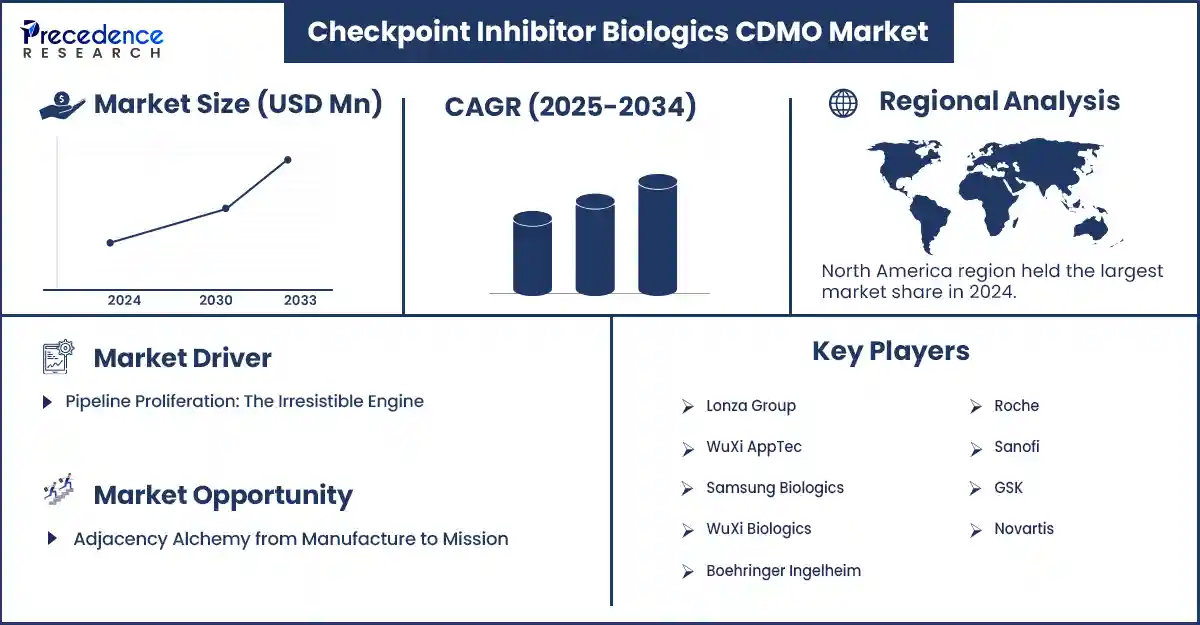

Checkpoint Inhibitor Biologics CDMO Market Revenue and Forecast by 2033

Checkpoint Inhibitor Biologics CDMO Market Revenue and Trends 2025 to 2033

The global checkpoint inhibitor biologics CDMO market revenue is expanding with rising demand for immuno-oncology outsourcing, scalable biologics production, and novel checkpoint therapies. This market is growing because pharmaceutical and biotechnology companies are increasingly relying on contract development and manufacturing organizations to design, produce, and scale checkpoint inhibitor biologics.

What are checkpoint inhibitor biologics, and why is this market growing?

Checkpoint inhibitor biologics are cancer treatments that utilize lab-made proteins to block checkpoint proteins on immune cells. The checkpoint inhibitor biologics CDMO market is experiencing growth, driven by the rising global cancer burden and unmet medical needs. This has spurred innovation in immuno-oncology and checkpoint inhibitor therapies, boosting demand for CDMO services known for their capabilities, quality, and regulatory compliance.

Many biopharma companies are opting out of investing in infrastructure for large-scale mammalian cell culture, purification, and biologics fill/finish. Technological advancements, such as single-use bioreactors and improvements in cell line engineering, that enhance yield, reduce contamination risks, and speed up time-to-market, are also key factors.

Moreover, regulatory clarity in major markets and advancements in biologics approval frameworks, particularly for monoclonal antibodies and advanced therapies, have bolstered investor confidence. The expansion into emerging markets, characterized by cost efficiencies, government incentives, and growing healthcare infrastructure, further enhances the attractiveness of these services.

Segment Insights:

- By service type, the commercial manufacturing segment dominated the market in 2024 due to its ability to sustain the large-scale manufacturing of commercially approved checkpoint inhibitor biologics, which come with high volume demand and significant regulatory requirements.

- By technology platform, the mammalian cell culture segment dominated the market in 2024 because of its capability to produce complex glycosylated proteins, such as monoclonal antibodies, with the necessary post-translational modifications.

- By drug class, the monoclonal antibodies segment dominated the market in 2024 because nearly all commercially available checkpoint inhibitors (anti-PD-1, anti-PD-L1, anti-CTLA-4) are monoclonal antibodies, which require CDMO expertise for production.

- By end-user, the pharmaceutical companies segment dominated the market in 2024 due to their preference for outsourcing development, scale-up, and commercial manufacturing to specialized CDMOs, thereby avoiding the costs and complexity of building a fully verticalized biologics manufacturing process.

Regional Insights:

North America dominated the checkpoint inhibitor biologics CDMO market in 2024 due to the presence of leading pharma/biotech companies, high investment levels in R&D, and the existence of a robust regulatory authority like the U.S. FDA. The U.S. is a major contributor to the market due to favorable reimbursement situations, advanced healthcare infrastructure, and an established network of high-capacity CDMOs.

Asia Pacific is the fastest-growing region, driven by increased healthcare investment, a rising incidence of cancer, lower biologics manufacturing costs, government incentives, and regulatory harmonization. Countries like India, China, and South Korea are expanding their biologics CDMO capacity for both domestic use and export. Moreover, many international biopharma companies are leveraging Asia's CDMO offerings to optimize costs and speed, further accelerating growth in the region.

Checkpoint Inhibitor Biologics CDMO Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Development

- In March 2025, Shilpa Medicare (India) formally launched a ‘hybrid CDMO’ at DCAT, an integrated platform designed to handle small and large molecule biologics, peptides, and off-the-shelf commercially ready formulations for licensing. Oncology, including checkpoint inhibitor biologics, is a key therapeutic focus. This model aims to provide pharmaceutical companies with both clinical and commercial outsourcing capabilities.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6981

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344