What is the Precision Turned Product Manufacturing Market Size?

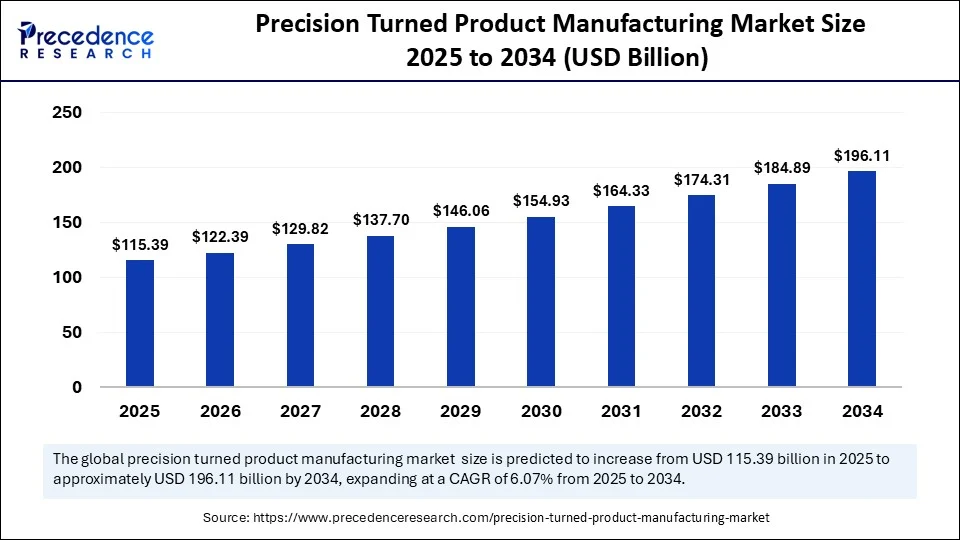

The global precision turned product manufacturing market size is calculated at USD 115.39 billion in 2025 and is predicted to increase from USD 122.39 billion in 2026 to approximately USD 196.11 billion by 2034, expanding at a CAGR of 6.07% from 2025 to 2034. The market is experiencing rapid growth due to increased demand for high-quality, precision-engineered components from industries such as aerospace, automotive, and healthcare. The market is further fueled by the rising adoption of automation and advanced machinery in manufacturing processes. The growing need for high-accuracy, cost-effective solutions is expected to propel market growth in the coming years.

Precision Turned Product Manufacturing Market Key Takeaways

- In terms of revenue, the global precision turned product manufacturing market was valued at USD 108.79 billion in 2024.

- It is projected to reach USD 196.11 billion by 2034.

- The market is expected to grow at a CAGR of 6.07% from 2025 to 2034.

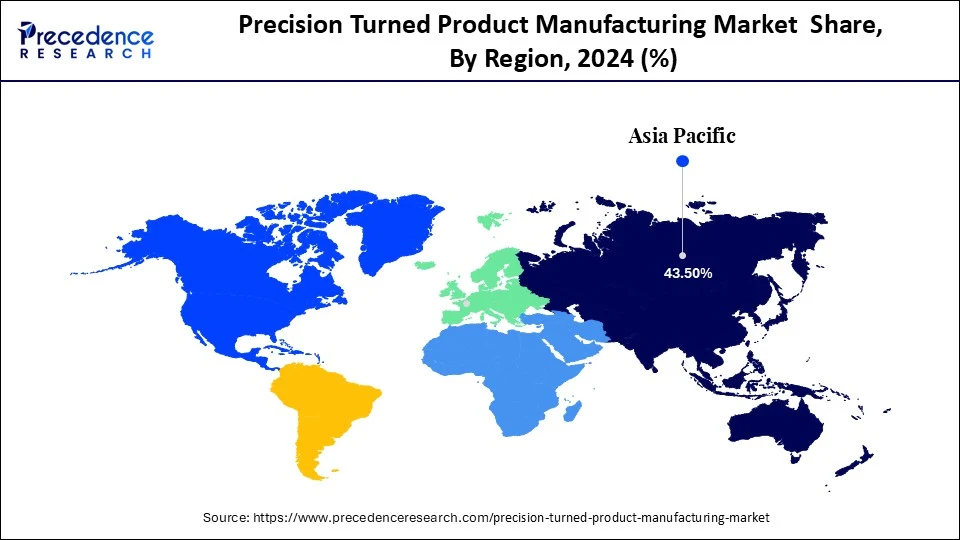

- Asia Pacific dominated the global precision turned product manufacturing market with the largest share of 43.50% in 2024.

- North America is expected to grow at the fastest CAGR from 2025 to 2034.

- By product type, the precision shafts and pins segment captured the biggest market share of 34.50% in 2024.

- By product type, the custom precision components segment is expected to grow at the fastest CAGR over the projected period.

- By material, the metals segment contributed the highest market share of 68.50% in 2024.

- By material, the plastics and composites segment is anticipated to grow at a significant CAGR from 2025 to 2034.

- By manufacturing process, the CNC turning segment held the major market share of 75% in 2024.

- By manufacturing process, the swiss-type turning segment is expanding at a significant CAGR from 2025 to 2034.

- By end-use industry, the automotive segment generated the largest market share of 33.50% in 2024.

- By end-use industry, the medical devices and equipment segment is projected to grow at a significant CAGR between 2025 and 2034.

- By size of component, the small components (<50mm) segment led the market with the biggest share of 44.50% in 2024.

- By size of component, the medium-sized component (50-200mm) segment is expected to grow at a significant CAGR over the projected period.

Role of AI in the Precision Turned Product Manufacturing Market

Artificial Intelligence (AI) is revolutionizing the market by improving quality control, process optimization, and predictive maintenance. AI systems can detect defects more accurately than humans, forecast equipment failures, and streamline production, resulting in higher efficiency and lower costs. Moreover, AI algorithms can analyze sensor data from machines to predict failures before they happen, allowing for proactive maintenance and reduced downtime. Overall, AI helps identify bottlenecks and inefficiencies in large datasets, suggesting process improvements to optimize tool performance and minimize disruptions, thereby supporting market growth.

Market Overview

The precision turned product manufacturing market involves the production of highly accurate, dimensionally precise components, mainly through turning processes on CNC (Computer Numerical Control) and conventional lathes. These products include complex parts such as shafts, pins, bushings, fittings, and threaded components made from metals, plastics, and composites, often for use in aerospace, automotive, medical devices, electronics, and industrial machinery. Precision turning ensures tight tolerances, superior surface finishes, and high repeatability, which are essential for critical applications. The market is projected to continue strong growth, driven by digital transformation, additive manufacturing, customization, and the need for supply chain resilience. The rising demand for high-precision components further contributes to market expansion.

What Are the Key Trends in the Precision Turned Product Manufacturing Market?

- Increased Demand for High-Precision Components: Advancements in technology and increasing complexity in various industries drive the need for highly accurate and reliable components. Industries like automotive, aerospace, electronics, and healthcare rely on precision-turned parts for critical functions, driving further market growth.

- Cost Efficiency and Automation: Companies are constantly looking for ways to reduce production costs, and precision turned product manufacturing can help achieve this through optimized processes and automated systems, including CNC machining and robotics, to enhance production speed, accuracy, and cost-effectiveness.

- Material Innovation: The development of new materials with improved properties, such as high strength-to-weight ratios with enhanced resistance to extreme temperatures, like lightweight alloys and composites in precision manufacturing, contributes to market growth.

- Globalization and Outsourcing: Companies are increasingly outsourcing their manufacturing demands to specialized firms, particularly in countries with lower production costs. Also, some companies are bringing their manufacturing operations back to their home countries or regions to reduce supply chain risks and improve control over production.

- Sustainable Manufacturing Solutions: Growing emphasis on environmentally friendly manufacturing processes and the longevity of precision components are driving market expansion through the adoption of sustainable manufacturing practices, including waste reduction and energy efficiency.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 196.11 Billion |

| Market Size in 2025 | USD 115.39 Billion |

| Market Size in 2026 | USD 122.39 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.07% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Material, Manufacturing Process, End-Use Industry, Size of Componentand Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Expansion of the Automotive Industry

The primary factor driving the growth of the precision turned product manufacturing market is the rapid expansion of the automotive industry, along with increasing vehicle production. The automotive industry is the largest consumer of precision-turned parts, including those for engine components, fuel systems, and braking systems, followed closely by the aerospace and defense industries. These industries depend heavily on precision-turned components for various applications, demanding high accuracy, durability, and tight tolerances. The rising global population and increasing demand for personal vehicles, especially in emerging markets, are boosting light vehicle production and, consequently, the demand for precision-turned parts.

Restraint

High Initial Investment Required for Advanced Machinery and Equipment

The major restraint in this market is the high initial investment required for advanced machinery and equipment, including CNC machines, specialized tools, and the necessary software for precision manufacturing. The field of precision manufacturing continually evolves with new technologies and software, requiring businesses to constantly invest in upgrades and replacements to stay competitive. This ongoing demand increases the financial burden, especially for small and medium-sized enterprises. Moreover, a shortage of skilled workers proficient in operating CNC machines limits production capacity, thereby restricting market growth.

Opportunity

Digitalization and Automation

A key future opportunity for the precision turned product manufacturing market lies in the adoption of digitalization and automation, driven by Industry 4.0. This leverages technologies like CNC machining, additive manufacturing, the Internet of Things (IoT), and AI to enhance efficiency, accuracy, and customization. The integration of digital technologies, including CNC machines, automated guided vehicles (AGVs), and robotic systems, is transforming precision turned product manufacturing by enabling real-time data analysis and optimized production processes.

Product Type Insights

How Did the Precision Shafts & Pins Segment Dominate the Precision Turned Product Manufacturing Market in 2024?

The precision shafts & pins segment dominated the market, accounting for about 30–35% share in 2024. This is mainly because these components are vital for improving accuracy, performance, and reliability across various industries. They are essential for achieving precise movements and tight tolerances in modern machinery, making them indispensable in applications ranging from automotive and aerospace to electronics and medical devices. These components enhance machinery by reducing friction, wear, and misalignment risks, which extend their lifespan and save costs.

The custom precision components segment is expected to grow at the fastest rate during the forecast period due to the rising demand for specialized, high-precision parts across multiple industries. Their flexibility is essential in modern manufacturing, where custom solutions help improve efficiency and product quality, leading to long-term savings. This segment's growth is further supported by advances in automation and CNC machines and the rising need for tailored solutions in sectors like automotive, aerospace, and medical devices, enabling faster turnaround times and quicker design-to-final-product cycles.

The precision shafts and pins segment held the largest share of 34.50% in the 2024 global precision turned product manufacturing market. The segments are crucial components harnessing products in this market. The precision shafts and pins are a huge support for motion control, power transmission. The segment largely connects various sectors such as medical, automotive, electronics, and aerospace. The development is fuelled by the demand for quality, performance, accuracy and long-term durability. This demand promotes advanced techniques such as CNC machining and other crucial systems.

The custom precision components segment is expected to grow at a CAGR of 9.80% during the forecast period. The segment is steadily leading due to its reliability, innovation, and quality performance throughout numerous industries, enabling scope for well-trimmed solutions and rigorous tolerances. The development is influenced and empowered by advanced technology, such as the popular Industry 4.0 unification. The development will lead to lower cost, improved safety and efficiency in sectors like defence, medical and more.

Material Insights

What Made Metals the Dominant Segment in the Market in 2024?

The metals segment dominated the precision turned product manufacturing market by capturing around 65–70% share in 2024. This is mainly because metals such as steel, aluminum, and brass offer excellent machinability, strength, and durability, along with the versatility of CNC machining. The wide range of applications needing high precision and reliability makes metals ideal for these processes. Continued research and development in metallurgy have led to innovations like new alloys with enhanced properties, further bolstering this dominance, especially with the rising demand for complex and intricate designs across various industries.

The plastics & composites segment is expected to grow at the fastest rate in the upcoming period due to their lightweight, durable, and cost-effective nature, providing an excellent strength-to-weight ratio compared to metals. These materials are increasingly used in automotive and aerospace applications where weight reduction is critical. Additionally, advances in recycling technology and growing applications in industries like automotive, aerospace, medical, consumer goods, and packaging are driving this growth.

The metals segment held the largest share of 68.50% in the 2024 global precision turned product manufacturing market. Metals play a significant role in the market. The metals like titanium, steel/stainless steel, copper, copper alloys and aluminium/aluminium alloys deliver fundamental properties such as stiffness and robustness. The development in the manufacturing process is backed by Industry 4.0 technologies and advanced alloys. The trend for typical lightweight materials such as titanium and aluminum is redesigning the future of manufacturing.

The engineering plastics segment is expected to grow at a CAGR of 10.40% during the forecast period. The segment is transitioning the precision turned product manufacturing with its design flexibility, lightweight form, and quality performance. These factors are used to embed only in metal parts, and now in engineering plastics too. This development leads the segment in fruition and is steadily gaining traction in the precision turned product manufacturing. The development indicates the segment's potential to shift from advanced polymers to a replacement agent for traditional materials.

Manufacturing Process Insights

Which Manufacturing Process Segment Dominated the Precision Turned Product Manufacturing Market in 2024?

The CNC turning segment dominated the market with the largest share of about 75% in 2024, thanks to its high precision, efficiency, and ability to consistently produce complex parts. This process uses computer numerical control to accurately manage cutting tools and workpiece rotation, ensuring accuracy and repeatability and minimizing errors and defects. These machines can be programmed to produce a wide variety of parts, making them versatile for different manufacturing needs. The rising demand for high-quality, complex components across sectors such as aerospace, automotive, and healthcare highlights the dominance of CNC turning.

The Swiss-type turning segment is expected to grow at the fastest CAGR during the projection period because Swiss lathes are well known for their ability to hold extremely tight tolerances and produce parts with very smooth finishes. This makes them ideal for industries such as medical, aerospace, and electronics. Their capacity to produce highly accurate, complex parts and adapt to various materials and industries makes them highly efficient for high-volume, low-margin production runs. These machines can perform multiple operations simultaneously, often equipped with bar feeders for continuous production, and can complete multiple tasks in a single setup, reducing the need for secondary processes and saving time and costs.

End-Use Industry Insights

Why Did the Automotive Segment Dominate the Market in 2024?

The automotive segment dominated the precision turned product manufacturing market with a 30–35% share in 2024, driven by the high demand for precision components in engines, transmissions, and other critical vehicle systems. This demand is further fueled by the need for lightweight, high-performance parts, especially with the global shift toward electric vehicles and stricter emissions regulations. Additionally, the automotive industry's reliance on mass production requires precision machining to ensure quality and efficiency, further boosting demand for precision-turned parts.

The medical devices & equipment segment is expected to experience the fastest growth in the coming years. The growth of the segment is primarily attributed to the rising need for high-precision components in medical devices. The increasing prevalence of chronic diseases, an aging population, and technological advancements in healthcare are also supporting segmental growth. This growth is also accelerated by innovations like miniaturization, AI integration, and remote patient monitoring, which are leading to a surge in the development and production of sophisticated medical equipment and accelerating the creation of new medical technologies.

The automotive segment held the largest share of 33.50% in the 2024 global precision turned product manufacturing market. The segment is leading due to the increased demand and growth in electric vehicles (EVs), autonomous vehicles and internal combustion engine (ICE) vehicles. With the rapid requirement for materials and components like metal, composite materials, nuts, screws and fitting agents, and more, the precision turned product manufacturing has accelerated.

The medical devices and equipment segment is expected to grow at a CAGR of 10.70% during the forecast period. The healthcare market seeks accuracy in its operations, so the segment has scaled rapidly, benefiting the precision-turn product manufacturing market. The surgical instruments, prosthetics, implants, therapeutic and diagnostic devices/instruments are essential and consistent in the healthcare sector, following which the demand for medical devices and equipment increases constantly.

Size of Components Insights

How Does the Small Components (<50mm) Segment Dominate the Precision Turned Product Manufacturing Market in 2024?

The small components (<50mm) segment dominated the market with a 40–45% share in 2024, driven by advancements in CNC technology, featuring high-speed spindles and multi-axis movement that are essential for manufacturing small, complex parts with high precision and efficiency. Furthermore, miniaturization trends across various industries, along with the inherent advantages of precision in smaller parts, such as enhanced machinery performance, streamlined production, and reduced maintenance, are contributing to longer equipment lifespans and lower maintenance costs.

The medium-sized components (50-200mm) segment is expected to expand at the fastest rate during the forecast period, propelled by increased demand from industries such as automotive, shipbuilding, aerospace, electronics, and medical devices. This growth is also supported by the need for higher manufacturing precision and the expanding applications of precision-turned parts across diverse sectors. Innovations in materials science, machining techniques, and quality control are improving the performance and reliability of these parts, encouraging broader adoption.

Manufacturing process/ operation Insights

The CNC turning segment held the largest share of 75.00% in the 2024 global precision turned product manufacturing market. The segment is critical in the market, delivering accuracy and massive production for sectors such as medical, aerospace and automotive. This increases business and growth in the sectors as well as the market. The segment's role is to generate difficult cylindrical parts with rigorous tolerance. The role and responsibility are extending with the growing material advancement, automation and demand for intelligent manufacturing with AI potential. The segment promotes CNC lathes, grinding, and milling machines responsible for the growth in the market.

The Swiss-type turning segment is expected to grow at a CAGR of 9.90% during the forecast period. The segment is a high-precision, crucial manufacturing process for creating complex, compact cylindrical parts in massive amounts. The development represents the transition from the traditional mechanical machines to the modern approach/ fully CNC-operated lathes with unified potential. The potential, such as laser cutting and axis milling, is leading with the accelerating demand for complex, compact components.

Regional Insights

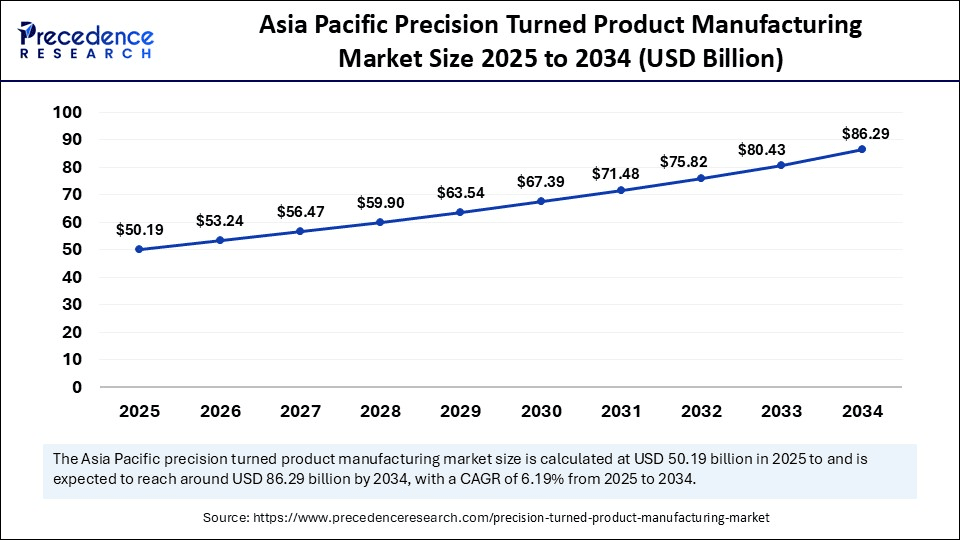

Asia Pacific Precision Turned Product Manufacturing Market Size and Growth 2025 to 2034

Asia Pacific precision turned product manufacturing market size is exhibited at USD 50.19 billion in 2025 and is projected to be worth around USD 86.29 billion by 2034, growing at a CAGR of 6.19% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Precision Turned Product Manufacturing Market in 2024?

Asia Pacific registered dominance in the market by holding the largest share of 43.5% in 2024. This is mainly due to its large manufacturing base, robust industrial growth, significant sector demands, and comparatively lower labor costs. A widespread and efficient supply chain network in the region facilitates the production and delivery of precision-turned products. Rapid industrialization and economic growth in countries like China and India have increased demand, while countries like Singapore are actively developing smart manufacturing capabilities and attracting investments as a hub for precision engineering. Key sectors, including automotive, electronics, aerospace, and healthcare, drive significant demand for precision-turned components.

China Precision Turned Product Manufacturing Market Trends

China plays a significant role in the market due to its large-scale production capacity and technological innovations, positioning it as a major supplier of precision components to industries such as automotive, aerospace, and electronics. Many Chinese manufacturers are focusing on quality control and compliance with international standards, often obtaining certifications to boost precision and efficiency. Being the world's largest producer of vehicles, there is a high demand for precision components, contributing to market growth.

India Precision Turned Product Manufacturing Market Trends

India is emerging as a major market, driven by its growing manufacturing sector, skilled workforce, and increasing adoption of advanced technologies. The country is becoming a key hub for manufacturing precision components, serving both domestic and international markets. Government initiatives like Make in India are encouraging investments in the sector, further enhancing precision manufacturing with lower labor costs and more efficient production processes.

What are the Major Factors Driving the Growth of the Precision Turned Product Manufacturing Market Within North America?

North America is expected to grow at the fastest CAGR during the forecast period, fueled by rising demand from industries such as automotive and aerospace. Technological advancements and a focus on Industry 4.0 principles further support market growth. The well-established supply chains increase the availability and accessibility to high-quality components that meet international standards. Government investments in aerospace and defense, along with an emphasis on automation and sustainable manufacturing, further support market expansion. Improvements in CNC machining and automation have greatly increased the speed, precision, and efficiency of manufacturing precision-turned products.

U.S. Precision Turned Product Manufacturing Market Trends

The U.S. plays a distinctive role in the market. It is a major producer of precision components, driven by a large manufacturing base and well-developed infrastructure, including advanced manufacturing technologies and equipment that enable the production of high-precision components. Additionally, strong demand from sectors such as automotive, electronics, defense, and healthcare relies heavily on precision-turned products. The market is characterized by the increasing adoption of advanced technologies like CNC machining and automation, along with a growing demand for complex, high-precision components.

In January 2023, Helios Technologies, Inc., a U.S.-based company, announced plans to acquire Schultes Precision Manufacturing, Inc., a trusted specialist in producing precision-machined components and assemblies that require very tight tolerances and high quality. Schultes serves industries such as hydraulics, aerospace, communication, food services, medical devices, and dental, offering superior value-added manufacturing processes.

(Source: https://www.heliostechnologies.com)

Why is Europe Considered a Significant Region in the Precision Turned Product Manufacturing Market?

Europe is considered to be a significantly growing area. The growth of the market in the region is driven by its robust manufacturing infrastructure, a well-established industrial base with a long tradition of precision engineering, a skilled workforce, and an emphasis on quality, especially in countries like Germany, Switzerland, and Italy. European manufacturers are known for producing high-quality, high-precision components for industries such as automotive, aerospace, and medical devices. Initiatives like the Chips Act for Europe aim to strengthen the region's semiconductor industry by leveraging advanced manufacturing technologies and collaborations. Europe is also actively adopting automation and digitalization in manufacturing processes to boost efficiency, accuracy, and productivity.

What Opportunities Exist in the Latin America Precision Turned Product Manufacturing Market?

Latin America is expected to grow at a notable rate in the upcoming period, owing to its large and expanding consumer goods sector, driven by an increasingly affluent population that creates strong domestic demand for manufactured goods, including precision-turned products. Moreover, abundant natural resources, strategic location, and a skilled, cost-effective labor force, combined with government efforts through various initiatives, including tax incentives, infrastructure development, and support for technological upgrades, are fostering manufacturing growth. Rising industrialization also supports regional market growth.

What Factors Contribute to Precision Turned Product Manufacturing Market in the Middle East & Africa?

The Middle East & Africa is witnessing robust growth, primarily driven by increased infrastructure investment, a rising middle class, and a focus on diversifying economies beyond oil dependence. The regional market growth is further supported by government initiatives that promote industrialization, technological progress, and strategic partnerships. Many countries in the MEA region are actively working to diversify their economies by investing in manufacturing, technology, and other sectors, leading to increased demand for precision manufacturing.

Precision Turned Product Manufacturing Market Companies

- Sandvik AB

- Kennametal Inc.

- Mitsubishi Materials Corporation

- GKN plc

- IMI Precision Engineering

- Shiloh Industries, Inc.

- Schunk Group

- Preci-Dip SA

- Thomas & Betts Corporation (A member of ABB)

- JTEKT Corporation

- Kongsberg Gruppen ASA

- Star Micronics Co., Ltd.

- Hexagon AB

- Eichenberger Gewinde AG

- Precision Castparts Corp.

- Honsberg GmbH

- Swagelok Company

- BorgWarner Inc.

- Amphenol Corporation

- Bharat Forge Limited

Industry Leader's Announcement

- In August 2024, CORE Industrial Partners announced that its portfolio company, PrecisionX Group, had acquired MSK Precision Products, Inc. Matthew Puglisi, Partner at CORE, said, “We believe the acquisition of MSK is highly strategic for several reasons, including enhanced capacity and expertise in specialty Swiss precision machining, deepened presence in the desirable medical and aerospace & defense end markets, and expanded geographic reach on the East Coast, from New York, New Jersey and Connecticut to now Florida.”

(Source: https://www.businesswire.com)

Recent Developments

- In March 2025, Dormer Pramet expanded its indexable tools lineup with the launch of new high-performance turning and milling solutions. These tools are designed to maximize productivity by combining enhanced precision, durability, and efficiency, empowering manufacturers to push their limits and representing the latest in technological advances along with the unified strength of Dormer Pramet as a master brand.

(Source: https://www.globenewswire.com) - In November 2023, Kennametal India Limited's WIDMA Machining Solutions Group launched the VT850, a 2-axis vertical turning lathe designed for precision and high productivity when machining large components. This launch enhances the standard products portfolio by improving customer turnaround time, ensuring consistent performance, and enabling multiple operations without sacrificing quality.

(Source: https://www.manufacturingtodayindia.com)

Segments Covered in the Report

By Product Type (Value in USD Billion and Volume in Mn Units)

- Precision Shafts & Pins

- Threaded Components

- Screws

- Bolts

- Nuts

- Bushings & Bearings

- Fittings & Connectors

- Gears & Splines

- Custom Precision Components

By Material (Value in USD Billion)

- Metals

- Steel (including stainless steel)

- Aluminum & Aluminum Alloys

- Titanium

- Copper & Copper Alloys (e.g., Brass)

- Plastics & Composites

- Engineering Plastics

- Composite Materials

By End-Use Industry (Value in USD Billion)

- Automotive

- Internal Combustion Engine (ICE) vehicles

- Electric Vehicles (EVs)

- Autonomous Vehicles

- Aerospace & Defense

- Commercial Aerospace

- Military & Defense

- Space Exploration

- Medical Devices & Equipment

- Surgical Instruments

- Implants and Prosthetics

- DDiagnostic and Therapeutic Devices

- Electronics & Electrical

- Consumer Electronics

- Industrial Electronics

- Telecommunications

- Industrial Machinery & Equipment

- Oil & Gas

- Energy & Power Generation

By Manufacturing Process / Operation (Value in USD Billion)

- CNC (Computer Numerical Control) Turning

- CNC Lathes

- CNC Milling Machines

- CNC Grinding Machines

- Swiss-Type Turning

- Manual Operation

- Machine Types

- Automatic Screw Machines

- Single-Spindle

- Multi-Spindle

- Rotary Transfer Machines

- Horizontal

- Vertical

By Region

- Asia-Pacific

- North America

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting