What is the Power Transmission Lines and Towers Market Size?

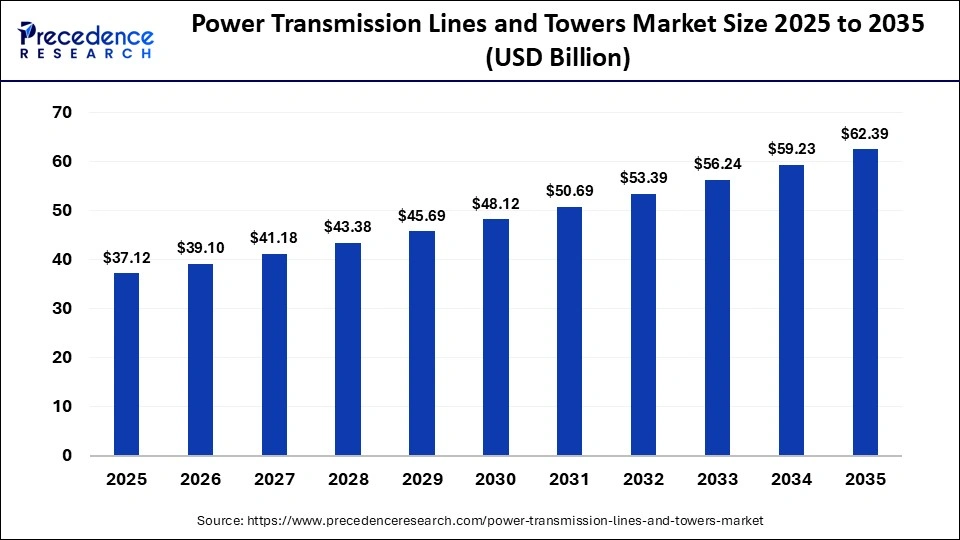

The global power transmission lines and towers market size was estimated at USD 37.12 billion in 2025 and is predicted to increase from USD 39.10 billion in 2026 to approximately USD 62.39 billion by 2035, expanding at a CAGR of 5.33% from 2026 to 2035. The major driving forces for the expansion of the power and energy sectors are surging electricity demand, integration of renewable energy, and grid modernization.

Key Takeaways

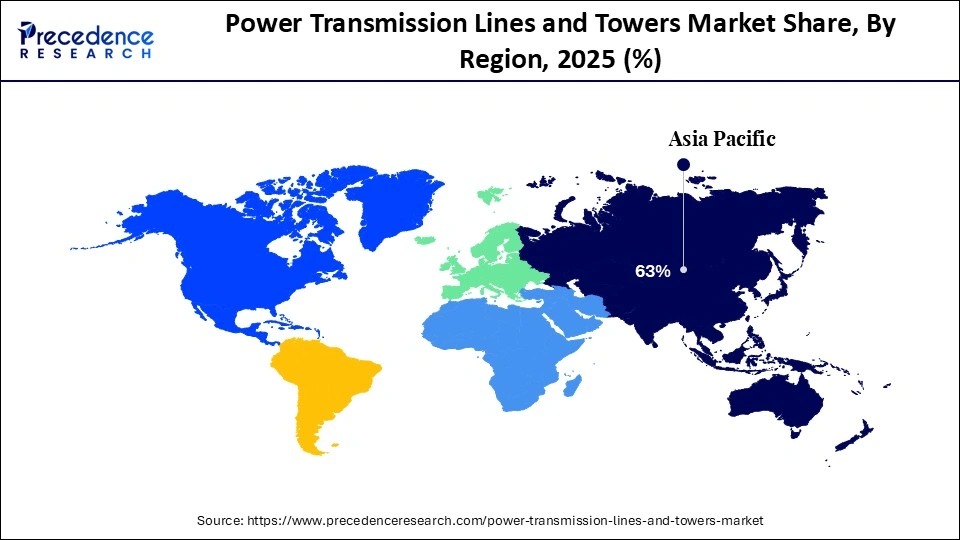

- Asia Pacific dominated the market with the largest market share 63% of in 2025.

- North America is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the transmission lines segment dominated the market in 2025.

- By product, the transmission towers segment in the market is expected to grow at the fastest CAGR in the market during the forecast period.

- By conductor, the conventional segment dominated the market in 2025.

- By conductor, the high temperature segment is expected to grow at the fastest rate in the market in 2025.

- By insulation, the PVC segment dominated the market in 2025.

- By insulation, the XLPE segment is expected to grow at the fastest CAGR in the market during the forecast period.

- By application, the extra high tension segment dominated the market in 2025.

- By application, the high tension segment is expected to grow at the fastest CAGR in the market during the forecast period.

Power Transmission Lines and Towers: Driving Rapid Economic Growth

The power transmission lines and towers market is majorly driven by the huge importance of high-voltage lines for transporting power to urban centers, heavy investments in infrastructure, and the expansion of data centers. The technological shifts, tower innovations like double-circuit towers, monopoles, and multi-circuit towers, and High-Voltage Direct Current (HVDC) systems are also boosting the power and energy sectors across the globe. The leading industrial players are Siemens Energy, GE Vernova, Prysmian Group, ABB, Hitachi Energy, Power Grid Corporation of India, Skipper Limited, and KEC International. The prominent regions like Europe and North America are heavily investing in retrofitting older lines to improve resilience.

What are the benefits of AI in the Market?

AI contributes to predictive analytics, root-cause detection, automated operations, self-healing systems, and digital twins for continuous optimization. AI-based fault analytics and visual intelligence have immense capabilities to automatically detect cable clutter, corrosion, cracks, and other safety issues directly from drone imagery. AI, IoT, and automation are transforming tower operations and redefining the power transmission lines and towers market. The utilities across the transmission and distribution sectors are actively utilizing AI solutions to create an intelligent grid and improve service delivery and operational efficiency.

Power Transmission Lines and Towers Market Trends

- Enhanced Material Features: The growing challenges of climate risk mitigation across the globe are raising the need for tower manufacturing firms to reduce their carbon footprint that will also expand the power transmission lines and towers market. This goal is achieved by using energy-efficient manufacturing processes and sustainable materials in tower manufacturing.

- Renewable Energy: India moves rapidly towards its ambitious goals of achieving a net-zero carbon footprint by 2070 and 500 GW of renewable energy capacity by 2030. There is a growing importance and the increased availability of a robust power transmission infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 37.12 Billion |

| Market Size in 2026 | USD 39.10 Billion |

| Market Size by 2035 | USD 62.39 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 5.33% |

| Dominating Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Conductor, Insulation, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Insights

How does the Transmission Lines Segment Dominate the Market in 2025?

The transmission lines segment dominated the power transmission lines and towers market in 2025, owing to the rising importance of modern lines to prevent blackouts by ensuring grid stability and resilience. The integration of IoT and AI allows these lines to offer real-time data on pricing and load, which makes smart infrastructure. There is a rapid shift towards advanced conductors, which eliminate the need for new towers.

The transmission towers segment is expected to grow at the fastest CAGR in the power transmission lines and towers market during the forecast period due to technological advancements and digitalization, including smart monitoring, asset management, and disaster resilience. Moreover, the design and material innovations are made across space optimization, advanced materials, and voltage scaling. Modern towers are integrated with AI-driven cameras, IoT sensors, and edge computing to monitor stress, vibration, and tilt in real-time.

Conductor Insights

What made Conventional the Dominant Segment in the Market in 2025?

The conventional segment dominated the power transmission lines and towers market in 2025, owing to the primary importance of conventional conductors like Aluminium Conductor Steel Reinforced (ACSR), driven by its lower upfront costs, proven reliability, and high strength-to-weight ratio. They are the preferred choice for new infrastructure and long-distance transmission lines. They remain the most cost-effective solution to reach low-density load centers.

The high temperature segment is estimated to grow at the fastest rate in the power transmission lines and towers market during the predicted timeframe due to the integral role of high temperature conductors in grid modernization, capacity improvement, and infrastructure optimization. Furthermore, the integration of renewable energy sources such as solar and wind, and urban electrification is raising the importance of high-temperature conductors. The advanced conductors are expanding in the market due to clean energy goals and the rising electricity demand.

Insulation Insights

How did the PVC Segment Dominate the Market in 2025?

The PVC segment dominated the power transmission lines and towers market in 2025, owing to the extensive research on nanotechnologies to assess their impact on improving technical and physical performance when applied to PVC cables. The PVC insulation plays a major role in low and medium-voltage distribution, renewable energy integration, and long-distance support. The PVC insulation is driven by a sustainability shift towards green PVC formulations to meet stricter environmental regulations. The innovations are made using nano-clays and nano-enhanced PVC to improve mechanical strength and thermal resistance.

The XLPE segment is anticipated to grow at a notable rate in the power transmission lines and towers market during the upcoming period due to the wide use of XLPE insulation for power cables to withstand high voltage and temperature, which makes them ideal for various industrial applications. The XLPE power cables are advantageous due to their superior electrical properties and excellent thermal performance. XLPE insulation allows the cables to carry heavy loads without overheating and has a high temperature rating.

Application Insights

Why did the Extra High Tension Segment dominate the Market in 2025?

The extra high tension segment dominated the power transmission lines and towers market in 2025, owing to the deployment of higher transmission voltages and advanced technologies, and the expansion of the network to enable large-scale power transfer. The evolution of transmission system planning and operations aims to strengthen grid resilience and flexibility. A strong and reliable transmission system is pivotal to maintain grid stability, transmit power efficiently across long-distances, and ensure an uninterrupted power supply.

The high tension segment is predicted to grow at a rapid rate in the power transmission lines and towers market during the studied period due to the increased use of high-voltage systems for long-distance efficiency and minimal energy loss. The huge adoption of High-Voltage Direct Current (HVDC) technology provides reliable solutions to connect national grids across borders and seas. The digitally-enabled networks are capable of maintaining grid stability and integrating vast amounts of renewable energy under extreme conditions.

Regional Insights

Asia Pacific Power Transmission Lines and Towers Market Size and Growth 2026 to 2035

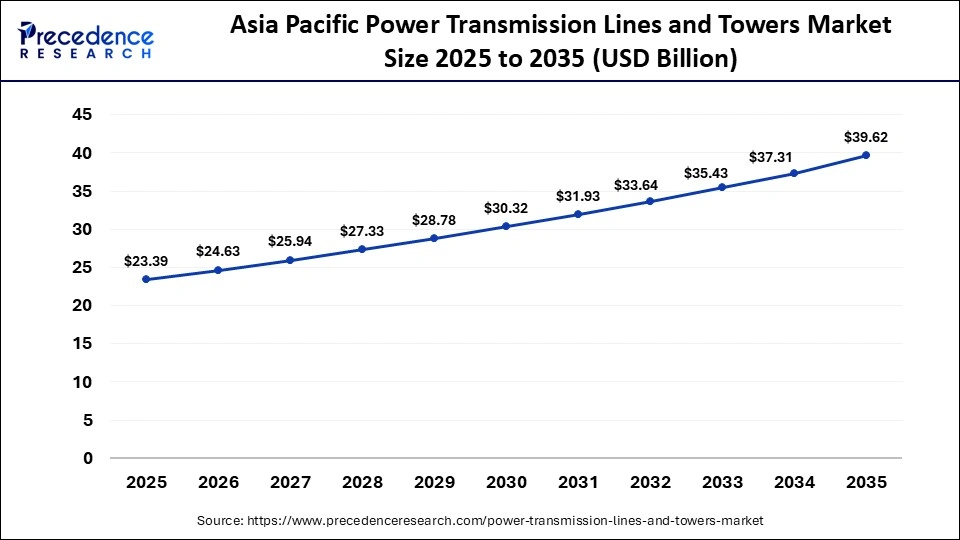

The Asia Pacific power transmission lines and towers market size was evaluated at USD 23.39 billion in 2025 and is expected to be worth around USD 39.62 billion by 2034, growing at a CAGR of 5.41% from 2025 to 2034.

Asia Pacific dominated the market in 2025, Economic development and the increasing population in countries like Southeast Asia, China, and India, which boost the demand for electricity. The utilities and power sector in the Asia Pacific is estimated to remain stable through 2026, which is backed by the increased capital investment in grid infrastructure and capacity expansion.

India Market Trends

India witnesses a continued expansion of transmission networks and the regional expansion of clean energy hubs across the expanding power transmission lines and towers market. In January 2026, the Government of India introduced 38,849 crore transmission projects in the year 2025, which aim to strengthen and support renewable power evacuation, stronger power sector finances, and grid expansion.

North America is expected to grow at the fastest CAGR in the market during the forecast period, owing to the urgent need for grid modernization, supportive federal policies, and significant funding for clean energy and long-distance transmission projects. According to the Biden Administration, America has set its goal to invest more than $30 billion in grid infrastructure from the Bipartisan Infrastructure Law and the Inflation Reduction Act. In September 2025, Hitachi announced the investment of USD $1 billion in manufacturing to shape the future of energy in America through the production of critical grid infrastructure.

U.S. Power Transmission Lines and Towers Market Analysis

The U.S. advances with new transmission networks and surging demand from AI and data centers that further expand the market. The Trump Administration launched its efforts to accelerate power grid projects for AI. The U.S. government has addressed the need for power grid upgrades and invested in grid infrastructure. The U.S. Transmission and Distribution (T&D) network is a well-equipped and reliable network.

How is the Noticeable reach of Europe in the Power Transmission Lines and Towers Market?

Europe is expected to grow at a notable rate in the market, owing to the increasing demand for electricity and strong cross-border interconnectivity. In December 2025, the European Commission launched a €1.2 trillion grid upgrade to strengthen energy resilience and expand electricity infrastructure in Europe. The European Union plans to modernize its electricity infrastructure, secure supply across borders, and lower energy costs.

Germany Power Transmission Lines and Towers Market Analysis

The German market is driven by legislative reforms and high demand for land-based and new subsea transmission infrastructure. Germany planned long-duration energy storage auctions for the years 2025 and 2026. Germany is moving forward to strengthen the domestic wind power industry and the market.

Value Chain Analysis

- Distribution Network Management: This stage includes real-time monitoring, automated network analysis, predictive maintenance of towers and lines, integration of decentralized resources, cybersecurity, and resilience.

- Key Players:Hitachi Energy, Siemens Energy AG, GE Vernova, Schneider Electric SE, ABB Ltd., KEC International, Skipper Limited, Prysmian Group, Nexans, Larsen & Toubro, Adani Energy Solutions Limited, Tata Power.

- Energy Storage Systems:This stage is expanding due to grid connectivity, smart management, transmission upgrades, and simplified ownership.

- Key Players:Tesla Energy, CATL, Fluence Energy, Sungrow Power Supply, Hitachi Energy, BYD, Burns & McDonnell, GE Vernova, Prysmian Group, KEC International, Skipper Limited.

- Grid Maintenance and Monitoring:This stage encompasses advanced monitoring techniques, predictive and reliability-centered maintenance, operational innovations, and future-ready skillsets.

- Key Players:Siemens Energy AG, Hitachi Energy, GE Vernova, ABB, Schneider Electric, Power Grid Corporation of India, KEC International, Prysmian Group, Skipper Limited, Cisco Systems.

Power Transmission Lines and Towers Market Companies

- KEC International

- Skipper Limited

- Kalpataru Projects International

- Prysmian Group

- Nexans

- Power Grid Corporation of India

- Larsen & Toubro

- Valmont Industries

Recent Developments in the Power Transmission Lines and Towers Market

- In January 2026, KEC International completed and energised a 380 kV transmission line in Saudi Arabia. This project involves the construction of approximately 103 km of 380 kV OHTL, which is backed by 239 transmission towers.

(Source: https://powerline.net.in) - In April 2025, Skipper Limited achieved a remarkable success with the launch of the second full-scale tower test bed, which positions the company in India with two independent test beds at a single location. This launch was introduced for the comprehensive testing of Monopoles and Lattice Towers. This facility setup enables faster project delivery, simultaneous testing, and superior reliability assurance.

(Source: https://www.skipperlimited.com)

Segments Covered in the Report

By Product

- Transmission Lines

- Transmission Towers

By Conductor

- Conventional

- High Temperature

- Others

By Insulation

- PVC

- XLPE

- Others

By Application

- High Tension

- Extra High Tension

- Ultra-High Tension

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting