What is the Inhalation Toxicology Testing Market Size?

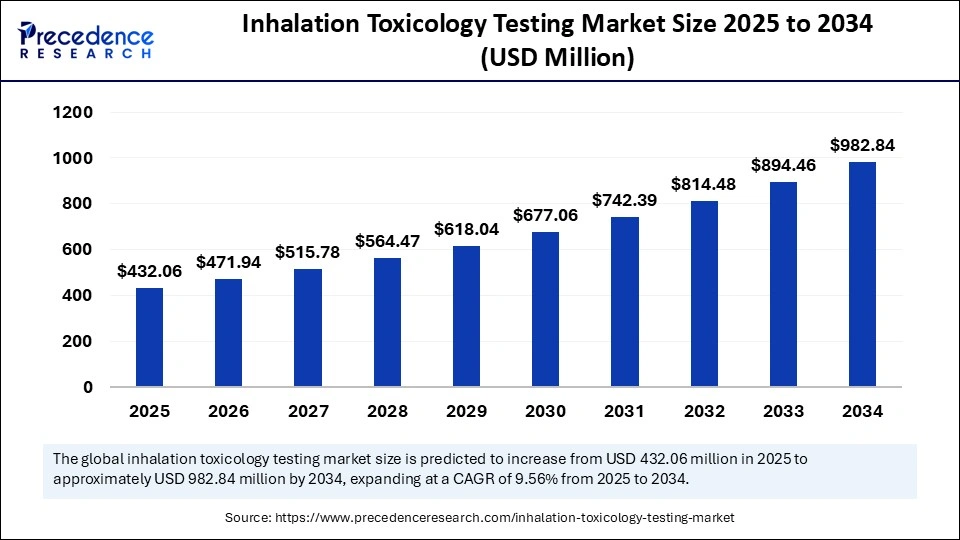

The global inhalation toxicology testing market size was calculated at USD 395.76 million in 2024 and is predicted to increase from USD 432.06 million in 2025 to approximately USD 982.84 million by 2034, expanding at a CAGR of 9.56% from 2025 to 2034. The increased demand for alternative testing methods and growing government funding for toxicology research are driving the global market. The market is further experiencing significant growth with rapid advancements in technology.

Market Highlights

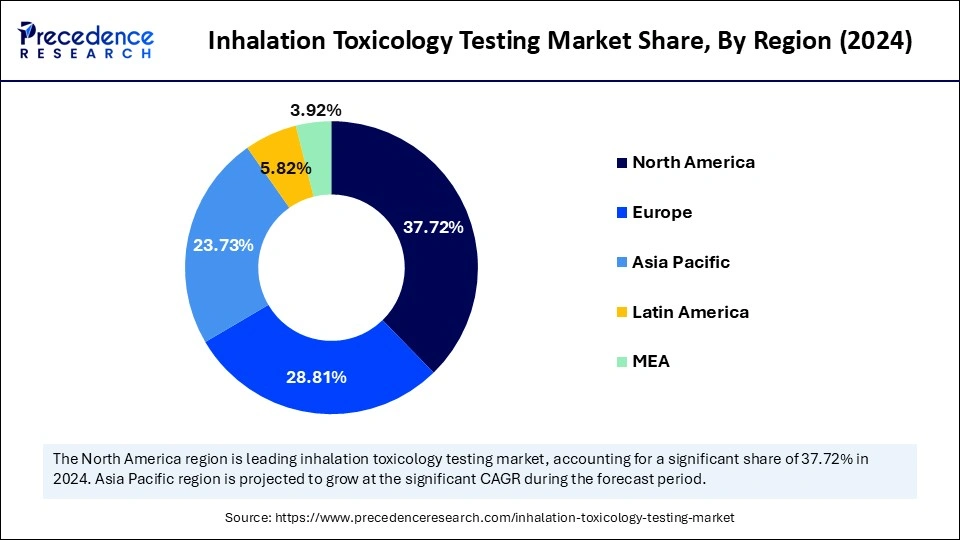

- North America dominated the global inhalation toxicology testing market with the largest share of 37.72% in 2024.

- Asia Pacific is expected to grow at a significant CAGR from 2025 to 2034.

- By study type, the repeated-dose inhalation toxicity segment contributed the biggest market share in 2024.

- By study type, in vitro inhalation assays and the NAMs segment are expected to grow at a notable CAGR between 2025 and 2034.

- By exposure mode/atmosphere, the aerosol-controlled MMAD/PSD segment captured the highest market share in 2024.

- By exposure mode/atmosphere, the nebulised/device-specific dosing segment is expected to grow notably between 2025 and 2034.

- By biological model, the in vivo segment led the market in 2024.

- By biological model, the in vitro will grow at a notable CAGR between 2025 and 2034.

- By end point/output, the histopathology and pulmonary pathology segment accounted for the significant market share in 2024.

- By end-market/application, the pharmaceutical segment generated the major market share in 2024.

- By end-point/output, the biomarkers, cytokines, omics segment will grow at a significant CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 395.76 Million

- Market Size in 2025: 432.06 Million

- Forecasted Market Size by 2034: USD 982.84 Million

- CAGR (2025-2034): 9.56%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is Inhalation Toxicology Testing

Inhalation toxicology testing evaluates the adverse effects of substances introduced into the body through the respiratory system. This testing is essential for assessing the toxicity of inhaled drugs, biologics, agrochemicals, industrial chemicals, and environmental pollutants. It also supports the evaluation of therapeutic efficacy for respiratory disease treatments. Test substances may be administered in various forms, including gases, dust, mists, fine particles, and nanoparticles, using exposure methods such as whole-body exposure, nose-only exposure, skin exposure, or intra-tracheal instillation in rodent models. For in vitro alternatives, direct exposure of test substances to cultured cells is used to simulate respiratory exposure.

Toxicological evaluations follow standard endpoints used in general toxicity studies, complemented by lung-specific assessments such as bronchoalveolar lavage, histopathological analysis, and biochemical examinations of lung tissue. All procedures are conducted in compliance with international Good Laboratory Practice (GLP) guidelines, including those set by OECD, FDA, EPA, and IMAFF.

Backed by over 30 years of experience, the Korea Institute of Toxicology (KIT) delivers high-quality, reliable inhalation toxicology services, supported by advanced infrastructure and state-of-the-art testing equipment, ensuring globally trusted data for regulatory submission and product development.

AI Impact on Inhalation Toxicology Testing

Artificial intelligence is playing a significant role in the inhalation toxicology testing market by enabling predictive modelling, data analysis, risk assessment, and automation. AI algorithms provide predictive modelling of toxicity, including chemical toxicity, and prioritise chemicals for further testing. AI can analyse a broad amount of data from different sources, like omics technologies and high-throughput screening, helping to detect patterns and correlations. AI algorithms enable assessing the risks associated with inhalation exposures to chemicals, providing more accurate and efficient risk evaluations. Moreover, the increased demand forpersonalized medicine is fueling the integration of AI with inhalation toxicology testing to help tailor drug treatments for individuals by analysing their genetic data and identifying genetic variants that are associated with drug metabolism and toxicity.

What are the Key Trends of the Inhalation Toxicology Testing Market?

- Regulatory Requirements: The strict regulatory guidelines for drug development and approval are driving the need for advanced inhalation toxicology testing.

- Increased Demand for Personalised Medicine: The demand for personalised medicine has increased, driving the need for specialised studies and endpoints like development, reproductive, and neurotoxicology.

- Government Initiatives: Governments worldwide are providing significant support and funding for toxicology research, driving the growth of inhalation toxicology testing solutions and advancements.

- Technological Advancements: The development of advanced technologies for toxicology research, like 3D cell culture and high-throughput screening, is contributing to the market growth.

- Outsourcing Trends: The increased outsourcing of preclinical and toxicology studies by pharmaceutical and biotech companies for CROs to manage cost and gain access to specialised expertise and facilities is leveraging market growth.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 395.76 Million |

| Market Size in 2025 | USD 432.06 Million |

| Market Size by 2034 | USD 982.84 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 9.56% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Study Type, Exposure Mode/Atmosphere, Biological Model, Endpoint/Output, End-Market/Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growth of Pharmaceuticals and Chemical Industry

Increased R&D spending, the introduction of new drug formulations, and the development of novel chemicals boost the need for safety testing. The increased demand for toxicology testing in these industries is fostering their growth and innovations. The expansion of the pharmaceutical and chemical industries is fostering drug discoveries and the requirement for regulatory companies. The rising consumer awareness of chemical safety is contributing to the adoption of testing.

This industry growth is driving the need for more comprehensive and sophisticated solutions, ensuring drug safety and efficacy, and driving the adoption of solutions that assess chemical components and medical devices for inhalation hazards. Additionally, the requirement of the pharmaceutical and chemical industry to comply with regulatory compliance to meet safety standards is further adding to the increasing adoption of inhalation toxicology testing.

Restraint

High Cost

The high cost of inhalation toxicology testing is a major restraint on the inhalation toxicology testing market. These solutions require complex and sophisticated equipment for accurate exposure and dosimetry. The specialised equipment and technology used in this testing are quite expensive. The trained professionals with expertise in biology, toxicology, and chemistry are needed for inhalation toxicology testing, which adds to the cost. Additionally, the requirement to comply with strict regulatory guidelines also adds to the cost associated with training and operations.

Opportunity

Animal Testing Alternatives

Regulatory bodies are fostering ethical concerns and bans on animal testing to accelerate the adoption of non-animal approaches. The regulatory emphasis on reduction and replacement of animal testing is driving approaches toward in vitro, in-silico, and other alternative testing methods. This approach is driving the adoption of more sophisticated inhalation methods to advance innovations and accuracy. Additionally, advanced silico modeling with computational model advancements, such as Quantitative Structure-Activity Relationship (QSAR) and Quantitative Read-Across (QRA) models, is enhancing inhalation toxicity prediction and providing greater predictability.

- In April 2025, a policy shift for reducing reliance on animal testing for drug development and incorporating novel approaches of methodologies (NAMs) like silico models was announced by the U.S. Food and Drug Administration (FDA). According to these initiatives, animal testing needs will be reduced, refined, and replaced by using a new range of approaches, like AI-based computational models of toxicity, cell lines, and organoid toxicity testing. (Source: https://www.hklaw.com)

Segment Insights

Study Type Insights

Which Study Type Segment Dominated the Inhalation Toxicology Testing Market?

The repeated-dose inhalation toxicity (short-term, sub-chronic, chronic) segment dominated the market in 2024, due to the large number of studies with repeated doses. The need for inhalation toxicology testing is high in repeated-dose toxicity studies for characterising adverse toxicological effects. These effects can occur from daily exposure to a substance for a specific time or period. Pharmaceuticals, environmental pollutants, and chemicals and agrochemicals are the sectors that drive the adoption of repeated-dose inhalation toxicity.

The in vitro inhalation assays (air-liquid interface [ALI], lung organoids) and NAMs segment is the second-largest segment, leading the market due to its reproducibility and ability to detect toxicity in the early drug development stage. These services enable more physiologically relevant models that replace animal testing. The ability of in vitro inhalation assays and NAMs to offer better respiratory disease and drug discovery insights aligns with 3R principles. The advancements in in vitro systems are driving service adoption in industries like pharmaceuticals, cosmetics, and consumer products.

Exposure Mode/Atmosphere Insights

Which Exposure Mode/Atmosphere Leads the Inhalation Toxicology Testing Market?

The aerosol (particulate) — controlled MMAD/PSD segment led the market in 2024, due to its large adoption in accurate drug delivery assessment. Mass Media Aerodynamic Diameter (MMAD) and Particle Size Distribution (PSD) are essential in regulatory compliance and understanding of the health impacts of toxicity. Pharmaceutical companies are driving demand for comprehensive control and measurements of aerosol properties to unveil the efficacy and safety of products. This makes aerosol-controlled MMAD/PSD a high-value area for testing.

The nebulised/device-specific dosing (pMDI, DPI, nebuliser) segment is expected to grow fastest over the forecast period, driven by the need for device-specific testing. The need for specialised testing for various devices like pressurised metered dose inhalers, dry powder inhalers, soft mist inhalers, and nebulisers is high in the pharmaceuticals, chemicals, and consumer products industry. The inhalation drug product testing is essential for nasal drug products and orally inhaled drug products. Technological advancements like cascade impaction, automated actuation systems, and laser diffraction are contributing to the segment's growth.

Biological Model Insights

How In Vivo Segment Dominates the Inhalation Toxicology Testing Market?

The in vivo (rodent — mouse/rat; non-rodent, rabbit, dog; NHP) segment dominated the market in 2024, due to exclusive tests, regulatory requirements, and increased demand for personalised medicines and innovations in animal models. The regulatory compliance regarding accurate prediction of human toxicity, cost, and the development of new approach methodologies (NAMs) is driving the adoption of inhalation toxicology testing in in vivo studies. In vivo studies need regulatory approvals for drugs and require chronic toxicity testing. Additionally, the growing emphasis on replacements and reducing animal use, particularly for certain rugs, is contributing to this growth.

The in vitro (primary human airway cultures, ALI, co-culture airway models) segment is the second-largest segment, leading the market, due to an increase in vitro assay activity. The in vitro studies are cost-effective, ethical, and more effective alternatives to animal testing. The innovations in primary human airway cultures, ALI, and co-culture airway models are further driving the adoption of in vitro studies. The growing regulatory emphasis on non-animal methods is further aiding in the growth of in vitro studies, driving the need for advanced inhalation toxicology testing.

End-Point/Output Insights

Which End-Point/Output Segment Dominated the Inhalation Toxicology Testing Market?

The histopathology and pulmonary pathology segment dominated the market in 2024, due to increased need for detailed, tissue-level evidence for the effects of substances on the respiratory system. The histopathology and pulmonary pathology are essential for safety evaluations and dose estimation in drug development and hazard assessments. The need to ensure sophisticated toxicological profiles, guide regulatory submissions, and prevent the need for more extensive studies, the histopathology and pulmonary pathology are crucial. The inhalation toxicology testing ensure histopathology and pulmonary pathology.

The biomarkers, cytokines, and omics segment is expected to grow fastest over the forecast period, driven by their crucial role in providing mechanism-based insights into the biological process of toxicity, such as inflammation and immune responses. These biomarkers, cytokines, and omics offer highly sensitive and predictive safety assessments to enhance drug development. The ability of biomarkers to offer more accessible and measurable indicators of toxicity, with cytokines tracking inflammation, makes them crucial in testing. Omics help to detect patterns in biological signals for revealing toxicity mechanisms and predicting adverse effects.

End-Market/Application Insights

What Made the Pharmaceutical Segment Dominate the Inhalation Toxicology Testing Market?

In 2024, the pharmaceutical segment dominated the market due to the expanding pharmaceutical industry and increased R&D spending. Pharmaceutical companies have increased outsourcing preclinical safety testing to CROs (contract research organization), enabling cost-effective and emphasizing core competencies. The rising need for rigorous safety assessment for complex biologics and novel drug modalities is further contributing to this growth. Pharmaceutical companies need to comply with strict regulations, the shift to safe, effective, and compliant respiratory condition requirements, driving the adoption of comprehensive inhalation toxicology testing.

Regional Insights

U.S. Inhalation Toxicology Testing Market Size and Growth 2025 to 2034

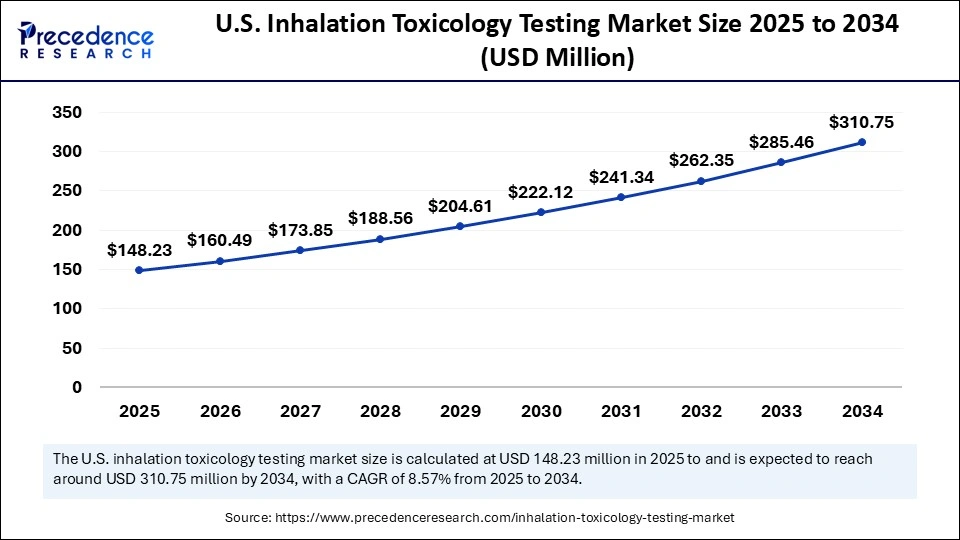

The U.S. inhalation toxicology testing market size was exhibited at USD 136.98 million in 2024 and is projected to be worth around USD 310.75 million by 2034, growing at a CAGR of 8.57% from 2025 to 2034.

North America Inhalation Toxicology Testing Market

North America dominated the global inhalation toxicology testing market, holding the largest share of 37.72% in 2024, driven by the region's well-established research and development sector and its strict dug safety regulations. North America has a well-established and expanded pharmaceutical and biotechnology industry, driving demand for new drugs and fostering investments in research and development. The rising regulatory requirements and increased adoption of cutting-edge in-vitro and 3D cell culture technologies are contributing to this growth. The increased demand for new and diverse chemical testing, strong emphasis on technological advancements, and regulatory support are fostering this growth.

The U.S. Market Trends

The U.S. is a major player in the regional market, growth driven by rising research and development activities and strong pharmaceutical and biotechnology companies. The U.S. government is implementing strict regulations for the safety of chemicals, medical devices, and consumer products, driving the need for sophisticated inhalation toxicology testing. The FDA guidelines for reducing and potentially replacing the use of animals for testing are fostering innovative approaches in the U.S. industry. The rising demand for animal testing alternative methods and expanding testing scope to include novel product categories such as nanoparticles and e-cigarettes are contributing to this growth.

Asia Pacific Inhalation Toxicology Testing Market

Asia Pacific is the fastest-growing region in the global market, growth driven by the region's expanding pharmaceutical industry and increasing prevalence of chronic disease. The expanded pharmaceutical companies have boosted demand for early toxicity detection solutions and services. Governments and companies' investments in research and development activities are enabling innovations and developments of inhalation toxicology testing across Asia. Additionally, the ongoing emphasis on advancements in technologies like 3D cell culture and in-silico modelling is further contributing to the market growth.

Increased R&D Activity: Fueling Need in China

China is a major player in the regional market, contributing to growth due to the country's well-established and rapidly expanding pharmaceutical and biotechnology sectors. China is the second-largest drug developer globally, driving a significant need for sophisticated toxicology services. The growing pharmaceutical pipeline and the need to ensure drug safety are leveraging this shift. The Government of China is investing in local pharmaceutical companies and supporting R&D activities, which leads to a boost in the country's market.

Europe Inhalation Toxicology Testing Market

Europe is a notable player in the global market, contributing to growth due to increasing R&D activity, increased demand for testing novel therapeutic areas, and stringent government regulations. The European Union has implemented strict regulations for drug safety and chemical products, driving the need for comprehensive inhalation toxicology testing. Additionally, the expanding areas like biologics and personalised medicines are further increasing the adoption of these testing. Europe's emphasis on advancements and adoption of cutting-edge technologies like AI and 3D cell culture in drug discovery and testing for more accurate, cost-effective, and fast solutions is boosting this growth.

Strong Pharmaceutical Industry: To Boost German Adoption

Germany dominates the regional market due to the country's robust pharmaceutical industry base. Germany's government and pharmaceutical companies are investing heavily in R&D. The strong and large laboratory network and strong pharmaceutical companies' commitment to regulatory compliance and innovations are contributing to the rising adoption of sophisticated toxicology testing, including inhalation toxicology testing.

Inhalation Toxicology Testing Market Companies

- Laboratory Corporation of America Holdings

- Charles River Laboratories, Inc.

- Eurofins Scientific

- Bureau Veritas

- Envigo

- Evotec AG

- Merck KGaA

- SGS Group

- Pharmaceutical Product Development

- LLC (PPD)

- WuXi AppTec

- ITR Laboratories Canada Inc.

- Charles River

- Battelle

- IITRI

- Inotiv (Envigo)

- Labcorp

- Creative Bioarray

- SGS

- ImmuONE

- Vivotecnia

- Creative Bioarray

Recent Developments

- In May 2025, AstraZeneca demonstrated its latest clinical and real-world data across leaing inhaled, biologic, and early science respiratory portfolio at the American Thoracic Society (ATS) International Conference, in San Francisco, CA. this launch includes over 75 abstratcs such as eight late-breakers, innovations in unmet needs in care in all severities of asthma, chronic obstructive pulmonary disease (COPD), and eosinophilic granulomatosis with polyangiitis (EGPA). (Source: https://www.astrazeneca.com)

- In March 2025, an innovator in predictive toxicology and drug discovery solutions, AsedaSciences, announced the launch of a state-of-the-art zebrafish screening service, ZBEScreenTM. This service has been developed in collaboration with the renowned Tanguay Lab to provide testing with the expertise of Prof. Robyn Tanguay. (Source: https://www.wjhl.com)

Segment Covered in the Report

By Study Type

- Acute inhalation toxicity (single/limited exposure).

- Repeated-dose inhalation toxicity (short-term, sub-chronic, chronic).

- Carcinogenicity inhalation studies.

- Developmental and reproductive (DART) inhalation studies.

- Inhalation pharmacokinetics (PK/TK), ADME, and biodistribution (including radiolabeled).

- Challenge/infectious-aerosol studies (BSL-2/3 as required).

- In vitro inhalation assays (air-liquid interface [ALI], lung organoids) and NAMs.

- Mechanistic/biomarker/-omics endpoints.

By Exposure Mode/Atmosphere

- Aerosol (particulate) — controlled MMAD/PSD

- Vapour/gas exposures.

- Whole-body exposure vs nose-only vs head-only vs intra-tracheal instillation.

- Nebulised/device-specific dosing (pMDI, DPI, nebuliser).

By Biological Model

- In vivo (rodent — mouse/rat; non-rodent — rabbit, dog; NHP)

- In vitro (primary human airway cultures, ALI, co-culture airway models)

- Ex vivo (precision-cut lung slices).

- In silico/IVIVE and PBPK modelling.

By Endpoint/Output

- Histopathology and pulmonary pathology

- Respiratory function (plethysmography, lung mechanics).

- Clinical pathology (BAL, blood chemistries).

- Biomarkers, cytokines, omics.

- Deposited dose/dosimetry and aerosol characterization.

By End-Market/Application

- Pharmaceutical

- inhaled drugs

- biologics

- vaccines

- OINDP

- Others

- Medical devices

- Inhalers

- Nebulizers

- combination products

- Tobacco and e-vapour/nicotine products.

- Chemicals and agrochemicals

- industrial/occupational exposure

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting