What is the Liquid-Applied Sound-Damping Coating Market Size?

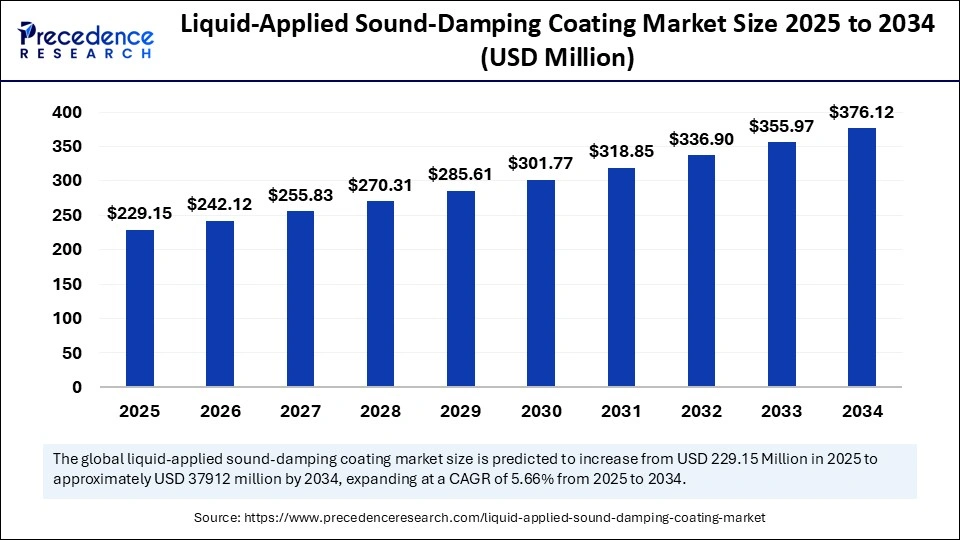

The global liquid-applied sound-damping coating market size was calculated at USD 216.88 million in 2024 and is predicted to increase from USD 229.15 million in 2025 to approximately USD 376.12 million by 2034, expanding at a CAGR of 5.66% from 2025 to 2034. The liquid-applied sound-damping coating market is driven by rising demand for noise reduction solutions across automotive, construction, and industrial applications to enhance comfort and regulatory compliance.

Market Highlights

- North America dominated the liquid-applied sound-damping coating market in 2024.

- Asia Pacific is anticipated to witness the fastest growth during the forecasted years.

- By type, the water-based LASD coatings segment held the biggest market share in 2024.

- By type, the hybrid/advanced polymer LASD coatings segment is anticipated to show considerable growth over the forecast period.

- By material, the acrylic-based segment led the market in 2024.

- By material, the polyurethane-based segment is anticipated to show considerable growth over the forecast period.

- By application method, the spray-applied segment captured the highest market share in 2024.

- By application method, the automated robotic application segment is anticipated to show considerable growth over the forecast period.

- By thickness range, the 1-2 mm segment contributed the maximum market share in 2024.

- By thickness range, the < 1 mm segment is anticipated to show considerable growth during the forecast period.

- By end-use industry, the automotive segment held a significant share in 2024 and is anticipated to show considerable growth over the forecast period.

- By distribution channel, the direct sales segment generated the major market share in 2024.

- By distribution channel, the online sales/specialty suppliers segment is anticipated to show considerable growth over the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 216.88 Million

- Market Size in 2025: USD 229.15 Million

- Forecasted Market Size by 2034: USD 376.12 Million

- CAGR (2025-2034): 5.66%

- Largest Market in 2024: North America

- Fastest Growing Market:Asia Pacific

What is Liquid Applied Sound Damping Coating?

The liquid-applied sound-damping coating market is facing a lot of attention with industries shifting their interest to lightweight solutions, efficient, and sustainable methods of controlling noise and vibration. LASD coating is a progressive liquid-based coating that can be directly applied by spraying or rolling, thus eliminating the use of conventional heavy mats and sheets. These are widely used in the automotive, aerospace, construction, and industrial machine sectors where the minimization of structural noises and enhancement of the acoustic comfort are of importance.

The growth of the market is driven by the automotive industry, in particular, by the growing use of electric vehicles (EVs), which require a higher level of noise, vibration, and harshness (NVH) control. Market growth is also driven by the aerospace industry as airlines and manufacturers increasingly use LASD coating on cabin interiors in the quest to make the cabin interior comfortable for passengers. The preference toward lightweight construction material, as well as the push towards automation in manufacturing, makes LASD coatings a disruptive solution with a significant growth opportunity.

How is AI Integration Transforming the Liquid-Applied Sound-Damping Coating Market?

The use of artificial intelligence is changing the market of liquid-applied sound-damping coating by streamlining the product development process, making manufacturing more efficient, and simplifying the installation. In research and development, AI-based modeling and simulations will enhance the development of high-level formulations that have high acoustic capabilities, with fire resistance and high durability. Using AI in manufacturing ensures accuracy in spray dispersion, coating layer, and minimizes waste of materials, which improves efficiency and reliability of large-scale production. The AI-based predictive maintenance also reduces the downtime of equipment, which ensures that it operates cost-effectively. AI can be used to predict the market by evaluating the trends of consumer demand and regulatory alterations to help firms remain competitive.

What Factors are Fueling the Rapid Expansion of the Liquid-Applied Sound-Damping Coating Market?

- Increased Demand in the Electric Vehicles: The movement towards electric vehicles is improving the demand for noise control solutions, since the electric vehicles produce secondary sounds, which the road and wind noise.

- Aerospace Interiors Adoption: LASD coating is being incorporated by the airlines and commercial jet manufacturers to make the cabin a more comfortable place by lowering noise and vibration in the cabin. They are lightweight, sprayable, and therefore suitable to be use in complicated aerospace products.

- Stiffer Noise Policies: International Environmental and occupational noise policies are forcing industries to use effective damping systems. The LASD coating offers economic advantages and satisfies the stringent requirements, as it is flexible and environmentally friendly.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 216.88 Million |

| Market Size in 2025 | USD 229.15 Million |

| Market Size by 2034 | USD 376.12 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.66% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Material Composition, Application Method, Thickness Range, End-Use Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand for lightweight and efficient noise reduction solutions

The push behind the liquid-applied sound-damping coating market is the growing need to have lightweight, efficient noise and vibration control products in automotive, aerospace, and even construction industries. This demand is also increased by the rapid introduction of electric vehicles, when the lack of engine noise allows secondary sounds, which include road noise, wind, and mechanical vibrations more noticeable.

Stricter environmental noise regulations worldwide have forced manufacturers to employ new high-level damping systems that meet the requirements of global compliance yet remain cheaper. LASD finishes also enable automation in the manufacturing processes, lowering the labour costs and increasing the throughput. The intensive market development makes LASD coatings an inevitable part of modern noise control strategies.

Restraint

High application costs and technical limitations in certain uses

The liquid-applied sound-damping coating market is facing the challenges that relate to the high application costs and certain technical limitations despite the favourable growth prospects. These needs increase the initial cost burden, especially to small and mid-sized manufacturers who work in price-sensitive markets. Besides, LASD coating, though highly effective in medium-frequency noise damping, might not be as effective as conventional heavy mats in low-frequency noise damping, thus limiting its use to specific applications.

Opportunity

Expanding applications in electric vehicles and sustainable manufacturing

The liquid-applied sound-damping coating market has huge potential with the increasing use in electric vehicles (EVs) and the growing world focus on sustainable manufacturing. In addition to EVs, sustainable practices are perceived as a good opportunity in the market, and there is a growing demand for waterborne LASD coating that lessens the emission of volatile organic compounds (VOC) and meets high standards of environmental regulations.

The building and the aerospace sector are considering LASD coating due to its ability to provide fire protection, durability, as well as automatability, which increases its area of application. Since the hybrid formulations and the AI-powered precision applications are going to evolve further due to the ongoing R&D, the LASD coatings will be well-placed to take the chances offered in numerous industries where efficiency, comfort, and sustainability are the key attributes.

Segment Insights

Type Insights

Why does the water-based LASD coatings segment lead the liquid-applied sound-damping coating market?

The water-based LASD coatings segment led the liquid-applied sound-damping coating market and accounted for the largest revenue share in 2024 because it is closely related to the global sustainability agenda and regulatory requirements. In comparison to solvent-based formulation, water-based paint would greatly lower the level of volatile organic compounds (VOC) emissions, thereby making the coating safe to the workers and environmentally friendly. These coatings are highly embraced in the automotive industry, with the automotive companies being under pressure to reduce their environmental footprints without compromising performance. Their adoption is further being enhanced through continuous innovations like shorter drying times and better resistance to fire. Together with their environmental friendliness, regulatory conformity, and applicability in large-scale processes, water-based LASD coatings comprise the majority segment.

The hybrid/advanced polymer LASD coatings segment is expected to grow at a significant CAGR over the forecast period, as it is more efficient and versatile. Such coatings are designed as a blend of superior polymers, resins, and fillers to provide superior noise damping, fire resistance, and durability than the conventional formulations. They overcome constraints of conventional water and solvent-based coating as they provide improved performance at both high-frequency and low-frequency noise levels, rendering it acceptable to a wider area of application. Hybrid LASD-based coatings are currently being established in the electric vehicle sector, which requires lightweight, but high-performance, acoustic solutions at an increasing pace. Moreover, these sophisticated materials are used in aerospace and industrial manufacturers in their interiors and heavy machinery, where high resistance to vibration, heat, and environmental stress is required. Continuous research and development are also enhancing innovation, which has allowed hybrid coating to deliver a multi-functional advantage, like lessening the weight and enhancing sustainability, which guarantees high growth in the markets.

Material Insights

Why did acrylic-based contribute the most revenue in 2024?

The acrylic-based segment contributed the most revenue in 2024 and is expected to dominate throughout the projected period. They are cost-effective and perform well, and they are widely used in industries. These coats are highly adhesive, strong, and flexible, hence they can be used diversely in the automotive, construction, and industrial sectors. They also give them a greater demand because they are compatible with waterborne formulations and as more manufacturers are moving towards eco-friendly and low-VOC solutions. LASD Coatings made of acrylic are also better in sprayability and even coverage, which is very desirable in automated production, especially in the automobile Industry, where accuracy and profitability a major concerns. Their capacity to endure environmental stress and their long-lasting acoustic output make them a choice in most industries. Also, continuous developments to enhance the drying period, fire resistance, and mechanical strength are keeping them on top.

The polyurethane-based segment is expected to grow substantially in the liquid-applied sound-damping coating market because of its superior mechanical strength, resistance to chemicals, as well as its acoustic response. Polyurethane formulations are great in elasticity, durability, which makes them especially useful in any demanding environment like automotive underbodies, aerospace components, and heavy machinery. This is an added competitive edge over other materials because of their capability to retain damping performance during extreme changes of temperature and in extreme operating conditions. With the spread of electric vehicles and the high-tech use of aerospace products, there is increased demand for coatings that are lightweight and at the same time with high vibration control and resilience. Moreover, polyurethane-based LASD coating is being considered to extend its capability in integrating with hybrid formulations and offering much better performance in a wider spectrum of frequencies. It is anticipated that with this increased preference for high-strength and advanced solutions, as well as flexibility, this will result in a major growth of the polyurethane-based segment.

Application Method Insights

Why did the spray-applied segment lead the liquid-applied sound-damping coating market in 2024?

The spray-applied segment led the liquid-applied sound-damping coating market and accounted for the largest revenue share in 2024, because of its adaptability, efficiency, and popularity in a wide range of industries. Spray application enables the application of coatings to large and tricky surfaces so that the coating has a uniform thickness and damping performance. Moreover, it can be used to facilitate both manual and semi-automated processes, which is why the approach can be used by small, mid-size, and large manufacturers. Its established capability in the provision of lightweight, durable, and efficient noise reduction technology places the application of spray as the most trusted and common mode of application.

The automated robotic application segment is expected to grow at a significant CAGR over the forecast period, owing to the increased demand for high accuracy, stability, and efficiency in modern production. Correct regulation of thickness and range of coating is ensured through the implementation of robot systems, which reduce errors and limit the dependence on human resources. The method is particularly desirable in the automotive industry and the aerospace industry, where production volumes are large, and some of the most stringent quality requirements are dictated by repetition and consistency. Also, artificial intelligence and more advanced sensors are being integrated to provide smarter robotic systems, which are able to change the parameters of coating on the fly to enhance efficiency and minimize material usage. The upfront cost of robotic systems is also quite high, but cost-saving, shortening of cycles, and high quality of products are making it acceptable in the long term.

Thickness Range Insights

Why did 1–2 mm contribute the most revenue in 2024?

The 1–2 mm contributed the most revenue in 2024 and is expected to dominate throughout the projected period, as it provides the best performance, cost, and versatility balance. The coatings in this range offer high levels of vibration and noise damping with an overall lightweight profile, hence are very applicable to automotive, aerospace, and construction industries. The 1-2 mm width is used extensively in the automotive industry and is applied in underbody, floor pan, and interior panels applications with good NVH (noise, vibration, and harshness) control without necessarily affecting fuel consumption or electric vehicle range. It can be used with both spray-applied and robotic application techniques, further making it suitable for large-scale use in industries.

The < 1 mm segment is expected to grow substantially in the liquid-applied sound-damping coating market. The thinner coatings are finding more applications where weight reduction is of the essence, such as in electric vehicles and aerospace interiors, where every single unit of reduction can lead to more efficiency and performance. These finishes utilize sufficient damping of high-frequency noise and, therefore, can be used in interior parts and lightweight structures. Also, the use of thinner layers is getting more effective due to the development of material science and AI-supported application techniques that provide the layer with a competitive acoustic performance at reduced material consumption. The segment of less than 1 mm is becoming increasingly popular as a new substitute to the heavier coating, and is set to be a powerhouse over the forecast period.

End-Use Industry Insights

Why did the automotive (passenger vehicles) segment lead the liquid-applied sound-damping coating market in 2024?

The automotive segment dominated the market in 2024, with the passenger vehicles sub-segment holding the largest revenue share. Passenger cars would need effective noise, vibration, and harshness control to improve the comfort of driving and meet the augmented consumer need to have the ability to reduce cabin noise. LASD provides a simple and effective alternative to traditional mats that provide a uniform coating to uneven vehicle geometry, such as floor pans, door panels, and underbodies. Their suitability for spray and robotics application techniques also makes them suitable for production in large quantities at less cost of labor and materials. The need to regulate emissions and fuel consumption among automakers also favored the implementation of LASD coatings, which help in reducing weight relative to the traditional options.

The electric vehicles sub-segment of the automotive segment is anticipated to have the fastest growth. This can be attributed to the special acoustic issues that EVs raise. This increases the demand for better NVH solutions to make passengers comfortable. The LASD coatings are lightweight and flexible, and therefore suited to EV applications since they offer good damping without causing excessive weight load, and this supports battery efficiency and performance as well as the driving range. Moreover, due to global trends of governments promoting the use of EVs via incentives and increased restrictions on the level of emissions, there is an increasing demand for innovative and sustainable noise control materials. The combination of the EV boom, the requirement to remain lightweight, and effective NVH management is making the LASD coatings an important solution.

Distribution Channel Insights

Why did direct sales contribute the most revenue in 2024?

The direct sales contributed the most revenue in 2024 and are expected to dominate throughout the projected period, because of the robust OEM supply contracts and long-term relationships with the leading automotive, aerospace, and construction companies. The manufacturers of LASD coatings can also work hand in hand with clients through direct sales channels, working together to provide tailor-made solutions to a client to a certain noise, vibration, and harshness problem. Such close integration facilitates innovation and enhances the client relationships, which generate a stable revenue stream. In addition, direct sales due to bulk procurement opportunities minimize the unit costs and ensure compliance with the regulations, which also makes it a channel of choice.

The online sales/specialty suppliers segment is expected to grow substantially in the liquid-applied sound-damping coating market because of growing demand among small and medium manufacturers, aftermarket consumers, and the niche industry. The increased accessibility, competitive prices, and faster deliveries of online platforms and dedicated distributors. Tailored technical assistance, variable quantities of orders, and inventive formulations to make custom applications are also provided by specialty suppliers in the construction, industrial equipment, and smaller EV startups sectors. With the emergence of e-commerce in industrial supplies in combination with digital procurement platforms, business companies are increasingly sourcing coatings without an intermediary. Moreover, with the ongoing diversification of the supply chains of industries as a form of resilience, a significant number of industries are resorting to the use of specialized distributors in terms of secondary or backup sourcing.

Region Insights

Why did Asia Pacific dominate the liquid-applied sound-damping coating market in 2024?

Asia Pacific held the dominating share of the liquid-applied sound-damping coating market in 2024, due to the vigorous increases in the automotive, construction, and industrial manufacturing industries. The biggest automotive markets in the world, passenger cars and electric cars, need superior noise, vibration, and harshness solutions to satisfy the expectations and regulations of consumers. Increasing urbanization and infrastructure developments in other countries, such as India, Japan, and South Korea, have also contributed to the increase in the demand for sound-damping solutions in buildings and industrial-related infrastructure.

China is the biggest car and manufacturing center in the Asia Pacific, and has played a major role in dominating the region in the LASD coating industry. The government policies of green manufacturing, energy efficiency, and the tighter environmental and workplace noise limits in China have also made manufacturers use water-based and environmentally-friendly sound-damping coating. Ongoing research and development and automation are improving the efficiency and performance of LASD coatings, and thus, it is very viable in the high-volume production environment in the country.

Why is North America expected to grow at the fastest CAGR in the liquid-applied sound-damping coating market?

North America is estimated to grow at the fastest CAGR during the forecast period, because of the growing utilization of sophisticated systems of noise and vibration control in the automotive, aerospace, and construction industries. The strict noise laws in the region are forcing manufacturers to employ high-performance LASD-based coating in their production, especially on passenger cars and industrial machines.

The increased demand for lightweight NVH-coats in electric vehicles further boosts the growth, as such coatings can reduce the secondary noises, including road and wind noises as well as the mechanical noises, and support the energy efficiency and the increased driving range. There is also the constant development of technology, including environment-friendly water-based formulations and polymer coats that are hybrid, which are maximizing the performance and sustainability, aiming at meeting regulatory standards and ensuring comfort to the consumer.

The U.S., being the largest automotive and aerospace market in North America, has been at the center of the high growth in the region. The attention of the U.S. government to the development of electric vehicle uptake, emission decreasing, and strict noise and VOC rules has generated a great demand for LASD coating. U.S. automakers and aerospace manufacturers are moving towards spray-applied and robotic LASD solutions to address the NVH requirements and enhance production efficiency.

Liquid-Applied Sound-Damping Coating Market Companies

- Henkel AG and Co. KGaA

- 3M Company

- PPG Industries, Inc.

- BASF SE

- Dow Chemical Company

- Sika AG

- Covestro AG

- LORD Corporation

- Daubert Chemical Company

- RPM International Inc.

- Mascoat

- Ziebart International Corporation

- L&L Products

- Soundcoat Company, Inc.

- Tremco Incorporated

- Akzo Nobel N.V.

- Kansai Paint Co., Ltd.

- Axalta Coating Systems

- Sherwin-Williams Company

- Nippon Paint Holdings Co., Ltd.

Recent Developments

- In April 2024, Henkel acquired special suppliers of protective coating and sealing solutions. The acquisition increases the world reach of Henkel and its MRO growth platform, and offers certified coating technologies with a complementary applicator network to serve retrofitting, smart maintenance, and civil infrastructure projects.(Source: https://www.henkel.com)

- In September 2023, BASF introduced the first biomass balance products of plastic additives, such as Irganox 1010 BMBcerttm and Irganox 1076 FD BMBcerttm. All these solutions are certified by TUV Nord through the ISCC PLUS and allow one to use renewable feedstock instead of fossil feedstock and assist their customers in meeting their sustainability goals.(Source: https://www.basf.com)

Segment Covered in the Report

By Type

- Water-based LASD coatings

- Solvent-based LASD coatings

- Hybrid/advanced polymer LASD coatings

By Material Composition

- Acrylic-based

- Epoxy-based

- Polyurethane-based

- Rubber/latex-based

- Others

By Application Method

- Spray-applied

- Roll-applied

- Brush-applied

- Automated robotic application

By Thickness Range

- < 1 mm

- 1–2 mm

- 2–3 mm

- 3 mm

By End-Use Industry

- Automotive

- Passenger vehicles

- Commercial vehicles

- Electric vehicles (EVs)

- Aerospace and Defense

- Marine and Shipbuilding

- Construction and Infrastructure

- Industrial Machinery and Equipment

- Consumer Appliances

- Others

By Distribution Channel

- Direct sales (OEM supply contracts)

- Distributors and coating suppliers

- Online sales/specialty suppliers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting