What is the Large Molecule Drug Discovery Outsourcing Market Size?

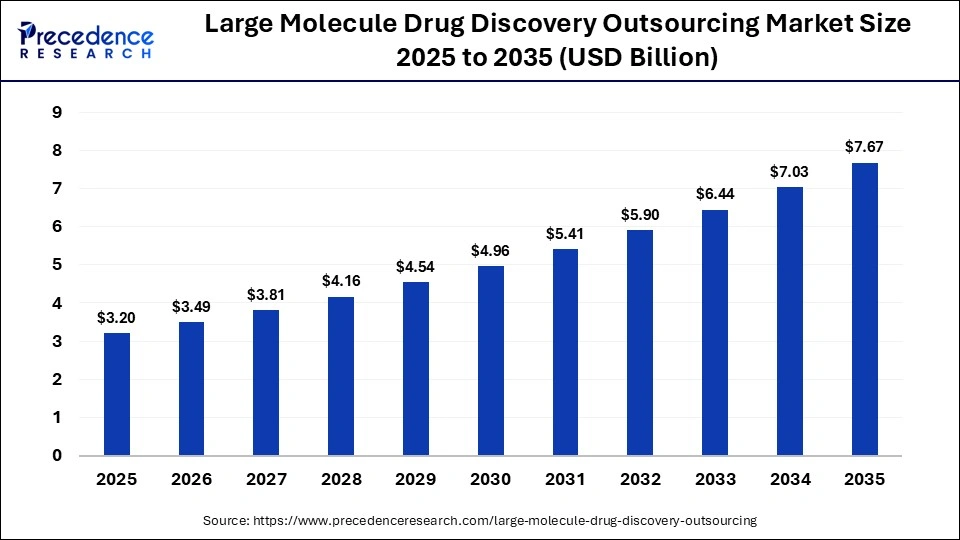

The global large molecule drug discovery outsourcing market size was calculated at USD 3.20 billion in 2025 and is predicted to increase from USD 3.49 billion in 2026 to approximately USD 7.67 billion by 2035, expanding at a CAGR of 9.14% from 2026 to 2035. The market growth is attributed to increasing adoption of advanced biologics, rising R&D investments, and expanding outsourcing partnerships with specialized CROs and CDMOs.

Market Highlights

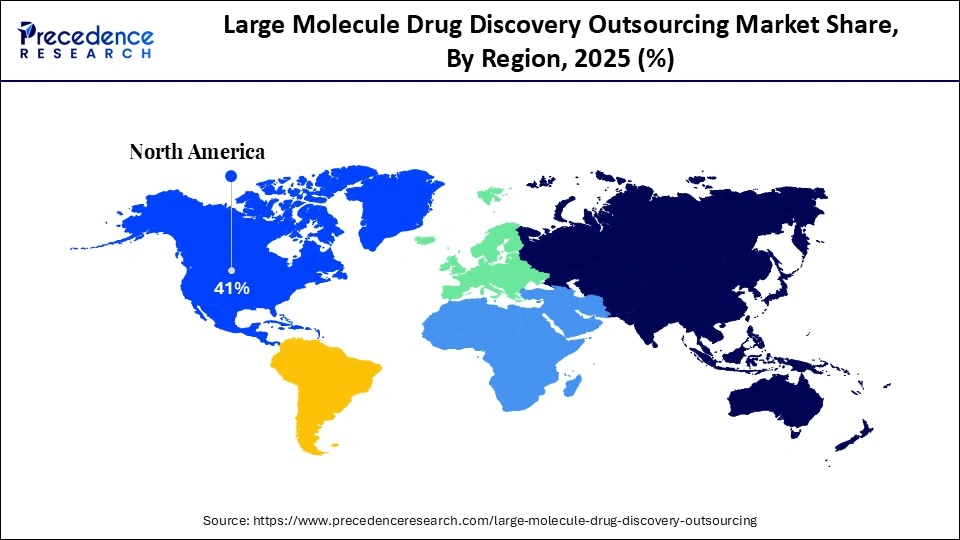

- North America held a dominant share of the market in 2025.

- The Asia Pacific is expected to grow at the fastest rate in the market between 2026 and 2035.

- By molecule type, the monoclonal antibodies (mAbs) segment held the largest share of the market in 2025.

- By molecule type, the bispecific antibodies segment is expected to grow at the highest CAGR between 2026 and 2035.

- By service type, the protein expression & purification segment led the market in 2025.

- By service type, the antibody engineering & humanization segment is set to grow at the fastest rate from 2026 to 2035.

- By technology platforms, the mammalian cell expression systems segment dominated the market in 2025.

- By technology, the single-cell screening platforms segment is expected to grow at the highest CAGR during the studied years.

- By end-user, the large biopharmaceutical companies segment dominated the market in 2025.

- By end-user, the small & mid-sized biotech companies segment is expected to expand rapidly in the coming years.

- By therapeutic area, the oncology segment led the market in 2025.

- By therapeutic area, the rare & genetic diseases segment is expected to grow at the fastest rate over the forecast period.

Market Overview

The large molecule drug discovery outsourcing market is evolving rapidly due to the increasing demand for complex biologics and advanced therapy. This necessitates the pharma institutions or companies to outsource specialized expertise that they do not have internally. Global health organizations and regulatory authorities have highlighted that biologic drugs account for a significant proportion of recent approvals, reflecting a growing research and development focus on large-molecule therapeutics. This trend has increased the demand for outsourcing solutions in the pharmaceutical industry, as companies seek specialized expertise and capacity to support complex biologic programs.

How is Artificial Intelligence Impacting the Large Molecule Drug Discovery Outsourcing Market?

The application of artificial intelligence (AI) in drug discovery enables predictive modeling and data-driven decision-making, transforming traditional research workflows into much faster, high-velocity processes. By leveraging machine learning and generative models, researchers are able to rapidly identify promising antibody and protein structures and efficiently advance them to the next stages of testing. Companies and research organizations report that integrating AI into their discovery programs not only shortens development timelines but also enhances the depth of scientific insight available to decision-makers, enabling more informed and strategic choices throughout the R&D process.

Large Molecule Drug Discovery Outsourcing MarketGrowth Factors

- Rising Adoption of AI-Driven Drug Design: Integration of artificial intelligence in biologics discovery is driving faster target identification and optimizing lead selection.

- Growing Demand for Personalized Biologics: Advances in precision medicine are boosting the need for custom antibody and protein therapeutics development.

- Expansion of Biotech Hubs in Asia-Pacific: Emerging biotech clusters are propelling outsourced discovery growth through skilled talent and advanced infrastructure.

- Increasing Strategic Partnerships with CROs: Collaborations between pharma sponsors and contract research organizations are fueling early-stage discovery efficiency and innovation.

- Advancements in High-Throughput Screening Platforms: Cutting-edge screening technologies are driving faster molecule evaluation and accelerating preclinical pipelines.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.20 Billion |

| Market Size in 2026 | USD 3.49 Billion |

| Market Size by 2035 | USD 7.67 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.14% |

| Dominating Region | North America |

| Dominating Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Molecule Type, Service Type, Technology Platform, End-User, Therapeutic Area, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Molecule Type Insights

Why Did the Monoclonal Antibodies Segment Lead the Market in 2025?

The monoclonal antibodies (mAbs) segment led the large molecule drug discovery outsourcing market with the largest share in 2025. This is mainly due to their demonstrated clinical efficacy, predictable safety profiles, and broad therapeutic applicability. These antibodies have been the foundation of biologics pipelines in the fields of oncology, immunology, and inflammatory diseases.

Major companies, such as Roche, Genentech, Amgen, and Johnson and Johnson, have remained active in executing several mAb programs at preclinical and clinical phases in 2024. This created the need for specialized discovery services such as antibody library development, functional characterization, and lead optimization. Moreover, the research funding by both public and private sectors to improve antibody discovery technologies, increased innovation, and strengthened the importance of outsourced expertise to support mAb programs contributed to the segment's dominance.

The bispecific antibodies segment is expected to grow at the fastest rate in the coming years, owing to their capacity to have two unique targets simultaneously. This provides an improved therapeutic response, particularly in the field of oncology and immuno oncology, where dual targeting has proven to be more effective. Furthermore, ongoing clinical advancements, strong regulatory support, and cutting-edge technological developments have positioned bispecific antibodies as the fastest-growing segment in outsourced biologics discovery, reflecting their increasing importance in next-generation therapeutics and the growing demand for specialized R&D services.

Service Type Insights

What Made Protein Expression & Purification the Dominant Segment in the Market in 2025?

The protein expression & purification segment dominated the large molecule drug discovery outsourcing market in 2025. This is mainly due to the increased development of biologics, including antibodies and enzymes, which require high-quality protein production for preclinical and clinical studies. Sponsors rely on specialized services to produce high-quality biologics, including monoclonal antibodies and enzyme formats, which are essential for early-stage discovery testing and functional validation.

The complexity of large-molecule therapeutics drives companies to rely on specialized contract research organizations (CROs) that offer expertise, advanced technologies, and scalable processes. Additionally, increasing demand for faster timelines and reliable data in early-stage development has strengthened the role of outsourcing protein expression and purification as a critical and high-value service.

The antibody engineering & humanization segment is expected to grow at the fastest CAGR in the coming years, as pharmaceutical companies increasingly pursue next-generation modalities that require more complex molecular design and optimization than traditional protein expression. The industry is shifting toward advanced antibody platforms, including humanized and fully human sequences, which help improve therapeutic compatibility and reduce immunogenicity.

The expansion of the engineered biologics pipeline and the regulatory approval of novel antibody modalities are further fueling demand for specialized humanization and optimization services. Additionally, the rising demand for faster timelines and high-quality biologics in early-stage development continues to drive the segmental growth.

Technology Platform Insights

How Does the Mammalian Cell Expression Systems Segment Contribute the Largest Market Share?

The mammalian cell expression systems segment dominated the large molecule drug discovery outsourcing market while holding the largest share in 2025, as they produce proteins with human-like post-translational modifications and proper folding. This is essential for therapeutic efficacy and safety in biologic drugs. Moreover, the segment's dominance is further reinforced by the growing demand for biologics with stringent safety and functional requirements, combined with the scalability and reliability of mammalian expression platforms.

The single-cell screening platforms segment is expected to grow at the fastest rate in the coming years, as they detect uncommon, high-value cells in populations by combining the analysis of individual cells instead of large populations. This significantly increases the resolution in both lead selection and functional profiling. These platforms are used to discover high-affinity antibodies and novel binding sequences over an etiological pathway and enhance success rates in early discovery. Furthermore, as therapeutic modalities become increasingly complex, sponsors are expected to rely heavily on single-cell screening platforms, enabling them to analyze functional nuances with unprecedented precision and granularity.

End-User Insights

Why Did the Large Biopharmaceutical Companies Segment Dominate the Market in 2025?

The large biopharmaceutical companies segment dominated the large molecule drug discovery outsourcing market by holding a major revenue share in 2025. This is because these companies handle extensive pipelines of complex biologics. Their high R&D budgets support sustained partnerships with specialized discovery service providers.

Large biopharma companies, including Pfizer, Roche, Merck & Co, and AstraZeneca, increasingly rely on outsourced services to accelerate early-stage discovery, optimize complex molecules, and reduce development timelines. Additionally, their focus on next-generation biologics and personalized therapies has driven demand for specialized CROs that offer expertise in protein expression, antibody engineering, and high-throughput screening, reinforcing the segment's market leadership.

The small & mid-sized biotech companies segment is expected to grow at the fastest CAGR in the coming years, driven by their adoption of agile, innovation-focused research models that rely heavily on external expertise throughout the discovery process. Outsourcing enables these companies to access advanced discovery platforms and technologies, similar to those used by large pharmaceutical firms, without the need to develop these capabilities internally. Furthermore, biotech R&D expenditure is increasing at roughly twice the rate of large pharma R&D, highlighting a growing trend toward workflow externalization and further boosting market growth.

Therapeutic Area Insights

Why Did the Oncology Segment Dominate the Large Molecule Drug Discovery Outsourcing Market?

The oncology segment dominated the large molecule drug discovery outsourcing market in 2025 due to the growing number of cancer patients and a high focus on developing targeted therapeutics. This further draws extensive research attention and regulatory support that pushed sponsors to seek external expertise for complex biologics discovery tasks

- In 2024, the U.S. FDA licensed 17 new oncology drugs against a variety of cancer types as part of long-term prioritization of cancer biologics and increasing the need to seek specialized services. Moreover, companies such as Roche, AstraZeneca, and Merck & Co. have increased the immuno-oncology and target therapy pipelines, boosting the demand for outsourcing services.

The rare & genetic diseases segment is expected to grow at the fastest CAGR over the forecast period. This is due to the increasing focus on personalized and targeted therapies that require specialized expertise in biologics. Developing treatments for rare and genetic conditions often involves complex proteins, antibodies, or gene-modifying molecules, which necessitate advanced technologies and highly skilled external partners. Additionally, the small patient populations and high regulatory requirements make outsourcing an attractive strategy for accelerating research, reducing costs, and accessing specialized platforms that can handle the unique challenges of these therapies.

Regional Insights

How Big is the North America Large Molecule Drug Discovery Outsourcing Market Size?

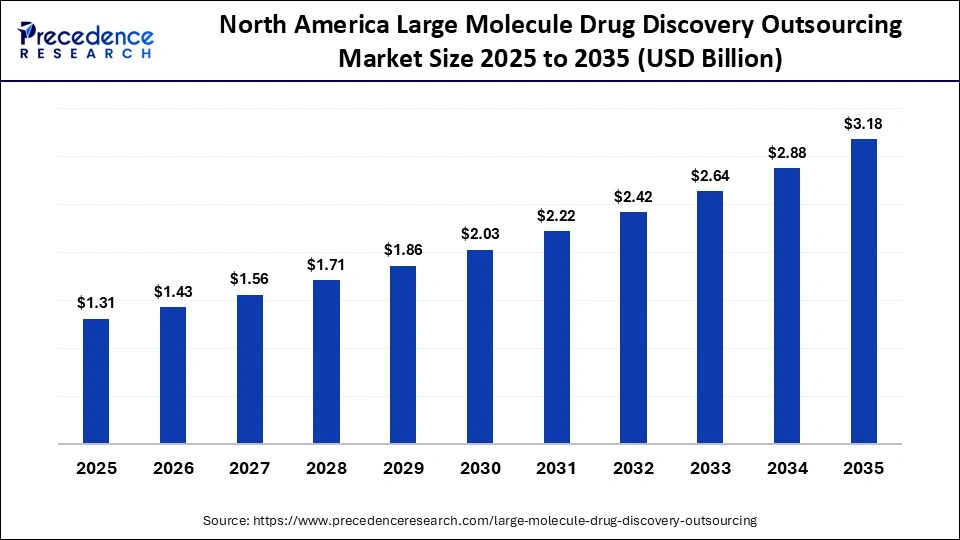

The North America large molecule drug discovery outsourcing market size is estimated at USD 1.31 billion in 2025 and is projected to reach approximately USD 3.18 billion by 2035, with a 9.27% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Large Molecule Drug Discovery Outsourcing Market?

North America registered dominance in the large molecule drug discovery outsourcing market by capturing the largest revenue share in 2025. This is mainly due to the strong focus of biopharmaceutical companies on developing high-quality biologics, established CRO/CDMO networks, and strong investment into R&D. The FDA approval activity in 2024 was focused on protein-based and antibody therapies, which significantly boosted the need for specialized external discovery services.

The region is home to leading market players, such as Pfizer, Merck & Co., and Johnson & Johnson, which are driving engagement with contract research organizations (CROs) to accelerate complex biological programs, strengthening the region's ecosystem of external services. In addition, strategic investments and expansions by global sponsors into U.S. and Canadian research sites are further fueling growth in the outsourced biologics research and innovation sector, supporting advanced capabilities and enhanced collaboration across the industry.

What is the Size of the U.S. Large Molecule Drug Discovery Outsourcing Market?

The U.S. large molecule drug discovery outsourcing market size is calculated at USD 984.00 million in 2025 and is expected to reach nearly USD 2,403.20 million in 2035, accelerating at a strong CAGR of 9.27% between 2026 and 2035.

U.S. Large Molecule Drug Discovery Outsourcing Market Trends

The U.S. is a major player in the market, supported by a combination of strong biopharmaceutical R&D investment, advanced research infrastructure, and a robust ecosystem of contract research organizations (CROs). Leading companies like Pfizer, Merck & Co., and Johnson & Johnson increasingly rely on outsourcing to accelerate complex biologics programs, including monoclonal antibodies, engineered proteins, and next-generation modalities. Additionally, the focus on innovation, regulatory support, and the adoption of advanced technologies, such as high-throughput screening, single-cell analysis, and AI-driven discovery, has further fueled demand for specialized outsourced services in the U.S.

What Makes Asia Pacific the Fastest-Growing Region in the Large Molecule Drug Discovery Outsourcing Market?

Asia Pacific is expected to grow at the fastest rate in the market during the forecast period, owing to the expanding R&D investments and supportive government policies that attract multinational engagement. China, India, Japan, and South Korea undertook great biologics discoveries in 2024, attracting international outsourcing technologies and services. Additionally, increasing investments by multinational pharma companies, government incentives, and the growing adoption of complex biologics have further accelerated outsourcing activities, positioning Asia Pacific as a key hub for biologics discovery and development.

China Large Molecule Drug Discovery Outsourcing Market Trends

China is leading the charge in the Asia Pacific market, driven by the booming biotech industry, the growing number of clinical research, and the growing global outsourcing. In 2024, China enrolled over 7,100 clinical drug trials, the most of any country, which is an indicator of intense scientific activity that drives the demand for discovery outsourcing. Moreover, China offers a large talent pool of skilled scientists, advanced laboratory infrastructure, and scalable biologics manufacturing, making it attractive for both domestic and global sponsors.

How is the Opportunistic Rise of Europe in the Market?

Europe is expected to grow at a significant rate in the large molecule drug discovery outsourcing market due to its strong academic research base, well-established biotech clusters, and harmonized regulatory frameworks that support cross-border development and early-stage discovery initiatives. Countries such as Germany, the UK, Switzerland, France, and Italy are leading regional outsourcing efforts, leveraging their expertise in translational research and advanced biologics innovation. Furthermore, long-term investments in life sciences infrastructure and the development of biosimilars are expected to drive the regional market growth.

Germany Large Molecule Drug Discovery Outsourcing Market Trends

Germany leads the European market due to its robust research foundation, well-developed biotech infrastructure, and widespread adoption of innovative technologies. Recognized as a scientifically advanced and reliable outsourcing partner, Germany benefits from strong support for translational research and close collaborations with academic centers, reinforcing its position as a key hub for biologics discovery and development in Europe.

Who are the Major Players in the Global Large Molecule Drug Discovery Outsourcing Market?

The major players in the large molecule drug discovery outsourcing market include Charles River Laboratories International, Inc., Dalton Pharma Services, Domainex Ltd., Eurofins Scientific SE, Evotec SE, GenScript Biotech Corporation, Jubilant Biosys Limited, Laboratory Corporation of America Holdings (Covance), Merck & Co., Inc., Pharmaceutical Product Development, LLC (PPD, part of Thermo Fisher), Pharmaron Beijing Co., Ltd., QIAGEN N.V., Syngene International Limited, TCG Lifesciences Pvt Ltd., and WuXi AppTec.

Recent Developments

- In September 2025, Eli Lilly launched TuneLab, an AI/ML platform providing selected biotech companies access to drug-discovery models trained on years of Lilly's research data. Initial public partners include Circle Pharma and insitro. Lilly stated that the first release represents over $1 billion in internal data investment.

- In March 2025, Raichur-based Shilpa Medicare launched its full-service ‘hybrid' contract development and manufacturing organization (CDMO). The CDMO will serve small and large molecule clients, as well as peptides, with oncology as a key therapeutic focus. In addition to comprehensive discovery, clinical, and commercial outsourcing, Shilpa's model includes commercially ready ‘off-the-shelf' novel formulations for exclusive B2B licensing, allowing pharmaceutical companies to leverage Shilpa's oncology expertise while reducing development risk and timelines.

- In December 2025, Eli Lilly (NYSE: LLY) announced plans to invest over $6 billion in a new manufacturing facility in Huntsville, Alabama. This next-generation synthetic medicine active pharmaceutical ingredient (API) site, the third of four planned U.S. facilities, will produce small-molecule synthetic and peptide medicines. The site will also manufacture or forglipron, Lilly's first oral small molecule GLP-1 receptor agonist, expected to be submitted to global regulatory agencies for obesity by the end of 2025.

- In December 2023, MilliporeSigma, the U.S. and Canada life science business of Merck KGaA, Darmstadt, Germany, launched AIDDISON, a drug discovery software promoted as the first software-as-a-service platform bridging virtual molecule design and real-world manufacturability using Synthia retrosynthesis software API integration.

(Source: https://www.drugdiscoverytrends.com)

(Source: https://www.prnewswire.com)

(Source: https://www.biopharminternational.com)

Segments Covered in the Report

By Molecule Type

- Monoclonal Antibodies (mAbs)

- Recombinant Proteins

- Peptides & Polypeptides

- Antibody-Drug Conjugates (ADCs)

- Bispecific Antibodies

- Fusion Proteins

By Service Type

- Target Identification & Validation

- Antibody Engineering & Humanization

- Protein Expression & Purification

- Assay Development & Screening

- Lead Identification & Optimization

- In Vitro & Early In Vivo Studies

By Technology Platform

- Hybridoma Technology

- Phage Display

- Yeast Display

- Mammalian Cell Expression Systems

- Single-Cell Screening Platforms

By End-User

- Large Biopharmaceutical Companies

- Small & Mid-Sized Biotech Companies

- Virtual / Emerging Biotech Firms

- Academic & Research Institutes

By Therapeutic Area

- Oncology

- Immunology & Inflammation

- Infectious Diseases

- Neurology

- Cardiovascular Disorders

- Rare & Genetic Diseases

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content