What is the Internet Security Market Size?

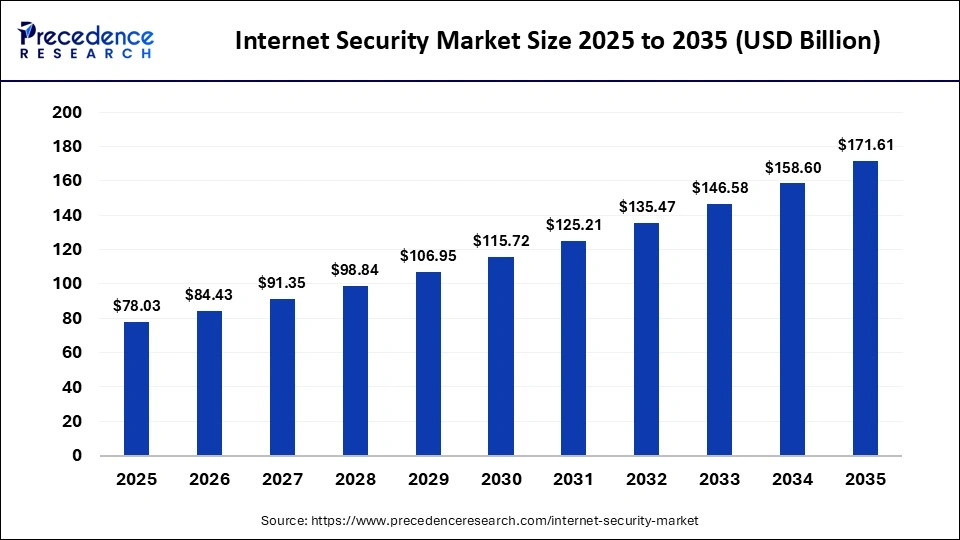

The global internet security market size was calculated at USD 78.03 billion in 2025 and is predicted to increase from USD 84.43 billion in 2026 to approximately USD 171.61 billion by 2035, expanding at a CAGR of 8.20% from 2026 to 2035. This market is growing due to the rising frequency of cyberattacks, increasing digitalization, and growing adoption of cloud-based services across industries.

Market Highlights

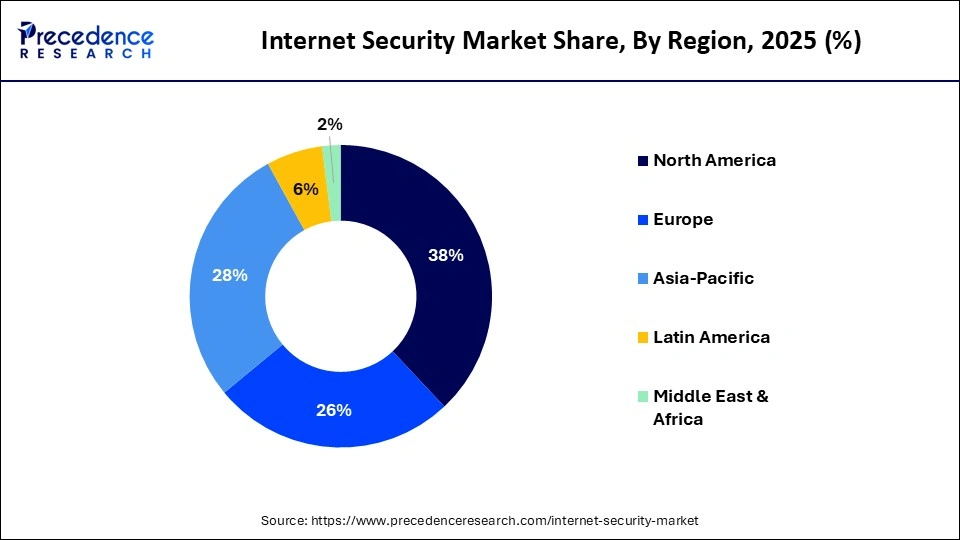

- North America dominated the global market with a share of approximately 38% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR between 2026 and 2035.

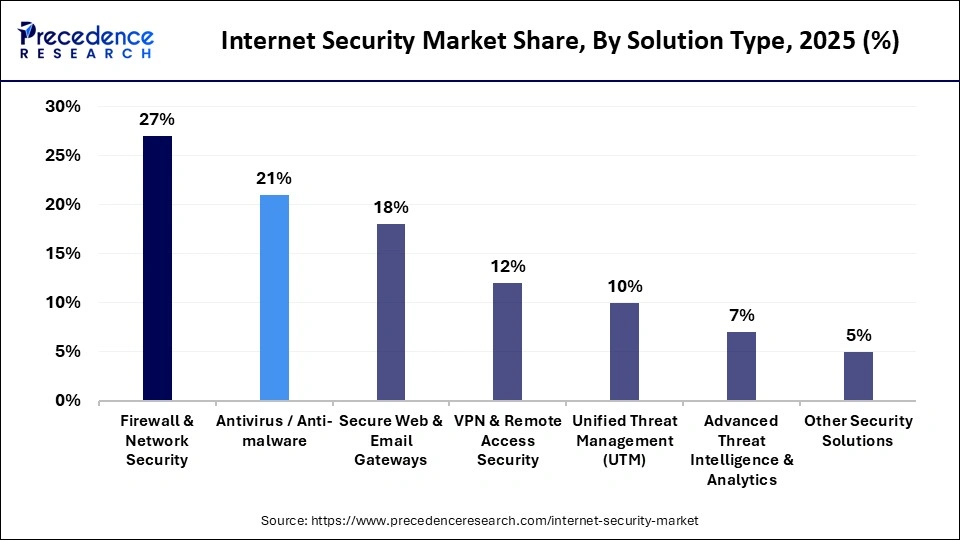

- By solution type, the firewall & network security segment generated the biggest market share of approximately 27% in 2025.

- By solution type, the advanced threat intelligence & analytics segment is expanding at the fastest CAGR between 2026 and 2035.

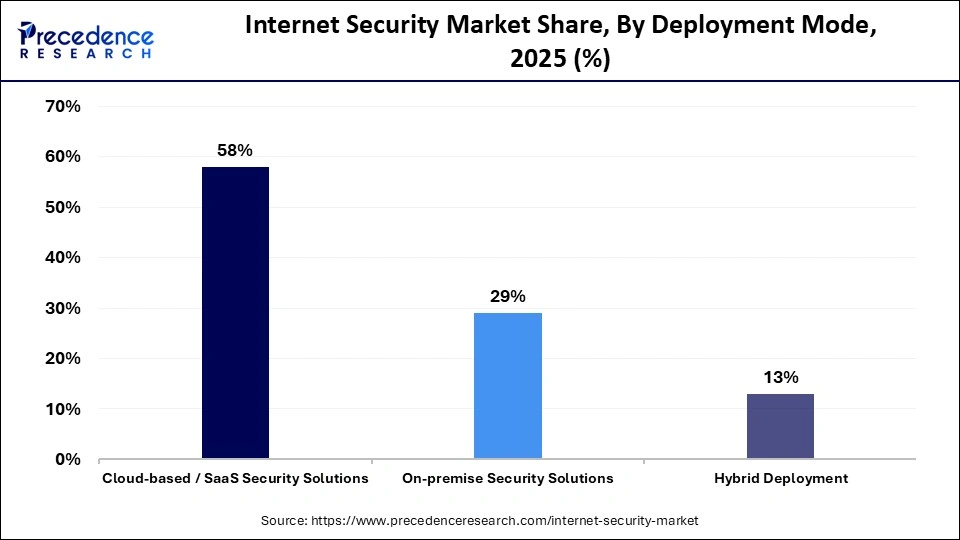

- By deployment mode, the cloud-based/SaaS security solutions segment contributed the highest market share of approximately 58% in 2025.

- By deployment mode, the hybrid deployment segment is growing at a strong CAGR between 2026 and 2035.

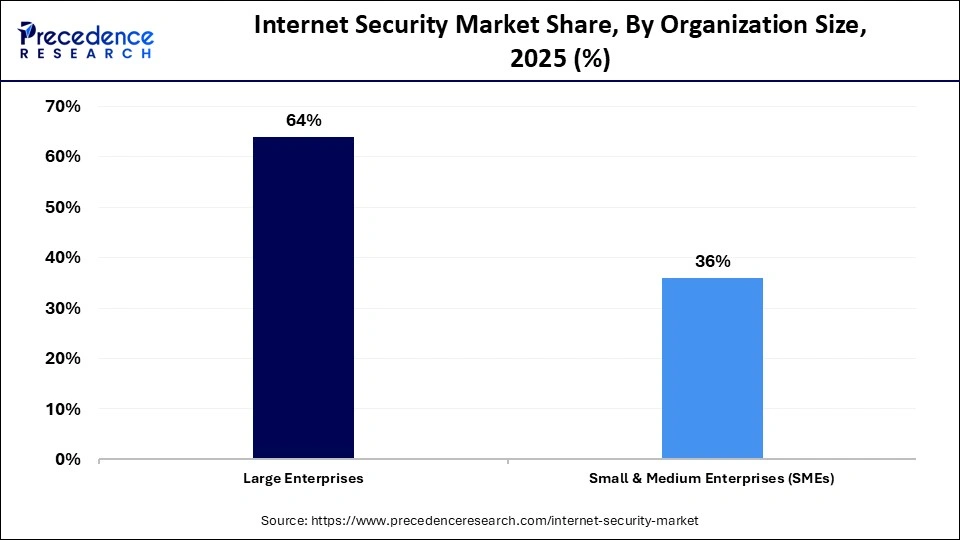

- By organization size, the large enterprises segment held a major market share of approximately 64% in 2025.

- By organization size, the SMEs segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By end user, the BFSI segment generated the biggest market share of approximately 22% in 2025.

- By end user, the healthcare & life sciences segment is expanding at the fastest CAGR between 2026 and 2035.

What are the Major Factors Driving the Growth of the Internet Security Market?

The internet security market is experiencing strong growth as cyberthreats, data breaches, and online fraud become increasingly frequent for individuals and organizations. Rapid digital transformation, widespread cloud adoption, and the rise of remote work have expanded attack surfaces, driving demand for advanced security solutions. Additionally, stricter data protection regulations and heightened awareness of privacy and compliance are encouraging businesses to invest in robust technologies such as threat detection systems, firewalls, and encryption.

Key Trends in the Internet Security Market

- Increasing adoption of AI-driven and machine-learning-based threat detection solutions.

- Growing demand for cloud security as enterprises migrate workloads to cloud platforms.

- Rising implementation of zero-trust security frameworks across organizations.

- Expansion of remote and hybrid work is driving the need for secure access solutions.

- Greater focus on data privacy and compliance with global cybersecurity regulations.

- Integration of automation and orchestration in security operations to reduce response time.

- Increasing use of multi-factor authentication and identity-based security solutions.

Future Market Outlook

- A growing number of cyberattacks is expected to create sustained demand for advanced security solutions.

- Rapid digitalization of small and medium enterprises is expected to open new market opportunities.

- Increasing adoption of IoT devices is expected to drive the demand for specialized internet security tools.

- Rising investments in AI and analytics to enhance proactive threat prevention create immense opportunities in the market.

- The expansion of e-commerce and online payments is increasing the need for secure transactions.

- Emerging markets offer growth potential due to improving digital infrastructure.

- Strategic partnerships between security providers and cloud service companies to expand offerings.

How is AI Strengthening the Internet Security Market?

Real-time threat detection, quicker incident response, and predictive cyber risk analysis are all made possible by artificial intelligence, which is revolutionizing the internet security market. Security systems driven by AI can recognize anomalous network activity, identify zero-day attacks, and automate countermeasures before threats become more serious. The use of AI-driven security solutions is assisting organizations in enhancing protection, speeding up response times, and bolstering overall cyberattacks grow more sophisticated and frequent.

How Does Investing in Internet Security Improve ROI?

Investing in internet security improves ROI by minimizing financial losses from cyberattacks, data breaches, and operational disruptions. Organizations benefit by avoiding regulatory fines, safeguarding their brand reputation, and ensuring business continuity. Advanced technologies, such as AI-driven threat detection and cloud-based security platforms, streamline security operations and reduce incident response costs. Over time, these measures not only cut expenses but also enable safer growth and greater operational efficiency, delivering a strong return on investment.

Government Initiatives Influencing the Internet Security Market

To protect vital infrastructure, private information, and digital services, governments all over the world are bolstering cybersecurity frameworks and regulations, which is greatly impacting the internet security market. National cybersecurity strategies for data protection laws and mandatory breach reporting requirements are some of the initiatives that are pushing businesses to spend money on cutting-edge security solutions. Further promoting the adoption of strong internet security technologies across industries are public-private partnerships, funding for cybersecurity education, and dedicated cybersecurity centers that improve workforce capabilities and threat readiness.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 78.03 Billion |

| Market Size in 2026 | USD 84.43 Billion |

| Market Size by 2035 | USD 171.61 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.20% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Solution Type, Deployment Mode, Organization Size, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Solution Type Insights

What made firewall & network security the dominant segment in the internet security market?

The firewall & network security segment dominated the market by capturing a major share of 27% in 2025, driven by its vital function in defending corporate networks against malware, cyberattacks, and illegal access. Firewalls and network security tools are the first line of defense for organizations in the government, BFSI, and IT sectors. The segment's dominance is further reinforced by ongoing improvements to intrusion prevention systems and next-generation firewalls. Furthermore, the demand for sophisticated network security solutions has increased due to the growing use of zero-trust architecture.

The advanced threat intelligence & analytics segment is expected to grow at the fastest CAGR in the coming years because cyber threats have become more sophisticated. Through AI and machine learning, these solutions facilitate real-time threat detection, predictive risk assessment, and quicker incident response. Enterprise adoption of proactive data-driven cybersecurity strategies is accelerating due to growing demand. Rapid growth is further supported by the integration of automated response capabilities and behavioral analytics.

Deployment Mode Insights

Why did the cloud-based/SaaS security solutions segment dominate the internet security market?

The cloud-based/SaaS security solutions segment dominated the market with the biggest share of 58% in 2025. The dominance of the segment is attributed to the rapid shift to remote and hybrid work models and the widespread use of cloud computing. For businesses managing dispersed networks, cloud-based solutions are very appealing due to their scalability cost effectiveness and quick deployment. The dominance of the segment is further strengthened by its capacity to offer centralized security management and ongoing updates. Higher adoption rates were also influenced by flexible subscription plans and lower infrastructure costs.

The hybrid deployment segment is expected to grow at the fastest CAGR in the coming years, as businesses attempt to strike a balance between cloud flexibility and on-premise control. Businesses can secure cloud workloads and legacy infrastructure at the same time with hybrid security models. The need for hybrid solutions is driven by growing data sensitivity and regulatory compliance requirements. The adoption of hybrid security solutions is accelerated by businesses in highly regulated industries.

Organization Size Insights

What made large enterprises the leading segment in the internet security market?

The large enterprises segment led the market while holding the largest share of 64% in 2025 because of their high IT security spending and increased exposure to cyberthreats. Advanced multi-layered security solutions are necessary for large organizations to safeguard intricate networks and substantial amounts of sensitive data. Sustained investment in cybersecurity is also motivated by reputational risk and regulatory compliance. Additionally, the existence of specialized cybersecurity teams facilitates the quick uptake of cutting-edge security technologies.

The SMEs segment is expected to grow at the fastest CAGR in the coming years because smaller businesses are increasingly digitizing operations, which exposes them to a higher risk of cyberattacks. Adoption is being driven by affordable cloud-based security solutions, rising awareness of data protection and compliance requirements, and support from managed security services and government programs, making it easier for SMEs to implement robust cybersecurity frameworks.

End User Insights

Why did the BFSI segment dominate the internet security market?

The BFSI segment dominated the market with a 22% share in 2025 due to the significant risks that financial institutions face from fraud, cybercrime, and data breaches. Constant investment in cutting-edge internet security solutions is driven by stringent regulatory requirements and the need to secure online transactions. The increasing use of fintech platforms and digital banking serves to further strengthen demand. Cybersecurity is a strategic priority for BFSI players due to their high transaction volumes and sensitive customer data.

The healthcare & life sciences segment is expected to grow at the fastest CAGR in the coming years due to rising adoption of digital health records, telemedicine, and connected medical devices. Increasing cyberattacks targeting patient data and healthcare infrastructure are accelerating demand for robust security solutions. Compliance with healthcare data protection regulations is also boosting adoption. Expansion of remote healthcare services is further increasing cybersecurity requirements.

Regional Insights

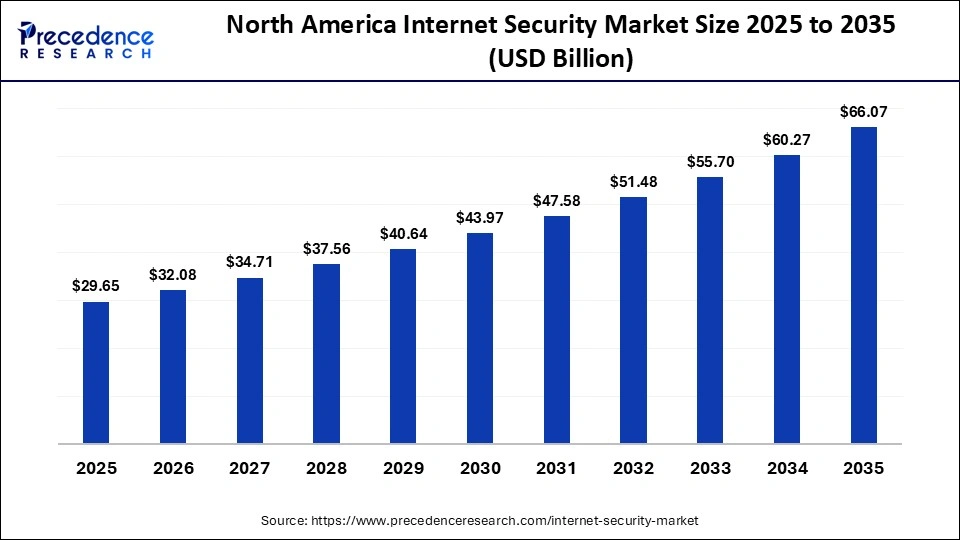

How Big is the North America Internet Security Market Size?

The North America internet security market size is estimated at USD 29.65 billion in 2025 and is projected to reach approximately USD 66.07 billion by 2035, with a 8.34% CAGR from 2026 to 2035.

What made North America the dominant region in the internet security market?

North America dominated the internet security market by capturing a major revenue share of 38% in 2025. The region's dominance in the market is driven by a strong presence of top security vendors and the early adoption of cutting-edge cybersecurity technologies. Sustained investments across industries are driven by strict data protection regulations and a high awareness of cyber risks. Market leadership is further reinforced by the region's established digital infrastructure. North America remains at the forefront thanks to constant innovation and significant cybersecurity spending.

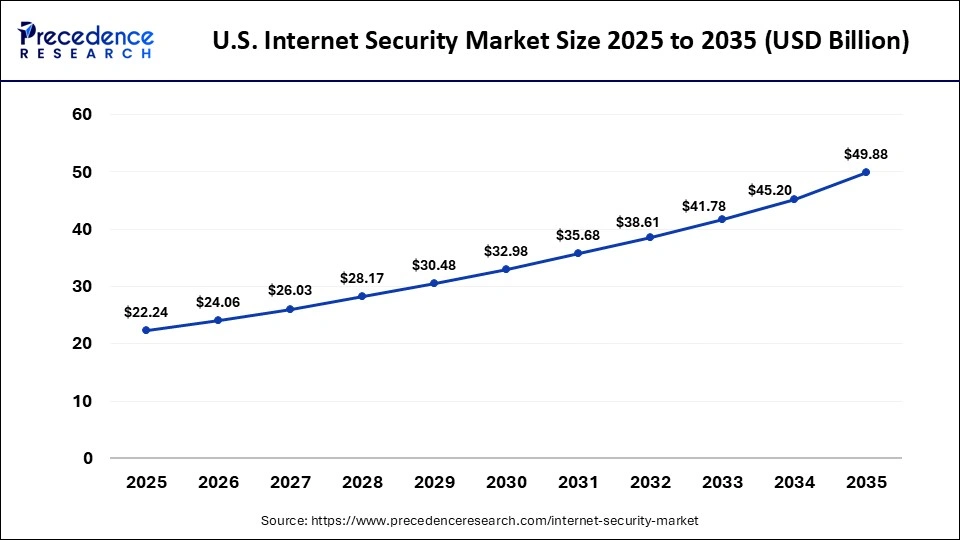

What is the Size of the U.S. Internet Security Market?

The U.S. internet security market size is calculated at USD 22.24 billion in 2025 and is expected to reach nearly USD 49.88 billion in 2035, accelerating at a strong CAGR of 8.41% between 2026 and 2035.

U.S. Internet Security Market Trends

The U.S. internet security market is highly mature and continues to grow steadily, driven by the growing sophistication and frequency of cyberattacks against critical infrastructure, government, and businesses. Sustained demand for security solutions in the U.S. is driven by robust regulatory frameworks, widespread use of cutting-edge technologies like artificial intelligence and zero-trust security, and high cloud adoption. The existence of a large number of security solution providers and high enterprise security expenditures are also driving the market in the U.S.

How is the opportunistic rise of Asia Pacific in the market?

Asia Pacific is expected to grow at the fastest CAGR in the coming years, driven by rapid digital transformation, expanding internet penetration, and increasing cyber threats. Growing adoption of cloud services, e-commerce, and mobile banking is fueling demand for internet security solutions. Government initiatives to strengthen national cybersecurity frameworks are also supporting regional growth. Rising investments in smart cities and digital infrastructure are further accelerating market expansion.

India Internet Security Market Trends

India's internet security market is witnessing rapid growth, bolstered by the growing number of internet users, the quickening pace of digitalization, and the growing uptake of cloud services. Demand for strong security solutions is being driven by an increase in cyber threats that target the BFSI, healthcare, and e-commerce industries. Market growth is also being aided by government programs supporting national cybersecurity and digital infrastructure, as well as raising SMEs' awareness.

Who are the Major Players in the Global Internet Security Market?

The major players in the internet security market include Palo Alto Networks, CrowdStrike, Fortinet, Cloudflare, Zscaler, Check Point Software, Okta, SentinelOne, CyberArk, Gen Digital, Tenable, Qualys, Varonis Systems, Rapid7, Rubrik, Akamai Technologies, and Darktrace.

Recent Developments

- In February 2026, IPVanish introduced Threat Protection Pro, a real-time malware detection and protection feature for its Windows Advanced subscription, providing on-device scanning that functions even when the VPN is disconnected. This launch reflects increasing consumer demand for integrated cybersecurity protections alongside VPN services.(Source: https://www.techradar.com)

- In January 2026, Sectigo completed the acquisition of Entrust's public certificate business, doubling its enterprise digital certificate lifecycle management capabilities to support a wider range of authentication and encryption use cases. The deal boosts Sectigo's market reach amid growing digital trust needs.

- In January 2026, Searchlight Cyber announced its acquisition of Assetnote to integrate attack surface management into its dark web intelligence and monitoring suite, enabling clients to identify risks earlier across exposed infrastructure. This marks Searchlight's first strategic acquisition.

- In January 2026, JumpCloud completed the acquisition of Stack Identity to enhance its access management and threat-detection capabilities across cloud environments, improving security posture for hybrid and remote workforces. The acquisition accelerates JumpCloud's identity security roadmap.

Segments Covered in the Report

By Solution Type

- Firewall & Network Security

- Next-Gen Firewalls (NGFW)

- Intrusion Prevention Systems (IPS)

- Antivirus/Anti-malware

- Secure Web & Email Gateways

- VPN & Remote Access Security

- Unified Threat Management

- Advanced Threat Intelligence & Analytics

- Other Security Solutions

By Deployment Mode

- Cloud-based/SaaS Security Solutions

- On-premise Security Solutions

- Hybrid Deployment

By Organization Size

- Large Enterprises

- Small & Medium Enterprises (SMEs)

By End-User

- BFSI (Banking, Financial Services & Insurance)

- IT & Telecom

- Healthcare & Life Sciences

- Retail & E-commerce

- Government & Public Sector

- Manufacturing & Industrial

- Energy & Utilities

- Other End-User

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting