What is the Lyophilized Oncology Drug Market Size?

The global lyophilized oncology drug market is witnessing steady growth as freeze-dried formulations improve drug stability, solubility, and shelf life in cancer therapies.The market is witnessing substantial growth due to the increasing complexity of cancer therapies and the critical demand for precise, effective, and transportable cancer treatments. This growth is further accelerated by advancements in biopharmaceutical research, which are producing a growing pipeline of innovative, yet delicate, biologic drugs that require the enhanced stability and extended shelf-life provided by lyophilization.

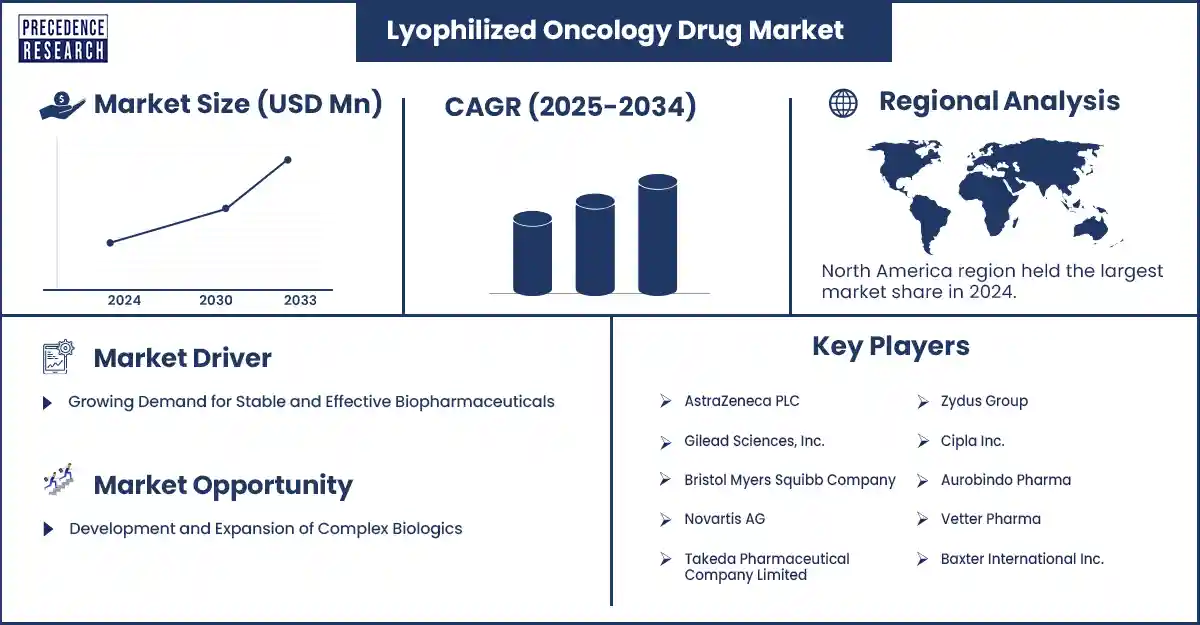

Lyophilized Oncology Drug Market Key Takeaways

- North America held the largest market share of around 44% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By drug type, the biologics segment dominated the market with around 42% share in 2024.

- By drug type, the peptide-based drug segment is expected to grow at a significant CAGR from 2025 to 2034.

- By formulation type, the lyophilized powders for injection led the market with around 55% share in 2024.

- By formulation type, the lyophilized powders for oral reconstitution segment is expected to witness the fastest CAGR during the foreseeable period.

- By therapeutic application, the solid tumors segment held the largest market share of about 60% in 2024.

- By therapeutic application, the hematologic cancers segment is expected to witness the fastest CAGR during the foreseeable period.

- By route of administration, the intravenous segment led the market with around 65% share in 2024.

- By route of administration, the subcutaneous segment is expected to grow at the fastest CAGR during the foreseeable period.

- By end user, the hospital & cancer treatment centers segment held the largest market share of about 50% in 2024.

- By end user, the specialty pharmacies segment is expected to witness the fastest CAGR during the foreseeable period.

What is a Lyophilized Oncology Drug?

A lyophilized oncology drug is a cancer medication that has undergone lyophilization, also known as freeze-drying. This process removes water from the drug product by freezing it and then reducing the surrounding pressure, allowing the frozen water to sublimate directly from a solid to a gas. The lyophilized oncology drug market encompasses freeze-dried cancer therapeutics that enhance the stability, shelf life, and handling of temperature-sensitive drugs. Products include biologics, small molecules, monoclonal antibodies, and peptide-based therapies, which are used in the treatment of solid tumors and hematologic cancers. Lyophilization ensures the drug's potency during storage and transport, enabling broader global distribution.

The market growth is driven by rising cancer incidence, increasing adoption of biologic therapies, advancements in lyophilization techniques, and expanding clinical pipelines. Enhanced cold-chain logistics, combination therapies, and personalized medicine approaches are accelerating adoption, while regulatory approvals for novel lyophilized formulations further support market expansion.

Key Technological Shift in the Lyophilized Oncology Drug Market

Artificial intelligence (AI) and advanced technologies are fundamentally transforming the lyophilized oncology drug market by speeding up the drug development process. In the discovery phase, AI algorithms analyze extensive biological and genetic datasets to identify new cancer targets and potential drug candidates, including rapid repurposing of existing drugs. During formulation, AI models predict optimal freeze-drying cycles, improving product stability, decreasing development time, and enhancing manufacturing consistency for these temperature-sensitive therapies, making research faster, more accurate, and more targeted.

Lyophilized Oncology Drug Market Outlook

- Market Growth Overview: The market for lyophilized oncology drugs is projected to experience robust growth from 2025 to 2034, driven by the rising global prevalence of cancer and the increasing demand for stable and effective injectable therapies. Specific high-growth segments include anti-neoplastic biologics, personalized medicine formulations, and drug delivery systems that enhance patient compliance.

- Global Expansion: Leading pharmaceutical companies are expanding their manufacturing and distribution capabilities into key emerging markets, particularly in the Asia-Pacific region, Eastern Europe, and Latin America, driven by rising healthcare expenditures and a growing patient population in these areas. Established players like Pfizer and Roche are heavily investing in technology and localized production.

- Major Investors: The market continues to attract significant investment from venture capital and private equity firms, as well as major strategic investors in the pharmaceutical and biotech sectors. The high technical barriers to entry, strong margins, and the critical clinical need for effective cancer treatments draw investors.

- Startup Ecosystem: A maturing startup ecosystem is focused on innovation in advanced lyophilization technologies and novel delivery systems. Emerging firms are attracting considerable VC funding by developing solutions for complex biopharmaceutical formulations, improved reconstitution devices, and therapies for rare oncology indications.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Formulation Type, Therapeutic Application, Route of Administration, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing Demand for Stable and Effective Biopharmaceuticals

The primary driver of the lyophilized oncology drug market is the growing demand for stable and effective biopharmaceuticals, particularly cancer biologics. Many new cancer treatments are complex biological molecules, such as antibodies, which are unstable in liquid form. Lyophilization is the preferred method for preserving the stability, potency, and structural integrity of these compounds. Lyophilized products have a significantly longer shelf life and are less susceptible to degradation from moisture and heat, making storage and transportation more convenient and reliable. This ensures patient safety and treatment efficacy.

Restraint

Complex and Costly Manufacturing Process

The main restraint in the lyophilized oncology drug market is the complex and costly manufacturing process. This challenge is particularly significant for oncology drugs, as many are complex biologics that require strict handling and specialized equipment to maintain their stability and potency. A stable formulation typically involves the addition of specific cryoprotectants and lyoprotectants to prevent degradation during the freeze-drying process. Establishing a commercial-scale lyophilization facility demands a substantial upfront investment in specialized equipment and infrastructure.

Opportunity

Development and Expansion of Complex Biologics

A key future opportunity in this market lies in the development and expansion of complex biologics, particularly Antibody-Drug Conjugates, which benefit from the stability and extended shelf life offered by lyophilization. This opportunity is driven by the increasing demand for targeted cancer therapies that minimize side effects and enhance patient outcomes. Innovations in drug delivery systems, such as prefilled syringes and reconstitution devices, are further enhancing the safety and ease of administering lyophilized drugs, thereby increasing their market appeal.

Segments Insights

Drug Type Insights

What Made Biologics the Dominant Segment in the Lyophilized Oncology Drug Market?

The biologics segment dominated the market while holding about 42% share in 2024. This is due to the inherent instability of biologic drugs, their high specificity for cancer cells, and their superior therapeutic outcomes. By converting liquid formulations into a stable, solid powder, lyophilization eliminates the need for costly frozen storage and reduces risks associated with cold-chain transportation. This is often the only viable way to stabilize these complex, temperature-sensitive macromolecules, including monoclonal antibodies, peptides, and advanced cell and gene therapies.

The peptide-based drugs segment is expected to grow at the fastest rate during the forecast period. This is primarily due to their high specificity, efficacy, and lower toxicity compared to traditional chemotherapy. Peptides are smaller than large-molecule biologics, such as monoclonal antibodies, which improves tumor penetration and boosts their overall therapeutic effect. Peptides can be prone to degradation in liquid form. Therefore, lyophilization is a highly effective method for stabilizing peptide-based formulations, extending shelf life, which is often a major challenge for peptide therapies.

Formulation Type Insights

How Did the Lyophilized Powders for Injection Segment Lead the Market in 2024?

The lyophilized powders for injection segment led the lyophilized oncology drug market, holding around 55% share in 2024. This is mainly due to their superior stability and longer shelf life. Many cutting-edge cancer drugs, especially biologics and protein-based therapies, are highly sensitive to temperature and moisture and are chemically unstable in liquid form. Lyophilization preserves the potency of these complex drugs, simplifying their storage and transport, even in areas with limited cold-chain infrastructure. This process minimizes microbial growth and contamination risks, ensuring rapid and complete absorption into the bloodstream.

The lyophilized powders for oral reconstitution segment is expected to expand at the fastest CAGR in the upcoming period. This growth is driven by enhanced patient convenience, compliance, drug stability, and new drug delivery advancements. This formulation overcomes challenges associated with injectable-only drugs and poor bioavailability in traditional oral therapies. By converting liquid formulations into stable powders, lyophilized products reduce costs and simplify the logistics of cold storage, transportation, and waste disposal, thereby making these drugs more accessible in various healthcare settings.

Therapeutic Application Insights

How Does the Solid Tumors Segment Dominate the Lyophilized Oncology Drug Market in 2024?

The solid tumors segment dominated the market with about 60% share in 2024. This is primarily because of the high worldwide prevalence of solid tumors, the complex nature of these cancers, and the chemical instability of many targeted therapies. Chemical instability of new-generation therapies, such as monoclonal antibodies and antibody-drug conjugates, is addressed through lyophilization. Lyophilized nanoparticle formulations can also be engineered to overcome barriers such as the dense extracellular matrix and high interstitial fluid pressure within solid tumors.

The hematologic cancers segment is expected to grow at the highest CAGR in the market. This growth is driven by the rising incidence of blood cancers, such as leukemia, lymphoma, and multiple myeloma, advances in targeted therapies and immunotherapies, and the benefits of lyophilization for complex biologics. These therapies, including monoclonal antibodies and CAR-T cells, are complex biological molecules that require lyophilization for long-term stability, easier transportation, and maintaining potency.

Route of Administration Insights

What Made Intravenous (IV) the Leading Segment in the Lyophilized Oncology Drug Market?

The intravenous (IV) segment held the market with a share of approximately 65% in 2024. This is mainly due to the treatment needs of cancer, the rapid onset of action, and bypassing gastrointestinal absorption issues. IV administration offers 100% bioavailability, ensuring the quick, complete, and reliable delivery of potent and sensitive anticancer drugs that are stabilized through lyophilization for long-term storage. It is the most effective way to deliver high, sustained drug concentrations needed to fight cancer, especially when using combination therapies.

The subcutaneous (SC) segment is expected to experience the fastest growth. This is because of improvements in patient convenience and cost savings. Converting IV oncology treatments to SC formulations allows easier administration and reduces healthcare costs. The simpler and quicker SC injections enable patients to get treatment in outpatient clinics or even self-administer at home. Switching to a fixed dosing regimen also eliminates the need for complicated dose calculations, thereby simplifying the treatment process.

End User Insights

Why Did Hospital & Cancer Treatment Centers Dominate the Lyophilized Oncology Drug Market in 2024?

The hospital & cancer treatment centers segment accounted for about 50% share of the market in 2024. This is mainly due to their specialized infrastructure, their crucial role in administering injectable cancer treatments, and their expertise in managing complex drug protocols. Hospital pharmacies are well-equipped with the necessary infrastructure, trained staff, and safety protocols to handle these potent drugs, prevent dosing errors or contamination, ensure drug potency, and reduce waste.

The specialty pharmacies segment is expected to grow at the fastest rate in he upcoming period. This growth is driven by the complex nature of these medications and the comprehensive patient support services needed. As cancer treatments become more advanced and personalized, specialty pharmacies play a vital role in managing logistics, ensuring patient adherence, and providing clinical expertise. Many of these drugs are restricted to specialty pharmacy distribution channels, which helps oversee prior authorizations.

Regional Insights

How Did North America Lead the Lyophilized Oncology Drug Market in 2024?

North America led the lyophilized oncology drug market with about 42% share in 2024. This dominance is attributed to a highly developed healthcare infrastructure, advanced technologies for cancer diagnosis and treatment, including precision oncology, substantial R&D investments, favorable regulations, and high cancer prevalence rates. Agencies like the U.S. FDA have a streamlined yet rigorous drug approval process. Initiatives like Project Orbis enable the concurrent review of oncology products with international partners, speeding up patient access to new treatments and reinforcing its market position leadership.

U.S. Lyophilized Oncology Drug Market Trends

The U.S. is a major contributor to the market in North America, due to its advanced healthcare infrastructure, significant investments in research and development, and a favorable regulatory environment that supports drug innovation, particularly for complex biologics and nanomedicines. This has resulted in North America, with the U.S. at its core, being the overall leader in the lyophilized injectable drugs market, with oncology treatments comprising a substantial portion of this market.

- In October 2025, the U.S. Department of Health and Human Services announced a doubling of funding for the Childhood Cancer Data Initiative (CCDI) at the National Institutes of Health (NIH), from $50 million to $100 million, to accelerate the development of diagnostics, treatments, and prevention strategies.

- In October 2024, Sandoz launched a generic paclitaxel formulation in the U.S., the first FDA-approved generic reference to Abraxane, for treating metastatic breast cancer. Keren Haruvi of Sandoz highlighted the importance of broader access to this life-changing medicine.

Why is Asia Pacific Considered the Fastest-Growing Region?

Asia Pacific is expected to experience the fastest growth during the forecast period. This is primarily driven by a high and rising cancer burden, improvements in healthcare infrastructure, and significant governmental support for pharmaceutical innovation. Favorable regulatory environments, a large patient population, and lower costs have made the Asia Pacific a hub for oncology clinical trials. Lyophilization technology is crucial for producing stable, high-quality, and long-lasting oncology injectables, making them easier to transport and store across diverse and often remote regional locations.

India Lyophilized Oncology Drug Market Trends

India is emerging as a significant player in the global market, driven by its rapidly expanding pharmaceutical industry, growing investments in biopharmaceutical research and development, and increasing prevalence of cancer. The country's strong manufacturing capabilities, particularly in the production of generic oncology drugs. India also benefits from a large patient population, a developing healthcare infrastructure, and an increasing focus on advanced drug delivery systems.

- For instance, the Production Linked Incentive (PLI) Scheme provides a ₹15,000 crore financial incentive over six years to manufacturers of high-value pharma products, including anti-cancer drugs, complex generics, and biopharmaceuticals. This scheme has already exceeded its original investment projection.

Regulatory Bodies and Regulations for Lyophilized Oncology Drugs

| Feature | U.S. | India | EU |

| Regulatory Authority | Food and Drug Administration (FDA) | Central Drugs Standard Control Organization (CDSCO) | European Medicines Agency (EMA) |

| Key Legislation | Food, Drug, and Cosmetic Act; Public Health Service Act | Drugs and Cosmetics Act, 1940, and Rules; New Drugs and Clinical Trials Rules, 2019 | Community directives; Clinical Trials Regulation |

| Manufacturing Oversight | Issues technical guides for inspecting lyophilization of parenterals, outlining cGMPs. | Ensures quality control for pharmaceuticals through the CDSCO. | Coordinates with national agencies for Good Manufacturing Practices (GMP). |

| Oncology-Specific Programs | Oncology Center of Excellence (OCE), Project Optimus, Project Orbis, Project Patient Voice | Focuses on oncology drugs within broader regulatory frameworks, including recent announcements on specific cancer drugs. | Issues scientific guidelines on evaluating anticancer medicinal products. |

| Focus/Approach | Competitive environment emphasizing scientific rigor and patient outcomes. | Affordability and promotion of indigenous drug development. | Scientific guidelines to ensure quality, safety, and efficacy. |

Top Companies in the Lyophilized Oncology Drug Market and Their Offerings

Tier I – Major Players

These companies dominate the lyophilized oncology drug market with extensive product portfolios, strong global distribution, and significant R&D investment. Collectively, they hold nearly half of the total market revenue.

- Pfizer Inc.:Pfizer leverages its extensive oncology pipeline and advanced lyophilization technologies to deliver stable, effective cancer therapeutics, ensuring improved shelf life and ease of distribution globally.

- Merck & Co., Inc.:Merck's robust focus on innovative cancer drugs, combined with its expertise in lyophilized formulations, supports the production of high-potency oncology drugs that maintain efficacy and patient safety.

- F. Hoffmann-La Roche Ltd.:Roche utilizes its cutting-edge R&D capabilities and strong global manufacturing network to produce lyophilized oncology drugs, emphasizing biologics and targeted therapies for various cancer types.

- Sanofi S.A.:Sanofi's contribution stems from its diverse oncology portfolio and commitment to advanced drug delivery systems, including lyophilization, which enhances the stability and usability of injectable cancer treatments.

- Johnson & Johnson Services, Inc.:Johnson & Johnson integrates comprehensive pharmaceutical manufacturing expertise with lyophilization processes to support scalable production of oncology drugs, focusing on innovation and patient-centric formulations.

Tier II – Mid-Level Contributors

These firms maintain a solid market presence with focused oncology pipelines and growing lyophilized drug portfolios, contributing about a third of the overall market revenue.

- AstraZeneca PLC

- Gilead Sciences, Inc.

- Bristol Myers Squibb Company

- Novartis AG

- Takeda Pharmaceutical Company Limited

Tier III – Niche and Regional Players

Smaller companies or those with regional reach that specialize in niche products or contract manufacturing, collectively accounting for roughly 15–20% of the market share.

- Zydus Group

Cipla Inc. - Aurobindo Pharma

- Vetter Pharma

- Baxter International Inc.

Recent Developments

- In April 2025, Amneal Pharmaceuticals and Shilpa Medicare announced the U.S. launch of BORUZU™, a ready-to-use formulation of bortezomib for subcutaneous or intravenous administration, aimed at simplifying preparation steps in treating multiple myeloma and mantle cell lymphoma. BORUZU™ carries a unique J-code for reimbursement and enhances patient care.(Source: https://investors.amneal.com)

- In October 2025, AstraZeneca Pharma India obtained approval from the Central Drugs Standard Control Organisation (CDSCO) to import Trastuzumab Deruxtecan (Enhertu), a treatment for adult patients with unresectable or metastatic HER2-positive solid tumors who have no satisfactory treatment options.

(Source: https://www.business-standard.com)

Expert Analysis

The lyophilized oncology drug market is poised for robust expansion, underpinned by escalating global cancer prevalence and the growing imperative for stable, efficacious drug formulations. Lyophilization, as a critical pharmaceutical technology, significantly enhances the stability, shelf-life, and bioavailability of oncology therapeutics, addressing inherent challenges associated with biologics and complex molecules. This market trajectory is further accelerated by advancements in lyophilization process optimization, integration of continuous manufacturing techniques, and heightened demand for cold-chain independent formulations, which collectively reduce logistic complexities and costs.

From a strategic investment perspective, the confluence of rising personalized oncology treatments, expanding pipeline of biologics, and increased adoption of injectable cancer therapies creates fertile ground for innovation and market penetration. Opportunities abound in leveraging novel excipients, formulation technologies, and process analytical tools (PAT) to improve product consistency and patient compliance. Moreover, emerging markets exhibit significant growth potential owing to expanding healthcare infrastructure, increased cancer diagnostics, and regulatory reforms facilitating faster drug approvals.

Industry stakeholders are urged to capitalize on these dynamics by fostering R&D collaborations, enhancing process scalability, and aligning with evolving regulatory frameworks emphasizing product quality and supply chain resilience. The integration of AI and machine learning for process modeling and predictive maintenance in lyophilization units further underscores the transformative potential within this sector, promising not only operational efficiencies but also superior therapeutic outcomes.

Segment Covered in the Report

By Drug Type

- Small Molecules

- Biologics

- Monoclonal Antibodies

- Peptide-Based Drugs

- Others

By Formulation Type

- Lyophilized Powders for Injection

- Lyophilized Powders for Oral Reconstitution

- Others

By Therapeutic Application

- Solid Tumors

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Others

- Hematologic Cancers

- Leukemia

- Lymphoma

- Multiple Myeloma

- Others

By Route of Administration

- Intravenous (IV)

- Subcutaneous (SC)

- Others

By End User

- Hospitals & Cancer Treatment Centers

- Specialty Pharmacies

- Research & Academic Institutes

- Biotechnology & Pharmaceutical Companies

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting