B-Cell Lymphoma Market Size and Forecast 2025 to 2034

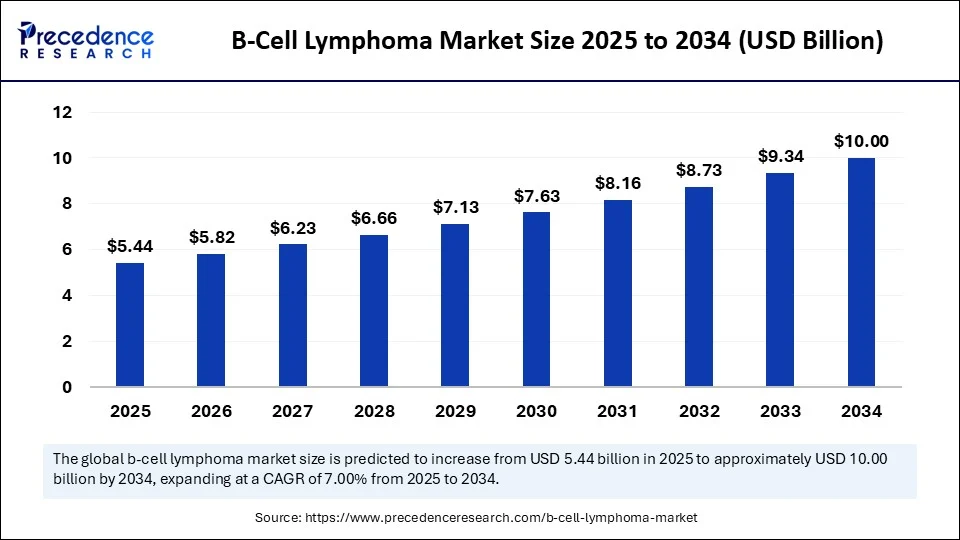

The global B-cell lymphoma market size accounted for USD 5.08 billion in 2024 and is predicted to increase from USD 5.44 billion in 2025 to approximately USD 10 billion by 2034, expanding at a CAGR of 7.00% from 2025 to 2034. The market is experiencing significant growth due to the rising prevalence of B-cell lymphoma and the increasing demand for targeted cancer therapies. Additionally, advancements in immunotherapies such as CAR-T cell therapy and monoclonal antibodies have broadened treatment options. The growing focus on personalized medicine and rising clinical trials are expected to accelerate market growth in the coming years.

B-Cell Lymphoma Market Key Takeaways

- In terms of revenue, the global B-cell lymphoma market was valued at USD 5.08 billion in 2024.

- It is projected to reach USD 10 billion by 2034.

- The market is expected to grow at a CAGR of 7.00% from 2025 to 2034.

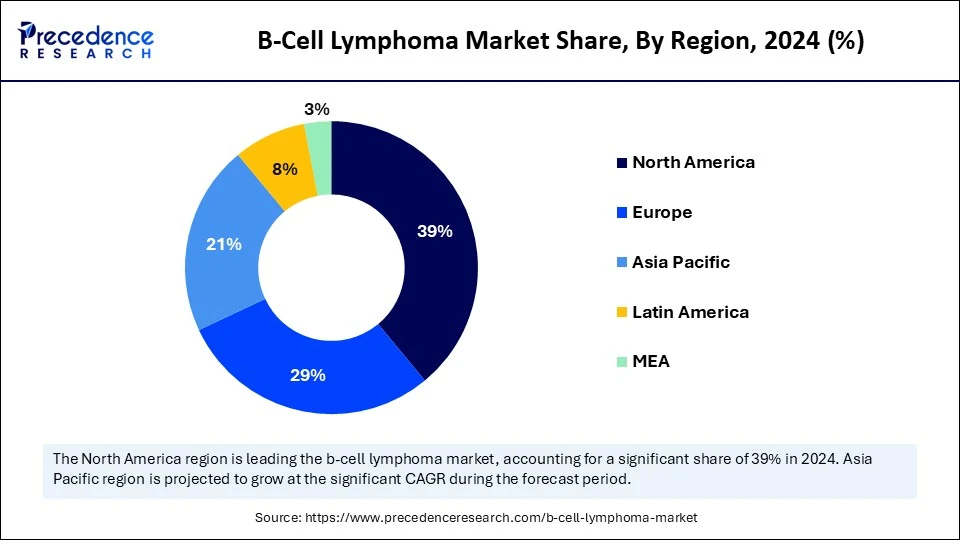

- North America dominated the B-cell lymphoma market with the largest share of 39% in 2024.

- Asia Pacific is anticipated to grow at a significant CAGR of 11% from 2025 to 2034.

- By disease type, the diffuse large B-cell lymphoma (DLBCL) segment captured the biggest market share of 64% in 2024.

- By disease type, the follicular lymphoma (FL) segment is expected to grow at the fastest CAGR over the projection period.

- By therapy type, the monoclonal antibodies segment contributed the highest market share of 38% in 2024.

- By therapy type, the antibody drug conjugates (ADCs) segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By route of administration, the intravenous (IV) segment held the major market share of 70% in 2024.

- By route of administration, the subcutaneous segment is expected to expand at the fastest CAGR from 2025 to 2034.

- By end-user, the hospitals segment generated the largest market share of 61% in 2024.

- By end-user, the homecare segment is projected to grow at the highest CAGR between 2025 and 2034.

How is AI Impact the B‑Cell Lymphoma Market?

Artificial intelligence (AI) is transforming the B-cell lymphoma market by improving diagnosis, treatment, and drug discovery. AI algorithms can analyze complex data from various sources, such as histopathology, imaging, and genomics, to enhance accuracy, personalize treatments, and speed up research. Deep learning models can analyze histopathological images and other data to accurately classify B-cell lymphoma subtypes, often surpassing traditional methods. AI can also evaluate liquid biopsy samples for early, non-invasive lymphoma detection and treatment monitoring. Overall, AI is accelerating market growth.

U.S. B-Cell Lymphoma Market Size and Growth 2025 to 2034

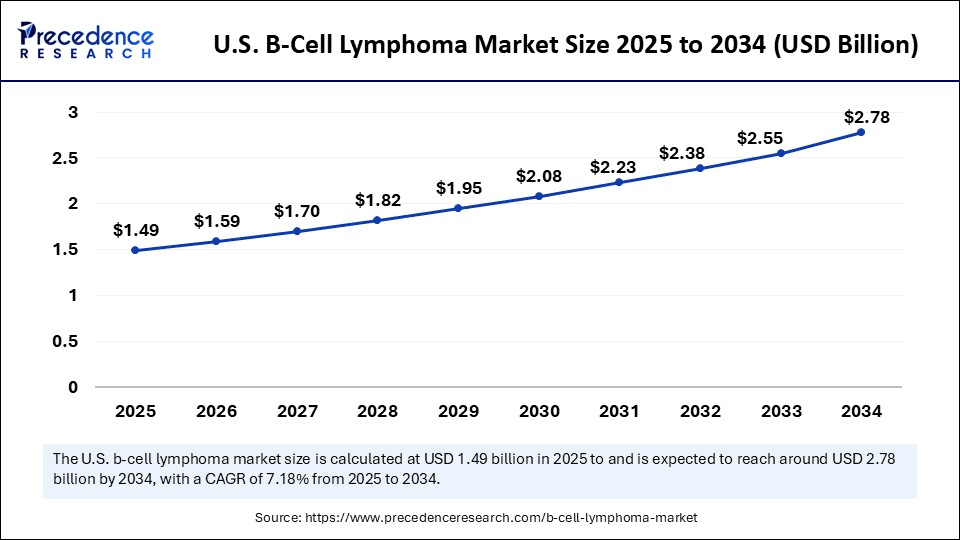

The U.S. B-cell lymphoma market size was exhibited at USD 1.39 billion in 2024 and is projected to be worth around USD 2.78 billion by 2034, growing at a CAGR of 7.18% from 2025 to 2034.

What Made North America the Dominant Region in the B‑Cell Lymphoma Market in 2024?

North America dominated the B-cell lymphoma market while holding the largest share in 2024. This is mainly due to its strong healthcare infrastructure, high disease prevalence, and significant advances in treatment options like immunotherapies and targeted therapies. The region boasts specialized cancer centers and research institutions that support the diagnosis, treatment, and management of lymphoma. The region is home to leading pharmaceutical companies, such as AbbVie, Gilead Sciences, Johnson & Johnson, Bristol Myers Squibb, Merck & Co., Novartis, and Pfizer, which focus heavily on oncology research and development. Additionally, the region has been at the forefront of developing and adopting new therapies like CAR-T cell therapies and other immunotherapies for lymphoma.

- In December 2023, the National Heart, Lung, and Blood Institute (NHLBI) helped establish the first-ever National Commission on Lymphatic Diseases (NCLD). Requested by the lymphatic community and supported by various parts of the NIH, this initiative was created in response to a congressional directive to promote lymphatic research.(Source: https://www.nhlbi.nih.gov)

U.S. B-Cell Lymphoma Market Trends

The U.S. is a major contributor to the North American B-cell lymphoma market. This is due to the high incidence of B-cell lymphomas, a strong pipeline of research and development encompassing innovative therapies like CAR T-cell therapy and targeted treatments, and a well-established healthcare infrastructure that ensures access to these advanced options. The FDA's expedited approval process also helps speed up the availability of new treatments to patients.

What Makes Asia Pacific the Fastest-Growing Region in the B Cell Lymphoma Market?

Asia Pacific is expected to experience the fastest growth in the market during the forecast period, mainly because of rising incidence rates, increased healthcare spending, and improvements in healthcare infrastructure. Countries like India and China are becoming major hubs for API manufacturing and biosimilar development, further contributing to market growth. Increased healthcare spending and awareness about lymphoma are creating the need for specialized treatments. The rising number of elderly individuals in the region, who are more vulnerable to lymphoma, also boosts the market. The development of new therapies, including immunotherapies and targeted treatments, improves treatment efficacy and reduces side effects, leading to market growth.

India B-Cell Lymphoma Market Trends

India maintains a stronghold in the B-cell lymphoma market within Asia Pacific, mainly because of a rising number of cases of B-cell lymphoma, advancements in treatment options, and increased accessibility to advanced healthcare services. The Indian pharmaceutical industry plays a crucial role in developing and providing affordable lymphoma treatments, including biosimilars and generics, which lower treatment costs. Government initiatives, such as the National Cancer Grid and Ayushman Bharat, also contribute to better access to care, especially for vulnerable populations. Moreover, expanding medical tourism supports market growth.

- In January 2025, Immuneel Therapeutics introduced Qartemi, a global CAR T-cell therapy for adult B-cell Non-Hodgkin Lymphoma (B-NHL). This personalized treatment addresses a significant gap in India's cancer immunotherapy landscape. Meeting international standards, this therapy is now available locally for patients who do not respond to conventional treatments, including chemotherapy.(Source: https://www.expresspharma.in)

Why is Europe Considered a Notable Market for the B-Cell Lymphoma Market?

Europe is expected to experience notable growth in the upcoming period, driven by rising incidence rates, advancements in treatment technology, and supportive government policies. Germany is leading with substantial research and development in areas like CAR-T cell therapy and precision oncology. The European Union (EU) invests heavily in cancer research, including developing new therapies for leukemia under programs like Horizon Europe. The European Medicines Agency (EMA) is crucial in approving innovative treatments such as CAR-T cell therapy and novel drug combinations, fueling market expansion.

What Factors Contribute to the Latin America B Cell Lymphoma Market?

Latin America holds a unique position in the global market, mainly due to increasing prevalence, advancements in targeted and immunotherapy, rising healthcare spending, and growing awareness and early diagnosis efforts. Initiatives to improve access to cancer treatments and strengthen healthcare infrastructure further support this growth. Innovations in CAR T-cell therapy are offering new hope for patients and driving market expansion. Moreover, governments and private sectors are investing more in healthcare infrastructure, including specialized cancer centers and diagnostic facilities, contributing to regional market growth.

What Opportunities Exist in the Middle East & Africa?

The B-cell lymphoma market in the Middle East & Africa is growing due to the rising cases of lymphoma, improved healthcare infrastructure, and supportive government initiatives. Ongoing government efforts to enhance oncology care and healthcare access, along with innovations in treatments like immunotherapies and targeted drug delivery systems, are fueling this growth. The expansion of healthcare facilities, especially within the Gulf Cooperation Council (GCC) countries and South Africa, is improving access to treatment and boosting the market growth in the region.

Market Overview

The B-cell lymphoma market refers to the global market for therapies targeting B lymphocyte malignancies, mainly B-cell non-Hodgkin lymphomas (NHL) such as diffuse large B-cell lymphoma (DLBCL), follicular lymphoma, mantle cell lymphoma, and chronic lymphocytic leukemia/small lymphocytic lymphoma (CLL/SLL). It includes chemotherapy, targeted therapies like monoclonal antibodies, BTK inhibitors, antibody-drug conjugates (ADCs), bispecific T-cell engagers (BiTEs), and CAR T-cell therapies. The market is expanding due to higher incidence rates, advancements such as CAR-T cell therapy, increased demand for more effective and personalized treatments, aging populations, and rapid approval of new immunotherapies.

B-Cell Lymphoma Market Growth Factors

- Ongoing advancements in treatment options are boosting the growth of the market.

- Improvements in diagnostic techniques, such as genetic testing and flow cytometry, facilitate the early detection of B-cell lymphoma, thereby contributing to market growth.

- Rising awareness about early disease detection and the diagnosis of B-cell lymphoma is boosting the market's growth.

- Rising government investments in research & development (R&D) activities further propel the growth of the market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 10 Billion |

| Market Size in 2025 | USD 5.44 Billion |

| Market Size in 2024 | USD 5.08 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Disease Type, Therapy Type, Route of Administration, End-User Setting, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of B-Cell Lymphomas and Advancements in Treatment

A major factor driving the market's growth is the increasing prevalence of B-cell lymphomas, including diffuse large B-cell lymphoma (DLBCL), which is attributed to factors such as an aging population and increased exposure to environmental risks. In addition, advancements in treatment options are likely to drive market growth. The success of CAR-T cell therapies in treating certain B-cell lymphomas, such as DLBCL, has fueled significant investment and development. Approval of new drugs and therapies, including biosimilars, broadens treatment options and fuels market growth. Advances in diagnostic solutions have led to a significant rise in the number of patients undergoing diagnosis, prompting the urgent need for innovative treatments.

Restraint

High Treatment Costs and Regulatory Hurdles

The primary restraint in the B-cell lymphoma market is the high cost associated with novel therapies, which limits patient access and restrains market growth. The complex and lengthy regulatory approval processes for novel drugs further delay market entry. The development of resistance to current therapies, particularly immunotherapies, necessitates substantial research into novel treatment combinations and strategies to counteract resistance and enhance patient outcomes. Resistance to targeted therapies such as rituximab (R) or other chemotherapies can lead to disease relapses or progression. Additionally, many patients with B-cell lymphoma do not achieve long-term remission with first-line treatments, creating a high unmet need for effective therapies in relapsed or refractory cases.

Opportunity

Development of Personalized and Precision Medicine

The key future opportunity in the B-cell Lymphoma market lies in the development of personalized and precision medicine approaches. This involves customizing treatments based on a patient's specific genetic and molecular profile to understand the unique characteristics of each lymphoma better. This enables the selection of effective treatments, improving outcomes and reducing adverse effects. Consequently, developing drugs that specifically target proteins or pathways involved in lymphoma cell growth and survival is a major focus. Moreover, emerging markets with increasing healthcare expenditures offer immense opportunities for pharmaceutical and biopharmaceutical companies.

Disease Type Insights

What Made Diffuse Large B-Cell Lymphoma (DLBCL) the Dominant Segment in the B‑Cell Lymphoma Market in 2024?

The diffuse large B-cell lymphoma (DLBCL) segment dominated the market with the largest share in 2024. This is primarily due to its high prevalence, aggressive behavior, and understanding of its molecular diversity, which has led to targeted therapies. DLBCL is not a single disease but a group of subtypes with different molecular features, prompting research into tailored treatments. It is the most common aggressive form of non-Hodgkin lymphoma, demanding prompt and effective therapy. Significant advancements in DLBCL treatment, such as CAR T-cell therapy and new targeted agents, have improved patient outcomes and increased interest in research and development.

The follicular lymphoma (FL) segment is expected to grow at the fastest CAGR during the forecast period. The growth of the segment is driven by increased awareness, improved treatments, and an increase in clinical trials focused on FL. Improved diagnostic techniques and symptom recognition lead to earlier detection and treatment. A surge in clinical trials focused on FL is indicative of the significant research & development efforts dedicated to finding new and improved treatment strategies. The development of novel therapies, including targeted agents and immunotherapies, has significantly extended survival and patient outcomes, contributing to segmental growth.

Therapy Type Insights

How Does the Monoclonal Antibodies Segment Dominate the B-Cell Lymphoma Market in 2024?

The monoclonal antibodies segment led the market in 2024. This is because of their targeted approach, ability to induce long-lasting immune responses, and advancements in antibody engineering. Their success relies on mechanisms like directly targeting tumor cells and reducing harm to healthy tissue, exemplified by rituximab targeting CD20 and enhancing immune response. They are often used in combination, creating synergistic effects and boosting treatment success. Modifications, such as humanization and conjugation with cytotoxic drugs or radioisotopes, have enhanced their efficacy and reduced immunogenicity, resulting in more potent and specific therapies.

The antibody drug conjugates (ADCs) segment is expected to experience rapid growth in the upcoming period due to its targeted delivery directly to cancer cells, minimizing damage to normal cells. ADCs like polatuzumab vedotin and loncastuximab tesirine have shown promising clinical results, encouraging further development of new ADCs for lymphoma. Ongoing research focuses on optimizing linkers and payloads to enhance the safety and effectiveness of therapies and optimize patient outcomes.

Route of Administration Insights

Why Did the Intravenous (IV) Segment Lead the B-Cell Lymphoma Market in 2024?

The intravenous (IV) segment led the market while holding the largest share in 2024. This is mainly because it delivers high drug concentrations directly into the bloodstream, ensuring efficient distribution throughout the body, including difficult-to-reach areas such as the central nervous system. This route can help overcome resistance mechanisms associated with single-agent therapies by enabling combination therapies and improving treatment outcomes. Additionally, many targeted therapies, such as rituximab, are administered via IV infusion, which enhances treatment efficacy and reduces off-target effects.

The subcutaneous segment is likely to experience the fastest growth in the coming years, primarily due to its convenience, patient preference, and potential to lower healthcare costs. This method enables self-administration or administration outside of a clinical setting, offering greater flexibility and potentially reducing the burden on healthcare systems. The growing development of targeted therapies and immunotherapies suitable for subcutaneous delivery further contributes to segmental growth.

End-User Insights

How Does the Hospitals Segment Dominate the B-Cell Lymphoma Market in 2024?

The hospitals segment led the market in 2024. This is primarily because of the complexity of diagnosis and treatment, requiring close monitoring. B-cell lymphomas often require advanced diagnostic tools like sophisticated imaging and pathology, which are readily available in hospitals. Treatment also involves complex chemotherapy regimens, which require specialized medical teams and facilities commonly found in hospitals. Moreover, hospitals are key hubs for clinical trials and research into new therapies for B-cell lymphomas, including targeted therapies, immunotherapies, and CAR T-cell therapies, making them a preferred setting for many patients.

The homecare settings segment is expected to grow at a rapid pace over the forecast period due to increasing patient preference for receiving care in comfortable, familiar environments, advancements in home infusion technologies, and broader access to therapies such as chemotherapy and immunotherapy, which are suitable for home administration. Innovations such as portable pumps, wearables, and telehealth integration are driving this trend. This shift offers cost benefits by reducing hospital stays and addresses the rising incidence of B-Cell Lymphoma, especially among the aging population, who may face more challenges accessing traditional healthcare settings.

B-Cell Lymphoma Market Companies

- Roche

- Pfizer

- Bristol Myers Squibb

- Gilead Sciences

- Novartis

- AbbVie

- AstraZeneca

- Takeda Pharmaceutical

- Merck KGaA

- Seagen (Pfizer subsidiary)

- Amgen

- Biogen

- Regeneron Pharmaceuticals

- Incyte

- Genmab

- Legend Biotech (partnered for Carvykti)

- Mylan (part of Bcell NHL generics)

- Teva Pharmaceutical

- Sun Pharmaceutical

- Cipla

Recent Developments

- In February 2025, the Food and Drug Administration approved brentuximab vedotin in combination with lenalidomide and a rituximab product for adult patients with relapsed or refractory large B-cell lymphoma (LBCL), including diffuse large B-cell lymphoma (DLBCL) not otherwise specified (NOS), DLBCL arising from indolent lymphoma, or high-grade B-cell lymphoma (HGBL), after two or more lines of systemic therapy, who are ineligible for autologous hematopoietic stem cell transplantation (auto-HSCT) or CAR T-cell therapy.(Source: https://www.fda.gov)

- In October 2024, Merck announced the completion of its acquisition of CN201 from Curon Biopharmaceuticals, a novel investigational clinical-stage bispecific antibody for treating B-cell related diseases. CN201 offers applications across B-cell malignancies and autoimmune diseases, and is currently being tested in Phase 1 and Phase 1b/2 trials for relapsed or refractory non-Hodgkin lymphoma (NHL) and relapsed or refractory B-cell acute lymphoblastic leukemia (ALL), respectively.(Source: https://www.merck.com)

- In June 2024, Roche launched a new highly sensitive test to more easily diagnose patients who may have B-cell lymphoma. This marked the first clinically approved, highly sensitive in-situ hybridization (ISH) test, the VENTANA Kappa and Lambda Dual ISH mRNA Probe Cocktail assay, in countries accepting the CE Mark. This highly sensitive assay provides diagnostic certainty for patients with suspected B-cell lymphoma by enabling faster diagnosis and access to treatment.(Source: https://www.roche.com)

Segments Covered in the Report

By Disease Type

- Diffuse Large B-Cell Lymphoma (DLBCL)

- Follicular Lymphoma (FL)

- Mantle Cell Lymphoma (MCL)

- CLL/SLL

By Therapy Type

- Chemotherapy

- Monoclonal Antibodies (e.g., rituximab)

- BTK Inhibitors (e.g., acalabrutinib)

- Antibody Drug Conjugates (ADCs) (e.g., polatuzumab vedotin, loncastuximab)

- Bispecific Antibodies (e.g., epcoritamab, glofitamab)

- CART Cell Therapies (e.g., Breyanzi, Kymriah)

By Route of Administration

- Intravenous (IV)

- Subcutaneous

- Others

By End-User Setting

- Hospitals

- Specialty Clinics / Cancer Centers

- Homecare Settings

By Region

- North America

- Europe

- AsiaPacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting