Lyophilized Injectable Drug Market Size and Forecast 2025 to 2034

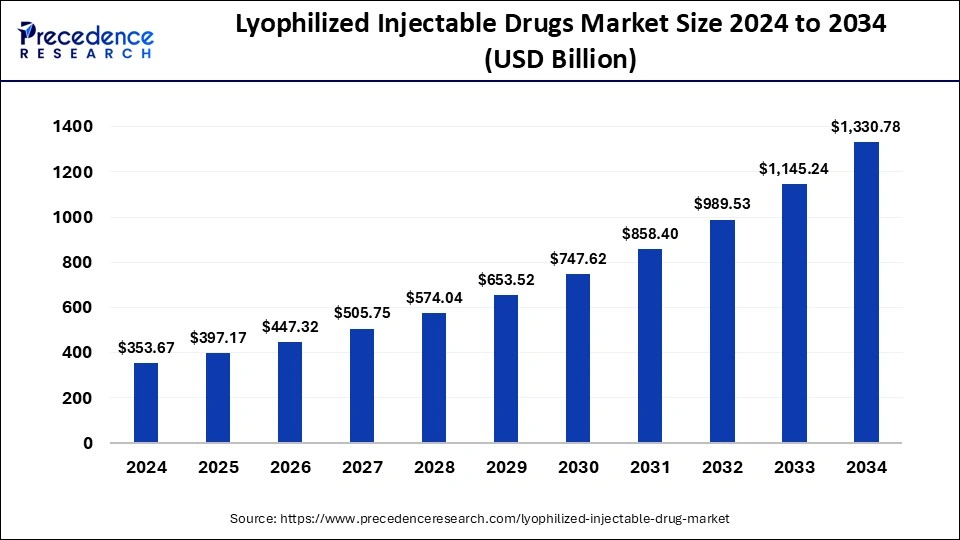

The global lyophilized injectable drug market size was estimated at USD 353.67 billion in 2024 and is predicted to increase from USD 397.17 billion in 2025 to approximately USD 1,330.78 billion by 2034, expanding at a CAGR of 14.40% from 2025 to 2034. Increased investments from the biotech, pharma, and biopharma industries have led to a rise in research and development efforts, which can fuel the growth of the lyophilized injectable drugs market

Lyophilized Injectable Drug Market Key Takeaways

- The global yophilized injectable drug market was valued at USD 353.67 billion in 2024.

- It is projected to reach USD 1,330.78 billion by 2034.

- The yophilized injectable drug market is expected to grow at a CAGR of 14.40% from 2025 to 2034.

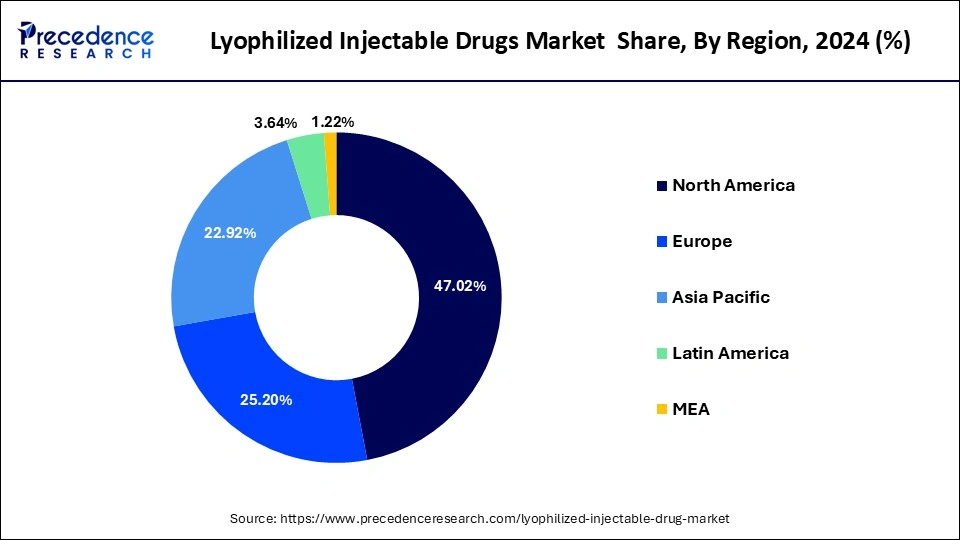

- North America dominated the market with the largest market share of 47.02% in 2024

- Europe is expected to gain a significant market share in the upcoming years.

- By drug type, the anti-infective segment contributed the highest market share of 38.48% in 2024.

- By drug type, the anti-neoplastic segment is predicted to experience rapid growth in the upcoming years.

- By indication, the oncology segment captured the biggest market share of 28.56% in 2024.

- By indication, the gastrointestinal disorder segment is the fastest growing over the forecast period.

- By packaging, the cartridge segment has held the largest market share of 62.75% in 2024.

- By delivery type, the Mmulti-step devices segment generated a major market share of 70.39% in 2024.

segment

U.S. Lyophilized Injectable Drug Market Size and Forecast 2025 to 2034

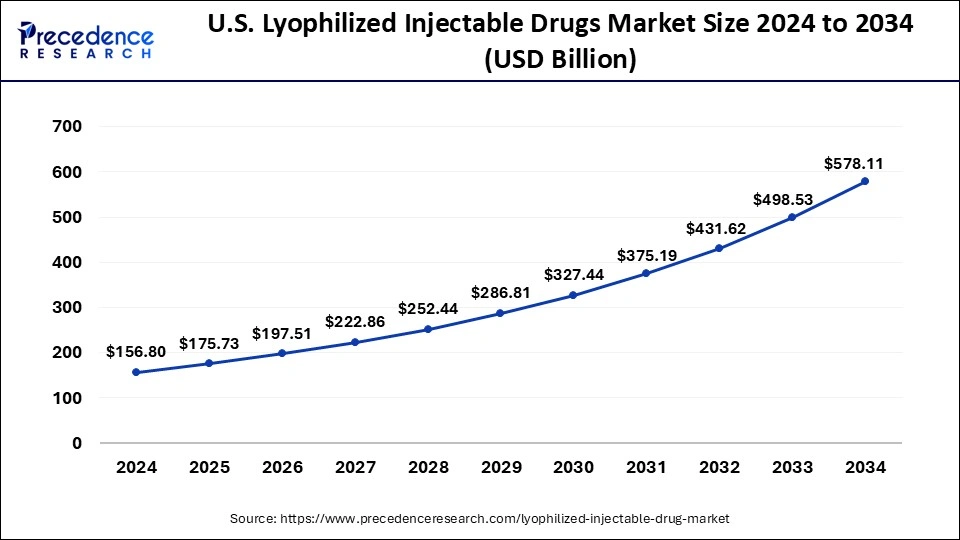

The U.S. lyophilized injectable drugs market size was estimated at USD 156.80 billion in 2024 and is predicted to be worth around USD 578.11 billion by 2034, at a CAGR of 14.10% from 2025 to 2034.

North America held the dominant share of the lyophilized injectable drugs market. Its advanced healthcare system, extensive research, and high rates of chronic diseases set it apart. The region's leading position is thanks to its strong healthcare infrastructure, significant disease rates, technological advancements, and established regulations. Research and development efforts, along with those of major pharmaceutical companies, are driving growth and innovation in the market, helping North America maintain its leadership role.

- In January 2024, Avenacy, a specialty pharmaceutical company focused on supplying critical injectable medications, announced it had launched Melphalan Hydrochloride for Injection in the United States as a therapeutic equivalent generic for Alkeran for Injection (melphalan hydrochloride) which is approved by the U.S. Food and Drug Administration.

Europe is expected to gain a significant market share in the upcoming years. Countries like the UK, France, and Germany have played a significant role in driving market growth in this area. Europe's position is due to its emphasis on biopharmaceutical advancements, specialized medicine, and strict regulations for drug development. Additionally, the demand for stable and effective formulations has increased due to the growing elderly population and rising rates of chronic diseases, further boosting the market for lyophilized injectable drugs.

- In February 2023, CARBOGEN AMCIS opens its doors to a new sterile liquid drug product manufacturing facility in Saint-Beauzire, France; EPM0 caught up with Pascal Villemagne, CEO of CARBOGEN AMCIS, to discuss what this will mean for CARBOGEN's capabilities in freeze-dried products.

Market Overview

The lyophilized injectable drugs market refers to the industry that offers medicines that have undergone the process of freeze-drying or lyophilization. This includes a variety of drugs such as biologics, hormones, antibiotics, vaccines, and anti-inflammatory drugs. The manufacturing, packaging, and distribution of lyophilized injectable drugs involves pharmaceutical companies, contract manufacturing organizations (CMOs), and healthcare facilities.

The lyophilization process removes water from the drug by freezing it and then allowing the ice to turn directly into vapor, leaving behind a stable, solid form. These drugs offer several benefits over liquid versions, such as better stability, lower risk of degradation or contamination, longer shelf life, and easier transport. They're used to treat a wide range of medical conditions, including autoimmune disorders, infections, cancer, and heart conditions.

Lyophilized Injectable Drugs Market Growth Factors

- Lyophilized injectable drugs offer benefits like longer shelf life, ease of transportation, improved stability, etc., which can lead to market growth.

- The rising demand for targeted therapy is expected to drive the growth of the lyophilized injectable drugs market.

- The increasing adoption of protein-based drugs and biologics can fuel the market growth.

- Advancements in technology and growing demand for parenteral drugs can propel the lyophilized injectable drugs market growth.

- Growing government expenditure in the market can contribute to the lyophilized injectable drugs market expansion.

Market Scope

| Report Coverage | Details |

| Global Market Size in 2024 | USD 353.67 Billion |

| Global Market Size in 2025 | USD 397.17 Billion |

| Global Market Size by 2034 | USD 1,330.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 14.40% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | By Drug Type, By Indication, By Delivery Type, Packaging, and By Distribution Channel |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Wide range of adoption across the globe

In recent years, there has been a significant rise in the number of businesses worldwide using lyophilization technology. This is because lyophilized medications offer better quality and longer shelf life compared to other forms. Global contract research and manufacturing firms have also seen a notable increase in the use of lyophilized injection pharmaceuticals. The main reason for this shift is to provide consumers with superior products. Opportunities in the global lyophilized injectable drugs market are being driven by factors such as the rapid growth of contract research manufacturing services (CRAMS). Compared to non-lyophilized products, lyophilized ones are gaining popularity due to their safety and ability to fulfill their intended purposes effectively.

- In February 2023, Thermo Fisher Scientific announced that its Applied Biosystems business introduced the TaqMan 2.5X Lyo-Ready 1-step qPCR Master Mix with an excipient, optimized, ready-to-use formulation for a lyophilization process.

Rising use of orphan drugs

The lyophilized injectable drugs market shows potential for growth in emerging markets, where healthcare facilities are improving and knowledge about advanced drug formulations is spreading. Entering these untapped markets strategically could lead to profitable outcomes for companies in the industry. One noticeable trend in the market is the rising use of orphan drugs for rare diseases, which often require special formulations to maintain stability and ensure effective delivery. Lyophilization provides a solution by preserving the integrity of these medications, making this trend significant in influencing market trends.

Restraint

Production complexities

The lyophilized injectable drugs market shows potential for growth in emerging markets, where healthcare facilities are improving and knowledge about advanced drug formulations is spreading. Entering these untapped markets strategically could lead to profitable outcomes for companies in the industry. One noticeable trend in the market is the rising use of orphan drugs for rare diseases, which often require special formulations to maintain stability and ensure effective delivery. Lyophilization provides a solution by preserving the integrity of these medications, making this trend significant in influencing market trends.

Opportunities

Investments in healthcare infrastructure

Investments in healthcare infrastructure in developing regions are creating opportunities for expanding the lyophilized injectable drugs market. Better healthcare facilities and distribution networks are making these medications more accessible, addressing unmet medical needs, and boosting market growth. This reflects a growing commitment to healthcare improvement and enhanced patient care in emerging economies. Advancements in precision medicine and targeted therapies are also driving the demand for customized lyophilized formulations in personalized medicine. These formulations are specific to individual patient needs and treatment effectiveness, which offers precise dosing and delivery for better therapeutic outcomes. This trend also underscores the increasing importance of personalized approaches in modern healthcare.

- In November 2022, Roha Dyechem, one of the largest players in the food color and ingredients industry, announced that it has fully acquired Saraf Foods Limited, a Vadodara-based freeze-drying specialist food processing company with a significant presence in global markets – U.S., Europe, and Latin America.

Growing utilization in the pharma sector

The recent increase in demand for the lyophilized injectable drugs market is directly linked to their growing use in the pharmaceutical sector. Biologics require specialized formulation techniques like lyophilization to improve stability and prolong shelf life, which is a significant factor driving market growth. This surge in demand is fueling the expansion of the market. Additionally, a noteworthy trend in this market is the shift toward personalized medicine. With the healthcare industry increasingly adopting personalized treatment approaches, lyophilized formulations are crucial for ensuring stability and effectiveness in drug therapies. This trend is reshaping the pharmaceutical landscape and driving the adoption of these injectable products.

Drug Type Insights

The anti-infective segment dominated the lyophilized injectable drugs market in 2024. The reason for this dominance is the continuous global need for antibiotics and other antimicrobial agents to fight infections. Lyophilization provides stability advantages that are especially important for preserving the effectiveness of these drugs, ensuring they remain potent, and reducing the risk of contamination during storage and transportation.

The anti-neoplastic segment is predicted to experience rapid growth in the upcoming years. This is due to the rising cases of cancer and the advancement of targeted therapies, leading to a higher demand for lyophilized injectable anti-cancer drugs. These medications often have intricate formulations and need precise dosing, making lyophilization beneficial for preserving their stability and improving their therapeutic effectiveness.

- In August 2022, Accord Healthcare, Inc., a leading generic pharmaceutical company, added Carmustine to its line of chemotherapy drugs. The drug is formulated as a sterile lyophilized (freeze-dried) powder to be reconstituted for intravenous infusion. Carmustine is approved for use in the treatment of certain types of brain tumors and blood cancers.

Lyophilized Injectable Drugs Market Revenue, By Drug Type 2022-2024 (USD Million)

| Drug Type | 2022 | 2023 | 2024 |

| Anti-infective | 88,674.4 | 99,448.6 | 1,11,676.4 |

| Anti-neoplastic | 1,07,403.3 | 1,20,816.4 | 1,36,079.9 |

| Anticoagulant | 10,188.5 | 11,360.2 | 12,682.7 |

| Hormones | 6,636.9 | 7,386.6 | 8,231.1 |

| Antiarrhythmic | 21,445.2 | 24,139.3 | 27,206.8 |

| Others | 46,283.8 | 51,687.1 | 57,794.8 |

Indication Insights

The oncology segment dominated the lyophilized injectable drugs market in 2024.The rise in demand for reliable and effective formulations for cancer treatments and targeted therapies has made this segment stand out. Lyophilized drugs excel in preserving the effectiveness of complex molecules commonly found in cancer treatments, which has increased their importance in this area.

The gastrointestinal disorder segment is the fastest growing over the forecast period. Gastrointestinal diseases impact your digestive system, stretching from your mouth to your anus. These diseases come in two main types: functional and structural. Examples include colitis, food poisoning, lactose intolerance, and diarrhea.

Packaging Insights

The cartridge segment dominated the lyophilized injectable drugs market in 2023 and is expected to grow at a significant rate during the projected period. This is attributed to the increasing need for medications, particularly injectable drugs for chronic conditions, and the demand from diabetic patients is driving up the popularity of pharmaceutical cartridges. Cartridges are convenient for users and eliminate the risk of leaks or needle breakage, making them the preferred choice for medication packaging. This trend is boosting the growth of the pharmaceutical cartridge segment.

- In November 2022, Global Contract Development and Manufacturing Organization (CDMO) Recipharm invested in a new high-speed filling line for pre-filled syringes and cartridges at its facility in Wasserburg, Germany, responding to increased customer demand in these high-growth file formats.

Lyophilized Injectable Drugs Market Revenue, By Packaging 2022-2024 (USD Million)

| Packaging | 2022 | 2023 | 2024 |

| Vials | 1,76,668.7 | 1,97,880.3 | 2,21,925.7 |

| Cartridges | 25,657.6 | 28,836.6 | 32,451.3 |

| Prefilled Devices | 78,305.7 | 88,121.2 | 99,294.7 |

Lyophilized Injectable Drugs Market Companies

- Pfizer Inc.

- Novartis AG

- Roche Holding AG

- Johnson & Johnson

- Sanofi S.A.

- Amgen Inc.

- AbbVie Inc.

- Merck & Co., Inc.

- Eli Lilly and Company

- AstraZeneca PLC

- Bristol Myers Squibb Company

- GlaxoSmithKline plc

- Gilead Sciences, Inc.

- Biogen Inc.

- Teva Pharmaceutical Industries Ltd.

- Mylan N.V.

- Celgene Corporation

- Novo Nordisk A/S

- Vertex Pharmaceuticals Incorporated

- Takeda Pharmaceutical Company Limited

Recent Developments

- In January 2023, the FDA signed its approval for the first lyophilized injectable drug that can be administered in the treatment of atopic dermatitis in children who are six months and older.

- In February 2023, a new technology for continuous lyophilization was strategized and developed aimed at improving the efficiency and quality of the process.

- In March 2023, a pharmaceutical company reported that it was expanding its manufacturing capacity for lyophilized injectable drugs so that the market could meet the growing demand.

Segments Covered in the Report

By Drug Type

- Anti-infective

- Anti-neoplastic

- Diuretics

- Proton Pump Inhibitor

- Anesthetic

- Anticoagulant

- NSAID's

- Corticosteroids

- Others

By Indication

- Oncology

- Autoimmune Diseases

- Hormonal Disorders

- Respiratory Diseases

- Gastrointestinal Disorders

- Dermatological Disorders

- Ophthalmic Diseases

- Others

By Delivery Type

- Prefilled Diluent Syringes

- Multi-step Devices

By Packaging

- Vials

- Cartridges

- Prefilled Devices

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting