What is the Online Gambling Market Size in 2026?

The global online gambling market size was calculated at USD 88.04 billion in 2025 and is predicted to increase from USD 97.94 billion in 2026 to approximately USD 255.44 billion by 2035, expanding at a CAGR of 11.24% from 2026 to 2035.The online gambling market is driven by increasing smartphone usage, high-speed internet access, and the convenience of digital payment systems.

Market Highlights

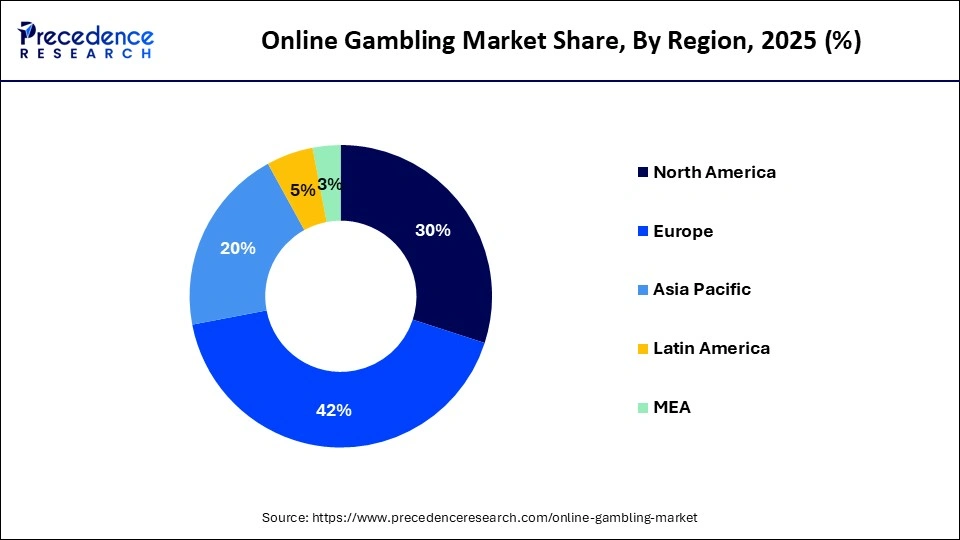

- Europe dominated the market, holding the largest market share of 42% in 2025.

- North America is expected to expand at the fastest CAGR of 11.5% in the market between 2026 and 2035.

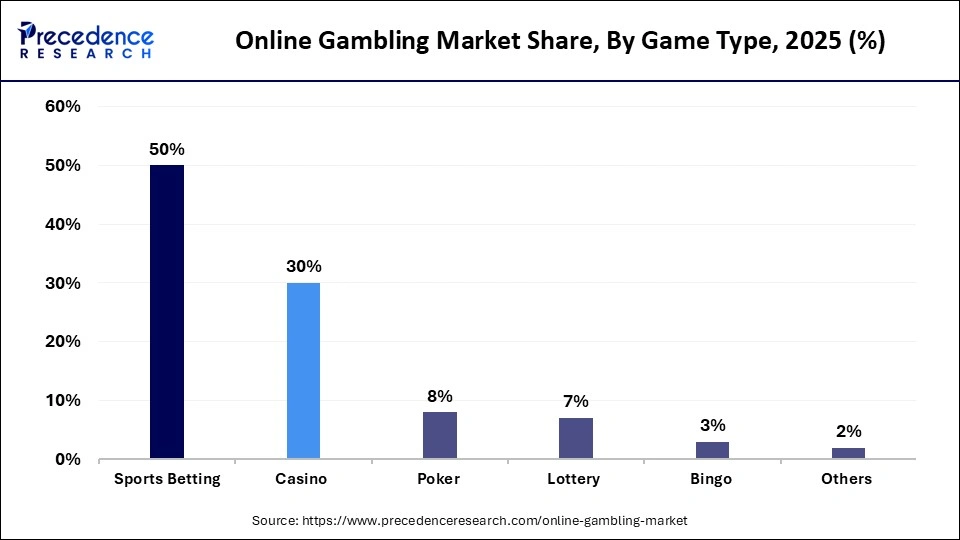

- By game type, the sports betting segment held the largest market share of 50% in 2025.

- By game type, the casino segment is expected to grow at a remarkable CAGR of 10.4% between 2026 and 2035.

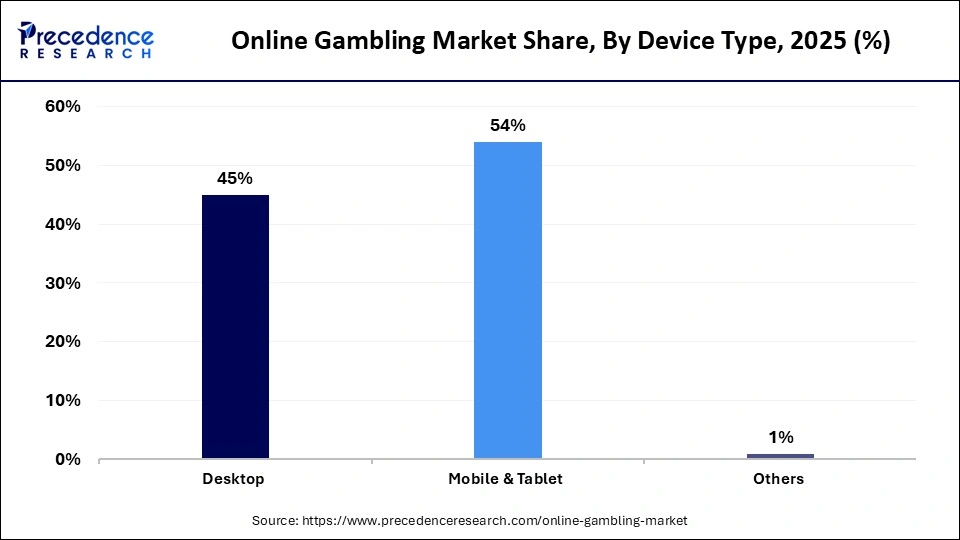

- By device type, the desktop segment held the largest market share of 45% in 2025.

- By device type, the mobile & tablet segment is expected to grow at a remarkable CAGR of 10.7% between 2026 and 2035.

Smart Platforms & Market Expansion: The Evolution of the Online Gambling Industry

The online gambling industry involves online betting and gambling services as well as internet-based gambling services such as sports betting, online casinos, poker, lottery, bingo, and other internet-based games involving the use of computers, smartphones, and other digital gadgets with an internet connection. Moreover, the legalization and regulation of online gambling in various countries have increased the number of users that can be addressed and consumer confidence. The key element is sustained innovation, where the operators are using their artificial intelligence, data analytics, live streaming, and cloud technologies to enhance the engagement of the players, fraud detection, and responsible gaming. The sports betting segment is the most predominant one since there is high fan involvement and regular sporting events around the globe, but the betting through online casinos and mobile platforms is registering the highest growth rates.

Key AI Integration in the Online Gambling Market

The integration of artificial intelligence is revolutionary in the online gambling market because it enhances the degree of user experience, working performance, and data security. One of the most visible personalized player engagements is personalized game recommendations, bonuses, and offers made through the use of AI to analyze user behavior, betting patterns, and preferences and make individualized game recommendations. Risk management of machine learning models detects anomaly transactions in real time to determine fraudulent transactions, money laundering, and account abuse. Also, predictive analytics assists operators in optimizing odds setting and liquidity management, as well as demand predictions in the case of major sporting events.

Online Gambling Market Trends

- The market is being dominated by mobile gambling, with players having more and more inclination towards using convenient platforms based on apps rather than using desktop-based platforms.

- In-play and live betting is an emerging phenomenon that is spreading quickly due to the immediacy of involvement and immediate access to the results.

- With the help of artificial intelligence and data analytics, it is possible to promote responsible individuals and games and enhance fraud detection.

- The use of cryptocurrencies and digital wallets is becoming more widespread in terms of making online gambling transactions faster, more secure, and anonymous all over the world.

- The legalization of its use in various countries is dealing a blow to the worldwide frontiers of users, investments, and competitive markets.

- Esports betting is also becoming a niche with a high growth potential, and it is gaining new audiences and gaming communities relying on technology all over the world.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 88.04 Billion |

| Market Size in 2026 | USD 97.94 Billion |

| Market Size by 2035 | USD 255.44 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.24% |

| Dominating Region | Europe |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Game Type, Device Type and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Game Type Insights

Why Did the Sports Betting Segment Hold a 50% Share in 2025?

In 2025, the sports betting segment commanded a 50% market share in the online gambling market. Most people love to bet on popular events like football leagues, cricket tournaments, basketball championships, international events, and so on; therefore, betting is a year-round activity. The emergence of in-play betting and live betting increased the involvement to a great extent, as users could bet throughout the matches, and this increased the number of transactions. Also, the collaboration with professional sports teams and with betting platforms increased brand awareness and credibility. The user experience was further reinforced by such advanced features as real-time statistics, cash-out, and AI-based odds optimization. The high rates of participation were also caused by the widespread legalization of sports betting in various countries, particularly in North America and in parts of Europe.

The casino segment is set to grow at a 10.4% CAGR and proved to be the most dynamic segment because of the fast technological advancement and the growing diversity of games. Live dealer games and the use of high-definition streaming and interactive interfaces make online casinos offer real-life experiences with the simulation of physical casinos. New slot formats, jackpots, and skill games are being introduced continuously, which attracts the casual and experienced players. Accessibility has also been increased by mobile compatibility, which allows users to play anywhere without regard to location. Personalization based on AI and blockchain transparency has increased trust and the level of engagement. The increased acceptance of digital entertainment amongst the younger demographics also helped in an increase in casino participation.

Device Type Insights

Why Did the Desktop Segment Lead the Online Gambling Market in 2025?

The desktop segment led the market while holding a 45% share in 2025, because it has the best user interface and processing power. A large number of professional and high-frequency bettors tend to utilize desktop platforms where they are able to get detailed analytics, multiple betting windows, and have a stronger visualization. Desktop systems are more stable when a betting session lasts longer, and playing a casino game is complicated, like live dealer games, which need continuous streaming to maintain the quality. Moreover, corporate and institutional punters tend to use desktops to have better control over their security and the management of their data. In new markets, desktops still have a significant gaming cafe and communal work setting and help propagate their consumption. The desktop platforms attract brand loyalty because of familiarity and account history, as well as among established users.

The mobile & tablet segment is projected to grow at a significant CAGR of 10.7% over the forecast period. Phones can be accessed online through smartphones, and they have become the main digital device in terms of entertainment, payments, and real-time communications, which is why smartphones are the best solutions in online gambling. Betting can be done quickly and without interruptions through the provision of better network connectivity, 5G, and lightweight mobile applications. The young users are highly attracted by mobile platforms because they are flexible and easy to use. Features such as push notification, biometric authentication, and instant messaging make things more convenient and secure. With smartphones penetrating at high rates in the emerging economies, mobile and tablet devices are likely to surpass desktops to become the major access device to online gambling across the world.

Regional Insights

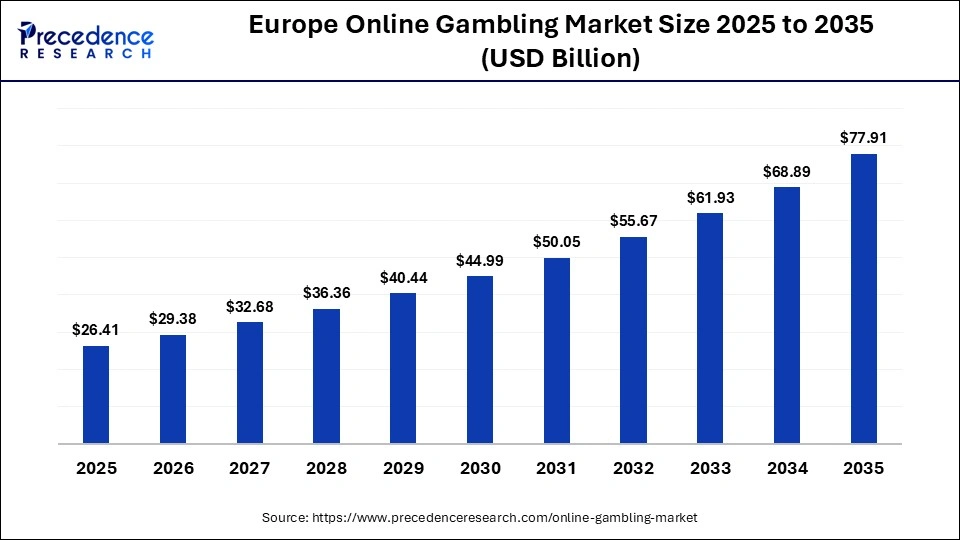

What is the Europe Online Gambling Market Size and Growth Rate?

The Europe online gambling market size has grown strongly in recent years. It will grow from USD 26.41 billion in 2025 to USD 77.91 billion in 2035, expanding at a compound annual growth rate (CAGR) of 11.42 % between 2026 and 2035.

Why Did Europe Lead the Global Online Gambling Market in 2025?

In 2025, Europe was the largest market with a 42% share of the online gambling market because the region has a mature regulatory framework and adopted digital betting platforms early. The UK, Italy, Spain, France, and Germany are some of the countries that have set up extensive licensing schemes to facilitate online casinos, sports betting, and live dealer games. Availability of high-speed internet and prevalence of smartphones also increased the participation of users across demographics. European operators have also undertaken a large investment in new technologies, such as AI-based personalization, live streaming, and data-driven odds management, enhanced engagement, and retention. The introduction was the use of cryptocurrency payments and safe digital wallets, thus making transactions more convenient. The responsible gambling and consumer protection ensured by strict control of such agencies as the European Gaming and Betting Association (EGBA) and governments can help to increase confidence in society.

UK Online Gambling Market Analysis

The UK remains among the most decisive markets in the online gambling ecosystem in Europe, with a well-regulated atmosphere under the UK Gambling Commission. The internet penetration in the market is good, customers are tech-savvy, and there is a well-established betting culture, particularly sports betting. The competitive environment is dominated by such giant players as Bet365, Flutter Entertainment, and Entain, which provide mobile-focused services, real-time betting, and a wide range of games. The UK is the pioneer in responsible gambling with strict standards of advertising and identity checks, as well as safeguarding the players. The regular introduction of new technology in the security of payments, artificial intelligence, and mobile apps has improved the reliability of the platforms and customer satisfaction.

How Big is the North America Online Gambling Market Size?

The North America online gambling market size is estimated at USD 36.98 billion in 2025 and is projected to reach approximately USD 108.96 billion by 2035, with a 11.37% CAGR from 2026 to 2035.

Why Is North America Undergoing the Fastest Growth in the Online Gambling Market?

The North America region is experiencing the most rapid growth in the world's online gambling market, with a 11.5% CAGR. The legalization of online sports betting and iGaming in several states in the U.S. and the Canadian provinces has greatly expanded the pool of legal consumers. The area also enjoys a high level of digital infrastructure, the presence of a high level of smartphone users, and mobile payment systems. Regional revenues are dominated by sports betting, which is backed by the usage of high-profile partnerships between gambling operators and large leagues (NFL, NBA, and NHL). The operators are spending a lot of money on AI-powered platforms, real-time analytics, and cybersecurity in order to improve performance and compliance. This regulatory advancement, technology adoption, and good sports culture remain the same reasons that make North America the most rapidly growing online gambling region in the world.

What is the Size of the U.S. Online Gambling Market?

The U.S. online gambling market size is calculated at USD 27.73 billion in 2025 and is expected to reach nearly USD 81.96 billion in 2035, accelerating at a strong CAGR of 11.45 % between 2026 and 2035.

U.S. Online Gambling Market Trends

The U.S. online gambling space has been marked by a robust growth in 2024, with the legalization of gambling by states, the growing use of smartphones, and enhanced technologies on the platforms. New York, Ohio, New Jersey, and Pennsylvania were some of the states that led to an increase in revenue after the legalization of sports betting and online casino gaming. The application of mobile betting is currently in control of user accessibility, and it provides easy registration, immediate deposits, and live betting. DraftKings and FanDuel are among the operators that are still growing their businesses by entering into agreements with sports franchises, broadcasters, and media companies to build strong brands. With more states endorsing regulated gambling systems, the American market will continue on a favorable trend and will continue to be a significant source of revenue in the world.

What is the Asia Pacific Online Gambling Market Size?

The Asia Pacific online gambling market size is expected to be worth USD 15.96 billion by 2035, increasing from USD 5.28 billion by 2025, growing at a CAGR of 11.7 % from 2026 to 2035.

Why Is the Asia-Pacific Online Gambling Market Experiencing Notable Growth?

The Asia-Pacific online gambling market, which has a share of 20%, is recording an amazing expansion as digital connectivity is catching up and the changing consumer lifestyles are transforming. The other most influential ones are China, India, Japan, and Australia, as they are now more concerned with sports betting, esports wagering, and online casino products. The increased disposable incomes and the youthful and technologically driven populations offer additional support to the development of the market. The use of cryptocurrency and mobile-first gaming platforms has enhanced accessibility in those areas where the banking system is minimal.

China Online Gambling Market Trends

The Chinese online gambling market has been a dominant force in Asia-Pacific despite the tight legal regulations on gambling. Domestic online gambling is illegal, but it is played by millions of customers using offshore betting programs and underground internet casinos. The booming esports betting, live-stream casino games, and mobile gambling apps market has made younger audiences interested. The widespread use of cryptocurrency and VPN technologies allows bypassing regulatory restrictions to make transactions anonymous and cross-border gambling. Though the Chinese government is still intensifying the search for cybersecurity laws and fighting the illegal producers, the implementation difficulties are not going to be overcome because of the high demand in the digital world. Betting is still promoted by the popularity of sports events and competitive gaming.

Who are the Major Players in the Global Online Gambling Market?

The major players in the online gambling market include Flutter Entertainment plc, Bet365 Group Ltd., Entain plc, DraftKings Inc., 888 Holdings / Evoke plc, Betsson AB, MGM Resorts International/BetMGM, Caesars Entertainment Corporation, Kindred Group plc, William Hill plc, Super Group (SGHC Limited), 22bet, LeoVegas AB, Penn National Gaming/Barstool Sportsbook, Rush Street Interactive.

Recent Developments

- In July 2025, Evolution reached a non-competition deal with Hasbro to produce online casino games around the brands Monopoly, Clue, and Battleship. The deal puts Evolution in a position to have diverse branded content and strengthens its lead position in live casino gaming.(Source:https://www.evolution.com)

- In April 2025, Caesars announced that it would first launch the Triple Coin Treasures slot family on its online casinos in a collaboration with AGS. This created Caesars as the sole online destination of these games in various states, such as New Jersey and Pennsylvania, in the United States.(Source:https://newsroom.caesars.com)

- In February 2024, Betsson AB also bought Holland Gaming Technology Ltd. at EUR27.5 million as part of a strategy to expand operations in the Dutch online gambling sector. The acquisition created a proprietary gaming platform and user base, which is useful in further expansion strategies of Betsson throughout Europe.

Segments Covered in the Report

By Game Type

- Sports Betting

- Casino

- Poker

- Lottery

- Bingo

- Others

By Device Type

- Desktop

- Mobile & Tablet

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting