What is the Hyaluronic Acid Raw Material Market Size?

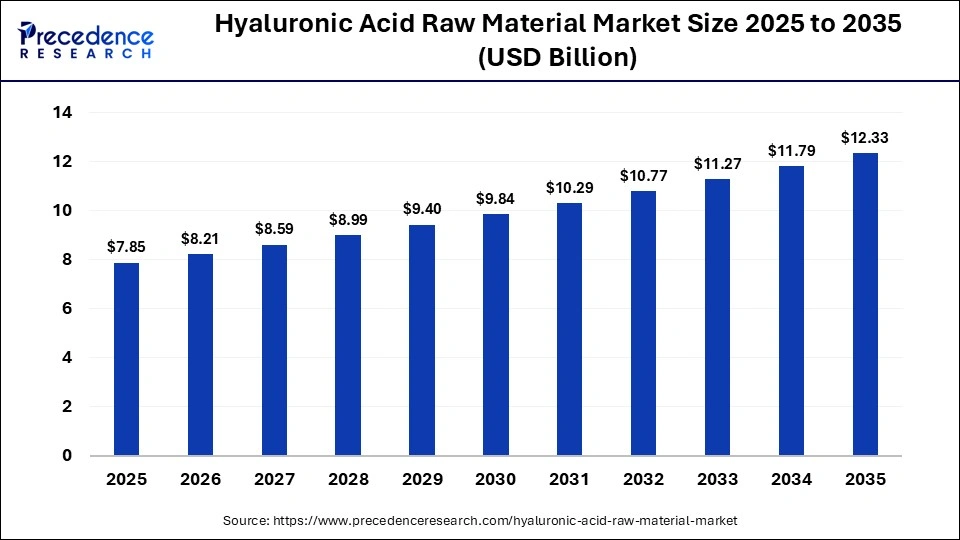

The global hyaluronic acid raw material market size was calculated at USD 7.85 billion in 2025 and is predicted to increase from USD 8.21 billion in 2026 to approximately USD 12.33 billion by 2035, expanding at a CAGR of 4.62% from 2026 to 2035. The increasing demand for animal-based hyaluronic acid from the cosmetics industry, as well as the rising use of dermal fillers, is driving market growth. Additionally, the rapid investment by food manufacturing companies in opening new manufacturing facilities to increase food supplement production, as well as technological advancements in the pharmaceutical industry, are also driving the market.

Market Highlights

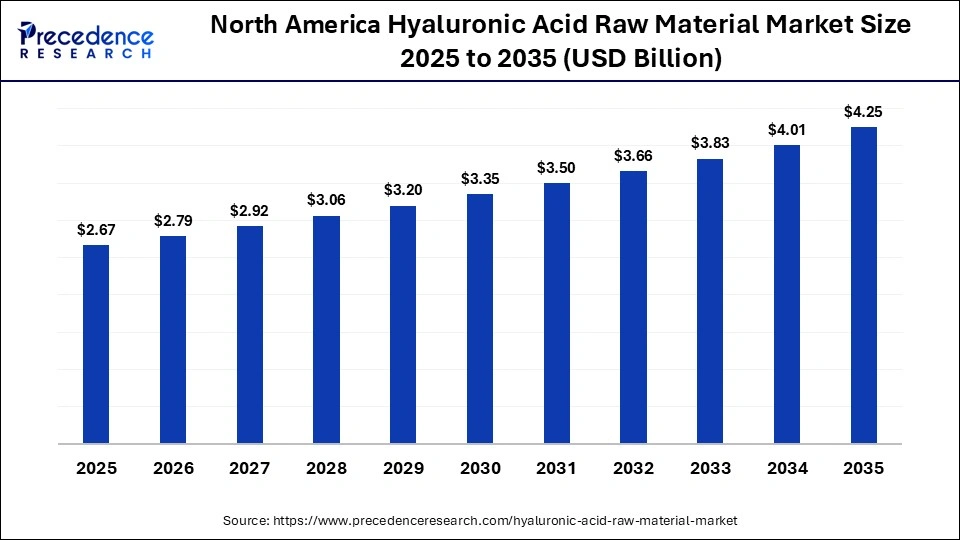

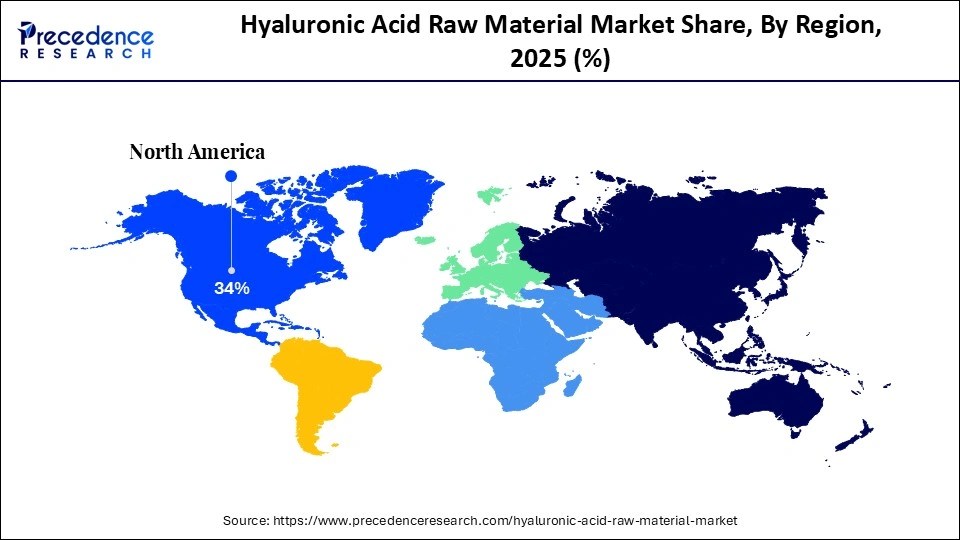

- North America led the market with a major market share of 34% in 2025.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2035.

- By type, the high molecular weight segment held the largest share of the market in 2025.

- By type, the low molecular weight segment is expected to expand at the highest CAGR between 2026 and 2035.

- By source, the biotechnology segment held the largest market share in 2025.

- By source, the animal extracts segment is expected to expand at the fastest CAGR from 2025 to 2035.

- By application, the pharmaceuticals segment held the highest share of the market in 2025.

- By application, the cosmetics segment is expected to grow at the highest CAGR from 2025 to 2035.

- By end use, the skincare products segment dominated the market in 2025.

- By end use, the injectable fillers segment is expected to grow at the fastest CAGR from 2025 to 2035.

Market Overview

The hyaluronic acid raw material industry is a significant segment of the global chemicals sector, focused on supplying hyaluronic acid raw materials to end users worldwide. Market growth is being driven by the increasing use of hyaluronic acid in the pharmaceutical industry for the production of injectable formulations, along with the rapid expansion of the global chemicals industry. In addition, the growing application of hyaluronic acid in the orthopedics sector for the manufacture of viscosupplements, as well as government initiatives aimed at strengthening the food and beverage industry, are supporting market expansion. With the continued growth of the global healthcare industry, the market is expected to witness substantial expansion in the coming years.

Hyaluronic Acid Raw Material Market Trends

- Partnerships: Numerous biotechnology companies are partnering with dental brands to launch hyaluronic-based products for consumers. For instance, in November 2025, Young Innovations partnered with Umayana. This partnership aims to launch Murnia (a hyaluronic-based mouth spray) in the U.S.

- Government Investments: Governments of several nations, such as the U.S., India, China, and Germany, are investing rapidly in strengthening the pharmaceutical industry, contributing to the market. For instance, in December 2025, the U.S. government announced the investment of around US$ 150 billion. This investment aims at developing the pharmaceutical sector in this nation.

- Product Launches: Several market players are engaged in launching a wide range of hyaluronic acid-based products to cater to the needs of end-users. For instance, in February 2025, Evolus, Inc. announced that the FDA approved its Evolyss smooth injectable hyaluronic acid (HA) gels.

What is the Significance of AI in the Hyaluronic Acid Raw Material Market?

Artificial Intelligenceplays a prominent role in shaping the landscape of the market by enhancing production efficiency, quality control, and process optimization. In the pharma sector, AI has been incorporated to accelerate drug discovery, enhance clinical trials, and managing supply chain. Nowadays,cosmetics companies are also deploying AI in their production plants to accelerate product development, creating personalized formulas and enhancing quality control through real-time monitoring. Additionally, AI-driven analytics help optimize fermentation conditions, improve yield consistency, and ensure high purity levels required for pharmaceutical and cosmetic applications.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.09 Billion |

| Market Size in 2026 | USD 3.42 Billion |

| Market Size by 2035 | USD 8.37Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 10.47% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Type,Source,Application,End Use, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

Why Did the High Molecular Weight Segment Dominate the Hyaluronic Acid Raw Material Market?

The high molecular weight segment dominated the market with the largest share in 2025. This is mainly due to the increased use of high molecular weight hyaluronic acids from the cosmetics industry for manufacturing skincare products. Numerous benefits of these hyaluronic acids, such as irritation reduction, protection of skin barriers, and intense surface hydration, are key factors boosting their use in the cosmetics industry. The growing demand from healthcare and aging populations further reinforced the dominance of this segment.

The low molecular weight segment is expected to grow at the highest CAGR between 2026 and 2035. This is mainly due to the surging application of low molecular weight hyaluronic acids in the pharma industry for manufacturing eye drops and viscosupplements. Several advantages of these hyaluronic acids, including deeper skin penetration, wound repairing capability, and anti-inflammatory properties, are boosting their adoption.

Source Insights

What Made Biotechnology the Leading Segment in the Hyaluronic Acid Raw Material Market?

The biotechnology segment led the market while holding the largest share in 2025 due to its ability to produce high-purity, consistent, and non-animal-derived hyaluronic acid through microbial fermentation. This method offers better control over molecular weight, higher scalability, and lower contamination risk compared to animal-based extraction. Additionally, biotechnology-based production aligns well with stringent pharmaceutical and cosmetic regulatory standards and supports sustainable, ethical manufacturing practices. The growing demand for medical-grade and injectable hyaluronic acid further strengthened the dominance of this segment.

The animal extracts segment is expected to grow at the highest CAGR from 2025 to 2035 due to its long-established use, proven efficacy, and cost-effectiveness in certain applications. Animal-derived hyaluronic acid, commonly sourced from rooster combs, is still preferred in some pharmaceutical and orthopedic products because of its natural biocompatibility and established clinical performance. Additionally, the surging use of animal-based hyaluronic acid in the pharma and supplement industry is expected to propel the growth of the segment.

Application Insights

What Made Pharmaceuticals the Dominant Segment in the Hyaluronic Acid Raw Material Market?

The pharmaceuticals segment dominated the market with a major revenue share in 2025. This is primarily due to the extensive use of hyaluronic acid in injectable drugs, ophthalmic solutions, and viscosupplement therapies. Its proven biocompatibility, safety, and therapeutic effectiveness make it a preferred ingredient for treating joint disorders, eye conditions, and wound care. Moreover, partnerships between pharma companies and biotech brands for developing hyaluronic-based medicines ensure the long-term growth of the segment.

The cosmetics segment is expected to expand at the highest CAGR from 2025 to 2035. The growth of the segment is driven by the growing demand for hyaluronic acid for manufacturing anti-aging products and skin conditioners. Also, the rapid investment by the cosmetics industry in opening new production centers, as well as the surging demand for aesthetic medicines from the dermatology sector, is positively contributing to the segmental growth. Moreover, collaborations between cosmetics brands and chemical companies to manufacture hyaluronic acid-based creams are expected to drive the growth of the segment.

End Use Insights

Why Did the Skincare Products Segment Dominate the Hyaluronic Acid Raw Material Market?

The skincare products segment dominated the market in 2025. The dominance of the segment is attributed to the increased demand for high-quality skincare items from the youth in several nations, such as China, the U.S., the UAE, and the UK. Hyaluronic acid is widely used in creams, serums, masks, and dermal formulations to improve skin hydration, elasticity, and smoothness. The rapid growth of the global cosmetics and personal care industry, along with rising consumer awareness of skincare ingredients, further drove demand. Additionally, the trend toward premium, natural, and science-backed skincare products reinforced the dominance of this segment.

The injectable fillers segment is expected to grow at the fastest CAGR from 2025 to 2035. The increasing use of injectable fillers for wrinkle reduction and scar correction is driving the segmental growth. Hyaluronic acid–based dermal fillers are widely preferred for facial volume restoration, wrinkle reduction, and contouring because of their biocompatibility, safety, and reversible nature. Increasing beauty consciousness, an expanding aging population, and higher acceptance of non-surgical cosmetic treatments are further driving segmental growth.

Regional Insights

How Big is the North America Hyaluronic Acid Raw Material Market Size?

The North America hyaluronic acid raw material market size is estimated at USD 2.67 billion in 2025 and is projected to reach approximately USD 4.25 5 billion by 2035, with a 4.76% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Hyaluronic Acid Raw Material Market?

North America dominated the hyaluronic acid raw material market by capturing the largest share in 2025. This dominance is driven by the increasing demand for high molecular weight hyaluronic acids from the pharmaceuticals industry across the U.S., Canada, and Mexico. The rapid investment by the cosmetics companies in opening new manufacturing centers, as well as numerous government initiatives aimed at strengthening the pharmaceutical industry, also contributed to the region's dominance in the market. Moreover, the presence of various market players, such as Allergan, Revance Therapeutics, and Suneva Medical, is expected to support the long-term market growth in North America.

- In August 2025, Revance Therapeutics launched Teoxane RHA in the U.S. Teoxane RHA is a dermal filler that was approved by the FDA in 2023.

What is the Size of the U.S. Hyaluronic Acid Raw Material Market?

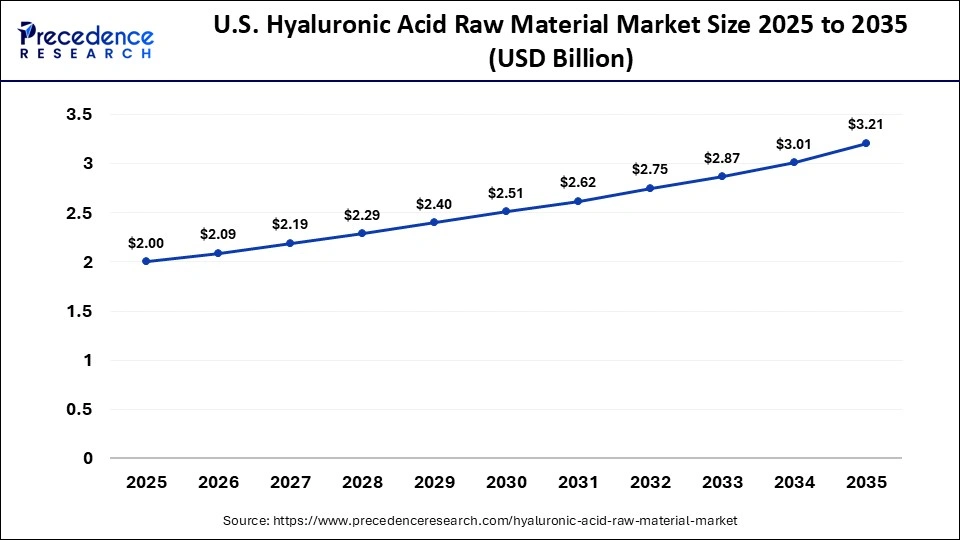

The U.S. hyaluronic acid raw material market size is calculated at USD 2.00 billion in 2025 and is expected to reach nearly USD 3.21 billion in 2035, accelerating at a strong CAGR of 4.84% between 2026 and 2035.

U.S. Hyaluronic Acid Raw Material Market Analysis

The market in the U.S. is growing due to rising demand from the pharmaceutical and cosmetic sectors, where hyaluronic acid is widely used in injectables, wound care, and skincare products. An aging population and increasing preference for minimally invasive aesthetic treatments have boosted the consumption of HA-based dermal fillers and therapeutic formulations. Additionally, strong healthcare infrastructure, high consumer awareness of advanced personal care ingredients, and ongoing product innovations support market expansion.

How is the Opportunistic Rise of Asia Pacific in the Hyaluronic Acid Raw Material Market?

Asia Pacific is expected to expand at a significant CAGR from 2025 to 2035. The growing sales of injectable fillers in various countries, such as India, Japan, China, and South Korea, are a major factor boosting the market expansion. Surging investment by the governments for strengthening the pharmaceuticals industry, as well as technological advancements in the biotechnology sector, is positively contributing to the market. Moreover, the presence of numerous market players, such as Bloomage Biotech, Freda Biotechnology, LG Chem, and Kewpie Corporation, and the rapid expansion of the healthcare, pharmaceutical, and cosmetics sectors are expected to propel the growth of the market in this region.

China Hyaluronic Acid Raw Material Market Analysis

The market in China is expanding due to strong demand from the rapidly expanding pharmaceutical, cosmetic, and healthcare sectors. Rising consumer awareness of skincare and anti-aging products, along with the increasing popularity of minimally invasive aesthetic procedures, is driving the consumption of HA-based dermal fillers and topical formulations. Additionally, government support for biotechnology and chemical manufacturing, coupled with investments in local production facilities, has improved availability and reduced costs.

- In May 2025, Sinclair Pharma Limited launched MaiLi Extreme. MaiLi Extreme is a hyaluronic acid (HA) injectable aesthetic product designed for consumers in China.

Value Chain Analysis

- Chemical Synthesis and Processing: Chemical synthesis of hyaluronic acid involves complex organic chemistry, using protected monomers for synthesizing smaller oligosaccharides to achieve specific linkages and lengths.

Key Companies: HTL Biotechnology, Contipro, and Seikagaku Corporation. - Quality Control: This stage involves testing molecular weight, purity, concentration, and physical properties of HA using various techniques, including HPLC, ELISA, GPC, UV Spectroscopy, and Rheology.

Key Companies: PerkinElmer, Elchemy, and Worldwide Quality Control (WQC). - Regulatory Compliance and Safety Monitoring: Regulatory compliance and safety monitoring of hyaluronic acids involve a comprehensive framework of legal, technical, and operational measures that are designed to minimize risks to personnel and the environment.

Key Companies: Intertek, AMCS Group, and Freyr Solutions.

Who are the Major Players in the Global Hyaluronic Acid Raw Material Market?

The major players in the hyaluronic acid raw material market include Bloomage Biotech, Seikagaku Corporation, Shandong Focuschem Biotech Co., Ltd., Shandong Freda Biopharm Co., Ltd., Shandong Topscience Biotech Co., Ltd., HTL Biotechnology, Fidia Farmaceutici S.p.A., Contipro a.s., Lifecore Biomedical, Inc., Kewpie Corporation.

Recent Developments

- In November 2025, Meditherapy launched a hyaluronic acid skin booster first serum. This serum is designed to deliver deep hydration and maximize skincare absorption using multi-layering technology.(Source: https://www.kark.com/business)

- In June 2025, HTL Biotechnology opened a new production unit in Javené, France. This new manufacturing plant was inaugurated to increase the production of hyaluronic acid for the end-users of this nation.(Source: https://htlbiotech.com)

- In April 2025, Givaudan launched PrimalHyal UltraReverse. It is a sustainable hyaluronic acid designed for the cosmetics industry.(Source: https://www.personalcaremagazine.com)

Segments Covered in the Report

By Type

- High Molecular Weight

- Low Molecular Weight

- Medium Molecular Weight

By Source

- Biotechnology

- Animal Extracts

- Synthetic

By Application

- Pharmaceuticals

- Cosmetics

- Food & Beverages

- Dietary Supplements

By End Use

- Skincare Products

- Injectable Fillers

- Ophthalmic Products

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content