What is the Liver Cancer Drug Market Size?

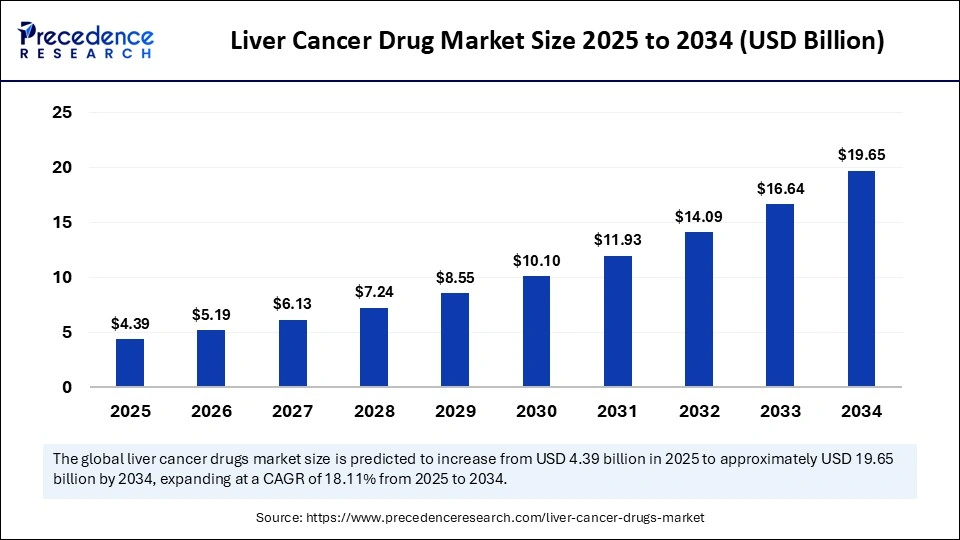

The global liver cancer drug market size accounted for USD 4.39 billion in 2025 and is predicted to increase from USD 5.19 billion in 2026 to approximately USD 19.65 billion by 2034, expanding at a CAGR of 18.11% from 2025 to 2034. The global liver cancer drug market is experiencing significant growth, driven by the increased liver cancer prevalence and advancements in treatment potions like antiviral and immunosuppressive therapies.

Market Highlights

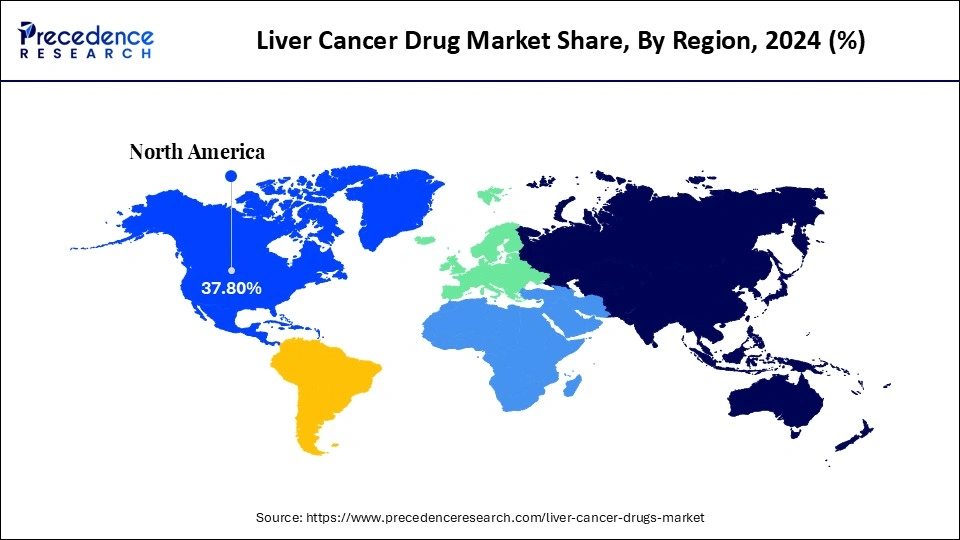

- North America dominated the global liver cancer drug market with the largest share of 37.8% in 2024.

- The Asia Pacific is expected to grow at the highest CAGR of 12.4% from 2025 to 2034.

- By drug type, the targeted therapy segment contributed the largest market share of 41.8% in 2024.

- By drug type, the immunotherapy segment is growing at a notable CAGR of 11.6% from 2025 to 2034.

- By mechanism of action, the tyrosine kinase inhibitors segment led the market while holding the largest share of 46.4% in 2024.

- By mechanism of action, the checkpoint inhibitors segment is expected to grow at a 11.8% CAGR between 2025 and 2034.

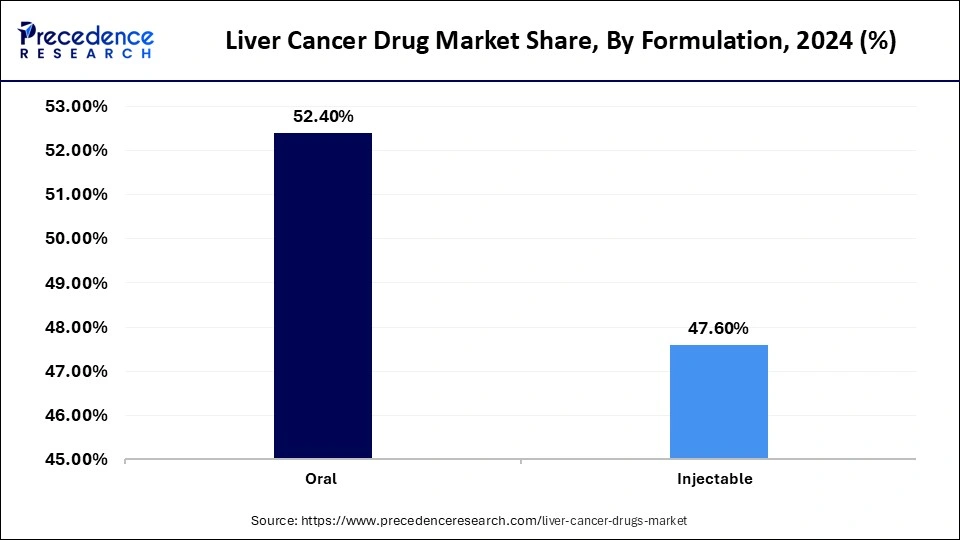

- By formulation, the oral segment led the market while holding the largest share of 48.4% in 2024.

- By formulation, the injectable segment is growing at a strong CAGR of 11.7% between 2025 and 2034.

- By application, the advanced liver cancer segment led the market while holding the largest share of 51.5% in 2024.

- By application, the early-stage liver cancer segment is expected to grow at a 12.2% CAGR between 2025 and 2034.

- By end-user, the hospitals segment led the market while holding the largest share of 45.4% in 2024.

- By end-user, the specialty oncology clinics segment is expected to grow at a 12.0% CAGR between 2025 and 2034.

What is Liver Cancer Drug?

The liver cancer drug market is experiencing significant growth, driven by the rising global incidence of liver cancer, advancements in therapeutics such as immunotherapies and targeted treatments, and increased R&D investment. The market encompasses pharmaceutical therapies for hepatocellular carcinoma (HCC), the most common form of liver cancer, as well as other hepatic malignancies. Key treatment modalities include targeted therapies, immunotherapies, chemotherapy, and combination regimens that aim to inhibit tumor progression and enhance patient survival outcomes.

Growth is further supported by the increasing prevalence of liver cancer, heightened awareness of early diagnosis, and the continuous development of novel agents such as immune checkpoint inhibitors and molecularly targeted drugs. Additionally, the adoption of personalized medicine is enabling more tailored and effective treatment strategies worldwide. Rising global awareness about liver cancer is amplifying the demand for early detection and therapeutic intervention.

- In October 2025, the Mayo Clinic became the first institution to administer an investigational radioactive medicine for a patient with hepatocellular carcinoma. This targeted radiopharmaceutical theragnostic (RPT) therapy is designed to home in on glypican-3 (GPC3), a protein overexpressed in HCC, representing a promising frontier in precision oncology.

Key Technological Shift in the Liver Cancer Drug Industry?

The liver cancer drug industry is undergoing a transformative technological paradigm shift, characterized by a robust pivot towards precision medicine and targeted therapeutic modalities. The rising demand for targeted therapies, such as sorafenib and Lenvatinib, centers on inhibiting key molecular pathways that drive tumor proliferation. Furthermore, the strategic integration of targeted agents with immunotherapies or chemotherapeutic regimens is enhancing therapeutic efficacy and overcoming tumor resistance mechanisms. This evolution is underpinned by escalating investments in R&D that facilitate adaptive clinical trials, enabling the customization of treatment protocols tailored to individual patient molecular profiles.

Simultaneously, the growing deployment of artificial intelligence (AI) technologies in drug discovery is catalyzing the identification of novel therapeutic targets and optimizing drug development pipelines, thereby accelerating the introduction of innovative liver cancer therapies. Industry frontrunners, including Roche, Bristol-Myers Squibb, Bayer AG, Merck & Co., Exelixis, BeiGene, and Gilead Sciences, are spearheading this technological transition, investing heavily in advanced platforms such as targeted nanoparticle delivery systems, immuno-oncology, organ-on-a-chip models, gene therapy, AI-driven radiomics, and multi-modal combination therapies. Emerging collaborations, exemplified by AI-enabled drug discovery partnerships like Cellares' integrated manufacturing platform, further exemplify the dynamic innovation shaping the liver cancer drug landscape.

Liver Cancer Drug Market Outlook

The liver cancer drug industry is projected to grow rapidly between 2025 and 2034 due to increased incidence of liver cancer, investments in research and development, and advancements in treatment options. Ongoing advancements in targeted therapies and immunotherapies are further fueling this market's growth.

The liver cancer therapeutics market is witnessing accelerated expansion in emerging regions such as Latin America and the Middle East & Africa. In Latin America, the growth is supported by efforts to improve diagnostic capabilities and broaden access to advanced treatment modalities. Meanwhile, in the Middle East & Africa, expanding healthcare infrastructure, rising disease awareness, and increased public-private partnerships are driving adoption. A growing emphasis on developing robust reimbursement frameworks is further strengthening the commercial viability of liver cancer therapies in these regions.

Leading pharmaceutical companies like Bayer AG and Bristol-Myers Squibb are making substantial investments in R&D and manufacturing to advance targeted therapies such as Stivarga and Nexavar, as well as immunotherapies. Moreover, recent strategic investments and acquisitions by firms such as Boston Scientific Corporation, Cure Genetics, Gilead Sciences, and HepaRegeniX are enriching the global treatment portfolio and bolstering the pipeline for next-generation immunotherapeutic agents in hepatocellular carcinoma and related liver malignancies.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 4.39 Billion |

| Market Size in 2026 | USD 5.19 Billion |

| Market Size by 2034 | USD 19.65 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 18.11% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Mechanism of Action, Formulation, Application, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Liver Cancer Drug Market Segment Insights

Drug Type Insights

The targeted therapy segment led the liver cancer drug market in 2024, capturing a 41.8% share, driven by the increased focus on developing precision therapies that selectively target cancer cells, thereby minimizing damage to healthy tissue and reducing side effects. These therapies significantly improve survival rates in advanced-stage liver cancer. Key drugs such as sorafenib, regorafenib, and lenvatinib remain the cornerstone of first-line targeted treatments. Additionally, the growing demand for personalized medicine and the emphasis on combination therapy approaches further propel this segment's growth.

The immunotherapy segment is expected to register the fastest CAGR of 11.6% from 2025 to 2034, fueled by a paradigm shift in treatment strategies. The increasing focus on novel immunotherapy combinations aims to enhance survival outcomes and complement existing targeted therapies. Innovative combinations such as atezolizumab plus bevacizumab and tremelimumab plus durvalumab have emerged as first-line treatments for advanced hepatocellular carcinoma (HCC), offering promising long-term benefits for patients.

Mechanism of Action Insights

The tyrosine kinase inhibitors segment dominated the market with a 46.4% share in 2024 due to their effectiveness in targeting specific molecular pathways involved in cancer cell growth. The introduction of TKIs like Lenvatinib, Regorafenib, and Sorafenib is shifting the industry grown conventional chemotherapy and well-established targeted therapy. These inhibitors are offering promising outcomes in the treatment of liver cancer, enhancing survival rates and patient outcomes. The growing need for precision medicine and treatment to reduce damage to healthy cells and reduce side effects, making tyrosine kinase inhibitors a major drug class.

The checkpoint inhibitors segment is expected to grow at the fastest CAGR of 11.8% in the upcoming period, as they preferred as a first-line standard treatment. Checkpoint inhibitors are the primary systemic treatment for advanced hepatocellular carcinoma (HCC). The PD-1 inhibitors like nivolumab and pembrolizumab are showing significant results in liver cancer treatments. The ongoing and steering research toward novel strategies and biomarkers is fueling this growth.

Formulation Insights

The oral segment dominated the market with a share of 48.4% in 2024 due to its high convenience and easy-to-use nature. Oral drugs like Lenvatinib and Sorafenib are convenient treatment options. Oral formulations enhance patient adherence to treatment, resulting in better outcomes. This formulation is affordable compared to the injectable formulation. Oral targeted therapies like TKIs tyrosine kinase inhibitors) have established standards of care in advanced hepatocellular carcinoma.

The injectable segment is expected to grow at a 11.7% CAGR over the forecast period due to its quick response. Injectables like Pembrolizumab and Nivolumab are essential for immunotherapies and combination therapies. Injectable formulation offers targeted delivery, like hepatic artery infusion delivers chemotherapy directly to the liver, targeting the tumor while reducing side effects on the rest of the body. The need for user-friendly delivery systems like auto-injectors and pre-filled syringes is to innovate in injectable formulations for liver cancer treatments.

Application Insights

In 2024, the advanced liver cancer segment led the market, holding about 51.5% share in 2024. This is primarily due to high unmet medical needs. The high prevalence of liver cancer, particularly hepatocellular carcinoma, and the requirement for effective treatments more than surgery for advanced cancer stages, drives the need for essential therapies and treatment solutions. The investments in research and development for targeted therapies and immunotherapies for advanced and metastatic disease have increased. Ongoing promise for results in Phase III clinical trials for targeted therapies, immunotherapies, and combination therapies is fueling the segment.

The early-stage liver cancer segment is expected to grow at the fastest CAGR of 12.2% between 2025 and 2034 due to the growing adoption of screening and diagnostic tests for early detection. The awareness about liver cancer has increased, so has the increase in the implementation of screening programs, leading to earlier diagnosis and higher demand for effective treatments. The targeted therapies like sorafenib and Lenvatinib are showing promising outcomes in treating early-stage liver cancer. The advanced immunotherapies, is as pembrolizumab and nivolumab, are transforming treatment approaches and outcomes for early-stage liver cancer.

End-User Insights

In 2024, the hospitals segment dominated the market with a share of 45.4% due to their ability to provide centralized treatment and access to advanced therapies. Hospitals are the main centers for diagnosis and comprehensive treatment of the disease, including liver cancer. Hospitals offer specialized, advanced, and high-cost therapies. Hospitals' pharmacies offer professional medical oversight to ensure safe and effective treatment administration. The ability of hospitals to provide monitoring and management by healthcare professionals contributes to hospitalization.

The specialty oncology clinics segment is expected to grow at the fastest CAGR of 12.0% over the forecast period, driven by their ability to offer personalized medicine and continuity of care. The specialty oncology clinics provide advanced treatments like immunotherapies and targeted therapies. Patients can get access to professional medical oversight and ensure safe and effective treatment administration in the specialty oncology clinics. This end-user provides specialized experts, integrated diagnostic, treatment services, and manages complex logistics for high-cost drugs.

Liver Cancer Drug MarketRegional Insights

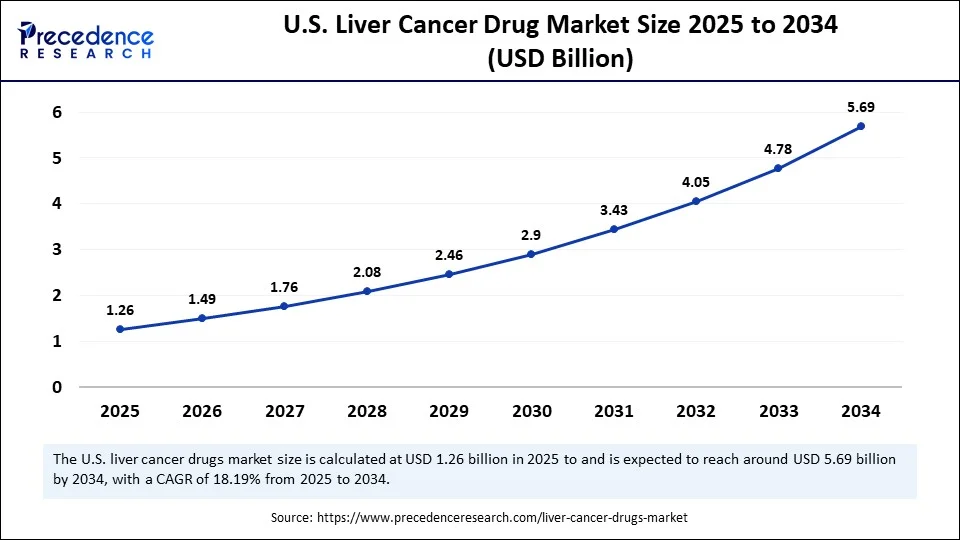

The U.S. liver cancer drug market size is evaluated at USD 1.26 billion in 2025 and is projected to be worth around USD 5.69 billion by 2034, growing at a CAGR of 18.19% from 2025 to 2034.

How Does North America Dominate the Liver Cancer Drug Market?

North America dominated the global liver cancer drug market, capturing the largest share of 37.8% in 2024, driven by the region's advanced healthcare infrastructure, favorable regulatory environment, and substantial investments in research and novel therapies. The availability of sophisticated medical facilities facilitates early diagnosis and effective treatment of liver cancer. Additionally, North America bears a significant burden of liver cancer cases, which further fuels demand for innovative treatments. The presence of leading pharmaceutical companies such as Pfizer, Merck, and Bristol-Myers Squibb is catalyzing substantial R&D activities and therapeutic advancements. With an increasing focus on targeted therapies and combination regimens, the regional market is poised for steady growth throughout the forecast period.

U.S. Liver Cancer Drug Market Trends

The U.S. is a major contributor to the North American liver cancer drug market, supported by its well-established healthcare infrastructure and significant investments in research and development. The rising prevalence of liver cancer is intensifying demand for innovative therapies and treatment solutions across the country. According to the American Cancer Society, in 2025, over 42,000 adults in the U.S. are expected to be diagnosed with liver cancer, with more than 30,000 projected deaths attributed to metastatic liver cancer—a form that originates elsewhere in the body and spreads to the liver. The increasing incidence of metastatic liver cancer further underscores the urgent need for advanced therapeutic interventions.

Asia Pacific is projected to grow at a robust CAGR of 12.4% from 2025 to 2034, driven by the rising prevalence of liver cancer and increasing healthcare expenditures. The region's vast population significantly contributes to the high incidence of liver cancer cases, creating substantial opportunities for pharmaceutical companies to innovate and develop advanced therapies and treatment solutions. Governments across Asia are actively implementing supportive policies and initiatives aimed at promoting early diagnosis and effective treatment of liver cancer. Key markets such as China, India, Japan, and South Korea are experiencing heightened demand for liver cancer therapies, further fueling market expansion.

China's Market Trends

China dominates the regional market due to expanding healthcare expenditure and government support for healthcare development and innovative research. China's regulatory frameworks are approving novel combination therapies. For instance, China's National Medical Products Administration approved a combination of toripalimab and bevacizumab for metastatic hepatocellular carcinoma in March 2025. The strong focus on rising regulatory collaboration with international bodies like the FDA for speeding novel drug approvals contributes to this growth.

India: An Emerging Market

India is the fastest-growing country in the regional market, contributing to growth due to increased cases of liver cancer and a focus on the development of advanced therapies and treatments. India suffering from around 6% of liver cancer cases of the world's liver cancer prevalence. The increasing hepatitis infections, obesity, delayed detection, and alcoholic liver disease are fueling countries' innovations and developments, particularly in Tamil Nadu, due to the increased prevalence of hepatocellular carcinoma (HCC) and metastases to the liver. An ‘Advanced Liver Cancers Clinic' was launched by Apollo Proton Cancer Centre (APCC) in July 2025. This clinic is an integrated clinic for primary liver cancers and liver metastases.

Europe is expected to experience notable growth in the liver cancer drug market, driven by the region's advanced healthcare infrastructure, a strong presence of leading pharmaceutical companies, and substantial R&D investments. The recent approval by the European Commission of the combination therapy nivolumab and lipidimomab for hepatocellular carcinoma highlights the momentum behind cutting-edge treatments, particularly in immunotherapy and targeted therapies. Additionally, Europe's robust research ecosystem and favorable regulatory environment significantly contribute to market expansion.

In a landmark development, Addenbrooke's Hospital in Cambridge launched a novel ultrasound treatment for liver cancer within the NHS in June 2025, marking the first-in-Europe use of a histotripsy machine that destroys tumors non-invasively without surgery or radiation. This advancement was supported by a donation from the Li Ka Shing Foundation.

Germany Liver Cancer Drug Market Trends

Germany is a major player in the regional market, contributing to the growth due to increased funding for cancer research and the adoption of cutting-edge medical technologies. Germany has an advanced healthcare infrastructure and a strong manufacturing base. Germany is leading the research and development of immunotherapy and targeted therapies. The rising focus on the utilization of AI in treatment planning and ongoing clinical trials for novel drugs is fueling this growth.

Liver Cancer Drug Market Value Chain

The development of liver cancer drugs entails a lengthy, intricate, and high-risk process aimed at discovering, testing, and bringing novel therapies to market. This phase encompasses multiple stages, including drug discovery, preclinical research, clinical development, and regulatory review and monitoring. The R&D efforts focus on identifying effective molecular targets and optimizing therapeutic efficacy while minimizing adverse effects.

Key Players: Bristol-Myers Squibb (BMS), Eisai Co., Ltd., Bayer AG, and AstraZeneca.

Liver cancer drug development advances through rigorous clinical trials, Phases I, II, and III, that evaluate safety, efficacy, dosing, and side-effect profiles in human subjects. Regulatory authorities such as the U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) oversee and grant approvals based on robust evidence demonstrating the therapeutic benefits and safety of new drugs. This stage is critical for market authorization and widespread clinical adoption.

Key Players: Bristol Myers Squibb, Genentech/Roche, AstraZeneca, Merck, Exelixis, and Ipsen.

Post-approval, comprehensive patient support programs (PSPs) and patient assistance programs (PAPs) play a pivotal role in facilitating treatment adherence and improving quality of life. These programs provide financial aid, educational resources, emotional support, and practical assistance to patients and caregivers, often delivered collaboratively by pharmaceutical companies, non-profit organizations, and governmental agencies.

Key Players: Bayer, Roche, Merck, Bristol-Myers Squibb, Eisai, and Exelixis.

Liver Cancer Drug Market Companies

Tier I: Market Leaders

These companies dominate the liver cancer drug market, collectively accounting for over 40% of the global revenue.

| Company | Key Offerings |

| Bayer AG | Nexavar (sorafenib), Stivarga (regorafenib) |

| Bristol Myers Squibb | Opdivo (nivolumab), Yervoy (ipilimumab) combined with Opdivo |

| Exelixis, Inc | Cabometyx (cabozantinib) |

| Merck KGaA | Bavencio (avelumab) |

| Eisai Co., Ltd. | Lenvima (lenvatinib) |

Tier II: Established Players

These companies have significant oncology portfolios and are expanding their market presence.

| Company | Key Offerings |

| Exelixis, Inc. | Cabometyx (cabozantinib) |

| Eli Lilly and Co. | Verzenio (abemaciclib), Alimta (pemetrexed) |

| GlaxoSmithKline (GSK) | Zejula (niraparib) |

| Pfizer Inc. | Ibrance (palbociclib), Xalkori (crizotinib) |

| AstraZeneca | Tagrisso (osimertinib), Lynparza (olaparib) |

Tier III: Emerging and Niche Players

These companies have smaller oncology portfolios or operate in specific regional markets.

| Company | Key Offerings |

| Gilead Sciences | Yescarta (axicabtagene ciloleucel), Trodelvy (sacituzumab govitecan-hziy) |

| Sanofi | Blincyto (blinatumomab), Libtayo (cemiplimab) |

| BeiGene | Brukinsa (zanubrutinib), tislelizumab |

| Daiichi Sankyo | Enhertu (fam-trastuzumab deruxtecan-nxki), U3-1402 |

| Bayer | Stivarga (regorafenib), Nexavar (sorafenib) |

| GSK | Zejula (niraparib) |

| Teva Pharmaceuticals | Copaxone (glatiramer acetate) (not oncology-focused) |

Recent Developments

- In August 2025, the study on the ImmunoTACE trial was published in Clinical Cancer Research, an academic journals, found enhanced progression-free survival (PFS) for patient with hepatocellular carcinoma (HCC). According to the study, patients who received the cell-based vaccine along with standard therapy saw a longer period of progression-free survival than patients who received standard therapy alone.(Source: https://ecancer.org)

- In June 2025, UPMC Central PA Surgical Oncology introduced a specialized treatment, hepatic arterial infusion (HAI) pump therapy for patients with either metastatic cancer to the liver or cancers emerging in the liver. HAI therapy is able to more precisely target liver tumors to improve patient eligibility for curative-intent surgery and overall survival of the patients. (Source: https://www.upmc.com)

- In April 2025, the combination of nivolumab and ipilimumab received approval from the U.S. Food and Drug Administration as a prior treatment for adults with metastatic hepatocellular carcinoma. U.S. FDA has approved this therapy, due to positive results of the Phase 3 CheckMte 9DW trial, with significant improvement in survival with the immunotherapy-based combinations.(Source: https://acsjournals.onlinelibrary.wiley.com)

Exclusive Analysis

The global liver cancer drug market is poised for substantial expansion, underpinned by several pivotal factors, including the escalating incidence of hepatocellular carcinoma (HCC), advancements in therapeutic modalities, and a robust pipeline of investigational agents. The therapeutic landscape is undergoing a significant transformation, shifting from traditional systemic chemotherapies to more targeted and personalized treatment approaches. Immunotherapeutic agents, particularly immune checkpoint inhibitors, have emerged as critical components in the management of HCC, offering enhanced survival outcomes and improved patient prognoses. The integration of combination therapies, such as the pairing of checkpoint inhibitors with vascular endothelial growth factors (VEGF) inhibitors or tyrosine kinase inhibitors (TKIs), is further augmenting the efficacy of treatment regimens.

Geographically, Asia Pacific is experiencing accelerated market growth, driven by a high prevalence of HCC and increasing healthcare infrastructure investments. In 2024, the region accounted for a significant portion of the global market share, with projections indicating continued dominance through 2034.

Strategic collaborations and licensing agreements are becoming increasingly prevalent, as pharmaceutical companies seek to enhance their portfolios and expedite the development of novel therapies. For instance, GSK's acquisition of efimosfermin, a promising agent for steatotic liver disease and metabolic-associated steatohepatitis, underscores the industry's commitment to addressing unmet medical needs within the liver disease spectrum.

In summary, the liver cancer drug market presents a dynamic and rapidly evolving landscape, characterized by significant investment opportunities and a strong pipeline of innovative therapies. Stakeholders within the biopharmaceutical sector are well-positioned to capitalize on these developments, contributing to the advancement of treatment paradigms and the improvement of patient outcomes in liver cancer management.

Liver Cancer Drug MarketSegments Covered in the Report

By Drug Type

- Targeted Therapy

- Immunotherapy

- Chemotherapy

- Combination Therapy

By Mechanism of Action

- Tyrosine Kinase Inhibitors

- Checkpoint Inhibitors

- Monoclonal Antibodies

- Anti-Angiogenic Agents

By Formulation

- Oral

- Injectable

By Application

- Advanced Liver Cancer

- Early-Stage Liver Cancer

- Post-Surgery Adjuvant Therapy

By End User

- Hospitals

- Specialty Oncology Clinics

- Cancer Research Institutes

- Homecare/Palliative Care

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting