What is the Internal Neuromodulation Devices Market Size?

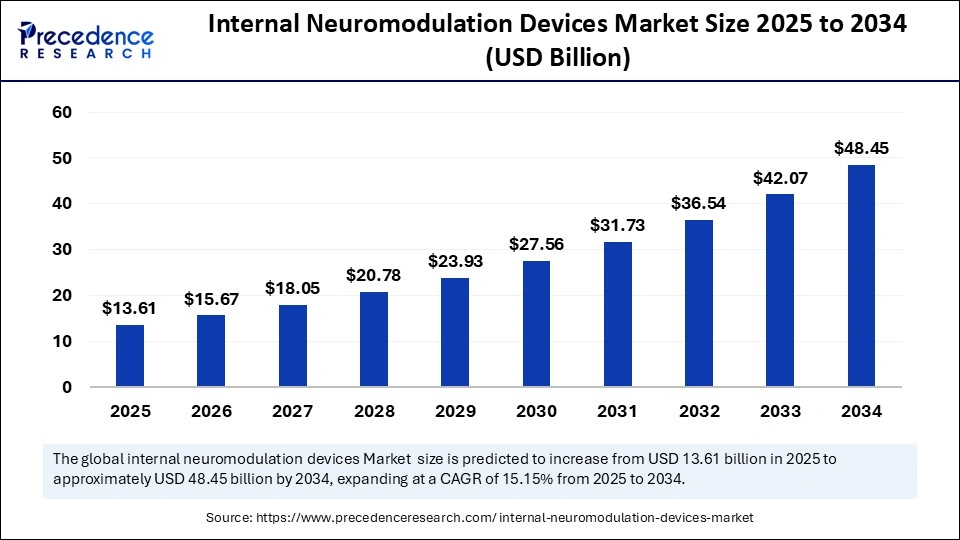

The global internal neuromodulation devices market size accounted for USD 11.82 billion in 2024 and is predicted to increase from USD 13.61 billion in 2025 to approximately USD 48.45 billion by 2034, expanding at a CAGR of 15.15% from 2025 to 2034.

Market Highlights

- North America dominated the market with the largest market share of 42% in 2024.

- Asia Pacific is expected to expand at the fastest CAGR between 2025 and 2034.

- By device type, the spinal cord stimulators segment led the market in 2024.

- By device type, the deep brain stimulator is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application type, the chronic pain management segment held the biggest market share in 2024.

- By application type, depression & psychiatric disorders are expected to grow at a high CAGR during the forecasted period.

- By technology type, the electrical stimulation segments captured the biggest market share in 2024.

- By technology type, closed-loop neuromodulation is expected to grow at a remarkable share of 25% CAGR between 2025 and 2034.

- By component type, the implantable pulse generators segment contributed the highest market share in 2024.

- By component type, software & data analytics platforms are expected to grow at a remarkable CAGR in the internal neuromodulation devices market between 2025 and 2034.

- â By patient demographics type, the adult patient segment accounted for the significant market share in 2024.

- By patient demographics type, geriatric patients are expected to grow at a remarkable CAGR between 2025 and 2034.

- â By end-user type, the hospital segment held the largest market share in 2024.

- By end-user type, specialty clinics are expected to grow at a remarkable CAGR between 2025 and 2034.

- â By price type, the mid-tier rechargeable systems segment generated the major market share in 2024.

- By price demographics type, premium adaptive & closed-loop systems are expected to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 11.82 Billion

- Market Size in 2025: USD 13.61 Billion

- Forecasted Market Size by 2034: USD 48.45 Billion

- CAGR (2025-2034): 15.15%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Constitutes the Internal Neuromodulation Devices Market?

The internal neuromodulation devices market has emerged as a pivotal frontier in modern medicine, offering transformative solutions for conditions such as chronic pain, epilepsy, Parkinson's disease, and spinal cord injuries. These implantable devices, by modulating neural activity, provide patients with respite where conventional pharmacological treatments prove inadequate. The burgeoning prevalence of neurological and lifestyle-related disorders, coupled with an aging global population, is catalyzing demand for these sophisticated interventions. Furthermore, the integration of miniaturization and biocompatible materials has elevated device safety, durability, and patient acceptance. Governments and healthcare institutions are also progressively recognizing neuromodulation as a cost-effective alternative to long-term drug regimens. Consequently, the market stands poised for sustained growth, underpinned by both medical necessity and technological innovation.

How AI is Impacting the Internal Neuromodulation Devices Market

Artificial intelligence is revolutionizing internal neuromodulation devices by augmenting their intelligence, precision, and adaptability in the internal neuromodulation devices market. Machine learning algorithms are being employed to analyze neural signals in real time, thereby enabling closed-loop systems that automatically calibrate stimulation patterns. This personalization significantly enhances therapeutic efficacy and reduces adverse effects. Moreover, AI-powered platforms facilitate predictive analytics for patient selection, improving outcomes while optimizing healthcare resource allocation. Beyond device function, AI aids in accelerating R&D pipelines through simulation models that reduce trial-and-error in electrode design and signal optimization. Collectively, these advancements are metamorphosing neuromodulation from static implants into dynamic, responsive systems of therapy.

Market Key Trends

- Transition toward closed-loop neuromodulation systems with AI integration.

- Rising demand for miniaturized, MRI-compatible implants.

- Expanding applications beyond pain management into psychiatric disorders like depression and OCD.

- Growth in wireless charging and remote monitoring technologies for implants.

- Increasing adoption of bioelectronic medicine as an alternative to pharmaceuticals.

- Collaborations between medtech companies, universities, and AI startups are driving R&D momentum.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 11.82 Billion |

| Market Size in 2025 | USD 13.61 Billion |

| Market Size by 2034 | USD 48.45 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.15% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Device Type, Application / Therapy Area, Technology / Stimulation Mode, Component, Patient Demographics, End-User, Price / Product Tier, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The Growing Neurological Disease Burdens Is Leading to Market Growth

The principal driver of the internal neuromodulation devices market is the escalating burden of neurological and chronic pain disorders, which remain refractory to traditional therapeutics. With populations aging, the incidence of Parkinson's disease, Alzheimer's, and spinal cord ailments is surging, propelling demand for effective long-term interventions. These devices offer superior efficacy by directly targeting neural circuits, circumventing systemic drug side effects. Technological evolution, manifested in biocompatible materials, rechargeable batteries, and wireless power systems, has amplified device reliability and patient compliance. Furthermore, a growing awareness among both patients and clinicians regarding the therapeutic promise of neuromodulation is expanding adoption. Favorable reimbursement frameworks in North America and parts of Europe further catalyze this uptake.

Another force invigorating the market is the robust pace of clinical innovation, with newer devices securing regulatory approvals across geographies. Academic consortia and industrial players are channeling unprecedented investment into neurotechnology research, broadening the therapeutic spectrum. In parallel, the digital health movement encompassing telemedicine and remote device management has strengthened the practical viability of neuromodulation therapies. Enhanced training of neurosurgeons and multidisciplinary care models are also bolstering market penetration. Together, these drivers provide the scaffolding for enduring global market momentum.

Restraints

Invasive Implants and High Complexities of Devices Restrict Growth

Notwithstanding its promise, the internal neuromodulation devices market is hampered by the invasive nature of implantation, which dissuades many potential patients. Surgical risks, ranging from infection to device migration, remain formidable concerns. Equally daunting are the prohibitive upfront costs of neuromodulation systems, which limit adoption in resource-constrained settings. The reimbursement landscape remains uneven globally, with several regions lacking supportive frameworks. Complex regulatory approval pathways further protract time-to-market for novel devices. Moreover, limited clinical expertise in implanting and managing neuromodulation systems restricts widespread availability.

In addition, concerns regarding long-term device durability and potential hardware malfunctions constrain confidence in adoption. Ethical questions, particularly around neurostimulation for psychiatric applications, add another layer of complexity. Emerging non-invasive alternatives, such as transcranial magnetic stimulation (TMS), also pose competitive threats by offering less risky interventions. Data security risks in AI-driven and remotely connected implants further exacerbate hesitancy. Collectively, these restraints temper the otherwise bullish outlook for the market.

Opportunities

New Applications in Psychiatric and Mental Health Domains Expected to Spur Growth

One of the foremost opportunities lies in expanding neuromodulation into psychiatric and cognitive domains, where pharmacological therapies often underperform. Disorders such as major depressive disorder, post-traumatic stress disorder, and treatment-resistant anxiety present vast untapped potential. In addition, the ongoing convergence with AI and digital therapeutics allows for real-time personalization, which will differentiate future generations of devices. Emerging economies with rising healthcare expenditure, notably in Asia and Latin America, provide fertile terrain for market expansion. Simultaneously, partnerships with healthcare systems to establish value-based care models can create new revenue streams.

Moreover, as surgical robotics advances, implantation procedures for neuromodulation devices are becoming less invasive and more precise, thus broadening patient eligibility. Companies that invest in wireless charging systems and minimally invasive electrode designs stand to capture significant market share. Furthermore, public and private research initiatives are accelerating the development of neuromodulation solutions for novel indications, including obesity and hypertension. This diversification of applications ensures a long-term growth horizon for the internal neuromodulation devices market.

Segment Insights

Device Type Insights

Why Are Spinal Cord Stimulators Dominating the Internal Neuromodulation Devices Market?

Spinal cord stimulators reign supreme, dominating the internal neuromodulation devices market, commanding the lion's share of global deployment. Their dominance arises from their efficacy in mitigating chronic pain, a condition of immense socioeconomic burden. These devices provide targeted relief by modulating aberrant nerve impulses, sparing patients from the systemic ravages of opioid therapy. Continuous refinements in electrode arrays, programming flexibility, and rechargeable battery systems have amplified their clinical appeal. Moreover, their extensive clinical validation across diverse indications consolidates trust among practitioners and payers alike. In effect, spinal cord stimulators embody the established bastion of neuromodulation technology.

Their adoption is also buoyed by strong reimbursement frameworks in the internal neuromodulation devices market, reinforcing their ubiquity in pain management clinics and tertiary hospitals. Strategic collaborations between manufacturers and hospitals have streamlined implantation procedures, lowering barriers to entry for patients. Ongoing innovations such as high-frequency stimulation and burst technology further expand therapeutic horizons. Patient satisfaction and long-term cost savings provide a virtuous cycle of adoption. Thus, spinal cord stimulators will likely remain the cornerstone of neuromodulation for the foreseeable future. Their centrality, however, is now being intriguingly challenged by more specialized devices such as deep-brain stimulators.

Deep brain stimulators represent the fastest-growing segment in the internal neuromodulation devices market, propelled by the increasing recognition of their utility in managing Parkinson's disease, dystonia, and emerging psychiatric applications. Their allure lies in their ability to modulate discrete brain circuits with unparalleled precision. Advances in imaging-guided surgery and miniaturized electrodes have enhanced both safety and efficacy. Furthermore, the expanding application into psychiatric disorders such as depression and OCD is broadening their clinical mandate. Clinical trials across continents are affirming their transformative role in refractory conditions. Thus, deep brain stimulators are evolving from niche instruments into symbols of neurotechnological daring.

The internal neuromodulation devices market expansion is being catalysed by regulatory approvals in new therapeutic indications, unlocking access to larger patient pools. Collaborative R&D between Medtech giants and academic neurologists is pushing boundaries of usage. Innovations in adaptive, closed-loop stimulation are poised to elevate their outcomes further. Reimbursement challenges remain, yet the demonstrable efficacy of these devices is eroding resistance. With growing societal acceptance of advanced neurosurgery, their trajectory appears inexorably upward. Deep brain stimulators, therefore, herald a future where the boundaries between neurology and psychiatry blur.

Application Insights

How Did the Chronic Pain Management Segment Lead the Internal Neuromodulation Devices Market?

Chronic pain management remains the dominant internal neuromodulation devices market. The soaring prevalence of musculoskeletal disorders, neuropathic pain, and failed back surgery syndrome has entrenched these devices as indispensable solutions. Unlike pharmacological regimens, neuromodulation circumvents risks of addiction, tolerance, and systemic toxicity. Spinal cord stimulators are emblematic of this dominance, with millions of patients benefiting globally. The cost-effectiveness of these devices, measured against the long-term burden of untreated pain, bolsters their case with policymakers.

Hence, chronic pain management constitutes both the clinical and commercial bedrock of internal neuromodulation devices. Increasing clinician awareness and patient advocacy further fortify their centrality in care pathways. Clinical guidelines in developed economies now endorse neuromodulation as a mainstream intervention. Ongoing innovation in stimulation waveforms and patient-specific programming elevates efficacy. Meanwhile, expanding insurance coverage gradually dismantles affordability barriers. The magnitude of the chronic pain epidemic ensures that demand remains perennial. For the foreseeable horizon, pain management will remain the lodestar of neuromodulation adoption.

The fastest-growing application area lies in the delicate yet urgent domain of psychiatric disorders in the internal neuromodulation devices market. Major depressive disorder, resistant to pharmacotherapy, is catalyzing unprecedented interest in neuromodulation interventions. Deep brain and vagus nerve stimulation are emerging as promising modalities, supported by a corpus of exploratory clinical evidence. The societal burden of mental illness, compounded by the limitations of existing therapies, makes this frontier a fertile landscape. Technological strides in adaptive, closed-loop stimulation hold the promise of tailoring therapy dynamically to neural states. In essence, psychiatric neuromodulation represents medicine's bold foray into the mind's labyrinth.

Venture capital flows into neuropsychiatry startups underscore the perceived commercial opportunity. Regulatory bodies are cautiously yet increasingly open to approving pilot indications. The stigma around invasive brain therapies is waning as clinical outcomes provide persuasive evidence. Insurance frameworks, though nascent, are beginning to recognize the dire economic burden of untreated depression. Multi-disciplinary collaborations between psychiatrists, neurologists, and engineers are expediting breakthroughs. Consequently, psychiatric neuromodulation is on the cusp of transformative mainstream acceptance.

Technology / Stimulation Mode Insights

Does Electrical Stimulation Remain the Main Modality Type in the Market for Internal Neuromodulation Devices?

Electrical stimulation continues to dominate the internal neuromodulation devices landscape as the most established and clinically validated approach. Its relative simplicity, reliability, and adaptability across multiple devices render it the default choice. Modulating aberrant electrical signals in neural circuits provides relief across a wide spectrum of disorders. The longevity of its usage, backed by decades of clinical evidence, strengthens physician confidence. Cost advantages over more experimental modalities.

Thus, electrical stimulation remains the archetypal backbone of neuromodulation technology. The breadth of its applicability, from spinal cord stimulators to deep brain implants, underscores its universal relevance. Incremental innovations, such as high-frequency and patterned waveforms, ensure it remains competitive. Its compatibility with rechargeable and miniaturized systems enhances patient comfort. Reimbursement frameworks, already established for electrical stimulation, further entrench its dominance. Moreover, its scalability to diverse socioeconomic contexts secures global traction. Electrical stimulation, therefore, stands as the perennial workhorse of neuromodulation.

Closed-loop neuromodulation is the fastest-growing segment in the internal neuromodulation devices market, revolutionizing the paradigm by integrating sensing and stimulation in real time. These systems respond dynamically to fluctuating neural activity, delivering truly personalized therapy. Artificial intelligence augments this responsiveness, predicting and pre-empting maladaptive patterns. The result is superior efficacy, minimized side effects, and reduced battery usage. Pilot studies in epilepsy and Parkinson's disease are already affirming its promise. Closed-loop neuromodulation thus symbolizes the dawn of intelligent therapeutics.

Market enthusiasm is palpable, with medtech leaders heavily investing in R&D and clinical trials. Early adopters highlight marked improvements in patient satisfaction and long-term outcomes. Regulatory bodies, though cautious, are supportive of evidence-backed innovations. Integration with wearable sensors and digital health ecosystems enhances its appeal. Despite higher initial costs, its potential to deliver value-based care ensures strong future demand. In sum, closed-loop neuromodulation is poised to metamorphose the field from reactive therapy to proactive precision.

Component Insights

Why Did Implantable Pulse Generators Lead the Internal Neuromodulation Devices Market?

Implantable pulse generators (IPGs) led the internal neuromodulation devices industry, serving as the indispensable engines of therapy delivery. Their evolution into smaller, rechargeable, and longer-lasting forms has cemented their indispensability. IPGs provide the programmability necessary for tailoring stimulation regimens across diverse pathologies. The reliability of their engineering, proven over decades, builds unmatched clinician confidence. Their high cost, paradoxically, underscores their centrality in device economics. Thus, IPGs are the irreplaceable linchpin of the neuromodulation ecosystem.

Advances in biocompatible casing, wireless recharging, and power efficiency are extending their functional lifespan. Integration with patient controllers enhances user autonomy and compliance. Standardization of implantation techniques further drives widespread adoption. The dominance of IPGs is unlikely to be eclipsed in the near term. They represent the sine qua non of neuromodulation hardware. Without the IPG, the neuromodulation paradigm itself would collapse.

The fastest-growing component lies in software and analytics platforms. These systems transform neuromodulation from static implants into intelligent, data-driven therapies. AI-enabled platforms analyze neural signals, personalize stimulation, and predict adverse events. Clinicians benefit from dashboards offering actionable insights, while patients gain enhanced monitoring and control. Cloud integration allows remote reprogramming and telehealth-based follow-ups. Software, once ancillary, is now emerging as the cerebral cortex of neuromodulation systems.

The rise of analytics also dovetails with the healthcare sector's shift toward value-based care. Data from devices can substantiate reimbursement claims and demonstrate outcomes. Interoperability with electronic health records further amplifies their relevance. As neuromodulation expands into psychiatric and cognitive domains, analytics will be indispensable. Moreover, the relatively low barriers to innovation in software compared to hardware invite entrepreneurial disruption. Thus, software and analytics are destined to be the fastest-ascending layer of neuromodulation value creation.

End-User Insights

Why Implantable Pulse Generators are Dominating the Internal Neuromodulation Devices Market?

Hospitals command the lion's share of the internal neuromodulation device market, owing to their comprehensive infrastructure, surgical expertise, and advanced therapeutic setups. These institutions serve as the primary epicenters for both implantations and post-procedural care, reinforcing their indispensability. Their multidisciplinary teams ensure not just device implantation but also longitudinal monitoring of patient outcomes. Furthermore, the presence of cutting-edge imaging suites and neurosurgical units consolidates hospitals' preeminence. Patients, particularly those with chronic pain or movement disorders, instinctively gravitate toward these establishments for both credibility and trust. Thus, hospitals stand as the lodestar of neuromodulation's clinical application.

Specialty clinics, however, are the fastest growing in the internal neuromodulation device market, riding the wave of outpatient-centric healthcare delivery. Their nimble and patient-centric approach enables quicker access, shorter waiting times, and reduced costs. Increasingly, neuromodulation implantation is shifting into these focused care environments, buoyed by advances in minimally invasive techniques. Moreover, specialty clinics often foster personalized therapeutic protocols tailored to unique patient profiles. Their compact scale paradoxically permits agility, experimentation, and adoption of niche technologies. This growing decentralization of neuromodulation reflects a paradigm where accessibility, affordability, and precision converge outside the conventional hospital bastion.

Price Insights

How Mid-tier Rechargeable Systems are Dominating the Internal Neuromodulation Devices Market?

Mid-tier rechargeable systems dominate owing to their equilibrium between affordability and functionality. These devices strike an optimal balance: offering reliable longevity without the prohibitive costs of ultra-premium systems. Their rechargeable capability substantially reduces the need for surgical replacements, minimizing both risk and expenditure for patients. Healthcare providers prefer them for their proven efficacy across multiple therapy areas, particularly in pain management. This pragmatic blend of sustainability and accessibility appeals strongly to payers, especially in markets where reimbursement frameworks are tightly scrutinized. Thus, mid-tier rechargeables epitomize the "golden mean" of neuromodulation accessibility.

In contrast, premium adaptive and closed-loop systems are rapidly ascending as the aristocracy of neuromodulation technology. They integrate intelligent algorithms that modulate stimulation dynamically, aligning device function with patient-specific neural signals. This bespoke adaptability enhances both therapeutic efficacy and patient comfort, reducing incidences of overstimulation or device inefficacy. Though initially constrained by exorbitant costs, their appeal grows as outcomes justify investment in high-value care. Elite hospitals and advanced research centers are spearheading their early adoption, paving the way for mainstream diffusion. These systems, while currently a niche, portend the future of hyper-personalized neuromodulation therapy.

Regional Insights

U.S. Internal Neuromodulation Devices Market Size and Growth 2025 to 2034

The U.S. internal neuromodulation devices market size was evaluated at USD 3.48 billion in 2024 and is projected to be worth around USD 14.52 billion by 2034, growing at a CAGR of 15.36% from 2025 to 2034.

Why Does North America Dominate the Internal Neuromodulation Devices Market?

North America presently dominates the internal neuromodulation devices market, owing to its sophisticated healthcare infrastructure, high incidence of neurological conditions, and strong reimbursement mechanisms. The United States serves as the epicentre of innovation, with companies like Medtronic, Abbott, and Boston Scientific spearheading global advancements. Clinical adoption is reinforced by robust regulatory systems that, despite being stringent, lend credibility and global confidence to devices cleared for use. Furthermore, the presence of leading research universities and teaching hospitals accelerates translational research into clinical practice. Patient awareness and demand for innovative treatments also drive market leadership.

The region's dominance is further buoyed by significant investment in digital health integration, allowing remote device programming and monitoring. Favourable insurance policies mitigate the high upfront cost barrier, ensuring greater accessibility. Strategic collaborations between device makers, AI startups, and healthcare providers sustain technological leadership. Moreover, the aging baby boomer population presents a ready demand base for neurotherapeutic interventions. Collectively, North America's amalgam of demand, innovation, and policy support ensures its commanding position in the market landscape.

Could Asia Pacific Be the New Neuromodulation's Next Frontier?

The Asia-Pacific region is anticipated to register the fastest growth in the internal neuromodulation devices market, driven by demographic momentum, burgeoning healthcare expenditure, and increasing neurological disease prevalence. Countries such as China, India, and Japan are witnessing a rising incidence of chronic pain and neurodegenerative conditions, which is intensifying the need for advanced therapeutic solutions. Governments are progressively investing in healthcare modernization, thereby paving the way for the adoption of high-end microdevices. Moreover, domestic players in China and South Korea are entering the neuromodulation domain, creating competitive local ecosystems. Rising disposable incomes and expanding insurance coverage are further improving patient access.

The region's momentum is also underpinned by strategic collaborations with Western medtech firms, facilitating technology transfer and local manufacturing. Asia-Pacific's youthful scientific workforce and burgeoning start-up culture provide fertile ground for innovation in neuromodulation technologies. Importantly, cost advantages in manufacturing are likely to position the region as a global production hub. With proactive regulatory reforms in several countries, the time-to-market for new devices is accelerating. Thus, Asia-Pacific stands at the cusp of becoming not merely a fast-growing consumer market but also a formidable center of innovation and production.

Internal Neuromodulation Devices Market Companies

- Medtronic plc

- Abbott Laboratories

- Boston Scientific Corporation

- Nevro Corp.

- LivaNova PLC

- Axonics, Inc.

- NeuroPace, Inc.

- Nuvectra Corporation

- Aleva Neurotherapeutics SA

- Synapse Biomedical Inc.

- NeuroSigma, Inc.

- Inspire Medical Systems, Inc.

- Saluda Medical Pty Limited

- Mainstay Medical International plc

- Biotronik SE & Co. KG

Recent Developments

- In September 2025, Neuroscience professor Grégoire Courtine of the Federal Institute of Technology Lausanne (EPFL) and neurosurgeon Jocelyne Bloch of Lausanne University Hospital, who also teaches at the University of Lausanne, explain that one of the hidden consequences of paralysis is the disruption of blood pressure regulation. In individuals with spinal cord injuries, the brain's signal that normally prompts blood vessels to constrict fails to reach its destination, as the necessary neurons remain inactive. The newly developed device restores this lost communication by stimulating the nerve cells responsible for controlling vascular tension.(Source:https://www.swissinfo.ch)

Segment Covered in This Report

By Device Type

- Spinal Cord Stimulators (SCS)

- Deep Brain Stimulators (DBS)

- Vagus Nerve Stimulators (VNS)

- Sacral Nerve Stimulators (SNS)

- Gastric Electrical Stimulators (GES)

- Other Peripheral Nerve Stimulators

By Application / Therapy Area

- Chronic Pain Management

- Parkinson's Disease

- Epilepsy

- Essential Tremor

- Depression & Psychiatric Disorders

- Urinary & Fecal Incontinence

- Gastroparesis

- Other Neurological & Functional Disorders

By Technology / Stimulation Mode

- Electrical Stimulation (traditional)

- Magnetic / Adaptive Stimulation

- Closed-Loop / Responsive Neuromodulation

- Multi-site / Hybrid Stimulation Systems

By Component

- Implantable Pulse Generators (IPGs)

- Leads & Electrodes

- Rechargeable vs. Non-rechargeable Batteries

- External Controllers & Programmers

- Software & Data Analytics Platforms

By Patient Demographics

- Adult Patients (18–64 years)

- Geriatric Patients (65+ years)

- Pediatric Patients (selected epilepsy & movement disorder cases)

By End-User

- Hospitals (neurosurgery & pain centers)

- Specialty Clinics (neurology, psychiatry, pain management)

By Price / Product Tier

- Standard Neuromodulation Systems (basic, lower-cost IPGs)

- Mid-tier Rechargeable Systems

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting