What is Incretin Mimetics Market Size?

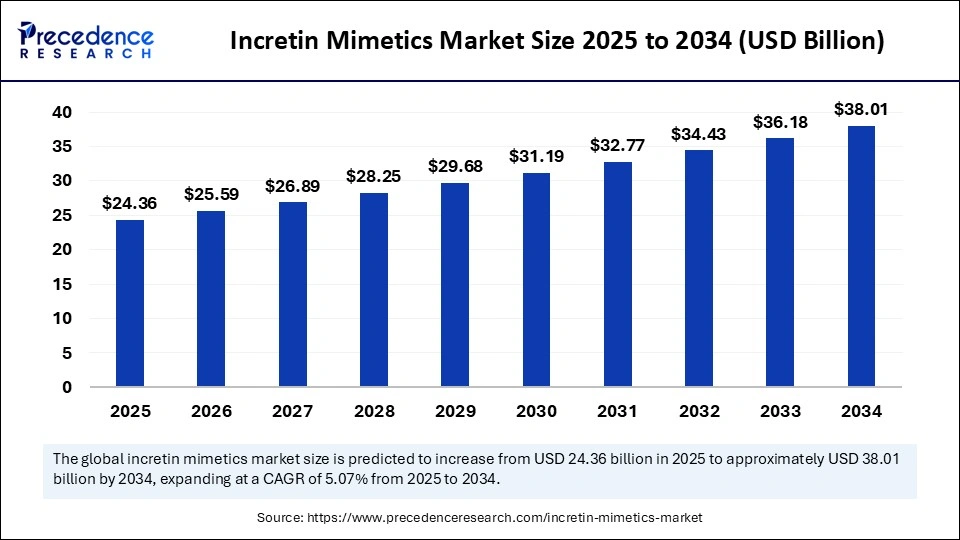

The global incretin mimetics market size is calculated at USD 24.36 billion in 2025 and is predicted to increase from USD 25.59 billion in 2026 to approximately USD 38.01 billion by 2034, expanding at a CAGR of 5.07% from 2025 to 2034. The market for incretin mimetics stands as a transformative frontier in diabetic care, blending pharmacological precision with physiological harmony. As metabolic disorders continue to escalate worldwide, these agents are designed to mimic natural incretin hormones.

Market Highlights

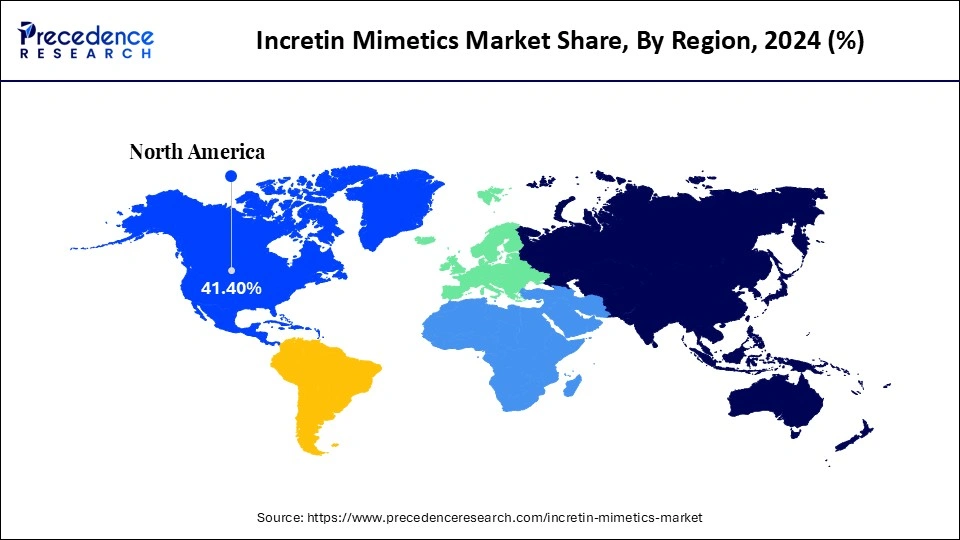

- North America dominated the market, holding largest market share of 41.4% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR of 7.2% between 2025 and 2034.

- By product type, the GLP-1 receptor agonists segment held the largest share of 56.4% in 2024.

- By product type, the dual/triple agonists segment is expected to reach a remarkable CAGR of 6.5% between 2025 and 2034.

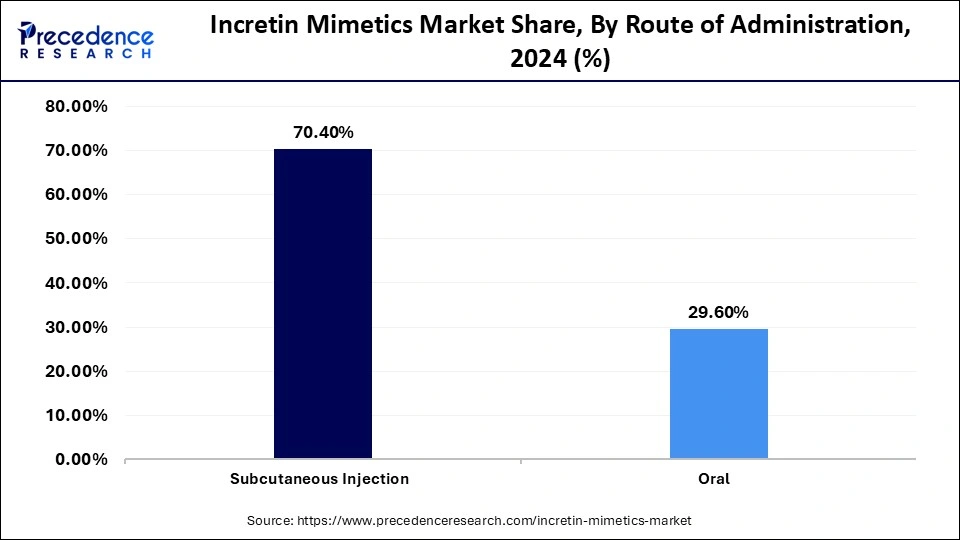

- By route of administration, the subcutaneous injection segment contributed the highest market share of 70.4% in 2024.

- By route of administration, the oral segment is expected to grow at a remarkable CAGR of 7.0% between 2025 and 2034.

- By dosage form, the pre-filled pens segment accounted for the largest market share of 58.4% in 2024.

- By dosage form, the vials segment is set to grow at a remarkable CAGR of 6.6% CAGR between 2025 and 2034.

- By end-user, the hospital segment generated the biggest market share of 48.5% in 2024.

- By end-user, the clinics segment is expected to expand at a remarkable CAGR of 6.9% CAGR between 2025 and 2034.

- By therapeutic application, the type 2 diabetes segment held the biggest market share of 54.4% in 2024.

- By therapeutic application, the obesity & weight management segment is set to grow at a remarkable CAGR of 6.8% between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 24.36 Billion

- Market Size in 2026: USD 25.59 Billion

- Forecasted Market Size by 2034: USD 38.01 Billion

- CAGR (2025-2034): 5.07%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What are Incretin Mimetics?

The incretin mimetics are a type of pharmaceutical drug that behaves similar to incretin hormones to stimulate insulin secretion and regulate blood glucose levels in patients with type 2 diabetes. These include GLP-1 receptor agonists and dual agonists, administered via subcutaneous injections or oral formulations. The market for incretin mimetics is driven by the rising prevalence of diabetes, growing awareness of advanced antidiabetic therapies, and the development of long-acting and combination therapies. These drugs also support weight management and cardiovascular benefits, expanding their therapeutic potential.

Market growth in the incretin mimetics segment has been propelled by surging cases of type 2 diabetes, lifestyle changes, and growing awareness of advanced diabetic therapies. These drugs, often functioning as GLP-1 receptor agonists, have demonstrated remarkable efficacy in not only glycemic control but also cardiovascular health. Increasing patient preference for once-weekly formulations and injectables has further catalyzed the shift toward convenience-driven therapies.

Additionally, strategic collaborations between biotech firms and pharmaceutical giants have accelerated the introduction of generation analogs. As global healthcare systems emphasize chronic disease management, the demand for long-acting, low-side-effect incretin mimetics continues to expand. The sector's momentum reflects an intersection of scientific innovation, patient-centricity, and market dynamism.

Market Outlook for Incretin Mimetics

- Industry Growth Overview: The industry's growth is anchored in continuous research and development investments and an expanding geriatric population vulnerable to metabolic disorders. The development pipeline brims with advanced peptides and oral formulations aimed at surpassing traditional injectables in compliance and efficacy. Additionally, regulatory bodies have shown supportive tendencies, expediting approvals for novel GLP-1 and GIP analogs. The competitive environment is intensifying, prompting both established players and emerging biotech firms to leverage partnerships, AI modelling, and peptide engineering for market differentiation.

- Sustainability Trends: Sustainability in the incretin mimetics market extends beyond ecological responsibility; it encompasses the ethical sourcing of raw materials, reduction of manufacturing waste, and the minimization of carbon footprints in cold-chain logistics. Companies are adopting green chemistry protocols and recyclable injector devices to align with global environmental mandates. Moreover, the integration of sustainable biotech processes ensures resource efficiency and reduces dependency on synthetic intermediates.

- Major Investors: Venture capitalists and institutional investors are showing growing confidence in incretin-based innovation, viewing it as a lucrative and socially relevant domain. Several biotechnology incubators and pharmaceutical conglomerates have directed multi-million-dollar funds into GLP-1 analog research, production scalability, and delivery systems. This capital infusion not only stimulates product development but also nurtures ancillary innovation ecosystems in peptide chemistry and formulation science.

- Startup Economy: The startup ecosystem around incretin mimetics is vibrant, characterized by small biotech firms pioneering peptide stability, nanocarrier delivery, and extended-release technologies. These entities often collaborate with academic research centers, forming translational hubs for pre-clinical innovation. Their agility enables them to swiftly adapt to emerging trends in metabolic research, making them indispensable contributors to the overall market vitality.

Key Technological Shifts in the Incretin Mimetics Market

The market's technological evolution is underscored by the rise of oral incretin mimetics, a milestone that breaks the barrier of peptide degradation. Artificial intelligence and computational biology are redefining drug design, enabling accurate simulation of peptide-receptor interactions. Nanotechnology has further improved bioavailability and stability, ensuring sustained drug action. Smart injectors with real-time glucose monitoring capabilities are bridging the gap between pharmacotherapy and digital health. Meanwhile, bioprinting and recombinant peptide synthesis are revolutionizing the production ecosystem, making manufacturing both scalable and cost-efficient.

Impact of AI in the Incretin Mimetics Market

Artificial intelligence (AI) is having a transformative impact on the incretin mimetics market by accelerating drug discovery, improving clinical outcomes, and optimizing manufacturing and supply chain processes. In research and development, AI-powered algorithms analyze massive biomedical datasets, including genomic, proteomic, and pharmacological information, to identify novel incretin-based drug candidates and optimize their molecular design. Machine learning models simulate peptide structure, stability, and receptor-binding affinity, critical for developing next-generation GLP-1 and GIP agonists with enhanced efficacy and fewer side effects

In clinical trials, AI enhances patient selection, predictive modeling, and real-time monitoring, improving trial efficiency and success rates. By analyzing patient data, AI helps identify responders to incretin mimetics, supporting the advancement of personalized diabetes and obesity treatments. In manufacturing, AI-driven predictive analytics optimize peptide synthesis, purification, and formulation processes, ensuring consistent quality and minimizing waste. Quality assurance is further strengthened by AI-enabled monitoring systems that detect impurities or deviations in real time.

Market Key Trends

- Growing adoption of once-weekly and oral formulations, integration of digital health monitoring, and expansion into obesity management are key market trends.

- Increasing physician awareness and patient education campaigns further strengthen adoption. The convergence of AI, data analytics, and precision medicine heralds a new era of therapeutic personalization.

Market Value Chain Analysis in the Incretin Mimetics Market

- Raw Material Sources: The supply chain hinges on high-purity peptide precursors, amino acid derivatives, and biologically active intermediates sourced from specialized chemical suppliers. Stringent quality controls and traceability ensure consistency and compliance across production nodes.

- Technology Used: Recombinant DNA technology, peptide solid-phase synthesis, and nanoencapsulation methods form the technological backbone of manufacturing in the incretin mimetics market. Automation in purification and crystallization processes enhances yield and scalability.

- Investment by Investors: Strategic capital inflows target innovation in formulation, delivery, and digital integration, emphasizing scalability and long-term sustainability. Investors favor companies demonstrating strong IP portfolios and late-stage clinical candidates.

- AI Advancements: Artificial intelligence assists in peptide design optimization, toxicity prediction, and clinical outcome modeling. These advancements shorten development cycles while enhancing therapeutic precision.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 24.36 Billion |

| Market Size in 2026 | USD 25.59 Billion |

| Market Size by 2034 | USD 38.01 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.07% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Route of Administration, Dosage Form, End-User, Therapeutic Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why GLP-1 Receptor Agonists are Dominating the Incretin Mimetics Market?

The GLP-1 receptor is dominating the incretin mimetics market by holding a share of 56.4%, driven by the dual efficacy in glucose regulation and weight modulation, positioning them endocrinologists and patients alike. These drugs enhance insulin secretion, inhibit glucagon release, and slow gastric emptying, offering multifactorial metabolic control. The sustained innovation in long-acting analogs and user-friendly delivery systems has amplified their clinical appeal. Pharmaceutical leaders are refining molecular stability and dosing frequency to optimize adherence and therapeutic outcomes. Collectively, GLP-1 receptor agonists exemplify a harmonious blend of physiological mimicry and pharmacological precision.

The market dominance of GLP-1 receptor agonists also stems from their proven cardiovascular benefits, as evidenced by multiple global trials. Their widespread inclusion in clinical guidelines further cements their leadership position. The availability of combination formulations with basal insulin has expanded their clinical applicability. Additionally, strategic marketing and physician training initiatives have reinforced their presence across both developed and emerging markets. As patient preference shifts toward holistic metabolic care, GLP-1 agonists remain an emblem of reliability and therapeutic sophistication.

The dual/triple agonists are expected to expand the fastest in the forecasted period in the incretin mimetics market, with an expected CAGR of 6.5%, driven by simultaneously activating multiple hormonal pathways such as GLP-1, GIP, and glucagon receptors. These agents offer superior glycemic control and profound weight loss benefits. Their mechanistic versatility enables more comprehensive metabolic correction compared to monotherapies. Clinical researchers and biotech firms are investing heavily in optimizing receptor selectivity and minimizing side effects. These compounds hold the promise of transforming chronic metabolic disease management into a precise, adaptable science.

Promising clinical outcomes in obesity management also drive the accelerating adoption of dual/triple agonists. Their potential to modulate lipid metabolism, energy expenditure, and appetite regulation broadens their appeal beyond diabetes. Early-stage pharmaceutical partnerships are expediting the development of next-generation peptides with improved bioavailability. As personalized medicine gains traction, these multi-agonist therapies are poised to become the nucleus of future metabolic treatment paradigms.

Route of Administration Insights

Why Subcutaneous Injection is Dominating the Incretin Mimetics Market?

The subcutaneous injection is dominating the incretin mimetics market by holding a share of 70.4%, offering reliable drug absorption and predictable pharmacokinetics. The preference for this route is attributed to the stability of peptide formulations and precise dose delivery. Modern auto-injectors and pen devices have significantly improved patient comfort and adherence, bridging the gap between efficacy and convenience. Furthermore, the evolution of pre-filled injectors with minimal preparation time enhances user confidence and compliance. Healthcare professionals favor injectable formulations for ensuring consistent therapeutic outcomes and minimizing variability in absorption rates.

The subcutaneous segment's dominance is also underpinned by extensive clinical validation and established manufacturing protocols. The introduction of once-weekly injectables has further elevated its relevance by reducing the burden of daily dosing. Pharmaceutical companies have refined formulation viscosity and injection comfort, making treatment more patient-friendly. As biotechnology advances, subcutaneous platforms continue to evolve toward precision dosing and sustained release, securing their stronghold in therapeutic administration.

The oral is set to be the fastest-growing segment in the incretin mimetics market, set to grow at a CAGR of 7.0%, overcoming traditional barriers of gastrointestinal degradation. Through innovative carrier systems and absorption enhancers, these formulations offer the convenience of oral dosing without compromising efficacy. This shift addresses one of the most persistent challenges in diabetes therapy: needle aversion among patients. The development of orally bioavailable GLP analogs signifies a major leap in therapeutic accessibility. Patients increasingly prefer this form due to its non-invasive nature and improved compliance.

The growth of the oral segment is further propelled by strategic R&D collaborations aimed at enhancing peptide stability in harsh gastric environments. Advanced formulation technologies such as enteric coating and nanoparticle encapsulation are enabling consistent systemic delivery. Moreover, the alignment of oral incretins with digital adherence monitoring tools is redefining patient engagement models. This evolution symbolizes a transition from invasive to intuitive diabetes management, marking a new chapter in therapeutic convenience.

Dosage Form Insights

Why Pre-Filled Pens are Leading the Incretin Mimetics Market?

The pre-filled pens are dominating the incretin minetics market by holding a share of 58.4%, due to their unmatched ease of use and dosage accuracy. They eliminate the need for manual preparation, thus minimizing contamination risks and dosing errors. The ergonomic design of these pens, coupled with adjustable dose settings, enhances patient autonomy in managing their treatment regimens. The rising adoption of smart injector technology with dose tracking and connectivity features has made pre-filled pens synonymous with modern diabetes care. Moreover, healthcare providers endorse them for their reliability and patient adherence benefits.

The growing popularity of pre-filled pens also stems from their role in supporting self-administration, a critical aspect in chronic disease management. Manufacturers are investing in recyclable materials and sustainable designs to align with global environmental standards. The integration of safety shields and intuitive interfaces further enhances patient confidence. With continuous advancements in device miniaturization and digital synchronization, pre-filled pens remain the gold standard for incretin delivery.

The vials are expected to be the fastest-growing segment of the incretin mimetics market, with an expected growth rate of 6.6%, driven by demand in clinical and hospital-based applications. Vials offer flexibility in dosing and are particularly suited for large-volume dispensing environments. Their cost-effectiveness appeals to healthcare facilities in developing markets seeking scalable solutions. The standardization of packaging and compatibility with multiple delivery systems enhances their utility. Furthermore, vials serve as a preferred choice in research and compounding applications where customization is critical.

In recent years, technological improvements in vial sterilization, material quality, and sealing integrity have revitalized their relevance. The growing preference among institutional buyers for bulk supply formats also contributes to their rising CAGR. As manufacturing technologies advance, vials are transitioning from traditional glass to advanced polymers that improve safety and storage efficiency. Their resurgence highlights the balance between affordability, functionality, and clinical versatility.

End-User Insights

Why are Hospitals Leading the Incretin Mimetics Market?

The hospital is dominating the incretin minetics market with a share of 48.5%, serving as the primary center for diabetes diagnosis, treatment initiation, and clinical trials. The integration of incretin mimetics into hospital formularies underscores their clinical reliability and physician trust. Hospitals also function as major distribution hubs for high-value biologics, ensuring regulated administration and monitoring. Their multidisciplinary infrastructure enables holistic care involving endocrinologists, dietitians, and pharmacists. This ecosystem strengthens patient adherence and fosters better outcomes.

Additionally, hospitals play a crucial role in the post-market surveillance of incretin therapies, contributing valuable real-world evidence. The availability of advanced diagnostic tools within these institutions facilitates accurate treatment optimization. As tertiary care centers expand globally, hospitals will remain at the core of incretin distribution and research. Their established credibility and compliance infrastructure make them indispensable stakeholders in the therapeutic value chain.

Clinics are set to be the fastest-growing segment of the incretin mimetics market, with an expected CAGR of 6.9%, driven by the growing emphasis on decentralized and accessible care. Their agility enables faster diagnosis, personalized therapy adjustments, and direct patient counseling. The rise of specialized diabetes clinics and metabolic wellness centers has amplified the distribution of incretin-based treatments. Patients are increasingly turning to clinics for cost-effective and continuous management of chronic conditions. This shift reflects a broader movement toward community-based healthcare delivery.

Moreover, clinics are becoming focal points for pilot programs involving AI-assisted glucose tracking and teleconsultation. Their lean operational model allows for rapid integration of digital tools and treatment innovations. Strategic partnerships with pharmaceutical distributors further enhance their reach in semi-urban and rural regions. As healthcare ecosystems evolve toward personalization and proximity, clinics are expected to be at the forefront of next-generation diabetes management.

Therapeutic Application Insights

Type 2 diabetes is dominating the incretin minetics market by share, 54.5%, representing its foundational clinical purpose. These therapies directly address the core pathophysiological challenges of insulin resistance and impaired beta-cell function. Their proven ability to control blood glucose without significant hypoglycemia risk has established them as indispensable in diabetes management. Physicians widely prescribe incretin-based agents due to their efficacy, safety, and added cardiovascular benefits. The introduction of long-acting formulations has enhanced adherence and therapeutic consistency.

Beyond glycemic control, incretin mimetics also offer ancillary metabolic benefits such as weight reduction and improved lipid profiles. This multidimensional efficacy has ensured their continued dominance across global treatment protocols. Public health programs focusing on diabetes control increasingly integrate incretin mimetics into their strategies. Strong clinical data and continuous innovation pipelines from major pharmaceutical companies further solidify the segment's leadership.

The clinics are the fastest growing the incretin mimetics market with an expected CAGR of 6.8%. The appetite-suppressing and metabolism-regulating properties of GLP-1 and dual agonists have revolutionized the approach to obesity treatment. Clinical evidence supports their role in achieving sustainable weight loss while improving cardiovascular markers. As obesity-related comorbidities rise globally, the demand for such pharmacological interventions continues to soar. The market is witnessing growing participation from wellness centers and obesity clinics.

The rapid adoption of incretin-based therapies in weight management also reflects a cultural shift toward medically supervised wellness. Pharmaceutical firms are expanding their research pipelines to develop formulations specifically tailored for non-diabetic obese individuals. Public awareness campaigns highlighting the metabolic benefits of these drugs further fuel market penetration. The intertwining of obesity therapeutics with aesthetic and preventive healthcare underscores this segment's immense potential.

Regional Insights

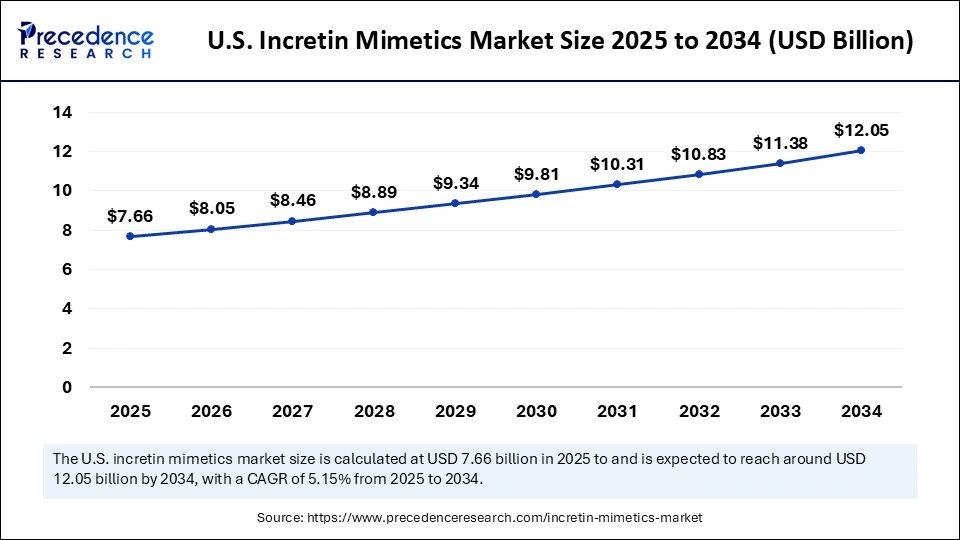

U.S. Incretin Mimetics Market Size and Growth 2025 to 2034

The U.S. incretin mimetics market size is exhibited at USD 7.66 billion in 2025 and is projected to be worth around USD 12.05 billion by 2034, growing at a CAGR of 5.15% from 2025 to 2034.

Why North America is Dominating the Incretin Mimetics Market?

North America dominates the incretin mimetics market by holding a share of 41.4%, propelled by robust healthcare infrastructure, high diabetes prevalence, and early adoption of next-generation therapeutics. The region's well-established reimbursement frameworks and presence of major pharmaceutical giants amplify market maturity. Continuous clinical innovation, coupled with extensive patient education programs, sustains its leadership position. Moreover, collaborations between biotech firms and academic research institutions foster a fertile ground for new drug development. Government-backed initiatives promoting metabolic health further enhance the region's dominance.

Why Does the U.S. Remain the Nerve Center of Incretin Innovation?

The U.S. anchors North America's supremacy through its unparalleled R&D capacity and biotechnology ecosystem. Favorable regulatory pathways from the FDA accelerate innovation, while high consumer awareness drives adoption. Companies like Eli Lilly and Novo Nordisk continue to set global benchmarks in GLP-1 therapies. The integration of digital health tools with diabetes management systems strengthens patient outcomes, consolidating the U.S. as the epicenter of metabolic medicine.

How is Asia Pacific Redefining the Incretin Mimetics Industry?

Asia Pacific is set to be the fastest growing region in the incretin innovation market, with an expected CAGR of 7.2%, driven by increasing disposable incomes and government-led chronic disease programs are catalyzing demand for advanced therapies. Local manufacturers are also entering strategic partnerships with global leaders to facilitate affordable access. Moreover, the cultural shift toward preventive healthcare aligns well with incretin-based interventions.

Expanding healthcare infrastructure, coupled with supportive reimbursement frameworks in emerging economies, is expected to further strengthen market penetration. Countries like China, India, and Japan are witnessing growing adoption of incretin-based drugs, supported by clinical research investments and regional production capabilities. Rising awareness campaigns for diabetes prevention and the integration of digital health platforms for early diagnosis are also contributing to sustained growth momentum across the region.

How is India leading the therapeutic landscape of Asia-Pacific for the Incretin Mimetics Market?

India's dynamic pharmaceutical industry, coupled with its extensive diabetic population, makes it a key contributor to regional expansion. Domestic players are investing in biosimilar incretin mimetics, ensuring affordability and scalability. Research collaborations with Western firms enhance technology transfer and formulation diversity. The convergence of AI-driven diagnostics and peptide-based therapies signifies India's growing prominence in the global diabetes care continuum.

Why Europe is Notably Growing in the Incretin Mimetics Market?

Europe displays a steady upward trajectory, shaped by increasing healthcare awareness and favorable reimbursement policies for diabetes management. The continent's emphasis on clinical excellence and patient safety ensures a rigorous yet rewarding market environment. Integration of sustainability-driven manufacturing practices further distinguishes the region. In addition, the presence of established pharmaceutical companies and strong research networks supports continuous innovation in incretin-based therapies.

The rising prevalence of diabetes and obesity has encouraged governments to expand public health initiatives and improve patient education on metabolic health. Clinical trials and collaborative projects across countries such as Germany, France, and the UK are further accelerating the adoption of advanced treatments. With growing investment in R&D and ongoing regulatory support from agencies like the EMA, Europe continues to strengthen its role as a key hub for the development, approval, and commercialization of incretin mimetics.

Can Germany Lead Europe's Incretin Revolution?

Germany's deep-rooted pharmaceutical ecosystem, precision manufacturing culture, and government-backed innovation incentives position it at the forefront of Europe's incretin renaissance. Its research clusters in metabolic disorders and biopharmaceuticals continue to yield groundbreaking innovations. As the EU harmonizes its clinical trial protocols, Germany's leadership is expected to further consolidate Europe's position in the global incretin mimetics market. The country's ongoing investment in R&D facilities and strong collaboration between academia and industry further enhance its competitiveness.

Major German cities such as Berlin, Munich, and Frankfurt are emerging as innovation hubs where pharmaceutical research, biotech startups, and digital health initiatives intersect. Continued support from public funding programs and EU innovation grants is also expected to strengthen Germany's manufacturing capabilities and regulatory alignment, ensuring sustained leadership in incretin-based drug development.

Incretin Mimetics Industry - Country Analysis

|

Company |

Country |

Product |

Investment Made |

Future Possibilities |

|

Novo Nordisk |

Denmark |

Semaglutide |

Significant R&D Was Invested |

To Expand Non-Diabetic Indications And Improve Delivery Mode |

|

Eli Lilly |

U.S.A/India |

Mounjaro |

Investment In Manufacturing Capacity |

To Control Type 2 Diabetes And Weight Management |

|

Glenmark Pharmaceuticals |

India |

Lirafit |

In Local Manufacturing And Regulatory Approvals |

Affordable Access In Emerging Markets |

|

Astrazeneca |

UK/Sweden |

Bydureon Bcise |

Expanding Indications For Therapies |

More Flexible Treatment In Regimens |

Top Incretin Mimetics Market Companies

- Novo Nordisk A/S: Novo Nordisk is the global leader in the incretin mimetics market, driven by its flagship GLP-1 receptor agonists such as Ozempic (semaglutide), Rybelsus, and Victoza. The company's continuous innovation in long-acting and oral formulations has set new standards in diabetes and obesity management. Novo Nordisk's extensive clinical research and expansion into cardiometabolic care further reinforce its dominance in the incretin therapy space.

- Eli Lilly and Company:Eli Lilly is a key competitor in incretin-based therapies, led by its groundbreaking dual GIP and GLP-1 receptor agonist Mounjaro (tirzepatide). This product has redefined treatment outcomes in type 2 diabetes and weight management through exceptional glycemic and metabolic control. Lilly continues to expand its incretin pipeline with next-generation co-agonists targeting broader metabolic and obesity-related indications.

- AstraZeneca PLC:AstraZeneca's presence in the incretin mimetics market is driven by its established products Bydureon (exenatide extended-release) and Byetta, which enhance insulin secretion and glucose control. The company's focus on integrated cardiometabolic solutions and patient-centric formulations strengthens its role in diabetes management. AstraZeneca continues to invest in combination therapies that complement its incretin portfolio.

- GlaxoSmithKline PLC: GlaxoSmithKline (GSK) maintains an active focus on metabolic research, exploring incretin-related pathways to enhance insulin sensitivity and energy metabolism. The company invests in peptide-based and long-acting drug candidates designed for chronic metabolic conditions. GSK's collaborations and early-stage research aim to expand the therapeutic potential of incretin mimetics in diabetes and obesity treatment.

- Boehringer Ingelheim GmbH: Boehringer Ingelheim plays a strong role in diabetes care through partnerships and the development of incretin-based therapies. Collaborations like those for Jardiance and Trulicity demonstrate its strategic commitment to combining GLP-1 receptor and SGLT2 inhibitor benefits. The company's R&D emphasizes long-acting incretin analogs and integrated solutions targeting cardiovascular and renal health.

Other Companies in the Incretin Mimetics Industry

- Sanofi S.A.: Sanofi offers a comprehensive diabetes care portfolio and continues to expand its research into GLP-1 analogs and fixed-dose combinations. Its strategy emphasizes long-acting formulations that enhance patient adherence and simplify treatment regimens.

- Pfizer Inc.: Pfizer is developing novel incretin mimetics using its expertise in peptide engineering and oral delivery technology. The company's focus is on advancing oral GLP-1 and GIP agonists that combine efficacy with patient convenience.

- Merck & Co., Inc.: Merck's presence in diabetes management extends into the incretin field through its research in GLP-1 receptor agonists. Its goal is to develop effective oral formulations with improved safety and bioavailability profiles for broader patient accessibility.

- Takeda Pharmaceutical Company Limited:Takeda develops peptide-based incretin mimetics that improve glucose metabolism and support weight management. The company leverages its global R&D capabilities to create next-generation long-acting analogs designed for improved therapeutic durability.

- Intarcia Therapeutics, Inc.: Intarcia is recognized for its innovative ITCA 650 delivery system, which continuously releases exenatide through a small implant. This approach provides steady drug delivery and eliminates the need for daily injections, addressing adherence challenges in diabetes management.

- Zealand Pharma A/S: Zealand Pharma focuses on peptide drug discovery, including GLP-1 receptor agonists and dual-acting incretin therapies. Its proprietary peptide engineering platform has produced multiple clinical candidates targeting diabetes and obesity, with several under collaboration with larger pharmaceutical firms.

- Hanmi Pharmaceutical Co., Ltd.: Hanmi develops long-acting incretin-based therapeutics using its LAPSCOVERY technology. This platform enables extended drug half-life, reducing injection frequency and improving patient compliance.

- H. Lundbeck A/S: H. Lundbeck participates in incretin research through collaborative ventures exploring metabolic and neuroendocrine interactions. The company's expertise in peptide drug development supports early-stage metabolic research initiatives.

- Lexicon Pharmaceuticals, Inc.: Lexicon Pharmaceuticals develops small-molecule and peptide-based therapies for metabolic disorders, including incretin-related mechanisms. Its research aims to improve glycemic control while minimizing side effects in diabetes treatment.

- Viatris Inc.: Viatris manufactures and markets a range of diabetes therapies, including biosimilar and generic incretin mimetics. Its strategy focuses on improving global access to effective, affordable metabolic treatments across emerging markets.

Recent Developments

- In October 2025, A study of over 21,000 military veterans with type 2 diabetes found that liraglutide (Victoza) and semaglutide (Ozempic) had similar cardiorenal outcomes. The risks of kidney failure, major adverse cardiovascular events (MACE), and a composite of both measures were comparable between the two GLP-1 receptor agonists. (Source: https://www.medpagetoday.com)

- In October 2025, the product demonstrates bioequivalence to Novo Nordisk Inc.'s Victoza injection. It is approved as an adjunct to diet and exercise for improving glycemic control in adults and pediatric patients aged 10 years and above with type 2 diabetes mellitus. According to IQVIA MAT data, the drug recorded estimated annual sales of around USD 350 million in the U.S. Spiro Gavaris, President of U.S. Generics at Lupin, stated that this development represents a significant milestone in strengthening the company's complex injectables portfolio and underscores its ongoing commitment to enhancing patient access to vital therapies. (Source: https://www.etnownews.com)

Segments Covered in the Report

By Product Type

- GLP-1 Receptor Agonists

- Dual/Triple Agonists

- Combination Therapies

By Route Of Administration

- Subcutaneous Injection

- Oral

By Dosage Form

- Pre-Filled Pens

- Vials

- Oral Tablets

By End-User

- Hospitals

- Clinics

- Homecare Settings

- Research Institutes

By Therapeutic Application

- Type 2 Diabetes

- Obesity & Weight Management

- Cardiovascular Risk Management

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting