What is High-Purity Quartz Market Size?

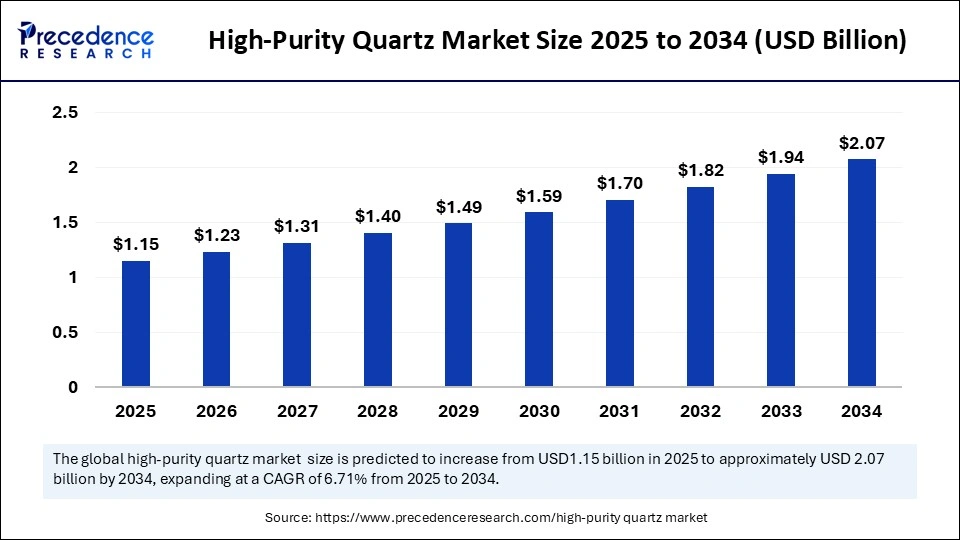

The global high-purity quartz market size accounted for USD 1.15 billion in 2025 and is predicted to increase from USD 1.23 billion in 2026 to approximately USD 2.07 billion by 2034, expanding at a CAGR of 6.71% from 2025 to 2034. Advances in chip making, a rise in solar power, and quicker fiber-optic connections are projected to push the high-purity quartz market towards steady growth.

Market Highlights

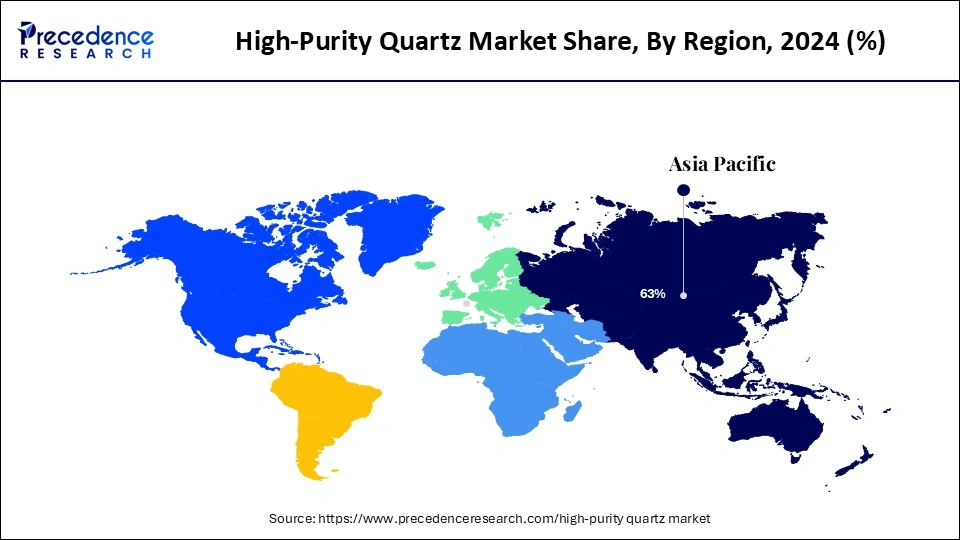

- Asia Pacific accounted for the largest market 63% in 2024.

- North America is expected to grow at the fastest CAGR of 6.62% during the forecasted years.

- By form, the sand segment held a significant share in 2024.

- By form, the powder segment is anticipated to show considerable growth in the market over the forecast period.

- By purity, the 99.997% and 99.998% SiO2 segments held a significant share in 2024.

- By purity, the 99.99% SiO2 segment is anticipated to show considerable growth in the market over the forecast period.

- By application, the semiconductors segment held a significant share in 2024.

- By application, the telecommunication and optics segment is anticipated to show considerable growth in the market over the forecast period.

- By end-use, the electrical and electronics sector held a significant share in 2024.

- By end-use, the energy and power segment is anticipated to show considerable growth in the market over the forecast period.

Artificial Intelligence Integration in the High-Purity Quartz Market

Smart artificial intelligence is helping to make the production of high-purity quartz easy and efficient. The sensors on crushers, magnetic separators, and reactors help machine-learning models change the time, amount of reagents, and furnace temperature to maintain a purity of over 99.995%. By using AI, we can detect small metal pollutants in the plasma and computers equipped with vision analyze the shape of the crystal to separate suitable material instantly. AI makes such technology affordable for others, motivates new entrants, and speeds up the use of HPQ silicon in these industries.

Market Overview

High purity quartz (HPQ) is a highly purified SiO? with very few iron, aluminum, titanium, and alkali metals. The best optical clarity, thermal consistency, and good insulation highly depend on purity; the presence of HPQ matters wherever these characteristics are vital. Quartz is so pure that it is used for forming silicon, focusing light in electronics factories, making high-performance lamps, and building fiber-optic cable. HPQ is serving as the foundation for chips that support AI technology, devices that collect solar energy, and eyeglass frames that transmit large amounts of data.

The rapid adoption of 5G, AI, and edge computing, the production of wafers grows a lot and uses even more quartz. With the rise in renewable energy, there is a need for more solar-grade polysilicon, as creating each gigawatt of solar panels requires large amounts of HPQ for its necessities. In addition, HPQ silica is used to produce link connections for modern internet and data centers. Using ultraviolet-C germicidal lamps, quantum-computing cryostat windows, and high-temperature aerospace ceramics is paving the way for new opportunities.

Growth Factors of High-Purity Quartz Market

- Shrinking the Structure of Very Large-Scale Integration (VLSI) Circuits: Contamination during crystal growth and plasma etching is avoided when using ultra-clean quartz crucibles, tubes, and photomask substrates. Fewer nodes in a chip require a more complex and pure HPQ, leading to steady and ongoing demand for this product.

- Construction of Fiber-Optic Technology:Silica preforms created from HPQ are extremely pure to ensure the best possible signal is maintained. With national broadband programs and increases in interconnection at big data centers, fiber is being deployed at more points in the network, providing the Corporation with strong and broad HPQ demand.

- Advancements in High-Tech:Since UV-C germicidal lamps, quantum-computing windows, aerospace thermal barriers, and advanced lithography optics are developing, the quartz used must have only minor impurities to last long and operate effectively. They sell for higher prices and grow quickly, making them positive contributors to the company's growing profits.

Market Scope

| Report Coverage | Details |

| Market Size by 2025 | USD 1.15 Billion |

| Market Size in 2026 | USD 1.23 Billion |

| Market Size in 2034 | USD 2.07 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.71% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Form, Purity, Application, End use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing adoption of quartz in the solar industry

More renewable energies mean that HPQ is increasingly important for the growth of solar-PV technology. The HPQ sand with a purity of 99.995 %+ can survive the challenges posed by the thermal and chemical effects in quartz crucibles for making silicon ingots into crystalline-silicon (c-Si) solar cells. With cost reductions and enhanced performance, more solar sign-ups are taking place as governments support both rooftops and large-scale projects. The increasing number of kerf-free and big-wafer approaches use a greater number of crucibles, thereby raising the amount of quartz required. The continuous expansion of the solar industry, along with increased purity demands, is expected to be the biggest driver for the global high-purity quartz market in the upcoming decade.

Restraint

Volatility of raw material prices and the high cost of quartz

The irregular supply of raw materials and the extra costs of processing them are the main problems for the HPQ market. HPQ feedstock is mined, and its output will be limited over time by weather conditions, regulatory issues, and political influences. A disturbance may lead to sudden price changes and cut the profits of companies that work with very narrow profit margins, such as refiners and those making semiconductors or solar panels. Traces of contamination make HPQ unfit for use in photolithography or polysilicon, so factories will not be able to use it as a substitute without lengthy and expensive reprocessing.

Opportunity

Expanding Demand from Telecom and Optics Industries

The HPQ industry is benefiting greatly from the telecom, optics, solar, and semiconductor sectors, all of which are growing rapidly. To manufacture optical fibers used in advanced internet and 5G, it is vital that HPQ has high purity and is extremely clear. They not lose signals and must be able to transmit them quickly to make data transfer dependable and swift.Due to widespread 5G deployments around the world, there is are higher needs for high-performance optical fiber cables which results in HPQ being consumed at a faster rate. HPQ manufactures high-quality lenses, laser optics and components for use in the medical, aerospace and defense fields. This trend allows manufacturers to make changes, increase their making power and gain more share in industries that are growing fast.

Segment Insights

Form Insights

The sand segment led the high-purity quartz market and accounted for the largest revenue share in 2024. Quartz sand is important for progress in aerospace, electronics, machinery, IT, petroleum, and other areas. The semiconductor industry requires high-purity quartz sand, since it cannot be replaced in the production of silicon wafers and similar products. Quartz sand is also in high demand from the solar industry because its components are needed for photovoltaic cells.

The powder segment is expected to grow at a significant CAGR over the forecast period. Quartz powder is widely used because of its fine grains and usability in various fields, especially where items must be exceptionally pure and finely processed. Because elemental selenium is commonly used as a powder, it is easier to add it to modern manufacturing and produce better electronic and solar products. An increase in demand for efficient and small semiconductor parts and high-functioning photovoltaic cells calls for more high-quality quartz powder.

Purity Insights

The 99.997% and 99.998% SiO2 contributed the most revenue in 2024 and are expected to dominate throughout the projected period. These purity grades do not contain many contaminants, they are essential for the semiconductor, aerospace, and leading optics industries. Where semiconductor gadgets and solar cells are made, purity is essential, so they are made with ultrahigh-purity quartz. The demand for powerful and efficient technology is fueling a greater demand for these highly pure types of quartz. Since companies aim for greater accuracy and better outcomes, the ultrahigh and hyper-purity segments are expected to continue to grow

The 99.99% SiO2 segment is expected to grow substantially in the high-purity quartz market. It is employed in so many semiconductor plants and products for solar panels and high-quality optical gadgets. Having a high purity is key for silicon wafers in semiconductors and solar cells, as any small impurity can harm their function. Due to the world's focus on clean energy and constant progress in computer chips, more than 99.99% pure quartz will be needed. The market share of this grade is increasing because it is highly pure and costs less to make than ultra- and hyper-pure semiconductors.

Application Insights

The semiconductors sector contributed the most revenue in 2024 and is expected to dominate throughout the projected period. In the semiconductor industry, high-purity quartz is needed because it forms wafers, crucibles, glass, windows, rods, tubes, and quartz caps. Since the purity of the material is very high, these silicon devices function well, and their reliability improves. Besides, as electronics in general and consumer electronics, vehicles, and telecom continue to grow, they play an essential role in the rise of this segment. The technology depends greatly on semiconductors, and the use of high-purity quartz should continue to shape the industry.

The telecommunication and optics segment is expected to grow substantially in the high-purity quartz market. They are needed to build high-speed internet, 5G networks, and sponsored communication systems. As more people access high-speed internet, the quick release of 5G technology and greater data usage boost the usage of fiber-optic cables that are made from pure quartz. The market for high-purity quartz in telecommunications and optics is growing because of the steady development of optical technologies.

End-use Insights

The electrical and electronics industry contributed the most revenue in 2024 and is expected to dominate throughout the projected period. With the advancements in artificial intelligence, the Internet of Things, and 5G technology, there will be a strong increase in demand for high-purity quartz in the electronics industry. There is a growing demand for materials made from high-purity quartz in the electrical and electronics sector due to the constant increase in function and decreasing size of electronic products.

The energy and power segment is expected to grow substantially in the high-purity quartz market. Many power plants use quartz as it resists heat well and protects electricity. The quicker rise of renewable energy and favorable measures will cause solar energy to improve at a faster rate, which is estimated to trigger greater demand for high-purity quartz. Using clean energy and other tactics for sustainable growth is impacting the increasing popularity of this sector.

Regional Insights

Asia Pacific High-Purity Quartz Market Size and Growth 2025 to 2034

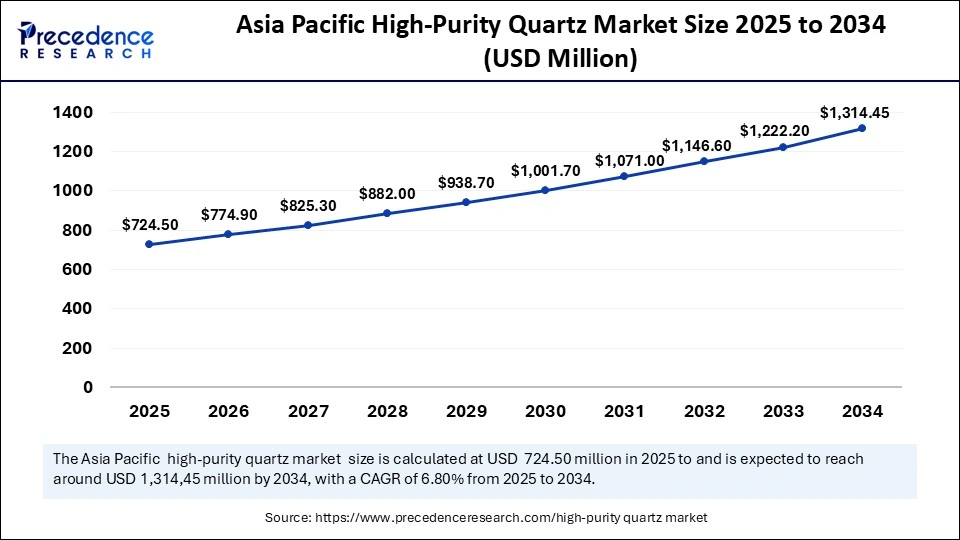

The Asia Pacific high-purity quartz market size is exhibited at USD 724.50 million in 2025 and is projected to be worth around USD 1,314.45 million by 2034, growing at a CAGR of 6.80% from 2025 to 2034.

Asia Pacific held the major market share of 63% in 2024. Japan, South Korea, Taiwan, and China depend heavily on HPQ to provide silicon wafers needed in integrated circuits. The industry grows because there is greater demand for advanced microchips, and a lot of money is invested in producing them. Moreover, renewable efforts led by APAC are raising the demand for Power Quantum in solar cells.

The most of the world's solar energy comes from China, the country's high demand for solar panels raises the demand for HPQ. The country's semiconductor industry increases the market's growth, driven by incentives and major efforts in advanced manufacturing from the government.

- In April 2025, China found a new mineral called high-purity quartz, which is expected to lessen the country's use of imports and help develop important industries such as semiconductors and photovoltaics.(Source: https://caliber.az)

North America High-Purity Quartz Market Trends

The North America region is expected to grow at the highest CAGR of 6.62% during the forecast period. There is greater demand for ultra-pure quartz due to the leading semiconductor companies and new developments in producing microchips. As solar technology develops, more energy is created from renewables, and this sparks greater needs for high-purity quartz in this sector.

With developed infrastructure, professionals and good research centers, North America encourages the use of high-purity quartz. The number of electronics in cars, phones and appliances is causing demand to increase. New technology, suitable laws and an increase in green energy use are predicted to make North America a strong leader in high-purity quartz market.

Why Is Europe Emerging as a Key Market for High-Purity Quartz?

Europe also emerged as a significant market for the high-purity quartz market, accounting for a substantial market share in 2024 due to its substantial and environmentally friendly manufacturing sector. Due to strong goals for renewable energy and government backing, the region's solar manufacturing is expanding rapidly.

Ultra-pure quartz is essential for the semiconductor industry in Europe because it is used for wafer production and other major applications. Sales of optics increase as a result of using high-quality quartz for making lenses, prisms and fiber optics. Because Europe is working towards low-carbon methods and inventions, more pure quartz will be required for solar, renewable, semiconductor and optical sectors in the coming years.

High-Purity Quartz Market Companies

- Sibelco

- The Quartz Corporation

- Jiangsu Pacific Quartz Co., Ltd.

- Russia Quartz LLC

- High Purity Quartz Ltd

- Donghai Shihu Quartz Co., Ltd.

- Creswick Quartz

- Covia Holdings Corporation

- TopTradeWay (TTW)

- Solar Quartz Technologies Corporation

Recent Developments

- In May 2025, Nippon Paint (Coatings) Philippines, Inc. introduced the Weatherbond Quartz series, indicating that it would become the new leader in shielding homes and buildings against weather damage.(Source: https://business.inquirer.net)

- In October 2023, Ferroglobe PLC purchased a large, high-purity quartz mine in South Carolina, US. The acquisition price was almost $11 million in cash with an additional $4 million projected in capital expenditures to build out the infrastructure, including rail access, loadout, and a processing facility.(Source-https://www.ferroglobe.com)

- In April 2023, Sibelco declared an investment of approx. USD 200 million to double high-purity quartz (HPQ) installed capacity at its Spruce Pine facility in North Carolina, United States.(Source-https://www.sibelco.com)

Segments Covered in the Report

By Form

- Powder

- Sand

- Rock

- Pebble

- Others

By Purity

- 99.95% SiO2

- 99.99% SiO2

- 99.997% and 99.998% SiO2

- 99.999% SiO2

By Application

- Semiconductor

- Solar

- Lighting (automotive xenon, halogen, HID lamps, UHP lamps, and others)

- Telecommunication and optics

- Microelectronics

- Ceramics

- Specialty glass (LCD, lenses, laboratory glassware, and others)

- High-purity fillers (paints, resins, abrasives, and others)

- Others

By End use

- Transportation (automotive (passenger cars and commercial vehicles), aerospace, marine, locomotive)

- Consumer goods

- Healthcare

- Energy and power

- Electrical and electronics

- Building and construction

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content