What is the Network Traffic Analytics Market Size?

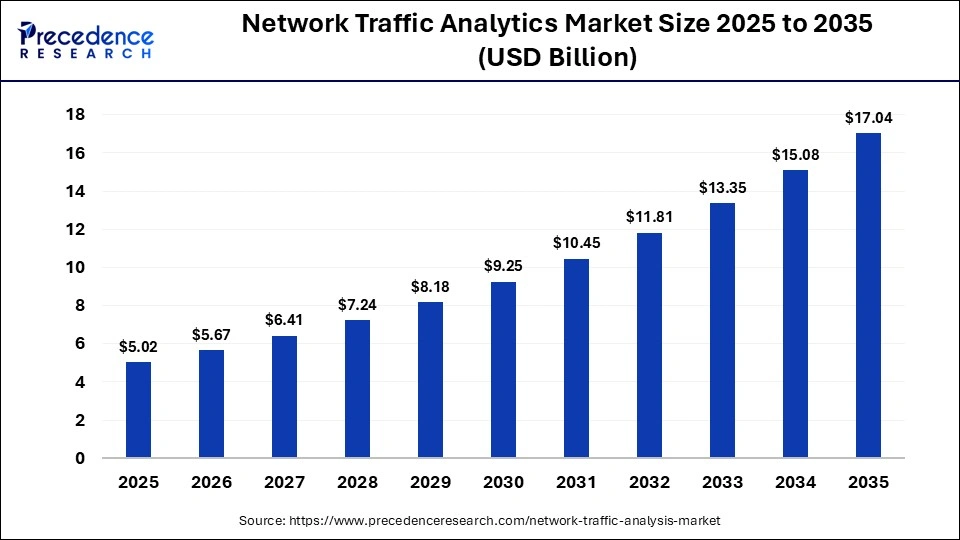

The global network traffic analytics market size accounted for USD 5.02 billion in 2025 and is predicted to increase from USD 5.67 billion in 2026 to approximately USD 17.04 billion by 2035, expanding at a CAGR of 13.00% from 2026 to 2035. The network traffic analytics market is growing due to rising demand for real-time network visibility and advanced security monitoring to manage increasing data volumes and cyber threats. Network traffic analytics is growing rapidly due to exploding data volumes from IoT, cloud, and remote work, demanding better security and performance visibility in complex hybrid networks, with AI/ML automating threat detection and management for compliance and efficiency.

Market Highlights

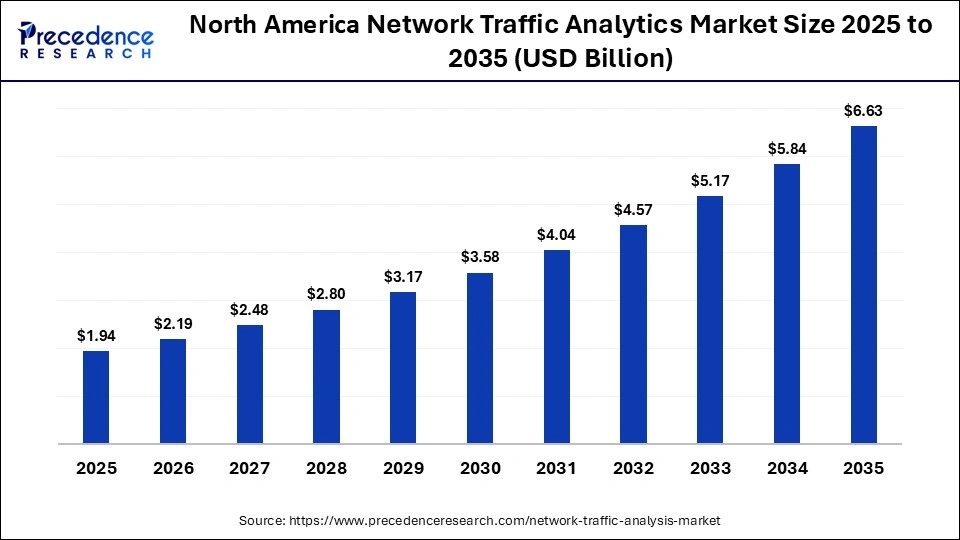

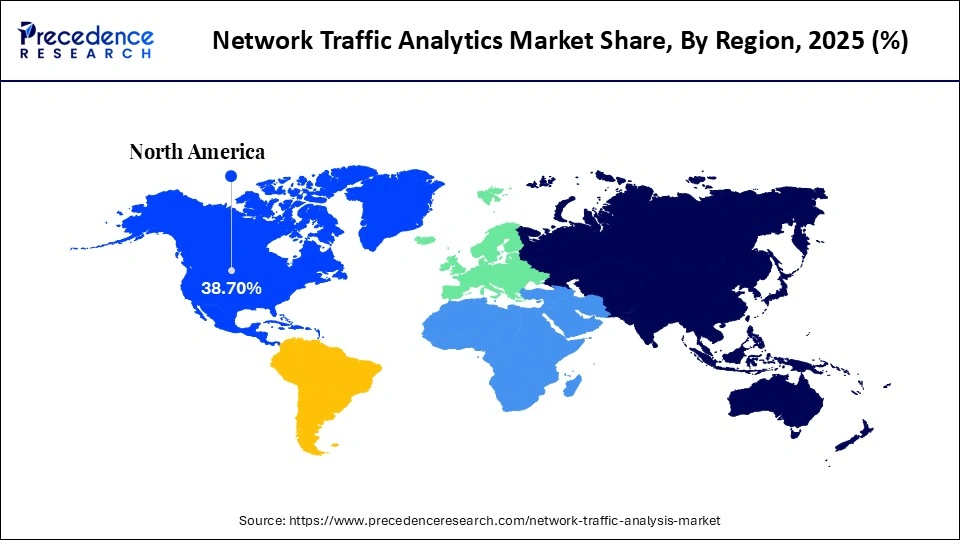

- North America dominated the global network traffic analytics market in 2025 with a share of 38.70%.

- Asia Pacific is expected to grow at the fastest CAGR of 13.90% between 2026 and 2035.

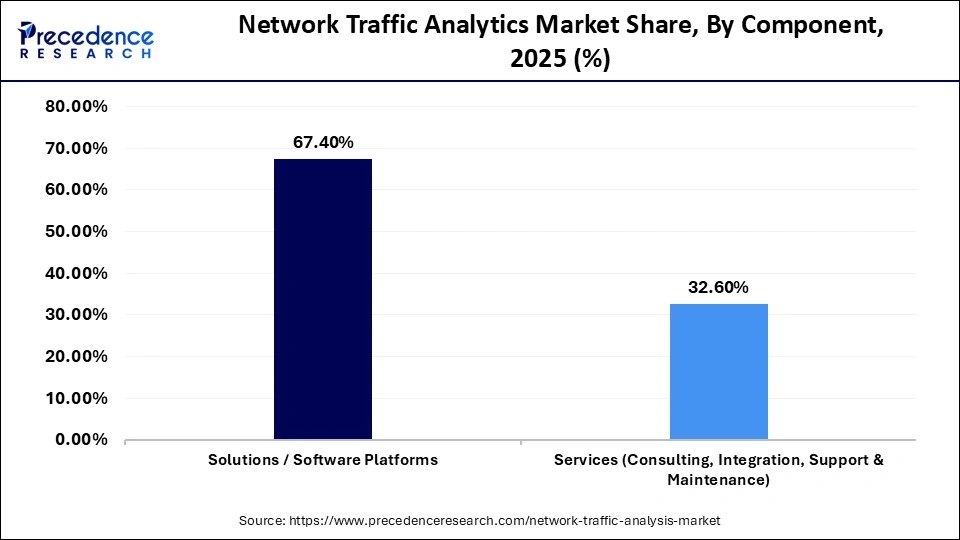

- By component, the solutions/software platforms segment generated the biggest market share of 67.40% in 2025, and the segment is expected to grow at the fastest CAGR of 11.30% during the forecast period.

- By component, the services segment is expected to expand at a significant CAGR of 9.80% between 2026 and 2035.

- By deployment model, the cloud-based segment contributed the highest market share of 48.90% in 2025, and is expected to grow at the fastest CAGR of 13.60% during the forecast period.

- By deployment model, the hybrid segment is growing at a strong CAGR of 11.90% between 2026 and 2035.

- By application, the network performance monitoring segment held a major network traffic analytics market share of 34.60% in 2025.

- By application, the security & threat detection segment is expected to expand at the fastest CAGR of 12.80% from 2026 to 2035.

- By end user, the enterprises segment contributed the highest market share of 46.80% in 2025.

- By end user, the data centers & cloud providers segment is growing at a strong CAGR of 12.50% between 2026 and 2035.

- By industry vertical, the IT & telecommunication segment held a major market share of 32.50% in 2025.

- By industry vertical, the BFSI segment is expected to expand at the fastest CAGR of 12.20% between 2026 and 2035.

What is Driving the Growth of the Network Traffic Analytics Market?

The network traffic analytics market is experiencing steady growth as businesses depend more on data-driven insights to secure monitoring and manage intricate network environments. Network infrstructure have grown more dispersed and challenging to manage with conventional tools due to the quick uptake of cloud computing, IoT devices, and remote working models. Network traffic analytics solutions are an essential part of contemporary IT and cybersecurity strategies because they enable businesses to obtain real-time visibility into data flows, identify anomalies, optimize performance, and react swiftly to security threats.

How is AI Transforming the Network Traffic Analytics Market?

Artificial intelligence is transforming the network traffic analytics market by making it possible to identify anomalies, dangers, and performance problems in real time. Compared to conventional tools, AI-powered models analyze massive data flows more quickly and accurately. Network optimization, automated response, and predictive insights are all enhanced by this. AI is becoming crucial for intelligent and scalable traffic management as networks get more complicated.

Network Traffic Analytics Market Trends

- Growing adoption of machine learning and AI for real time anamaly detection and predictive network insights

- Increased focus on cybersecurity and threat intelligence to identify suspicious traffic and reduce breach risks

- Rising use of cloud-based and SaaS analytics platforms for scalable and cost-effective deployment.

- Expansion of analytics solutions to support hybrid and multi-cloud environments.

- Integration with SDN and NFV technologies to improve network performance and automation.

- Higher demand from enterprises for compliance monitoring and data visibility across complex networks

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.02 Billion |

| Market Size in 2026 | USD 5.67 Billion |

| Market Size by 2035 | USD 17.04 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.00% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Deployment Model, Application, End User, Industry Vertical, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Network Traffic Analytics Market Opportunities

- Rising demand for advanced threat detection solutions as cyberattacks become more frequent and sophisticated.

- Growing adoption of 5G networks is creating new opportunities for real-time traffic monitoring and analytics.

- Increased use of IoT devices is driving the need for continuous network visibility and performance optimization.

- The expansion of cloud and edge computing is opening avenues for scalable and decentralized analytics solutions.

- Opportunities to develop industry-specific analytics tools for sectors such as BFSI, healthcare, and telecom.

- Strong potential in emerging markets as enterprises invest in modern network management and security infrastructure.

Segmental Insights

Component Insights

What made the solutions/software platforms segment dominate the market in 2025?

The solutions/software platforms segment is dominating the network traffic analytics market with 67.40% market share and is estimated to achieve the fastest growth rate of 13.60% during the predicted timeframe, driven by the increasing demand for scalable, intelligent, and integrated software solutions that can effectively monitor, analyze, and optimize network traffic. Businesses are depending more on these platforms for automated responses to network anomalies, predictive analytics, and real-time insights. Furthermore, these platforms' ongoing integration of AI and machine learning has improved their capacity to identify intricate patterns and proactively optimize network performance.

The services segment is expected to experience significant growth of 9.80% in the market during the forecast period. Driven by the growing need for consulting support, managed services, and professional services that assist businesses in successfully implementing and maintaining network analytics solutions. The need for outsourced services to effectively manage and optimize network operations is being driven by the growing complexity of IT networks and the lack of internal expertise.

Deployment Model Insights

What made the cloud-based segment dominate the market in 2025?

The cloud-based segment is dominating the network traffic analytics market with 48.90% market share and is estimated to experience a rapid CAGR of 13.60% during 2026-2035. Its dominance is attributed to the flexibility, scalability, and cost efficiency offered by cloud solutions, which allow businesses to manage network traffic analytics without heavy upfront infrastructure investments. Cloud deployments also enable seamless updates, remote access, and quick integration with other cloud native services, making them heavily attractive to modern enterprises.

The hybrid segment is expected to experience significant growth with 11.90% in the market during the forecast period. Driven by businesses looking for a solution that combines cloud scalability and on-premises control for sensitive and important network data. The hybrid approach is favored by sectors with stringent data regulations because it enables businesses to strike a balance between operational effectiveness and compliance requirements.

Application Insights

What made the network performance monitoring segment dominate the market in 2025?

The network performance monitoring segment is dominating the network traffic analytics market with 34.60% market share. This is due to organizations prioritizing the optimization of network speed, reliability, and uptime to support critical business operations and minimize downtime. Growing reliance on cloud applications, IoT devices, and high-volume data transfer further reinforced the demand for robust performance monitoring tools.

The security & threat detection segment is expected to experience the fastest growth with 12.80% in the market during the forecast period. Businesses are concentrating more on proactive threat detection and cybersecurity measures to protect sensitive data. Organizations are being forced to implement advanced network threat detection and response solutions due to an increase in cyberattacks, ransomware incidents, and stricter data privacy regulations.

End User Insights

Why did the enterprise segment dominate the market in 2025?

The enterprises segment is dominating the network traffic analytics market with 46.80% market share, driven by large-scale adoption by enterprises to manage complex IT networks, enhance operational efficiency, and improve overall network visibility. Enterprises are also leveraging analytics insights for better decision-making, resource optimization, and ensuring smooth digital transformation initiatives.

The data centers & cloud providers segment is expected to experience the fastest growth with 12.50% in the market during the forecast period, because the need for high-performance analytics solutions to support cloud infrastructure, maximize resource utilization, and guarantee network dependability is growing. The need for automated network management, multi-talent environments, and growing cloud adoption are the factors propelling this expansion across providers.

Industry Vertical Insights

What made the IT & telecommunication segment dominate the market in 2025?

The IT & telecommunication segment is dominating the network traffic analytics market with 32.50% market share, driven byt he sectors heavy reliance on robust network analytics for maintaining seamless operations, reducing downtime, and supporting digital transformation initiatives. The growth is also fueled by the rapid adoption of 5G networks, edge computing, and increasing data traffic across global networks.

The BFSI segment is expected to experience the fastest growth with 12.20% in the market during the forecast period as more financial institutions spend money on network analytics for regulatory compliance, security, and fraud detection. Network analytics solutions are being adopted more quickly in this industry due to expanding digital banking services, online transaction and the need for continuous operations.

Regional Insights

How Big is the North America Network Traffic Analytics Market Size?

The North America network traffic analytics market size is estimated at USD 1.94 billion in 2025 and is projected to reach approximately USD 6.63 billion by 2035, with a 13.08% CAGR from 2026 to 2035.

Why did North America dominate the market in 2025?

North America is dominating the network traffic analytics market with a revenue of 38.70%, propelled by the U.S. holding most of the market share. The existence of significant market participants in widespread use of cutting-edge analytics tools and large investments in cybersecurity infrastructure are all factors contributing to this dominance. North American businesses are leading the way in the use of AI-powered analytics, network monitoring, and threat detection tools.

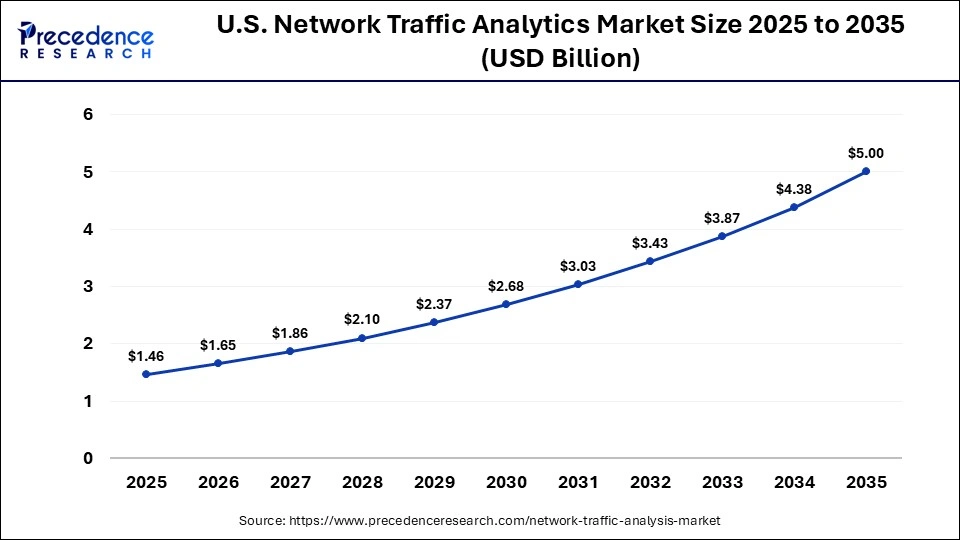

What is the Size of the U.S. Network Traffic Analytics Market?

The U.S. network traffic analytics market size is calculated at USD 1.46 billion in 2025 and is expected to reach nearly USD 5.00 billion in 2035, accelerating at a strong CAGR of 13.10% between 2026 and 2035.

U.S. Network Traffic Analytics Market Trends

The U.S. is leading in the market, driven by the widespread use of advanced analytics solutions by businesses and IT infrastructure providers. This expansion has been driven by significant investments in cloud computing, cybersecurity, and AI-enabled network monitoring. The U.S. has also been strengthened by the existence of important market participants and a tech-savvy business environment.

Asia Pacific is expected to grow rapidly with a CAGR of 13.90%, driven by rapid digital transformation and increasing adoption of cloud-based solutions. Growing investments in smart city initiatives, IoT infrastructure, and edge computing are accelerating demand. Enterprises across the region are increasingly deploying network analytics to optimize performance, enhance security, and support the growing data traffic.

India Network Traffic Analytics Market Trends

India is leading due to strong demand, which is being driven by the expansion of IT services, telecom modernization, and enterprise adoption of cloud computing. India's rapidly expanding market is also being aided by government initiatives that promote digitalization, the expansion of data centers, and the raising of cybersecurity awareness.

Who are the Major Players in the Global Network Traffic Analytics Market?

The major players in the network traffic analytics market include Arista Networks, Broadcom, Cisco Systems, ExtraHop Networks, Huawei Technologies, IBM Corporation, Juniper Networks, Kentik, NETSCOUT Systems, Nokia, Palo Alto Networks, SolarWinds, and Zscaler.

Recent Developments

- In January 2026, Hitachi, Ltd. announced its collaboration with NVIDIA, Google Cloud, and Nozomi Networks at CES 2026. This partnership integrates AI into social infrastructure to enhance real-time network traffic analysis and operational efficiency.(Source: https://www.hitachi.com)

- In January 2026, NTT DATA announced the launch of a new company, Intra-Asia Marine Networks, to build the $1 billion "I-AM" submarine cable system. The project connects Japan, Malaysia, and Singapore to bolster digital infrastructure and support the expanding regional AI economy.(Source: https://www.nttdata.com)

- In October 2025, Tosi announced the expanded global availability of its Advanced Network Traffic Analytics solution. This platform offers real-time visibility into Operational Technology (OT) networks by analyzing traffic flows to detect anomalies and cyber threats. It integrates natively into the TosiControl interface, enabling organizations to monitor industrial environments without extra hardware probes. For more information, visit Tosi's website.

Segments Covered in the Report

By Component

- Solutions/Software Platforms

- Services (Consulting, Integration, Support & Maintenance)

By Deployment Model

- Cloud-based

- On-premise

- Hybrid

By Application

- Network Performance Monitoring

- Security & Threat Detection

- Traffic Optimization & Capacity Planning

- Application Performance Management

- Compliance & Policy Enforcement

By End User

- Enterprises

- Telecom Service Providers

- Data Centers & Cloud Providers

- Government & Public Sector

By Industry Vertical

- IT & Telecommunications

- BFSI

- Healthcare

- Retail & E-commerce

- Manufacturing

- Government & Defense

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content