What is the Polystyrene Resin Recycling Market Size?

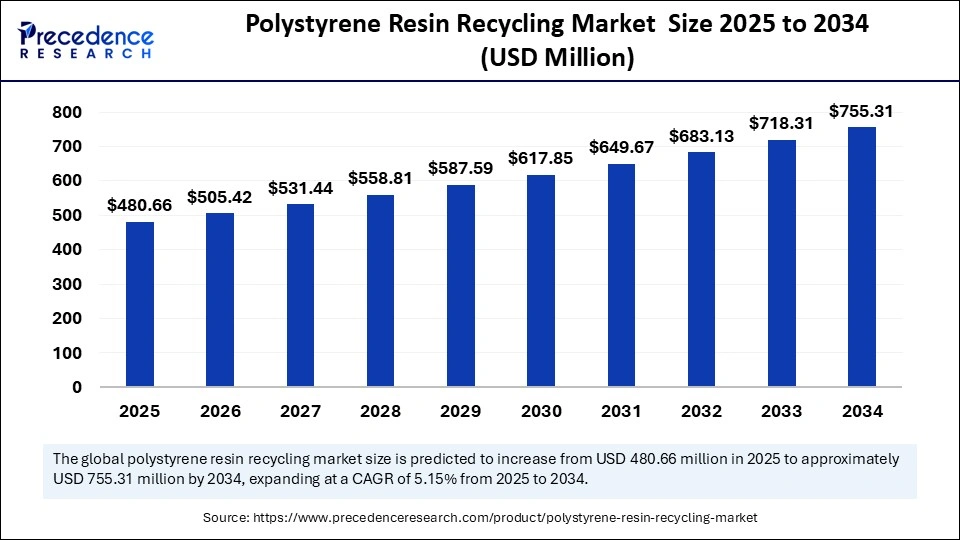

The global polystyrene resin recycling market size accounted for USD 457.12 million in 2024 and is predicted to increase from USD 480.66 million in 2025 to approximately USD 755.31 million by 2034, expanding at a CAGR of 5.15% from 2025 to 2034. The market is driven by advanced chemical and mechanical recycling technologies, sustainability initiatives, and increasing demand for circular economy solutions worldwide.

Market Highlights

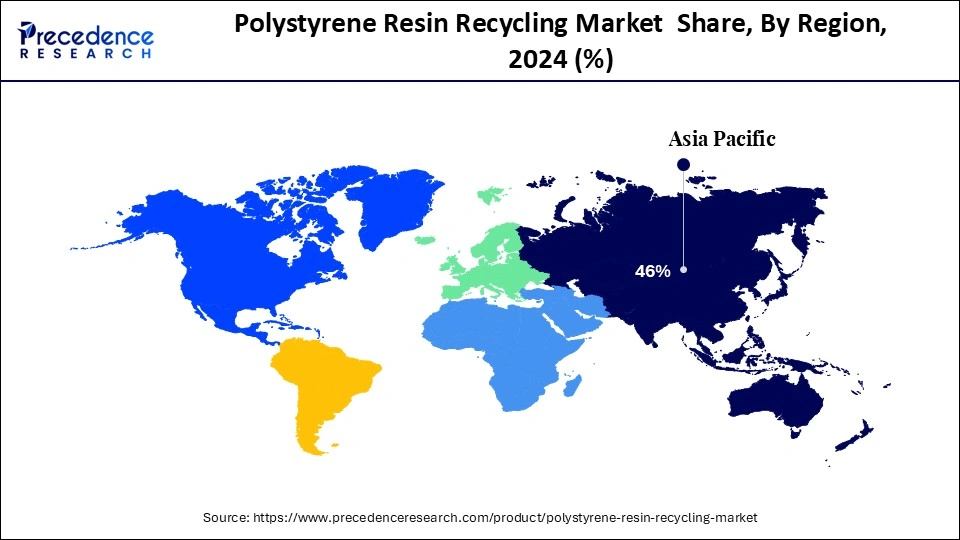

- Asia Pacific dominated the polystyrene resin recycling market with the largest market share of 46% in 2024.

- North America is estimated to expand the fastest CAGR between 2025 and 2034.

- By PS type, the expanded polystyrene (EPS) segment held the biggest market share in 2024.

- By PS type, the high-impact polystyrene (HIPS) reuse segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By source, the post-industrial PS segment captured the highest market share in 2024.

- By source, the post-consumer PS segment is expected to expand at a notable CAGR over the projected period.

- By recycling method, the mechanical recycling segment contributed the maximum market share in 2024.

- By recycling method, the chemical/feedstock recycling segment is expected to expand at a notable CAGR over the projected period.

- By product/output, the recycled PS pellets (regrind) segment led the market in 2024.

- By product/output, the recovered styrene monomer (RSM) segment is expected to expand at a notable CAGR over the projected period.

- By collection method, the industrial scrap collection segment accounted for the significant market share in 2024.

- By collection method, the specialized EPS reclamation programs segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

- By distribution channel, the material distributors/brokers segment generated the major market share in 2024.

- By distribution channel, the direct OEM contracts for the recycled content segment is anticipated to grow at a remarkable CAGR between 2025 and 2034.

Market Size and Forecast

- Market Size in 2024: USD 457.12 Million

- Market Size in 2025: USD 480.66 Million

- Forecasted Market Size by 2034: USD 755.31 Million

- CAGR (2025-2034): 5.15%

- Largest Market in 2024: Asia Pacific

- Fastest Growing Market: North America

Market Overview

The polystyrene resin recycling market consists of the systematic collection, processing, and conversion of post-consumer and post-industrial polystyrene (PS), including expanded (EPS), general-purpose (GPPS), and high-impact (HIPS), into feedstock for reuse or recycled resins. Recycling approaches range from mechanical reprocessing, such as densification, washing, and pelletizing, to more sophisticated approaches, such as solvent purification and several chemical recycling approaches, including depolymerisation and pyrolysis, that recover styrene monomer or oil fractions. The demand for recycled PS is growing in many segments, including packaging, insulation, consumer goods, electronics housings, and construction, due to the circular economy and tightening global sustainability regulations.

AI-Powered Breakthroughs Driving the Future of Polystyrene Resin Recycling

Polystyrene recycling is being transformed by artificial intelligence by enhancing sorting accuracy, detecting contamination, and improving recycling processes. New advances in chemical recycling of polystyrene (PS) exist, such as in June 2025, EcoStyrene technology developed by Sulzer, which has enabled the efficient processing of contaminated PS to produce higher-quality recycling feedstock resin for reuse. AI-powered predictive analytics is also driving a small but growing improvement in recycling yields by accurately predicting material flows and optimizing plant performance. (Source: https://www.sulzer.com)

- In Commerce City, Colorado, a new AI-driven material recovery facility is being constructed to process approximately 60,000 tons of recyclables per year. This facility will employ robots and optical sorters to automatically conduct nearly all of the sorting, from traditional optical sorting, and from detailed camera recognition of the polymer processing using air jets to divert each material. (Source: https://www.denver7.com)

Polystyrene Resin Recycling Market Growth Factors

- Increasing Sustainability Regulations:Legislation and single-use plastic ban, driving sectors to implement recycling programs for polystyrene and enhancing their integration into the circular economy.

- Packaging Industry Growth: The widespread utilization of polystyrene molded foam in the foodservice, e-commerce, and protective packaging sectors is creating a demand for recycled resins, as brands look to decrease their carbon footprint with a recycled product.

- Advances in Recycling Technologies: Improvements in depolymerisation, purification using solvents, and pyrolysis all lead to an enhancement in the quality of recycled PS, which helps improve the recovery efficiency and overall quality of recycled PS, making recycled feedstock a competitive alternative to virgin resin.

- Corporate Commitments to Sustainability: The largest producers and retailers of consumer-packaged goods are announcing their commitment to businesses using recycled content and increased demand for recycled polystyrene to realize their ESG commitments and improve overall environmental performance.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 457.12 Million |

| Market Size in 2025 | USD 480.66 Million |

| Market Size by 2034 | USD 755.31 Million |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.15% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | PS Type, Source, Recycling Method, Product/Output, Collection Method, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Does Expanded Recycling Access Effectively Drive Growth in Polystyrene Resin Recycling?

One of the key driving forces in the polystyrene resin recycling market is more access to recycling and collection infrastructure. Polystyrene, as a material, and particularly when it is expanded (EPS), is lightweight and bulky. It is comprised of 98% air and only 2% plastic, and is not easy to efficiently collect and transport. However, initiatives are shifting to focus on overcoming this challenge. For example, in 2024 will execute the launch of the Polystyrene Recycling Alliance will launch in the U.S. to expand collection systems and drive expanded recycling access.

- As it currently stands, approximately 32% of the U.S. population has access to recycling of some polystyrene products, with the aim of attaining the degree of “widely recyclable” by 2030. Improvements in infrastructure are essential to waste volume reduction and establishing improved practices for the circular economy community members. (Source: https://www.extrusion-info.com)

Restraint

What is Challenging the Recycling Stream of Polystyrene Resin?

In the polystyrene resin recycling sector, the foremost barrier is the cost of collection, sorting, and processing, which can greatly exceed any return. Although polystyrene is essentially recyclable, its lightweight nature and food-grade contamination complicate recovering it in a clean form, increasing an operator's logistics costs. A recent assessment states that recycling rates are relatively low since the recycling of polystyrene is not as profitable as making virgin polystyrene because it is usually cheaper and easier to get.

- For example, in December 2024, INEOS Styrolution developed a yoghurt cup from a clean post-consumer feedstock of 100% recycled polystyrene that passed the EU's most stringent food-safe regulations. Innovations like this occur rarely in practice, whereas they are now expensive. Until recycling systems improve for the resin, it will remain a challenge to deploy at scale without the supportive infrastructure to make the recycling process more affordable. (Source: https://chemicaltoday.in)

Opportunity

Can Next-Generation Chemical Recycling Unlock a Significant Opportunity for Polystyrene Recycling Resin?

Recently, there may be a significant opportunity for the polystyrene resin recycling market in next-generation chemical recycling technologies that can help overcome the limitations of traditional mechanical recycling processes. Next-generation chemical recycling technologies are able to process contaminated, colored, or mixed polystyrene waste and return it to high-purity styrene monomer or valuable base chemicals, while traditional mechanical recycling cannot.

This opportunity is reinforced by existing development. In September 2025, under a research partnership between Technip Energies and Anellotech, the Plas-TCat™ technology that convert mixed plastic wastes back into their constituent basic chemicals. (Source: https://www.ten.com)

- Similarly, in July 2025, Sulzer's EcoStyrene technology can convert heavily contaminated polystyrene that affects food contact (e.g., food residue or additives) into food-grade styrene monomer as part of a closed-loop recycling system. Collectively, these progressions expand the feedstock base of recyclables into materials and facilitate the economic viability of recycling polystyrene, which better supports large-scale adoption of polystyrene recycling for companies pushing circular economy objectives. (Source: https://www.indianchemicalnews.com)

Segments Insights

PS Type Insights

Which PS Type Dominates the Polystyrene Resin Recycling Market?

The expanded polystyrene (EPS) segment dominated the polystyrene recycling resin market in 2024, due to the extensive usage of EPS in packaging, insulation, and consumer goods products. EPS is lightweight and durable, which leads to massive volumes of waste production, creating a strong demand for recycling services. The collection systems to retrieve EPS products for reuse are well established, and EPS is suited for efficient and economical recycling processes. EPS is prevalent in the packaging market as well as in construction, where sustainability is quickly becoming a necessity in design.

The high-impact polystyrene (HIPS) reuse segment is projected to grow at the fastest rate due to an ever-expanding list of applications using recycled HIPS materials for electronics, appliances, and consumer products. HIPS is experiencing rising demand from both automotive interior applications and electronic housing applications to use durable recycled materials. Mechanical and enhanced chemical recycling processes are elevating the quality of recovered HIPS, which is improving the future growth outlook.

Source Insights

What is the Primary Source Available in the Polystyrene Resin Recycling Market?

The post-industrial PS segment is dominating the recycling polystyrene resin market in 2024, due to the fact that manufacturers tend to produce consistent and clean scrap during production processes. These streams are easier to collect, sort, and process than post-consumer or other waste streams, thereby increasing recycling often to 100%; manufacturers want to use their own post-industrial PS because it cuts down on processing time and maintains material quality, which makes it a reliable source of recycled resin.

The post-consumer PS segment will experience the most significant growth trajectory. Increased global consumption of packaging and, subsequently, increased waste will generate significant and growing demand for recycling options. Governments are pushing these; consumers want new sustainable solutions, and better collection programs are narrowing the market for investment to develop technologies to recover valuable materials from post-consumer streams, driving progress in sustainability in packaging and single-use applications.

Recycling Method Insights

Which is the Most Dominant Recycling Method in the Polystyrene Resin Recycling Market?

The mechanical recycling segment is the dominant method in the polystyrene recycling resin market due to its established infrastructure, cost-efficient practice, and capacity for large quantities of clean polystyrene waste. It has become the norm for applications in packaging or consumer goods because it involves simple processes of shredding the waste, washing it, and re-melting it to produce recycled pellets for reprocessing. Its ability to reliably scale up recycling production assures mechanical recycling of its dominant position.

The chemical/feedstock recycling segment is the fastest emerging method because of its ability to depolymerize polystyrene waste back into styrene monomers. This chemistry provides a solution to challenges specific to contamination and mixed waste that mechanical recycling cannot overcome efficiently. There is increasing demand for higher purity recycled styrene in new products for all types of industries, and investment in pyrolysis and depolymerization technologies, coupled with the chemical recycling solutions, greatly enhances the recycling process for polystyrene.

Product/Output Insights

Which Product/Output Segment Dominates the Polystyrene Resin Recycling Market in 2024?

The recycled PS pellets (regrind) segment has the largest market share in 2024, because they can be applied in packaging, consumer goods, and construction applications. They are easy to process, and manufacturers can mechanically mix the regrind into their existing production lines. The consistent quality and low-cost alternative make regrind a trusted substitute to virgin PS with consistent, strong demand in multiple end-use markets.

The output segment that is growing the fastest is recovered styrene monomer (RSM), which is a result of advancements in chemical recycling technologies. RSM offers near-virgin quality and can be utilized for applications where performance is crucial, like packaging, electronics, and automotive. Availability of recovered monomer will subsequently increase with industry investments, which are now being made in depolymerisation plants and further established partnerships between recyclers and chemical producers.

Collection Method Insights

Which Collection Method has the Largest Polystyrene Resin Recycling Market Share?

The industrial scrap collection segment has the largest market share as it provides clean and consistent polystyrene waste directly from the manufacturing facility. This collection method allows for fewer sorting difficulties, a lower processing cost, and consistent supplies of materials. Manufacturers like this option because it provides high-quality recyclate with minimal contaminants. This makes it the most dependable and efficient source for large-scale recycling operations.

The specialized EPS reclamation programs segment is the fastest-growing collection method, which is assisted by growing knowledge of the EPS waste challenge and sustainability programs. This collection method specifically targets and collects post-consumer packaging and insulation waste through specific collection spots and partnerships with retailers or municipalities. Some of the reasons they are expanding so quickly around the world are improved logistics for these programs, greater community involvement and participation, and corporate commitments to reduce plastic waste.

Distribution Channel Insights

What Distribution Channel Possesses the Largest Polystyrene Resin Recycling Market Share?

The material distributors/brokers segment held a dominant market share in 2024, as they built on established networks to supply recycled polystyrene to a wide variety of industries. They function as intermediaries between recyclers and the end-users, establishing availability, price, and bulk quantities of materials. Their ability to bridge the demand and supply positions them as the most influential channel to market.

The direct OEM contracts for the recycled content segment is growing rapidly. This growth is the result of a commitment to sustainability and a traceable supply chain from manufacturers. Companies in the packaging, electronics, and automotive industries use fierce practices and long-term contracts with recyclers to engage and lock down the capacity to maintain high-quality recycled PS. This builds stability in supply, bolsters brand credibility, and fulfills the requirements of regulation for practices in the circular economy.

Regional Insights

Asia Pacific Polystyrene Resin Recycling Market Size and Growth 2025 to 2034

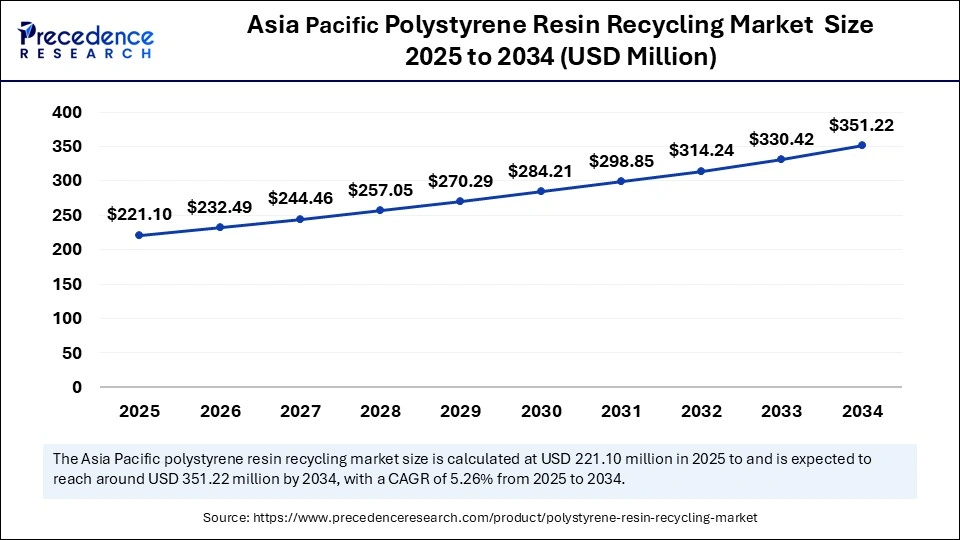

The Asia Pacific polystyrene resin recycling market size was exhibited at USD 210.28 million in 2024 and is projected to be worth around USD 351.22 million by 2034, growing at a CAGR of 5.26% from 2025 to 2034.

What is the Reason for Asia-Pacific Controlling the Polystyrene Resin Recycling Market?

Asia Pacific dominated the polystyrene resin recycling market, Holds the largest market share of 46% in 2024,Asia-Pacific has the largest grouped production, consumption, and coastal manufacturing clusters for polystyrene, which balances large post-use flows back to post-use flows, making collecting and servicing industrial recycling economically feasible. Combined public and private investments into regional waste infrastructure and cross-national importing/selling of containers of scrap are breeding stronger vertical integration into APAC's communal role for aggregate feedstocks and downstream reuse.

China is unique in scale: proposed production clusters, long-established collection nexus, and increasing formal industrial recycling projects that reconstitute EPS and post-consumer PS into reusable resin or recovered styling. Government intervention around waste management and their establishment of industrial pilot R&D have created synergies with chemical recycling for commercialization, while large converters and styrenic manufacture are investing in capacity options to close loops domestically.

Why is North America Projected to be the Fastest-Growing Region During the Forecast Period?

North America is becoming the fastest-growing area in the polystyrene resin recycling market due to supportive policy initiatives at the state and national levels, industry partnerships, and a wide range of financial investments in both chemical and molecular recycling to process PS streams that are difficult to process. The combination of state bans on EPS foodware, along with individual corporate sustainability goals from brands, is further catalyzing collection programs and end-market development.

In the United States, regulatory pressure and corporate investment are used simultaneously. In January 2025, the Plastics Industry Association (PLASTICS), Washington, formed the Polystyrene Recycling Alliance (PSRA) to collaborate with brands, converters, and recyclers for “widely recyclable status” for PS. This collaborative program is designed to improve collection networks, improve the quality of the recycled resin, and enhance the end-market, putting the U.S. on the map as the largest contributor to a fast-growing polystyrene recycling market in North America. (Source: https://www.recyclingtoday.com)

Value Chain Analysis

- Supply of Raw Materials: Suppliers can provide either virgin polystyrene or post-consumer polystyrene waste. The availability, quality, and collection efficiency of the materials significantly influence the overall efficiency and sustainability of recycling.

- Manufacturing of Products: The recycled PS goes on to be used in manufacturing packaging products, insulation panels, and consumer products. Using recycled PS in manufacturing operations requires compliance with material quality specifications and compatibility with their existing manufacturing processes.

- Distribution and Marketing: Recycled PS products are distributed to end processors. Market acceptance and demand for recycled products can be positively influenced through strategic partnerships, branding, or compliance with sustainability regulations.

- Waste Management and Recycling: Post-consumer PS products enter the collection stage of the recycling process, which helps create a closed-loop system. During this stage, ongoing feedback about the quality of the material collected and the efficiency of collection operations can help optimize recycling operations and maximize overall circularity.

Polystyrene Resin Recycling Market Companies

- Agilyx

- Pyrowave

- Polystyvert

- GreenMantra Technologies

- Veolia

- SUEZ

- MBA Polymers

- Trinseo

- INEOS Styrolution

- BASF

- Brightmark

- Erema

- APK AG

- KBR

- Waste Management, Inc.

- CleanTech

- Plastic Recycling, Inc.

- Avangard Innovative

- Ravago Group

- TotalEnergies

Recent Developments

- In March 2025, Trinseo launched food-contact recycled polystyrene using dissolution technology, marking a significant step toward sustainable packaging with high safety standards for consumer applications. (Source: https://packagingeurope.com)

- In February 2025, PolyCycl introduced its Generation VI chemical recycling technology, enhancing polystyrene recycling efficiency and supporting circular economy goals with improved material recovery and reduced environmental impact.(Source: https://www.indianchemicalnews.com)

Segments Covered in the Report

By PS Type

- Expanded Polystyrene (EPS)

- General Purpose Polystyrene (GPPS)

- High Impact Polystyrene (HIPS)

- Other styrenic blends/copolymers

- Mixed polystyrene streams

By Source

- Post-consumer PS

- Post-industrial PS

- Construction and demolition PS waste

- Institutional/commercial PS waste

By Recycling Method

- Mechanical recycling

- Collection and densification (compaction/baling)

- Washing and contaminant removal

- Pelletizing/extrusion reprocessing

- Solvent/dissolution recycling (solvent purification)

- Chemical/feedstock recycling

- Depolymerization to styrene monomer (batch/continuous)

- Pyrolysis/thermal cracking (to oils/gases)

- Catalytic thermochemical routes

- Hybrid/advanced recycling processes

- Others (emerging biochemical routes)

By Product/Output

- Recycled PS pellets (regrind)

- Recovered styrene monomer (RSM)

- Densified EPS blocks/beads

- Recycled blends and compound formulations

- Energy recovery

By Collection Method

- Curbside/municipal collection streams

- Commercial/retail take-back programs

- Industrial scrap collection

- Drop-off/consolidation centers

- Specialized EPS reclamation programs

By Distribution Channel

- Direct OEM contracts

- Material distributors/brokers

- Plastic recyclers/compounders

- B2B marketplaces

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting