Aluminium Casting Market Revenue to Attain USD 151.26 Bn by 2033

Aluminium Casting Market Revenue and Trends 2025 to 2033

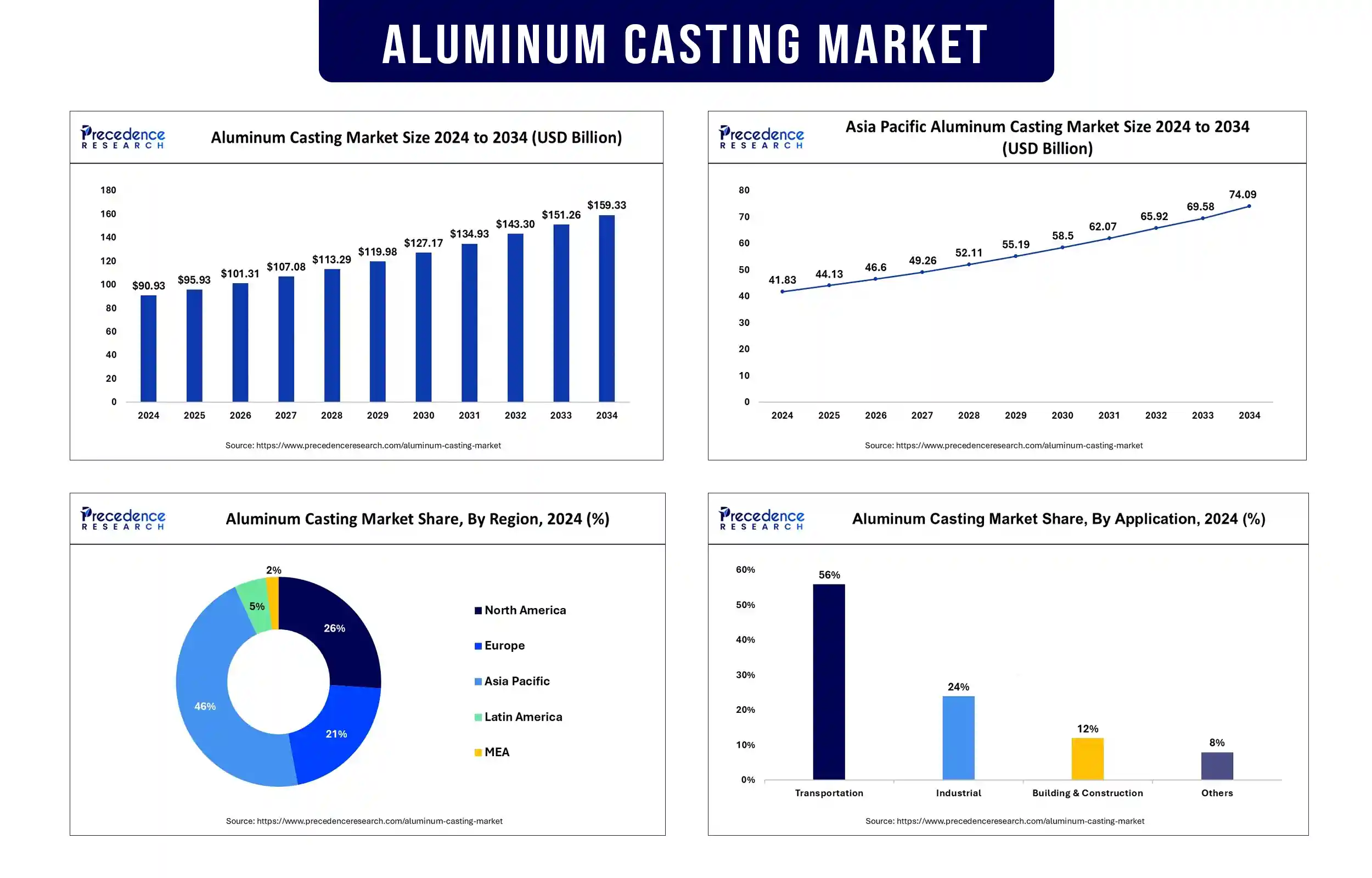

The global aluminium casting market revenue is reached USD 95.93 billion in 2025 and is predicted to attain around USD 151.26 billion by 2033 with a CAGR of 5.77%.

Marketing Overview

The aluminum casting industry is growing rapidly because of increasing demands from significant sectors such as automotive, aerospace, construction, and industrial manufacturing. Due to its high strength, low weight, and corrosion resistance, aluminum is an ideal material for enhancing fuel economy and structure performance, which is driving the industry. With global industries increasingly turning towards energy efficiency and sustainability, aluminum casting has come forth as a critical solution, especially in electric vehicle (EV) manufacturing and light machinery.

Developments in casting technologies like die casting, sand casting, and permanent mold casting are further enlarging the ambit of applications and hence fuelling market adoption. Also, the increase in infrastructure development in the emerging economies, along with the initiatives of governments for green materials, is playing a pivotal role in the expansion of the market. With ongoing advancements and a big thrust for recyclable and green materials, the aluminum casting market will be witnessing considerable growth in the years to come.

Marketing Trends

Focus on Technological Innovation

One of the most characteristic marketing trends across the aluminum casting industry is the fast-paced shift towards smart manufacturing technologies. From AI-driven production lines to IoT-monitored monitoring systems, manufacturers are using sophisticated tools to enhance accuracy, minimize waste, and increase overall efficiency. Process such as investment casting and high-pressure die casting are being positioned as differentiators in chief, particularly for high-performance applications across industries such as aerospace and automotive. Firms selling these products are emphasizing innovation and environmental quality assurance to attract industrial consumers looking for the latest, high-quality components.

Strategic Alliances and Industry Partnerships

Strategic partnerships and alliances are being vigorously encouraged as signs of strength and innovation. Companies are engaging in joint ventures, partnering raw material suppliers, and engaging in cross-sector projects to enhance product development and grow economically. These partnerships are often highlighted in press releases and marketing brochures to develop credibility and show long-term growth to clients and investors.

Higher Demand for Green Process and Sustainability

Sustainability is not a choice anymore; it's a fundamental marketing message. The process of aluminum casting is progressing increasingly towards the utilization of recycled aluminum along with green processes of casting. The green features of aluminum, such as 100% recyclability and zero carbon footprint, are being emphasized by the customers to cater to green consumers. There is also high demand for efficient energy use in melting and casting so that businesses can demonstrate their green manufacturing commitment and achieve a competitive edge overseas.

Multi-Channel Engagement and Digital Marketing

With both old-world manufacturing and state-of-the-art technology under one roof in an economy, digital transformation is a certainty. Aluminum castings companies are expanding their presence through SEO websites, B2B content marketing, and social media marketing. The tendency is even more powerful towards interacting with web-based trade shows, webinars, and virtual technical forums to connect with global prospects easily. These multi-channel practices are increasing visibility, credibility, and qualified leads.

Reports of the highlights of the Aluminium Casting Market

Process Insights

The die-casting segment accounted for the highest revenue market share of over 51% in 2024 due to increasing demand for casting products made of aluminum in the automotive industry. Die-casting is employed to produce various auto components that find applications in mass-produced and luxury vehicles, including engines, cylinders, gears, and flywheels. This is due to factors such as the cheapness of die casting and the stringent CO2 pollution rules that have been implemented everywhere across the globe. There are secondary splits for pressure die casting and other types of aluminum die casting. It is estimated that the distinctive features of pressure die casting, namely its close accuracy in measurement, strong mechanical properties, clean finishing surface, and ease in filling the cavity, will support market expansion, particularly in the automobile industry.

Application Insights

In 2024, the revenue from the transportation application was around 56% of the overall revenue. This increase is due to rising demand for light vehicles and planes across the world. One of the most profitable sectors for light vehicles is the sports car industry. The popularity of sports events, racing, and rallies in North America and Europe continues to fuel the demand for sports cars and increase demand for aluminum casting.

Regional Outlook

When talking about aluminum casting business, Asia-Pacific is the largest region in the entire world. China and India are the leaders with their vastly growing automobile industries, low-cost production, and vastly growing construction activities. China alone exports and consumes the greatest quantity of cast aluminum products due to its vast industrial infrastructure and strong export potential.

North America has been growing incrementally during the period due to strict environmental regulations that encourage decarbonized content and growing utilization of lightweight auto components, specifically in the electric vehicle arena.

Aluminium Casting Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2025 | USD 95.93 Billion |

| Market Revenue by 2033 | USD 151.26 Billion |

| CAGR from 2025 to 2033 | 5.77% |

| Quantitative Unit | Revenue in USD million/billion, Volume in units |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Recent Developments

- In July 2024 with the aid of 3D printing technology, the 76th Commodities Maintenance Group from Tinker Air Force Base and REACT Lab stepped up their in-house sand-casting capability. Efforts continue to reach Grade A standards, and this capability will allow the 3D printing of aluminum components up to 120 pounds at the Grade B level.

- In September 2023, to expand the amount of recycled post-consumer aluminum scrap used in the automotive market, Norsk Hydro spent $42.5 million to initiate the HyForge casting line at its plant in Germany. Through the creation of high-quality billets that are suitable for direct forging, the new line eliminates the necessity of additional processing steps.

Aluminum Casting Market Key Players

- Walbro

- Alcoa Corporation

- Consolidated Metco, Inc.

- BUVO Castings

- RDW Wolf, GmbH

- Georg Fischer Ltd.

- Dynacast

- GIBBS

- Ryobi Limited

- Martinrea Honsel Germany GmbH

- Bodine Aluminum

- Alcast Technologies

- Endurance Technologies Limited

- Aluminum Corporation of China Limited

Market Segmentation

By Processes

- Die Casting

- Pressure Die Casting

- Permanent Mold Casting

- Others

- Others

By Application

- Transportation

- Industrial

- Building & Construction

- Others

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape

overview @https://www.precedenceresearch.com/sample/2915

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344