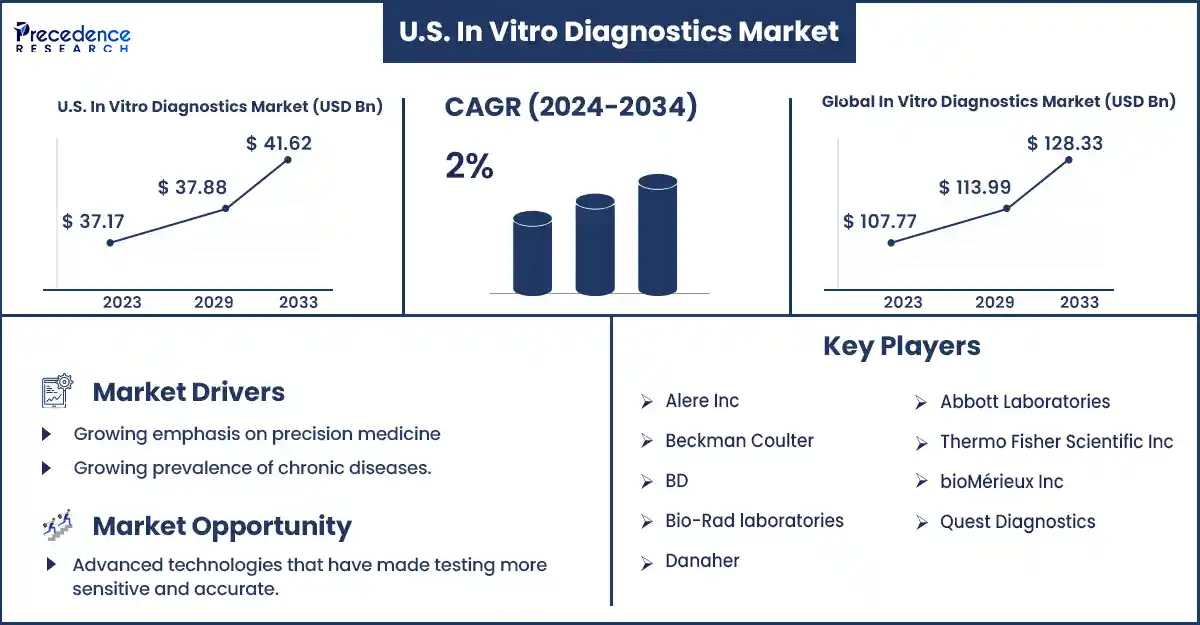

U.S. In Vitro Diagnostics Market Revenue to Attain USD 41.62 Bn by 2033

U.S. In Vitro Diagnostics Market Revenue and Trends 2023 to 2033

The U.S. in vitro diagnostics market revenue surpassed USD 34.98 billion in 2024 and is predicted to attain USD 41.62 billion by 2033, with a CAGR of 2%. The increasing demand for automated in vitro diagnostic systems in hospitals and laboratories and the rising prevalence of chronic diseases are expected to fuel the growth of the U.S. in vitro diagnostics market.

Market Overview

In vitro diagnostics (IVDs) are tests that analyze samples from the body to identify disease, infection, and other conditions. These tests help decide proper treatment plans, preventing or mitigating the risk of life-threatening disease. In vitro diagnostic tests are performed using components like cells, tissues, or biological molecules that are extracted from the human body, which play a significant role in providing healthcare professionals with accurate patient health data and guiding them with precise treatment and monitoring of various diseases and conditions.

These tests are carried out on samples like urine, saliva, blood tissue, or other body fluids and include a range of technologies and procedures such as molecular diagnostics, immunoassays, hematology, clinical chemistry, and microbiology. They also help in personalized medicine and early detection and improve overall healthcare management.

The rising number of chronic diseases, such as diabetes, cancer, and cardiovascular diseases, are driving the U.S. in vitro diagnostics market. For instance, according to the United Health Foundation's America's Health Rankings 2023 annual report, diabetes prevalence in the U.S. increased to 11.5% between 2021 and 2022, affecting approximately 31.9 million adults, while the prevalence of chronic obstructive pulmonary disease (COPD) was 7.1 times higher and cancer was 3.9 times higher among American adults.

The rising geriatric population is one of the major factors boosting the growth of the market. With the rising awareness regarding health and benefits and increasing healthcare expenditures, the demand for personalized medicine and targeted treatments is rising. In vitro diagnostic tests play a crucial role in personalized medicines and treatments, as they scan a person's DNA to detect genomic variations.

Key players operating in the market are investing heavily in research and development to develop new technologies with accuracy that help target life-threatening conditions and prevent disease. Moreover, specialized diagnostic tests are also in demand, as they assist healthcare providers in finding novel biomarkers and developing more precise diagnostic techniques.

Report Highlights of the U.S. In Vitro Diagnostics Market

- By product, the reagents segment held the largest share of the market in 2023, as these components are widely used in diagnostic assays and tests that identify specific biomarkers or particular substances in the samples like blood, urine, or tissue. Moreover, the rising adoption of molecular diagnostic techniques like polymerase chain reaction and nucleic acid amplification tests boost the need for specialized reagents, thus contributing to segmental expansion.

- By test location, the point of care segment accounted for the largest market share in 2023. Point-of-care testing is performed at or near the patient, allowing for rapid and convenient diagnostic procedures and results and helping in decision-making and treatment plans. Moreover, advancements in technologies like biosensor molecular diagnostic procedures used in point-of-care devices bolstered the segment's growth.

- By technology, the immunoassay segment led the market with the largest share in 2023. Immunoassays rely on the interactions of antibodies and antigens and detect the presence of biomarkers like hormones, proteins, drugs, or infectious agents in the samples. They are also used across several applications, such as oncology clinical diagnostics, infectious disease testing, allergy testing, endocrinology, and therapeutic drug monitoring.

- By application, the infectious diseases segment dominated the U.S. in vitro diagnostics market in 2023. This is mainly due to the rising cases of infectious diseases. However, in vitro diagnostic tests accurately diagnose a disease condition and provide effective treatment management and control. These tests help identify infectious agents and provide a proper treatment plan.

- By end user, the hospitals segment led the market with the largest share in 2023. With the growing patient pool in hospitals, these settings widely prefer in vitro diagnostic tests. These tests provide precise information about patients' health, including cell counts and blood chemistry, thereby enhancing health outcomes.

U.S. In Vitro Diagnostics Market Trends

- Rising Demand for Targeted Medicines: The increased emphasis on personalized medicine is driving the market for U.S. in vitro diagnostics. In vitro diagnostic tests identify patients who are likely to benefit from precision medicines. Moreover, they provide insights into the patient's health, which is crucial in precision medicines and treatments.

- Emphasis on Personalized Treatments: The growing emphasis on personalized therapeutic approaches is likely to propel market growth. Increasing government funding for personalized treatments and drug discovery further contributes to market expansion. The most commonly used personalized treatments include the HbA1c test for monitoring diabetes, therapeutic drug monitoring test for selecting drugs for resistant HIV strains, and cholesterol testing that monitors the effectiveness of lipid-lowering therapy. Moreover, in vitro diagnostics is also important in drug discovery, making clinical trials more efficient.

- Demand for Automated Instruments: The demand for automated in vitro diagnostics systems is increasing in clinical laboratories due to the increasing patient pool. Automated systems reduce human errors and enhance diagnostic accuracy, further improving patient safety and satisfaction. They also eliminate batch testing and provide quick results to healthcare providers. In addition, automation helps increase the test's efficiency and effectiveness and provides better treatment plans.

Market Opportunity

Technological Advancements

Advances in technology are revolutionizing the U.S. in vitro diagnostics market. The country is at the forefront of technological advancements, leading to the rapid development of automated in vitro diagnostic systems. Implementing advanced technologies, such as artificial intelligence and machine learning algorithms, in these systems enables precise and customized treatment plans. In addition, these technologies help understand and interpret complex test results and predict patient outcomes, thereby enhancing diagnostic accuracy.

U.S. In Vitro Diagnostics Market Coverage

| Report Attribute | Key Statistics |

| Market Revenue in 2024 | USD 34.98 Billion |

| Market Revenue by 2033 | USD 41.62 Billion |

| CAGR | 2% from 2024 to 2033 |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Base Year | 2023 |

Market News

- In October 2024, Abionic announced that its IVD CAPSULE PSP test received 510(k) clearance from the U.S. Food and Drug Administration (FDA) to accelerate the Time-to-Detection of Sepsis. Already certified under the EU IVDR, this FDA clearance marks a pivotal moment for Abionic’s expansion into the U.S. market.

Market Segmentation

By Product

- Reagents

- Instruments

- Services

By Test Location

- Point of Care

- Home Care

- Others

By Technology

- Immunoassay

- Instruments

- Reagents

- Services

- Hematology

- Instruments

- Reagents

- Services

- Clinical Chemistry

- Instruments

- Reagents

- Services

- Molecular Diagnostics

- Instruments

- Reagents

- Services

- Coagulation

- Instruments

- Reagents

- Services

- Microbiology

- Instruments

- Reagents

- Services

- Others

- Instruments

- Reagents

- Services

By Application

- Diabetes

- Cardiology

- Nephrology

- Infectious Disease

- Oncology

- Drug Testing

- Autoimmune Diseases

- Others

By End User

- Standalone Laboratories

- Hospitals

- Academic & Medical Schools

- Point-of-Care

- Others

Get this report to explore global market size, share, CAGR and trends, featuring detailed segmental analysis and an insightful competitive landscape overview@ https://www.precedenceresearch.com/checkout/3712

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 804 441 9344