Biosimilar Monoclonal Antibody Market is Likely to Rise at 23.2% CAGR By 2032

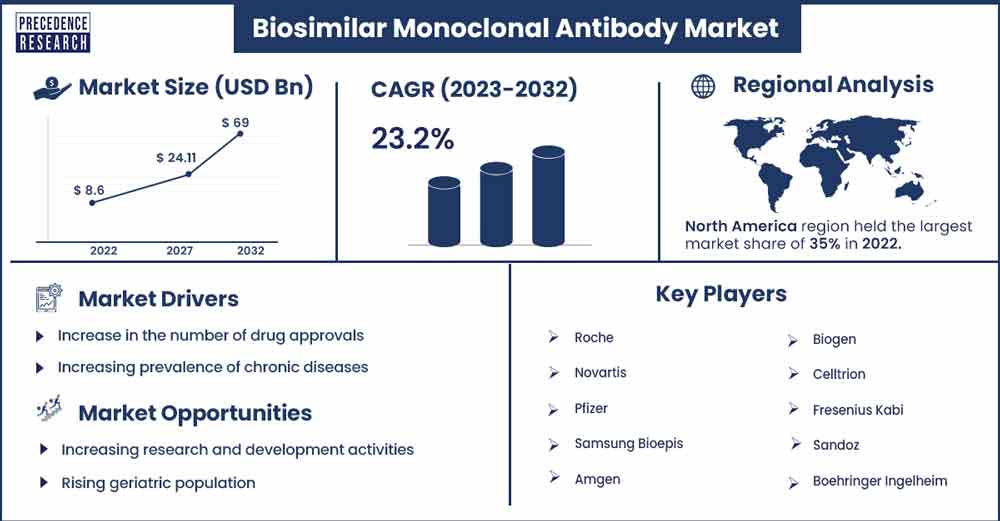

The global biosimilar monoclonal antibody market size was exhibited at USD 8.6 billion in 2022 and is projected to attain around USD 69 billion by 2032, growing at a CAGR of 23.2% during the forecast period 2023 to 2032.

Market Overview

A biosimilar is defined as a biological product that is highly similar to a well-known regulatory-approved biologic in terms of structure, function, purity, safety, and efficacy. The biosimilar monoclonal antibody domain is a branch of the pharmaceutical industry dedicated to developing, producing, and distributing biosimilar monoclonal antibodies. Within this industry, regulatory authorities such as the European Medicines Agency (EMA) and the United States Food and Drug Administration (FDA) are responsible for developing a product design and approval regulatory pathway. Cancer, autoimmune disorders, and inflammatory diseases are some areas that have well-established and approved biosimilar monoclonal antibodies-based treatment options.

The biosimilar monoclonal antibody market is driven by several factors, including increasing product approvals, a rise in the number of patent expirations, rapid adoption of novel treatment options, increasing awareness regarding early diagnosis, rising geriatric population, rising product innovations, and evolving patient accessibility to essential treatment. Additionally, a growing number of chronic ailments may boost the development of the biosimilar monoclonal antibodies market. Biosimilar monoclonal antibodies have reshaped the healthcare infrastructure and increased the accessibility for the treatment of a wide range of diseases while offering higher efficacy, quality, and safety.

- In March 2023, Sandoz, a pioneer in generic and biosimilar pharmaceuticals, signed a Memorandum of Understanding (MOU) to build a new biologics production plant in Lendava, Slovenia. The company’s investment is projected to be at least USD 400 million, which is likely to support the company’s ambition to fuel the future growth of its global biosimilar portfolio. It is one of the largest-ever international private-sector investments in Slovenia.

- In February 2023, Gland Pharma announced the expansion plan in Genome Valley near Hyderabad with an investment worth ₹400 crore. The company’s expansion will add more capabilities to its existing facility to manufacture biologicals, antibodies, biosimilars, and recombinant insulin. The expanded facility is expected to offer employment opportunities for more than 500 qualified, skilled, and semi-skilled people, mostly from nearby areas.

- In February 2022. Gland Pharma established its biopharmaceutical facility at Genome Valley with an investment worth ₹300 crore for manufacturing biologicals, vaccines, biosimilars, and antibodies. The facility recruited 200 people for the facility.

- In May 2023, Alkem Laboratories launched Cetuxa, the world's first biosimilar of cetuximab for the treatment of head and neck cancer. The launch was made to ensure accessibility, affordability, and availability while saving the lives of severely ill cancer patients. Head and neck cancers (HNCs) are one of the most common cancers globally.

Regional Insights

North America is expected to hold the largest market share over the forecast period owing to the increasing prevalence of chronic diseases, sophisticated healthcare infrastructure, growing development of advanced drugs, increasing investment in research and development activities, expansion in the number of pipeline biosimilar drugs and presence of prominent market players such as Pfizer Inc., Amgen, Mylan N.V., Amneal Pharmaceuticals, Biogen Inc., Coherus BioSciences, Inc., and others.

In addition, the rise in the number of product approvals for biosimilars is expected to fuel the market's growth. For instance, 44 biosimilars are currently approved by the U.S. FDA. The most recent biosimilar approval was Wezlana (ustekinumab-auub) on 31st October 2023. In the United States, Breast cancer is one of the most common types of cancer in women. According to data published by the American Cancer Society, it is estimated that about 1 in 3 females suffers from cancer each year. Herceptin blocks the action of HER2 and encourages the natural immune system to destroy cancer cells. Thus, this is expected to propel the market growth in the region during the forecast period.

Biosimilar Monoclonal Antibody Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 10.55 Billion |

| Projected Forecast Revenue by 2032 | USD 6.9 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 23.2% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increase in the number of drug approvals

The increase in drug approvals is projected to fuel the market's expansion in the coming years. For instance, the FDA's Center for Drug Evaluation and Research (CDER) approved 37 new molecular entities in 2022. 17 of 2022's new drugs were small molecules, accounting for 46%. Large molecules, such as biosimilars, biologics, and cell and gene therapies, are projected to witness the fastest growth during the forecast period.

Increasing prevalence of chronic diseases

The prevalence of chronic diseases is expected to fuel the biosimilar monoclonal antibodies market during the forecast period. Biosimilar monoclonal antibodies are widely used to treat chronic disorders such as cancer, autoimmune disease, rheumatoid arthritis, psoriasis, and diabetes. Cancer is a leading cause of death globally, with cases increasing rapidly year by year. For instance, The American Cancer Society estimated that 1,958,310 new cancer cases and 609,820 cancer deaths are expected to occur in the United States in 2023. As per the Centers for Disease Control and Prevention, 6 in 10 adults in the U.S. have a chronic disease, and 4 in 10 adults have two or more chronic diseases. The growing cases of such diseases, the demand for medication, and the accessibility to essential treatment are predicted to fuel market expansion in the coming years.

Restraint

Stringent government regulations

Implementation of stringent government regulations is projected to hinder the growth of the biosimilar monoclonal antibodies market. Governments of various areas have different rules regarding the production and use of biosimilars. Over the projected period, the biosimilar monoclonal antibody market's expansion is anticipated to be constrained by the rigid regulations imposed on approvals of biosimilars.

Opportunities

Increasing research and development activities

The rising investment in research and development activities is expected to fuel the market's growth in the coming years. The key market players and reputed institutions are focusing on R&D activities to launch new biosimilars that assist in the treatment of chronic diseases. In addition, increasing collaborations among key market players are also projected to propel the market's growth by offering a lucrative opportunity for market growth during the forecast period.

Rising geriatric population

The rising geriatric population is expected to fuel the market's expansion during the forecast period as the ageing population is more susceptible to chronic diseases. As per the United Nations World Social Report 2023, the number of persons aged 65 years or older across the globe is projected to double over the next three decades. The rising cases of age-related diseases have spurred the demand for regenerative medicine. Biosimilar monoclonal antibodies address the healthcare needs of the ageing population by providing effective therapies at relatively less cost than branded drugs as they are exact replicas of their branded counterparts. Therefore, less healthcare expenditure are expected to offer a lucrative opportunity for market growth during the forecast period.

Recent Developments

- In April 2022, Amneal Pharmaceuticals, Inc. received United States Food and Drug Administration ("FDA") approval for a Biologics License Application ("BLA") for pegfilgrastim-pbbk, a biosimilar referencing Neulasta. The product will be marketed under the proprietary name FYLNETRA.

- In September 2023, Samsung Bioepis Co., Ltd. agreed with Sandoz to commercialize SB17, a proposed biosimilar to Janssen Pharmaceuticals' Stelara (ustekinumab) for autoimmune disorders including Crohn's disease, psoriatic arthritis, plaque psoriasis, and ulcerative colitis. This agreement is anticipated to help to expand access to biosimilar medicines. Through the collaboration, Sandoz will have the right to commercialize the drug in Canada, the United States, EEA, Switzerland, and the United Kingdom. Samsung Bioepis will be responsible for the development, regulatory registration, manufacturing, and supply of the Stelara (ustekinumab) biosimilar.

- In May 2022, Biocon Biologics Ltd. and Viatris Inc. received approval from Health Canada across four oncology indications for Abevmy (Bevacizumab), a biosimilar to Roche's Avastin (Bevacizumab).

- In January 2022, Biogen Inc. partnered with Samsung Biologics, whereby Samsung Biologics will acquire Biogen's equity stake in the Samsung Bioepis joint venture for an aggregate consideration of up to USD 2.3 bn. The complete buyout of Biogen's stake by Samsung Biologics is expected to strengthen Samsung Bioepis' biosimilar development capabilities and performance in the new drug development process.

Key Market Players

- Roche

- Novartis

- Pfizer

- Samsung Bioepis

- Amgen

- Mylan

- Teva Pharmaceutical Industries

- Biogen

- Celltrion

- Fresenius Kabi

- Sandoz

- Boehringer Ingelheim

- Merck

- Amneal Pharmaceuticals

- Biocon

Market Segmentation

By Type

- Adalimumab

- Bevacizumab

- Infliximab

- Rituximab

- Trastuzumab

- Others

By Indication

- Oncology

- Autoimmune diseases

- Others

By End User

- Hospitals

- Cancer treatment centers

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3400

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308