Lymphoma Treatment Market Size and Forecast 2025 to 2034

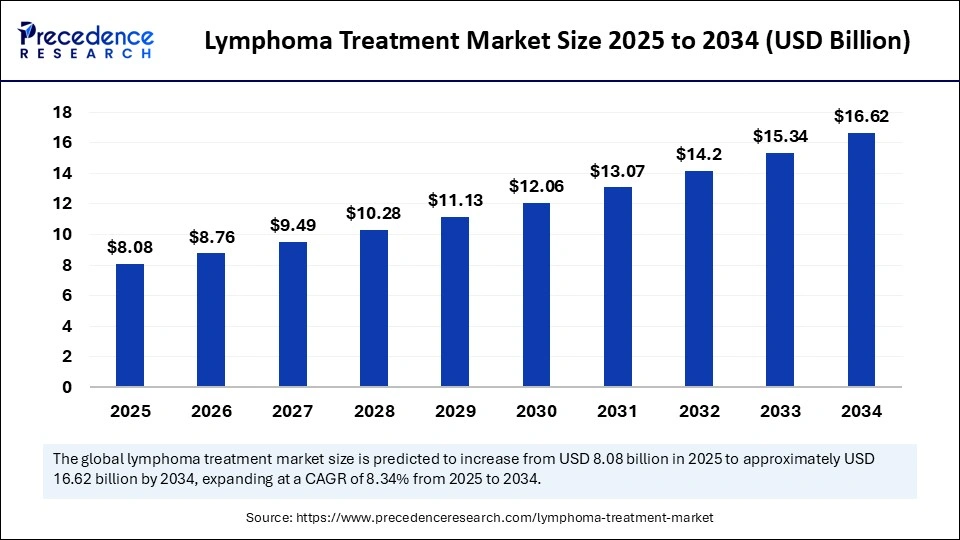

The global lymphoma treatment market size was calculated at USD 7.46 billion in 2024 and is predicted to increase from USD 8.08 billion in 2025 to approximately USD 16.62 billion by 2034, expanding at a CAGR of 8.34% from 2025 to 2034. The rapid growth of the global market, driven by advanced therapies, increased early diagnosis, and rising investment in targeted and immuno-oncology treatments.

Lymphoma Treatment Market Key Takeaways

- In terms of revenue, the global lymphoma treatment market was valued at USD 7.46 billion in 2024.

- It is projected to reach USD 16.62 billion by 2034.

- The market is expected to grow at a CAGR of 8.34% from 2025 to 2034.

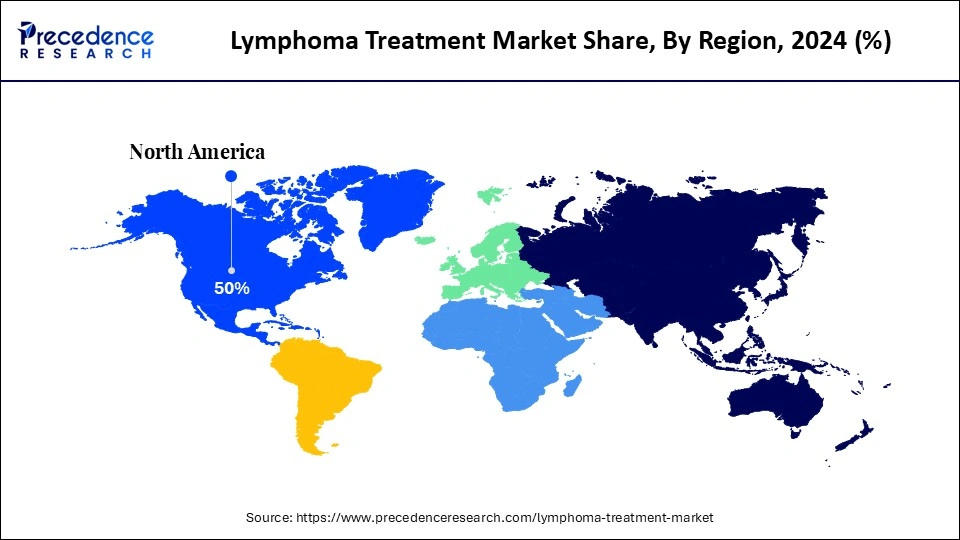

- North America dominated the lymphoma treatment market with the largest market share of 50% in 2024.

- Asia Pacific is estimated to expand the fastest CAGR between 2025 and 2034.

- By disease type, the non-Hodgkin lymphoma (NHL) segment held the biggest market share in 2024.

- By disease type, the Hodgkin lymphoma (HL) segment is anticipated to grow at the fastest CAGR between 2025 and 2034.

- By therapy type, the immunotherapy/targeted therapy segment captured the highest market share in 2024.

- By therapy type, the cellular therapies (CAR-T) segment is expected to expand at a notable CAGR over the projected period.

- By drug class/mechanism, the anti-CD20 segment contributed the maximum market share in 2024.

- By drug class/mechanism, the CAR-T & other cell therapies segment is expected to expand at a notable CAGR over the projected period.

- By line of therapy, the first-line (frontline) segment dominated the market in 2024.

- By line of therapy, the relapsed/refractory (R/R) segment is expected to expand at a notable CAGR over the projected period.

- By mode of administration, the intravenous/infusion segment generated the major market share in 2024.

- By mode of administration, the oral (small molecules) segment is expected to expand at a notable CAGR over the projected period.

Market Overview

The lymphoma treatment market covers a wide range of treatment types for both Hodgkin lymphoma and non-Hodgkin lymphoma. The market growth is driven by the continual growth and uptake of targeted treatments, which include monoclonal antibodies, antibody-drug conjugates, and small molecule inhibitors. Immunotherapeutic agents, which include CAR-T cells, checkpoint inhibitors, and bispecific antibodies, are also growing and expected to increase further in uptake. Nicely, stem cell transplant and radiation therapy will continue to play a role in treatment for particular patient groups, while supportive care impacts treatment.

Hospitals, outpatient clinics, and specialty centres are the main distributors of lymphoma treatments. Overall, patient demand is increasing in all regions globally, partly due to research and development in precision medicine (i.e., drugs based on specific patient biological factors), biomarker-informed therapies, and increased access to novel treatment options.

AI Transforming Lymphoma Diagnosis and Treatment

Artificial intelligence (AI) is changing lymphoma care at a rapid pace, improving accuracy in diagnosing the disease and personalizing treatment options. New studies are showing that AI is able to evaluate medical imaging, including PET/CT scans, detecting lymphomatous lesions with outstanding accuracy. AI platforms are providing better insight into patient response, refining therapeutic choices for clinicians, and enabling them to appropriately match patients for clinical trials in a rapid fashion. In a noteworthy profile, Reid Hoffman, co-founder of LinkedIn, raised $25 million on Jan 28 of the year 2025, to advance cancer care with AI. The aim is to enhance treatment for breast cancer, prostate cancer, and lymphoma patients. AI is quickly emerging as a source of utilization and innovation aimed at improving patient outcomes and rapidly facilitating precision oncology. (Source: https://qz.com)

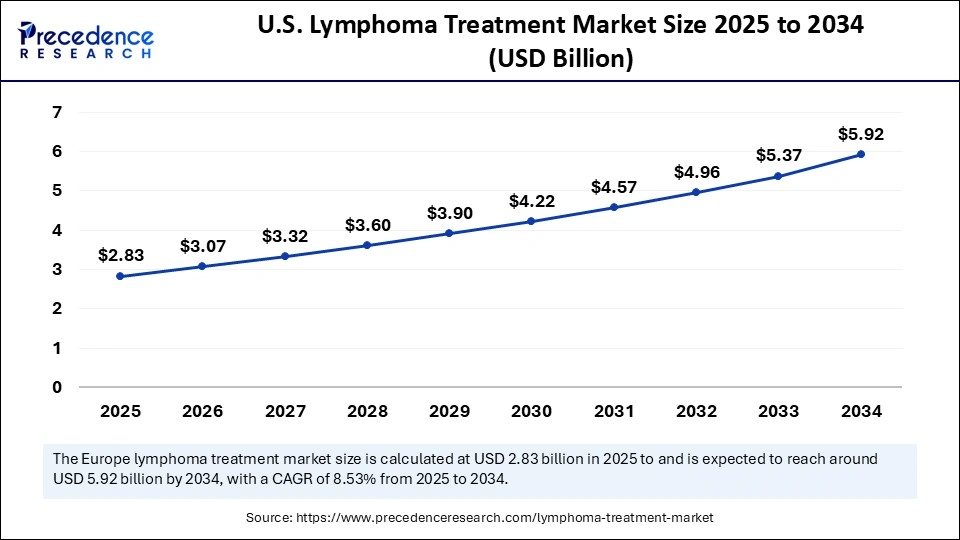

U.S. Lymphoma Treatment Market Size and Growth 2025 to 2034

The U.S. lymphoma treatment market size was exhibited at USD 2.61 billion in 2024 and is projected to be worth around USD 5.92 billion by 2034, growing at a CAGR of 8.53% from 2025 to 2034.

Why is North America the Leading Region in the Lymphoma Treatment Market?

North America is the dominant region in the global lymphoma treatment market due to the high prevalence of the disease, enhanced healthcare delivery infrastructure, and leading pharmaceuticals and research and development. North America has the benefit of quick adoption of innovative therapies like CAR-T cell therapy and other monoclonal antibodies and targeted therapies with favorable regulations and reimbursement paths. This region has a huge volume of clinical trials research and is the largest healthcare funder, which is an advantage in developing the region as a leader and innovative centre in patient-focused lymphoma treatment.

The U.S. is the dominating country in the North America region, as Non-Hodgkin lymphoma disease, in the United States, still displays a significant prevalence with an estimated 80,620 new cases in 2024. (Source: https://www.cancer.org)

Additionally, in March 2025, the FDA approved ADCETRIS by Pfizer for the combination regimen in relapsed/refractory diffuse large B-cell lymphoma based on the positive Phase 3 ECHELON-3 trial data, sharing a 37% reduction in the risk of death. This approval demonstrates the U.S. willingness to develop and use the most cutting-edge therapy in order to improve patient outcomes. Now more than ever, the Janus experience of fielding truly patient-centric lymphoma care, a last position as leading in a global marketplace. (Source: https://www.pfizer.com)

Why is Asia Pacific the Fastest-Growing Lymphoma Treatment Market?

Asia Pacific is growing at a spectacular rate, benefiting from rising cancer incidences alongside improvements in healthcare infrastructure and growing awareness around earlier diagnosis and new therapies. Countries within the Asia Pacific, like China, Japan, and India, are improving medical research that furthers options for targeted and immunotherapy treatments. Through government intervention and investments in healthcare, patients can gain access to all these treatment options, and with a progressively larger, more diverse population, there is increasing demand for effective lymphoma treatment across the region.

China is leading the Asia Pacific region in the lymphoma treatment market with advancements and a number of new therapy approvals. For example, sintilimab was approved for classical Hodgkin's lymphoma and also received approval in April 2025. InnoCare Pharma's BTK inhibitor, orelabrutinib, was authorised for first-line treatment of chronic lymphocytic leukaemia (CLL)/small lymphocytic lymphoma (SLL) by the China National Medical Products Administration (NMPA). These highlight growing options for an advanced treatment landscape that help patient outcomes. (Source: https://www.innocarepharma.com)

Lymphoma Treatment Market Growth Factors

- Increasing Incidence of Lymphomas: Rising global incidence of Hodgkin and non-Hodgkin lymphomas is driving demand for effective treatment and leading to investment in new therapies, along with access to new and existing diagnostic and therapeutic options for patients.

- Advances in Targeted and Immunotherapy:Advances in monoclonal antibodies, CAR-T, specifics, and checkpoint inhibitors (among other therapies) are greatly enhancing the ability to treat lymphomas and provide patients with better survival outcomes while facilitating health systems to adopt treatment paradigms that are more precise and less toxic.

- Growing Interest in Clinical Trials and Approvals:Strong clinical trial activity and accelerated approval of new drugs generate more treatment options, which create significant pathways for commercialization, while supporting ongoing innovation within classes of therapy.

- Growing Network of Healthcare Infrastructure:Developments in hospital networks, oncology centres/availability of treatment in emerging economies provide an expanded global footprint where new therapies may enter the market and ultimately support rapid uptake of novel innovative lymphoma treatments.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 16.62 Billion |

| Market Size in 2025 | USD 8.08 Billion |

| Market Size in 2024 | USD 7.46 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.34% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Disease Type, Therapy Type, Drug Class / Mechanism, Line of Therapy, Mode of Administration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Is the Rising Prevalence of Lymphoma Accelerating the Demand for Advanced Treatments?

One of the leading factors contributing to the increase in the lymphoma treatment market is the significant rise in the number of cases diagnosed around the world. As per the American Cancer Society, there will be an estimated 80,350 people in the U.S. being diagnosed with non-Hodgkin lymphoma (NHL) in 2025, which includes adults and children. This emergence of patients demonstrates that there is an unmet need for innovative options in treatment because the number of options in helpful therapies continues to rise. (Source: https://www.cancer.org)

Next-generation therapies, including CAR-T cell therapies and targeted immunotherapies, are gaining traction to meet this need. Additionally, the rising demand is driving therapeutic advancement by reviewing the number of clinical trials and FDA approvals that are typically novel drugs, which show how the market is currently shifting as a response to meet the increasing demand for lymphoma, creating long-term growth opportunities for pharmaceutical companies.

Restraint

Does the High Cost of Advanced Therapies Impede Progress in Treating Lymphoma?

One of the most substantial obstacles in the lymphoma treatment market is the unreasonably high cost of advanced therapies, like CAR-T cell therapy. Although these therapies generate extraordinary clinical outcomes, the costs to patients are a level up from the access and affordability concerns that plague the market. Report from Dana-Farber, second-line CAR-T costs regularly exceed US$400,000 per infusion. The report also found that the U.S. health sector would spend an additional $6.8 billion over five years with CAR T as the new standard of care. (Source: https://www.dana-farber.org)

Access to therapies is largely geographically limited to high-income regions, and middle-income countries must deal with delayed adoption and reimbursement. Even in the UK, CAR-T was delayed until special pricing agreements were established. Financial barriers of this sort continue to limit patient access and slow global uptake.

Opportunity

Will Armored CAR-T Therapy Make a Difference for Patients with Refractory Disease?

One of the most encouraging opportunities in the lymphoma treatment market is armored CAR-T cell therapy. Armored CAR-T is engineered to secrete interleukin-18 (IL-18) in contrast to classic CAR-T therapy, potentially achieving greater immune activation and overcoming prior CAR-T resistance. The results of a recent Phase I trial from Penn Medicine that included 21 heavily pretreated patients were reported by AABB. Data from the Phase I study showed 81% of patients had a response, with 52% achieving complete remission, and many remaining in remission for over two years. (Source: https://www.aabb.org)

The trial also demonstrated practicality as the therapy can be quickly manufactured in about s three-day time frame, and it had manageable side effects and a safety profile. Overall, there is an opportunity with armored CAR-T to treat challenging lymphoma cases where standard therapies have failed.

Disease Type Insight

Which Disease Type Segment Dominated the Lymphoma Treatment Market in 2024?

The non-Hodgkin lymphoma (NHL) segment holds the largest share of lymphoma treatment as it has a higher incidence than Hodgkin lymphoma, and there is a wide range of therapeutic options. The availability of targeted therapies, immunotherapies, and established monoclonal antibodies fortified its position.

Within the NHL itself, the Hodgkin lymphoma (HL) segment is the fastest-growing. The time-limited growth in this segment is a result of continued uptake of next-generation therapies, including CAR-T therapies, bispecific antibodies, and small-molecule inhibitors. In addition, clinical trials are proceeding quickly, regulatory processes are improving with respect to time, and patient expectations for better efficacy with less toxicity are trending to help improve access to the advanced approaches to treatment.

Therapy Type Insights

Why Is Immunotherapy / Targeted Therapies Leading the Lymphoma Treatment Market?

The immunotherapy/targeted therapy segment leads the market. Immunotherapy and targeted therapies are now the mainstay for treating lymphoma and offer substantially improved outcomes compared to standard systemic chemotherapy. Monoclonal antibodies, checkpoint inhibitors, and kinase inhibitors have infiltrated standard of care regimens across the spectrum of lymphoma patients, providing durable responses and fewer toxicities. With their established clinical benefits and integration into practice in both aggressive and indolent lymphoma patients, they lead this therapy area.

The cellular therapies (CAR-T) segment is growing at the fastest pace, driven by exceptional efficacy in relapsed or refractory patients. They are also broadly used and approved, with more indications being approved through new trials and increasing availability across the world. With their ability to address unmet clinical needs and their potential for cure, they are well-positioned as the growth engine of next-generation therapies in the annual market for lymphoma treatment.

Drug Class Insights

Which Drug Class Has a Larger Share of the Lymphoma Treatment Market?

The anti-CD20 segment, led by rituximab and followed by newer generations, dominates the drug class segment because of its established role in front-line and maintenance therapy for NHL. Their proven effectiveness, high clinical acceptance, and incorporation into combination regimens have underlined their applications in lymphoma therapy for over 20 years.

The CAR-T & other cell therapies segment represents the fastest-growing drug classes because of their strong potential in relapsed or refractory settings. These exciting new therapies are being adopted quickly since they provide a mode of action specific to the tumor, have improved survival outcomes, have extended clinical trial support, and continue to expand Graham's conception of transformative options in lymphoma treatment.

Line of Therapy Insights

Which Line of Therapy Dominates the Lymphoma Treatment Market in 2024?

The first-line (frontline) segment takes center stage in the lymphoma treatment market as it encompasses the largest patient pool and establishes the best platform to manage disease in the long term. Standard regimens that combine chemotherapy with monoclonal antibodies are still commonplace, and new targeted therapies have been introduced earlier into the treatment paradigm.

The relapsed/refractory (R/R) segment is the fastest-growing by far, driven by innovative treatments entering the market such as CAR-T (chimeric antigen receptor T-cell) therapies, bispecific antibodies, and novel small molecules. These high-cost, high-impact therapies are being utilized more frequently in later lines of therapy, where traditional options have failed, and thus, the R/R segment is the key driver of innovation and revenue growth.

Mode of Administration Insights

What Mode of Administration Leads the Lymphoma Treatment Market?

The intravenous/infusion segment continues to dominate the treatment of lymphoma, as the majority of monoclonal antibodies, immunotherapies, and CAR-T cell therapies are administered by infusion as hospitals and infusion centre settings continue to be the major treatment settings, further cementing intravenous infusion as the dominant mode of administration in lymphoma, especially given its existing infrastructure and the physician comfort level with this approach.

The oral (small molecules) segment is a recent growth area, primarily for its convenience, fewer visits to hospitals or infusion centers, and better patient compliance. The recent offer of multiple oral kinase inhibitors and subcutaneous monoclonal antibodies will continue to change patient preference for their treatment. These new treatment options enhance quality of life and reduce treatment burden, along with increasing adoption of these formulations for the treatment of lymphoma.

Value Chain Analysis

- R&D

Research and development encourage innovation in lymphoma therapies, concentrating on finding new drugs, immunotherapy, and/or targeted treatments

- Formulation and Final Dosage Preparation

Then the therapy has been approved, it will be formulated in the final dosage forms, e.g., tablets, injectables, and infusion solution. When manufacturing dose forms for patient use, stability, bioavailability, and patient-friendly should all be considered for effective disease management.

- Distribution to Hospitals, Pharmacies

There are efficient systems of supply chains that transport lymphoma therapies to hospitals, clinics, and pharmacies.

- Patient Support and Services

After the therapy has been conducted, support services are offered for counselling, adherence programs, financial support, monitoring, etc.

Lymphoma Treatment Market Companies

- F. Hoffmann-La Roche (Roche)

- Novartis • Gilead Sciences (Kite/Gilead)

- Bristol-Myers Squibb

- Pfizer

- AstraZeneca

- Bayer

- BeiGene

- Johnson & Johnson (Janssen)

- AbbVie

- Takeda

- Amgen

- Eli Lilly

- Incyte

- Biogen

Recent Developments

- In April 2025, Amneal Pharmaceuticals launched BORUZU™, the first bortezomib injection that comes ready to inject for the treatment of multiple myeloma and mantle cell lymphoma. The introduction of BORUZU™ from Amneal eliminates the preparation step and simplifies the administration of this important medicine.(Source: https://investors.amneal.com)

- In February 2025, Tempus AI collaborated with the Institute for Follicular Lymphoma Innovation to create a multimodal, de-identified data library for follicular lymphoma. This partnership hopes to support AI-generated and informed treatment and drug development.(Source: https://www.businesswire.com)

- In January 2025, Immuneel Therapeutics launched Qartemi, India's first approved CAR T-cell therapy for adult B-cell non-Hodgkin lymphoma. Dr Siddhartha Mukherjee, Board Director & Co-Founder, Immuneel Therapeutics, stated, “By combining world-class research CAR-T cell therapy with indigenous manufacturing, we are offering new hope to patients facing aggressive blood cancers.”(Source: https://www.expresspharma.in)

Segments Covered in the Report

By Disease Type

- Hodgkin lymphoma (HL)

- Non-Hodgkin lymphoma (NHL)

By Therapy Type

- Chemotherapy

- Radiation therapy

- Immunotherapy/ Targeted therapy (small molecules, TKIs, BCL-2 inhibitors)

- Monoclonal antibodies (naked mAbs)

- Antibody-drug conjugates (ADCs)

- Immunomodulators (IMiDs)

- Immune checkpoint inhibitors

- Cellular therapies (CAR-T)

- Stem-cell / bone-marrow transplant

- Supportive care (growth factors, antiemetics, prophylactics).

By Drug Class / Mechanism

- Anti-CD20 mAbs (e.g., rituximab)

- CD30 ADCs (e.g., brentuximab)

- BTK inhibitors (e.g., ibrutinib)

- BCL-2 inhibitors (e.g., venetoclax)

- PI3K inhibitors

- Checkpoint inhibitors (PD-1/PD-L1)

- CAR-T & other cell therapies

- Others (HDAC inhibitors, proteasome inhibitors).

By Line of Therapy

- First-line (frontline)

- Second-line

- Relapsed / refractory (R/R)

- Maintenance therapy.

By Mode of Administration

- Intravenous / infusion

- Subcutaneous

- Oral (small molecules)

- Intrathecal/localized (where applicable).

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting