What is the Nylon 6 Market Size?

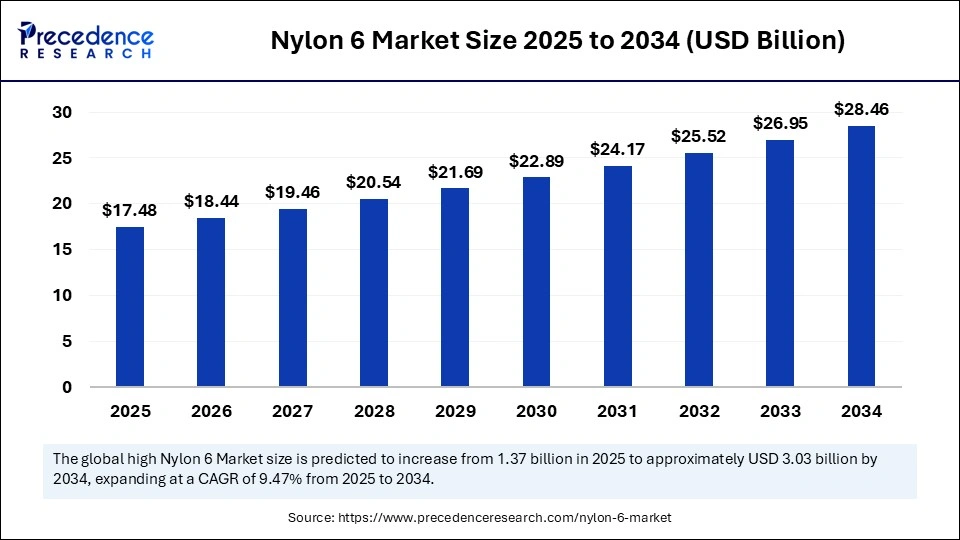

The global nylon 6 market size accounted for USD 16.56 billion in 2024 and is predicted to increase from USD 17.48 billion in 2025 to approximately USD 28.46 billion by 2034, expanding at a CAGR of 5.57% from 2025 to 2034. The nylon 6 market has emerged as a cornerstone of the global polymers and synthetic fibers industry, driven by its versatility, resilience, and ability to substitute metals in lightweight engineering applications.

Market Highlights

- Asia Pacific dominated the nylon 6 market in 2024.

- North America is expected to expand at the fastest CAGR between 2025 and 2034.

- By product form, the fibers segment held the largest share in 2024.

- By product form, film is expected to grow at a remarkable CAGR between 2025 and 2034.

- By grade type, the Standard grade segment held the largest share in the market for nylon 6.

- By grade type, reinforced grades are expected to grow at a remarkable CAGR between 2025 and 2034.

- By feedstock type, the caprolactam-based Nylon 6 segments held the largest market share in 2024.

- By feedstock type, recycled Nylon 6 is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application type, the textiles & apparel segments held the largest share in the nylon 6 market during 2024.

- By application type, automotive components are expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user type, the textile segment held the largest market share in 2024.

- By end-user type, automotive is expected to grow at a remarkable CAGR between 2025 and 2034.

- By distribution channel type, the direct sales segment held the largest market share in 2024.

- By distribution channel type, Online B2B platforms are expected to grow at a remarkable CAGR in the nylon 6 market between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 16.56 Billion

- Market Size in 2025: USD 17.48 Billion

- Forecasted Market Size by 2034: USD 28.46 Billion

- CAGR (2025-2034): 5.57%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What is Nylon 6? How is Shaping the Future of Engineering Plastics?

The nylon 6 market represents a critical segment of the global engineering plastics and synthetic fibres industry, derived from caprolactam polymerization. Nylon 6 is widely recognized for its high tensile strength, elasticity, resistance to abrasion and chemicals, and excellent processability. It serves diverse industries, including textiles, automotive, electrical & electronics, packaging, and consumer goods. Nylon 6 is produced in various grades and forms, including fibres, films, and engineering plastics, enabling applications from industrial yarns to automotive engine parts. Demand is supported by lightweighting trends in vehicles, the expansion of packaging films, and rising textile consumption. Growing emphasis on sustainability is further pushing investments in bio-based and recycled Nylon 6, making it a dynamic material in global markets.

The nylon 6 market is witnessing steady expansion, propelled by increasing demand for engineering plastics and high-performance fibres. Its adaptability in producing automotive components, industrial yarns, and consumer products reinforces its dominant role. Market competition is intensifying as manufacturers focus on recycling technologies, bio-based alternatives, and advanced compounding methods. With industries prioritizing lightweight and sustainable solutions, Nylon 6 continues to capture significant market share. Growth is particularly strong in emerging economies, where infrastructure and industrial development demand cost-efficient yet durable materials.

How AI is Impacting the Nylon 6 Market?

Artificial Intelligence is reshaping the nylon 6 market by optimising manufacturing, supply chain, and quality monitoring. AI-driven predictive analytics enabled precise demand forecasting, resulting in reduced wastage and overproduction. Machine learning models are increasingly deployed for process automation, enhancing consistency in polymerisation and fibre spinning. AI also accelerates R&D, helping innovators test new formulations and improve recyclability. Moreover, AI-based material stimulations allow companies to anticipate performance outcomes before prototyping, reducing costs and timelines. Collectively, these advancements are enabling a more efficient, agile, and sustainable Nylon 6 ecosystem.

Market Key Trends

- Rising focus on bio-based and recyclable nylon 6 solutions.

- Growing demand in electric vehicles due to lightweighting needs.

- Expansion of textile applications driven by fast fashion and technical fabrics.

- Integration of smart manufacturing and AI for process optimization.

- Strategic partnership to expand regional production capacity.

- Strong shift toward circular economy models within polymers and fibres.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 16.56 Billion |

| Market Size in 2025 | USD 17.48 Billion |

| Market Size by 2034 | USD 28.46 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.57% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Form, Grade, Feedstock / Source, Processing Method, Application, End User Industry, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

The Nylon 6 market is propelled by the rising demand for lightweight yet durable engineering plastics in the automotive industry, where weight reduction directly translates to fuel efficiency and sustainability. In textiles, Nylon 6 remains a preferred material due to its strength, elasticity, and resistance to wear, fueling growth in both fashion and industrial fabrics. Packaging industries are increasingly adopting Nylon 6 films for their barrier properties, catering to food safety and extended shelf life. Urbanization and industrial growth in emerging economies further expand the consumer base, driving consistent demand for products and services. Moreover, the cost-effectiveness of Nylon 6 compared to metals and alternative polymers strengthens its competitive edge. Finally, sustainability initiatives and innovations in recycling are opening new avenues for market expansion.

Restraint

Despite its advantages, the Nylon 6 market faces challenges from volatility in raw material prices, which directly affect production costs and profit margins. Environmental concerns over plastic waste and carbon emissions also place Nylon 6 under scrutiny, particularly in regions with strict sustainability mandates. Growing competition from alternative high-performance polymers, such as Nylon 66 and polyesters, creates additional market pressure. Regulatory constraints on petrochemical-derived materials may further restrict Nylon 6's scope in certain applications. High energy consumption in production poses another limitation, especially as industries move toward greener operations. Additionally, market fragmentation and pricing competition make it difficult for smaller players to thrive in the global landscape.

Opportunity

The shift toward bio-based Nylon 6 derived from renewable resources represents a significant growth opportunity, aligning with global sustainability goals. Expanding demand for lightweight, high-performance components in electric vehicles is another lucrative pathway. Recycling technologies are opening profitable new streams, transforming waste into valuable raw material. Rapid industrialization and infrastructure development in emerging economies present a vast, untapped market for Nylon 6 applications. AI-driven smart manufacturing offers efficiency gains, reducing waste and enhancing product quality. Ultimately, the potential for custom-engineered Nylon 6 composites tailored for niche industries, such as aerospace, medical devices, and electronics, creates a promising horizon for innovation-led growth.

Segments Insights

Product Form Insights

Why Do Fibers Dominate the Nylon 6 Market?

Fibers remain the most dominant product type in the Nylon 6 market due to their extensive use in textiles, apparel, and industrial fabrics. Their superior tensile strength, abrasion resistance, and elasticity make them indispensable for everyday clothing, sportswear, and performance apparel. Industrial applications, such as ropes, tire cords, and carpets, also rely heavily on Nylon 6 fibers because of their durability and cost-effectiveness. Growing consumer preference for comfort and durability further cements Nylon 6's role in global fiber production. The adaptability of Nylon 6 fibers across multiple industries ensures their continued leadership. Their balance of performance and affordability strengthens their long-term dominance.

The widespread adoption of Nylon 6 fibers also owes much to rapid urbanization and changing lifestyles. The expansion of fast fashion and high-performance sportswear continues to fuel demand in both developed and emerging economies. Technical textiles, including protective clothing and medical fabrics, offer further growth streams. Additionally, recycling innovations are enabling sustainable fiber production, appealing to eco-conscious consumers. As a result, Nylon 6 fibers not only dominate but also adapt to modern sustainability narratives. This positions them as a resilient backbone of the global Nylon 6 industry.

Films are emerging as the fastest-growing product type in the Nylon 6 market, driven by their exceptional barrier properties against oxygen, aroma, and moisture. These attributes make Nylon 6 films particularly attractive for food packaging, where freshness and shelf life are paramount. In pharmaceuticals, Nylon 6 films are gaining ground for protecting sensitive products from contamination. The lightweight yet durable nature of these films reduces packaging weight while maintaining strength. Rising e-commerce activity has also boosted the need for strong, secure packaging solutions. Together, these dynamics are accelerating the uptake of Nylon 6 films.

Beyond packaging, Nylon 6 films are finding applications in automotive components and electronics. Their thermal stability and chemical resistance make them well-suited for demanding industrial uses. As industries prioritize both performance and sustainability, recyclable Nylon 6 films are gaining preference over traditional plastics. The push for flexible packaging formats also supports robust growth. Additionally, their compatibility with multilayer composites expands their utility across high-value applications. This rapid diversification ensures Nylon 6 films will remain the industry's fastest-growing product segment.

Grade Insights

Why Does Standard Grade Nylon 6 Lead the Market for Nylon 6?

Standard grade Nylon 6 dominates the market thanks to its versatility and cost-efficiency. It is widely used in textiles, packaging, and consumer goods, where performance requirements are well-balanced with affordability. Manufacturers value its ease of processing and ability to deliver consistent quality across applications. In textiles, standard-grade Nylon 6 is the backbone of apparel and upholstery fabrics. Its mechanical strength and resistance to wear make it equally vital in packaging films. These qualities have ensured its enduring dominance in the Nylon 6 landscape.

Standard grade Nylon 6 also benefits from economies of scale in production. Its established supply chain makes it more readily available and affordable than specialty grades. For industries with high-volume demands, this accessibility is crucial. Despite emerging competition from reinforced variants, the broad utility of standard grade secures its leadership. Its adaptability across both consumer and industrial sectors also enhances resilience against market fluctuations. Thus, standard grade Nylon 6 remains the trusted choice for mainstream applications.

Reinforced grade Nylon 6 is the fastest-growing category, owing to its superior mechanical and thermal properties. By blending Nylon 6 with glass fibers, carbon fibers, or mineral fillers, manufacturers create materials with enhanced rigidity and strength. These reinforced variants are increasingly essential in automotive, electronics, and industrial applications. Automakers favor reinforced Nylon 6 for lightweight, high-strength parts that meet stringent performance standards. Similarly, electronics manufacturers leverage their thermal stability for circuit housings and connectors. This makes reinforced grade a cornerstone of advanced engineering applications.

The rising demand for electric vehicles and renewable energy systems amplifies the need for reinforced Nylon 6. Its ability to withstand higher stress and temperatures makes it ideal for next-generation designs. Additionally, sustainability efforts are fueling innovations in reinforced composites that maintain performance while reducing environmental impact. Industries seeking to replace metals with durable plastics are accelerating their adoption. With its unique balance of strength, durability, and adaptability, reinforced Nylon 6 is reshaping high-performance markets. Its growth trajectory is therefore set to outpace all other grades.

Feedstock/Source Insights

Which Feedstock/Source Segment Make Up a Large Share of the Nylon 6 Market?

Caprolactam-based Nylon 6 remains the dominant feedstock due to its established production infrastructure and consistent performance. As the traditional precursor, caprolactam provides reliability in quality and supply. Its cost-effectiveness and large-scale availability make it the backbone of Nylon 6 manufacturing. From fibers to films, caprolactam-derived Nylon 6 powers most end-use applications. Industries value the proven chemistry and wide adoption of caprolactam-based production. This entrenched dominance is unlikely to diminish in the near term.

Moreover, ongoing innovations in caprolactam production are enhancing efficiency and reducing costs. Emerging low-carbon and sustainable caprolactam processes are addressing environmental concerns. Such improvements preserve its competitive relevance in global markets. For large-scale industries, the assurance of supply continuity is indispensable. This makes caprolactam-based Nylon 6 the anchor of stability in a rapidly evolving market. Even as alternatives gain attention, caprolactam continues to dominate through scale, affordability, and versatility.

Recycled Nylon 6 is the fastest-growing feedstock, fueled by global sustainability mandates and consumer demand for eco-friendly products. Recycling processes, including chemical depolymerization, allow waste Nylon 6 to be converted back into high-quality polymers. This circular approach reduces dependency on petrochemicals and minimizes landfill waste. Textile, automotive, and packaging industries are leading adopters of recycled Nylon 6. The appeal of reducing carbon footprints while maintaining material performance is driving rapid uptake. Recycled Nylon 6 is transforming from niche to mainstream.

Corporate commitments to sustainability and green supply chains further support the momentum. Governments and regulators are also incentivizing the use of recycled plastics, thereby boosting adoption rates. Advances in recycling technology are improving yield, efficiency, and material quality. These developments ensure that recycled Nylon 6 can compete effectively with virgin feedstock. As industries adopt circular economy principles, recycled Nylon 6 is poised to become the material of the future. Its trajectory underscores both ecological responsibility and commercial opportunity.

Processing Method Insights

Why Did Injection Molding Dominate the Market for Nylon 6?

Injection molding dominates as the primary processing method for Nylon 6 due to its precision and scalability. The technique enables the production of complex, high-volume components with consistent quality. Industries like automotive, electronics, and consumer goods heavily rely on injection-molded Nylon 6. The ability to create lightweight yet durable products has underscored the importance of this method. Its cost efficiency also makes it the most practical choice for mass manufacturing. This ensures its dominance in global markets.

Additionally, injection molding supports customization, offering manufacturers design flexibility for evolving needs. From intricate gears to robust housings, its versatility is unmatched. Technological improvements in molding machines are enhancing cycle times and energy efficiency. This strengthens its appeal as industries pursue leaner, greener operations. Despite competition from extrusion, injection molding remains the method of choice for volume-driven industries. Its adaptability and scalability secure its long-standing leadership.

Extrusion is the fastest-growing processing method for Nylon 6, driven by demand for films, sheets, and profiles. Its continuous production capability makes it ideal for packaging, construction, and industrial uses. The method's efficiency in creating long, uniform products aligns with the needs of high-growth sectors. Nylon 6 films and fibers produced through extrusion are gaining traction across packaging and textiles. This scalability ensures extrusion's rising prominence in the market.

Emerging innovations in extrusion technology are also fueling its expansion. Advances in die design and cooling systems improve product quality and reduce energy consumption. The method's adaptability to recycled Nylon 6 adds another dimension of growth. Industries seeking sustainable yet high-performance solutions are increasingly adopting extrusion. With rising demand for flexible packaging and technical textiles, extrusion is set to outpace traditional processing methods. Its trajectory underscores efficiency, sustainability, and innovation.

Application Insights

Why Does Textiles and Apparel Lead the Market for Nylon 6?

Textiles and apparel dominate Nylon 6 applications due to the material's strength, elasticity, and wear resistance. From sportswear to everyday clothing, Nylon 6 fibers offer comfort and durability. Industrial fabrics, carpets, and upholstery also rely heavily on this versatile polymer. The fast fashion industry, with its demand for affordable yet stylish materials, reinforces Nylon 6's dominance. Its adaptability across both functional and aesthetic needs ensures sustained relevance. Nylon 6 remains the fabric of choice for performance and practicality.

Moreover, rising disposable incomes and shifting consumer lifestyles are expanding textile demand globally. Technical textiles, including protective and medical fabrics, further enhance Nylon 6's footprint. The material's recyclability is increasingly aligning it with sustainable fashion trends. For designers, Nylon 6 offers a unique balance of creativity and functionality. This dual advantage secures its dominance in apparel and beyond. In essence, textiles remain the heartland of Nylon 6's global market.

Automotive is the fastest-growing application for Nylon 6, propelled by the industry's shift toward lightweighting. Automakers are replacing metals with Nylon 6 in components such as engine covers, air intake manifolds, and interior trims. This substitution enhances fuel efficiency and reduces emissions. The rise of electric vehicles further amplifies demand, as lightweight materials extend battery range. Reinforced Nylon 6 is particularly valued for high-performance parts. This positions the automotive sector at the forefront of Nylon 6 adoption.

Growing regulatory pressure for sustainable and efficient vehicles strengthens this trajectory. Nylon 6's durability and resistance to heat and chemicals make it ideal for critical automotive components. As automakers explore bio-based and recycled variants, the alignment with green goals is reinforced. Emerging markets with booming automotive production are also adding momentum. Together, these factors fuel the sector's rapid growth. The automotive industry is poised to redefine the role of Nylon 6 in the future.

Distribution Channel Insights

Which Distribution Channel Dominates the Nylon 6 Market?

Direct sales dominate as the preferred distribution channel for Nylon 6, especially among large-scale manufacturers. This model ensures reliability in supply, pricing stability, and close supplier-customer relationships. Industries with bulk demand, such as textiles and automotive, rely on direct procurement to streamline operations. The absence of intermediaries also allows better negotiation and customization. This makes direct sales the backbone of the Nylon 6 distribution ecosystem. Its dominance reflects the efficiency it offers in supply chain management.

Additionally, direct sales enable manufacturers to exert greater control over quality assurance and delivery timelines. Strategic partnerships between producers and end-users are strengthening this channel. For established players, it creates a competitive moat by securing long-term contracts. Bulk transactions also reduce logistical complexities, further enhancing efficiency. Despite the rise of online platforms, direct sales remain indispensable for core industries. Their stability ensures sustained dominance in the distribution landscape.

Online B2B platforms are the fastest-growing distribution channel for Nylon 6, reshaping procurement in the digital era. These platforms offer convenience, transparency, and expanded access to global suppliers. For SMEs, online channels offer a cost-effective alternative to traditional procurement methods. The ability to compare pricing, track shipments, and source from diverse geographies is highly attractive. This digital shift is accelerating adoption across industries.

Furthermore, the pandemic accelerated the transition to online procurement, a trend that continues to gain traction. Digital platforms also support smaller, flexible order sizes, broadening accessibility. The integration of AI and analytics into these platforms enhances efficiency and predictive procurement capabilities. As sustainability reporting becomes crucial, digital platforms provide transparent traceability. Together, these advantages make online B2B platforms the fastest-growing segment in Nylon 6 distribution. They symbolize the modernization of industrial supply chains.

Regional Insights

How Is Asia Pacific Commanding a Dominant Share in the Nylon 6 Market?

Asia-Pacific dominates the Nylon 6 market, driven by robust manufacturing bases and rising consumption across automotive, packaging, and textile industries. Countries like China, India, and Japan are spearheading demand, supported by rapid industrialization and growing consumer markets. The region's strong infrastructure pipeline and booming fashion industry also amplify Nylon 6 consumption. With cost advantages in production, the Asia-Pacific continues to attract global investors. The region's emphasis on innovation, coupled with its scale, ensures sustained leadership in both production and consumption. Export strength further cements Asia-Pacific's global dominance.

The dominance of Asia-Pacific also rests on its ability to adapt swiftly to sustainability mandates. Recycling technologies and circular economy initiatives are gaining traction, with regional players investing in eco-friendly Nylon 6 production. Growing collaborations between local firms and global majors are accelerating advancements. In addition, Asia-Pacific's massive e-commerce and packaging industry is spurring consistent demand for films and fibres. Rising middle-class income levels fuel fashion and lifestyle consumption, strengthening the textile segment. With its scale, cost efficiency, and adaptability, the Asia-Pacific region remains the powerhouse of Nylon 6.

Why Is North America the Fastest-Growing Region for the Nylon 6 Market?

North America is emerging as the fastest-growing market for Nylon 6, bolstered by innovation-driven economies and strong regulatory frameworks. The automotive industry in both regions is driving significant adoption, particularly in lightweight components for electric vehicles. Additionally, advanced packaging and industrial applications are gaining momentum, supported by a strong consumer base. The shift toward sustainable polymers aligns with both regional policies and consumer awareness. High R&D spending further amplifies product innovation and recycling capabilities. These regions are poised for accelerated growth in high-value applications.

Sustainability and high-performance applications are driving the growth trajectory of Nylon 6 in these regions. North America's regulatory focus on reducing plastic waste is fuelling demand for recyclable Nylon 6 solutions. Meanwhile, North America is witnessing increased applications in aerospace and electronics. Strong innovation ecosystems ensure continuous technological evolution in both production and application. Furthermore, collaborations between chemical giants and automotive leaders are fostering the development of next-generation Nylon 6 composites. The robust presence of global market leaders strengthens regional market dynamism. Collectively, these factors ensure North America and Europe remain high-growth markets.

Nylon 6 Market Companies

- BASF SE

- DuPont de Nemours, Inc.

- DSM Engineering Materials

- UBE Corporation

- Toray Industries, Inc.

- RadiciGroup

- Lanxess AG

- Domo Chemicals

- Invista (Koch Industries)

- Asahi Kasei Corporation

- Kolon Industries, Inc.

- Arkema S.A.

- Shenma Industrial Co., Ltd.

- Hyosung Corporation

- Aquafil S.p.A.

- Ascend Performance Materials

- EMS-Chemie Holding AG

- SABIC

- Toyobo Co., Ltd.

- AdvanSix Inc.

Recent Developments

- In September 2025, Samsara Eco, an Australian biotech company, launched its inaugural plant in Jerrabomberra, New South Wales, to produce low-carbon, virgin-quality recycled materials such as nylon 6,6 and polyester. The facility utilizes the company's enzymatic recycling technology, EosEco, which leverages AI-designed enzymes to break down mixed plastics into reusable raw materials. This innovation enables brands to incorporate sustainable materials into their products. The plant also features expanded enzyme production and AI-powered enzyme discovery capabilities, positioning Samsara Eco to develop recycling solutions for a wider range of plastics.(Source: https://www.ragtrader.com.au)

Segments Covered in the Report

By Product Form

- Fibers

- Staple fibers

- Filament yarns

- Industrial yarns

- Engineering plastics

- Compounded Nylon 6

- Unfilled Nylon 6

- Films

- Biaxially Oriented Nylon (BOPA) films

- Cast Nylon films

- Others

By Grade

- Standard grade

- Heat-stabilized grade

- Flame-retardant grade

- Reinforced grade

- Glass-fiber reinforced

- Mineral-filled reinforced

- Specialty grades (UV-stabilized, impact-modified, lubricated)

By Feedstock / Source

- Caprolactam-based Nylon 6

- Recycled Nylon 6

- Bio-based Nylon 6

By Processing Method

- Injection molding

- Extrusion

- Blow molding

- Compression molding

- Others

By Application

- Textiles & apparel

- Carpets & home furnishings

- Industrial yarns & tire cords

- Packaging films & sheets

- Automotive components

- Engine covers & under-the-hood parts

- Fuel system & air intake manifolds

- Electrical & electronic components

- Connectors

- Housings

- Switches

- Consumer goods

- Kitchenware

- Sports equipment

- Others

By End User Industry

- Automotive

- Electrical & electronics

- Packaging

- Textiles

- Consumer goods

- Industrial manufacturing

- Others

By Distribution Channel

- Direct sales (OEM supply, long-term contracts)

- Distributors & traders

- Online B2B platforms

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting