What is the IoT Chips Market Size?

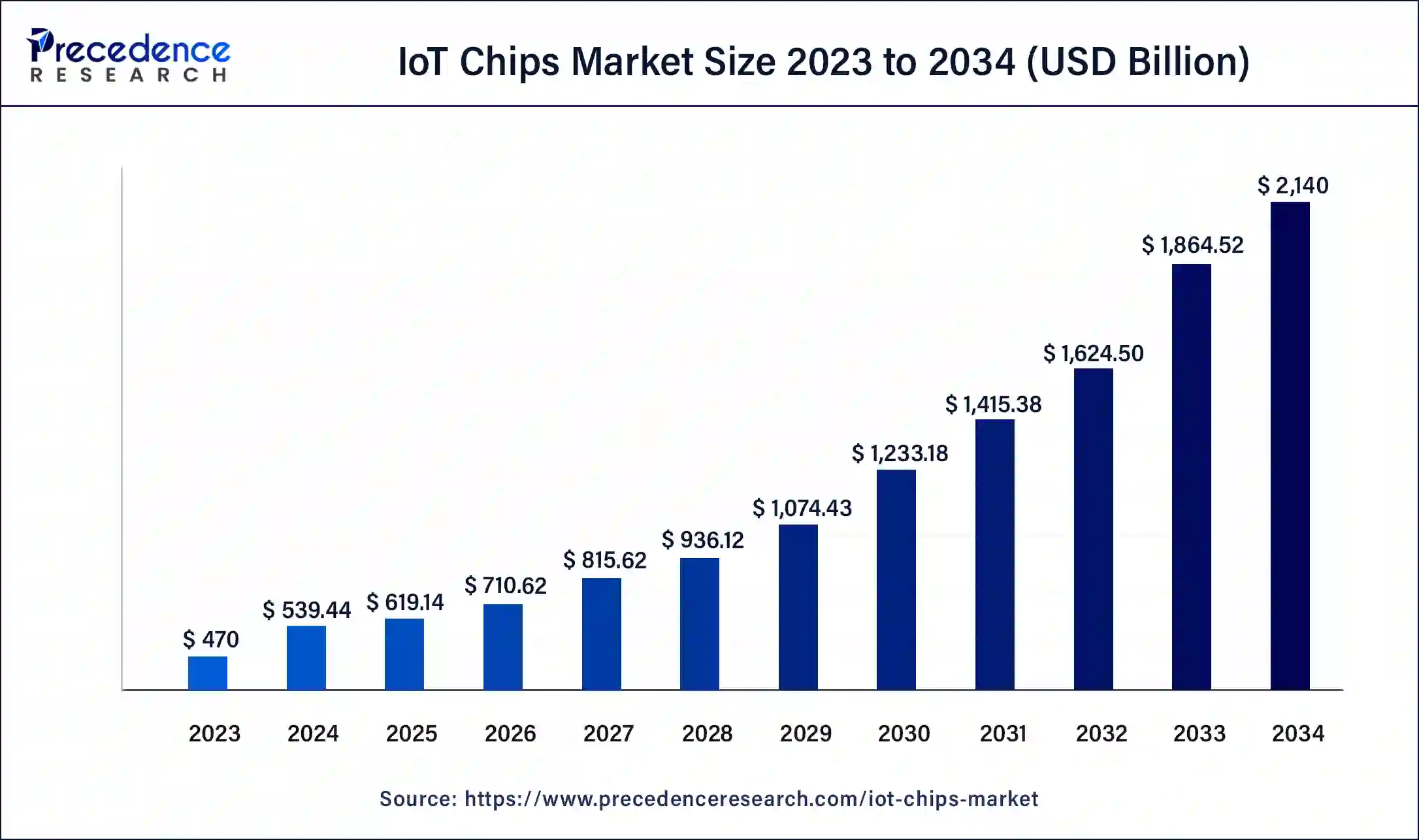

The global IoT chips market size is calculated at USD 619.14 billion in 2025 and is predicted to increase from USD 710.62 billion in 2026 to approximately USD 2,391.84 billion by 2035, expanding at a CAGR of 14.47% from 2026 to 2035. The North America IoT chips market size reached USD 173.90 billion in 2023. The IoT chips market is driven by the creation of safe, low-power semiconductors that guard against security lapses.

IoT Chips Market Key Takeaways

- In terms of revenue, the market is valued at USD 619.14 billion in 2025.

- It is projected to reach USD 2,391.84 billion by 2035.

- The market is expected to grow at a CAGR of 14.47% from 2026 to 2035.

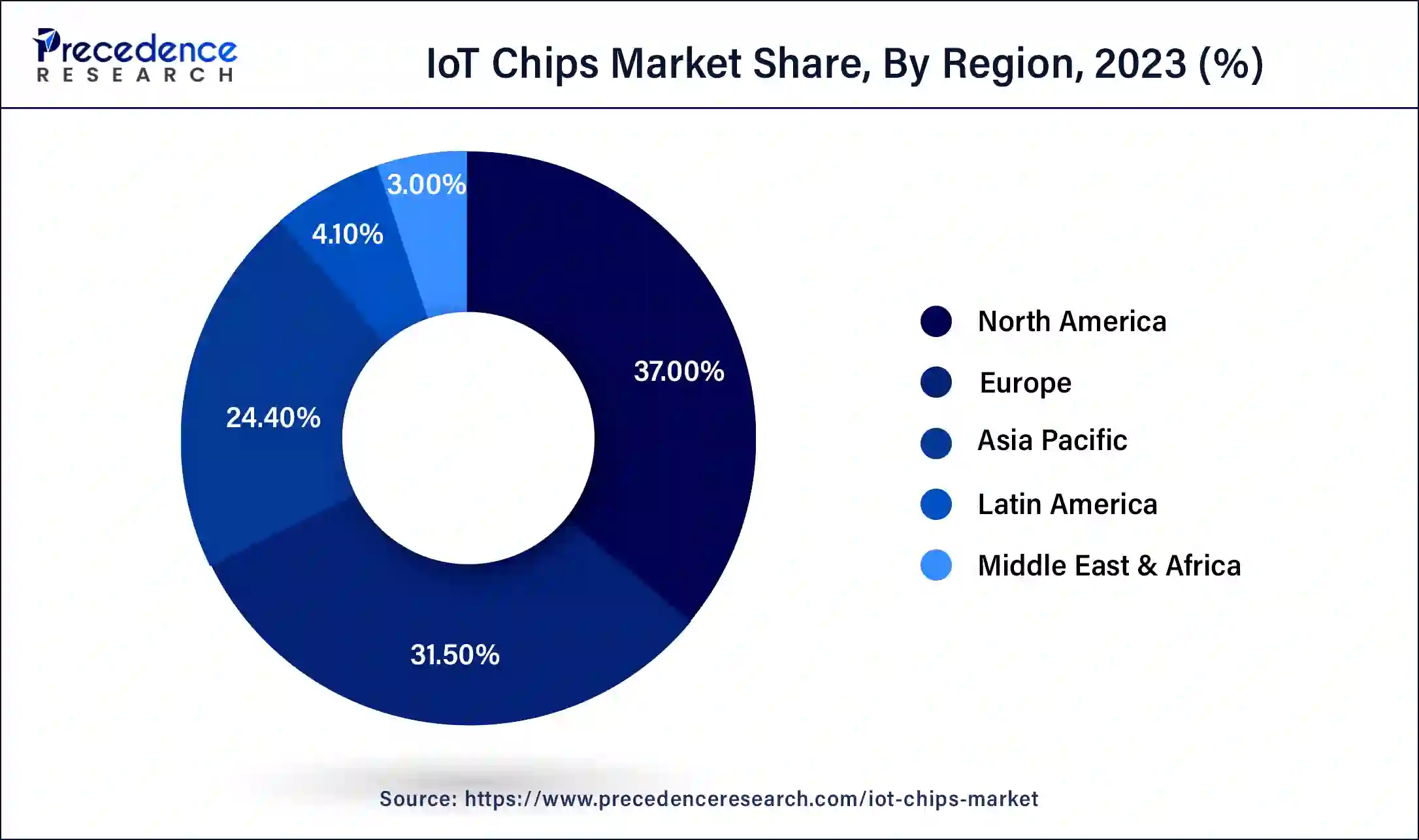

- North America dominated in the IoT chips market in 2025 and accounted 37% revenue share.

- Asia Pacific is observed to be the fastest growing in the IoT chips market during the forecast period.

- By hardware, the processor segment has accounted revenue share of 36% in 2025.

- By hardware, the sensor segment is observed to be the fastest growing in the IoT chips market during the forecast period.

- By industrial vertical, the industrial segment dominated the IoT chips market in 2025.

- By industrial vertical, the consumer electronics segment is observed to be the fastest growing in the IoT chips market during the forecast period.

Market Overview

Due to the Internet of Things (IoT), billions of smart devices can communicate with one another through the almost universal Internet Protocol. Almost every system utilizes the Internet and cloud computing ecosystems to innovate and improve the intelligence and awareness of a wide range of devices. The broad availability of low-cost, low-power embedded components and high-quality, reliable wireless communication is propelling the development of various internet-connected devices.

The increased demand for IoT devices is the main factor propelling the growth of the IoT chips market. The growing acceptance of automation in various end-user verticals, such as healthcare, consumer electronics, automotive, BFSI, and retail, is driving up the use of IoT chips in different IoT devices.

IoT Chips Market Trends

- Vodafone and Microsoft have agreed to collaborate for ten years to provide generative AI, digital, enterprise, and cloud services to over 300 million customers and businesses in Vodafone's European and African countries.

- Microsoft will then assist in growing Vodafone's mobile banking platform in Africa and convert it into an equity stakeholder in the managed Internet of Things (IoT) platform when it is spun out as a separate company by April 2024.

- The British business will spend $1.5 billion on customer-focused AI created using Copilot and Azure OpenAI from Microsoft. Azure cloud services, which are more affordable and scalable, will replace actual data centers.

- In August 2023, Sequans, a French IoT chip firm, was purchased by the Japanese electronics behemoth Renesas for $249m. Chips and modules for 5G and 4G cellular IoT are Sequans Communications' areas of expertise. It has signed a memorandum of understanding (MoU) with Renesas to buy Sequans' outstanding common stock, valued at about $249 million, net debt included.

IoT Chips Market Outlook

The IoT chips market is expected to grow rapidly from 2025 to 2034 as connected devices evolve from simple sensing to sophisticated, real-time intelligence. Massive investments in industrial automation, smart utilities, connected mobility platforms, and edge-enabled consumer electronics are fueling market expansion. Large-scale smart manufacturing initiatives and government-backed digitalization efforts are contributing to market growth. Additionally, the rising demand for secure, low-latency, and ultra-low-power chipsets is boosting market growth.

The market is undergoing a major technological shift, with companies focusing on integrating AI acceleration, multi-protocol RF, and embedded security into smaller, more power-efficient SoCs. This shift reflects a broader trend where organizations aim to enhance chip performance while reducing energy consumption. Additionally, the growing adoption of Matter, Zigbee, UWB, Bluetooth LE Audio, and LPWAN standards is driving manufacturers to develop multi-mode chips compatible across different ecosystems, further fueling market growth.

The sustainability trend is increasingly influencing the market, with companies focusing on smaller die geometries and using recyclable or halogen-free packaging materials. Industry leaders such as Infineon, Texas Instruments, and STMicroelectronics are investing significantly in low-power analog and mixed-signal designs to reduce energy consumption across billions of deployed devices. Additionally, lifecycle energy management and the use of environmentally friendly materials are driving the shift toward more sustainable chipset manufacturing practices, further aligning the market with global sustainability goals.

The market is expanding worldwide due to rising demand for connected devices and advancements in AI, 5G, and edge computing, which are enhancing the functionality and efficiency of IoT ecosystems. Emerging regions such as Asia Pacific, Latin America, and the Middle East & Africa present significant opportunities due to expanding industrialization, the rise of smart cities, growing consumer adoption of IoT devices, and government investments in digital infrastructure and smart technologies.

Private equity firms, sovereign wealth funds, and strategic corporate investors are intensifying their focus on IoT-linked semiconductor assets because of their long-term defensibility and engineering-driven margins. Growth in edge AI, analog power management, and secure connectivity continues to draw capital from groups such as Silver Lake, Bain Capital, Temasek, and SoftBank. Additionally, the investment activity shows strong confidence in the IoT chip sector's technological path and long-term adoption trend.

The IoT semiconductor startup ecosystem is rapidly expanding as innovations in edge AI, low-power wireless, and secure microcontroller architectures gain momentum. Syntiant, Edge Impulse, GreenWaves Technologies, and Saankhya Labs are other startups developing neural processors, RISC-V architectures, and advanced RF solutions aimed at ultra-low-power devices. The growing adoption of TinyML enables new startups to create chips capable of processing speech, detecting anomalies, and handling vision tasks without relying on the cloud, thereby opening up significant market opportunities.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 2,391.84 Billion |

| Market Size in 2025 | USD 619.14 Billion |

| Market Size in 2026 | USD 710.62 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 14.47% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Hardware, Industry Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

IoT Chips Market Growth Factors

- More individuals and places with access to dependable internet are driving up the number of linked devices needing IoT chips.

- IoT processors with sophisticated algorithms and data processing capabilities are in high demand as AI-powered gadgets proliferate. This drives the growth of the IoT chips market.

- 5G's quicker speeds and lower latency make a greater range of IoT device applications possible, which calls for strong and suitable chips.

- IoT chips connect devices, which are necessary for the growth of smart homes, cities, and industries.

Recent Investments in the IoT Chips Market

| S.No. | Acquirer | Acquired Company | Deal Size | Category |

| 1. | Kontron | Bsquare | $38 M | IoT platform/data/analytics |

| 2. | LumenRadio | Radiocrafts | $7.8 M | IoT connectivity |

| 3. | Nokia | Fenix Group | NA | Industrial IoT/defense |

| 4. | Vontas | Orion Labs | NA | IoT connectivity |

| 5. | KORE Wireless | Twilio – IoT business | NA | IoT connectivity |

Market Dynamics

Drivers

Increasing adoption of IoT devices

Consumer electronics (smartphones, wearables), industrial applications (predictive maintenance, automation), healthcare (remote monitoring devices), and smart cities (traffic management, smart grids) are just a few of the industries that use IoT devices. Due to their widespread application, the demand for Internet of Things chips is high. IoT chips are becoming increasingly necessary as consumers and businesses look to use IoT technology for more convenience, efficiency, and innovation.

The cost of IoT chips is lowered by manufacturers' economies of scale, which are attained when the use of IoT devices rises. IoT technology can now be incorporated into more products to lower costs. This drives the growth of the IoT chips market.

Growth in smart cities

Smart cities use IoT sensors and gadgets to optimize traffic flow, lessen congestion, and increase safety. Many IoT chips are needed for the sensors found in cameras, smart car systems, and traffic lights. Smart street lighting systems that modify brightness in response to occupancy and environmental factors require Internet of Things (IoT) chips. These methods decrease both operating expenses and energy usage. Building management systems use Internet of Things (IoT) chips to regulate security, HVAC, lighting, and ventilation. These chips make automated and effective control of building operations possible.

Restraints

Concerns regarding the security and privacy of user data

IoT devices are especially susceptible to hacks because they frequently have limited processing capacity and resources built into them. These flaws can be used by hackers to obtain unauthorized access, change data, or interfere with the operation of devices. Prominent assaults, like the Mirai botnet, have illustrated how large-scale IoT networks can be breached, leading to severe disruptions in operations and data leaks. These kinds of occurrences increase consumer and business knowledge and anxiety, making them reluctant to adopt IoT solutions that use these chips. This limits the growth of the IoT chips market.

Technological limitations that affect the IoT's functionality

The computational power of IoT devices is frequently insufficient for local data processing. This results in a dependence on cloud computing, which adds latency and network connectivity requirements for data processing. The onboard memory of IoT chips restricts the amount of data that may be locally saved and processed. This limits the functioning of IoT devices in applications that need quick responses and impairs their ability to make real-time decisions.

Opportunities

Rise of autonomous and connected vehicles

Advanced driver assistance systems (ADAS) such as automated emergency braking, adaptive cruise control, and lane-keeping assistance are supported by IoT chips. Real-time data processing and communication are essential to these aspects, and IoT technology makes this possible. It is necessary to protect cars from cyberattacks as they grow more networked. Strong encryption and security features on IoT chips are crucial for preventing hacking and data leaks.

Integration of AI capabilities and edge computing in IoT devices

Reducing dependency on cloud infrastructure through local data processing results in lower costs for cloud services and data storage. The ability of edge devices to manage growing workloads independently also makes it possible for more scalable systems. AI integration and edge computing can result in more energy-efficient processes. This is important for battery-operated IoT devices because it allows devices to optimize their power usage based on data and local conditions. With the deployment of sophisticated AI models on edge devices, which demand high processing power, complex activities such as image recognition, natural language processing, and predictive maintenance can be accomplished without the need for cloud support. This opens an opportunity for the growth of the IoT chips market.

Segment Insights

Hardware Insights

The processor segment dominated the IoT chips market in 2025. The need for advanced processors has expanded dramatically due to the widespread use of smart devices, including wearable technology, home automation systems, smartwatches, and smartphones. The brains of the gadgets, these processors allow for sophisticated features and effective operation. Real-time data processing is necessary for many Internet of Things applications to work correctly. For applications like industrial automation, healthcare monitoring systems, and driverless cars, processors guarantee that data is analyzed and acted upon in real-time.

The sensor segment is observed to be the fastest growing in the IoT chips market during the forecast period. The need for different kinds of sensors has grown dramatically as smart homes, smart cities, and smart industrial applications become more common. Sensors are essential in smart cities for energy management, public safety, traffic control, and environmental monitoring. Security systems, home automation, energy management, and health monitoring all use sensors in smart homes.

Industrial Vertical Insights

The industrial segment dominated the IoT chips market in 2025. IoT chips are utilized in many different safety applications, like monitoring dangerous situations and guaranteeing worker security. Sensor data collected in real-time might prompt quick reactions to possible safety risks. Through monitoring and surveillance systems, IoT chips also contribute to the security of industrial sites. Enabling real-time access point tracking and control ensures strong security measures.

The consumer electronics segment is observed to be the fastest growing in the IoT chips market during the forecast period. The market for smart home appliances, including voice assistants, security cameras, lighting controls, and thermostats, is expanding. IoT chips play a significant role in the functionality and connectivity of these devices. The growing popularity of wearable technology, such as fitness trackers, smartwatches, and health monitoring gadgets, pushes demand for sophisticated IoT processors. IoT chips are used in smart TVs, streaming gadgets, and game consoles to improve user experiences, connectivity, and streaming capabilities.

Regional Insights

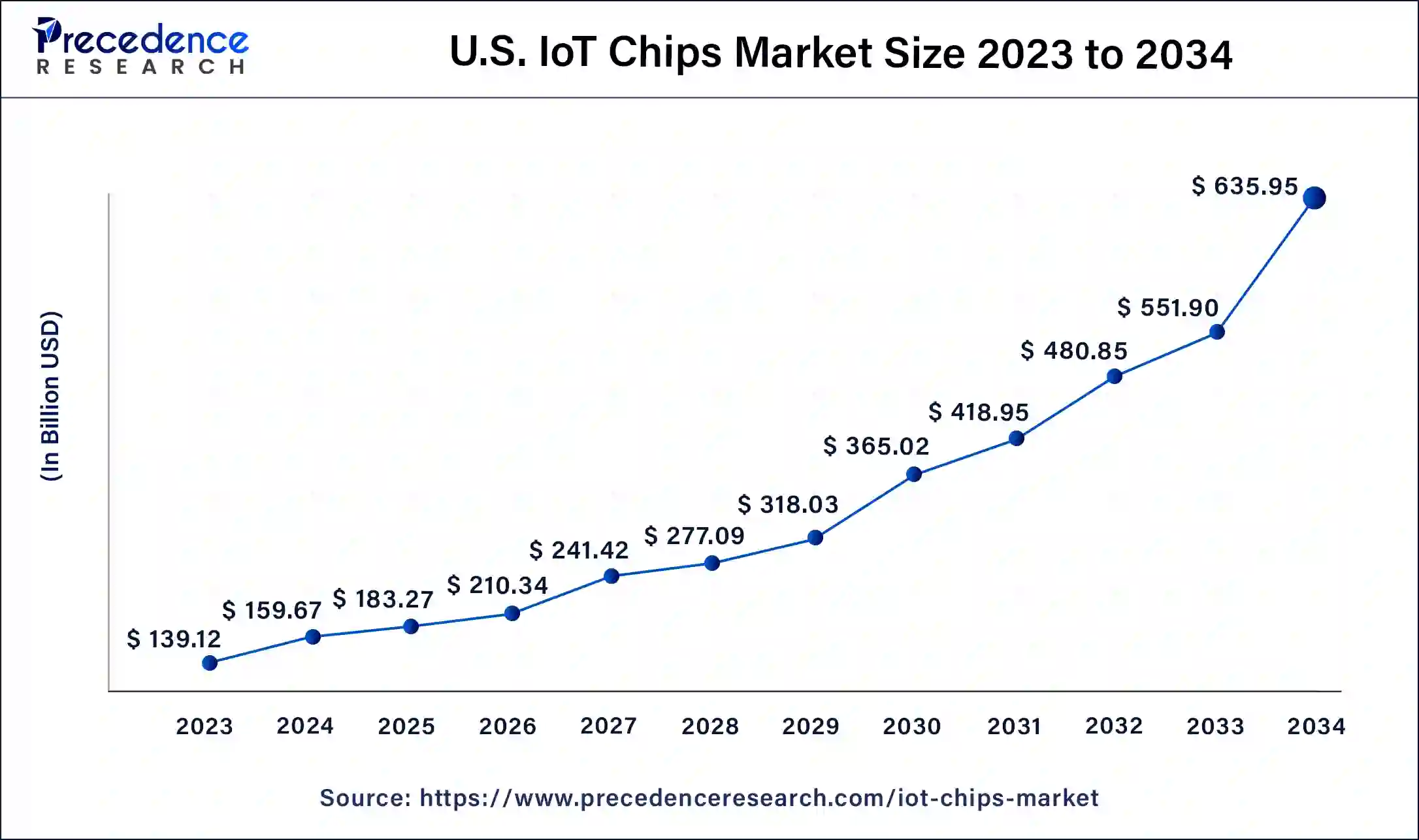

The U.S. IoT chips market size is exhibited at USD 183.27 billion in 2025 and is projected to be worth around USD 711.33 billion by 2035, growing at a CAGR of 14.52% from 2026 to 2035.

North America dominated in the IoT chips market in 2025. Academic institutions, well-established businesses, and tech startups coexist in a thriving ecosystem in North America. This ecosystem accelerates the development of IoT technology and promotes collaboration. Having access to venture capital funding supports small businesses and startups developing cutting-edge Internet of Things solutions, stimulating innovation.

Being a part of international and regional consortiums, including the Industrial Internet Consortium and the Internet of Things, enables North American businesses to remain on the forefront of IoT standards and technology development.

U.S. IoT Chips Market Trends

The U.S. is a major player in the market thanks to its strong semiconductor R&D capabilities, advanced fab expansions, and high adoption of edge-AI and industrial automation systems. The growth is further supported by the CHIPS Act, which incentivizes domestic manufacturing of microcontrollers, RF chipsets, and secure connectivity ICs, while strong collaboration between chip designers, hyperscalers, and automotive suppliers continues to drive market expansion.

Asia-Pacific is observed to be the fastest growing in the IoT chips market during the forecast period. Technological improvements in IoT are driven by Asia-Pacific firms' high investments in R&D. Electronics and semiconductor technology innovation is well-known in nations like South Korea and Japan. IoT applications are greatly aided by the quick deployment of 5G networks throughout the area, which provide the infrastructure needed for fast, low-latency connectivity.

The growing middle class in nations such as China and India raise disposable income, which drives demand for IoT-enabled goods and services. The region's robust economic growth encourages industry expansion and the adoption of cutting-edge technology, such as the Internet of Things.

China IoT Chips Market Trends

China is leading the charge in Asia Pacific. The Market in China is driven by its massive consumer electronics production, advanced sensor manufacturing ecosystems, and the rapid expansion of smart city deployments. Significant investments in domestic fab capacity and packaging units are expected to bolster regional supply chain stability, while the rise of electric vehicles and telematics solutions is further boosting the demand for secure, power-optimized chipsets, accelerating market growth.

The European IoT chip market is expected to witness significant growth over the forecast period. Driven by the growing popularity of IoT solutions in different industries and an increasing demand for connected devices. The most important spheres, such as healthcare, automotive, manufacturing, and smart cities, are quickly including IoT solutions to become more efficient and connected. This increase is further stimulated by the European efforts to move to Industry 4.0, which contributes to the digitalization and automation of its economy.

There is a high technological foundation in the region, with centres of innovation present in Germany, the UK, and France, facilitated by EU initiatives and initiatives on implementing digitalisation and sustainability. The expansion of 5G and government support to go digital will uplift the use of intelligent devices, a trait that facilitates the demand for new chip levels of IoT under 5G.

Germany IoT Chips Market Trends

In Germany, the market is fueled by its strong automotive electronics production, widespread adoption of Industry 4.0 automation, and the critical need for secure microcontrollers. There is a strong emphasis on industrial automation, which is expected to drive the demand for low-power processors and multi-protocol RF chips in the coming years, thereby driving market growth.

The market in the Middle East & Africa is driven by the adoption of Industrial IoT applications in manufacturing, utilities, and other industrial sectors. Specialized IoT chips operate during critical functions such as predictive maintenance, asset tracking, and real-time monitoring to help industries improve efficiency and reduce downtime. Government programs and efforts to invest in smart technologies also support progress toward implementing IoT solutions.

UAE IoT Chips Market Trends

In the UAE, market growth is driven by strong investment in smart city infrastructure, public safety systems, and connected mobility platforms. Digitalization of oil and gas operations is expected to boost demand for rugged sensor chips and long-range communication ICs. Additionally, the need for smart utilities and real-time infrastructure monitoring increases the demand for energy-efficient industrial chipsets.

Latin America is expected to experience an opportunistic rise in the market due to the adoption of smart metering and agri-tech sensors, as well as the growing demand for energy-efficient embedded processors. The growing trend toward a large number of interconnected medical equipment and retail automation systems is expected to facilitate the wider adoption of chipsets. There is a rising demand for low-power microcontrollers and RF modules, further supporting market growth.

Brazil IoT Chips Market Trend

Brazil dominates the Latin American market due to increasing adoption of smart utility meters, agricultural automation systems, and logistics monitoring platforms. Brazilian telecom providers are expected to expand NB-IoT, LTE-M, and initial 5G rollouts, enabling broader use of IoT chipsets. Government-supported digital transformation efforts and new manufacturing investments strengthen Brazil's position in Latin America's IoT growth.

IoT Chips Market - Value Chain Analysis

The value chain begins with sourcing high-purity silicon wafers, specialty gases, photolithography chemicals, and rare materials needed for semiconductor fabrication. These inputs form the base for manufacturing advanced IoT microcontrollers, sensors, RF chips, and connectivity SoCs.

Key Players: Shin-Etsu Chemical, SUMCO Corporation, GlobalWafers, Siltronic.

Specialized engineering teams create architectures for low-power IoT chipsets, focusing on microcontroller cores, RF modules (Wi-Fi, Bluetooth, ZigBee), AI accelerators, and security engines. This stage also includes licensing CPU architecture and communication IP.

Key Players: ARM, Synopsys, Cadence, Imagination Technologies.

IoT chips are produced in large-scale semiconductor fabs using advanced photolithography, deposition, etching, and packaging technologies. Foundries ensure energy efficiency, small die sizes, and wireless performance, which are critical for IoT applications.

Key Players: TSMC, Samsung Foundry, GlobalFoundries, UMC.

Freshly fabricated wafers undergo dicing, advanced packaging (QFN, BGA, WLP), and extensive quality testing for RF compliance, power efficiency, and environmental durability. Packaged chips are then validated for reliability across temperature cycles and power variations.

Key Players: ASE Group, Amkor Technology, JCET Group, Powertech Technology Inc.

Manufacturers distribute IoT chipsets and modules to electronics OEMs, industrial integrators, smart device makers, and cloud service providers. This stage also includes firmware updates, SDK support, and the enablement of cloud connectivity.

Key Players: Amazon AWS IoT, Microsoft Azure IoT, Google Cloud IoT, Arrow Electronics, Avnet.

IoT Chips Market Companies

Intel provides high-performance IoT processors and edge AI chipsets designed for industrial automation, smart infrastructure, and connected devices.

Samsung develops advanced IoT SoCs and connectivity chipsets optimized for smart home devices, wearables, and low-power consumer electronics.

STMicroelectronics offers ultra-low-power microcontrollers, sensors, and wireless IoT chips widely used in automotive, smart manufacturing, and energy-efficient systems.

MediaTek delivers highly integrated IoT chipsets with built-in connectivity for smart home appliances, edge devices, and multimedia IoT applications.

Texas Instruments specializes in low-power microcontrollers, analog components, and wireless connectivity ICs essential for industrial IoT and automotive systems.

Microchip provides secure, low-energy microcontrollers, edge processing units, and IoT connectivity solutions for embedded applications and smart infrastructure.

Analog Devices delivers precision analog, mixed-signal, and sensor ICs that support industrial automation, condition monitoring, and high-reliability IoT use cases.

Qualcomm leads in wireless IoT chipsets, offering advanced LTE/5G IoT modems and edge AI processors powering smart home, industrial, and enterprise devices.

NXP provides secure IoT processors, NFC/RFID chips, and automotive-grade microcontrollers widely used in smart mobility and industrial connectivity.

Infineon produces power-efficient microcontrollers, security chips, and sensor solutions that enhance performance and safety in IoT edge and industrial applications.

Top Companies in IoT Chips Market and their Contributions

- EdgeQ: The Company has been involved with encouraging the development of high-performance and low-power chips in edge computing. Its EdgeQ AI chip, a flagship product of the company, manages localized data processing at the edge to limit risks of latency and dependency on cloud infrastructures.

- GreenWaves Technologies: GreenWaves Technologies wants to develop low-powered IoT chipsets for edge AI. It is the case of their main product line, the GAP8 IoT processor, which would provide extremely low power consumption, together with sufficient computing resources to perform AI functions at the edge.

Leaders Announcements

- In March 2025, GCT Semiconductor Holding Inc., a leading designer and supplier of advanced 4G and 5G semiconductor solutions, and Globalstar, Inc., the next-generation mobile satellite and communications services provider, partnered to develop IoT modules for two-way satellite, cellular, and band 53 connectivity. This partnership will, for the first time, enable seamless connectivity across cellular, private, and satellite networks worldwide. (Source: https://www.businesswire.com)

- In March 2025, Ceva, Inc., the leading licensor of silicon and software IP that enables Smart Edge devices to connect, sense and infer data more reliably and efficiently, announced that Sharp Semiconductor Innovation Corporation (SSIC), a subsidiary of Sharp Corporation, has developed "ASUKA", a System-on-Chip (SoC) for Beyond 5G (6G) IoT terminals, based on scalable 5G modem platform IP, the Ceva-PentaG2. (Source: https://www.prnewswire.com)

- In March 2025, Qualcomm and IDEMIA partnered to launch the iSIM Solution for IoT devices. With a focus on reducing logistics and manufacturing costs, footprint, and power consumption for battery-powered devices, Qualcomm Technologies has integrated a highly security-focused and EAL5+[1] pre-certified enclave in its new E41 4G Modem-RF. (Source: https://smestreet.in)

Recent Developments

- In January 2025, Morse Micro, the world's leading provider of Wi-Fi HaLow chips based on the IEEE 802.11ah specification, announced the launch of its highly anticipated second-generation MM8108 System-on-Chip (SoC). The MM8108 offers even better performance in all key areas of range, throughput, and power efficiency while reducing the cost, effort, and time to bring the next generation of Wi-Fi HaLow-enabled products to market. (Source: https://iotbusinessnews.com)

- In May 2024, Mindgrove Technologies, a Peak XV Partners-backed fabless semiconductor startup, launched India's first commercial high-performance SoC (system on chip) for the Internet of Things (IoT) devices. The RISC-V-based chip will allow Indian OEMs to use an indigenous SoC in their products and help reduce the cost of their feature-rich devices, without compromising on high-end features. (Source: https://swarajyamag.com)

- In April 2025, Synaptics (SYNA) launched its first Wi-Fi 7 systems-on-chip (SoCs) family for IoT applications, expanding its Veros wireless portfolio. The new family includes the SYN4390 and SYN4384 chips, delivering up to 5.8 Gbps peak speed and supporting bandwidths up to 320 MHz. The chips feature multi-link operation (MLO) technology, enabling simultaneous data transmission across multiple frequency bands for enhanced performance in gaming, AR/VR, security monitoring, and entertainment applications. (Source: https://www.stocktitan.net)

- In May 2024, Mindgrove Technologies stated that it unveiled India's first high-performance, commercial SoC (system on chip).

- In June 2023, Qualcomm Technologies, Inc. disclosed the Qualcomm 212S Modem and the Qualcomm 9205S Modem, two modem chipsets with satellite capability. The new Qualcomm modem chipsets enable IoT enterprises, developers, OEMs, and manufacturers to leverage real-time data and insights to manage business projects. They also power off-grid industrial use cases requiring standalone non-terrestrial network (NTN) or hybrid connectivity alongside terrestrial networks.

- In January 2023, Microsoft Corp. bought the venture-backed data center semiconductor business Fungible Inc. The acquisition's financial conditions were not made public. Blocks and Files stated that the sale was worth $190 million. Microsoft plans to integrate Fungible's technology into the Azure cloud platform's data centers.

Segments Covered in the Report

By Hardware

- Processor

- Sensor

- Connectivity IC

- Memory Device

- Logic Device

- Others

By Industry Vertical

- Wearable Devices

- Healthcare

- Consumer Electronics

- Automotive & Transportation

- Building Automation

- Manufacturing

- Retail

- BFSI

- Oil & Gas

- Agriculture

- Aerospace & Defense

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting