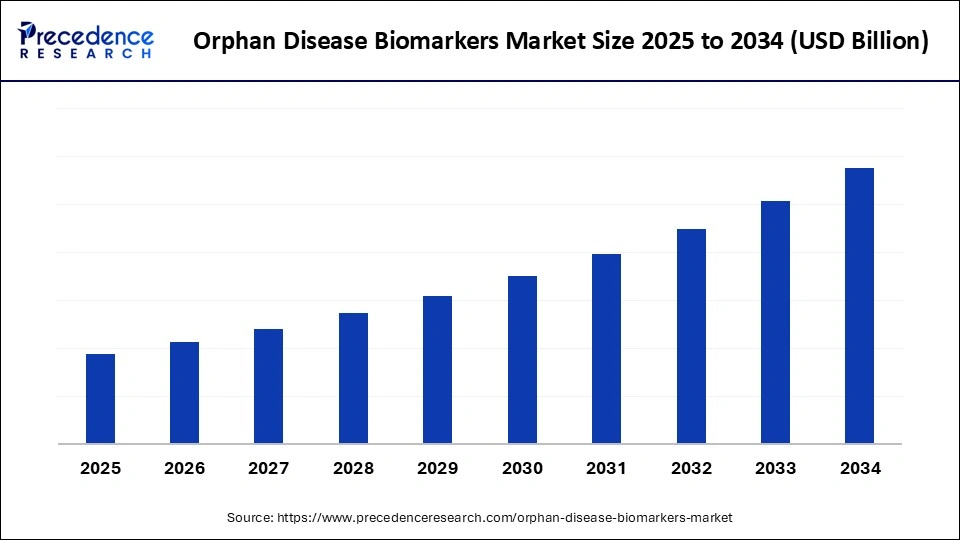

Orphan Disease Biomarkers Market Size and Forecast 2025 to 2034

The orphan disease biomarkers market is witnessing strong growth as healthcare systems focus on early detection of rare diseases. Biomarkers help accelerate diagnosis and enable targeted therapies. The market is growing due to the rising demand for early and precise diagnostic tools that support the development of targeted therapies for rare diseases.

Orphan Disease Biomarkers Market Key Takeaways

- North America dominated the orphan disease biomarkers market the largest market share of 40% in 2024.

- Asia Pacific is expected to grow at a notable CAGR during the forecast period.

- By disease type, the genetic disorders segment held the biggest market share of 35% in 2024.

- By disease type, the neurological disorders segment is expected to grow at the fastest CAGR during the forecast period.

- By biomarker type, the genetic biomarkers segment captured the highest market share of 30% in 2024.

- By biomarker type, the epigenetic biomarkers segment is expected to grow at the fastest CAGR during the forecast period.

- By application, the diagnostics segment contributed the maximum market share of 40% in 2024.

- By application, the personalized medicine segment is expected to grow at the fastest CAGR during the forecast period.

- By technology, the next-generation sequencing segment accounted for the considerable market share of 45% in 2024.

- By technology, the PCR-based technology segment is observed to grow at the fastest CAGR during the forecast period.

- By end-user, the pharmaceutical & biotech companies segment generated the major market share of 50% in 2024.

- By end-user, the research & academic institutions segment is expected to grow at the fastest CAGR during the forecast period.

Market Overview

Why is the orphan disease biomarkers market witnessing strong growth worldwide?

Increased awareness of rare diseases, increased funding for biomarker research, and changing regulatory environments that support early diagnosis and tailored treatments are all contributing to the orphan disease biomarkers market's strong global expansion. Biomarkers are increasingly being incorporated into clinical trials and therapeutic development pipelines supported by developments in molecular diagnostics and AI-powered biomarker discovery platforms. The development and commercialization of novel biomarkers that are transforming early diagnosis, patient stratification, and treatment monitoring for rare conditions are being accelerated by collaborative efforts involving biotech companies, nonprofits, and pharmaceutical companies, as well as targeted funding and government incentives.

- On 23 June 2025, Jaguar Health, Inc. shared positive updates on its orphan disease program for crofelemer, noting that early proof-of-concept data show reductions of up to 27% in total parenteral nutrition needs among pediatric patients with microvillus inclusion disease, as enrollment continues in Phase 2 trials

(Source: https://www.newswire.com)

How is AI transforming the Orphan Disease Biomarkers Market?

The marker for orphan disease biomarkers is changing because of AI's ability to quickly and accurately identify and validate new biomarkers using sophisticated data analytics. By utilizing extensive multi-omics imaging and clinical datasets, these AI-powered platforms expedite the development of orphan drugs and streamline the process of finding biomarkers. AI especially helps with patient stratification, detecting subtle disease signals, enhancing diagnostic precision, and tracking treatment outcomes for uncommon conditions.

- In November 2024, Healx announced a collaboration with Sanofi to use its AI-driven drug discovery platform, Healnet, to identify new rare disease indications for a discontinued Sanofi compound. This illustrates how AI platforms are expanding biomarker-driven drug development efforts in the orphan disease space.

(Source: https://www.businesswire.com)

Orphan Disease Biomarkers Market Growth Factors

- Rising Prevalence of Rare Diseases: Growing patient populations with rare conditions are boosting demand for biomarkers that enable earlier detection and accurate diagnosis.

- Advancements in Genomics & Molecular Diagnostics: Progress in sequencing and omics technologies is accelerating biomarker discovery and supporting personalized therapies.

- Supportive Regulatory Incentives: Orphan drug designations, tax credits, and grants encourage companies to invest in biomarker R&D for rare diseases.

- AI and Big Data Integration: AI-powered platforms analyze complex datasets to identify novel biomarkers, enhance diagnosis, and improve trial efficiency

- Increasing Pharma & Biotech Investments: Rising R&D spending and collaborations between pharma, biotech, and academia are fueling innovation in biomarker development.

- Patient Advocacy & Funding Support: Advocacy groups and non-profits are raising awareness and funding, driving momentum for rare disease biomarker research.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Disease Type, Biomarker Type, Application, Technology, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Unmet Medical Needs

With over 7,000 rare diseases still lacking effective treatment, there's intense demand for biomarkers that facilitate early and accurate diagnosis, guide therapeutic development, and enable better patient management. Rare diseases are often misdiagnosed or diagnosed late due to overlapping symptoms and a lack of awareness, which increases the need for robust biomarkers. Early detection using validated biomarkers not only reduces disease burden but also improves patient quality of life by allowing timely therapeutic intervention. Additionally, healthcare providers are relying more on biomarker-based approaches to personalize care for complex rare disease cases, allowing for growth in the orphan disease biomarkers market.

- In December 2024, Exegenesis Bio announced that the FDA granted Orphan Drug Designation to EXG110, a novel one-time gene therapy for Fabry disease, underlining the critical need for innovative treatments and related biomarker development.(Source: https://www.businesswire.com)

Growing Orphan Drug Development Pipelines

Biomarkers are essential to effective drug development strategies in this field because of the rise in orphan drug research and development and the corresponding increase in demand for them to guide patient selection, track efficacy, and support regulatory filings. Rare diseases are becoming a top priority for many pharmaceutical and biotech companies due to their high unmet needs and alluring incentives, which are creating a larger and more valid drug pipeline. Regulators are requiring more biomarker-supported data and medications to enter clinical trials to guarantee safety and effectiveness in small patient groups. Thus, the incorporation of biomarkers is increasingly becoming a prerequisite for reimbursement plans and orphan disease biomarkers market approvals.

- In July 2025, Precision BioSciences revealed that the FDA granted Orphan Drug Designation to PBGENE-DMD, a gene-editing therapy for Duchenne muscular dystrophy, signaling how new therapies drive biomarker needs.(Source: https://in.investing.com)

Restraints

High Development Costs & Limited Funding

Developing biomarkers for rare diseases is highly resource-intensive, requiring advanced technologies, large datasets, and extensive validation studies. Since patient populations are small, the return on investment for companies can be uncertain, which often discourages funding. The high costs of clinical trials, coupled with limited venture capital focused on rare conditions, add to the challenge. Smaller biotechs face significant financial strain when balancing biomarker development with therapeutic pipelines.

Limited Patient Populations

Rare diseases, by definition, have very small patient pools, which makes it difficult to obtain enough patient samples for biomarker validation studies. Because of this, achieving statistical significance is challenging, which slows down the development and regulatory approval. Longitudinal studies and patient recruitment are made more difficult by geographic dispersion. In sufficient cohorts prevent many promising biomarkers are prevented from moving from research to clinical application, and restrictions in the orphan disease biomarkers market.

Opportunities

Expansion of Precision Medicine in Rare Diseases

Biomarkers are becoming essential for selecting treatments tailored to rare disease subtypes, tracking progression, and stratifying patients as healthcare moves toward personalized care. With this accuracy, unnecessary treatments can be reduced, and more focused intervention plans can be created. Biomarkers can be easily incorporated into standard clinical practice thanks to new developments in molecular profiling and genomic sequencing. Due to its alignment with personalized medicine, rare disease diagnostics is a significant investment and innovation.

- In June 2025, Variant Bio launched its next-generation precision medicine platform using population genomics to accelerate biomarker discovery in rare diseases.(Source: https://www.nih.gov)

Increasing Government & Nonprofit Support

Governments and nonprofits are ramping up funding for biomarker research in rare diseases via initiatives like grants, tax benefits, and policy incentives. These resources help bridge funding gaps for expensive early-stage research. Simultaneously, patient advocacy groups are creating registries and networks to support streamlined recruitment and data collection, fueling public-private collaboration and accelerating translation from discovery to clinics.

- In February 2025, the National Institutes of Health (NIH) announced a funding opportunity supporting Rare Diseases Clinical Research Consortia (RDCRC) that emphasize biomarker-driven diagnostics and clinical trial readiness.(Source: https://grants.nih.gov)

Disease Type Insights

Why Did the Genetic Disorders Segment Dominate the Orphan Disease Biomarkers Market in 2024?

The genetic disorders segment dominates the orphan disease biomarkers market in 2024, owing to most rare conditions stem from inherited mutations that require advanced molecular testing for accurate diagnosis. Biomarkers play a critical role in detecting disease-causing variants, predicting onset, and guiding targeted therapies. With increasing adoption of genomic sequencing and greater availability of genetic testing panels, this segment continues to capture the largest share.

The neurological disorders segment is growing rapidly, propelled by an increase in the prevalence of uncommon neurodegenerative diseases like Huntington's disease, ALS, and uncommon pediatric syndromes. Biomarkers are being used to monitor therapeutic responses, track the course of diseases, and support precision medicine in the field of neurology. In this market, the adoption of biomarkers is further accelerated by growing R&D pipelines for orphan neurological medications.

Biomarker Type Insights

Why Did the Genetic Biomarkers Segment Dominate the Orphan Disease Biomarkers Market in 2024?

Genetic biomarkers hold the largest share of the orphan disease biomarkers market as they provide reliable insights into disease mechanisms and hereditary risks, making them crucial for early diagnosis and therapy development. Widely adopted in clinical trials and diagnostic testing, genetic biomarkers form the backbone of personalized medicine approaches for orphan diseases. Their high reproducibility and integration into companions have cemented their dominance.

The epigenetic biomarkers segment is growing rapidly, driven by an increasing body of research on the effects of changes in gene expression on the onset and course of rare diseases. By identifying reversible changes, these biomarkers offer extra levels of precision and present opportunities for both new therapeutic targets and diagnostics. The search for new epigenetic biomarkers is accelerating due to developments in bioinformatics and sequencing.

Application Insights

Why Did the Diagnostics Segment Dominate the Orphan Disease Biomarkers Market in 2024?

The diagnostics segment dominates the orphan disease biomarkers market in 2024, due to early detection is crucial for rare conditions where treatment delays can be life-threatening. Biomarkers are widely used in genetic screening, newborn testing, and clinical diagnosis to provide actionable insights. Increasing awareness and improved access to molecular diagnostics have ensured this segment maintains the largest share.

The personalized medicine segment is growing rapidly, with customized treatments for uncommon conditions made possible by biomarker-guided methodologies. Biomarkers are changing clinical trial designs and medication pipelines by classifying patients and forecasting therapeutic responses. The quick growth of this market is being driven by the expanding trend of precision healthcare and multi-omics integration.

Technology Insights

Why Did the Next-Generation Sequencing Segment Dominate the Orphan Disease Biomarkers Market in 2024?

Next-generation sequencing segment is dominating the orphan disease biomarkers market because of its ability to analyze multiple genes simultaneously and provide comprehensive insights into rare diseases. NGS has become a gold standard in biomarker discovery and companion diagnostics for orphan diseases. Its scalability and decreasing costs further reinforce its strong adoption.

The PCR-based technology segment is growing fastest, motivated by its accuracy, affordability, and broad applicability in routine clinical testing and biomarker validation. Sensitivity is increasing due to developments in digital and real-time PCR, which makes this technology more appealing for smaller-scale biomarker research and quick diagnostics.

End User Insights

Why Did the Pharmaceutical & Biotech Companies Dominate the Orphan Disease Biomarkers Market in 2024?

Pharmaceutical & biotech companies are dominating the orphan disease biomarkers market due to their focus on developing orphan drugs and companion diagnostics. These organizations heavily invest in biomarker research to streamline clinical trials, identify patient populations, and support regulatory submissions. Their robust R&D budgets and strategic collaborations maintain their leadership in adoption.

Research & academic institutions are growing rapidly because of having key role in early-stage validation and biomarker identification. These organizations, which receive grants from the government and charitable donations, frequently serve as hubs for new ideas in the study of orphan diseases. Their market presence is being further enhanced by expanding alliances with industry participants.

Regional Insights

Why Did North America Dominate the Orphan Disease Biomarkers Market in 2024?

North America dominated the orphan disease biomarkers market owing to substantial funding for rare disease research, sophisticated healthcare infrastructure, and robust regulatory support. Numerous clinical trial networks, significant biotech hubs, and the quick uptake of genomic technologies all benefit the area. Government funding programs and supportive laws like the Orphan Drug Act continue to create an environment that is conducive to the development and commercialization of biomarkers.

Asia Pacific is growing rapidly, driven by growing genomics research capabilities, growing healthcare spending, and growing awareness of rare diseases. The development of biomarkers and their clinical adoption are being fueled by expanding partnerships between international biotech companies and regional research centers. The market is expanding throughout the region at an accelerated rate thanks to supportive government initiatives and quick developments in molecular diagnostics.

Orphan Disease Biomarkers Market Companies

- Roche

- Thermo Fisher Scientific

- Abbott Laboratories

- QIAGEN

- Bio-Rad Laboratories

- PerkinElmer

- Illumina

- Agilent Technologies

- Merck KGaA

- Siemens Healthineers

- GE Healthcare

- Danaher Corporation

- Novartis

- BioMérieux

- Abbott Diagnostics

- Medtronic

- F. Hoffmann-La Roche AG

- Labcorp Drug Development

- Invitae Corporation

- Eurofins Scientific

Recent Developments

- In July 2025, NIH issued a Request for Applications (RFA) calling for biomarker and clinical outcome assessment development for rare diseases, to be conducted alongside prospective natural history studies—supporting rigorous trial design.(Source: https://grants.nih.gov)

- In July 2025, Alterity Therapeutics reported positive topline results from its Phase 2 trial of ATH434 in Multiple System Atrophy (MSA), and earlier in May secured Fast Track Designation for the same asset—indicating strong clinical momentum.(Source: https://alteritytherapeutics.com)

- In April 2025, U.S. FDA Commissioner Marty Makary announced plans for a new ultrarare drug approval pathway based on a “plausible mechanism,” potentially enabling conditional approvals without randomized, controlled trials.(Source: https://friendsofcancerresearch.org)

Segments Covered in the Report

By Disease Type

- Genetic Disorders

- Neurological Disorders

- Metabolic Disorders

- Rare Cancers

- Autoimmune Diseases

- Muscular Dystrophies

- Hematological Disorders

By Biomarker Type

- Genetic Biomarkers

- Protein Biomarkers

- Metabolic Biomarkers

- Epigenetic Biomarkers

- RNA Biomarkers

- Autoantibody Biomarkers

- Cell Surface Biomarkers

By Application

- Diagnostics

- Drug Discovery & Development

- Personalized Medicine

- Disease Monitoring & Prognosis

- Clinical Trials

- Companion Diagnostics

By Technology

- PCR-based Technology

- Microarray Technology

- Mass Spectrometry Technology

- Next-Generation Sequencing

- Immunoassays

- Flow Cytometry

- ELISA-based Technology

By End-User

- Hospitals & Diagnostic Laboratories

- Pharmaceutical & Biotech Companies

- Research & Academic Institutions

- Contract Research Organizations (CROs)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content