What is the Oil Condition Monitoring Market Size?

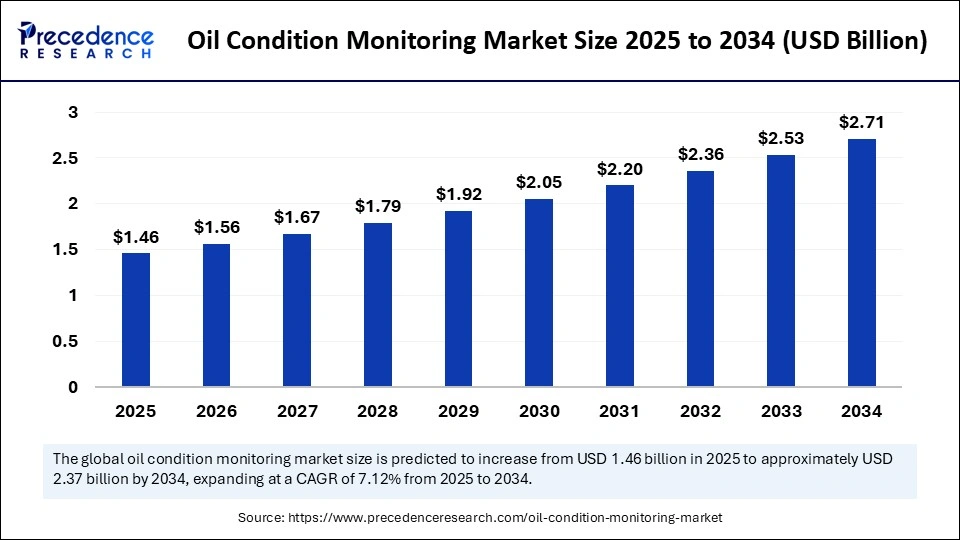

The global oil condition monitoring market size is calculated at USD 1.46 billion in 2025 and is predicted to increase from USD 1.56 billion in 2026 to approximately USD 2.71 billion by 2034, expanding at a CAGR of 7.12% from 2025 to 2034. This market is growing due to increasing emphasis on predictive maintenance and equipment reliability across industries.

Market Highlights

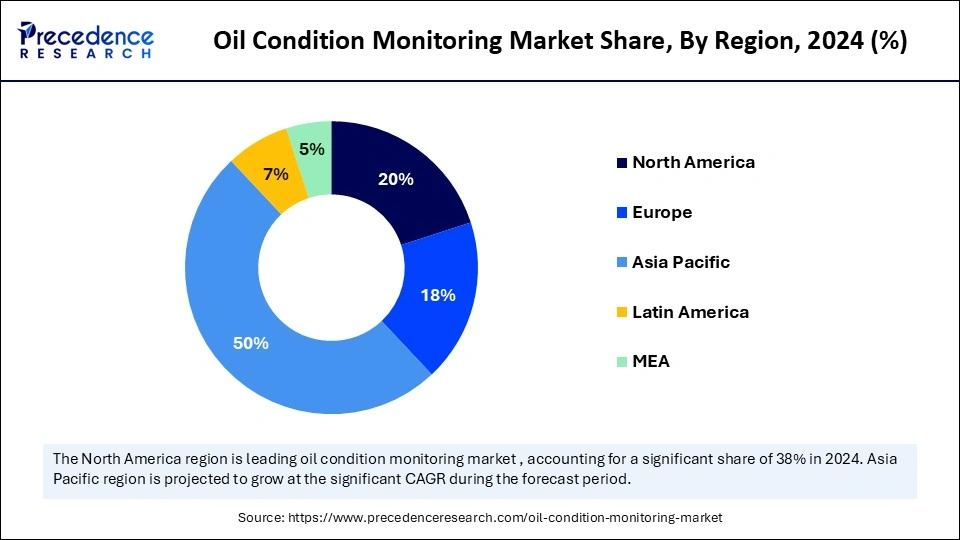

- Asia Pacific dominated the market, holding the largest market share of 50% in 2024.

- The North America is expected to grow at a notable CAGR from 2025 to 2034.

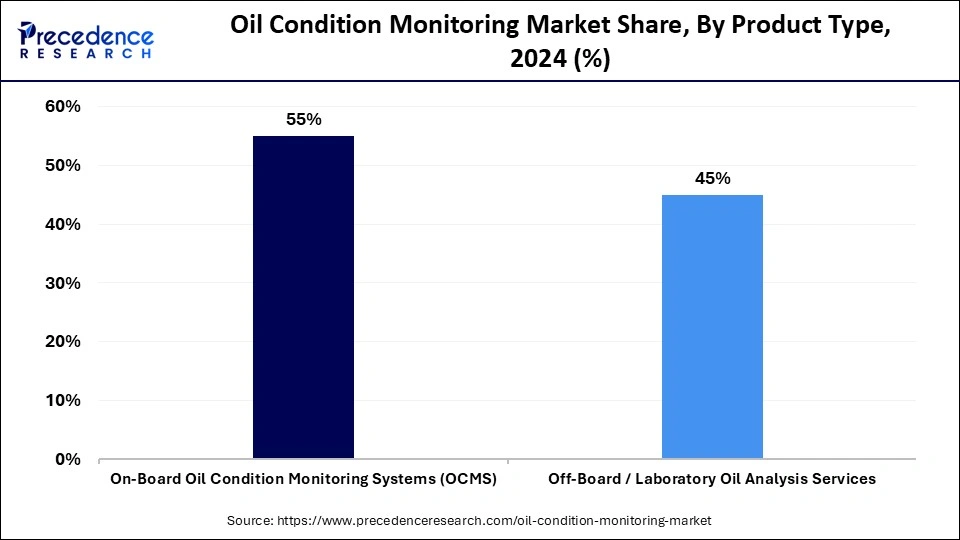

- By product type, the on-board oil condition monitoring systems segment held the major market share at 55% in 2024.

- By product type, the off-board/laboratory oil analysis services segment is growing at a strong CAGR from 2025 to 2034.

- By technology type, the viscosity and temperature sensors segment contributed the biggest share of the market at 30% in 2024.

- By technology type, the dielectric & conductivity sensors segment is expanding at a fastest CAGR from 2025 to 2034.

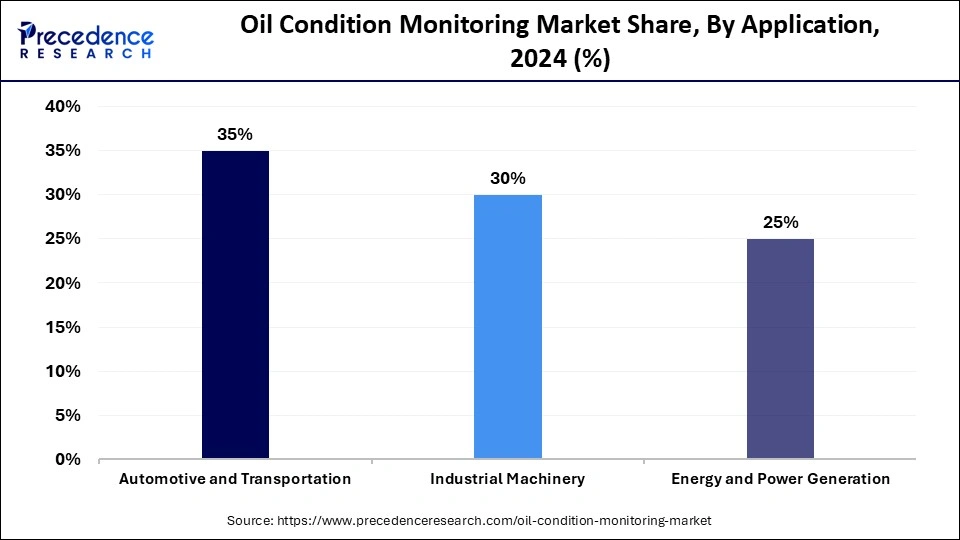

- By application, the automotive & transportation segment accounted for the highest market share of 35%.

- By application, the industrial machinery segment contributed the second largest market share of 30% in 2024.

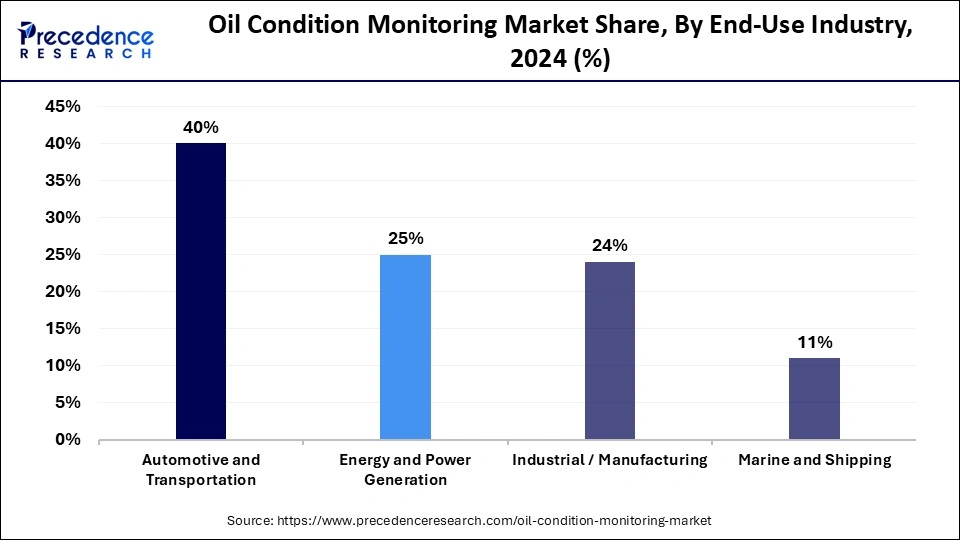

- By end-use industry, the automotive and transportation segment held the largest market share at 40% in 2024.

- By end-use industry, the energy & power generation segment is expected to grow at the fastest CAGR from 2025 to 2034.

Market Size and Forecast

- Market Size in 2025: USD 1.46 Billion

- Market Size in 2026: USD 1.56 Billion

- Forecasted Market Size by 2034: USD 2.71 Billion

- CAGR (2025-2034): 7.12%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

What Is Oil Condition Monitoring?

Oil condition monitoring is experiencing transformative growth because of the increasing demand for operational efficiency and predictive maintenance in sectors like manufacturing, power generation, automotive, and aerospace. Businesses are increasingly using data-driven maintenance techniques instead of reactive ones in an effort to increase machinery lifespan and reduce downtime. Furthermore, real-time monitoring and early fault detection capabilities have been improved by the use of IoT and AI technologies, which have further fueled market expansion.

Key Technological Shifts in the Oil Condition Monitoring Market

- Integration of IoT-enabled sensors for continuous, real-time oil quality and equipment health tracking.

- Adoption of artificial intelligence and machine learning algorithms to predict failures and optimize maintenance schedules.

- Use cloud-based analytics platforms for remote monitoring and centralized data management.

- Development of portable and automated oil testing devices for faster, on-site diagnostics.

Oil Condition MonitoringMarket Outlook

The oil condition monitoring market is growing rapidly due to sectors transitioning to intelligent asset management and predictive maintenance. Businesses can prolong the life of their machinery and avoid unplanned breakdowns by switching from traditional maintenance to real-time oil analysis. Manufacturers of power plants can now more easily monitor equipment remotely, thanks to the integration of IoT sensors and AI analytics, which increases productivity and lowers operating costs.

In this market, sustainability is becoming a major factor because oil condition monitoring lowers waste and promotes environmentally friendly operations. Businesses can reduce their environmental impact by prolonging lubricant life and minimizing oil disposal. To encourage more environmentally friendly maintenance procedures, many manufacturers are now concentrating on biodegradable sensor technologies and energy-efficient monitoring systems.

The startup ecosystem for oil condition monitoring is expanding with innovations in sensor design, data analytics, and cloud-based maintenance platforms. New companies are concentrating on creating portable, reasonably priced, and AI-enabled tools that assist industries in monitoring oil quantity in real time.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.46 Billion |

| Market Size in 2026 | USD 1.56 Billion |

| Market Size by 2034 | USD 2.71 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.12% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Technology Type, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Oil Condition Monitoring Market Segmental Insights

On-board/ in-line monitoring systems hold a dominating 55% oil condition monitoring market share since they can supply constant real-time data straight from equipment by monitoring lubricant health without interfering with operations. These systems enable prompt remedial actions and minimize unscheduled downtime. For sectors like heavy manufacturing, energy, and automotive, they are the go-to option because their integration with IoT platforms and predictive maintenance software guarantees precise real-time insights. Off-board/laboratory oil analysis services are experiencing rapid growth in the oil condition monitoring market, as industries increasingly rely on thorough testing to evaluate oil quality and identify potential equipment problems. These services offer profound insights into lubricant chemicals, contaminants, and wear particles that aren't always observable in real time. Strong growth in this market is being driven by the increasing use of condition-based maintenance techniques, improvements in portable lab equipment, and quicker turnaround times.

The viscosity & temperature sensors segment holds a dominating 30% market for oil condition monitoring because of their broad use in lubricant health monitoring and machinery operation. For predictive maintenance, especially in applications involving industrial and automotive machinery, these sensors offer vital real-time data. The dielectric and conductivity sensors segment is witnessing rapid growth as industries increasingly adopt advanced technologies to detect oil contamination, water content, and insulation degradation in real time. Their enhanced accuracy and seamless integration with IoT and AI analytics are driving strong demand across sectors such as energy, manufacturing, automotive, and aerospace. These sensors are becoming vital for predictive maintenance and process optimization, allowing operators to monitor critical parameters remotely and respond proactively to equipment faults. The incorporation of AI-driven data interpretation enables continuous learning and adaptive calibration, improving reliability and extending the lifespan of industrial assets.

The automotive & transportation segment is the market leader with a 35% share, caused by many automobiles and fleets that need constant observation to avoid engine failures and lower maintenance expenses. Well-established maintenance infrastructure and broad knowledge of the financial benefits of predictive monitoring and advantages in this market. In April 2024, Shell Lubricants India announced an upgraded portfolio of its Shell Advance Motorcycle oils, offering advanced performance and a superior riding experience to consumers. While this isn't a new launch of the LubeAnalyst service, it represents Shell's continuous innovation within its core lubricants business, which directly supports the automotive and transportation segment's maintenance needs and adoption of oil condition monitoring. The industrial machinery segment is the fastest-growing in the oil condition monitoring sector for 2024, driven by the expansion of heavy industries and large-scale manufacturing facilities. The increasing use of predictive maintenance techniques, relying heavily on oil condition monitoring to assess lubricant health, contamination levels, and wear patterns, is enabling companies to maximize productivity and equipment uptime. High-value machinery in sectors such as mining, power generation, and metal processing demands constant monitoring to prevent costly breakdowns and ensure operational continuity.

The automotive & transportation segment is the market leader with a 40% share of the oil condition monitoring space due to the critical need for regular lubricant monitoring to ensure vehicle performance and safety. The segment is supported by strong aftermarket services, high fleet density, and regulatory compliance requirements. Ongoing technological improvements in sensor accuracy and connectivity continue to strengthen this segment's dominant position. The energy and power generation segment is the fastest-growing in the oil condition monitoring industry because of the critical need to maintain oil efficiency and prevent costly equipment failures. Power plants, both conventional and renewable, rely on high-value turbines, compressors, and generators that demand consistent lubricant performance to ensure uninterrupted operation. As hybrid and renewable energy infrastructures expand, the complexity of mechanical systems increases, further amplifying the need for dependable and real-time lubricant monitoring systems. Advanced oil condition monitoring solutions help detect early signs of wear, contamination, and oxidation, enabling predictive maintenance and reducing downtime risks.Product Type Insights

Technology Type Insights

Application Insights

End Use Industry Insights

Oil Condition Monitoring MarketRegional Insights

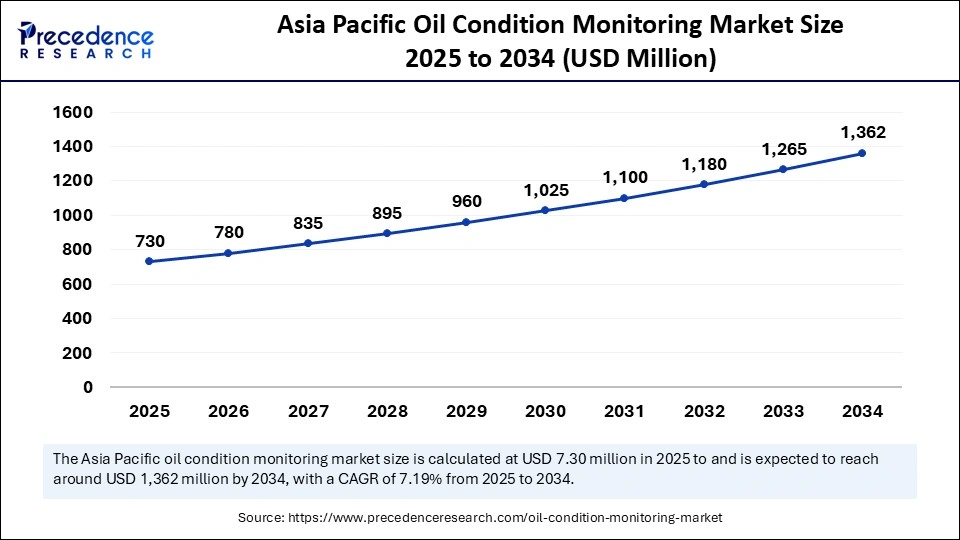

The Asia Pacific oil condition monitoring market size is exhibited at USD 730 million in 2025 and is projected to be worth around USD 1,362 million by 2034, growing at a CAGR of 7.19% from 2025 to 2034.

What Made Asia Pacific Dominate the Oil Condition Monitoring Market in 2024?

The Asia Pacific region dominated the oil condition monitoring market in 2024, securing 50% market share, driven by growing manufacturing sectors and quick industrialization have boosted the use of monitoring technologies. The growth is also being aided by robust government initiatives to modernize industrial infrastructure and adopt digital maintenance practices. Businesses' growing consciousness of the need to improve equipment lifespan and minimize operational downtime strengthens this dominant position.

How Is India Faring in the Oil Condition Monitoring Market?

India remains the largest market for the oil condition monitoring market, propelled by industrial and manufacturing companies' growing awareness of condition-based monitoring and predictive maintenance. These services give businesses comprehensive information about contaminants, wear particles, and oil quality, which helps them plan maintenance more effectively and extend the life of their equipment.

North America is the fastest-growing region, driven by rising investments in smart maintenance systems, Industry 4.0 techniques, and the need to cut down on unscheduled downtime in the transportation and industrial sectors. New growth prospects are being created by the growing use of predictive analytics tools and connected machinery.

Why Is the United States Leading North America in the Oil Condition Monitoring Market?

The U.S. is witnessing growth in the oil condition monitoring market because it has been widely adopted in the industrial automotive and energy sectors, as these systems offer constant real-time data that operators can identify problems early and minimize unscheduled downtime. These systems are very effective, dependable, and popular in American industries that place a high value on equipment longevity and operational efficiency.

Oil Condition Monitoring Market Companies

Parker Hannifin is a global leader in motion and control technologies, offering advanced oil condition monitoring and filtration systems. Its real-time sensors detect contaminants, oxidation, and water ingress to ensure lubricant integrity and extended equipment life. By integrating data analytics and IoT connectivity, Parker enables predictive maintenance and energy-efficient operations across industrial and mobile sectors.

Schaeffler AG provides intelligent condition monitoring solutions that combine oil quality sensors with bearing diagnostics for rotating machinery. Its SmartCheck and Optime systems measure parameters such as wear particles and viscosity to prevent mechanical failures. Schaeffler’s predictive maintenance technologies help optimize machine uptime and reduce maintenance costs in industrial applications.

ifm electronic GmbH specializes in oil quality sensors and real-time condition monitoring solutions for industrial automation. Its systems analyze dielectric constant, conductivity, and temperature to assess lubricant health. The company’s focus on digital integration enables continuous monitoring and optimized lubrication management in critical machinery.

Eaton provides fluid cleanliness and hydraulic monitoring systems that enhance reliability and operational efficiency. Its oil analysis technologies detect oxidation, contamination, and wear metals, helping industries reduce downtime. Eaton’s smart sensors and filtration solutions are widely used in aerospace, energy, and heavy equipment sectors.

Emerson Electric delivers AI-driven oil condition monitoring solutions as part of its Plantweb™ digital ecosystem. Its sensors and analytical tools detect contamination, oxidation, and degradation, supporting predictive maintenance strategies. Emerson’s integration of IIoT technologies helps industries improve asset reliability and reduce unplanned outages.

SKF offers oil condition monitoring combined with bearing health diagnostics through its Enlight and RecondOil platforms. Its systems enable oil reconditioning and continuous analysis, supporting sustainable and cost-efficient operations.

Spectro Scientific, part of AMETEK, provides portable and laboratory oil analysis instruments such as FluidScan and MiniLab. These tools detect wear metals, contaminants, and viscosity changes for rapid, on-site maintenance decisions.

Intertek provides laboratory oil analysis and field testing services for monitoring lubricant degradation and contamination. Its global expertise supports predictive maintenance across industrial, marine, and energy applications.

Other Companies in the Oil Condition Monitoring Market

- SGS SA: SGS offers oil condition monitoring and fluid testing to evaluate contamination, additive depletion, and oxidation. Its global network delivers fast, data-driven insights to optimize maintenance programs.

- Bureau Veritas SA: Bureau Veritas provides comprehensive lubricant analysis and diagnostics for equipment reliability and preventive maintenance. Its services help clients identify early wear and contamination in critical assets.

- ALS Limited: ALS Limited specializes in oil, fuel, and coolant analysis for predictive maintenance, using advanced spectroscopic techniques to detect oxidation and metal wear.

- Techenomics International: Techenomics delivers oil and fluid analysis for mining, marine, and industrial sectors. Its customized testing improves maintenance planning and equipment reliability.

- TestOil (Insight Services Inc.): TestOil offers expert laboratory oil analysis, data interpretation, and maintenance consultation. Its diagnostics help industries identify early signs of wear and optimize lubrication schedules.

- C.C. Jensen A/S: C.C. Jensen manufactures oil filtration and monitoring systems that maintain fluid cleanliness and prevent water contamination. Its offline filtration units extend oil and component service life.

- General Electric Company: GE integrates oil condition monitoring into its Industrial Internet of Things (IIoT) platform, Predix, combining lubricant data with predictive analytics for proactive asset management.

- Exxon Mobil Corporation: ExxonMobil's Mobil Serv Lubricant Analysis uses AI-based diagnostics to assess oil degradation and contamination, enabling predictive maintenance and longer equipment uptime.

- Chevron Corporation: Chevron's Lubewatch program provides in-depth analysis of lubricant condition, contamination, and metal wear. Its reports support data-driven maintenance decisions for fleet and industrial operations.

- Shell plc: Shell's LubeAnalyst service monitors lubricant degradation and contamination to improve machinery reliability. Its digital reporting tools help optimize oil change intervals and reduce downtime.

- TotalEnergies SE: TotalEnergies' ANAC oil analysis program assesses lubricant performance and wear trends to prevent failures and extend maintenance intervals in transport and industrial applications.

- BP plc (Castrol): BP's Castrol Labcheck provides detailed oil condition reports analyzing contamination, oxidation, and wear. Its predictive approach supports efficiency and equipment longevity across industries.

Recent Developments

- In August 2024, SKF announced its acquisition of John Sample Group's Lubrication and Flow Management businesses. This strategic move expands SKF's offerings and its business operations in India and Southeast Asia (ISEA) regions. By acquiring JSG, which provides lubrication management systems and services, SKF can further help its customers avoid premature bearing failures, a key focus area for the company. (Source: https://www.skf.com)

- In February 2024, Tan Delta Systems launched its SENSE-2 oil condition monitoring kit. The kit uses a sensor to provide continuous, real-time data on oil quality. This helps optimize maintenance schedules and reduces operating costs by ensuring that oil is only changed when it has reached the end of its useful life, rather than based on a fixed time schedule.

Oil Condition Monitoring Market Segments Covered in the Report

By Technology Type

- Viscosity & Temperature Sensors

- Capillary Viscometers

- Thermal Sensors

- Spectrometric Sensors

- Atomic Emission Spectroscopy (AES)

- Inductively Coupled Plasma (ICP)

- Dielectric & Conductivity Sensors

- Permittivity Measurement

- Conductivity Sensors

- Wear Debris / Particle Counters

- Ferrography

- Optical Particle Counters

- Other Emerging Sensors

- Ultrasonic Sensors

- Acoustic Emission Sensors

By Application

- Automotive & Transportation

- Passenger Vehicles

- Commercial Trucks

- Rail Engines

- Industrial Machinery

- Manufacturing Equipment

- Hydraulic Systems

- Compressors & Turbines

- Energy & Power Generation

- Gas Turbines

- Wind Turbines

- Hydroelectric Plants

- Marine & Shipping

- Shipping Engines

- Offshore Platforms

By End-Use Industry

- Automotive and Transportation

- Energy and Power Generation

- Industrial/Manufacturing

- Marine & Shipping

By Region

- Asia Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting