What is Pigment Dispersion Market Size?

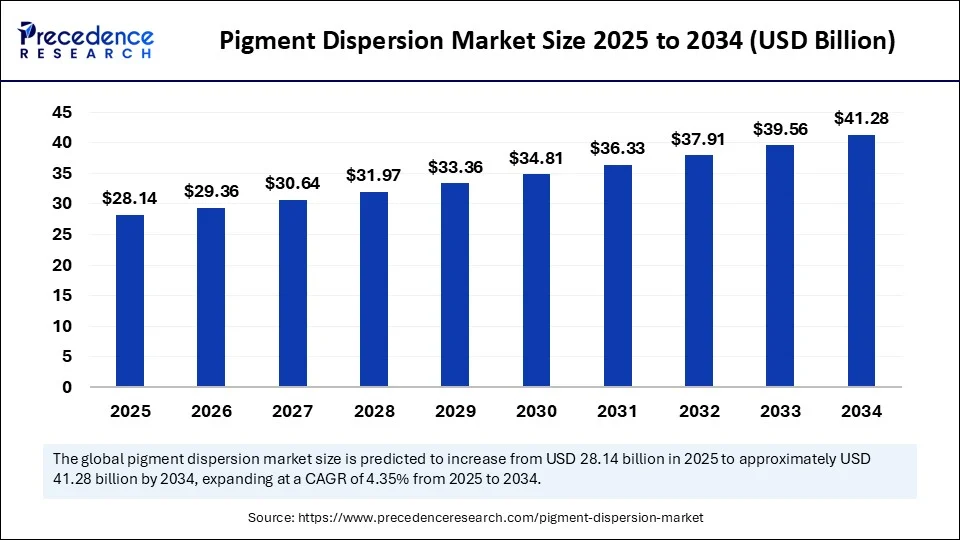

The global pigment dispersion market size is calculated at USD 28.14 billion in 2025 and is predicted to increase from USD 29.36 billion in 2026 to approximately USD 41.28 billion by 2034, expanding at a CAGR of 4.35% from 2025 to 2034. The pigment dispersion market is growing need from key end-user industries such as packaging, construction, automotive, and textiles, which demand high-quality and aesthetically pleasing finishes.

Market Highlights

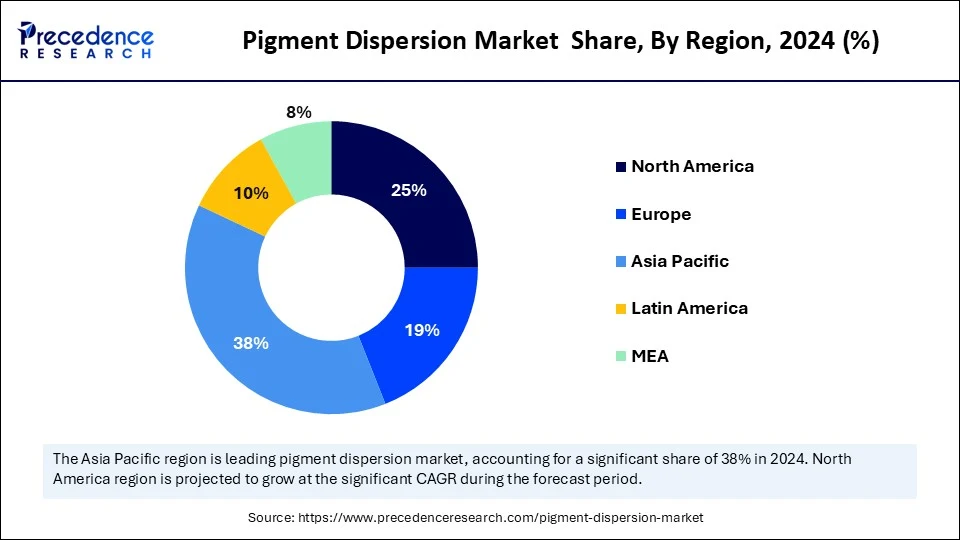

- Asia Pacific dominated the pigment dispersion market with the largest share of 38% in 2024.

- Europe is expected to grow at the fastest CAGR during the forecast period.

- By pigment type, the inorganic pigments segment held the biggest market share in 2024.

- By pigment type, the organic pigments segment is expected to grow at the fastest CAGR during the forecast period.

- By dispersion, the water-based segment led the market in 2024.

- By dispersion, the solvent-based segment is projected to grow at the fastest CAGR during the forecast period.

- By application, the paints & coatings segment captured the biggest market share in 2024.

- By application, the inks segment is expected to grow at the fastest CAGR during the forecast period.

- By end use industry, the building & construction segment generated the major market share in 2024.

- By end use industry, the automotive segment will expand rapidly in the coming years.

Market Overview: Strategic Overview of the Global Pigment Dispersion Industry

The pigment dispersion market is significant because pigment dispersions are vital for adding color, opacity, and even functionality to products across major industries such as paints & coatings, plastics, inks, and textiles. Pigment dispersions are important for achieving consistent and even vibrant colors in everyday items, from protective paints as well as high gloss finishes on cars to colorful plastic toys along with durable construction materials. The market is evolving to include water-based, more sustainable, and solvent-free dispersions to meet stricter environmental regulations as well as customer requirements for eco-friendly products.

- According to the FDA, materials that are permissible for usage as food colorants are permitted to be used as coloring agents for food packaging along with printing inks. However, pigments containing polynuclear aromatic hydrocarbons as well as benzopyrene, exceeding 0.5 parts per million and 5.0 parts per million, respectively, are prohibited from application in food packaging

Artificial Intelligence: The Next Growth Catalyst in Pigment Dispersion

AI's impact on the pigment dispersion market includes enhancing market analysis, driving personalized product development via data insights, optimizing production processes, decreasing costs, and improving sustainability by enabling the creation of environmentally friendly, low-impact formulations. Artificial intelligence algorithms identify large datasets from numerous sources to uncover consumer trends, preferences, and even purchasing behaviors related to pigments and their applications.

AI and even automation streamline repetitive and labor-intensive aspects of manufacturing, reducing operational expenses and minimizing human error. AI can facilitate the advancement of more sustainable, low-influence pigment dispersion formulations, aligning with circular economy goals and decreasing environmental footprints..

Pigment Dispersion Market Growth Factors

- The growth of the construction and automotive sectors creates a significant need for durable and even aesthetically pleasing paints and coatings, which heavily depend on pigment dispersions.

- The requirement for attractive, durable colors in vehicles boosts the expansion of pigment dispersions for automotive paints and coatings.

- The advancement of high-performance pigments that provide better durability and specific properties supports market expansion.

- Rapid urbanization as well as infrastructure development in emerging economies contribute to increased need for building materials and construction, driving the paints and coatings sector.

Market Outlook

- Market Growth Overview: The pigment dispersion market is expected to grow significantly between 2025 and 2034, driven by sustainability and eco-friendly solutions, rising demand from end-use industries, and growing urbanization and infrastructure.

- Sustainability Trends: Sustainability trends involve eco-friendly formulations, green manufacturing processes, and digitalization and innovation.

- Major Investors: Major investors in the market include State Street Corp, IndiaRF, Motilal PE, Reitech Corp., SOSV, Sparxell, and Venrex.

- Startup Economy: The startup economy is focused on bio-based and natural pigments, high-tech and nanotechnology solutions, and sustainable and circular economy models.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 28.14 Billion |

| Market Size in 2026 | USD 29.36 Billion |

| Market Size by 2034 | USD 41.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.35% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | Europe |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Pigment Type, Dispersion Type, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising demand from the paints and coatings and printing inks industries

Demand from the paints and coatings industry is extremely strong and is the primary driver for the pigment dispersion market, boosted by increasing construction, automotive production, and the demand for durable, high-performance, and aesthetically appealing finishes. Rising construction activities and rising urbanization globally, especially in emerging economies such as China and India, create a huge requirement for paints and coatings. The expanding packaging sector creates a continuous requirement for pigments for printing on numerous packaging materials. The pigment dispersion market as a whole is undergoing robust growth, with forecasts projecting remarkable expansion in the coming years.

Restraint

Stringent regulation

Environmental regulations, including bans on heavy metals such as lead and cadmium, are stringent and increasing, acting as a significant restraint on the pigment dispersion market by rising compliance expenses and forcing innovation. Producers face significant operational burdens and expenses to comply with these rules, including investments in waste treatment and even emission control equipment. The regulations boost a shift away from conventional heavy metal-based pigments towards waterborne and even high-solids dispersions and eco-friendly pigments. Stringent regulations can limit market access for non-compliant products, and firms that innovate with sustainable solutions gain a competitive edge.

Opportunity

Growing preferences for eco-friendly products

Growing consumer preference for eco-friendly products creates an opportunity for the pigment dispersion market because it drives need for water-based and even organic pigment dispersions, that are non-toxic, have a lower environmental influence, and meet tightening regulatory standards. Regulatory bodies globally are imposing stricter rules on hazardous chemicals and even emissions. This forces producers to accept eco-friendly solutions, shifting away from harmful inorganic pigments as well as towards safer alternatives such as organic pigments along with water-based dispersions to ensure compliance.

The need for eco-friendly solutions is not restricted to a single sector. Industries like paints and coatings, textiles, inks, automotive, plastics, and even packaging are all shifting towards sustainability, generating a broad market for eco-friendly pigment dispersions.

Why does the adoption of digital printing technologies act as an opportunity for the pigment dispersion market?

The adoption of digital printing technologies creates demand for high-quality, stable pigment dispersions by enabling customized, on-demand, and sustainable printing solutions across numerous sectors such as textiles, packaging, and even ceramics. Digital technology's ability to offer small batches as well as personalized items cost-effectively caters to niche markets and custom choices, driving the demand for tailored pigment dispersions. Advancements in pigment dispersion, like nano-scale pigments, permit even finer particle sizes, resulting in enhanced print quality and more vibrant colors.

Segment Insights

Pigment type insights

The inorganic pigments segment dominates the pigment dispersion market due to their stability, superior durability, and lower production expenses compared to organic pigments. Inorganic pigments provide excellent resistance to light, heat, and chemicals, making them essential for requiring applications like automotive and industrial coatings, where longevity is paramount. The manufacturing of inorganic pigments is generally less expensive than that of organic pigments, which usually require complex, multi-stage syntheses and even costly starting materials.

The organic pigments segment is witnessing the fastest growth as it provides rising demand for vibrant, eco-friendly colors over industries such as printing inks, coatings, and textiles, boosted by user preference for sustainable products as well as stringent environmental regulations. There's a strong impact on enhancing the appearance of food products, contributing to greater usage of organic pigments that meet stringent regulatory requirements.

Dispersion insights

The water-based segment dominates the pigment dispersion market due to strict environmental regulations, raised consumer and industry need for sustainable products, and developments in water-based technology that enhance their performance and durability. Improvements in water-based technology, like nano-dispersion techniques and even bio-based polymers, have improved the performance, durability, and even color vibrancy of water-based dispersions, permitting them to rival solvent-based options. Water-based dispersions are generally safer to manage and pose less toxicity risk compared to solvent-based options, contributing to a better working environment.

The solvent-based segment is witnessing the fastest growth due to its superior performance in applications such as automotive and industrial coatings, providing excellent durability and adhesion, it will remain a top option in performance-critical industries. Solvent-based systems offer excellent adhesion, durability, and even resistance to moisture and extreme temperatures. Consumers and also industries are increasingly looking for eco-friendly solutions to reduce their environmental footprint.

Application insights

The paints and coatings segment dominates the pigment dispersion market due to solid need from the construction industry for both new projects and even renovations, as well as increasing user preferences for aesthetic appeal along with durability in buildings. Pigment dispersions offer vibrant colors, consistent hues, and even opacity necessary for the decorative aspects of coatings, while also providing crucial protection against UV radiation, weather, and wear.

The inks segment is growing rapidly, fueled by the rising need for high-quality, vibrant, and even sustainable packaging and printing materials, boosted by rising brand competition and the expansion of digital printing and packaging industries. To stand out, brands are increasingly needing high-quality, vivid colors in their packaging and even printed materials, pushing the demand for superior pigment dispersions. The single-service food packaging sector depends on paper, plastic, and paperboard, which are improved with dyes to create attractive packaging.

End use industry insights

The building and construction segment dominates the pigment dispersion market due to the high requirement for architectural paints, coatings, and few construction materials, boosted by global urbanization, infrastructure development, as well as the requirement for aesthetic appeal and durability. Pigment dispersions are integral to decorative paints, exterior coatings, and even finishes used on walls, facades, and roofs, directly leading to the aesthetic qualities of buildings. They are vital for achieving consistent, vibrant colors in building materials, which is crucial for meeting design specifications and even consumer preferences.

The automotive segment is growing rapidly, due to the industry's continuous demand for improved durability, aesthetic appeal, as well as functional properties in vehicle finishes, fueled by technological developments and consumer need for high-performance and customizable coatings. Tighter environmental regulations and increasing consumer knowledge are pushing the automotive industry to accept water-based and even low-VOC (volatile organic compound) pigment dispersions, which provide functional performance with decreased environmental impact.

Regional Insights

Asia Pacific Pigment Dispersion Market Size and Growth 2025 to 2034

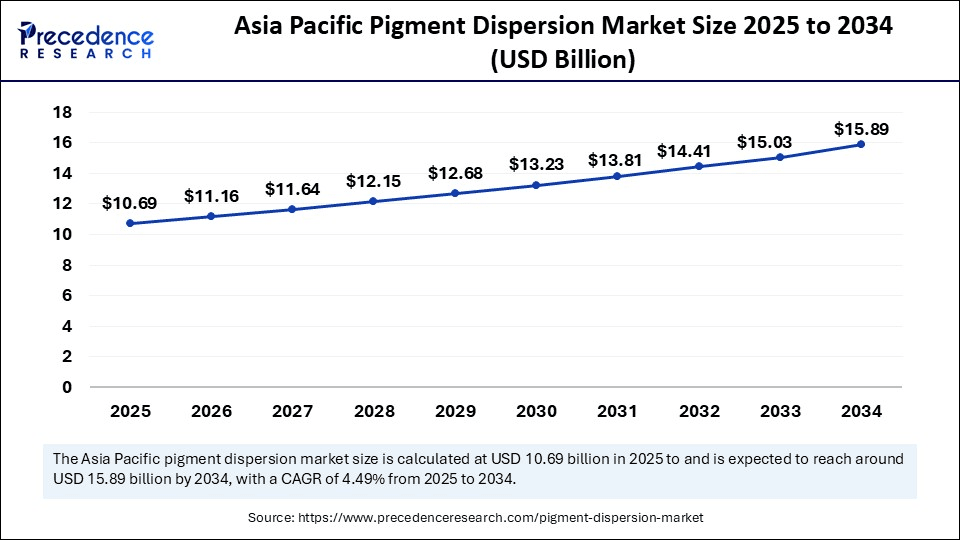

The Asia Pacific pigment dispersion market size is evaluated at USD 10.69 billion in 2025 and is projected to be worth around USD 15.89 billion by 2034, growing at a CAGR of 4.49% from 2025 to 2034.

Asia Pacific dominates the pigment dispersion market due to its rapid industrialization, increasing end-use industries such as automotive, construction, and packaging, and expanding production base in countries such as China and India, which have well known large and growing manufacturing bases for plastics, paints and coatings, positioning them as key manufacturers and consumers of pigment dispersions.

The EU's significance on green chemistry, low-VOC solutions, and even heavy-metal-free pigments is a major catalyst. This drives the advancement and acceptance of eco-friendly pigment solutions, like organic and bio-based pigments, and even accelerates the transition to sustainable, water-based dispersions. Users are increasingly inclined toward high-performance pigments for cosmetics, decorative coatings, and other consumer products. The need for unique, personalized, and even visually striking finishes in automotive together with other sectors also contributes significantly.

Asia Pacific: China Pigment Dispersion Market Trends

China's pigment dispersion market growth is driven by a shift towards water-based, eco-friendly formulations, fueled by stricter environmental regulations and rising consumer demand for sustainable products. The market is also propelled by the fast-expanding automotive sector, especially the electric vehicle segment, which requires high-performance pigments for specialized coatings.

Europe: Germany Pigment Dispersion Market Trends

Germany's powerful industrial base and strict EU environmental regulations are accelerating the shift towards sustainable, water-based, and low-VOC formulations. The automotive sector, particularly the growing demand for electric vehicle coatings, focuses on advanced technologies like nano-dispersion and digitalization to ensure high quality, precision, and efficiency in production.

Value Chain Analysis of the Pigment Dispersion Market

- Raw Material Supply

This foundational stage involves sourcing the primary raw materials required for pigment dispersions: dry pigments, solvents, and specialized additives.

Key Players: BASF SE, Clariant AG, Huntsman Corporation, Eastman Chemical Company - Manufacturing & Processing

This core stage involves the physical process of milling and dispersing pigments into a liquid medium using specialized equipment to ensure optimal particle size, stability, and color strength.

Key Players: Sun Chemical (DIC Corporation), Heubach Color, and Sudarshan Chemical Industries - Distribution and Logistics

This stage ensures that the finished pigment dispersions are efficiently transported from the manufacturer to the end-user, often with specific handling requirements due to the chemical nature of the product.

Key Players: IMCD N.V. and Brenntag SE - End-User Industries

The final stage encompasses the diverse range of industries that purchase and integrate pigment dispersions into their final products to add color, functionality, and aesthetic appeal.

Key Players: PPG Industries and Sherwin-Williams Company

Top Companies in the Pigment Dispersion Market & Their Offerings:

- BASF SE: BASF is a major contributor to the pigment dispersion market, supplying both raw pigments and specialty additives like dispersants and surfactants, which are essential components for achieving stable and high-quality dispersions. globally.

- DIC Corporation (including Sun Chemical): DIC Corporation, primarily through its subsidiary Sun Chemical, is a global leader in the production of printing inks, coatings, and pigments, supplying high-performance pigment dispersions for the packaging, graphic arts, and digital printing industries.

- Sudarshan Chemical: Sudarshan Chemical is a prominent supplier of organic, inorganic, and effect pigments to the global market, providing the foundational raw materials required for manufacturing pigment dispersions.

- Cabot Corporation: Cabot contributes to the market as a leading supplier of specialty carbon black and fumed metal oxides, which are crucial raw materials for black pigment dispersions used in a wide range of applications, from automotive coatings to electronics.

- Heubach GmbH: Following its acquisition of Clariant's pigments business, Heubach is a significant global provider of a comprehensive range of organic, inorganic, and hybrid pigments for the coatings, plastics, and printing ink industries.

- Pidilite Industries: While primarily known for adhesives and sealants, Pidilite Industries also has a presence in the pigment dispersion market, offering products for use in textiles, paints, and other applications, particularly within the Indian subcontinent.

- Chromaflo Technologies: Chromaflo Technologies is a leading independent manufacturer of colorant systems, chemical and pigment dispersions, providing tailored solutions for architectural and industrial coatings, as well as the thermoset composites market.

- Penn Color: Penn Color specializes in the manufacture of high-quality pigment dispersions, masterbatches, and other color concentrates for a variety of industries, including packaging, automotive, and textiles.

- DyStar: DyStar is a leading provider of dyes, auxiliaries, and related services to the textile industry, and while more focused on soluble dyes, it also plays a role in related colorant applications for technical textiles and performance coatings.

Recent Developments

- In April 2025, DyStar, a leading specialty chemical firm with a heritage of more than a century in product advancement and innovation, declared the cessation of production operations at DyStar Hilton Davis with partial incorporation of production within DyStar LP in Reidsville, North Carolina. (Source:https://www.dystar.com)

- In March 2025, Sun Chemical, a wholly owned subsidiary of DIC Corporation, will launch two latest effect pigments alongside its full range of high-performing color stylings and showcase new innovative polymers, resins, and even packaging film treatments for the coatings industry during the European Coatings Show in Nuremberg, Germany. (Source: https://www.dic-global.com)

- In March 2025, Sudarshan Chemical Industries Limited declared that, through its wholly owned subsidiary Sudarshan Europe B.V., it had completed its previously declared acquisition of Germany-derived Heubach Group (“Heubach”) in a combination of an asset and share deal. (Source:https://www.sudarshan.com)

Segments Covered in the Report

By Pigment Type

- Inorganic Pigments

- Organic Pigments

By Dispersion Type (Base)

- Water-Based

- Solvent-Based

By Application

- Coatings / Paints & Coatings

- Inks

- Plastics

- Epoxy

- Adhesives

- Sealants

- Others

By End-Use Industry

- Building & Construction

- Automotive

- Packaging

- Paper & Printing

- Textiles

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting