What is the Ready-to-Cook Food Market Size?

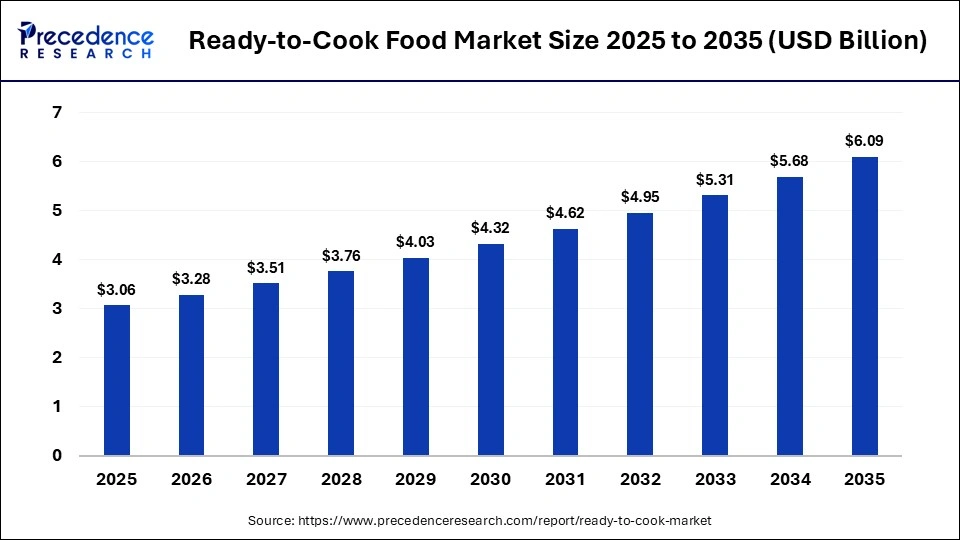

The global ready-to-cook food market size was calculated at USD 3.06 billion in 2025 and is predicted to increase from USD 3.28 billion in 2026 to approximately USD 6.09 billion by 2035, expanding at a CAGR of 7.12% from 2026 to 2035. The ready-to-cook food market is driven by rising demand for convenient, time-saving meal solutions amid busy lifestyles and increasing workforce participation.

Market Highlights

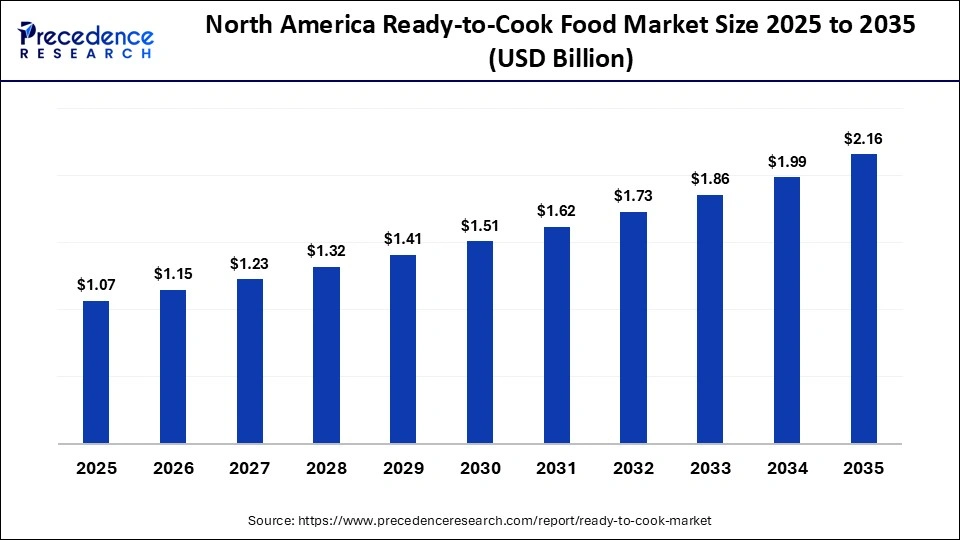

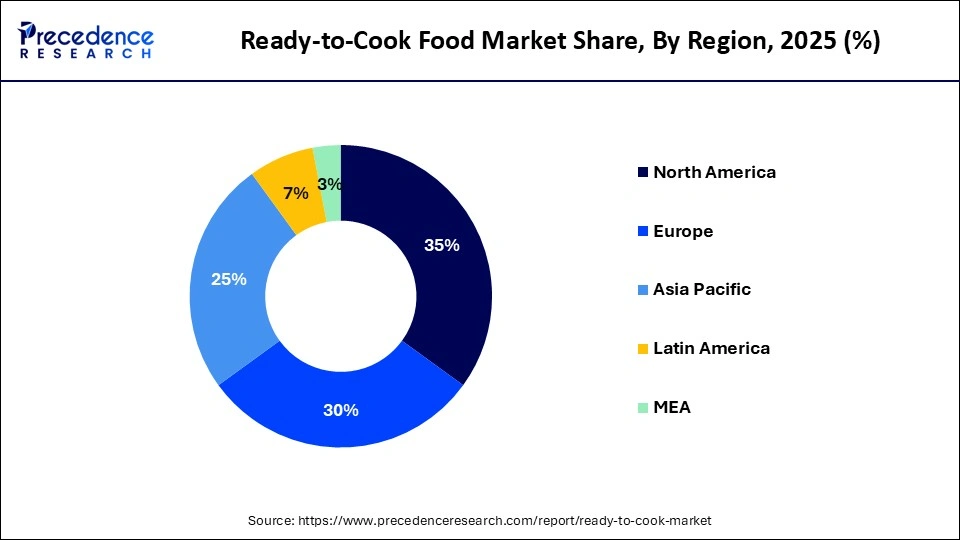

- North America dominated the market, holding the largest share of 35% in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 7.5% during the forecast period.

- By product type, the frozen meals segment held the largest market share of 45% in 2025.

- By product type, the meal kits segment is expected to grow at the fastest CAGR 6.6% between 2026 and 2035.

- By distribution channel, the supermarkets/hypermarkets segment held the largest market share of 40% in 2025.

- By distribution channel, the online retail segment is expected to grow at a robust CAGR of 6.8% in the upcoming period.

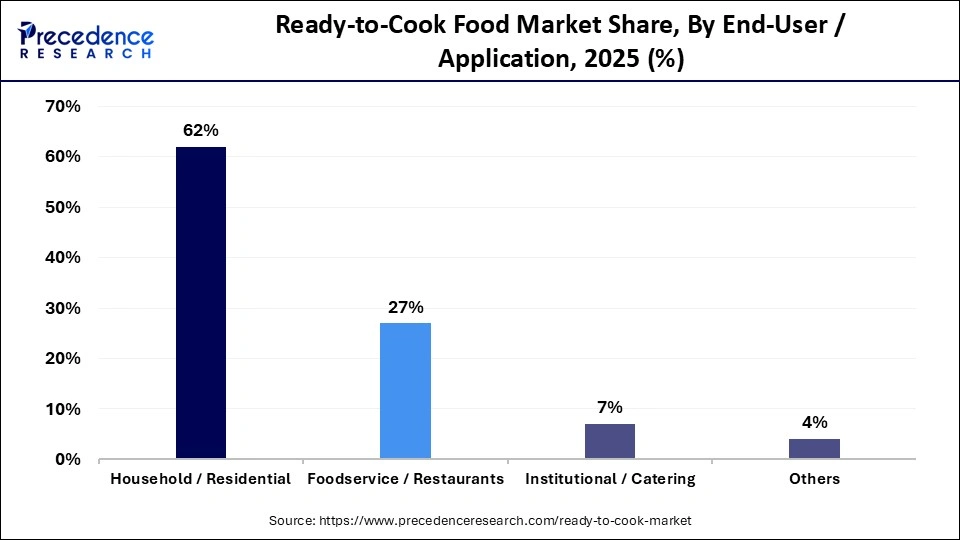

- By end-user / application, the household / residential segment held the largest market share of 62% in 2025.

- By end-user / application, the foodservice / restaurants segment is expected to expand at a healthy CAGR of 6.2% from 2026 to 2035.

- By cuisine type, the western segment held the largest market share of 40% in 2025.

- By cuisine type, the Asian segment is expected to grow at the fastest CAGR of 6.4% over the forecast period.

Market Overview

The global ready-to-cook food market has been experiencing rapid growth as more consumers are demanding convenience and time-saving meal options without compromising taste, nutrition, and quality. RTC items such as frozen foods, meal preparations, shelf-stable mixes, and chilled preparations are meant to provide easy cooking as well as provide the same outcome when used by both households and food service providers. Moreover, accessibility of products has been enhanced in both developed and developing economies due to the rise of supermarkets, hypermarkets, and online grocery stores. Increased exposure of consumers to foreign foods, alongside relentless advancement in packaging technology, portion control, and customized meal products also drives the market.

How is AI Revolutionizing the Ready-to-Cook Food Market?

The introduction of AI is transforming the market by increasing efficiency, improving product quality, and enhancing communication with customers across the value chain. Manufacturers are leveraging AI-based demand prediction to more accurately anticipate consumption trends, reduce food waste, and prevent surplus inventory. In product development, AI-powered analytics can analyze consumer preferences, dietary trends, and regional taste profiles to create recipes with a higher likelihood of market success. Additionally, AI enables intelligent pricing strategies and dynamic supply chain optimization, improving delivery schedules and minimizing operational costs.

What are the Major Trends in the Ready-to-Cook Food Market?

- There is a growing demand for ready-to-cook meals among urban consumers who seek convenient meals that save preparation time while retaining a homemade flavor, particularly among working professionals and dual-income families.

- Improved cold chain logistics and freezer penetration are enhancing the availability of frozen and chilled ready-to-cook foods, extending shelf life without compromising taste or nutritional value.

- Greater accessibility through grocery stores, online platforms, and on-demand delivery services is also boosting visibility and encouraging impulse purchases, while efficient last-mile delivery ensures convenience.

- Companies are adopting recyclable packaging with clear ingredient labeling to meet government regulations and satisfy growing consumer demand for environmentally friendly and trustworthy food products.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 3.06 Billion |

| Market Size in 2026 | USD 3.28 Billion |

| Market Size by 2035 | USD 6.09 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 7.12% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Distribution Channel, End-User/Application, Cuisine Type, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Product Type Insights

Why Did the Frozen Meals Segment Contribute the Largest Market Share in 2025?

The frozen meals segment held the largest share of 45% in the ready-to-cook food market in 2025. The dominance of this segment is mainly supported by their long shelf life, consistent product quality, and widespread availability in supermarkets, hypermarkets, and online platforms. Frozen RTC foods are also prepared with the least amount of effort and give the guarantee of consistency and quantity. The innovations in technology in the aspects of freezing, vacuum-sealing, and cold-chain logistics have enhanced the texture, flavor retention, and nutritional value to a large extent, enhancing consumer confidence. Moreover, frozen meals help minimize food waste and simplify meal planning, making them particularly appealing to cost-conscious consumers.

The meal kits segment is expected to grow at a significant CAGR of 6.6% over the forecast period due to the increasing demand for fresh, personalized, and interactive home-prepared meals. Increasing health consciousness and the desire for portion-controlled diets are key factors supporting the adoption of meal kits. The models of subscription-based delivery that are accompanied by mobile applications and online e-commerce platforms have contributed greatly to enhancing accessibility and customer retention. With the growing penetration of digital grocery platforms and the rising consumer interest in cooking experiences, meal kits are expected to capture an increasingly larger share of the market.

Distribution Channel Insights

What Made Supermarkets / Hypermarkets the Dominant Segment in the Ready-to-Cook Food Market?

The supermarkets / hypermarkets segment dominated the market with a 40% share in 2025. This is mainly due to their extensive product range, large shelf presence, and strong brand recognition, which give them a competitive advantage, enabling consumers to easily compare prices and products. Physical retail outlets also provide customers with an opportunity to examine packaging, look at nutritional labels, and assess freshness, that instils confidence in the quality of products. In-store promotions, such as special offers, bundled deals, sampling stands, and loyalty programs, further encourage impulse purchases. Additionally, supermarkets serve as key channels for launching new and seasonal products.

The online retail segment is expected to expand at a 6.8% CAGR in the market during the projection period. This is mainly due to the convenience and accessibility it offers, allowing consumers to order products anytime and from anywhere. The increasing penetration of digital grocery platforms, along with subscription services and personalized recommendations, has made it easier for consumers to discover and purchase RTC foods. Additionally, online channels provide a wider product variety, attractive promotions, and safe, contactless delivery, which appeal to busy and cost-conscious consumers.

End-User/Application Insights

Why Did the Household / Residential Segment Lead the Ready-to-Cook Food Market in 2025?

The household / residential segment led the market, capturing a 62% share in 2025. This dominance is driven by lifestyle changes, including longer working hours, the rise of dual-income families, and limited time for preparing traditional meals. Consumers often perceive home-prepared meals using RTC products as more cost-effective and healthier compared to dining out or ordering delivery. The availability of a wide variety of portioned dishes and healthier options, such as low-fat or high-protein products, further encourages adoption. Additionally, widespread ownership of freezers and modern kitchen appliances supports bulk buying and convenient storage of RTC food, contributing to segmental dominance.

The foodservice / restaurants segment is expected to grow at a healthy CAGR of 6.2% in the upcoming period due to its ability to save preparation time, maintain consistent taste and quality across locations, and address labor shortages. Rising urbanization and increasing consumer preference for dining out are further boosting demand. Additionally, the expansion of online food delivery services has encouraged restaurants to adopt standardized RTC ingredients, which help improve operational efficiency, reduce costs, and shorten service times during peak hours. These factors collectively drive the adoption of RTC foods in the foodservice sector.

Cuisine Type Insights

Why Did the Western Segment Dominate the Market in 2025?

The western segment dominated the ready-to-cook food market with the largest share of 40% in 2025. The segment's leadership is supported by the global popularity of products such as pasta, pizza, burgers, lasagna, and baked snacks, which can be conveniently offered in both frozen and shelf-stable formats. Strong brand recognition, consistent recipes, and a well-established fast-food culture further enhance its appeal, especially among younger consumers. Promotional campaigns and quick-service restaurant menus prominently feature Western RTC foods, reinforcing familiarity and trust in flavor. This combination of accessibility, recognizable taste, and brand familiarity continues to drive high demand in both developed and developing markets.

The Asian segment is expected to grow at the fastest CAGR of 6.4% during the projection period due to the increasing global interest in Chinese, Indian, Thai, Japanese, and Korean food items. Growing cultural exchange, international tourism, exposure to digital media, and migration have significantly increased consumer awareness and acceptance of Asian flavors. Many consumers associate Asian foods with healthy diets, diverse spices, and nutritious cooking methods, further boosting demand. Companies are rapidly expanding their product portfolios to include authentic regional recipes in frozen, chilled, and shelf-stable formats, while retailers and online platforms are dedicating more space to ethnic foods, improving accessibility.

Region Insights

How Big is the North America Ready-to-Cook Food Market Size?

The North America ready-to-cook food market size is estimated at USD 1.07 billion in 2025 and is projected to reach approximately USD 2.16 billion by 2035, with a 7.28% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Ready-to-Cook Food Market in 2025?

North America dominated the ready-to-cook food market with the largest share of 35% in 2025 due to a high consumption of convenience and packaged foods and elevated income levels. Busy lifestyles, long working hours, and the prevalence of dual-income households have increased reliance on fast and minimally prepared meals. Well-established cold chain infrastructure, modern retail chains, and advanced e-commerce grocery platforms make product accessibility convenient and efficient. Major food producers are also investing heavily in product innovation, introducing healthier, organic, and plant-based RTC options to meet evolving consumer preferences.

What is the Size of the U.S. Ready-to-Cook Food Market?

The U.S. ready-to-cook food market size is calculated at USD 803.25 million in 2025 and is expected to reach nearly USD 1,632.27 million in 2035, accelerating at a strong CAGR of 7.35% between 2026 and 2035.

U.S. Market Trends

The ready-to-cook food market is growing in the U.S. due to busy lifestyles, longer working hours, and the rise of dual-income households, which increase demand for convenient and time-saving meal solutions. Consumers are also increasingly seeking healthier, organic, and plant-based options, driving innovation in RTC products. Well-developed cold-chain infrastructure, modern retail chains, and e-commerce grocery platforms make these products easily accessible.

Why is Asia Pacific Considered the Fastest-Growing Region in the Ready-to-Cook Food Market?

Asia Pacific is expected to grow at the fastest CAGR of 7.5% throughout the forecast period due to the rapid urbanization, increasing middle-class population, and changing food habits. The rise in the number of workers and women's participation in the workforce is boosting the demand for convenient meal options in economies, including China, India, Japan, and Southeast Asian countries. The rise in modern retail formats, increased mobile phone usage, and the development of food delivery and e-commerce have enhanced access to ready-to-cook products even in semi-urban areas.

China Market Trends

China is a major contributor to the Asia-Pacific ready-to-cook food market. This is due to its large population, increasing urbanization, and rising disposable incomes, which drive demand for convenient meal solutions. Changing lifestyles, including longer working hours and a growing number of dual-income households, have boosted the adoption of RTC foods. Additionally, the expansion of modern retail chains, e-commerce grocery platforms, and improvements in cold-chain infrastructure have made RTC products more accessible across the country.

What Makes Europe a Notably Growing Region in the Ready-to-Cook Food Market?

Europe is expected to grow at a notable rate in the market. High consumer awareness around nutrition, sustainability, and ingredient transparency is prompting manufacturers to offer clean-label, organic, and minimally processed RTC products. The increasing number of single-person households and the aging population is driving demand for portion-controlled, easy-to-prepare meals. Additionally, fast-paced urban lifestyles, combined with a high concentration of supermarkets and discount retail chains, support consistent consumption of RTC foods across the region.

Recent Developments

- In July 2025, Tyson Simple Ingredient Nuggets will also be released as part of the company's effort to reach health-conscious consumers with a new product using simple and familiar ingredients. The intention to launch was to simplify meal time and, at the same time, meet the rising demand for eating healthy and convenient foods.(Source: https://www.tysonfoods.com)

- In May 2025, Red Planet introduced ready-to-eat meals with the outrageous shelf life of 25 years at the Saudi Food Show 2025 based on the newest freeze-drying technology. The offering was directed toward the preservation of taste and nutritional value so as to support the important sectors and long-term food security.(Source: https://www.zawya.com)

Who are the Major Players in the Global Ready-to-Cook Food Market?

The major players in the ready-to-cook food market include Nestle S.A., Conagra Brands, Inc., The Kraft Heinz Company, General Mills, Inc., Unilever PLC, McCain Foods Limited, Nomad Foods Ltd., Tyson Foods, Inc., Pinnacle Foods, Inc., Hormel Foods Corporation, Ajinomoto Co., Inc., Bakkavor Group plc, Dr. Oetker GmbH, ITC Limited, and Greencore Group plc.

Segments Covered in the Report

By Product Type

- Frozen Meals

- Meal Kits

- Refrigerated

- Shelf-Stable

- Instant/Others

By Distribution Channel

- Supermarkets/Hypermarkets

- Online Retail

- Convenience Stores

- Specialty Stores

- Others

By End-User/Application

- Household/Residential

- Foodservice/Restaurants

- Institutional/Catering

- Others

By Cuisine Type

- Western

- Asian

- Latin American

- Middle Eastern & Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content