NdFeB Permanent Magnets Market Size and Forecast 2025 to 2034

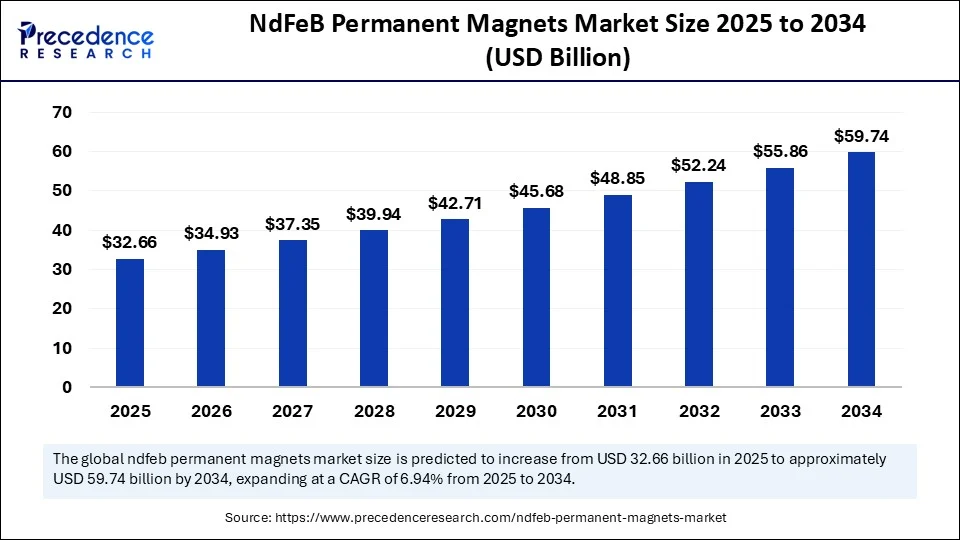

The global NdFeB permanent magnets market size was calculated at USD 30.54 billion in 2024 and is predicted to increase from USD 32.66 billion in 2025 to approximately USD 59.74 billion by 2034, expanding at a CAGR of 6.94% from 2025 to 2034. The market growth is attributed to the rising adoption of electric vehicles, wind energy systems, and high-efficiency motors that rely on NdFeB magnets for compact design and superior performance.

NdFeB Permanent Magnets Market Key Takeaways

- In terms of revenue, the global NdFeB permanent magnets market was valued at USD 30.54 billion in 2024.

- It is projected to reach USD 59.74 billion by 2034.

- The market is expected to grow at a CAGR of 6.94 % from 2025 to 2034.

- Asia Pacific dominated the global NdFeB permanent magnets market in 2024 and is expected to sustain the growth in the coming years.

- By type/product, the sintered NdFeB magnets segment held the major market share of 58% in 2024.

- By type/product, the bonded NdFeB magnets segment is projected to grow at a CAGR between 2025 and 2034.

- By application, the electric motors segment contributed the biggest revenue share in 2024.

- By application, the generators/wind turbines; EV motors segment is expanding at a significant CAGR between 2025 and 2034.

- By end-user industry, the automotive segment led the market in 2024.

- By end-user, the energy (wind/renewable) segment is expected to grow at a significant CAGR over the projected period.

Impact of Artificial Intelligence on the NdFeB Permanent Magnets Market

Artificial intelligence (AI) is having a massive impact on the NdFeB permanent magnets market by simplifying activities along the full production chain, from materials extraction through to the finished product and its optimization. The application of AI is now giving manufacturers the ability to efficiently tailor the design of magnets to achieve better performance and higher efficiency. Furthermore, the companies use AI in tracking changes in the supply chain, particularly considering that sourcing of rare earths is geopolitically sensitive, to allow them to predict disruptions and make sound procurement decisions.

Market Overview

NdFeB (Neodymium Iron Boron) permanent magnets are the strongest commercially available rare earth magnets, made from an alloy with a tetragonal Ndâ‚‚Feâ‚â‚„B crystalline structure. They are widely used in high-performance applications like electric motors, hard disk drives, and other advanced technologies due to their exceptional magnetic properties.

It is estimated that the growing demand for clean energy and electric mobility would support the growth of the NdFeB permanent magnets market. The NdFeB technology involves the use of a high-strength combination of neodymium, iron, and Boron alloys. They provide high magnetic properties and allow the development of lightweight, compact motors. Due to their strong power-to-weight ratio and energy efficiency, engineers use sintered NdFeB magnets to optimize the power-to-weight ratio and energy efficiency.

The trend is supported by government and NGO statistics, such as international agencies and organizations estimated worldwide additions of more than 117 GW of wind energy in 2024, with a large proportion using permanent‑magnet generators. Developers of renewable energy and the manufacturers of vehicles collaborate with American manufacturers such as Noveon Magnetics after GM was supplied with NdFeB magnets, starting on a multi-year contract. Furthermore, the increased investments in electrified infrastructure and local magnet-making capacity favour the long-term market position.

(Source: https://www.gwec.net)

NdFeB Permanent Magnets Market Growth Factors

- Driving Expansion of Autonomous Vehicles: Rising demand for compact, high-torque electric motors in autonomous mobility systems is fuelling the use of advanced NdFeB magnets.

- Boosting Demand in Medical Imaging Equipment: Growing reliance on high-precision MRI systems and diagnostic devices is driving increased magnet consumption in healthcare technology.

- Rising Adoption of Drone and UAV Technologies: Expanding applications in defense, logistics, and agriculture are propelling the need for lightweight, high-power magnet-based propulsion systems.

- Fueling Demand from Data Centers and Cooling Systems: Increasing installation of energy-efficient magnetic cooling and fan systems in hyperscale data centers is boosting magnet deployment.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 59.74 Billion |

| Market Size in 2025 | USD 32.66 Billion |

| Market Size in 2024 | USD 30.54 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.94% |

| Dominating Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type/Product, Application, End User Industry and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Is the Global Shift Toward EVs Powering Growth in the NdFeB Permanent Magnets Market?

Increasing demand for electric vehicles (EVs) is projected to significantly boost the market growth. The high-performance rare earth magnets are expected to increase exponentially on the consumption side since electric vehicles (EVs) are gaining popularity among people. The traction motors of EVs employ the use of NdFeB magnets because of these magnets' properties of having higher magnetic strength and low weight, which assist in promoting energy economy and enhancing traveling range. The world-leading automakers are still changing to electric drives, which have given a boost to the use of advanced magnet technologies.

Tesla, BYD, and Volkswagen are examples of companies pouring investments into permanent magnet motor designs to increase torque density and minimize energy losses. The increase in global EV adoption, due to the stringent emission laws and government subsidies, is likely to enhance the continuous demand for such magnets to be used in the powertrain. According to the International Energy Agency (IEA), in 2024, worldwide EV sales exceeded 14 million, which was a 35% growth over 2023, and China, Europe, and the U.S. reported the largest growth. Furthermore, the rising focus on energy efficiency and lightweight materials is likely to propel the use of advanced magnet solutions in transportation and aerospace applications.(Source: https://www.iea.org)

Restraint

Supply Chain Concentration in China

Supply chain concentration around the world is expected to hinder global market growth. China dominates a majority of the world's rare earth mining and magnetic production, with over three-quarters of the global supplies of NdFeB magnet. This intense concentration establishes geopolitical and trade-related exposure risks to international manufacturers, especially those of North America and Europe. Furthermore, the standardized recovery technologies and logistical systems hamper material recovery from consumer electronics, thus further hindering the market.

Opportunity

Is the Expansion of Wind Energy Infrastructure Driving Demand for NdFeB Permanent Magnets?

Growing investments in renewable energy infrastructure are anticipated to create immense opportunities for the players competing in the market. The increasing commitment to renewable energy infrastructure is expected to support the demand for rare earth magnets, which are incorporated in wind turbines. Direct-drive wind turbines, especially offshore applications, rely on NdFeB magnets to offer the benefits of compact size, low maintenance, and high efficiency. Nations such as China, Germany, and the United States are still growing their wind power capacity, and this constant growth provides sustained demand for specialized magnet components.

Shift toward less harmful sources of energy only supports the idea that permanent magnets are a vital part of achieving decarbonization goals worldwide. In 2024, the International Renewable Energy Agency (IRENA) announced a total growth in worldwide wind energy capacity of over 117 GW, of which over a quarter came from offshore wind. Additionally, the largest manufacturers, such as Hitachi Metals or JL MAG Rare-Earth Co., Ltd., started mass production in 2024 to cover increasing international demand, further boosting the segment in the coming years.(Source: https://www.gwec.net)

Type/Product Insights

Why is the Sintered NdFeB Magnets Segment Leading the NdFeB Permanent Magnets Market?

The sintered NdFeB magnet segments dominated the NdFeB permanent magnets market in 2024 due to their growing need for high‑torque, high‑efficiency applications, including EV traction motors and wind turbine generators. Sintered NdFeB magnets were industry-dedicated posts that were used on a large scale to support direct-drive wind turbines and synchronous electric propulsion systems. Furthermore, the public-private domestic capacities are making an effort to expand the volume of processing of sintered magnets onshore without necessarily relying on Chinese inputs, further boosting the segment in the coming years.

The USGS 2024 report also echoed the strategic reliance of the U.S. on sintered NdFeB magnets used in defense and aerospace applications of the U.S., and it included sintered NdFeB magnets at the highest priority level in secure supply chains. The primary technologies of manufacturers involved the equivalent of sintered technology, where coercivity, thermo-stability, and energy density were involved. They were critical to many applications in automotive drive, renewable energy, and industrial drive applications. (Source:https://www.federalregister.gov)

The bonded NdFeB magnets segment is expected to grow at the fastest CAGR in the coming years, owing to its suitability for compact motors, sensors, and low-profile drive systems. OEMs embraced bonded NdFeB as auxiliary motors in EVs for their lower tooling expense and easier processing through compression or injection bonding processes. Additionally, advances in injection moulding and additive manufacturing technologies have made mass customization possible, further propelling the segment in the coming years.

Application Insights

How is the Electric Motors Segment the Core of the NdFeB Permanent Magnets Market?

The electric motors segment held the largest revenue share in the NdFeB permanent magnets market in 2024. Synchronous permanent-magnet motors used in battery and hybrid automobiles depend almost exclusively on NdFeB magnets. R&D by U.S. national labs like Ames and Argonne was rushed to enhance the sintered NdFeB toughness and coercivity of next-generation traction systems. Moreover, the manufacturers focused on NdFeB magnets for their high levels of torque density, light weight, and high thermal stability, thus further fuelling the market.

The generators/wind turbines segment is expected to grow at the fastest rate in the coming years, owing to the growing application of advanced NdFeB permanent magnets in this sector. The U.S. Department of Energy pointed out that PMSGs minimise nacelle weight, have no gearbox, and provide greater reliability, which attracts robust specifications of direct-drive systems. Furthermore, the OEMs countered this by re-designing drivetrains and moving from gearbox-based generators and permanent-magnet generators using NdFeB in support of both increasing system efficiency and simplified maintenance.

IRENA observed that total wind capacity in the world had grown by a marked 116 GW in 2023. In 2024, it remained at 82 GW, with 43% of the new power potential renewable, added to the mix in 2023. Based on the use of PMSGs in offshore platforms and advanced onshore models, the IEA predicted that demand in the wind sector would increase beyond neodymium and praseodymium.(Source: https://www.irena.org)

End-User Industry Insights

Which End-User Dominated the NdFeB Permanent Magnets Market?

The automotive segment dominated the NdFeB permanent magnets market in 2024, due to the growing demand for electric and hybrid vehicle traction systems. Any form of traction motor would need about 112 to 25 kg of NdFeB material, making consumption per vehicle high. Prior reasons that drove OEMs and Tier-1 suppliers to use the NdFeB were its good torque density, thermal stability, and compact construction to meet the industry requirement of lightweight and efficient propulsion systems.

Included in the list of critical minerals assessment studies by DOE are NdFeB magnets, which triggered vehicle manufacturers to make investments in secure global supply networks. U.S.-based supply chain development by MP Materials. As the European Commission JRC observed in 2024, the European Union depends on NdFeB supply chains as the EV sector drives the demand for permanent magnets, which is expected to triple by 2030. As indicated by the USGS 2024 Mineral Commodity Summary, China provided more than 87% of the global rare earths, and the automotive industry was therefore exposed to high geopolitical risk.

The energy (wind/renewable) segment is expected to grow at the fastest CAGR in the coming years, owing to the increasing demand for permanent-magnet synchronous generators for their efficiency. Furthermore, the German DERA identified NdFeB as a high-supply-risk material with implications for the offshore wind strategy in Europe and pushed towards necessary supply diversification, thus further fuelling the segment. (Source:https://joint-research-centre.ec.europa.eu)

(Source: https://www.ey.com)

Regional Insights

Asia Pacific Cemented Its Position as the Dominating and Fastest-Growing Region

Asia Pacific dominated the global NdFeB permanent magnets market in 2024, and is expected to sustain the growth in the coming years, due to high industrial and automotive, and renewable infrastructure growth. Such monopolistic control of REE production and processing has converted into the mass production of magnets in China, which in turn supports high NdFeB demand in the entire economy. The policies of government development in different countries, such as China, India, and South Korea, focused on magnet-integrated manufacturing in 2024, enhancing the APAC supply chain. Both automotive and electronic large-scale manufacturers made their investments into a secure supply of NdFeB magnets to meet their needs in the EV and industrial motor manufacturing.

Passive policy support in Asia Pacific contributed to the generation of new renewable energy capacity globally to the tune of 61% between 2024 and 2030. The investment in wind energy puts the permanent-magnet synchronous generators at the epicentre of the burgeoning demand. Local OEMs reacted by re-engineering wind turbine drive trains to permanent-magnet generators, which are more efficient and have less maintenance overhead. APAC governments in 2024 raced to implement policy support of domestic magnet manufacturing and supply chain resilience in line with the objectives of energy transition and build‑out of industrial capacity. (Source: https://vir.com.vn)

NdFeB Permanent Magnets Market Companies

- Hitachi Metals, Ltd.

- Shin Etsu Chemical Co., Ltd.

- VacuumSchmelze GmbH & Co. KG (VAC)

- TDK Corporation

- Advanced Technology & Materials (AT&M)

- Zhejiang Innuovo Magnetics Co., Ltd.

- Ningbo Yunsheng Co., Ltd.

- Beijing Zhongke San Huan High Tech Co., Ltd.

- JPMF Guangdong Co., Ltd.

- Molecorp Inc. (Molycorp/Magnetechnology)

- Neo Performance Materials (Magnequench)

- MP Materials

- Noveon Magnetics (US-based)

- Magnetic Technologies Corporation

- Bunting Magnetics Company

- Electron Energy Corporation

- Adams Magnetic Products, Inc.

- Shougang Magnetic Material Co., Ltd.

- Tianhe Magnets

- Alliance LLC—UMAG, NeoM Magnet & Co.

LatestAnnouncements by Industry Leaders

- In June 2025, the Ministry of Heavy Industries (MHI) and the Department of Atomic Energy (DAE) are expected to finalize an INR 1,000 crore incentive scheme to boost India's domestic rare earth magnet manufacturing. The program will support an annual production capacity of 1,500 tonnes, with India Rare Earths Limited (IREL) supplying 500 tonnes of raw materials to OEMs. Arun Misra, CEO of Hindustan Zinc and Executive Director at Vedanta, said, “Just mining monazite and making chlorides is not a solution. We need to develop ways to produce neodymium so we can manufacture permanent magnets.”

(Source: https://www.cnbctv18.com)

Recent Developments

- In January 2025, MP Materials began commercial production of NdPr metal and trial production of automotive-grade NdFeB magnets at its Fort Worth, Texas, facility, reviving a domestic supply chain for the first time in decades. Meanwhile, e-VAC Magnetics, part of Germany's VAC Group, announced a USD 500 million investment in South Carolina, establishing its first U.S. magnet manufacturing plant. The facility is expected to create 300 new jobs, supporting critical sectors such as defence, EVs, and renewable energy.(Source: https://mpmaterials.com)

- In November 2024, Northern Rare Earth, China's leading rare earth supplier, launched a USD 5.5 million joint venture, Northern Zhaobao Magnetic Co., Ltd., focused on producing 3,000 tons/year of high-performance NdFeB magnets. The new facility will integrate R&D, production, and sales of mid-to-high-end magnetic materials, supporting China's industrial shift toward low-carbon and green technologies, especially for clean energy systems and advanced manufacturing.(Source: https://rareearthexchanges.com)

- In May 2024, Heraeus opened Europe's largest rare earth magnet recycling facility in Bitterfeld, Germany, with a capacity of 600 tons/year, expandable to 1,200 tons. Operating under Heraeus Remloy, the plant supports sustainable, closed-loop rare earth use, enabling local access to critical raw materials for magnet producers across Europe and reducing reliance on primary mining and imports. (Source: https://www.heraeus-group.com)

- In October 2024, Niron Magnetics launched its commercial pilot facility in Minneapolis, producing rare-earth-free permanent magnets. This first-of-its-kind development addresses both supply chain risks and environmental concerns associated with traditional neodymium magnets, as nearly 90% of global magnet production remains concentrated in China. Niron's sustainable solution could reshape magnet sourcing for EVs, wind turbines, and electronics.(Source:https://www.businesswire.com)

Segments Covered in the Report

By Type/Product

- Sintered NdFeB Magnets

- Bonded NdFeB Magnets

- Hot pressed/Hot deformed NdFeB Magnets

By Application

- Electric Motors

- Generators/Wind Turbines

- Instruments & Meters

- Automotive (beyond motors), Consumer Electronics, Others

By End User Industry

- Automotive

- Electronics

- Energy (Wind/Renewable)

- Medical, Industrial Machinery

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting