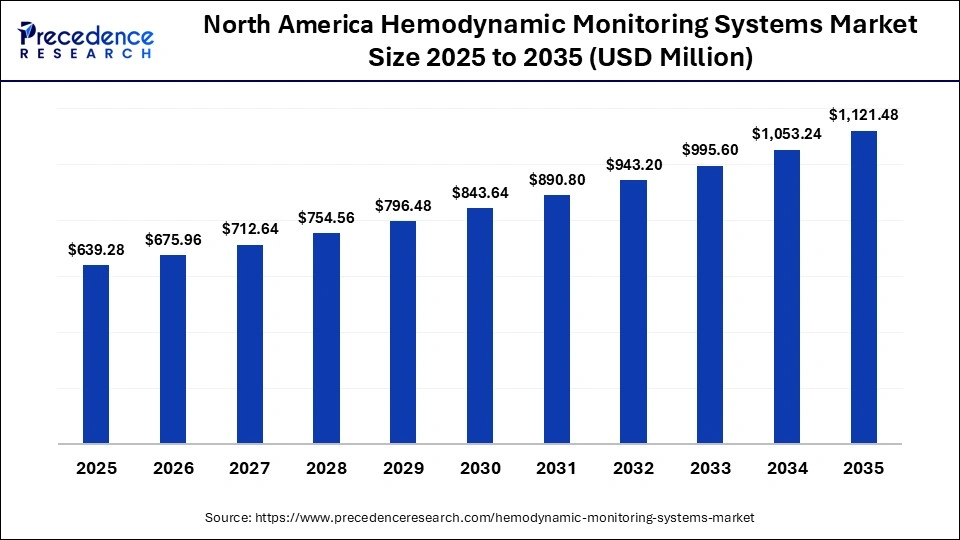

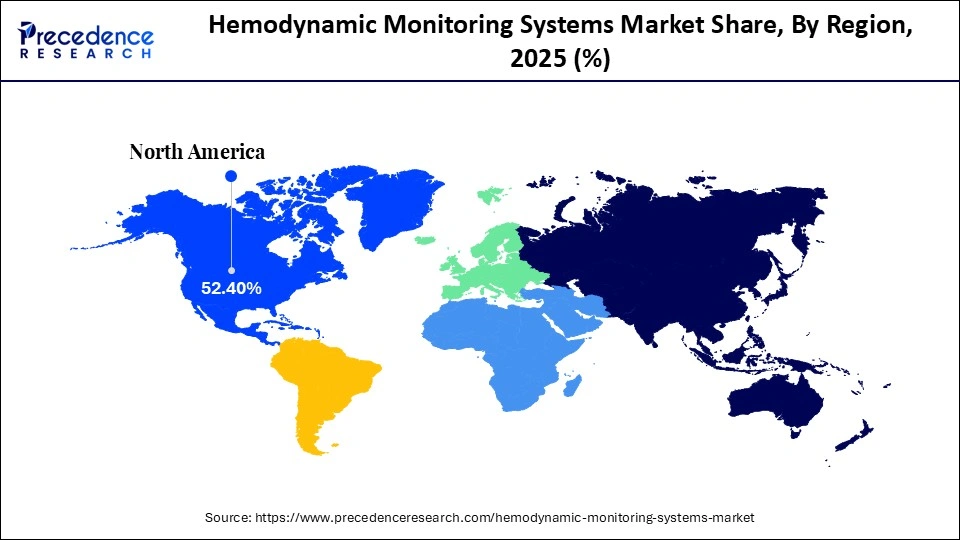

- North America dominated the market, holding the largest market share of 52.4% in 2025.

- Asia-Pacific is expected to grow at the fastest CAGR of 6.0% between 2026 and 2035.

- By system/type, the invasive systems segment held the largest market share of 52.4% in 2025.

- By system/type, the non-invasive systems segment is expected to grow at a CAGR of 5.4% between 2026 and 2035.

- By application, the critical care segment held the largest share of 46.5% in 2025.

- By application, the cardiac surgery segment is set to grow at a CAGR of 5.1% between 2026 and 2035.

- By end-use, the hospitals segment held the largest market share of 58.7% in 2025.

- By end-use, the ambulatory surgical segment is expected to experience remarkable growth of 5.3% between 2026 and 2035.

- By product/component, the monitors/systems segment captured the largest market share of 62.4% in 2025.

- By product/component, the disposables/sensors segment is growing at a CAGR of 5.2% between 2026 and 2035.

Hemodynamic Monitoring Systems Market Overview

The hemodynamic monitoring systems market includes medical devices and technologies that measure and monitor cardiovascular parameters such as blood pressure, cardiac output, and blood flow to support clinical decision-making in critical care, surgical, and chronic disease settings. These systems range from invasive catheter-based technologies to minimally invasive and noninvasive monitors equipped with advanced analytics. Hemodynamic monitoring systems evaluate heart function and tissue perfusion, which is critical for managing critically ill patients and preventing organ dysfunction. By providing continuous, real-time data, these systems enable clinicians to optimize oxygen delivery and fluid management for vital organs.

Market growth is supported by rising ICU admissions, increasing surgical volumes, and a growing burden of cardiovascular and septic conditions. Advances in sensor technology and algorithm-based interpretation are improving accuracy while reducing procedural risk. Adoption of minimally invasive and noninvasive systems is increasing due to lower complication rates and ease of use. Integration with electronic health records and bedside monitoring platforms is enhancing clinical workflow efficiency. Expanding use in perioperative care and emergency medicine is further broadening application scope.

How Are AI-Driven Innovations Reshaping the Hemodynamic Monitoring Systems Sector?

In the rapidly evolving technological landscape, the integration of Artificial Intelligence (AI) is driving innovation and accelerating the growth of the hemodynamic monitoring systems sector through predictive patient care, providing proactive alerts, reduced false alarms, enhanced diagnostic accuracy, and personalized treatment. AI-driven innovation is significantly enhancing the reliability and accuracy of non-invasive and minimally invasive cardiac monitoring technologies. Artificial intelligence (AI) is overcoming the limitations associated with traditional approaches, offering real-time insights that contribute to improved patient outcomes. AI can substantially reduce alarm fatigue by providing real-time monitoring.

Machine learning algorithms can efficiently process complex data from various non-invasive sensors to improve the precision of cardiac output estimates and provide crucial insights for clinical decision-making. ML algorithms provide an understanding of a patient's cardiovascular status that can assist the healthcare professional's decision-making abilities and improve treatment outcomes.

Smith and Wood found that 51% of patients had one or more abnormal vital signs in the form of tachycardia, hypotension, hypo or hyperthermia, tachypnea, altered mental status, or decreased urine output in the 24 hours before their cardiac arrest. These warning signs often go unnoticed. AI provides real-time monitoring in hemodynamic assessment involving the continuous analysis of physiological data, such as blood pressure, heart rate, and cardiac output.

Hemodynamic Monitoring Systems Market Outlook

- Industry Growth Overview: Between 2026 and 2035, the industry is expected to experience accelerated growth. The growth of the hemodynamic monitoring systems market is driven by increasing prevalence of cardiovascular disease, rising geriatric care needs, and the increasing shift toward remote and continuous patient monitoring. The market's expansion is also supported by rapid technological innovation in hemodynamic monitoring devices and the rising number of surgeries.

- Global Expansion: Several leading players in the hemodynamic monitoring systems industry are expanding their global reach, particularly into the established North American and European markets, and targeting the emerging Asia-Pacific market through various strategic initiatives like new product launches (non-invasive, AI-driven solutions), acquisitions, and partnerships or collaborations. Companies are primarily focusing on broadening their reach to meet the rising healthcare needs.For instance, in January 2023, Canon Medical Systems USA, a subsidiary of Canon Medical Systems Corp., announced a new strategic partnership expected to increase the company's presence in the cardiovascular market. The partnership is with ScImage, a California-based healthcare technology company known for its extensive enterprise imaging background. The two companies plan to work toward expanding Canon's hemodynamics footprint by putting more time and energy into Fysicon's QMAPP Hemodynamics solutions.

- Major Investors: Several strategic investors and companies, including both established medical device manufacturers and specialized technology firms. The prominent companies, such as Edwards Lifesciences Corporation, Koninklijke Philips N.V., GE HealthCare, Baxter International Inc., and others, are actively engaged in the hemodynamic monitoring systems market, which is heavily investing in research and development to meet growing demands and incorporate advanced technologies such as advanced sensors, wireless connectivity, and data analytics. Thereby accelerating market growth during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.22 Billion |

| Market Size in 2026 | USD 1.29 Billion |

| Market Size by 2035 | USD 2.12 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.68% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | System/Type, Application, End-Use, Product/Component, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

System/Type Insights

What Has Led the Invasive Systems Segment to Dominate the Hemodynamic Monitoring Systems Market in 2025?

The invasive systems segment is dominating the hemodynamic monitoring systems market with the largest market share of 52.4% in 2025, owing to the increasing number of complex surgeries like cardiac and transplants being conducted throughout the global healthcare system. These invasive systems play a crucial role in high-risk surgeries and severe conditions where non-invasive methods fall short. Invasive systems provide direct and precise measurements for managing high-risk cardiac situations such as trauma, severe cardiac arrest, and septic shock. Moreover, the rapid technological innovations in catheter design and digital integration are pushing the demand for robust invasive solutions in hospitals, particularly for advanced triage in operating rooms and ICUs.

The non-invasive systems segment is a rapidly growing segment and is expected to experience a remarkable growth rate of 5.4% between 2026 and 2035. Non-invasive systems offering real-time insights into cardiovascular status for guiding treatment pose no additional risk to the patient as well as allow much earlier application and diagnosis. Non-invasive hemodynamic monitoring systems track blood flow and pressure without harming the skin, using modern technologies like pulse oximetry, photoplethysmography, bioimpedance/bioreactance, pulse wave analysis, and point-of-care ultrasound (POCUS). Non-invasive hemodynamic monitoring is safer, provides greater patient comfort, and is easier to use compared to invasive methods, making it ideal for widespread chronic patient care.

Application Insights

Which Segment Dominated Applications in the Hemodynamic Monitoring Systems Market?

The critical care segment is dominating the hemodynamic monitoring systems market by holding a majority share of 46.5% during 2025. In critical care, a hemodynamic monitoring system measures the circulatory status of a patient, providing real-time information about blood flow, heart function, and the ability of the circulatory system to deliver oxygen and nutrients. The growth of the segment is majorly driven by the increasing trend towards non-invasive technology and the growing risk of heart disease, even among relatively younger patients. This is coupled with respiratory failures caused by pollution and other related factors, shock, trauma, and sepsis, leading to growth in the segment. Geriatric populations are also more susceptible to cardiac illnesses, leading to more ICU admissions and increasing the need for sophisticated hemodynamic monitoring.

The cardiac surgery segment is the fastest-growing segment in the hemodynamic monitoring systems market, and the segment is set to grow at a notable CAGR of 5.1% between 2026 and 2035. The rising cases of heart failure, hypertension, and cardiovascular diseases (CVDs) globally necessitate cardiac surgeries, which propel the demand for real-time hemodynamic data of blood flow and cardiac output assessment to improve overall treatment outcomes. Hospitals are increasingly adopting hemodynamic monitoring systems to enhance safety and quality of care in cardiac surgeries.

End-user Insights

What Causes the Hospital Segment to Dominate the Hemodynamic Monitoring Systems Industry?

The hospital segment is dominating the hemodynamic monitoring systems market with a 58.7% market share in 2025, owing to the high patient volumes and chronic diseases such as heart failure, sepsis, respiratory failure, shock, and trauma. Hospitals are the largest end-users in the hemodynamic monitoring systems industry. Hospitals have established infrastructure, skilled staff, and significant investment in modern technology for critical care. In hospitals, hemodynamic monitoring is widely used in Intensive Care Units (ICUs), operating rooms (ORs), and catheterization labs (Cath Labs) for managing blood pressure, cardiac assessment output, and guiding therapy. The use of this technology leads to improved patient outcomes in hospitals.

The ambulatory surgical segment is expected to grow at a significant CAGR of 5.3% between 2026 and 2035. Ambulatory Surgical Centers (ASCs) are gaining popularity owing to their cost-effectiveness, operational efficiency, and growing demand for minimally invasive outpatient procedures. Hemodynamic monitoring systems in these facilities ensure patient safety during and after surgical procedures and facilitate quicker patient recovery times. The rise in the number of surgical procedures performed in ASCs increases the demand for compact, easy-to-use, and continuous hemodynamic assessment solutions.

Product/Component Insights

What Caused the Monitors/Systems Segment to Dominate the Hemodynamic Monitoring Systems Market in 2025?

The monitors/systems segment held the largest market share of 62.4% in 2025. The increasing global burden of cardiovascular diseases like hypertension, heart failure, and others, and the surge in the number of surgical procedures are anticipated to fuel the need for continuous hemodynamic monitoring. Monitoring provides crucial real-time and precise patient data for managing critically ill heart patients, especially in ICUs.

The disposables/sensors segment is expected to grow at a remarkable CAGR of 5.2% between 2026 and 2035, owing to the increasing incidence of cardiovascular diseases, an aging population, and growing demand for infection control. The use of single-use sensors reduces the risk of healthcare-associated infections and cross-contamination, which makes them a preferred choice in clinical and home settings. Moreover, the rising trend of miniaturization, integration with AI, and wireless capabilities significantly enhances sensor performance.

Regional Insights

How Big is the North America Hemodynamic Monitoring Systems Market Size?

The North America hemodynamic monitoring systems market size is estimated at USD 639.28 million in 2025 and is projected to reach approximately USD 1,121.48 million by 2035, with a 5.78% CAGR from 2026 to 2035.

Why Was North America Dominating in the Hemodynamic Monitoring Systems During 2025?

North America dominated the hemodynamic monitoring systems market in 2025, holding the majority of the revenue share at 52.4%. The region benefits from advanced healthcare infrastructure, including well-developed hospitals, nursing homes, and ambulatory surgical centers that are rapidly adopting hemodynamic monitoring technologies. Growth is driven by early technology adoption, rising prevalence of chronic and cardiovascular diseases, an expanding elderly population, and a strong focus on patient safety in critical care environments. Increasing uptake of telemedicine and demand for remote monitoring solutions are further supporting market expansion.

High ICU admission rates and complex surgical procedures are increasing routine use of continuous hemodynamic monitoring. Strong reimbursement coverage for critical care monitoring is improving accessibility across care settings. Clinical adoption is accelerating for wireless, AI-enabled, and noninvasive monitoring platforms that reduce procedural risk. Ongoing innovation by established device manufacturers is reinforcing North America's leadership in this market.

- In July 2025, ECU Health North Hospital announced the installation of a cutting-edge hemodynamic monitoring system in its Cardiac Catheterization Laboratory (Cath Lab), marking a significant advancement in cardiovascular care for the Community.

What is the Size of the U.S. Hemodynamic Monitoring Systems Market?

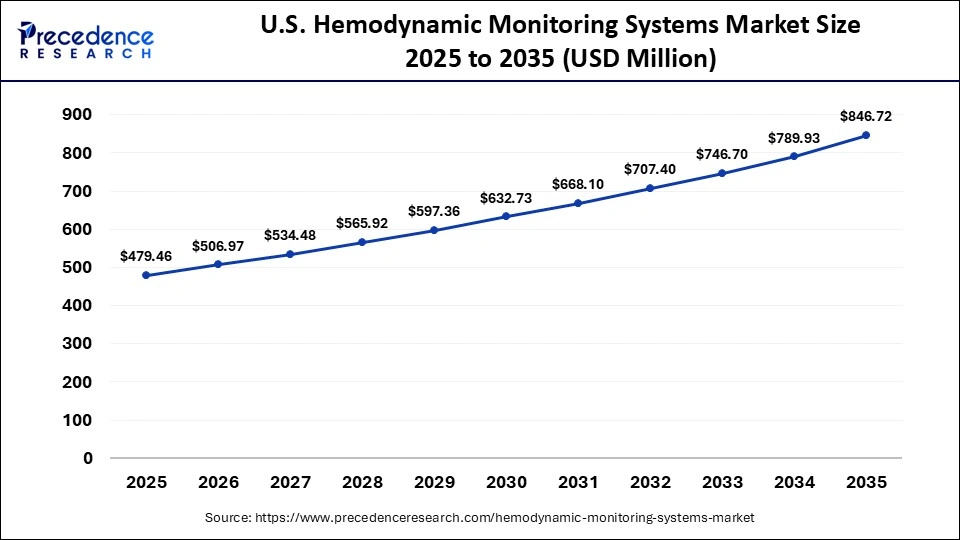

The U.S. hemodynamic monitoring systems market size is calculated at USD 479.46 million in 2025 and is expected to reach nearly USD 846.72 million in 2035, accelerating at a strong CAGR of 5.85% between 2026 and 2035.

U.S. Hemodynamic Monitoring Systems Industry Trends

The United States leads the hemodynamic monitoring systems industry in the North American region. The country is a major contributor to the market for hemodynamic monitoring systems due to its strong healthcare infrastructure and presence of key industry players like Edwards Lifesciences, Tensys Medical, Philips Healthcare, Medtronic, and GE HealthCare. The growth of the country is fueled by rising cardiovascular disease prevalence, rising clinical needs, and rapid technological progress. The significant government (NIH) and private investment in cardiovascular research to advance monitoring technologies for better patient outcomes.

The rise in the number of heart disease deaths creates demand for effective monitoring systems. For instance, according to the American Heart Association's 2025 Heart Disease and Stroke Statistics Update, heart disease remains the leading cause of death in the U.S. Cardiovascular diseases, including heart disease and stroke, claim more lives in the U.S. than all forms of cancer and accidental deaths. Nearly 2,500 people in the U.S. die from cardiovascular disease every day. According to the Association's 2025 report, in 2022 (the most recent year for which final data is available), the overall number of cardiovascular disease (CVD)-related deaths in the U.S. was 941,652, an increase of more than 10,000 from the 931,578 CVD deaths in 2021.

Why Is Asia Pacific Showing Signs of the Fastest Growth in the Hemodynamic Monitoring Systems Market?

Asia Pacific is the fastest-growing region and is expected to expand at the fastest CAGR of 6.0% in the hemodynamic monitoring systems market between 2026 and 2035. This growth is driven by rapid expansion of healthcare infrastructure, a sharply rising aging population, and increasing demand for advanced monitoring solutions in both hospital and home-care settings. Governments across the region are investing heavily in critical care capacity, emergency medicine, and perioperative monitoring as part of broader healthcare system upgrades. Rising prevalence of chronic conditions such as cardiovascular diseases, respiratory failure, trauma, and sepsis is increasing clinical reliance on continuous hemodynamic assessment to guide timely interventions. The shift toward personalized and protocol-driven care pathways is further reinforcing demand for real-time cardiovascular monitoring tools.

Growing adoption of minimally invasive and noninvasive monitoring technologies is accelerating uptake in resource-variable clinical settings. Expansion of tertiary hospitals and ICU beds in urban centers is increasing procurement of advanced monitoring platforms. Local manufacturing and technology partnerships are improving affordability and access to hemodynamic devices across emerging markets. Integration of digital health platforms and remote monitoring is supporting use beyond traditional ICUs. Together, infrastructure investment, disease burden, and technology diffusion are positioning Asia Pacific as the most dynamic growth region for hemodynamic monitoring systems.

India Hemodynamic Monitoring Systems Industry Trends

India is experiencing significant growth in the hemodynamic monitoring systems market, supported by the rising healthcare expenditure, the surging aging population, and supportive government initiatives for better healthcare infrastructure. The increasing burden of heart disease, hypertension, shock, trauma, sepsis, and COPD is driving significant innovation in hemodynamic monitoring systems. The rising R&D investment and the strong presence of major manufacturers foster innovation in both invasive and noninvasive systems.

Why Is Europe Seeing Notable Growth in the Hemodynamic Monitoring Systems Market?

The Europe region holds a substantial market share in the hemodynamic monitoring systems market. The growth is largely driven by the increasing patient population of chronic diseases, a surge in the older population, an increasing shift to personalized care, and high healthcare spending. The region is experiencing a strong shift toward noninvasive, continuous, and AI-integrated technologies. These advancements improve patient safety and comfort while providing accurate and real-time data for proactive clinical decision-making. Moreover, the established presence of a large number of hospitals, ambulatory surgical centers (ASCs), home care, and nursing homes is anticipated to boost the growth of the hemodynamic monitoring systems sector in the region.

Germany Hemodynamic Monitoring Systems Market Trends

Early and widespread adoption of advanced monitoring technologies in Germany, built on the back of a strong healthcare infrastructure offering an extensive hospital network and advanced surgical care capabilities, is creating demand for advanced monitoring systems. The hemodynamic monitoring systems market is experiencing significant growth, driven primarily by the increasing incidence of heart diseases, the wide availability of trained clinicians, the rising preference for telehealth services, the growing number of surgeries, and rapid technological advancements in hemodynamic monitoring devices. Several companies are increasingly integrating artificial intelligence (AI) and machine learning into monitoring systems to analyze large volumes of data, provide predictive insights, and offer early warning signs of potential complications.

Why Are the Middle East & Africa Expected to Grow at a Notable Rate in the Hemodynamic Monitoring Systems Market?

The hemodynamic monitoring systems market is expected to grow at a notable rate in the Middle East & Africa region. The Middle East & Africa region's growth is primarily driven by the improving healthcare infrastructure, increasing focus on improving patient care, rising awareness of remote, home-based, and portable monitoring solutions, and a rising elderly population prone to chronic conditions like heart and respiratory failure, shock, sepsis, and hypertension. The region is also strongly focused on medical innovation and the significant adoption of advanced technologies, including AI-enabled and minimally invasive systems. Such a combination of factors is expected to propel the growth of the hemodynamic monitoring systems industry during the forecast period.

In January 2025, Royal Philips, a global leader in health technology, will showcase its latest healthcare innovations at Arab Health 2025. These solutions aim to empower hospitals and health systems in delivering better care for more people. Philips showcases healthcare innovations, focusing on diagnostic solutions, hospital patient monitoring, precision care, and informatics. These industry-leading solutions, including cloud-based data management, advanced visualization, automation, and AI, aim to reduce administrative burdens, optimize workflows, and empower clinicians with insights to enhance experiences and improve patient outcomes.

South Africa Hemodynamic Monitoring Systems Sector Trends

South Africa is experiencing remarkable growth in the market due to increasing investments in modern hospitals and critical care facilities boosting demand for advanced monitoring of heart conditions. Factors like a growing geriatric population, increasing burden of chronic diseases, rising regulatory support, and increased healthcare spending are driving demand for sophisticated monitoring solutions, strengthening the market position in the South Africa The rapid technological innovation and rising government initiatives focus on upgrading healthcare services and supporting market growth for advanced, non-invasive, and home-based monitoring solutions. These factors collectively are expected to fuel the expansion of the hemodynamic monitoring systems sector in the coming years.

Who are the major players in the global hemodynamic monitoring systems market?

The major players in the hemodynamic monitoring systems market include Edwards Lifesciences, Philips Healthcare, GE Healthcare, Medtronic, Siemens Healthineers, Getinge (Pulsion), ICU Medical, LiDCO Group, CNSystems Medizintechnik, Nihon Kohden, Osypka Medical, Deltex Medical, Cheetah Medical/Baxter (brand acquisitions), Draegerwerk, and Tensys Medical.

Recent Developments

- In April 2025, Medtronic, a global leader in healthcare technology, announced that it had agreed with Retia Medical, an innovative digital health company that develops advanced hemodynamic solutions, to distribute the Argos cardiac output monitor. The Argos monitor provides healthcare professionals with accurate hemodynamic data to support the treatment of high-risk surgical and critically ill patients.(Source: https://news.medtronic.com)

- In April 2025, BD (Becton, Dickinson and Company), a leading global medical technology company, launched a new advanced hemodynamic monitoring platform using predictive, artificial intelligence (AI)-based algorithms that can help clinicians proactively address blood pressure instability and optimize blood flow to help avoid potential life-threatening situations during procedures.(Source: https://investors.bd.com)

Segments Covered in the Report

By System/Type

- Invasive

- Minimally Invasive

- Non-Invasive

By Application

- Critical Care

- Cardiac Surgery

- Emergency Medicine

- Anesthesia/Pulmonary Medicine

By End-Use

- Hospitals

- Ambulatory Surgical Centers

- Clinics/Specialty Centers/Home Healthcare

By-Product/Component

- Monitors/Systems

- Disposables/Sensors

- Catheters

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting