What is the Phage Therapy Market Size?

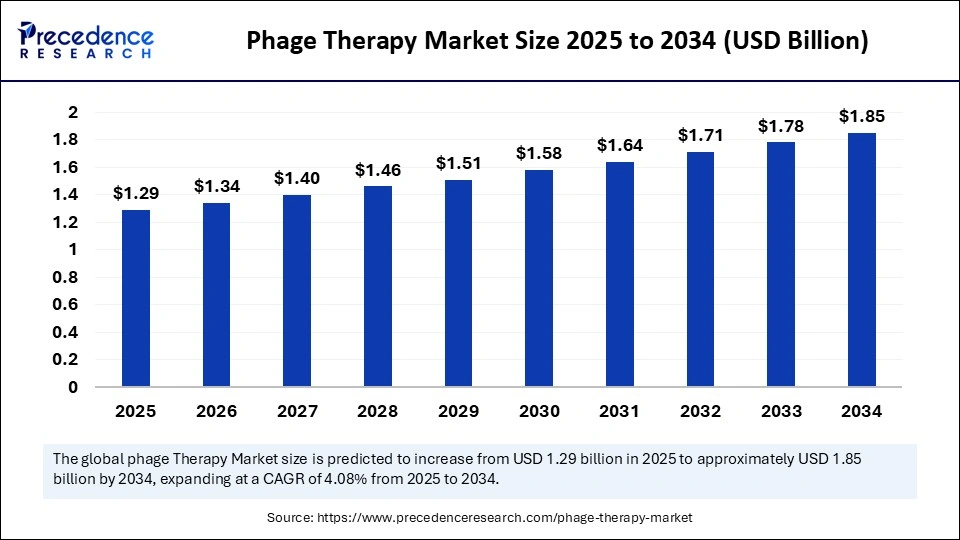

The global phage therapy market size accounted for USD 1.29 billion in 2025 and is predicted to increase from USD 1.34 billion in 2026 to approximately USD 1.85 billion by 2034, expanding at a CAGR of 4.08% from 2025 to 2034. This market is rising due to the increasing global crisis of antibiotic resistance and the rising demand for precision antimicrobial solutions.

Market Highlights

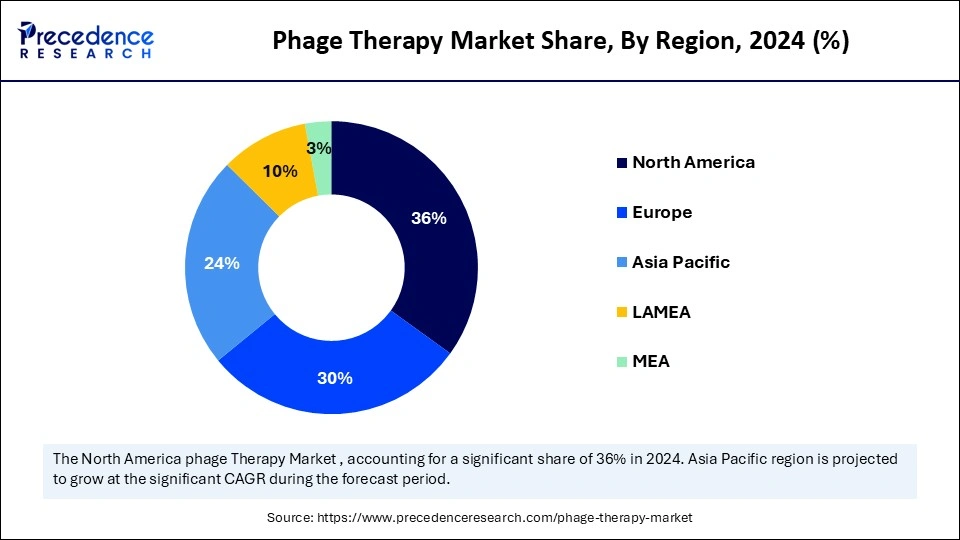

- North America dominated the phage therapy market by holding more than 36% of market share in 2024.

- The Asia-Pacific region is expected to grow at the fastest rate during the forecast period.

- By therapy type, the monophage therapy segment held the largest share of the phage therapy market in 2024.

- By therapy type, the phage cocktails segment is expected to grow at the fastest rate during the forecast period.

- By application, the infectious disease treatment segment held the largest share in 2024.

- By application, the food safety and agriculture segment is projected to grow at the fastest rate in the market for phage therapy.

- By route of administration, the oral segment held the largest share in the market during 2024.

- By route of administration, the topical segment is the fastest-growing segment

- By end-user, the hospitals & specialty clinics segment held the largest share of the market in 2024.

- By end-user, the research institutes & biotech companies segment is projected to grow at the fastest rate in the market.

What is the Phage Therapy Market?

Phage therapy is the application of bacteriophages as a therapeutic potential to treat infections caused by bacteria. Phages are capable of targeting and selectively killing pathogenic bacteria while sparing beneficial microbiota. The use of phage therapy is particularly attractive for treating multidrug-resistant bacterial infections. Over time, phage therapy evolved from small-scale academic studies and clinical trials to a more structured process or pipeline model for engineered, standardized, and compliant therapeutic products. The market also includes delivery modalities & methods of administration, quality control, phage banks, and bioinformatics. With increasing resistance to conventional antibiotic therapies, phage therapy is advancing from its original niche back to the forefront of infectious disease, food safety, and pathogen control.

Phage Therapy Market Outlook

- The phage therapy market will transition from experimental and compassionate use to more standardized and scalable models, supported by regulatory clarity, investments from biotech, and clinical evidence.

- Regardless of the specific growth percentages, the prevailing trend will be in one direction: wider use cases, larger investments, and advancement in manufacturing and delivery technologies will combine to increase market access.

- The phage therapy marketplace is maturing into an ecosystem with multiple angles, where disciplines will converge, including synthetic biology, computational biology, regulatory science, and CDMOs.

- Accordingly, the landscape anticipates more use cases not only in human infection, but agriculture, aquaculture, veterinary medicine, and food safety, which will generate more revenue streams. As infrastructure for the deployment of phage therapy evolves, costs will go down, which means more access will be available.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 1.29 Billion |

| Market Size in 2026 | USD 1.34 Billion |

| Market Size by 2034 | USD 1.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.08% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Therapy Type, Application, Route of Administration, End-User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

What Are the Key Drivers Propelling the Growth of the Phage Therapy Market?

The major driver of phage therapy adoption is the worldwide increase in antibiotic resistance. The growing number of multidrug-resistant bacterial strains, combined with the limited availability of new antibiotics, is pushing healthcare systems to explore alternative treatments. Phage therapy offers a highly specific and flexible approach that targets specific bacteria and can be used in conjunction with existing antibiotics. Additionally, the increasing interest in personalized medicine is fueling its adoption, as phage therapy can be customized to individual bacterial infections.

Advancements in synthetic biology, genomics, and artificial intelligence are enhancing phage selection, host-range engineering, and predictive matching between phages and their bacterial hosts. Alongside these scientific developments, supportive regulatory frameworks and favourable policies in key markets are driving further investment. Stakeholders are recognizing the long-term health and economic benefits, leading to increased funding for research, development, and infrastructure in phage therapy. This growing momentum is positioning phage therapy as a vital tool in combating antibiotic resistance.

Restraints

What Barriers Are Slowing the Growth of the Phage Therapy Market?

Even with momentum, several issues temper rapid expansion. Foremost among these barriers is regulatory complexity, along with the associated approval processes. Phage therapy is unusual, as phages are living, evolving agents, leading to standard practice having a harder time being applied to these living drugs. This leads to uncertainty in clinical trial design, manufacturing diagnostics, and safety monitoring. We face challenges with manufacturing scale and standardization. Another barrier to industry growth is narrow host specificity. Many individual phages specifically target only narrow bacterial strains, further complicating the development of a usable library of phage or cocktails of phage.

Opportunitiey

What Opportunities Exist in the Phage Therapy Market?

Opportunities exist in the engineering of synthetic and modular phages that can overcome the limitations of natural isolates by incorporating desirable characteristics into phages. Advances in genetic engineering technologies such as CRISPR, along with AI-guided phage matching, nitro-genomics, and computational screening, are creating efficient discovery pipelines. These innovations enable rapid identification, design, and optimization of phages with enhanced functionality, expanding their therapeutic and commercial potential.

Beyond human therapeutics, the emerging food safety and agricultural sectors represent significant growth opportunities. Phages can be applied to reduce bacterial contamination or serve as biocontrol agents in these industries. There is also potential for expansion into veterinary medicine and aquaculture, supported by strategic partnerships that can accelerate market entry. As regulatory and market access frameworks evolve, they are expected to become more adaptive. At the same time, public and institutional funding may further support early adoption, infrastructure development, and the integration of phage therapy into standard care models.

Top Products in the Phage Therapy Market

| Product Type | Description | Key Benefits | Common Applications |

| Phage Cocktails / Mixtures | Combinations of multiple bacteriophages targeting diverse bacterial strains | Broad host range reduces bacterial resistance, adaptable to polymicrobial infections | Treatment of multidrug-resistant (MDR) infections, wound healing, and gut infections. |

| Single-Phage Therapeutics | A single, highly specific lytic phage used against a known bacterial pathogen. | High specificity, minimal disruption to healthy microbiota, and customizable | Targeted bacterial infections (e.g., Pseudomonas, Staphylococcus aureus). |

| Lyophilized (Freeze-Dried) Phage Formulations | Phages are preserved in powder form for long-term stability and easy transport. | Extended shelf life, easy storage, and stable in varying temperatures. | Oral, topical, or injectable phage delivery in clinical and veterinary use. |

| Liquid / Aqueous Phage Preparations | Ready-to-use phage suspensions for immediate therapeutic application. | Rapid administration is a commonly used format for clinical trials. | Intravenous, oral, topical, or inhalation therapy. |

| Encapsulated / Microencapsulated Phages | Phages enclosed in polymers, liposomes, or nanoparticles | Protects against gastric acids, allows for controlled release, and enhances bioavailability | Oral therapies, gut microbiome modulation, and veterinary applications. |

| Phage-Derived Enzymes (Endolysins) | Enzymes derived from phages that lyse bacterial cell walls | Effective against antibiotic-resistant bacteria, this medication is both stable and fast-acting. | Skin infections, nasal sprays, and adjunct antibacterial therapies. |

| Phage-Based Diagnostic Kits / Biosensors | Tools using phages or phage proteins to detect bacterial contamination. | Rapid detection, high specificity, and low false-positive rates. | Food safety testing, hospital infection monitoring, and environmental screening. |

| Immobilized / Magnetic Phage Systems | Phages immobilized on solid or magnetic supports for the removal of bacteria. | Enables targeted bacterial capture and inactivation, a reusable system | Food processing, wastewater treatment and sterilization of medical equipment. |

Segmental Insights

Therapy Type Insights

Which Therapy Type Is the Most Popular in the Phage Therapy Market?

The monophage therapy held a dominant presence in the phage therapy market in 2024 due to its comparative simplicity, understanding of its dynamics, and proven safety. Monophage approaches have been the focus of early phage research and have been used primarily in compassionate-use frameworks for many years. Monophage therapy is defined as the use of a single strain of bacteriophage to target a specific bacterial pathogen. For phase commercial products, they are easier to characterize, validate, and regulate. In their canonical single-target approach, phage therapies are more limited, with on-target activation and fewer off-target effects than other therapeutic options, allowing for simpler safety and pharmacokinetic modeling. Thus, at various stages of early trials and in use settings, monophage therapy remains the leading outcome in terms of products and uptake for commercial products across multiple indications.

Phage cocktails, on the other hand, are the fastest-growing segment of phage therapies, and interest in approaching multi-strain populations or multidrug-resistant bacterial populations continues to grow even more rapidly. Cocktail therapies broaden the host range and provide a degree of protection against bacterial escape through resistance. Additionally, cocktail therapies have the potential for even broader adoption through computational matching and multiplex manufacturing of similar bacterial pathogens. All types of cocktails are increasingly being offered in clinical and commercial pipelines and are receiving increasing investment as a more durable therapeutic approach to treating more complex infections.

Application Insights

Why Are Infectious Disease Treatments Registering Dominance Over the Market for Phage Therapy?

The infectious disease treatment registered its dominance over the market for phage therapies in 2024 due to its effectiveness against particularly resistant, multidrug-resistant bacterial infections. This encompasses use in hospitals through compassionate use and clinical trials for difficult-to-treat infections. The infectious disease space is the dominant use case right now, primarily due to the urgent situation created by antimicrobial resistance, the existing clinical need for such a therapeutic modality, and the established use cases for it.

The food safety & agriculture application is set to be the fastest-growing segment in the phage therapy market during the forecasted period. As a result, to decrease antibiotic usage in agriculture, the production of phages to control bacterial pathogens in agriculture, aquaculture, and food production is on the rise (e.g., Salmonella, Listeria). The regulatory tolerance for nonhuman bacteriophage use is often significantly lower than for human health applications, making market access easier in some respects. Consequently, the growing movement towards using bacteriophages in food safety and agriculture will likely increase demand for these applications as global food safety standards continue to rise.

Route of Administration Insights

Why Is the Oral Segment Leading the Route of Administration in the Sector for Phage Therapies?

The oral segment maintained a leading position in the phage therapy sector in 2024, as the oral route is generally preferred for treating gastrointestinal and certain systemic bacterial infections. It is also used more frequently due to its ease of use and patient compliance, as well as its natural context within the gut microbiome. Oral phages access pathogens in the gut help maintain the balance of the microbiome, and provide non-invasive access, which is why oral phage formulations are typically the major route of administration with pipeline and preclinical formulations.

The topical administration (e.g., in creams, gels, wound dressings) segment is projected to experience the highest growth rate in the market between 2025 and 2034, particularly for skin infections, burns, ulcers, and biofilms related to wounds. The localized delivery route minimizes systemic risk, eases formulation, and is ideally suited for deploying phages in skin applications. As the frequency of skin and wound infections continues to rise, topical phage therapies are rapidly advancing into development and commercialization pipelines.

End-User Insights

Why Are Hospitals and Specialty Clinics Leading End-Users in the Market?

The hospitals and specialty clinics (including reference or tertiary care centers)segment captured a significant portion of the phage therapeutics sector in 2024 because these facilities have the necessary supportive infrastructure (sterile compounding, diagnostics, supervisory capabilities) to allow the delivery and intervention of phages either through compassionate use or controlled protocols, since it is more commonly in conjunction with salvage therapies that clinical demand emerges in hospital settings.

The research institutes, academic centers, and biotech companies segment is predicted to witness significant growth in the market over the forecast period, as this subset is engaged in innovation, conducting foundational research and development, creating phage banks, developing computational methods, engineering phages, and piloting next-generation products. As these entities expand their internal manufacturing and translational capabilities, they begin to act not just as developers but also as early consumers and adopters, contributing to a growing ecosystem.

Regional Insights

U.S. Phage Therapy Market Size and Growth 2025 to 2034

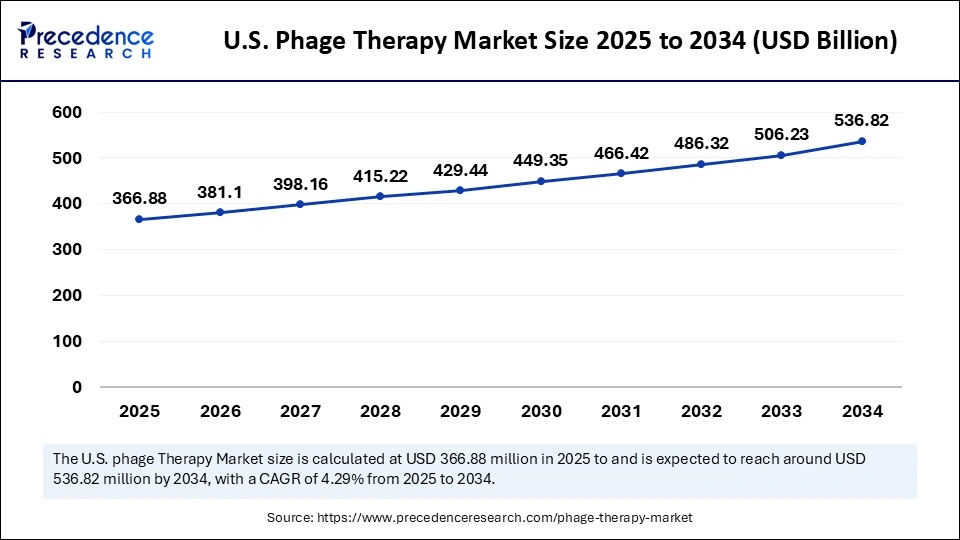

The U.S. phage therapy market size is exhibited at USD 366.88 million in 2025 and is projected to be worth around USD 536.62 million by 2034, growing at a CAGR of 4.29% from 2025 to 2034.

United States Phage Therapy Market Trend

The U.S. is leading the way in phage therapy developments as a result of increasing antibiotic resistance and a favorable FDA regulatory framework for especially experimental medicines. Academic institutions and biotech companies are speeding up clinical trials for phage as public awareness and investment grow globally in phage therapies geared toward personalized medicine. The U.S. is taking the lead in research, commercialization, and regulatory frameworks for phage therapy

Why Did North America Dominate the Phase Therapy Market in 2024?

North America continues to be the largest region for phage therapy development, mostly due to activity in the United States. This region is advanced in terms of healthcare systems, biotechnology ecosystems, and awareness of antimicrobial resistance. Industry and academia in the region, with the support of the FDA, are actively engaged in clinical trials and the development of phage therapy products. The expanded access framework from the FDA is also a crucial and timely addition to government policy, supporting phage therapy in the region. These trials and the FDA's willingness to incorporate phage therapy into treatment for severely ill patients who have an unlikely chance of survival with antibiotics add an appeal not found in other regions. The presence of venture capital and partnerships with leading hospitals provides an added incentive to explore and fund phage therapy commercialization and innovation of bacteriophage therapeutics.

The Asia-Pacific region is expected to experience the fastest growth during this same forecasting period. With figures from countries such as India, China, South Korea, and Australia, the region has become a growing hotspot for phage therapy as antibiotic-resistant infections increase and investment in biotechnology research rises, with a focus on food safety and agricultural applications in phage therapy. The relatively lower cost of conducting clinical research and product manufacturing is largely attractive to global pharmaceutical companies, which collaborate with institutions in this region. Governments in countries in this region have also recognized the need to provide additional resources for phage therapy as a public health priority, acknowledging the challenge posed by antimicrobial resistance.

China Phage Therapy Market Trend

China is rapidly developing its phage therapy environment, using government-supported biotech projects and their impressive pharmaceutical manufacturing capacity. China's hospitals and research organizations are actively working to develop phage treatments for infections in patients with multi-drug resistant infections. However, collaboration with foreign research companies has increased along with clinical trials intending to expand upon the Chinese phage therapy initiative and to expand their current healthcare innovation system.

Europe: Why Is Phage Therapy Developing?

Europe is experiencing significant growth in phage therapy adoption, primarily due to heightened awareness of antibiotic resistance and the continent's exceptionally strong research infrastructure. European countries are becoming increasingly interested in personalized medicine, willing to run clinical trials related to phage therapy and/or related to regulatory pathways for compassionate use. There are numerous public-private collaborations within strong biotech ecosystems, and significant focus on deployment in Western Europe. Lastly, rising initiatives by governments to combat superbugs are significantly accelerating the market.

Germany is currently the leading country developing phage therapy in Europe partly because of its sophisticated biotechnology infrastructure and favorable regulatory environment. The country is continuously increasing investments in clinical research and personalized medicine to treat antibiotic-resistant infectious diseases. Group dynamics around universities, hospitals, and biotechnology firms are enhancing the development of phage therapy and its commercialization nationwide.

Why Is Phage Therapy Emerging in Latin America?

Latin America is an emerging market for phage therapy, driven by the immediate need to address antibiotic-resistant infections, as well as growing access to healthcare. Additionally, there has been significant research collaboration and emerging investment into regionally based biotech startup companies to drive development, although no clear regulatory pathway exists at this point. Countries are exploring the applications for phage therapy, targeting both hospitals and the agricultural sector, as a way to improve public health outcomes.

Brazil is a leader in phage therapy development in Latin America given its large potential patient population and growing awareness of antibiotic resistance. Various biotech startups, research programs funded by the Brazilian government institutions, and woven healthcare infrastructure are advancing development. There is also a major drive in Brazil to establish and integrate the application of phage therapy into the clinical and agricultural approach used to respond to challenges for public health.

Top Players in the Phage Therapy Market

- Armata Pharmaceuticals, Inc.: Armata is a U.S.-based biotechnology company focused on developing precisely engineered bacteriophage therapies to treat antibiotic-resistant infections. Its pipeline includes phage candidates targeting Pseudomonas aeruginosa and Staphylococcus aureus, supported by partnerships with major pharma companies such as Merck.

- Adaptive Phage Therapeutics, Inc. (APT): APT leads in personalized, adaptable phage therapy using a proprietary phage library platform to match active phages to patient infections in real-time. The company collaborates with the U.S. Department of Defense and BARDA to advance clinical programs for multidrug-resistant bacterial infections.

- Pherecydes Pharma: Based in France, Pherecydes develops therapeutic phage cocktails targeting hospital-acquired pathogens such as S. aureus, E. coli, and P. aeruginosa.The company's focus is on clinical-stage programs in Europe, supported by partnerships with public hospitals and research institutions.

- Intralytix, Inc.: A pioneer in bacteriophage technology, Intralytix develops phage-based products for food safety, human health, and environmental protection.It was among the first to receive regulatory approval for phage use in food processing and continues to expand into therapeutic applications.

- Locus Biosciences, Inc.: Locus uses CRISPR-enhanced bacteriophages to selectively destroy pathogenic bacteria while preserving the healthy microbiome.Its precision-engineered phages are being developed for infectious diseases, including urinary tract infections and antibiotic-resistant strains.

Phage Therapy Market Companies

- Micreos B.V.

- Eliava Biopreparations Ltd.

- PhagePro Inc.

- EnBiotix, Inc.

- Technophage SA

- Fixed-Phage Ltd.

- iNtODEWORLD

- Proteon Pharmaceuticals S.A.

- Phagelux Inc.

- AmpliPhi Biosciences

Recent Developments

- In June 2025, researchers from Monash University introduced Entelli-02, a precision phage cocktail engineered to target Enterobacter infections, achieving a bacterial load reduction of over 99% in infected mice. It represents one of the first hospital-specific, clinical-ready phage therapeutics and is now available for compassionate use.(Source: https://www.technologynetworks.com)

- In May 2025, Cytophage Technologies Ltd. secured New Substance Notification approval in Canada, paving the way for the initiation of clinical trials of Enterococcus phage therapy and regulated human studies in that jurisdiction.(Source: https://cytophage.com)

Segments Covered in the Report

By Therapy Type

- Monophage Therapy

- Phage Cocktail

- Engineered/Synthetic Phages

- Other Phage-based Modalities (e.g., Phage Lysins, Endolysins)

By Application

- Infectious Disease Treatment (Human Health)

- Veterinary Applications

- Food Safety & Agriculture

- Environmental Applications (Wastewater, Bioremediation, etc.)

- Other Applications (Microbiome Modulation, Diagnostics, etc.)

By Route of Administration

- Oral

- Topical

- Injectable

- Other Routes (Inhalation, Nasal, etc.)

By End-User

- Hospitals & Specialty Clinics

- Research Institutes & Academic Centers

- Veterinary Clinics & Animal Health Providers

- Other End-Users (Food Safety Agencies, Environmental Bodies, etc.)

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting