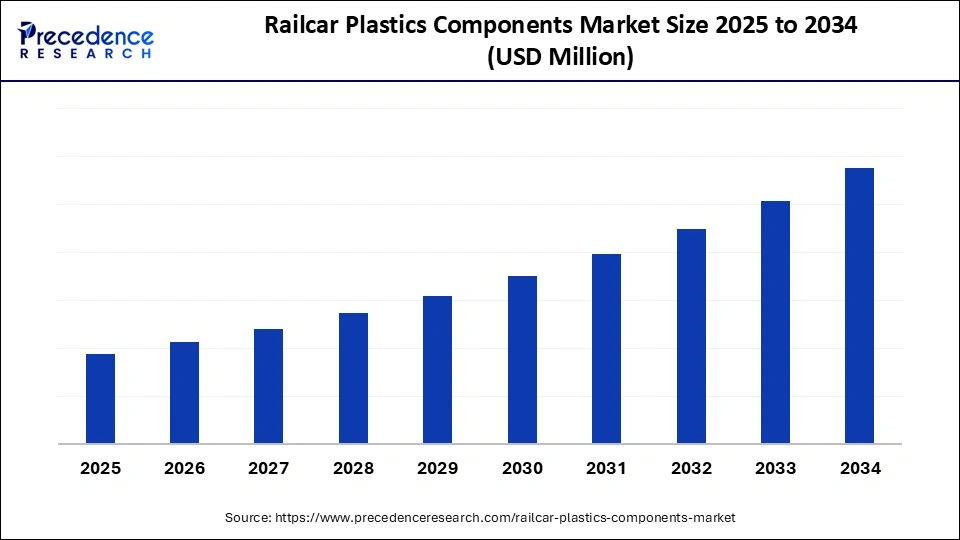

What is Railcar Plastics Components Market Size?

The global railcar plastics components market is driven by rising rail infrastructure investments, demand for lightweight parts, and innovations in high-performance polymer components. The market growth is attributed to the increasing adoption of lightweight, durable, and energy-efficient plastic components in modern railcar manufacturing.

Market Highlights

- By region, the North America segment held a dominant presence in the market in 2024, accounting for an estimated 35% market share.

- The Asia Pacific segment is expected to grow at the fastest rate from 2025 to 2034, accounting for 25% of market share.

- By material type, the thermoplastics segment accounted for a considerable share of the railcar plastics components market in 2024 that holding a market share of about 60%.

- By material type, the composites segment is projected to experience the highest CAGR between 2025 and 2034 accounting for 15% market share.

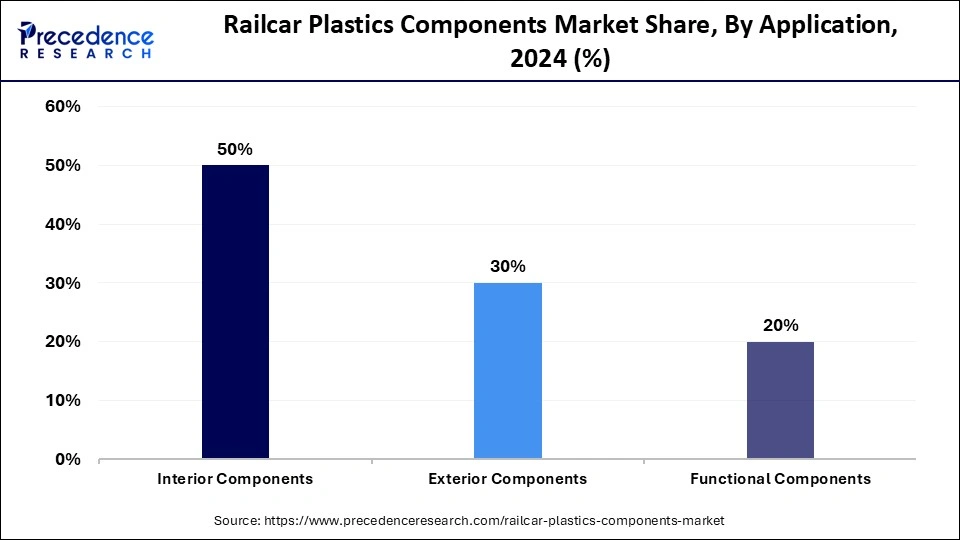

- By application, the interior components segment led the market, accounting for an estimated 50% market share.

- By application, the functional components segment is set to experience the fastest rate from 2025 to 2034, accounting for 20% of market share in 2024.

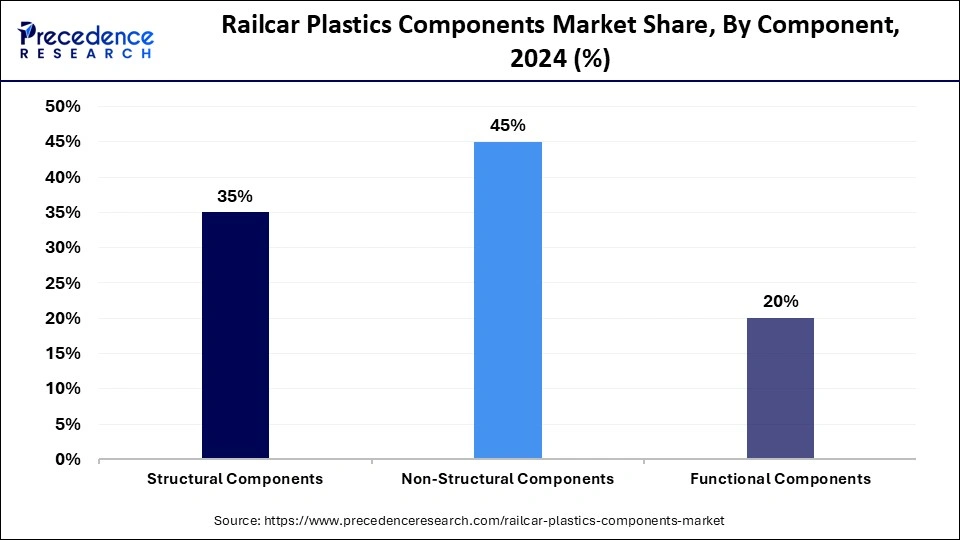

- By component, the non-structural components segment held the major market share of 45% in 2024.

- By component, the functional component segment is growing at a notable CAGR from 2025 to 2034, accounting for 20% market share in 2024.

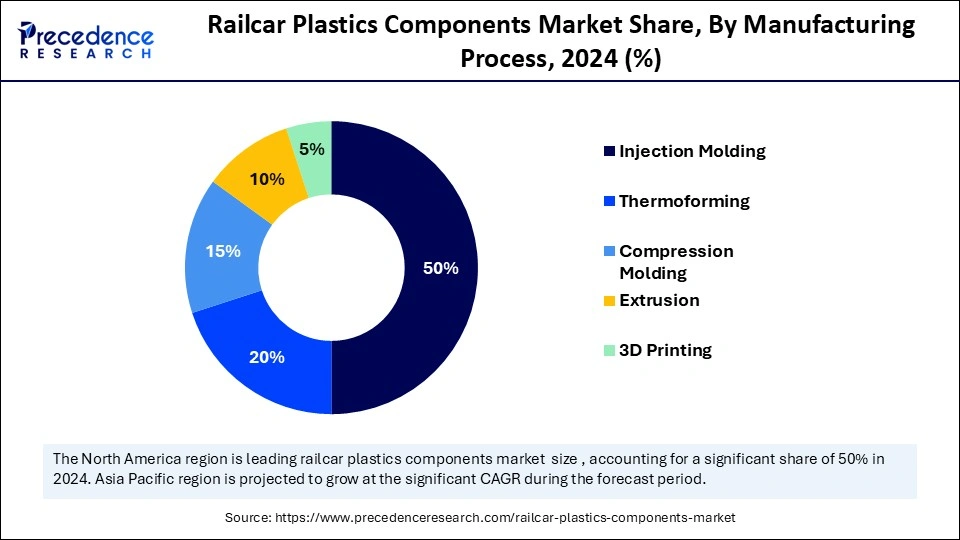

- By manufacturing process, the injection molding segment dominated the market, accounting for an estimated 50% market share.

- By manufacturing process, the 3D printing segment growing at a strong CAGR from 2025 to 2034.

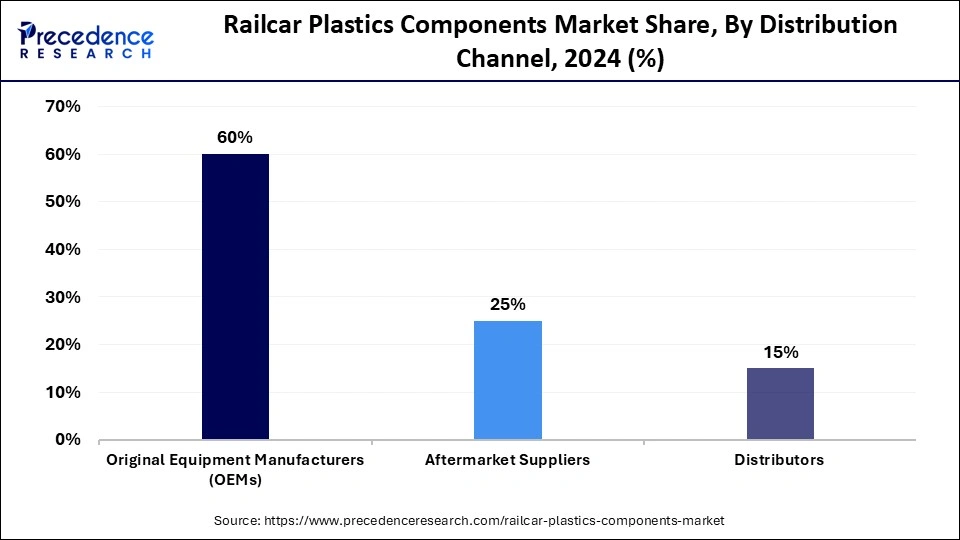

- By distribution channel, the OEMs segment held the major market share of 60% in 2024.

- By distribution channel, the aftermarkets supplies segment is poised to grow at a solid CAGR between 2025 and 2034.

Market Overview

Increasing expenditure in upgrading of rail infrastructure is likely to fuel the railcar plastics components market as governments across North America, Europe, and the Asia-Pacific region. They expand and modernize the rail networks to enhance efficiency and safety. By 2024, the United Nations Economic Commission for Europe (UNECE) announced that the growth rate of European rail freight, with the demand for rolling stocks growing towards durable and lightweight materials.

Plastics such as thermoplastics and fiber-reinforced composites used in railcar manufacturing are strong and have a good weight-to-weight ratio, and provide flexibility in design. This allows manufacturers to minimize the weight of trains and maximize energy efficiency.

Rail networks in Asia-Pacific are spreading at a rapid rate, with China and India alone putting in thousands of kilometers of rail in 2024, according to the Asian Development Bank (ADB), which increases the need for plastic components in new train constructions. Additionally, the increase in government regulations of energy efficiency and emissions is expected to further increase the acceptance of high-performance railway plastics in the coming years.

Impact of Artificial Intelligence on the Railcar Plastics Components Market

Artificial Intelligence-driven systems are currently employed by manufacturers to study thepolymer properties, anticipate the performance results. Further create compounds to meet the particular requirements of a railcar, including structural panels and interior fittings, and aerodynamic parts. Moreover, AI helps sustainability programs to recognize environmentally friendly substances and recycling programs to reduce carbon footprints.

Growth Factors

- Rising Demand for Lightweight Railcars: Growing emphasis on fuel efficiency and energy savings is driving the adoption of lightweight plastic and composite components in modern trains.

- Boosting Rail Modernization Programs: Expanding investments in rail infrastructure across North America, Europe, and the Asia-Pacific are propelling the need for advanced railcar plastics.

- Driving Safety and Fire Compliance Standards: Increasing implementation of fire-retardant and anti-bacterial polymer solutions is fueling the demand for high-performance interior and functional components.

- Growing Preference for Sustainable Materials: Rising environmental regulations and corporate sustainability goals are accelerating the shift toward recyclable and bio-based polymers in railcar manufacturing.

Global Trade of Railcar Plastic Components: Import & Export Statistics

China is a leading exporter of railcar plastic components, particularly thermoplastics and composite materials, accounting for a significant share of global shipments between March 2023 and February 2024. The country's export value for this segment is estimated to be between USD 42–48 billion.

Germany ranks second globally in railcar plastic component exports, with an estimated export value of USD 25–30 billion. The country is particularly strong in specialty coatings, performance additives, and advanced intermediates.

The United States is the exporter, with an estimated plastic component export value of around USD 80.08 billion. Key exports include agrochemicals, oilfield chemicals, and high-performance materials.

In 2024, the Netherlands serves as a major import hub for the EU, with significant inbound trade in coatings, chemical intermediates, and specialty resins, much of which is re-exported across Europe.

Brazil and Mexico are importing lightweight interior and functional plastic components to upgrade suburban rail networks and freight wagons. Import volumes in 2024 are estimated at USD 380–420 million, largely sourced from China and Europe.

India, Japan, and Vietnam have seen a surge in import demand due to ongoing metro and high-speed rail projects. India alone imported railcar plastic components valued at USD 1.08 billion in 2025 (year-to-date), including seating modules and lightweight flooring panels for new urban transit lines.

(Source: https://oec.world)

(Source: https://oec.world)

(Source: https://tradingeconomics.com)

(Source: https://www.cbs.nl)

(Source: https://www.railwaygazette.com)

(Source: https://www.constructionworld.in)

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material Type, Application, Component, Manufacturing Process, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver: How is the rising demand for lightweight materials shaping innovations in railcar plastics components?

Increasing demand for lightweight materials is expected to drive the market in the coming years. The growth in demand for lightweight materials is likely to create a high level of development in the railcar plastics compound industry. According to the AAR and FRA, rail operators in North America indicated that, as a result of using polymer-based components. The average weight of railcars decreased by about 12-15% in 2024, leading to higher fuel efficiency and capacity.

In 2024, railcar manufacturers of China State Railway Group Co., Ltd. introduced reinforced polypropylene and polyamide panels in freight wagons. They improve the structural strength of the vehicle and also improve its corrosion resistance. Furthermore, the growing popularity of trains as transportation is further strengthened with high-performance thermoplastics in both the passenger and freight rail segments.

European Rail Passenger Revival: Tracking the Journey from Disruption to Recovery (2018–2023)

|

Year |

National Rail Transport (Million Passenger-Kilometers) |

|

2018 |

377,573 |

|

2019 |

389,268 |

|

2020 |

212,791 |

|

2021 |

245,554 |

|

2022 |

345,554 |

|

2023 |

406,501 |

(Source:https://www.aar.org)

(Source:https://ec.europa.eu)

Restraint: Hampered by High Material and Production Costs

High-performance engineering plastics are expensive relative to conventional metals used in railcar manufacturing is expected to hinder the market. This price pressure likely curbs the adoption in freight and commuter segments with price sensitivity. Additionally, the compliance with global fire, smoke, and toxicity standards, including EN 45545 in Europe and NFPA 130 in the United States, is projected to impede the adoption of certain polymer grades.

Opportunity: How is the push for sustainability and recyclable materials transforming railcar plastics production

Rising emphasis on sustainability and recyclability is estimated to create immense opportunities for the railcar plastic component market. Alstom further noted that in 2024, 94% of products sold by the company were reusable or recyclable, indicating the increased adoption of the principle of a circular economy within the industry.

Rail producers are creating recyclable and bio-based polymers, which adhere to environmental standards, including the EU Green Deal or U.S. EPA emission limits, and which cause less impact on the environment without affecting structural integrity. Greenbrier reported in 2024 that new railcars were made out of recycled 56% of steel, and 35% of electricity was generated at U.S. plants. Furthermore, the growing investment in rail infrastructure modernization is anticipated to boost the adoption of advanced plastic-based components in rolling stock.

Segmental Insights

Material Type Insights

Why Did Thermoplastics Dominate the Railcar Plastics Components Market in 2024?

The thermoplastics segment dominated the railcar plastics components market in 2024, accounting for an estimated 60% market share, as they were versatile and economical, and easy to process. Polypropylene (PP), polyethylene (PE), polyamide (PA), and polycarbonate (PC) were the materials that provided a good compromise between mechanical strength and low weight.

The manufacturers of rail used thermoplastics to make interior panels, seating systems, ducting, and protective covers. Furthermore, the thermoplastics also offered better resistance to moisture and corrosion, making them suitable for the passenger and freight rail systems, thus further fuelling the segment.

The composites segment is expected to grow at the fastest rate in the coming years, accounting for 15% market share, owing to its strength-to-weight ratios and flexibility in design. Their implementation is likely to improve fuel efficiency and lower the lifecycle maintenance expenses. Moreover, the flexibility of composites for tailoring material properties to load-bearing further propels the demand for composite railcar materials.

Application Insights

Why Did Interior Components Lead the Railcar Plastics Components Market?

The interior components segment held the largest revenue share in the railcar plastics components market in 2024, accounting for 50% of the market share, as railcar plastics offer lightweight, durability, and fire retardation characteristics. Moreover, the segment leadership is enhanced by growing modular interior designs, which support quick maintenance and upgrading of the lifecycle.

The functional components segment is expected to grow at the fastest CAGR in the coming years, accounting for 20% of market share, as the advanced performance-driven materials and technology are increasingly integrated. Underframes, door systems, HVAC housings, couplings, and braking system covers have been developed with high-performance composites and reinforced thermoplastics to make them more durable and lighter.

- In 2024, CRRC introduced door panels made of CFRP in commuter trains, which cut the weight of the components by up to 18% and made them more energy-efficient. Furthermore, the OEMs and polymer experts worked together to simplify the production process, facilitating implementation in various rail networks, thus further boosting the market.

Component Insights

Why Are Non-Structural Components the Leading Segment in Railcar Plastics?

Non-structural components segment dominated the railcar plastics components market in 2024, which held a market share of about 35%, due to the long use of such parts in passenger comfort, safety, and operational efficiency. Thermoplastics and fiber-reinforced composites are used in more seating systems, interior panels, flooring, and luggage racks.

These materials save on the weight of the railcars, hence improving the fuel economy and minimizing emissions. In 2024, SABIC and BASF launched special polymers that met the requirements of EN 45545 fire safety in addition to being durable and easy to maintain. Additionally, the manufacturers lay emphasis on the modular, cleanable, and versatile appearance of interior designs in rail networks across the world, further propelling the demand for non-structural components.

The functional component segment is expected to grow at the fastest rate in the coming years, accounting for 20% market share, owing to the growing need for high-performance components. Lightweight, durable, and sustainable functional components are becoming a focus in railcar design by the rail operators. They are considered to be a major driver of growth for this segment in contemporary railcar design.

Manufacturing Process Insights

Why Has Injection Molding Emerged as the Dominant Manufacturing Process for Railcar Plastic Components?

The injection molding segment held the largest revenue share in the railcar plastics components market in 2024, accounting for 50% market share, as it is efficient in mass production of complex, lightweight, and durable components.This process was used in manufacturing interior panels, seating systems, flooring, and luggage racks for consistent quality of manufacture by rail manufacturers. Furthermore, the injection molding to create modular designs that are easier to assemble and maintain further facilitates the segment growth.

The 3D printing segment is expected to grow at the fastest CAGR in the coming years, accounting for 5% of market share, as it is versatile in producing complex and customized components with short lead times. 3D printing was used by rail operators and manufacturers to create parts and prototypes quickly. Additionally, the alliance of lightweight design, material development, and fast manufacturing accelerates the uptake of 3D printing in the plastics production of rail cars.

Distribution Channel Insights

Why Do OEMs Dominate the Distribution of Railcar Plastic Components?

The OEMs segment dominated the railcar plastics components market in 2024, accounting for an estimated 60% market share. Owing to the rising fleet modernization programs in North America, Europe, and the Asia-Pacific region.They are at the center of making new railcars and incorporating high-performance components in their production. Furthermore, the OEMs also spurred the use of innovation in modular constructions, further facilitating the segment growth.

The aftermarket suppliers segment is expected to grow at the fastest rate in the coming years, accounting for 25% market share. Owing to the increased demand for replacement parts and maintenance solutions of the aging railcar fleets. Additionally, the increasing focus on sustainability, energy efficiency, and modular retrofitting speeds up the pace of the adoption of the aftermarket segment.

Regional Insights

Why Did North America Dominate the Railcar Plastics Components Market in 2024?

North America led the railcar plastics components market, capturing the largest revenue share in 2024, accounting for 25% of the market share, due to a vast network of rail wires and wide investments in modernization. The US and Canada have developed with huge funding for freight and passenger rail systems that require lightweight and durable components.

- According to 2024 data from the Association of American Railroads (AAR), U.S. freight railroads have invested over $825 billion, equivalent to approximately $1.3 trillion in today's dollars, in infrastructure improvements between 1980 and 2024, strengthening the nation's rail network and operational efficiency.

Polycarbonate, polypropylene, and flame-retardant ABS were used to ensure compliance with fire safety requirements in NFPA 130 and EN 45545 guidelines. Work in JV with suppliers like SABIC and BASF resulted in faster R&D of fire-retardant, anti-bacterial, and lightweight materials. These initiatives were aimed at sustaining the leadership role of North America and innovating on the next-generation railcars.(Source: https://www.aar.org)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, accounting for 25% of market share, owing to the vigorous rail extension and modernization initiative. The presence of high-speed railway activities and other urban transportation measures in the region also contributed to the rise of functional plastic parts. Indian Railways made flame-protecting and anti-microbial thermoplastics interior module standards, which enhanced hygiene and safety standards.

In 2024, China State Railway Group (CRRC) also adopted CFRP door panels and thermoplastic HVAC housings in high-speed trains with enhanced energy efficiency. In China, the Green Transport Policy, and in India, the Smart Rail initiative, are some of the sustainability policies that promote the use of recyclable and bio-based polymers. Furthermore, the developments envisaged to continue the high rate of growth in Asia-Pacific and transform it into a center of high-level railcar plastic utilization.(Source: https://www.crrcgc.cc)

Top Vendors in Railcar Plastics Components Market & Their Offerings

- Röchling Group: Röchling Group is a global leader in high-performance plastics and composites for transportation, offering structural components that combine flame retardancy, weight reduction, and impact resistance. The company's rail solutions include thermoplastic interior panels, exterior covers, and electrical insulation parts designed for long-term durability and compliance with railway safety standards.

- Hitachi Rail: Hitachi Rail integrates lightweight engineered plastics into its rail systems to enhance energy efficiency and passenger comfort. Its advanced polymer components are used in interior fittings, cable management, and aerodynamic structures, contributing to the company's sustainability and design optimization goals in modern rail manufacturing.

- Benecke-Kaliko AG:Benecke-Kaliko, part of Continental AG, produces polymer-coated fabrics and surface materials for railcar interiors, including seating, wall coverings, and flooring. The company emphasizes durability, easy cleaning, and flame-retardant performance, offering customizable materials that improve passenger experience and reduce maintenance needs.

- Productive Plastics: Productive Plastics specializes in thermoformed plastic components for railcar interiors, such as seat shells, ceiling panels, and bulkhead partitions. Its materials are designed to be lightweight, cost-efficient, and compliant with stringent flame, smoke, and toxicity (FST) standards, making it a trusted partner in mass transit manufacturing.

- Miner Enterprises: Miner Enterprises develops polymer-based railcar components like liners, draft gears, and friction control systems that improve railcar performance and reduce wear. The company's focus on composite materials and advanced polymers enhances durability and noise reduction, supporting both freight and passenger rail applications globally.

Other Railcar Plastics Components Market Companies

- Adval Tech Holding AG: Specializes in precision plastic and metal components for transportation systems, offering lightweight molded parts used in railcar interiors and assemblies.

- Custom Advanced Connections: Manufactures durable plastic fittings, seals, and connectors used in railcar fluid handling and HVAC systems.

- Hammond Machine Works: Provides custom-engineered plastic and composite parts for rolling stock, including structural and mechanical components designed for heavy-duty use.

- Handling Specialty Inc.: Designs motion and lifting equipment with plastic and composite housings for rail maintenance and component handling systems.

- Hannay Reels: Produces polymer-based hose and cable reels used in rail maintenance and service applications, emphasizing corrosion resistance and weight reduction.

- Helwig Carbon Products Inc.: Develops carbon and engineered plastic components for electrical systems in railcars, including brush holders and insulation housings.

- Hempel USA Inc.: Supplies polymer-based coatings and paints that protect plastic and composite railcar components from corrosion, abrasion, and UV exposure.

- Herzog Railroad Services Inc.: Manufactures railcar assemblies incorporating polymer and composite parts to reduce maintenance needs and improve performance efficiency.

- Hilliard Enterprises Inc.: Focuses on the remanufacturing and distribution of railcar components, including replacement polymer and composite parts.

- Kolzam S.A.: A Polish rail manufacturer using advanced plastics and composites for modernization projects, including interior paneling and electrical housings.

- Piedmont Plastics: Supplies engineering-grade thermoplastics for railcar interiors, exteriors, and electrical enclosures, offering materials like polycarbonate and ABS.

- Salco Products, Inc.: Manufactures plastic valves, fittings, and hatches for freight railcars, emphasizing chemical resistance and safety compliance.

- SRG Global: A leader in decorative and functional plastic components, providing trim, coatings, and surface solutions for railcar interiors and exteriors.

- Swissplast: Produces thermoformed and injection-molded plastic components for rail transport, emphasizing lightweight design and thermal stability.

- TST Inc.: Supplies precision-molded and machined polymer components for railcar mechanical systems, offering high durability under extreme conditions.

Recent Developments

- In May 2025, J.B. Hunt Transport Services Inc. (NASDAQ: JBHT), one of the largest supply chain solutions providers in North America, BNSF Railway (BNSF), North America's largest intermodal railroad, and GMXT, the largest rail provider in Mexico, announced the launch of a new intermodal offering for Mexican businesses with service-sensitive freight delivery.

- In September 2024, China Energy Railway Equipment Co., Ltd. achieved a breakthrough in sustainable rail innovation by releasing its first batch of carbon fiber open freight cars in Qiqihar, Heilongjiang Province, according to Railway Supply. These next-generation freight cars mark a significant departure from traditional steel designs, offering reduced weight, improved fuel efficiency, and lower maintenance costs. The company plans to produce six complete trains utilizing these advanced carbon fiber models, underscoring China's growing commitment to green rail technologies.

- In July 2024, CRRC unveiled the CETROVO 1.0, the world's first commercial carbon fiber metro train, in Qingdao, designed specifically for Qingdao Metro Line 1. Originally showcased at InnoTrans 2018, the innovative metro train is 11% lighter than traditional steel models, significantly boosting energy efficiency and operational performance. This launch cements CRRC's leadership in the global green rail transport sector, setting a new benchmark for lightweight, energy-efficient metro solutions.

Segments Covered in the Report

By Material Type

- Thermoplastics

- Polycarbonate (PC)

- Acrylonitrile Butadiene Styrene (ABS)

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- High-Density Polyethylene (HDPE)

- Thermosetting Plastics

- Phenolic Resins

- Epoxy Resins

- Melamine Formaldehyde

- Composites

- Glass Fiber Reinforced Plastics (GFRP)

- Carbon Fiber Reinforced Plastics (CFRP)

- Natural Fiber Composites

By Application

- Interior Components

- Seating Systems

- Wall Panels

- Flooring Systems

- Storage Solutions

- Lighting Fixtures

- Exterior Components

- Body Panels

- Roofing Systems

- Windows and Doors

- Underframe Components

- Functional Components

- Ducting Systems

- Cable Management

- Insulation Materials

- Fire Safety Components

By Component

- Structural Components

- Chassis Parts

- Mounting Brackets

- Reinforcement Plates

- Non-Structural Components

- Interior Panels

- Seating Components

- Storage Units

- Functional Components

- HVAC Ducts

- Cable Trays

- Insulation Materials

By Manufacturing Process

- Injection Molding

- Thermoforming

- Compression Molding

- Extrusion

- 3D Printing

By Distribution Channel

- Original Equipment Manufacturers (OEMs)

- Aftermarket Suppliers

- Distributors

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content